Professional Documents

Culture Documents

GST Rates, Composition Scheme, and Input Tax Credit

Uploaded by

Kailash KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GST Rates, Composition Scheme, and Input Tax Credit

Uploaded by

Kailash KumarCopyright:

Available Formats

GS

T2

GS

T2

' TM

09850850800

2

GST

Goods & Services Tax (GST)

Most Recent Updates

Join us

Vsmart Academy page/group

Most Recent Videos

Subscribe

Vsmart Academy channel

VALUATION, RATE, COMPOSITION & ITC

TAX

GST Rates in India

Rate Goods Service Composition Scheme ADDITIONAL CONDITIONS:-

> Taxable Person opting composition scheme shall not

WITHDRAWAL FROM COMPOSITION SCHEME

1) When aggregate turnover exceeds 1 Cr./75 lacs during the financial year.

Section 15 - Valuation 0% 50% of the consumer price Exemption is given in service tax for some

basket, including foodgrains services

APPLICABILITY AS PER SEC 10

- Applicable to “Registered Person” whose aggregate turnover in preceding

collect tax on outward supplies

> Taxable Person opting composition scheme will not be

2) If he ceases to satisfy any of the conditions required to opt for composition scheme

EFFECTS AFTER WITHDRAWAL

Diamonds, Precious Stones — year is not exceeding 1 Cr. or 75 Lacs (in special category state) eligible to claim input tax credit

1) To file an intimation for withdrawal in prescribed form within 7 days from such event.

0.25% etc. - It is an optional scheme > Would be applicable for all business vertical having

registrations under same PAN of the conditions required to 2) Shall issue a tax invoice for every taxable supply made thereafter

3) Shall be allowed to avail input tax credit in respect of stock held by him as on date.

Sec 15(1) Sec 15(2) Sec 15(3) Silver, Gold, Platinum etc. —

3% RATE

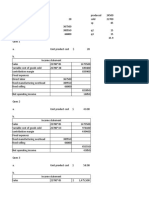

Cases CGST SGST Total

opt for composition scheme

RESTRICTIONS AS PER COMPOSITION RULES

Note : Special category states are : Arunachal Pradesh, Assam, Jammu & Kashmir, Manipur,

Value of = Transation value Inclusion to Transaction Value Deduction of discount Mass consumption items Transport of goods by Rail/Road/ Air/ Ship Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh & Uttarakhand.

Taxable Supply

Price actually

5% like spices and mustard oil Transport of passengers Rail / Road /

Economy air travel, Tour operator, Print

Manufacturer

Trader

1%

0.5%

1%

0.5%

2%

1%

Of State

Turnover

> He is neither a casual taxable person nor a non-resident

taxable person Sec 2(6) - Aggregate Turnover Sec 2(112) Turnover in State” or “Turnover in

a b c d e Media, Ads, News Paper Printing Catering & Restaurant 2.5% 2.5% 5% > Goods held in stock as on appointed date are not Union Territory

paid or payable purchased:- “Aggregate Turnover” ” “turnover in State” or “turnover in Union territory” means the

for Supply Any discount given before Any discount given after supply Processed foods Air travel business class, Non-AC TURNOVER LIMIT IN CURRENT YEAR FOR COMPOSITION - In course of interstate trade or commerce aggregate value of

means the aggregate value of

Duties & Taxes

All taxes levied

3rd party payment

Any payment

Incidental expenses:

Any incidental expenses

Interest, late

fee penalty

Subsidy

Subsidy directly

or at the time of Time of Supply

12% restaurant, Hotel Rooms rent ` 1000-

2500, Construction of building /complex,

Temp transfer of intellectual prop.

Agrregate Turnover does not exceeds 1 Cr. or 75 lacs. - imported from place outside India

- From his agent or principal outside State, where the

Ü all taxable supplies (excluding the value of inward

supplies on which tax is payable by a person on

Ü all taxable supplies (excluding the value of inward

supplies on which tax is payable by a person on

Conditions: under any law included by the charged by supplier & for delay linked to price ELIGIBILITY CONDITIONS (in current year) option is exercised under sub-rule 1 of rule 1 reverse charge basis), reverse charge basis) and

1) Not related party for time being in recipient for which any amount charged for payment of by person other Deductible from value Soaps, Oil, toothpaste, General Rate on all services except 1) Not engaged in supply of services other than catering & restaurant services - From unregistered person under RCM basis, provided he

2) Price is sole consideration force other than

GST Acts if

supplier is liable to

pay

anything done by the

supplier at the time of

consideration than govt. Agreed at the Time or before supply Not Agreed 18% refrigerator, smartphones covered in 5%, 12% and 28% 2) Not engaged in supply of goods which are non taxable under GST Act.

3) Not engaged in making any inter state outward supply of goods

can opt the scheme on payment of tax on RCM basis

Ü exempt supplies, Ü exempt supplies made within a State or Union

territory by a taxable person,

Deduction allowed Deduction Ü exports of goods or services or both and Ü exports of goods or services or both and

charged supply or before delivery White goods, Cars Race club, Gambling, Hotel rent more than 4) Not engaged in supply of goods through an E-Commerce operator . PROCEDURAL REQUIREMENT

separately

i) linked to the invoice

ii) ITC reversed by recipient

not allowed 28% ` 5000/day, Services provided in Five star

Hotels, Cinema/ Multiplexes/ IPL/ Casino,

5) Not a manufacturer of notified goods i.e.

