Professional Documents

Culture Documents

781155830NTDOP One Pager April 2018

Uploaded by

Vinay DanthuriCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

781155830NTDOP One Pager April 2018

Uploaded by

Vinay DanthuriCopyright:

Available Formats

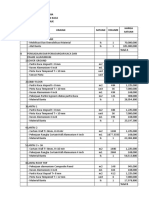

NTDOP Strategy April 2018 Update

Investment Objective Top 10 Holding & Top 5 Sectors

The Strategy aims to deliver superior returns by investing in stocks Scrip Names % Holdings

from sectors that can benefit from the Next Trillion Dollar GDP growth

Kotak Mahindra Bank 11.40

by focusing on different Multicap stocks

Voltas 10.09

Performance Page Industries 8.63

Bajaj Finance 8.61

NTDOP Strategy Nifty 500 5.52X Eicher Motors 6.48

60.00

50.00 City Union Bank 4.56

40.00 Bosch 4.11

30.00 Max Financial Services 4.08

20.00 1.75X Bharat Forge 3.98

10.00

0.00 Godrej Industries 3.95

Mar-13

Mar-08

Mar-09

Mar-10

Mar-11

Mar-12

Mar-14

Mar-15

Mar-16

Mar-17

Mar-18

Sep-08

Dec-08

Sep-09

Sep-10

Sep-11

Sep-12

Sep-13

Sep-14

Sep-15

Sep-16

Sep-17

Dec-17

Dec-07

Dec-09

Dec-10

Dec-11

Dec-12

Dec-13

Dec-14

Dec-15

Dec-16

Jun-08

Jun-09

Jun-10

Jun-11

Jun-12

Jun-13

Jun-14

Jun-15

Jun-16

Jun-17

Sectors % Allocation

Banking & Finance 32.00

FMCG 16.38

NTDOP Strategy Nifty 500

30.27 Auto & Auto Ancillaries 14.56

28.06

Diversified 14.04

23.54

22.01 Oil & Gas 6.52

17.53 17.99

15.99 14.96 Cash 0.45

14.28

11.47

10.72

8.50 8.82 Market Capitalization

5.59

Market Capitalization % Equity

Large cap 41.02

1 year 2 Year 3 Years 4 Years 5 Years 10 years Since Inception Midcap 48.94

Smallcap 9.59

Performance Attribution Analysis (1 Year Trailing 31st March 2018) Weighted Average Market Cap (Rs. in Crs) 53618.14

Scrip Contribution Scrip Contribution Risk Ratios

Voltas 3.80% Godrej Industries 0.30% 1 Year Data Scheme Benchmark

Page Industries 3.60% Emami 0.20% Standard Deviation 13.32% 10.65%

Beta 0.96 1.00

Bajaj Finance 3.40% Colgate-Palmolive (India) 0.10% Sharpe Ratio 0.68 0.45

Upside Capture 0.97 1.00

Kotak Mahindra Bank 1.70% Ipca Laboratories 0.10% Downside Capture 0.97 1.00

L&T Technology Services 1.40% Engineers India 0.10%

City Union Bank 1.20% Bayer CropScience -0.20%

Bharat Forge 1.20% Jammu & Kashmir Bank -0.20% Portfolio Fundamentals

Eicher Motors 0.90% Alkem Laboratories -0.30% TTM* FY18E FY19E

Aegis Logistics 0.80% Cummins India -0.80% PAT Growth 18% 23% 24%

HPCL 0.60% Federal Bank -0.80%

RoE 20% 21% 22%

PE 43 37 29

Development Credit Bank 0.50% Max Financial Services -1.10%

Container Corpn. Of India 0.40% Bosch -1.20%

Glaxosmithkline Consumer

0.40%

Ageing

Healthcare

No. of Scrips Holding Period

Adjusted Market Rate as on 2 Since Inception

Stock Purchase Date Purchase % Growth

31-Mar-18 12 > 5 Years

Price

Page Industries Dec-07 456 22,685 4871% 5 > 2 Years but < 5 Years

Bajaj Finance Aug-10 63 1,768 2726% 5 < 2 Years

Eicher Motors Aug-10 1174 28,373 2318% The average holding period for stocks held under NTDOP Strategy is

