Professional Documents

Culture Documents

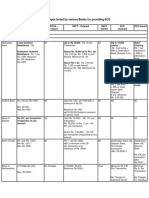

IDFC Bank AQB/AMB account charges and features comparison

Uploaded by

gaurav_p_9Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IDFC Bank AQB/AMB account charges and features comparison

Uploaded by

gaurav_p_9Copyright:

Available Formats

Description of Charge/Feature Param Vishesh

AQB/AMB AMB: Rs 1000 AMB: Rs 5000

AMB: >= Rs.500/- to < Rs. 1000/-: Rs. 50/- AMB: >= Rs. 2500/- to < Rs. 5000/-: Rs. 150/-

Charges for non-maintenance - (Rs)

AMB: < Rs.500/-: Rs. 100/- AMB: < Rs. 2500/-: Rs. 300/-

Interest will be calculated on daily available balance and will be credited at the end of every quarter.

Interest Calculation

Minimum interest of Rs.1/- will only be credited.

Account Opening Amount Rs 1000 Rs. 5000

Cash Transaction

Cash Deposit-Home/Non Home First 4 txns or Rs 2 lakh whichever is

First 4 txns or Rs 2 lakh whichever is earlier.(Free)

Branch(Monthly) earlier.(Free)

Cash Deposit (above free limit)

Rs 5/1000. Min Rs 150 Rs 5/1000. Min Rs 150

Home/Non Home branch

Cash Withdrawal-Home/Non Home First 4 txns or Rs 2 lakh whichever is

First 4 txns or Rs 2 lakh whichever is earlier.(Free)

Branch earlier.(Free)

Cash Withdrawal (above free limit)

Rs 5/1000. Min Rs 150 Rs 5/1000. Min Rs 150

Home/Non Home branch

Payment Service

Intrabank-Fund Transfer-Branch Free Free

Intra-Bank Fund Transfer -Internet

Free Free

Banking

RTGS Payment - Branch/Internet Rs 2Lakh to Rs 5 Lakh: Rs 25/transaction Rs 2Lakh to Rs 5 Lakh: Rs 25/transaction

Banking Above Rs 5 Lakh-Rs 50/transaction Above Rs 5 Lakh-Rs 50/transaction

Up to Rs 10000-Rs 2.5/transaction Up to Rs 10000-Rs 2.5/transaction

NEFT Payment - Branch/Internet Above Rs 10000 to Rs 1 Lakh:Rs 5/transaction Above Rs 10000 to Rs 1 Lakh:Rs 5/transaction

Banking Above Rs 1 Lakh to Rs 2 Lakh: 15/transaction. Above Rs 1 Lakh to Rs 2 Lakh: 15/transaction.

Above Rs 2 Lakh: Rs 25/transaction Above Rs 2 Lakh: Rs 25/transaction

Up to Rs 1 Lakh-Rs 5/transaction Up to Rs 1 Lakh-Rs 5/transaction

IMPS-outgoing

Above Rs 1 Lakh to Rs 2 Lakh-Rs 15/txn Above Rs 1 Lakh to Rs 2 Lakh-Rs 15/txn

Rs.100 per D.D. up to Rs.10,000;.Rs.3/ per Rs.100 per D.D. up to Rs.10,000;.Rs.3/ per thousand

DD/PO payable at IDFC BANK thousand rupees for DD of more than rupees for DD of more than Rs.10,000, subject to a

locations. Rs.10,000, subject to a minimum charge of minimum charge of Rs.100 and maximum of Rs.

Rs.100 and maximum of Rs. 10,000 per DD. 10,000 per DD.

DD/PO- Duplicate

Rs.100 per D.D Rs.100 per D.D

Issuance/cancellation/ revalidation

Rs.100 per D.D. up to Rs.10,000;.Rs.3/ per Rs.100 per D.D. up to Rs.10,000;.Rs.3/ per thousand

DD/PO payable at Correspondent thousand rupees for DD of more than rupees for DD of more than Rs.10,000, subject to a

bank locations. Rs.10,000, subject to a minimum charge of minimum charge of Rs.100 and maximum of Rs.

