Professional Documents

Culture Documents

Factors To Be Taken Into Account While Computing Compensation Under Motor Vehicles Act

Uploaded by

Lavkesh BhambhaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Factors To Be Taken Into Account While Computing Compensation Under Motor Vehicles Act

Uploaded by

Lavkesh BhambhaniCopyright:

Available Formats

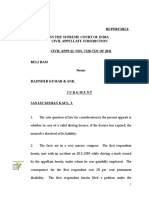

FACTORS TO BE TAKEN INTO ACCOUNT WHILE COMPUTING COMPENSATION

UNDER MOTOR VEHICLES ACT

INTRODUCTION

The Motor Vehicle Act, 1988 envisages multiple provisions with respect to compensation to

victims in case of accidental injury or death caused due to motor vehicles plying on the roads.

The said consolidates and amends the previous law relating to motor vehicles i.e. The Motor

Vehicles Act, 1939.

RELEVANT PROVISIONS

Sections 140 provides for interim compensation on ‘No Fault’ Basis. According to this

provision Rs. 50,000/- is to be given to the kith and kin of the deceased and Rs.

25,000/- to the grievously injured victim.

Section 163 provides for compensation on the basis of structured formula given under

Second Schedule, the compensation can be claimed in case of death or permanent

disablement of a person in a motor vehicle accident.

Section 163-A articulates the Alternative method of compensation or Payment of

Compensation on structured formulae basis. Under this provision the owner of the

motor vehicle of the authorized insurer shall be liable to pay in the case of death or

permanent disablement due to accident arising out of the use of motor vehicle,

compensation, as indicated in the Second Schedule, to the legal heirs or the victim as

the case may be.

Section 166 provides that in case of hit and run motor accidents the compensation of

Rs. 25,000/- shall be paid if the accident results in death of any person and Rs. 12,500/-

LANDMARK JUDGMENTS

Supe Dei v. National Insurance Company Limited [(2009) 4 SCC 513]

The Apex Court in this case has opined that the position is well settled that the Second

Schedule under Section 163-A to the Act which gives the amount of compensation to be

determined for the purpose of claim under the section can be taken as a guideline while

determining the compensation under Section 166 of the Act.

Sarla Verma v. DTC [(2009) 6 SCC 121]

The Court laid down the facts which are needed to be established for assessing

compensation in case of death :

1. Age of the deceased

2. Income of the deceased

3. Number of dependants

RECENT JUDGMENTS

National Insurance Company Limited v Pranay Sethi and Ors. [SLP (CIVIL) NO.

25590 OF 2014]

The Apex Court in this landmark judgment laid down following guidelines which the

tribunal should keep in mind while determining the compensation under MV Act:

1. Addition of future prospects to determine the multiplicand– The determination of

income while computing compensation has to include future prospects so that the

method will come within the ambit and sweep of just compensation as postulated

under Section 168 of the Act.

2. The selection of multiplier shall be as indicated in the Table in Sarla Verma case.

3. The age of the deceased should be the basis for applying the multiplier.

4. Reasonable figures on conventional heads, namely, loss of estate, loss of

consortium and funeral expenses should be Rs. 15,000/-, Rs. 40,000/- and Rs.

15,000/- respectively. The aforesaid amounts should be enhanced at the rate of 10%

in every three years.

You might also like

- SUBMISSION TORTS (Nikhil Kumar Karn 1054)Document17 pagesSUBMISSION TORTS (Nikhil Kumar Karn 1054)NikhilNo ratings yet

- Project Report On: Application For Grant of Compensation Under Section 166 of Motor Vehical Act, 1988Document16 pagesProject Report On: Application For Grant of Compensation Under Section 166 of Motor Vehical Act, 1988Hanu MittalNo ratings yet

- The Oriental Insurance Co. Ltd. v. Hansrajbhai V. Kodala & Others (2001) 5 SCC 175-Interpretation of StatutesDocument7 pagesThe Oriental Insurance Co. Ltd. v. Hansrajbhai V. Kodala & Others (2001) 5 SCC 175-Interpretation of Statutesadv_animeshkumar100% (1)

