Professional Documents

Culture Documents

ICICI Bank Analysis

Uploaded by

Ankita DasCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ICICI Bank Analysis

Uploaded by

Ankita DasCopyright:

Available Formats

-------------------

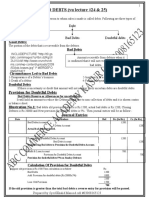

Standalone Balance

in Rs. Cr.

Sheet

-------------------

Mar '17 Mar '16 Mar '15 Mar '14 Mar '13

12 mths 12 mths 12 mths 12 mths 12 mths

Capital and Liabilities:

Total Share Capital 1,165.11 1,163.17 1,159.66 1,155.04 1,153.64

Equity Share Capital 1,165.11 1,163.17 1,159.66 1,155.04 1,153.64

Share Application Money 6.26 6.7 7.44 6.57 4.48

Reserves 95,737.57 85,748.24 79,262.26 72,051.71 65,547.84

Net Worth 96,908.94 86,918.11 80,429.36 73,213.32 66,705.96

Deposits 490,039.06 421,425.71 361,562.73 331,913.66 292,613.63

Borrowings 147,556.15 174,807.38 172,417.35 154,759.05 145,341.49

Total Debt 637,595.21 596,233.09 533,980.08 486,672.71 437,955.12

Other Liabilities &

34,245.16 34,726.44 31,719.86 34,755.55 32,133.60

Provisions

Total Liabilities 768,749.31 717,877.64 646,129.30 594,641.58 536,794.68

Mar '17 Mar '16 Mar '15 Mar '14 Mar '13

12 mths 12 mths 12 mths 12 mths 12 mths

Assets

Cash & Balances with RBI 31,702.41 27,106.09 25,652.91 21,821.83 19,052.73

Balance with Banks, Money

44,010.66 32,762.65 16,651.71 19,707.77 22,364.79

at Call

Advances 464,232.08 435,263.94 387,522.07 338,702.65 290,249.44

Investments 161,506.55 160,411.80 186,580.03 177,021.82 171,393.60

Gross Block 7,805.21 7,576.92 4,725.52 4,678.14 4,647.06

Revaluation Reserves 3,042.14 2,817.47 0 0 0

Net Block 4,763.07 4,759.45 4,725.52 4,678.14 4,647.06

Other Assets 62,534.55 57,573.70 24,997.05 32,709.39 29,087.07

Total Assets 768,749.32 717,877.63 646,129.29 594,641.60 536,794.69

Contingent Liabilities 1,053,616.90 922,453.51 868,190.58 794,965.35 802,383.84

Book Value (Rs) 166.37 149.47 138.72 634.6 578.65

---------------

---- in Rs.

Standalone Profit & Loss

Cr.

account

---------------

----

Mar '17 Mar '16 Mar '15 Mar '14 Mar '13

12 mths 12 mths 12 mths 12 mths 12 mths

Income

Interest Earned 54,156.28 52,739.43 49,091.14 44,178.15 40,075.60

Other Income 19,504.48 15,323.05 12,176.13 10,427.87 8,345.70

Total Income 73,660.76 68,062.48 61,267.27 54,606.02 48,421.30

Expenditure

Interest expended 32,418.96 31,515.39 30,051.53 27,702.59 26,209.18

Employee Cost 5,733.71 3,012.69 4,749.88 4,220.11 3,893.29

Selling, Admin & Misc

24,949.36 23,109.60 14,631.56 12,296.88 9,503.20

Expenses

Depreciation 757.65 698.51 658.95 575.97 490.16

Operating Expenses 14,755.06 12,683.55 11,495.83 10,308.86 9,012.89

Provisions & Contingencies 16,685.66 14,137.25 8,544.56 6,784.10 4,873.76

Total Expenses 63,859.68 58,336.19 50,091.92 44,795.55 40,095.83

Mar '17 Mar '16 Mar '15 Mar '14 Mar '13

12 mths 12 mths 12 mths 12 mths 12 mths

Net Profit for the Year 9,801.09 9,726.29 11,175.35 9,810.48 8,325.47

Profit brought forward 17,132.19 17,261.42 13,318.59 9,902.29 7,054.23

Total 26,933.28 26,987.71 24,493.94 19,712.77 15,379.70

Equity Dividend 0 2,907.52 2,898.81 2,656.28 2,307.23

Corporate Dividend Tax 0 279.37 271.15 231.25 292.16

Per share data (annualised)

