Professional Documents

Culture Documents

Jan PDF

Uploaded by

BHAUSAHEB KOKANEOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jan PDF

Uploaded by

BHAUSAHEB KOKANECopyright:

Available Formats

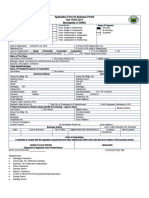

DUROVALVES INDIA PRIVATE LIMITED

F-57-58, MIDC Industrial Area,Waluj,, Aurangabad - 431136

Pay Slip for the month of January 2018

Emp. Code 00012802 Month Day 31.00 Plant Name DIPL

Name Bhausaheb Machchhindra Kokane LOP 0.00 Bank Name IDBI BANK LIMITED

Designation Sr.Engineer-Maintenance Arrear Days 0.00 Bank A/c 0076104000458931

Department Maintenance LOP Hrs 0.00 PAN No. CERPK9746Q

Plant Code 4000 DOL Arr LOP Hrs 0.00 PF No. MH/AB/80819/2120

DOJ 17/11/2012 Gender Male Payable Days 31.00 UAN 100111771407

Earnings Deductons Reimbursements

Descripton Rate Monthly Arrear Total Descripton Amount Descripton Claimed Reimb

Basic Salary 14,942 14,942 14,942 PF 1,793

HRA 7,471 7,471 7,471 Prof.Tax 200

Transport Allow 1,600 1,600 1,600 Bus Ded 200

Uniform Allow 1,250 1,250 1,250

Mispay 2,082 2,082 2,082

Bonus 1,400 1,400 1,400

GROSS PAY 28,745 28,745 GROSS DED 2,193 TOTAL

Net Pay : 26,552 (RUPEES TWENTY-SIX THOUSAND FIVE HUNDRED FIFTY-TWO AND ZERO PAISE ONLY )

Income Tax Worksheet for the Period April 2017 - March 2018

Descripton Gross Exempt Taxable Deducton Under Chapter VI-A

Basic Salary 179,180 179,180 Investments u/s 80C

HRA 89,591 89,591 PF+VPF 21,502

Transport Allow 19,187 19,187

Uniform Allow 14,990 14,990

Mispay 24,967 24,967

Bonus 16,788 16,788

Gross Salary 344,703 34,177 310,526 Total of Investment u/s 80C 21,502

Deducton U/S 80C 21,502

Previous Employer Professional Tax

Professional Tax 2,400

Under Chapter VI-A 21,502

Any Other Income

Taxable Income 286,624

Total Tax 1,831

Tax Rebate 1,831

Surcharge

Tax Due

Educatonal Cess 0

Net Tax 0

Tax Deducted (Previous Employer) Leave Balances

Tax Deducted Till Date Type Opening Enttlement Availed Closing

Tax to be Deducted PL 0.00 0.00 0.00 0.00

Tax / Month Total of Ded Under Chapter VI-A 21,502 CL 0.00 0.00 0.00 0.00

Tax on Non-Recurring Earnings SL 0.00 0.00 0.00 0.00

Tax Deducton for this month Interest on Housing Loan

HRA Calculaton

From To Rent Paid Actual HRA 40/50% of Basic Rent - 10% of Basic Exempt HRA

Total

You might also like

- Pay Slip For The Month of February 2018: Earnings Deductons ReimbursementsDocument1 pagePay Slip For The Month of February 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENo ratings yet

- Pay Slip SeptemberDocument1 pagePay Slip SeptemberboomiNo ratings yet

- PDF&Rendition 1Document8 pagesPDF&Rendition 1Pranjali PFNo ratings yet

- Ack 504547400170723Document1 pageAck 504547400170723varsha sardesaiNo ratings yet

- Acctstmt FDocument3 pagesAcctstmt FAbhay SinghNo ratings yet

- Admin 48131116Document1 pageAdmin 48131116Manpreet KambojNo ratings yet

- PaySlip 11 2023Document1 pagePaySlip 11 2023Sujoy GhoshalNo ratings yet

- Appointment Letter - 80501803Document2 pagesAppointment Letter - 80501803Anirban MazumdarNo ratings yet

- Mr. Pankaj Kumar Tyagi APLDocument8 pagesMr. Pankaj Kumar Tyagi APLRashi SrivastavaNo ratings yet

- Subject: Merit Increase: Emp Code: 901105 Name: Ashish Kumar Singh Designation: Officer Department: ProductionDocument4 pagesSubject: Merit Increase: Emp Code: 901105 Name: Ashish Kumar Singh Designation: Officer Department: ProductionAshish SinghNo ratings yet

- PRASANT KUMAR DAKUA Pay Slip February 2019Document1 pagePRASANT KUMAR DAKUA Pay Slip February 2019biki222No ratings yet

- Salary Slip (30385759 May, 2018)Document1 pageSalary Slip (30385759 May, 2018)munafNo ratings yet