- Reshma Vs MadanDocument34 pagesReshma Vs MadanBar & BenchNo ratings yet

- Compensation Under Section 163-A of The Motor Vehicles Act - Need For Review of Supreme CourtDocument4 pagesCompensation Under Section 163-A of The Motor Vehicles Act - Need For Review of Supreme CourtAST TROLLINGNo ratings yet

- Motor Vehicle ActDocument2 pagesMotor Vehicle ActAmrit chutiaNo ratings yet

- No Fault Liability PDFDocument10 pagesNo Fault Liability PDFfaizan waniNo ratings yet

- Assessment of Compensation in Motor Accident Claim CasesDocument5 pagesAssessment of Compensation in Motor Accident Claim Casesrkaran22No ratings yet

- Case Analysis On Manjuri Bera v. The Oriental Insurance Company Ltd.Document10 pagesCase Analysis On Manjuri Bera v. The Oriental Insurance Company Ltd.Siddharth soniNo ratings yet

- Manipal University Jaipur School of LawDocument13 pagesManipal University Jaipur School of LawadityaNo ratings yet

- The Motor Vehicles Act PDFDocument5 pagesThe Motor Vehicles Act PDFAnupamaNo ratings yet

- High Court Delays Justice for Road Accident VictimsDocument8 pagesHigh Court Delays Justice for Road Accident VictimsdaljitsodhiNo ratings yet

- 858 Manusha Sreekumar v United India Insurance Co Ltd 17 Oct 2022 440330 (1)Document6 pages858 Manusha Sreekumar v United India Insurance Co Ltd 17 Oct 2022 440330 (1)iamkathir2001No ratings yet

- List Amendments M V Act 23.04.2022Document7 pagesList Amendments M V Act 23.04.2022Diksha MishraNo ratings yet

- Transportation Law Project (Raj Vardhan Agarwal) BBA - LLB (H) 8th SemesterDocument14 pagesTransportation Law Project (Raj Vardhan Agarwal) BBA - LLB (H) 8th Semesterraj vardhan agarwalNo ratings yet

- Claims TribunalDocument7 pagesClaims TribunalPriyanka Porwal JainNo ratings yet

- Pranay SethiDocument1 pagePranay SethiNikhilparakhNo ratings yet

- Award in Motor AccidentcasesDocument178 pagesAward in Motor Accidentcasesverma associateNo ratings yet

- 11_chapter+3Document27 pages11_chapter+3Akanksha PandeyNo ratings yet

- Notes On 174 - Pay and Recovery 1Document14 pagesNotes On 174 - Pay and Recovery 1Haritha DharmarajanNo ratings yet

- 11 - Chapter 3 PDFDocument79 pages11 - Chapter 3 PDFFaizan BhatNo ratings yet

- MOTOR InsuranceDocument95 pagesMOTOR InsuranceRajat ShuklaNo ratings yet

- Rajesh Tyagi Case (Delhi High Court Judgement)Document19 pagesRajesh Tyagi Case (Delhi High Court Judgement)PrasannaKadethotaNo ratings yet

- Insurance Co seeks compensation under MV ActDocument13 pagesInsurance Co seeks compensation under MV ActAldrin ZothanmawiaNo ratings yet

- Define Term Hit and Run Motor Accident Under the Motor Vehicle (Amendment) Act, 2019Document8 pagesDefine Term Hit and Run Motor Accident Under the Motor Vehicle (Amendment) Act, 2019Debalina ChakrabortyNo ratings yet

- The Motor Vehicle Act, 1988Document14 pagesThe Motor Vehicle Act, 1988Hiba AmmuNo ratings yet

- GPE (India) Ltd. v. Twarit Consultancy Services Pvt. Ltd.Document20 pagesGPE (India) Ltd. v. Twarit Consultancy Services Pvt. Ltd.Samakshi PandeyNo ratings yet