- Ice cream, edible ice

> He shall issue a bill of supply & shall mention the words

“composition taxable person, not eligible to collect tax on

Ü inter-State supplies of persons having the same

Permanent Account Number,

Ü inter-State supplies of goods or services or both

Amusement Parks/Sporting events made from the State or Union territory by the said

- Pan Masala supplies” at the of top of such bill taxable person

to be computed on all India basis

- Tobacco & Tobacco substitutes > On every notice or signboard displayed at prominent place

28%

Plus Cess

Luxury cars, pan masala,

tobacco, aerated drinks

—

6) Neither a casual taxable person nor a non-resident taxable person. of business shall mention words “composition taxable

but excludes central tax, State tax, Union territory tax,

integrated tax and cess

but excludes central tax, State tax, Union territory tax,

integrated tax & cess.

person'

Sec 15(4) Sec 15(5)

If value of supply cannot be determind u/s 15(1) i.e

Notwithstanding anything contained in sec 15(1)/15(4) Value of supply notified by the govt.shall be determined as per Rules INPUT TAX CREDIT

Ü Supply without price

Ü Related party transaction Valuation in special cases [Rule 32]

Sec 2(59) Input : Means any Sec 2(60) Input Service : Sec 2(19) Capital Goods : Means goods, the Sec 2(46) Electronic Credit Ledger: means the Sec 2(47) Inward Supply : in

Ü Supply without consideration or any other considerations then apply 32(2) :Purchase or sale of foreign currency

Note : goods used other than capital Means any service used or value of which is capitalised in the books of account electronic credit ledger as referred in Sec 49(2) i.e. the input tax relation to a person, shall mean receipt

CGST Rules 2017 FC= Foreign currency

credit as self assessed in return of registered person shall be

EV = Exchange Value goods used or intended to be used intended to be used by a supplier of the person claiming the input tax credit and which are of goods or services or both whether by

by supplier in course of furtherance in the course or furtherance of used or intended to be used in the course or furtherance credited to electronic credit ledger in accordance with section 41, purchase acquisition or any other with or

Option 1 Option 2 of business. business of business to be maintained in the manner as may be prescribed. without consideration.

Rule 27 Rule 28 Rule 29

(a) Exchange value up to ` 1,00,000.

When consideration is not Supply between distinct or related person Supply between FC to `

Value = 1% of gross amount exchange value but min

FC to FC

wholly in money (a) Open Market Value (OMV) principle & agent ` 250 Sec 16 : Eligibility & Sec - 17(1), 17(2) & 17(3) Apportionment of Credit Sec - 17(5) Blocked Credit

(b) If (a) is not available convert both (b) Exchange value more than 1 Lac but below 10Lac

(a) Open market value (OMV) (a) Open Market Value (OMV )

value = value of like kind & quality RBI Ref. rate is availabe RBI Ref. not availabe the currencies Value = 1000+0.5% of (E.V. - 1,00,000)

Conditions & Time limit

(b) If (a) is not available (c) If (a) & (b) not determinable then apply OR in Indian ` by T Total input tax (IT) on capital goods (CG) Cases, where ITC not available Exemptions, where ITC allowed

value = consideration in money + Rule 30 or 31 in that order Value = applying RBI rate (c) Exchange Value above 10 L Sec. 16(1) : Eligibility criteria :

FMV of consideration not in money Proviso 1: 90% of price of like kind & Value =1% of Value = 5500+0.1% of (E.V. - 10,00,000) Total IT on I + IS Motor Vehicle and other Conveyance (A) Motor vehicle & other conveyance used for transportation of goods

(c) If (a) & (b) not determinable

If further supply is as such by recipient at option of supplier

Value = 90% of price charged for like kind &

quality by the recipient.

Where such goods are

Dealers

buying or –RBI

base

selling rate rate

gross amount

of currency exchanged in `

Value = 1%

of lower of but max 60,000

- Person should be registered person

- Goods used/intented to be used in the (a) (b) ‘A’

(B) Motor vehicle & other conveyance used for making taxable supplies of

(i) such motor vehicle & other conveyance

Value = value of like kind & quality above amount

quality by recipient. intended for further supply. course or Furtherance of business. (ii) transportation of passengers

(d) If (a) (b) or (c) not determinable then Proviso 2 :

T1 T2 T3 C1 IT on CG used exclusively IT on CG used exclusively IT on CG not covered (iii) imparting training on driving / flying/ navigation such motor vehicle

(b) If (a) is not available then 32 (3) : Value of the supply of Services in relation to booking of tickets for travel by air for non-business/exempt for taxable supplies under (a) & (b). Useful life

apply Rule 30 or 31 in that order If recipient is eligible Full ITC then OMV = Rule 30 or 31 in order. Sec. 16(2) : Conditions : & other conveyance

(a) Domestic Booking - Value = 5% of basic fare IT on I+IS used IT on I=IS used Blocked credit u/s Remaining ITC supplies including zero rated of CG – 5 years from date

Value declared in invoice for supply of goods or services. a) Tax invoice /Debit note is in possession supply (ZRS) of inovice

(b) International Booking - Value = 10% of basic fare exclusively for exclusively for 75(5) credited to ECrL Food and beverages, Outdoor catering, Where a particular category of such inward supplies is used for making an

Note: Basic fare means airfare on which commission is payable to air travel agent. i.e. It doesn’t includes other charges & taxes. b) Receipt/received of Goods or services non-business exempt supplies = T-(T1 + T2 +T3) Beauty Treatment, Health Services, Cosmetic outward taxable supply of the same category - [Sub-contracting] or as an

32 (4) : Life insurance business both purposes & Plastic Surgery element of a taxable composite or mixed supply.

