Professional Documents

Culture Documents

Commissioner vs St Luke's Medical Center tax exemption status

Uploaded by

Anonymous MikI28PkJcOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commissioner vs St Luke's Medical Center tax exemption status

Uploaded by

Anonymous MikI28PkJcCopyright:

Available Formats

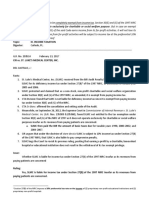

(No18.)Commissioner of Internal Revenue vs.

St Luke's Medical Center

Facts:

St. Luke’s Medical Center, Inc. (St. Luke’s) is a hospital organized as a non-stock and non-profit corporation. St.

Luke’s accepts both paying and non-paying patients. The BIR assessed St. Luke’s deficiency taxes for 1998

comprised of deficiency income tax, value-added tax, and withholding tax. The BIR claimed that St. Luke’s should

be liable for income tax at a preferential rate of 10% as provided for by Section 27(B). Further, the BIR claimed

that St. Luke’s was actually operating for profit in 1998 because only 13% of its revenues came from charitable

purposes. Moreover, the hospital’s board of trustees, officers and employees directly

benefit from its profits and assets.

On the other hand, St. Luke’s maintained that it is a non-stock and non-profit institution for charitable and social

welfare purposes exempt from income tax under Section 30(E) and (G) of the NIRC. It argued that the making of

profit per se does not destroy its income tax exemption.

Issue:

The sole issue is whether St. Luke’s is liable for deficiency income tax in 1998 under Section 27(B) of the

NIRC, which imposes a preferential tax rate of 10^ on the income of proprietary non-profit hospitals.

Ruling:

Section 27(B) of the NIRC does not remove the income tax exemption of proprietary non-profit hospitals

under Section 30(E) and (G). Section 27(B) on one hand, and Section 30(E) and (G) on the

other hand, can be construed together without the removal of such tax exemption.

Section 27(B) of the NIRC imposes a 10% preferential tax rate on the income of (1) proprietary non-

profit educational institutions and (2) proprietary non-profit hospitals. The only qualifications for hospitals are

that they must be proprietary and non-profit. “Proprietary” means private, following the definition of a

“proprietary educational institution” as

“any private school maintained and administered by private individuals or groups” with a government

permit. “Non-profit” means no net income or asset accrues to or benefits any member or specific person, with

all the net income or asset devoted to the institution’s purposes and all its activities conducted not for profit.

To be exempt from real property taxes, Section 28(3), Article VI of the Constitution requires

that a charitable institution use the property “actually, directly and exclusively” for charitable

purposes.

You might also like

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Cir v. St. Luke's - BassigDocument2 pagesCir v. St. Luke's - Bassigynahbassig100% (1)

- CIR Vs ST LukesDocument1 pageCIR Vs ST LukesMeAnn TumbagaNo ratings yet

- Cir Vs St. Luke - S Medical CenterDocument13 pagesCir Vs St. Luke - S Medical CenterJon Gilbert MagnoNo ratings yet

- CIR vs. St. Luke's Medical Center (2017)Document17 pagesCIR vs. St. Luke's Medical Center (2017)Phulagyn CañedoNo ratings yet

- 04 CIR v. St. Lukes Medical Center IncDocument3 pages04 CIR v. St. Lukes Medical Center IncMark Anthony Javellana SicadNo ratings yet

- CIR vs. St. Luke's Medical CenterDocument2 pagesCIR vs. St. Luke's Medical CenterTogz Mape100% (1)

- CIR vs. St. Luke's Medical Center GR No. 203514, Feb. 13, 2017Document11 pagesCIR vs. St. Luke's Medical Center GR No. 203514, Feb. 13, 2017Anonymous sgEtt4No ratings yet

- Estafa or BP 22Document2 pagesEstafa or BP 22Anonymous MikI28PkJcNo ratings yet

- CIR V ST Lukes 1 and 2Document4 pagesCIR V ST Lukes 1 and 2Jane CuizonNo ratings yet

- CIR V St Luke's Tax Exemption RulingDocument22 pagesCIR V St Luke's Tax Exemption Rulingada mae santoniaNo ratings yet

- 8.cir vs. ST - LukesDocument2 pages8.cir vs. ST - LukesAnonymous FvcKWLNo ratings yet