- MACP Reference Manual-2014Document102 pagesMACP Reference Manual-2014HANIF S. MULIANo ratings yet

- Dharmendra gurjar, COMPENSATION CASE LAWDocument5 pagesDharmendra gurjar, COMPENSATION CASE LAWutkarshdubey.capNo ratings yet

- Deepika LL.M.IV Apr 2020 Iv-Converted 17-4 PDFDocument7 pagesDeepika LL.M.IV Apr 2020 Iv-Converted 17-4 PDFVELUSAMY MNo ratings yet

- J 2007 SCC OnLine Jhar 723 2007 4 JLJR 659 Aryan1996arora Gmailcom 20230616 091147 1 4Document4 pagesJ 2007 SCC OnLine Jhar 723 2007 4 JLJR 659 Aryan1996arora Gmailcom 20230616 091147 1 4Ritwik BatraNo ratings yet

- Compensation Under The Workmen's Compensation Act 1923 Viz A Viz Motor Vehicle Act 1988 1Document19 pagesCompensation Under The Workmen's Compensation Act 1923 Viz A Viz Motor Vehicle Act 1988 1hrteam.kolkataNo ratings yet

- National Insurance Co LTD Vs Mahendra Singh and OrR050743COM615621Document4 pagesNational Insurance Co LTD Vs Mahendra Singh and OrR050743COM615621Nisha ShivakumarNo ratings yet

- MACTs Directed by SC To Choose Correct Multiplier As Per Age of Deceased For CompensationDocument9 pagesMACTs Directed by SC To Choose Correct Multiplier As Per Age of Deceased For CompensationLatest Laws TeamNo ratings yet

- New India Assurance Co LTD Vs Srikakulapu AyyababuA090713COM339330Document9 pagesNew India Assurance Co LTD Vs Srikakulapu AyyababuA090713COM339330SiddhantNo ratings yet

- Kurvan Ansari Alias Kurvan Ali VS Shyam Kishore Murmu PDFDocument3 pagesKurvan Ansari Alias Kurvan Ali VS Shyam Kishore Murmu PDFM. NAGA SHYAM KIRANNo ratings yet

- L.G.R. Enterprises v. P. AnbazhagDocument7 pagesL.G.R. Enterprises v. P. AnbazhagRakshit GuptaNo ratings yet

- Motor Accidents Claims Tribunal MACTDocument18 pagesMotor Accidents Claims Tribunal MACTविशाल चव्हाणNo ratings yet

- No fault liablity - casesDocument4 pagesNo fault liablity - casesVaibhav BhardwajNo ratings yet

- Motor Vehicles Claims Tribunals: Jurisdiction and Powers ExplainedDocument21 pagesMotor Vehicles Claims Tribunals: Jurisdiction and Powers ExplainedVivek GurnaniNo ratings yet

- Macp Reference ManualDocument92 pagesMacp Reference ManualArjun ChopraNo ratings yet

- Rajasthan State Road Transport Corporation and Orss Case On Labour LawDocument16 pagesRajasthan State Road Transport Corporation and Orss Case On Labour LawKishita GuptaNo ratings yet

- Efore Inod Umar OY AND UD AND Emant UptaDocument12 pagesEfore Inod Umar OY AND UD AND Emant UptaPrakhar AgarwalNo ratings yet

- CHAPTER X LIABILITY WITHOUT FAULT IN CERTAIN CASES - Patil & AssociatesDocument5 pagesCHAPTER X LIABILITY WITHOUT FAULT IN CERTAIN CASES - Patil & AssociatesDama ScenoneNo ratings yet

- State of Maharashtra v. Madhukar Balkrishna PDFDocument7 pagesState of Maharashtra v. Madhukar Balkrishna PDFSandeep Kumar VermaNo ratings yet