Not to be credited to Credited to ECrL Credited to ECrL

Exception : Bill to ship to Electronic Credit Ledger

Rule 30 & 31 are applicable in order in following cases If goods are supplied on direction of third (ECrL) Membership of Club, health and fitness —

1) If situation covered in rule 27,28,29 but Valuation can not be done by applying the principles Stated in rules Saving policy Single Annul Risk Policy (i) Exempt supplies include reverse Tc center

Policy person then goods are deemed to be charge supplies, transactions in

2) If situation not covered in a fore said rules. value shall be determined as received by third person when supplied by securities, sale of building when Common credit on CG = TC =Σ (A) Rent a cab, Life insurance and health (A) Services notified by the Government as being obligatory for an

Value =10% of per Sec15(1) supplier to the recipient entire consideration is received

T4 C2 if CG under (a)/(b) subsequently get covered

Investment or saving Investment not intimated to policy holder - single premium charged i.e. gross premium charged insurance employer to provide to its employees under any law

c) The payment of tax to the government has after CC. Tm under ‘A’, = (a)/(b) - 5% of IT for a quarter or

intimated to policy holder (a) 1st year value = 25% of premium charged (B) Where a particular category of such inward supplies is used for making

Rule 30: Value of supply Rule 31: Residual method or Best judgement been made on such supply. (ii) Aggregate value of exempt Credit attributable to I+IS Common credit part thereof

Value = gross (b) 2nd year value = 12.5% of premium charged used exclusively in taxable

an outward taxable supply fo the same category [Sub-contracting] or

supplies and total turnover = C1 – T4

based on Cost by using reasonable means Premium -Investment d) He has file the return. supplies including ZRS Common credit of CG for a tax as part of a taxable composite or mixed supply.

Cost of production Note : If this option is exercised it can’t withdrawn in the same financial year exclude the CED, SED & VAT Tr

– Consistent with the principles & general provision of Sec 15 period during their useful life

Value = 110% of Cost of acquisition – Provision of this chapter (i.e. earlier rules) Tm = Tc/60 Travel benefits extended to employees on —

32 (5) : Buying & Selling of 2nd hand goods. Other : Common credit at the beginning of a tax vacation such as leave or home travel

Cost of provision of service Note: In case of supply of services supplier may option for rule 31 instead of rule 30

1) If, goods received in lots - then, ITC is period for all CG having useful life in that tax

D1 D2 C3 period

concession

on ‘Receipt of last lot/install.

Tr = Tm of such CG Works contract service for construction of (A) Works Contract services for Plant & (A) Construction includes re-

If ITC is not taken on purchase of such goods 2) Payment to Supply within 180 days - Credit attributable to exempt Credit attributable to non- Remaining

Rule 33 : Deduction of expenses incurred as a pure agent If ITC is taken on purchase of such goods supplies - business purpose if Common credit immovable property Machinery construction/ renovation/

Definition of pure agent : Means a person Service recipient pay 180 days. [Value+tax] addition/ alterations/ repairs

This rule is applicable for all supply of services not with standing to E xC common I + IS used partly = C2 - (D1 + D2) (B) Where Works contract service for to the extent of capitalisation

- Value = selling price - purchase price Value = Transaction value U/S 15(1) or outward supply of such goods But if not 180 days then, D1 = — Te

anything contained in the provision on this chapter F 2

for business + non-business immovable property is input service for to said immovable property.

Value shall exclude the expenditure & cost incurred by the supplier as (a) entering into contractual agreement with the E= Value of ES during tax period purposes further supply of works contract services (B) Plant & Machinery means

In case of reposed goods from defaulting borrowers. Common credit towards exempted supplies

recipient to incurred the expenditure as pure Amt. = ITC added in outward lia F = Total turnover during tax period D2 = 5% x C2 Eligible ITC [Sub-contracting] apparatus, equipment &

a pure agent subject to following conditions.