Earning Per Share (Rs) 16.83 16.73 19.28 85.04 72.22

Equity Dividend (%) 125 250 250 230 200

Book Value (Rs) 166.37 149.47 138.72 634.6 578.65

Appropriations

Transfer to Statutory

8,188.34 6,668.62 4,062.57 3,506.65 2,878.03

Reserves

Transfer to Other Reserves 0 0.01 0 0 0

Proposed

0 3,186.89 3,169.96 2,887.53 2,599.39

Dividend/Transfer to Govt

Balance c/f to Balance

18,744.94 17,132.19 17,261.42 13,318.59 9,902.29

Sheet

Total 26,933.28 26,987.71 24,493.95 19,712.77 15,379.71

Other income: Total income 26.48% 22.51% 19.87% 19.10% 17.24%

Int exp: Int income 59.86% 59.76% 61.22% 62.71% 65.40%

Total Op exp : Int income 85% 79% 65% 63% 57%

NP margin 18.10% 18.44% 22.76% 22.21% 20.77%

NP margin (total income) 13.31% 14.29% 18.24% 17.97% 17.19%

NW 96,908.94 86,918.11 80,429.36 73,213.32 66,705.96

RONW 10.11% 11.19% 13.89% 13.40% 12.48%

Long term funds 427,775.20 683,151.20 614,409.44 559,886.03 504,661.08

ROCE 58,905.71 55,378.93 49,771.44 44,297.17 39,408.41

ROCE 13.77% 8.11% 8.10% 7.91% 7.81%

Key Financial Ratios

Mar '17 Mar '16 Mar '15 Mar '14 Mar '13

Investment Valuation Ratios

Face Value 2 2 2 10 10

Dividend Per Share 2.5 5 5 23 20

Operating Profit Per Share

13.29 15.89 14.15 58.45 46.36

(Rs)

Net Operating Profit Per

92.98 90.7 84.68 382.97 347.66

Share (Rs)

Free Reserves Per Share

-- -- -- -- --

(Rs)

Bonus in Equity Capital -- -- -- -- --

Profitability Ratios

Interest Spread 6.58 6.83 7.04 7.35 7.82

Adjusted Cash Margin(%) 14.33 15.31 19.31 19.02 18.2

Net Profit Margin 18.09 18.44 22.76 22.2 20.77

Return on Long Term

46.54 50.29 57.03 56.92 56.37

Fund(%)

Return on Net Worth(%) 10.11 11.19 13.89 13.4 12.48

Adjusted Return on Net

10.11 11.19 13.89 13.4 12.48

Worth(%)

Return on Assets Excluding

166.37 149.47 138.72 634.6 578.65

Revaluations

Return on Assets Including

171.59 154.31 138.72 634.6 578.65

Revaluations

Management Efficiency Ratios

Interest Income / Total Funds 7.29 7.73 7.91 7.81 7.93

Net Interest Income / Total

2.92 3.11 3.07 2.91 2.74

Funds

Non Interest Income / Total

2.62 2.25 1.96 1.84 1.65

Funds

Interest Expended / Total

4.36 4.62 4.84 4.9 5.19

Funds

Operating Expense / Total

1.88 1.76 1.75 1.72 1.69

Funds

Profit Before Provisions / Total

3.56 3.5 3.18 2.93 2.61

Funds

Net Profit / Total Funds 1.32 1.43 1.8 1.73 1.65

Loans Turnover 0.12 0.13 0.14 0.14 0.15

Total Income / Capital

9.91 9.98 9.88 9.65 9.58

Employed(%)

Interest Expended / Capital

4.36 4.62 4.84 4.9 5.19

Employed(%)