- White Gold Marine Services, Inc Vs Pioneer Insurance (Summary)Document2 pagesWhite Gold Marine Services, Inc Vs Pioneer Insurance (Summary)Coyzz de Guzman100% (1)

- CIR vs. St. Luke's Medical CenterDocument1 pageCIR vs. St. Luke's Medical CenterAnonymous MikI28PkJcNo ratings yet

- SC rules SLMC subject to 10% taxDocument1 pageSC rules SLMC subject to 10% taxVel June50% (2)

- Commissioner of Internal Revenue Vs ST Lukes Medical Center IncSt Lukes Medical Center Inc Vs Commissioner of Internal RevenueDocument5 pagesCommissioner of Internal Revenue Vs ST Lukes Medical Center IncSt Lukes Medical Center Inc Vs Commissioner of Internal RevenueKhian JamerNo ratings yet

- CIR v. St. Luke's Medical CenterDocument3 pagesCIR v. St. Luke's Medical CenterZandra LeighNo ratings yet

- CIR Vs ST LukeDocument7 pagesCIR Vs ST LukeMark Lester Lee Aure100% (2)

- Yolanda Mercado Vs AMA, DigestDocument1 pageYolanda Mercado Vs AMA, DigestAlan Gultia100% (1)

- CIR vs. ST Lukes DigestDocument2 pagesCIR vs. ST Lukes DigestKath Leen100% (4)

- ADR Law of 2004Document8 pagesADR Law of 2004Anonymous MikI28PkJcNo ratings yet

- CIR v St. Luke’s Medical Center Tax Exemption RulingDocument2 pagesCIR v St. Luke’s Medical Center Tax Exemption RulingTrisha Dela RosaNo ratings yet

- St. Luke's Medical Center Tax CaseDocument2 pagesSt. Luke's Medical Center Tax CaseEmmanuel Yrreverre100% (1)

- Cir V SLMC DigestDocument3 pagesCir V SLMC DigestYour Public ProfileNo ratings yet

- Title: Commissioner of Internal Revenue vs. St. Luke's Medical Center, IncDocument3 pagesTitle: Commissioner of Internal Revenue vs. St. Luke's Medical Center, IncKim GuevarraNo ratings yet

- Reckless Imprudence Rsulting To Multiple HomicideDocument10 pagesReckless Imprudence Rsulting To Multiple HomicideAnonymous MikI28PkJcNo ratings yet

- Commissioner of Internal Revenue vs. ST Luke's Medical CenterDocument14 pagesCommissioner of Internal Revenue vs. ST Luke's Medical CenterRaquel DoqueniaNo ratings yet

- Commissioner of St. Lukes CAse Digest TAxDocument1 pageCommissioner of St. Lukes CAse Digest TAxKayee KatNo ratings yet

- St. Lukes Case DIgest TAxDocument3 pagesSt. Lukes Case DIgest TAxKayee KatNo ratings yet

- Commissioner of Internal Revenue vs. St. Luke'S Medical Center, IncDocument3 pagesCommissioner of Internal Revenue vs. St. Luke'S Medical Center, IncChrizllerNo ratings yet

- CIR Vs ST LukesDocument4 pagesCIR Vs ST LukesJohn Dexter FuentesNo ratings yet

- Supreme Court Rules on Sin Tax LawDocument6 pagesSupreme Court Rules on Sin Tax LawNoel IV T. Borromeo0% (1)

- Cir vs. ST Luke's 2012 CaseDocument5 pagesCir vs. ST Luke's 2012 Casewinter_equinox4No ratings yet

- Commissioner of Internal Revenue vs. St. Luke'S Medical Center, IncDocument1 pageCommissioner of Internal Revenue vs. St. Luke'S Medical Center, IncEman EsmerNo ratings yet

- St. Luke's Medical Center Tax Exemption CaseDocument2 pagesSt. Luke's Medical Center Tax Exemption CaseOlan Dave LachicaNo ratings yet

- Tax 6-14Document36 pagesTax 6-14mjpjoreNo ratings yet

- Commissioner of Internal Revenue vs. ST Luke's Medical CenterDocument5 pagesCommissioner of Internal Revenue vs. ST Luke's Medical CenterMarie CecileNo ratings yet

- Commissioner of Internal Revenue vs. ST Luke's Medical CenterDocument1 pageCommissioner of Internal Revenue vs. ST Luke's Medical CenterTJ Dasalla GallardoNo ratings yet