Rs.100 and maximum of Rs. 10,000 per DD. 10,000 per DD.

Cheque Drawn on us/deposited/ECS-bounce charge

Cheque Deposited-Outward clearing Rs 50/Instrument Rs 50/Instrument

Due to technical reasons Nil (Technical reasons will not be charged) Nil (Technical reasons will not be charged)

Cheque Issued-Inward

Rs 250 Rs 250

Clearing(Drawn on us)

SI return Charges Rs 50/Instrument Rs 50/Instrument

ECS Debit Return charges Rs 50/Instrument Rs 50/Instrument

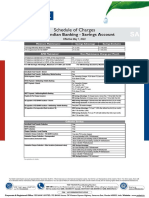

Collection Service

Intra-Bank Fund Transfer Collection Free Free

RTGS Collection Free Free

NEFT Collection Free Free

ECS Collection - Transaction Free Free

ECS Collection - Mandate (New /

Free Free

Modify / Cancel/Stop)

Cheque collection-local clearing Free Free

Outstation cheque collection-IDFC

Free Free

Bank Location

Upto Rs.5,000/- Rs.25/- Above Rs.5,000/- up to

Upto Rs.5,000/- Rs.25/- Above Rs.5,000/- up to

Rs.10,000/- Rs.50/- AboveRs.10,000/-up to

Rs.10,000/- Rs.50/- AboveRs.10,000/-up to Rs.1.00

Outstation cheque collection-Non Rs.1.00 lac Rs.110/- AboveRs.1.00 lacs

lac Rs.110/- AboveRs.1.00 lacs uptoRs.5.00 lac

IDFC Bank Location uptoRs.5.00 lac Rs.225/- AboveRs.5.00 lacs

Rs.225/- AboveRs.5.00 lacs uptoRs.10.00 lac

uptoRs.10.00 lac Rs.250/- Above Rs.10.00 lacs

Rs.250/- Above Rs.10.00 lacs Rs.280/-(Max)

Rs.280/-(Max)

Upto Rs.5,000/- Rs.25/- Above Rs.5,000/- up to

Outstation cheque collection at Upto Rs.5,000/- Rs.25/- Above Rs.5,000/- up to

Rs.10,000/- Rs.50/- AboveRs.10,000/-up to Rs.1.00

correspondent bank location and Rs.10,000/- Rs.50/- AboveRs.10,000/-up to

lac Rs.110/- AboveRs.1.00 lacs uptoRs.5.00 lac

other location: Non MICR Rs.1.00 lac Rs.110/- AboveRs.1.00 lacs

Rs.225/- AboveRs.5.00 lacs uptoRs.10.00 lac

cheque/Non CTS cheque uptoRs.5.00 lac Rs.225/- AboveRs.5.00 lacs upto

Rs.250/- Above Rs.10.00 lacs Rs.280/-(Max)

Rs.10.00 lac Rs.250/- Above Rs.10.00 lacs

Rs.280/-(Max)

Debit Card and ATM Charges

Issuance charge Rs. 250/- Rs. 500/-

Annual Fees Rs. 250/- Rs. 300/-

ATM transaction-IDFC Bank First 5 transaction/Month-Free 6th onwards to First 5 transaction/Month-Free 6th onwards to be

Location(Financial/non- financial) be charged charged

ATM transaction-Non IDFC Bank

First 5 transaction/Month-Free 6th onwards to First 5 transaction/Month-Free. 6th onwards to be

ATMS(Financial-non financial

be charged charged

transaction)

6th transaction onwards charge will apply for

6th onwards charge as follows: Rs 20 + taxes for

ATM transaction charges beyond free transactions done on IDFC / Non IDFC Bank ATMs

financial transaction and Rs 8 + taxes for non-

limit Rs 20 + taxes for financial transaction and Rs 8 +

financial transaction

taxes for non-financial transaction

Re-issuance of card(Lost or damaged) Rs. 200/- Rs. 200/-

Pin Regeneration(Green Pin) Nil for All Channels Nil for All Channels

Cheque Book Issuance

Rs. 4 per cheque leaf on issuance and 4 per cheque leaf on issuance and subsequent