- Huhtamaki PPL LTD (Hyderabadplant) : Payslip For The Month of August-2019Document1 pageHuhtamaki PPL LTD (Hyderabadplant) : Payslip For The Month of August-2019Ashok SrinivasNo ratings yet

- VIRCHOW Petrochemical Pay SlipsDocument5 pagesVIRCHOW Petrochemical Pay SlipsraajiNo ratings yet

- Offer Letter - Noor Basha.sDocument7 pagesOffer Letter - Noor Basha.sVenkatesh RoyalNo ratings yet

- 7Document1 page7solankivijayv8No ratings yet

- AccentureDocument1 pageAccenturesdrfNo ratings yet

- PDF 691846850250723Document1 pagePDF 691846850250723Anish MishraNo ratings yet

- Offer Letter - Akash Gupta PDFDocument4 pagesOffer Letter - Akash Gupta PDFkaushal vermaNo ratings yet

- Appraisal Letter Salary IncrementDocument2 pagesAppraisal Letter Salary Incrementmitendra pratap singhNo ratings yet

- Countingup Statement 2023 07Document1 pageCountingup Statement 2023 07SophiaNo ratings yet

- DeepikaDocument3 pagesDeepikatashiNo ratings yet

- Appointment Letter - C1681 - Sahil Shah - 28 Dec - EncryptedDocument11 pagesAppointment Letter - C1681 - Sahil Shah - 28 Dec - EncrypteditsmesahilshahhNo ratings yet

- Employee full and final settlement detailsDocument3 pagesEmployee full and final settlement detailsतेजस्विनी रंजनNo ratings yet

- Rochak Agrawal-Offer PDFDocument4 pagesRochak Agrawal-Offer PDFrochak agrawalNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinaya ChennadiNo ratings yet

- Rajan Barot Mumbai Offer LetterDocument6 pagesRajan Barot Mumbai Offer LetterRajan BarotNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part Asamir royNo ratings yet

- Itr 23-24Document1 pageItr 23-24addy01.0001No ratings yet

- CombinepdfDocument16 pagesCombinepdfAtharva RaoNo ratings yet

- Ack Cdhpa3843f 2022-23 220950670290722Document1 pageAck Cdhpa3843f 2022-23 220950670290722rtaxhelp helpNo ratings yet

- AugustDocument1 pageAugustNikhil DubeyNo ratings yet

- Amrit Placement Services Pvt. LTD.: Salary Slip For The Month of September 2021Document1 pageAmrit Placement Services Pvt. LTD.: Salary Slip For The Month of September 2021Anil SharmaNo ratings yet

- FUPVNO1894 Arman Khan's Digital Appointment Letter - PVR PDFDocument5 pagesFUPVNO1894 Arman Khan's Digital Appointment Letter - PVR PDFdilipkhanaman1980No ratings yet

- Offer Letter: Corporate Office Registered Office EmailDocument2 pagesOffer Letter: Corporate Office Registered Office EmailAnkur TripathiNo ratings yet

- Pay SlipDocument1 pagePay SlipabhiNo ratings yet

- FORM 16 CERTIFICATEDocument3 pagesFORM 16 CERTIFICATEDebesh KuanrNo ratings yet

- Offer Letter - Siddhartha Sharma (Signed)Document8 pagesOffer Letter - Siddhartha Sharma (Signed)SiddharthNo ratings yet

- Form 16 TDS CertificateDocument9 pagesForm 16 TDS CertificateAmit GautamNo ratings yet

- Ack 367661020050723Document1 pageAck 367661020050723Sivaram PopuriNo ratings yet

- A S Soft Technologies Private Limited: Pay Slip For The Month of July 2018Document1 pageA S Soft Technologies Private Limited: Pay Slip For The Month of July 2018srini reddyNo ratings yet

- Philam Asset MGT V CIRDocument3 pagesPhilam Asset MGT V CIRbrendamanganaanNo ratings yet

- Deepak Giri Sai Kumar - Offer LetterDocument5 pagesDeepak Giri Sai Kumar - Offer Lettersaikumar009.mallaNo ratings yet

- UpgardDocument4 pagesUpgardTraining & PlacementsNo ratings yet

- Appraisal Letter 2Document1 pageAppraisal Letter 2csreddyatsapbiNo ratings yet

- Ankit MishraDocument7 pagesAnkit MishraRähûl Prätäp SïnghNo ratings yet

- Abrpb4480f Partb 2020-21Document3 pagesAbrpb4480f Partb 2020-21Subray N BanaulikarNo ratings yet

- Statement 20141230Document15 pagesStatement 20141230adam sandsNo ratings yet

- Technical Support Executive Appointment LetterDocument4 pagesTechnical Support Executive Appointment LetterArvind SinghaniyaNo ratings yet

- Fixed Term Contract OfferDocument8 pagesFixed Term Contract OfferMohsin DesaiNo ratings yet