1) Supplier act as pure agent of the recipient while making payment

agent

(b) Neither holding any title on supplies procured

Purchase = Purchase price of

price defaulting borrower

–

5% of each qtr or part there of between date

of purchase of defaulting borrower & date of disposal by person

(+) Interest @ 18% if no turnover during the tax

period/values not available, values

attributable to

business &

E

Te = — x Tr

F

E – Aggregate value of exempt supplies Inward supplies received by taxable person (A) Construction of Plant & Machinery

machinery fixed to earth by

foundation or structural

to 3rd party supports but excludes land

as a pure agent Regain when payment is made. for last period may be used. taxable supplies for construction of immovable property on his (B) Construction of immovable property for

during the tax period; F — Tutal turnover building/ other civil

2) Amount separately shown in invoice (c) Doesn’t use such supplies for his own interest 32 (6) : Value of token, voucher, coupon. including ZRS during the tax period. own account including when such supplies others structures, tele-

Exception : 1) Tax payable under RCM Ineligible credits Added to output tax liability along

3) Supplies of goods / services procured by the supplier as a pure (d) Received only the actual amount incurred to Value = money value of goods / services / both redeemable against such coupon, token, voucher, stamp If no turnover during the tax period/values not are used in the course or furtherance of communication towers and

2) Deemed supplies without consideration with interest pipelines laid outside the

agent are in addition to services he supplies on his own A/c. procure supplies under pure agent. 32 (7) : Value of supply of service to distinct person. In case of notified supply of services by govt. the value of supply available, values for last tax period may be business

[Sch.I] used. factory premises.

made to distinct person where ITC is available shall be Nil To be added to output tax liability

Inward supplies received by NRTP Goods imported by him

Sec. 16 (B) - claimed & depreciation on tax Ü C3 will be computed separately for ITC of CGST, SGST/ UTGST and IGST.

Sec 2(61) “Input Service Distributor”

component under income tax act = ITC Ü Σ(D1 + D2) will be computed for the whole financial year, by taking exempted

Sec 20 – Distribution of credit Goods or services or both on which tax —

Sec 19- Goods sent by principal for Job Work not allowed turnover and aggregate turnover for the whole financial year. Ü Te will be computed separately for ITC of CGST, SGST/UTGST and has been paid under Sec 10

Means an office of the supplier of goods or services or both If this amount is more than the amount already added to output tax liability every

by Input Service Distributor which receives tax invoices issued under section 31 month, the differential amount will be added to the output tax liability in any of the

IGST.

Goods or services or both received by non- —

The principal shall be allowed input tax credit on inputs sent to a Sec. 16(4) - Time limit for availing ITC Ü Exempt suppliies include reverse charge supplies, transactions in

towards the receipt of input services Earlier of following month till September of succeeding year along with interest @ 18% from 1st April securities, sale of land and sale of building when entire consideration resident taxable person except on goods

job-worker for job-work. The Input Service Distributor shall distribute the credit of and of succeeding year till the date of payment. imported by him

1) Due date of sep. of + FY is received after completion certificate.

1

issues a prescribed document for the purposes of Ü If this amount is less than the amount added to output tax liability every month, the Ü Aggregate value of exempt supplies and total turnover excludes the

Ü central tax as central tax or 2 integrated tax distributing the credit of Limit [i.e. 20th Oct of next F.Y] additional amount paid has to be claimed back as credit in GSTR 3 or any month Goods or services or both used for personal —

central excise duty, State excise duty & VAT.

and Ü Central tax, till September of the succeeding year. consumption

Ü State tax, OR

Ü integrated tax as 1

integrated tax or 2central tax, ÜIntegrated tax or

Sec 17(4) : Special option of ITC to banking and F.I. Goods lost, stolen, destroyed, written off or —

Inputs sent for Capital Goods sent for Ü Union territory tax paid on the said services

2) Date of filling Annual Return Avail of every month, an amount equal to 50% of the eligible input tax credit on inputs, capital gooda nd input services in that month and the rest shall lapse disposed of by way of gift or free samples

Note : 100% ITC is available if inward supply from another registered branch under same PAN (except block credit)

Job work Job work Ü State tax as 1

State tax or 2 integrated tax to a supplier of taxable goods or

services or both having the same Permanent Account

by way of issue of a document containing the amount of input tax credit being

distributed in such manner as may be prescribed.

Number as that of the said office. Sec 18 : Reversal of Credit

Where inputs sent for job work – Where capital goods sent for job work Sec 18(1) Availment of Credit Sec 18 (3) Transfer of ITC Reversal of Credit

> Are not received back by the principal after – The Input Service Distributor may distribute the credit of central tax, integrated tax, and state tax subject to the

completion of job-work or otherwise or > are not received back by principal following conditions namely:-

> Are not supplied from the place of business Within a period of 3 years of being a) The credit can be distributed to the recipients of credit against a document containing such details as may

be prescribed (c) (d) In case of Sec 18(4) Reversal of credit

of the job worker as per sec 143 sent, it shall be treated as deemed (a) (b)

Registered person switching from Registered person is exempt

In case of Sec 18 (6) : Reversal of credit on supply

Person applied or Person obtaining - Sale, Amalgamation, Demerger in Special Cases of Capital Goods/ Plant & Machinery on

Within 1 year of being sent, it shall be treated supply by principal to job worker b) the amount of the credit distributed shall not exceed the amount of credit available for distribution registration within voluntary composition levy to normal tax payment supplies becoming a taxable supply Lease, Transfer of business

which ITC has been taken

as deemed supply and ITC if availed shall be c) the credit of tax paid on input services attributable to a recipient of credit, shall be distributed only to that 30 days & becoming Registration

reversed liable for registration Person entitled for ITC on Registered person 1) If capital goods or plant & machinery on

recipient The Registered apportion his ITC in ratio of

- Input as such held in stock Registered person switching from Taxable supply Cancellation which ITC has been taken are supplied

person shall transfer his Value of asset transfered to normal scheme of payment of tax becoming exempt of

d) the credit of tax paid on input services attributable to more than one recipient, shall be distributed on pro Person entitled for ITC on - Inputs contained in semi finished goods unutilized ITC in Ecr ledger