- G.R. No. 195909, September 26, 2012: Commissioner of Internal Revenue vs. St. Luke'S Medical Center, IncDocument5 pagesG.R. No. 195909, September 26, 2012: Commissioner of Internal Revenue vs. St. Luke'S Medical Center, IncDarren RuelanNo ratings yet

- CIR V. St. Luke’s Medical Center Tax Exemption CaseDocument2 pagesCIR V. St. Luke’s Medical Center Tax Exemption CaseOz AbzNo ratings yet

- CIR Vs St. Luke's Medical Center, Inc.Document3 pagesCIR Vs St. Luke's Medical Center, Inc.Nathalie YapNo ratings yet

- RMC No 67-2012Document5 pagesRMC No 67-2012evilminionsattackNo ratings yet

- Lung Center v. QC CaseDocument2 pagesLung Center v. QC CaseSBNo ratings yet

- Tax Case 114Document1 pageTax Case 114ChugsNo ratings yet

- Tax Review Cases 2 - Page 1 of 24Document24 pagesTax Review Cases 2 - Page 1 of 24el jeoNo ratings yet

- St. Luke's liable for 10% tax on income under Section 27(B) NIRCDocument4 pagesSt. Luke's liable for 10% tax on income under Section 27(B) NIRCCharmaine Ganancial SorianoNo ratings yet

- Comm. of Internal Revenue vs. St. Luke's Medical Center, IncDocument2 pagesComm. of Internal Revenue vs. St. Luke's Medical Center, Incmaginoo69No ratings yet

- Cir vs. St. Luke'S Medical Center, IncDocument4 pagesCir vs. St. Luke'S Medical Center, IncKevin AmanteNo ratings yet

- Aiiim Tax 1 DigestsDocument8 pagesAiiim Tax 1 DigestsJohn Matthew CruelNo ratings yet

- 14 Commissioner of Internal Revenue vs. St. Lukes Medical Center Inc. 682 SCRA 66 September 26 2012Document28 pages14 Commissioner of Internal Revenue vs. St. Lukes Medical Center Inc. 682 SCRA 66 September 26 2012DannethGianLatNo ratings yet

- Commissioner of Internal Revenue vs. St. Luke's Medical Center, Inc.Document16 pagesCommissioner of Internal Revenue vs. St. Luke's Medical Center, Inc.Jonjon BeeNo ratings yet

- 2 CIR v. St. Luke'sDocument28 pages2 CIR v. St. Luke'sKristine COrpuzNo ratings yet

- St. Luke's Medical Center Tax Exemption Case ExplainedDocument7 pagesSt. Luke's Medical Center Tax Exemption Case ExplainedJohnde MartinezNo ratings yet

- 17 - CIR Vs ST Luke - SDocument20 pages17 - CIR Vs ST Luke - SsophiaNo ratings yet

- Cir Vs St. LukesDocument15 pagesCir Vs St. LukesLalaine FelixNo ratings yet

- CTA rules St. Luke's hospital not tax exemptDocument2 pagesCTA rules St. Luke's hospital not tax exemptAling KinaiNo ratings yet

- Case Title: BAR SUBJECT: TAX Tax Exemption For Charitable InstitutionsDocument1 pageCase Title: BAR SUBJECT: TAX Tax Exemption For Charitable InstitutionsRed HoodNo ratings yet

- Tax Cases by LamosteDocument5 pagesTax Cases by LamosteJade Marlu DelaTorreNo ratings yet

- Republic of the Philippines Supreme Court Rules on Tax Exemption for Non-Profit HospitalsDocument17 pagesRepublic of the Philippines Supreme Court Rules on Tax Exemption for Non-Profit HospitalsDianne YcoNo ratings yet

- CIR vs. St. Lukes Medical Center Inc. G.R. No. 195909Document7 pagesCIR vs. St. Lukes Medical Center Inc. G.R. No. 195909ZeusKimNo ratings yet

- VII. CIR vs. St. Luke's Medical Center, Inc. G.R. No. 195909Document10 pagesVII. CIR vs. St. Luke's Medical Center, Inc. G.R. No. 195909stefocsalev17No ratings yet

- VII. CIR vs. St. Luke's Medical Center, Inc. G.R. No. 195909Document11 pagesVII. CIR vs. St. Luke's Medical Center, Inc. G.R. No. 195909Stef OcsalevNo ratings yet