- LL.B 1 Semester Paper - Iv Law of Torts, Consumer Protection and Motor Vehicles ActDocument15 pagesLL.B 1 Semester Paper - Iv Law of Torts, Consumer Protection and Motor Vehicles ActFaizan BhatNo ratings yet

- TRANSPORTATION LAWDocument15 pagesTRANSPORTATION LAWSHEKHAWAT FAMILYNo ratings yet

- Licensed To:: Finder Doc Id # 918174 Use Law Finder Doc Id For CitationDocument20 pagesLicensed To:: Finder Doc Id # 918174 Use Law Finder Doc Id For CitationBakash ArshNo ratings yet

- J 2021 SCC OnLine Del 5428 Prabhatsingh19 Nludelhiacin 20230323 132257 1 3Document3 pagesJ 2021 SCC OnLine Del 5428 Prabhatsingh19 Nludelhiacin 20230323 132257 1 3PRAFULL BHARDWAJNo ratings yet

- Note of 780 of 2012-DBDocument10 pagesNote of 780 of 2012-DBRishabh BhandariNo ratings yet

- Union of India (Uoi) and Ors.Document7 pagesUnion of India (Uoi) and Ors.MOUSOM ROYNo ratings yet

- National Insurance Company LTD Vs Sinitha & OrsDocument39 pagesNational Insurance Company LTD Vs Sinitha & OrsAshish DavessarNo ratings yet

- Tag this Motor Vehicles Act JudgmentDocument7 pagesTag this Motor Vehicles Act JudgmentMOUSOM ROYNo ratings yet

- DN GhoshDocument9 pagesDN GhoshShreesha Bhat KailankajeNo ratings yet

- Drafting, Pleading and Conveyance: Project Report OnDocument12 pagesDrafting, Pleading and Conveyance: Project Report Ontushal bagriNo ratings yet

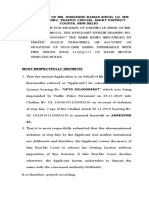

- Reportable in The Supreme Court of India Civil Appellate Jurisdiction CIVIL APPEAL NOS. 7220-7221 OF 2011 Beli Ram AppellantDocument19 pagesReportable in The Supreme Court of India Civil Appellate Jurisdiction CIVIL APPEAL NOS. 7220-7221 OF 2011 Beli Ram AppellantPrakhar SinghNo ratings yet

- Insurance Presentation SpeechDocument5 pagesInsurance Presentation SpeechgouravbosenhgssNo ratings yet

- ILECO III and SIPC PSC ApprovalDocument19 pagesILECO III and SIPC PSC ApprovalSamMooreNo ratings yet

- The State Rep. By2.SatheeDocument7 pagesThe State Rep. By2.SatheeMOUSOM ROYNo ratings yet

- MutationDocument6 pagesMutationLavkesh BhambhaniNo ratings yet

- Lease of Immovable Property Under Transfer of Property Ac1Document16 pagesLease of Immovable Property Under Transfer of Property Ac1Lavkesh BhambhaniNo ratings yet

- RTI For Damaged Waste MaterialsDocument2 pagesRTI For Damaged Waste MaterialsLavkesh BhambhaniNo ratings yet

- Complaint - Us 138 Ni ActDocument15 pagesComplaint - Us 138 Ni ActLavkesh Bhambhani100% (8)

- Sources of International LawDocument19 pagesSources of International LawLavkesh BhambhaniNo ratings yet

- Case LawDocument1 pageCase LawLavkesh BhambhaniNo ratings yet

- In The Court of Mr. Himanshu Raman Singh, Ld. Mm-02, (Sukhdev, Traffic Circle), Saket District Courts, New DelhiDocument2 pagesIn The Court of Mr. Himanshu Raman Singh, Ld. Mm-02, (Sukhdev, Traffic Circle), Saket District Courts, New DelhiLavkesh Bhambhani100% (1)

- FD Releasing ApplicationDocument3 pagesFD Releasing ApplicationLavkesh Bhambhani75% (4)