[Removed as such by way of sale

> Nothing contained in this section shall apply to moulds, dies, jigs & fixtures or tools sent out for job work rata basis of No benefit demerged unit to composition Levy Supply Registration transfer barter etc.] then registered

- Input as such held in stock - Inputs contained in finished goods held instock or transferee

- Inputs contained in semi-finished goods on Capital - Capital goods person shall pay higher of the following

- the turnover in state / union territory of such recipient during the relevant period to the aggregate of the 1) Amt to be reversed is equivalent to ITC on

Note:- For inputs – The period of 1 year shall be counted from the date of receipt of inputs by the job worker - Inputs contained in finished goods held in stcok goods [ITC = Input tax - 5% per qtr. or part these of from the date of invoice.] - Input as such held in stock a) Payment = ITC - 5% per at or part

For Capital goods – The period of 3 years shall be counted from the date of receipt of capital goods by the job worker turnover of all such recipients to whom such input service is attributable & which are operational in the Conditions - Inputs contained in semi finished goods

thereof

current year, during the said relevant period If person liable for registration Voluntary Registration Composition to normal : on the date immediately Exempt to taxable : on the date immediately 1) There is a specific provision for transfer of liabilities - Inputs contained in finished goods held in stock

2) Conditions of Rule 41 OR

As per sec 2(68) “job work” means any treatment or process undertaken by a person on goods belonging to another registered person and the e) The credit of tax paid on input services attributable to all recipients of credit shall be distributed amongst On the date immediately preceding on the date immediately preceding the date from which person become liable preceding the date from which such supply - Capital goods [reversal on prorata basis pertaining to remaining useful life in a month (taking

to pay tax under normal scheme become taxable. (a) declaration of details in the form GST ITC 02 for transfer of useful life as 5 yrs.

expression “job worker” shall be construed accordingly; such recipient on pro rata on the basis of the date from which he becomes preceding the date of credit . b) GST on transaction value

liable to pay tax registration After reversal balance if any in Ecr. ledger shall lapse

- - the turnover in state / union territory of such recipient during the relevant period to the aggregate of the 1) As per Sec 18(2) person is not entitled to take ITC if supply of input or capital goods is after expiry of 1 year from the (b) Certification of transfer of liabilities from CA/CMA

date of issue of tax invoice. (c) Acceptance of transferred credit by transferee on common Rule 44 : Procedure & conditions 2) In case of refectories bricks, modules &

As per sec 2(88)“principal” means a person on whose behalf an agent carries on the business of supply or receipt of goods or services or both turnover of all such recipients to whom such input service is attributable & which are operational in the current Important Comment : 2) Imp provisions of rule 40 : 1) Reversal of inputs shall be determined with corresponding invoices. If invoice is not available die, jugs & fixtures supplied as a scrap

portal

year, during the said relevant period If person failed to apply for reg. within 30 days then he is not a) Declaration in form GST ITC of within 30 days

(d) inputs & capital goods so transferred are duly accounted by then reversal is based on prevailing market price of inputs. then person may pay tax on transaction

b) If the aggregate claim amt is more than ` 2,00,000 it should be duly certified by practicing CA or CMA 2) Reversal of ITC shall be calculated separately for CGST, SGST & IGST. value instead of above 2 options.

For detailed discussion of this section refer chapter notes of Input tax credit eligible to take such ITC. c) ITC claimed under clause (c) & (d) of Sec 18(1) shall be crossverified by with details furnished by supplier in form transferee in his books of A/c GS

2

3) Reversal amt. will be added in output tax liability & details to be furnished in GST ITC 03

T

GSTR-1 & GSTR-4 on Common portal.

GS

T2

You might also like

- Valuation, Composition and ITCDocument1 pageValuation, Composition and ITCsowmithNo ratings yet

- GST Charts by Vishal SirDocument3 pagesGST Charts by Vishal SirVikram KatariaNo ratings yet

- CA FINAL GST Chart 3-Ilovepdf-CompressedDocument1 pageCA FINAL GST Chart 3-Ilovepdf-CompressedVedantNo ratings yet

- Vision Collage of Management Kanpur Submitted To, Miss Keerti Tiwari Submitted By, M/S. Anam FatimaDocument24 pagesVision Collage of Management Kanpur Submitted To, Miss Keerti Tiwari Submitted By, M/S. Anam FatimaAnam FatimaNo ratings yet

- GST Pracital Class 2Document7 pagesGST Pracital Class 2Nayan JhaNo ratings yet

- GSTDocument9 pagesGSTCelina AlexNo ratings yet

- GST Debit Note Format in ExcelDocument4 pagesGST Debit Note Format in ExcelVivek PadoleNo ratings yet

- Calculation of Tax Liability Assignment: Rishabh KaushikDocument22 pagesCalculation of Tax Liability Assignment: Rishabh KaushikLkNo ratings yet

- Goods and Services Tax (GST) in India: A Presentation by KRISHNA SHUKLADocument30 pagesGoods and Services Tax (GST) in India: A Presentation by KRISHNA SHUKLAKrishna ShuklaNo ratings yet