Cheque Book Facility

subsequent cheque book cheque book

Cheque Book Issued on request Issued on request

Miscellaneous Charges

Physical copy through MATM / BOC / Branch - Physical copy through MATM / BOC / Branch - INR

Account Statement Physical (Branch)

INR 100 100

Issue of Duplicate/Adhoc

Rs. 100 Rs 100

statement(Branch/Channel)

Issue of passbook facility Nil Nil

Duplicate Passbook Rs 50 Free

Account Closure Free Free

SMS/ E mail Alerts SMS: Rs. 15/- per quarter SMS: Rs. 15/- per quarter

Phone Banking Free Free

Net Banking Free Free

Mobile Banking Free Free

Standing Instruction- Set Up/

Free Free

Execution/ Amendment

Bill Payment- Net Banking Free Free

Bankers Verification ( Photo/

Free Free

Signature/ Address)

Balance Confirmation Certificate Free Free

Record Retrieval Free Free

One copy free/year. Rs 50/certificate for more One copy free/year. Rs 50/certificate for more than

Interest/ TDS Certificate

than one copy in F.Y one copy in F.Y

Stop Payment per

Rs 50/cheque Rs 50/cheque

Instruction(Particular cheque/Range

Rs 100 for range of cheque) Rs 100 for range of cheque)

of cheque)

Balance Enquiry ( Branch/ Channels) Free Free

Activation of dormant/inoperative

Free Free

account

Taxes at prevailing rates as per Government Rules shall be applicable over and above the mentioned charges. The charges as indicated above

are subject to periodic revision.

You might also like

- Schedule of Business Bank Account ChargesDocument2 pagesSchedule of Business Bank Account ChargesJella RamakrishnaNo ratings yet

- IndusInd Bank service charges scheduleDocument4 pagesIndusInd Bank service charges schedulesatyabrataNo ratings yet

- NRI Savings Account Tariff StructureDocument4 pagesNRI Savings Account Tariff StructureRishiNo ratings yet

- Schedule of Charges For Nri Accounts PrimeDocument4 pagesSchedule of Charges For Nri Accounts PrimeSonam SharmaNo ratings yet

- Schedule of Charges Edge Business 1st Feb 20 PDFDocument2 pagesSchedule of Charges Edge Business 1st Feb 20 PDFRavie S DhamaNo ratings yet

- Soc Ca 01.01.22Document4 pagesSoc Ca 01.01.22Abhishek ShivappaNo ratings yet

- Schedule of Charges - Retail (India)Document2 pagesSchedule of Charges - Retail (India)John PeterNo ratings yet

- General Charges of Kotak BankDocument2 pagesGeneral Charges of Kotak BankSarafraj BegNo ratings yet

- Savings - Account - Mar - 2019 - 20190325104947Document4 pagesSavings - Account - Mar - 2019 - 20190325104947Manish kumar yadavNo ratings yet

- Service Charges As Per Rbi GuidelinesDocument10 pagesService Charges As Per Rbi Guidelineskrunal3726No ratings yet

- Financial Inclusion 15012019Document5 pagesFinancial Inclusion 15012019Joydeep Chatterjee100% (1)

- Current Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILDocument1 pageCurrent Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILKulwinder Singh MayaanNo ratings yet

- Common Service Charges (1)Document3 pagesCommon Service Charges (1)atharvxunoNo ratings yet

- Notice To SB CA OD Account Customer Annexure IIIDocument4 pagesNotice To SB CA OD Account Customer Annexure IIIratnesh singhNo ratings yet

- Branch)Document3 pagesBranch)Jeyavel NagarajanNo ratings yet

- 811 - Kotak Mahindra BankDocument5 pages811 - Kotak Mahindra BankVivek EadaraNo ratings yet