- Superdari ApplicationDocument4 pagesSuperdari ApplicationLavkesh Bhambhani100% (2)

- Final Thesis (Dated On 17 August - 14)Document348 pagesFinal Thesis (Dated On 17 August - 14)Prateek Bansal100% (1)

- Appeal affidavit before Appellate Tribunal for ElectricityDocument1 pageAppeal affidavit before Appellate Tribunal for ElectricityLavkesh BhambhaniNo ratings yet

- Supreme Court of India Judgment in Triple Talaq CaseDocument395 pagesSupreme Court of India Judgment in Triple Talaq CaseIndia TVNo ratings yet

- Dispute over unpaid invoices and export order cancellationDocument6 pagesDispute over unpaid invoices and export order cancellationLavkesh Bhambhani50% (4)

- Act 06Document9 pagesAct 06Lavkesh BhambhaniNo ratings yet

- CoL Unit 3Document24 pagesCoL Unit 3Lavkesh BhambhaniNo ratings yet

- The History and Development of Islamic Law: WaiteDocument12 pagesThe History and Development of Islamic Law: WaiteLavkesh Bhambhani100% (1)

- Judicial Interpretation: Duty of Executing Court To Determine True Extent of DecreeDocument1 pageJudicial Interpretation: Duty of Executing Court To Determine True Extent of DecreeLavkesh BhambhaniNo ratings yet

- Note Notification ObcDocument1 pageNote Notification ObcLavkesh BhambhaniNo ratings yet

- Case NoteDocument1 pageCase NoteLavkesh BhambhaniNo ratings yet

- Para 17 Govt. TeacherDocument9 pagesPara 17 Govt. TeacherLavkesh BhambhaniNo ratings yet

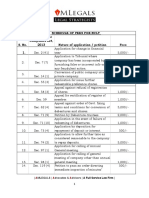

- Schedule of Fees in NCLT 1Document4 pagesSchedule of Fees in NCLT 1Lavkesh BhambhaniNo ratings yet

- Case NoteDocument1 pageCase NoteLavkesh BhambhaniNo ratings yet

- 009 - Police Investigation - A Review (260-271)Document12 pages009 - Police Investigation - A Review (260-271)Lavkesh BhambhaniNo ratings yet

- BIBLIOGRAPHYDocument1 pageBIBLIOGRAPHYLavkesh BhambhaniNo ratings yet

- CRPC ProjectDocument19 pagesCRPC ProjectHarry PunyaniNo ratings yet

- Acknowledgement CRPCDocument1 pageAcknowledgement CRPCLavkesh BhambhaniNo ratings yet

- Criminal Procedure Bibliography Books & WebsitesDocument1 pageCriminal Procedure Bibliography Books & WebsitesLavkesh BhambhaniNo ratings yet

- Gambling laws in UK and USDocument2 pagesGambling laws in UK and USLavkesh BhambhaniNo ratings yet

- Lease Agreement ZiaDocument5 pagesLease Agreement ZiaLavkesh BhambhaniNo ratings yet

- Affirmative Action in India: Ensuring Equality and Social JusticeDocument11 pagesAffirmative Action in India: Ensuring Equality and Social JusticeDeepa MoondraNo ratings yet

- The Page Cannot Be Found: Custom Error MessagesDocument14 pagesThe Page Cannot Be Found: Custom Error MessagesMuhammad Umar AshrafNo ratings yet

- NTA Doorman Diversion Warning Letter June 2008Document2 pagesNTA Doorman Diversion Warning Letter June 2008TaxiDriverLVNo ratings yet

- GN12 WTIA Comparison of Welding Inspector Qualifications and CertificationsDocument4 pagesGN12 WTIA Comparison of Welding Inspector Qualifications and Certificationskarl0% (1)