HPCL Jun-14 98 345 252% over 5 years 1 month

Bosch Dec-07 4864 18,018 270%

Emami Oct-12 292 1,069 266%

Disclaimers and Risk Factors

: NTDOP Strategy Inception Date: 5th Dec 2007 :: Data as on 31st March 2018 :: Data Source: MOAMC Internal Research :: RFR: 7.25% ::*For December quarter

Please Note: The above strategy returns are of a Model Client as on 31st March 2018. Returns of individual clients may differ depending on time of entry in the Strategy. Past

performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. Returns below 1 year are absolute and above 1 year are

annualized. Strategy returns shown above are post fees & expenses. The stocks forming part of the existing portfolio under NTDOP Strategy may or may not be bought for new client.

Name of the PMS Strategy does not in any manner indicate its future prospects and returns. The Company names mentioned above is only for the purpose of explaining the concept

and should not be construed as recommendations from MOAMC.

You might also like

- Group Case: Manjit's Meal DeliveryDocument3 pagesGroup Case: Manjit's Meal DeliveryVinay DanthuriNo ratings yet

- Sample Business ReportDocument12 pagesSample Business ReportVinay DanthuriNo ratings yet

- Apple and Nokia: The Transformation From Products To ServicesDocument19 pagesApple and Nokia: The Transformation From Products To ServicesAnas BahrNo ratings yet

- Apple and Nokia: The Transformation From Products To ServicesDocument19 pagesApple and Nokia: The Transformation From Products To ServicesAnas BahrNo ratings yet

- Business Ethics CSR-2Document7 pagesBusiness Ethics CSR-2Vinay DanthuriNo ratings yet

- Anamika CaseDocument6 pagesAnamika CaseVinay DanthuriNo ratings yet

- Business Ethics andDocument3 pagesBusiness Ethics andVinay DanthuriNo ratings yet

- Vinay Danthuri (2131578) University Canada West BUSI 601: Ethics, CSR, and Business Environment Prof. Sylvain Charbonneau June 10, 2022Document21 pagesVinay Danthuri (2131578) University Canada West BUSI 601: Ethics, CSR, and Business Environment Prof. Sylvain Charbonneau June 10, 2022Vinay DanthuriNo ratings yet

- Acct 621-45 Spring 2022 - Sarvir HothiDocument7 pagesAcct 621-45 Spring 2022 - Sarvir HothiVinay DanthuriNo ratings yet

- Behavioral Assignment Vinay.dDocument9 pagesBehavioral Assignment Vinay.dVinay DanthuriNo ratings yet

- Monthly Investment Guidance April 2018Document33 pagesMonthly Investment Guidance April 2018Vinay DanthuriNo ratings yet

- 0361 Aacc Usd PB GemDocument40 pages0361 Aacc Usd PB GemVinay DanthuriNo ratings yet

- Project Portfolio Management Implementation ReviewDocument10 pagesProject Portfolio Management Implementation ReviewVinay DanthuriNo ratings yet

- Security Analysis and Portfolio Management Mba Project ReportDocument75 pagesSecurity Analysis and Portfolio Management Mba Project ReportJyostna Kollamgunta70% (10)

- Reoprt On "Portfolio Management Services" by Sharekhan Stock Broking LimitedDocument111 pagesReoprt On "Portfolio Management Services" by Sharekhan Stock Broking LimitedAshutosh Rathod91% (22)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- ExamplesDocument5 pagesExamplesAstraea KimNo ratings yet

- UTI-GTB Merger Lessons for Future Bank MergersDocument4 pagesUTI-GTB Merger Lessons for Future Bank MergersManmeet KaurNo ratings yet

- PEST Analysis Test ACCADocument5 pagesPEST Analysis Test ACCAAshwin Jain0% (1)

- The Perspective of Camping Tourism in Romania: Andreea Marin-PantelescuDocument9 pagesThe Perspective of Camping Tourism in Romania: Andreea Marin-PantelescumoiseelenaNo ratings yet

- Suspense Magazine November December 2018Document104 pagesSuspense Magazine November December 2018Riyaansh MittalNo ratings yet