- HDFC Vs IciciDocument10 pagesHDFC Vs IciciRahulNo ratings yet

- Schedule of Charges Effective July 22, 2021Document3 pagesSchedule of Charges Effective July 22, 2021Vivek DixitNo ratings yet

- Account Tariff Structure Basic Savings AccountDocument1 pageAccount Tariff Structure Basic Savings Accountgaddipati_ramuNo ratings yet

- Axis Bank Service ChargesDocument4 pagesAxis Bank Service ChargesRanjith MeelaNo ratings yet

- Schedule of Service Charges and Fees: Name of The Bank Allahabad BankDocument5 pagesSchedule of Service Charges and Fees: Name of The Bank Allahabad BankmodijiNo ratings yet

- Monthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Document2 pagesMonthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Shoaib MohammedNo ratings yet

- SBI Site Upload-Service Charges-2017 June 2017 (REVISED)Document1 pageSBI Site Upload-Service Charges-2017 June 2017 (REVISED)NDTVNo ratings yet

- 9114 Accts-SERVICE CHARGhjgjgnj)Document5 pages9114 Accts-SERVICE CHARGhjgjgnj)Girish KumarNo ratings yet

- Cover Table 292Document1 pageCover Table 292Moneylife FoundationNo ratings yet

- Services ProvidedDocument15 pagesServices ProvidedParul AroraNo ratings yet

- Rationalization ServiceDocument5 pagesRationalization Servicesachin9984No ratings yet

- Website Notice BoardDocument3 pagesWebsite Notice BoardYuvraj KumarNo ratings yet

- UCO Bank Service Charges for Remittances, Collections & ReturnsDocument34 pagesUCO Bank Service Charges for Remittances, Collections & Returnshimz101No ratings yet

- Schedule of Charges BandhanDocument3 pagesSchedule of Charges BandhanSoumya ChatterjeeNo ratings yet

- ECS ChargesDocument14 pagesECS ChargesgnanaNo ratings yet

- Service Charges On RTGS, NEFT, ETS of All BanksDocument7 pagesService Charges On RTGS, NEFT, ETS of All BanksSulthan .ANo ratings yet

- Pca 14 6Document2 pagesPca 14 6Arora MathewNo ratings yet

- Service Charges Annexure-A Revised 18-7-11Document28 pagesService Charges Annexure-A Revised 18-7-11Dhaliwal JassieNo ratings yet

- Au Current Account: Schedule of Charges ForDocument2 pagesAu Current Account: Schedule of Charges Forhiteshmohakar15100% (1)

- Privilege Banking AccountsDocument5 pagesPrivilege Banking AccountsVinod MohiteNo ratings yet

- Digital Savings Account Effective July 2021Document3 pagesDigital Savings Account Effective July 2021Nikhil KumarNo ratings yet

- New Bank of Baroda New Commission Chart 28.11.2020Document1 pageNew Bank of Baroda New Commission Chart 28.11.2020kaleeswaran MNo ratings yet

- Gib Savings Account Wef 01may2022Document3 pagesGib Savings Account Wef 01may2022Ankur VermaNo ratings yet

- SBI Commission Structure W.E.F 01102015Document4 pagesSBI Commission Structure W.E.F 01102015Mahesh V KalbhairavNo ratings yet

- One Globe Trade AccountDocument5 pagesOne Globe Trade AccountKhushi VarshneyNo ratings yet

- 2014 06 16 Cir 336 2014 NOTICE - OnlyDocument2 pages2014 06 16 Cir 336 2014 NOTICE - OnlyVirat GoyalNo ratings yet

- Comparison of Standard Chartered Bank With Citibank and HSBCDocument5 pagesComparison of Standard Chartered Bank With Citibank and HSBCarpit_tNo ratings yet

- ICICI Bank Service ChargesDocument7 pagesICICI Bank Service ChargesRanjith MeelaNo ratings yet

- Standard Schedule of Charges For SB-CA-NRI-July 1 2016Document4 pagesStandard Schedule of Charges For SB-CA-NRI-July 1 2016Vasundhara GuptaNo ratings yet