Total Assets Turnover Ratios 0.07 0.08 0.08 0.08 0.08

Asset Turnover Ratio 0.08 0.08 0.08 0.08 0.08

Profit And Loss Account Ratios

Interest Expended / Interest

59.86 59.76 61.22 62.71 65.4

Earned

Other Income / Total Income 26.48 22.51 19.87 19.1 17.24

Operating Expense / Total

19 17.61 17.69 17.82 17.6

Income

Selling Distribution Cost

0.53 0.4 -- -- --

Composition

Balance Sheet Ratios

Capital Adequacy Ratio 17.39 16.64 17.02 17.7 18.74

Advances / Loans Funds(%) 75.25 77.02 75.94 73.26 69.64

Debt Coverage Ratios

Credit Deposit Ratio 98.69 105.08 104.72 100.71 99.25

Investment Deposit Ratio 35.32 44.32 52.43 55.79 60.38

Cash Deposit Ratio 6.45 6.74 6.85 6.54 7.21

Total Debt to Owners Fund 6.58 6.86 6.64 6.65 6.57

Financial Charges Coverage

1.84 1.78 1.68 1.62 1.52

Ratio

Financial Charges Coverage

1.33 1.33 1.39 1.37 1.34

Ratio Post Tax

Leverage Ratios

Current Ratio 0.12 0.13 0.06 0.09 0.09

Quick Ratio 16.31 14.97 13.81 11.31 10.53

Cash Flow Indicator Ratios

Dividend Payout Ratio Net

-- 29.89 25.93 27.07 27.71

Profit

Dividend Payout Ratio Cash

-- 27.89 24.49 25.57 26.17

Profit

Earning Retention Ratio 100 70.11 74.07 72.93 72.29

Cash Earning Retention Ratio 100 72.11 75.51 74.43 73.83

AdjustedCash Flow Times 46.41 40.43 30.55 31.96 33.19

Mar '17 Mar '16 Mar '15 Mar '14 Mar '13

Earnings Per Share 16.83 16.73 19.28 85.04 72.22

Book Value 166.37 149.47 138.72 634.6 578.65

Source : Dion Global Solutions Limited

Int income 54,156.28 52,739.43 49,091.14 44,178.15 40,075.60

Int expenses 32,418.96 31,515.39 30,051.53 27,702.59 26,209.18

Loans & Adv 464,232.08 435,263.94 387,522.07 338,702.65 290,249.44

Dep. & borrow 637,595.21 596,233.09 533,980.08 486,672.71 437,955.12

Int earned 11.67% 12.12% 12.67% 13.04% 13.81%

Int expended 5.08% 5.29% 5.63% 5.69% 5.98%

Spread 6.58% 6.83% 7.04% 7.35% 7.82%

Operating expense 46,195.78 39,504.35 31,536.22 27,401.82 22,899.54

Total funds 734,504.15 683,151.20 614,409.44 559,886.03 504,661.08

Net Int income 21,737.32 21,224.04 19,039.61 16,475.56 13,866.42

Int income/ total funds 7.37% 7.72% 7.99% 7.89% 7.94%

Net Int income /total funds 2.96% 3.11% 3.10% 2.94% 2.75%

Interest Expended / Total Funds 4.41% 4.61% 4.89% 4.95% 5.19%

Operating Expense / Total Funds 6.29% 5.78% 5.13% 4.89% 4.54%

Profit Before Provisions / Total Funds 3.61% 3.49% 3.21% 2.96% 2.62%

Net Profit / Total Funds 1.33% 1.42% 1.82% 1.75% 1.65%

Credit Deposit Ratio 94.73% 103.28% 107.18% 102.05% 99.19%

Investment Deposit Ratio 32.96% 38.06% 51.60% 53.33% 58.57%

16.82 16.72 19.27 16.99 14.43

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Swot of AmtekDocument11 pagesSwot of AmtekSanchit JainNo ratings yet

- India's Growing Tourism IndustryDocument16 pagesIndia's Growing Tourism IndustryKiran SoniNo ratings yet

- AUT TL WhitePaper 5 PDFDocument17 pagesAUT TL WhitePaper 5 PDFAnkita DasNo ratings yet

- Global Automotive Executive Survey 2017 PDFDocument56 pagesGlobal Automotive Executive Survey 2017 PDFVipul KhandelwalNo ratings yet

- AUT TL WhitePaper 5 PDFDocument17 pagesAUT TL WhitePaper 5 PDFAnkita DasNo ratings yet

- NETFLIX'S CULTURE OF FREEDOM AND RESPONSIBILITYDocument11 pagesNETFLIX'S CULTURE OF FREEDOM AND RESPONSIBILITYAnkita Das100% (5)

- 1307174808status of Microfinance in India 2016-17Document278 pages1307174808status of Microfinance in India 2016-17Om PrakashNo ratings yet

- The Indian Automotive Industry: Evolving DynamicsDocument36 pagesThe Indian Automotive Industry: Evolving DynamicsShakti DashNo ratings yet

- Asian PaintsDocument21 pagesAsian PaintsAnkita DasNo ratings yet

- Organisational Structure of NetflixDocument2 pagesOrganisational Structure of NetflixAnkita Das57% (7)

- Challenges For Auto IndustryDocument20 pagesChallenges For Auto IndustryAnkita DasNo ratings yet