- I.K Gujral Punjab Technical University, Jalandhar KapurthalaDocument71 pagesI.K Gujral Punjab Technical University, Jalandhar KapurthalaVishwamittarNo ratings yet

- Goods and Service Tax (GST)Document19 pagesGoods and Service Tax (GST)Saurabh Kumar SharmaNo ratings yet

- Unit1 GSTDocument26 pagesUnit1 GSTAryan SethiNo ratings yet

- Dr. Shakuntala Misra National Rehabilitation University: Lucknow Faculty of LawDocument9 pagesDr. Shakuntala Misra National Rehabilitation University: Lucknow Faculty of LawVimal SinghNo ratings yet

- Implementing GST will boost India's economyDocument3 pagesImplementing GST will boost India's economyVasundhara SinghNo ratings yet

- 51 GST Flyer - Chapter 47 - TDS On GSTDocument5 pages51 GST Flyer - Chapter 47 - TDS On GSTRanjanNo ratings yet

- Understanding Indirect TaxDocument98 pagesUnderstanding Indirect TaxIndhuja MNo ratings yet

- Study On Goods and Services Tax (GST)Document42 pagesStudy On Goods and Services Tax (GST)TARUN BARNo ratings yet

- Chapter 5 Composition Scheme Nov 2020Document41 pagesChapter 5 Composition Scheme Nov 2020Alka GuptaNo ratings yet

- Mathematics Class 10: Goods and Service Tax (GS T)Document10 pagesMathematics Class 10: Goods and Service Tax (GS T)Mohd Yousha AnsariNo ratings yet

- E Way Bill Under GST 1.2Document43 pagesE Way Bill Under GST 1.2Kunal KapadiaNo ratings yet

- GST - A Game Changer: 2. Review of LiteratureDocument3 pagesGST - A Game Changer: 2. Review of LiteratureMoumita Mishra100% (1)

- GST Project ReportDocument29 pagesGST Project ReportHENA KHANNo ratings yet

- Final ReportDocument24 pagesFinal ReportPrachikarambelkarNo ratings yet

- GST Place of SupplyDocument52 pagesGST Place of SupplyDeepaNo ratings yet

- Chanakya National Law University GST ProjectDocument18 pagesChanakya National Law University GST ProjectSHASHI BHUSHANNo ratings yet

- GST PPT Tkil FinalDocument53 pagesGST PPT Tkil FinalVikas SharmaNo ratings yet

- GST Study MaterialDocument30 pagesGST Study Materialkowc kousalyaNo ratings yet

- GST Question BankDocument359 pagesGST Question BankSiddhesh Kamat AzrekarNo ratings yet

- Handbook On Exempted Supplies Under GSTDocument205 pagesHandbook On Exempted Supplies Under GSTkaaryafacilitiesNo ratings yet

- GST Rates on Automobiles Before and After GSTDocument3 pagesGST Rates on Automobiles Before and After GSTsaket kumarNo ratings yet

- GSTDocument55 pagesGSTSheetalNo ratings yet

- GST OverviewDocument15 pagesGST OverviewHimanshu ChandnaNo ratings yet

- GST PPT TaxguruDocument30 pagesGST PPT TaxgurupraveerNo ratings yet

- GST PDFDocument81 pagesGST PDFPankaj JainNo ratings yet

- CA FINAL DT Amendment Book BY Durgesh SinghDocument115 pagesCA FINAL DT Amendment Book BY Durgesh SinghRaviteja GundabattulaNo ratings yet

- Understanding Goods and Services TaxDocument23 pagesUnderstanding Goods and Services TaxTEst User 44452No ratings yet

- Chargeble GSTDocument87 pagesChargeble GSTgopaljha84No ratings yet

- Indian GSTDocument55 pagesIndian GSTShivam KharuleNo ratings yet

- GST BookDocument100 pagesGST BookNaman ChopraNo ratings yet

- GST STeps To File ReturnDocument22 pagesGST STeps To File ReturnAnnu KashyapNo ratings yet

- GST User ManuelDocument195 pagesGST User Manuelsakthi raoNo ratings yet

- GST ArticleDocument5 pagesGST ArticleKumar SurajNo ratings yet

- CH 5 Place of SupplyDocument63 pagesCH 5 Place of SupplyManas Kumar SahooNo ratings yet

- GST Impact On The Supply ChainDocument8 pagesGST Impact On The Supply ChainAamiTataiNo ratings yet

- E-Book On GST by CA. (DR.) G. S. Grewal - 2020Document58 pagesE-Book On GST by CA. (DR.) G. S. Grewal - 2020Aarav DhingraNo ratings yet

- GST Concept Book (Amended)Document185 pagesGST Concept Book (Amended)Ajai SNo ratings yet

- Of The Master of Business AdministrationDocument48 pagesOf The Master of Business AdministrationArun ksNo ratings yet

- Author Name: Shubham MishraDocument17 pagesAuthor Name: Shubham MishraShubham MishraNo ratings yet

- GST Compendium September 2022Document48 pagesGST Compendium September 2022sbsreddyNo ratings yet

- GST ProjectDocument63 pagesGST ProjectPariNo ratings yet

- Audit Under Fiscal Laws GST AuditDocument4 pagesAudit Under Fiscal Laws GST AuditRanjit BhogesaraNo ratings yet