- Commission Structure: S.No. Particulars CSP ShareDocument4 pagesCommission Structure: S.No. Particulars CSP ShareKunal ShivhareNo ratings yet

- RBI SERVICE CHARGES GUIDELINESDocument11 pagesRBI SERVICE CHARGES GUIDELINESJithin VijayanNo ratings yet

- ROAMING CURRENT ACCOUNT SCHEDULE AND CHARGESDocument3 pagesROAMING CURRENT ACCOUNT SCHEDULE AND CHARGESHimesh ShahNo ratings yet

- Glossary of Terms: Variant Standard Classic Premium Gold Gold Plus Platinum EliteDocument4 pagesGlossary of Terms: Variant Standard Classic Premium Gold Gold Plus Platinum EliteAlka RanjanNo ratings yet

- Revision of Service Charges - DepositDocument10 pagesRevision of Service Charges - DepositThe QuintNo ratings yet

- Lesson Plan Kangaroo Mother CarDocument1 pageLesson Plan Kangaroo Mother CarhanishanandNo ratings yet

- Titanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowDocument2 pagesTitanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowGaurav Singh RathoreNo ratings yet

- Current account schedule of charges comparisonDocument3 pagesCurrent account schedule of charges comparisonfatrag amloNo ratings yet

- Parameter Au Samriddhi Current AccountDocument2 pagesParameter Au Samriddhi Current Accounthiteshmohakar15No ratings yet

- Baroda Apex Academy, Gandhinagar: S. No Commission Per TransactionDocument1 pageBaroda Apex Academy, Gandhinagar: S. No Commission Per TransactionJitenNo ratings yet

- Effective From 1st April, 2020Document2 pagesEffective From 1st April, 2020SundarNo ratings yet

- Simplified Nri Savings Account Tarrif Structure W.E.F April 01, 2014Document5 pagesSimplified Nri Savings Account Tarrif Structure W.E.F April 01, 2014gaddipati_ramuNo ratings yet

- Proposition Edge Business Prime Business Exclusive BusinessDocument1 pageProposition Edge Business Prime Business Exclusive Businesskazaalite1008No ratings yet

- Annexure-I: (Scribe Declaration Form For AAO (Generalist/IT/Chartered Accountant/Actuarial/Rajbhasha)Document26 pagesAnnexure-I: (Scribe Declaration Form For AAO (Generalist/IT/Chartered Accountant/Actuarial/Rajbhasha)MeherNo ratings yet

- Quantitative Techniques For Management PDFDocument507 pagesQuantitative Techniques For Management PDFNelsonMoseM100% (6)

- List of Common Media TypesDocument8 pagesList of Common Media Typesgaurav_p_9No ratings yet

- VoIP Presentation on Voice over Internet ProtocolDocument16 pagesVoIP Presentation on Voice over Internet Protocolgaurav_p_9No ratings yet

- Ip Addressing: Conversion of Bits Into Decimal FormDocument3 pagesIp Addressing: Conversion of Bits Into Decimal Formgaurav_p_9No ratings yet

- VoIP Presentation on Voice over Internet ProtocolDocument16 pagesVoIP Presentation on Voice over Internet Protocolgaurav_p_9No ratings yet

- Finmar Finals 2021Document45 pagesFinmar Finals 2021Nune SabanalNo ratings yet

- Bank Secrecy Case DigestsDocument19 pagesBank Secrecy Case Digestsroquesa burayNo ratings yet

- 12 FT and 30 FT CC Road - Ramky One HarmonyDocument12 pages12 FT and 30 FT CC Road - Ramky One Harmonysweta.singhNo ratings yet

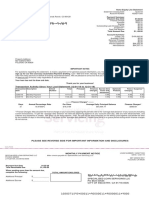

- Httpsoctoenergy Production User Documents.s3.Amazonaws - Combilling Statements20230520A 140A6EE9 143275850 1.PdfAWSAccessDocument3 pagesHttpsoctoenergy Production User Documents.s3.Amazonaws - Combilling Statements20230520A 140A6EE9 143275850 1.PdfAWSAccessollythepolarbear71No ratings yet