- Asian PaintsDocument19 pagesAsian PaintsAnkita DasNo ratings yet

- J Smythe Shell FileDocument2 pagesJ Smythe Shell FileAnkita DasNo ratings yet

- HDFC Bank RatiosDocument1 pageHDFC Bank RatiosAnkita DasNo ratings yet

- Asian PaintsDocument19 pagesAsian PaintsAnkita DasNo ratings yet

- HDFC Bank AnalysisDocument2 pagesHDFC Bank AnalysisAnkita DasNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Executive SummaryDocument287 pagesExecutive SummaryNomi KhanNo ratings yet

- 152276Document73 pages152276Shofiana IfadaNo ratings yet

- Exhibit 3.1 Balance Sheet of Horizon Limited As at March 31, 20x1Document121 pagesExhibit 3.1 Balance Sheet of Horizon Limited As at March 31, 20x1DrSwati BhargavaNo ratings yet

- Week 1 - IBO 01 02 Financial System Explanation URP 2023-l and 1st AssigmentDocument16 pagesWeek 1 - IBO 01 02 Financial System Explanation URP 2023-l and 1st AssigmentJuliana Chancafe IncioNo ratings yet

- F4309Document105 pagesF4309Shahab KhanNo ratings yet

- Introduction To Consolidated Financial Statements: - Definitions - AssociatesDocument26 pagesIntroduction To Consolidated Financial Statements: - Definitions - AssociatesK58 Nguyễn Hương GiangNo ratings yet

- Chapter 07 Positive Accounting TheoryDocument15 pagesChapter 07 Positive Accounting Theorymehrabshawn75% (4)

- Financial Statement AnalysisDocument17 pagesFinancial Statement AnalysisToufique KaziNo ratings yet

- Advact PrelimDocument10 pagesAdvact PrelimSano ManjiroNo ratings yet

- Alliance 2019Document364 pagesAlliance 2019Bill LyeNo ratings yet

- AFAR - Partnership Formation and OperationDocument2 pagesAFAR - Partnership Formation and OperationJoanna Rose DeciarNo ratings yet

- CEO Private Equity 6-06Document16 pagesCEO Private Equity 6-06dysertNo ratings yet

- CF FS and Reporting EntityDocument2 pagesCF FS and Reporting Entitypanda 1No ratings yet

- Quiz Results: Week 12: Conceptual Framework: Expenses Quizzer 2Document31 pagesQuiz Results: Week 12: Conceptual Framework: Expenses Quizzer 2marie aniceteNo ratings yet

- AKM 2 Extinguishment Non-Current Liability1Document21 pagesAKM 2 Extinguishment Non-Current Liability1aurellia putriNo ratings yet

- Assignment FIN 501Document14 pagesAssignment FIN 501MmeraKiNo ratings yet

- Assignment AdvaccDocument6 pagesAssignment AdvaccAccounting Materials0% (1)

- Forensic Investigation TextbookDocument216 pagesForensic Investigation Textbookethyan2No ratings yet

- Financial Accounting: Balance SheetDocument53 pagesFinancial Accounting: Balance SheetSNo ratings yet

- MGT 101 SampleDocument9 pagesMGT 101 SampleWaleed AbbasiNo ratings yet

- Fra - Financial Statement Analysis-An IntroducitonDocument23 pagesFra - Financial Statement Analysis-An IntroducitonSakshiNo ratings yet

- Econet Wireless - HY2019 Analyst Briefing PresentationDocument49 pagesEconet Wireless - HY2019 Analyst Briefing PresentationTapiwa AmisiNo ratings yet

- List of Important Mergers and Acquisitions in India 2022 - Download PDFDocument7 pagesList of Important Mergers and Acquisitions in India 2022 - Download PDFPrerna PardeshiNo ratings yet

- Practice Exercise 11-28-22Document82 pagesPractice Exercise 11-28-22崔梦炎No ratings yet

- Principles of Accounting SummaryDocument9 pagesPrinciples of Accounting SummaryMichael BrandonNo ratings yet

- BBA 3002 Financial Statement AnalysisDocument33 pagesBBA 3002 Financial Statement AnalysisAus Rica YuNo ratings yet

- Beams11 ppt04Document49 pagesBeams11 ppt04Rika RieksNo ratings yet

- Chapter 2 Practice Questions PDFDocument9 pagesChapter 2 Practice Questions PDFleili fallahNo ratings yet

- ACCT 310 Fall 2011 Midterm ExamDocument12 pagesACCT 310 Fall 2011 Midterm ExamPrince HakeemNo ratings yet

- Reimers Finacct03 sm09 PDFDocument48 pagesReimers Finacct03 sm09 PDFChandani DesaiNo ratings yet