- Edited VikramDocument1 pageEdited Vikramnaresh0% (1)

- UGUGFUGDocument1 pageUGUGFUGDhirendra JenaNo ratings yet

- Muthoot Finance Pvt Ltd Appointment LetterDocument3 pagesMuthoot Finance Pvt Ltd Appointment LetterSantosh Kumar RautNo ratings yet

- Offer Letter: D-278, Near Hanuman MandirDocument3 pagesOffer Letter: D-278, Near Hanuman MandirGhanshyam SinghNo ratings yet

- Accenture Solutions PVT LTDDocument1 pageAccenture Solutions PVT LTDVaraprasad ReddyNo ratings yet

- PaySlip July 2022Document1 pagePaySlip July 2022Kaushal YadavNo ratings yet

- Pay SlipDocument1 pagePay SlipKumar AshuNo ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro LimitedPrantik PramanikNo ratings yet

- 1 1000 Form16Document5 pages1 1000 Form16Rakshit SharmaNo ratings yet

- Rapid Methodical Testing Private Limited: Payslip For The Month of July-2017Document6 pagesRapid Methodical Testing Private Limited: Payslip For The Month of July-2017goblinsNo ratings yet

- Itr 1 FormatDocument3 pagesItr 1 FormatPawanNo ratings yet

- Manish Kumar - Appointment LetterDocument4 pagesManish Kumar - Appointment Letterak4784449No ratings yet

- Salary Sheet (Jestha) - Amar ThakurDocument1 pageSalary Sheet (Jestha) - Amar ThakurAmar ThakurNo ratings yet

- Prashant Narhari Atule - Offer LetterDocument4 pagesPrashant Narhari Atule - Offer LetterKhushal NandeNo ratings yet

- Z Im Wum MEMLHx BAGNDocument15 pagesZ Im Wum MEMLHx BAGNIssac EbbuNo ratings yet

- Pri External Increase Tution Fee ApplicationDocument2 pagesPri External Increase Tution Fee ApplicationEvelyn MaligayaNo ratings yet

- Auto Loan Calculator: Purchase Price (Before Tax)Document10 pagesAuto Loan Calculator: Purchase Price (Before Tax)Hithayathulla KhanNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Shashank TripathiNo ratings yet

- Hello Michael Ray,: Your Bill at A GlanceDocument3 pagesHello Michael Ray,: Your Bill at A GlancegarrettloehrNo ratings yet

- MandateFormDocument1 pageMandateFormLavanya GoleNo ratings yet

- Solved Virginia Owns 100 of Goshawk Company in The Current YearDocument1 pageSolved Virginia Owns 100 of Goshawk Company in The Current YearAnbu jaromiaNo ratings yet

- Tax credit claim form guideDocument2 pagesTax credit claim form guideVivian KongNo ratings yet

- F0PFBAPEEE5TMBZ63AZQGZFH10Document1 pageF0PFBAPEEE5TMBZ63AZQGZFH10ahmedmy4nNo ratings yet

- National Automated Clearing House)Document3 pagesNational Automated Clearing House)santhosh sNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceVitrrag ShahNo ratings yet

- Apauline IciciDocument41 pagesApauline Icicihalotog831No ratings yet

- May 2022Document1 pageMay 2022Surendra KumarNo ratings yet

- Estatement 2020021813Document1 pageEstatement 2020021813ALL IN ONE. BOOLIWOOd SONGNo ratings yet

- Aussie Broadband Invoice 17023569Document2 pagesAussie Broadband Invoice 17023569mdgold1mNo ratings yet

- Unit 5Document6 pagesUnit 5deepshrmNo ratings yet

- ACCDocument16 pagesACCFarah AlyaNo ratings yet

- OD226171048157067000Document3 pagesOD226171048157067000Gyandeepptel GyandeepNo ratings yet

- Application Form For Business Permit Tax Year 2017 Municipality of GAMUDocument1 pageApplication Form For Business Permit Tax Year 2017 Municipality of GAMUGamu DILGNo ratings yet

- M PassbookDocument4 pagesM Passbookirfan shaikhNo ratings yet

- Chapter 3-Income TaxDocument42 pagesChapter 3-Income TaxRochelle ChuaNo ratings yet

- M431871385Document2 pagesM431871385Sheta PiyushNo ratings yet

- Form Easycash Plan 01112018Document1 pageForm Easycash Plan 01112018Sufandi SalimNo ratings yet

- T G Ramakrishnan 2009 AssochamDocument9 pagesT G Ramakrishnan 2009 AssochamAnkit BagariaNo ratings yet

- Form 12B - Previous Employment Income DetailsDocument2 pagesForm 12B - Previous Employment Income DetailsSachin5586No ratings yet

- Letter of Fiscal: By: Zaqiah Jihan SijayaDocument10 pagesLetter of Fiscal: By: Zaqiah Jihan SijayaZaqiah Jihan SijayaNo ratings yet