- The Law of Tax-Exempt Healthcare Organizations 2016 SupplementFrom EverandThe Law of Tax-Exempt Healthcare Organizations 2016 SupplementNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- "Social Double-Account-System with Three-Column-Funding with free prices and money administration by the citizens themselves" Adapted to US Economy, strong market-based and joining social needs (All your claims are fulfilled): A potential Health Care Act by Donald Trump, President of the United States (To be urgently forwarded to) New Deal Health Care (to vanish old-fashioned "Obama Care")From Everand"Social Double-Account-System with Three-Column-Funding with free prices and money administration by the citizens themselves" Adapted to US Economy, strong market-based and joining social needs (All your claims are fulfilled): A potential Health Care Act by Donald Trump, President of the United States (To be urgently forwarded to) New Deal Health Care (to vanish old-fashioned "Obama Care")No ratings yet

- What Happens at The End of A Fixed Term ContractDocument3 pagesWhat Happens at The End of A Fixed Term ContractAnonymous MikI28PkJcNo ratings yet

- Litigation OverviewDocument9 pagesLitigation OverviewAnonymous MikI28PkJcNo ratings yet

- Tax DecDocument2 pagesTax DecAnonymous MikI28PkJcNo ratings yet

- ADR AlanGultiaDocument1 pageADR AlanGultiaAnonymous MikI28PkJcNo ratings yet

- ADRDocument1 pageADRAnonymous MikI28PkJcNo ratings yet

- Recto LAWDocument1 pageRecto LAWIman BundaNo ratings yet

- QuotesDocument1 pageQuotesAnonymous MikI28PkJcNo ratings yet

- Sarasola v. Trinidad, 40 Phil. 252Document58 pagesSarasola v. Trinidad, 40 Phil. 252Anonymous MikI28PkJcNo ratings yet

- Know Your Rights: A Citizen's Primer On Law EnforcementDocument50 pagesKnow Your Rights: A Citizen's Primer On Law EnforcementJoan AdvinculaNo ratings yet

- 123456789ADRrr PDFDocument27 pages123456789ADRrr PDFSarang PalewarNo ratings yet

- CommRev Notes For Corpo2Document55 pagesCommRev Notes For Corpo2Anonymous MikI28PkJcNo ratings yet

- Extend Martial LawDocument3 pagesExtend Martial LawAnonymous MikI28PkJcNo ratings yet

- Cyber-Bullying Via Social Media Seen As Crime: DJ Yap @deejayapinqDocument4 pagesCyber-Bullying Via Social Media Seen As Crime: DJ Yap @deejayapinqAnonymous MikI28PkJcNo ratings yet

- Supreme Court of the Philippines rules on civil liability arising from crimesDocument2 pagesSupreme Court of the Philippines rules on civil liability arising from crimesSherwin Anoba CabutijaNo ratings yet

- Sarasola and Philippine Rabbit CaseDocument2 pagesSarasola and Philippine Rabbit CaseMRose Serrano50% (2)

- Nestle CasesDocument10 pagesNestle CasesAnonymous MikI28PkJcNo ratings yet

- WorldwidetaxvsterritorialDocument2 pagesWorldwidetaxvsterritorialAnonymous MikI28PkJcNo ratings yet

- Extend Martial LawDocument3 pagesExtend Martial LawAnonymous MikI28PkJcNo ratings yet

- Revenue Regulations No 3-98Document9 pagesRevenue Regulations No 3-98Anonymous MikI28PkJcNo ratings yet

- RA 8504 AIDS Prevention and Control Act of 1998Document10 pagesRA 8504 AIDS Prevention and Control Act of 1998Anonymous MikI28PkJcNo ratings yet

- ADR AlanGultiaDocument1 pageADR AlanGultiaAnonymous MikI28PkJcNo ratings yet

- Chua V TorresDocument4 pagesChua V TorresDhin CaragNo ratings yet

- Stricter Anti-Carnapping LawDocument3 pagesStricter Anti-Carnapping LawKen DG CNo ratings yet

- Stricter Anti-Carnapping LawDocument3 pagesStricter Anti-Carnapping LawKen DG CNo ratings yet

- Know Your Rights: A Citizen's Primer On Law EnforcementDocument50 pagesKnow Your Rights: A Citizen's Primer On Law EnforcementJoan AdvinculaNo ratings yet