- GST Registration PPT Ver6 28042017Document46 pagesGST Registration PPT Ver6 28042017Sonal AggarwalNo ratings yet

- Narrate The History of GST in IndiaDocument6 pagesNarrate The History of GST in IndiaHari KrishnanNo ratings yet

- Goods and Service Tax (GST)Document17 pagesGoods and Service Tax (GST)Manav SethiNo ratings yet

- GST NotesDocument282 pagesGST NotesMRUNALI KUMBHARNo ratings yet

- GST Economics ProjectDocument11 pagesGST Economics ProjectAbeer ChawlaNo ratings yet

- Comparision Between Pre GST and Post Gst....Document26 pagesComparision Between Pre GST and Post Gst....Yash MalhotraNo ratings yet

- The GST InvoiceDocument2 pagesThe GST Invoiceraju dasNo ratings yet

- GST Basic ChartsDocument48 pagesGST Basic ChartsAvantika SinghNo ratings yet

- M81 CURVE KPI 100 Kontrak 18 Bulan SD Nov'23Document5 pagesM81 CURVE KPI 100 Kontrak 18 Bulan SD Nov'23Dimas TaufiqNo ratings yet

- (Identifying The Appropriate Net Asset Classification) For Each of The Following Transactions, Identify The Net Asset Classification (Document4 pages(Identifying The Appropriate Net Asset Classification) For Each of The Following Transactions, Identify The Net Asset Classification (Kailash KumarNo ratings yet

- Silven Industries, Which Manufactures and Sells A Highly Successful Line of Summer Lotions and Insect RepellentsDocument5 pagesSilven Industries, Which Manufactures and Sells A Highly Successful Line of Summer Lotions and Insect RepellentsKailash KumarNo ratings yet

- Napa Tours Co. Is A Travel Agency. The Nine Transactions Recorded by NapaDocument2 pagesNapa Tours Co. Is A Travel Agency. The Nine Transactions Recorded by NapaKailash KumarNo ratings yet

- Thompson Industrial Products Inc Is A DiversifiedDocument4 pagesThompson Industrial Products Inc Is A DiversifiedKailash KumarNo ratings yet

- Schrand Corporation PurchaseDocument1 pageSchrand Corporation PurchaseKailash KumarNo ratings yet

- Alpha Corporation Issued 2,500 Shares of $4 Par Value Common Stock.Document1 pageAlpha Corporation Issued 2,500 Shares of $4 Par Value Common Stock.Kailash KumarNo ratings yet

- Calculate inventory balances, cost of goods sold, and net income with corrected inventory amountsDocument3 pagesCalculate inventory balances, cost of goods sold, and net income with corrected inventory amountsKailash KumarNo ratings yet

- The Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekDocument4 pagesThe Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekKailash KumarNo ratings yet

- Whispering-Air Is Selling A New Model of High-Efficiency Air ConditionerDocument2 pagesWhispering-Air Is Selling A New Model of High-Efficiency Air ConditionerKailash KumarNo ratings yet

- Jennys FroyoDocument16 pagesJennys FroyoKailash Kumar100% (2)

- On April 1, 2018, Intel Issued $1,600,000 of 12% Face Value Bonds For $1,703,411.40.Document3 pagesOn April 1, 2018, Intel Issued $1,600,000 of 12% Face Value Bonds For $1,703,411.40.Kailash KumarNo ratings yet

- Crane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoDocument1 pageCrane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoKailash KumarNo ratings yet

- On January 1, 20X5, Pirate Company Acquired All of The Outstanding Stock of Ship Inc.,Norwegian Company, ADocument17 pagesOn January 1, 20X5, Pirate Company Acquired All of The Outstanding Stock of Ship Inc.,Norwegian Company, AKailash KumarNo ratings yet

- Crane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoDocument2 pagesCrane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoKailash KumarNo ratings yet

- Is A Construction Company Specializing in Custom PatiosDocument8 pagesIs A Construction Company Specializing in Custom PatiosKailash KumarNo ratings yet

- Turcotte Corp Reported The Following Revenues and Cost of Goods Sodl AmountsDocument1 pageTurcotte Corp Reported The Following Revenues and Cost of Goods Sodl AmountsKailash KumarNo ratings yet

- Pastore Drycleaners Has Capacity To Clean UpDocument4 pagesPastore Drycleaners Has Capacity To Clean UpKailash KumarNo ratings yet

- Periodic Inventory Three MethodsDocument2 pagesPeriodic Inventory Three MethodsKailash KumarNo ratings yet

- Kristen Lu Purchased A Used Automobile ForDocument1 pageKristen Lu Purchased A Used Automobile ForKailash KumarNo ratings yet

- O-Level Accounting Paper 2 Topical and yDocument343 pagesO-Level Accounting Paper 2 Topical and yKailash Kumar100% (3)

- Prince Corporation Acquired 100 Percent of Sword CompanyDocument2 pagesPrince Corporation Acquired 100 Percent of Sword CompanyKailash Kumar50% (2)

- Adjusting Entry Pracyice Perry Company PaidDocument1 pageAdjusting Entry Pracyice Perry Company PaidKailash KumarNo ratings yet