- Comparative Analysis of Aixs BankDocument7 pagesComparative Analysis of Aixs Bankpearl6988No ratings yet

- MBA Review Questions CH 8 & CH 10 Princ. Acc. IIDocument5 pagesMBA Review Questions CH 8 & CH 10 Princ. Acc. IIMirna Kassar100% (1)

- INTERNSHIP REPORT United Bank Limited UBDocument51 pagesINTERNSHIP REPORT United Bank Limited UBayesha ChNo ratings yet

- Dial Toll Free 1912 For Bill & Supply Complaints: A/C No. 0131306000Document1 pageDial Toll Free 1912 For Bill & Supply Complaints: A/C No. 0131306000Utkarsh SrivastavaNo ratings yet

- MBF QuestionDocument3 pagesMBF QuestionShoaib MalikNo ratings yet

- Internship Report on Askari Bank LimitedDocument62 pagesInternship Report on Askari Bank LimitedShining EyesNo ratings yet

- Builder NocDocument3 pagesBuilder NocLonari Kunbi SamajNo ratings yet

- DT MCQs & Case Scenarios Booklet Solutions Yash KhandelwalDocument89 pagesDT MCQs & Case Scenarios Booklet Solutions Yash Khandelwalhtassociates12No ratings yet

- PDFDocument2 pagesPDFDonna SmithNo ratings yet

- Sample Question BCom 2019 PatternDocument17 pagesSample Question BCom 2019 PatternNikhil BalwaniNo ratings yet

- Debit Card - Project Wark PDFDocument158 pagesDebit Card - Project Wark PDFManisha GuptaNo ratings yet

- 5 - Ang Tek Lian Vs CADocument3 pages5 - Ang Tek Lian Vs CAShane Fernandez JardinicoNo ratings yet

- Proof of CashDocument2 pagesProof of Cashmjc24100% (2)

- Axis Gold ETF KIM Application FormDocument6 pagesAxis Gold ETF KIM Application Formrkdgr87880No ratings yet

- Zoleta Vs SandiganbayanDocument9 pagesZoleta Vs SandiganbayanMc Alaine Ligan100% (1)

- 03 - Cash & Cash Equivalents - TheoryDocument2 pages03 - Cash & Cash Equivalents - TheoryROMAR A. PIGANo ratings yet

- MBL Foreign Exchange Operations Case StudyDocument313 pagesMBL Foreign Exchange Operations Case StudyShohan_1234100% (1)

- Dub 5198522Document1 pageDub 5198522Anand BabuNo ratings yet

- E BankingDocument77 pagesE BankingDEEPAKNo ratings yet

- Non-Bank Financial Institutions Providing Leasing Services in BangladeshDocument48 pagesNon-Bank Financial Institutions Providing Leasing Services in BangladeshMahmuda Siddiquea Mithun100% (2)

- Revenue Cycle Activities ExplainedDocument6 pagesRevenue Cycle Activities ExplainedSamonte JemimahNo ratings yet

- XI Revision Notes On BRSDocument6 pagesXI Revision Notes On BRSJay muthaNo ratings yet

- Interpretation Algorithms - SAP EBSDocument4 pagesInterpretation Algorithms - SAP EBSLeonardoCunhaNo ratings yet

- FLR2399HA101 Fundamentals of Oil and Gas Agreements WebsiteDocument4 pagesFLR2399HA101 Fundamentals of Oil and Gas Agreements WebsitejmavzlaNo ratings yet

- Law Relating To Dishonour of Cheques in India PDFDocument5 pagesLaw Relating To Dishonour of Cheques in India PDFSatyadeep Singh100% (1)

- 50 Ic30 Gen 012 A Scrap Handling & DisposalDocument24 pages50 Ic30 Gen 012 A Scrap Handling & DisposalnguyencaohuygmailNo ratings yet