- TeSys D - LC1DWK12M7Document3 pagesTeSys D - LC1DWK12M7anm bNo ratings yet

- BOA Firm ListDocument48 pagesBOA Firm ListHtet Aung LinNo ratings yet

- Uyguangco v. CADocument7 pagesUyguangco v. CAAbigail TolabingNo ratings yet

- Case StudyDocument15 pagesCase Studysonam shrivasNo ratings yet

- The Medical Act of 1959Document56 pagesThe Medical Act of 1959Rogelio Junior RiveraNo ratings yet

- Duterte's 1st 100 Days: Drug War, Turning from US to ChinaDocument2 pagesDuterte's 1st 100 Days: Drug War, Turning from US to ChinaALISON RANIELLE MARCONo ratings yet

- Cins Number DefinitionDocument3 pagesCins Number DefinitionJohnny LolNo ratings yet

- Legal Status of Health CanadaDocument11 pagesLegal Status of Health CanadaMarc Boyer100% (2)

- Phil Hawk Vs Vivian Tan Lee DigestDocument2 pagesPhil Hawk Vs Vivian Tan Lee Digestfina_ong62590% (1)

- Sec - Governance ReviewerDocument4 pagesSec - Governance ReviewerAngela Abrea MagdayaoNo ratings yet

- Instant Download Foundations of Analog and Digital Electronic Circuits Issn PDF FREEDocument32 pagesInstant Download Foundations of Analog and Digital Electronic Circuits Issn PDF FREEjoyce.parkman948100% (43)

- Form OAF YTTaInternationalDocument5 pagesForm OAF YTTaInternationalmukul1saxena6364No ratings yet

- 1 2 PNP Professional Code of Conduct and Ethical StandardsDocument47 pages1 2 PNP Professional Code of Conduct and Ethical Standardsunknown botNo ratings yet

- Magnolia Dairy Products Corporation v. NLRC, G.R. No. 114952, January 29, 1996Document3 pagesMagnolia Dairy Products Corporation v. NLRC, G.R. No. 114952, January 29, 1996Katrina Pamela AtinNo ratings yet

- Guide To Plan Management PDFDocument20 pagesGuide To Plan Management PDFArrigo Lupori100% (1)

- BasketballDocument24 pagesBasketballnyi waaaah rahNo ratings yet

- SENSE AND SENSIBILITY ANALYSIS - OdtDocument6 pagesSENSE AND SENSIBILITY ANALYSIS - OdtannisaNo ratings yet

- LTC ApllDocument4 pagesLTC ApllSimranNo ratings yet

- DV Consulting Inc Summary of ServicesDocument5 pagesDV Consulting Inc Summary of ServicesDv AccountingNo ratings yet

- Pacific University Under Federal Investigation For Excluding White PeopleDocument3 pagesPacific University Under Federal Investigation For Excluding White PeopleThe College FixNo ratings yet

- Applications Forms 2 EL BDocument2 pagesApplications Forms 2 EL Bilerioluwa akin-adeleyeNo ratings yet

- Notice: Valid Existing Rights Determination Requests: Daniel Boone National Forest, KY Existing Forest Service Road UseDocument5 pagesNotice: Valid Existing Rights Determination Requests: Daniel Boone National Forest, KY Existing Forest Service Road UseJustia.comNo ratings yet

- Test FAR 570 Feb 2021Document2 pagesTest FAR 570 Feb 2021Putri Naajihah 4GNo ratings yet

- ASEAN Integration Opens Philippines to Regional Economic GrowthDocument40 pagesASEAN Integration Opens Philippines to Regional Economic GrowthTESDA Korea-Phil. Information Technology Training CenterNo ratings yet

- Understanding ASEAN: Its Systems & StructuresDocument59 pagesUnderstanding ASEAN: Its Systems & StructureskaiaceegeesNo ratings yet

- Title Pages 1. 2: 22167 Sexuality, Gender and The Law STUDENT ID: 201604269Document21 pagesTitle Pages 1. 2: 22167 Sexuality, Gender and The Law STUDENT ID: 201604269Joey WongNo ratings yet