- Calculating differential values and percentages from financial statementsDocument2 pagesCalculating differential values and percentages from financial statementsKailash KumarNo ratings yet

- Accounting entries for asset valuationDocument2 pagesAccounting entries for asset valuationKailash KumarNo ratings yet

- Industry Volume and Market Share Missing DataDocument1 pageIndustry Volume and Market Share Missing DataKailash KumarNo ratings yet

- La Femme Accessories Inc Produces Womens HandbagsDocument1 pageLa Femme Accessories Inc Produces Womens HandbagsKailash KumarNo ratings yet

- Bracey Company Manufactures and Sells One ProductDocument2 pagesBracey Company Manufactures and Sells One ProductKailash KumarNo ratings yet

- Bethany's Bicycle CorporationDocument15 pagesBethany's Bicycle CorporationKailash Kumar100% (2)

- Diamond Hardware Uses The Periodic Inventory SystemDocument7 pagesDiamond Hardware Uses The Periodic Inventory SystemKailash KumarNo ratings yet

- James Kimberley President of National Motors Receives A BonusDocument1 pageJames Kimberley President of National Motors Receives A BonusKailash KumarNo ratings yet

- Science Room Rules Teaching PlanDocument1 pageScience Room Rules Teaching PlanraqibsheenaNo ratings yet

- Bend Steel in Steel BarDocument3 pagesBend Steel in Steel BarMir Masood ShahNo ratings yet

- E No Ad Release NotesDocument6 pagesE No Ad Release NotesKostyantinBondarenkoNo ratings yet

- 26 27 16 Electrical Cabinets and EnclosuresDocument3 pages26 27 16 Electrical Cabinets and EnclosureskaichosanNo ratings yet

- Sp8300 Part CatalogoDocument111 pagesSp8300 Part CatalogoLeonard FreitasNo ratings yet

- 0 Proposal Form Top Up SUBMITTED BY Markandeya Raju PDFDocument3 pages0 Proposal Form Top Up SUBMITTED BY Markandeya Raju PDFHOD (MVGR Civil)No ratings yet

- DowerDocument7 pagesDowerabrash111No ratings yet

- Cladding & Hardfacing ProcessesDocument16 pagesCladding & Hardfacing ProcessesMuhammed SulfeekNo ratings yet

- Practice Ch3Document108 pagesPractice Ch3Agang Nicole BakwenaNo ratings yet

- Innovative Uses of Housing Lifting Techniques-JIARMDocument16 pagesInnovative Uses of Housing Lifting Techniques-JIARMPOOJA VNo ratings yet

- 2 - Brief Report On Logistics Workforce 2019Document39 pages2 - Brief Report On Logistics Workforce 2019mohammadNo ratings yet

- Maisie Klompus Resume 02Document1 pageMaisie Klompus Resume 02api-280374991No ratings yet

- Sharp Ar-Bc260 P S ManDocument382 pagesSharp Ar-Bc260 P S Manxerox226No ratings yet

- PW Trail Beaver Valley Oct 25Document63 pagesPW Trail Beaver Valley Oct 25Pennywise PublishingNo ratings yet

- Chapter Three Business PlanDocument14 pagesChapter Three Business PlanBethelhem YetwaleNo ratings yet

- TruShot Product Sheet-05-18 PDFDocument2 pagesTruShot Product Sheet-05-18 PDFAgostina MiniNo ratings yet

- A Review of Bharat Nirman ProgrammeDocument3 pagesA Review of Bharat Nirman Programmevivek559No ratings yet

- Juno Batistis, Petitioner, V. People of The Philippines, Respondent.Document2 pagesJuno Batistis, Petitioner, V. People of The Philippines, Respondent.Jeff LambayanNo ratings yet

- Practical Approach To Practice 5SDocument4 pagesPractical Approach To Practice 5SNikola DjorovicNo ratings yet

- A Case Study On Design of Ring Footing For Oil Storage Steel TankDocument6 pagesA Case Study On Design of Ring Footing For Oil Storage Steel Tankknight1729No ratings yet

- Improving Network Quality Through RTPO 2.0 InitiativesDocument21 pagesImproving Network Quality Through RTPO 2.0 InitiativesArgya HarishNo ratings yet

- Compound Interest Factor PDFDocument32 pagesCompound Interest Factor PDFFelicia TayNo ratings yet

- US20170335223A1Document18 pagesUS20170335223A1hugo vignoloNo ratings yet

- April 10, 2015 Strathmore TimesDocument28 pagesApril 10, 2015 Strathmore TimesStrathmore TimesNo ratings yet

- ReleaseDocument36 pagesReleasebassamrajehNo ratings yet

- Politics FinalDocument29 pagesPolitics Finalmaychelle mae camanzoNo ratings yet

- Masonry Design and DetailingDocument21 pagesMasonry Design and DetailingKIMBERLY ARGEÑALNo ratings yet

- Power BI 101@ ScaleDocument46 pagesPower BI 101@ ScalePRANAV INDINo ratings yet

- Factors for Marketing Success in Housing SectorDocument56 pagesFactors for Marketing Success in Housing SectorNhyiraba Okodie AdamsNo ratings yet

- Lecture No 5Document41 pagesLecture No 5sami ul haqNo ratings yet