- Sc2 Self Certification FormDocument2 pagesSc2 Self Certification FormdiannehoosonNo ratings yet

- 6a Prepare and Process Banking DocumentsDocument3 pages6a Prepare and Process Banking Documentsapi-27922856750% (2)

- Potentialities of Capitalism in Mughal IndiaDocument47 pagesPotentialities of Capitalism in Mughal IndiamzubairabbasiNo ratings yet

- Effect of Adoption of Taxpro Max On Firs Tax Remittance in NigeriaDocument8 pagesEffect of Adoption of Taxpro Max On Firs Tax Remittance in NigeriaEditor IJTSRDNo ratings yet

- Feasibility Report Honda SP 125Document10 pagesFeasibility Report Honda SP 125chthakorNo ratings yet

- TEF 1000 NAMES 2019 TEF Partners 1 .01Document7 pagesTEF 1000 NAMES 2019 TEF Partners 1 .01KAMPAMBA LUKWESANo ratings yet

- D Internet Myiemorgmy Iemms Assets Doc Alldoc Document 2618 Jurutera Nov 2012 OptDocument56 pagesD Internet Myiemorgmy Iemms Assets Doc Alldoc Document 2618 Jurutera Nov 2012 OptsallymazeeraNo ratings yet

- Technical Data: Ex-Control Switch Typ 292 Without and Typ 293 With Measuring InstrumentDocument5 pagesTechnical Data: Ex-Control Switch Typ 292 Without and Typ 293 With Measuring InstrumentAli RazaNo ratings yet

- Kevin Byun's Q1 2010 Denali Investors LetterDocument9 pagesKevin Byun's Q1 2010 Denali Investors LetterThe Manual of IdeasNo ratings yet

- Schloss-10 11 06Document3 pagesSchloss-10 11 06Logic Gate CapitalNo ratings yet

- Indifference CurveDocument10 pagesIndifference Curveamit kumar dewanganNo ratings yet

- RENCANA ANGGARAN BIAYA PEMASANGAN KACA PROYEK GEDUNG 21 AVENUEDocument5 pagesRENCANA ANGGARAN BIAYA PEMASANGAN KACA PROYEK GEDUNG 21 AVENUEAswal Al-fakirNo ratings yet

- Chapter 1 - Introduction To Food MarketingDocument42 pagesChapter 1 - Introduction To Food MarketingMong Titya79% (14)

- Archive of Aurelius Ammon, Scholasticus, Son of Petearbeschinis 2Document13 pagesArchive of Aurelius Ammon, Scholasticus, Son of Petearbeschinis 2Nabil RoufailNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument8 pagesRequest For Taxpayer Identification Number and Certificationxintong liuNo ratings yet

- Corona Marketing PlanDocument52 pagesCorona Marketing PlanDina AlfawalNo ratings yet

- 2nd Ra BillDocument6 pages2nd Ra Billalok kumarNo ratings yet

- Handicraft ReportDocument38 pagesHandicraft ReportMohd Danish Hussain0% (1)

- Net BankingDocument2 pagesNet BankingJayNo ratings yet

- Specific Instuctions To BiddersDocument33 pagesSpecific Instuctions To BiddersErin JohnsonNo ratings yet

- Gold - Regional Report Vietnam InvestmentDocument48 pagesGold - Regional Report Vietnam InvestmentRaven LyNo ratings yet

- Kiaer Christina Imagine No Possessions The Socialist Objects of Russian ConstructivismDocument363 pagesKiaer Christina Imagine No Possessions The Socialist Objects of Russian ConstructivismAnalía Capdevila100% (2)

- Starbucks Exposed For Avoiding Millions in TaxDocument2 pagesStarbucks Exposed For Avoiding Millions in Taxapi-302252730No ratings yet

- Reactor Modeling and Simulations in Synthesis Gas ProductionDocument39 pagesReactor Modeling and Simulations in Synthesis Gas ProductionSteven Sandoval100% (1)

- Hindi Book-BINA AUSHADHI KE KAYAKALP by Shri Ram Sharma PDFDocument48 pagesHindi Book-BINA AUSHADHI KE KAYAKALP by Shri Ram Sharma PDFAnil S ChaudharyNo ratings yet