Professional Documents

Culture Documents

Buying Deveoping Market Internet Growth

Uploaded by

Dow Jones Investment BankerOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Buying Deveoping Market Internet Growth

Uploaded by

Dow Jones Investment BankerCopyright:

Available Formats

Dow Jones Investment Banker

Buying Developing Market

Internet Growth

With the mail.ru IPO due to come to market on November

8th, Dow Jones Investment Banker unpicks some of the

numbers behind the prospectus documents.

© 2010 Dow Jones & Company

Dow Jones Investment Banker

The Company ............... Mail.ru Group Limited.

The GDRs ................. Each GDR will represent one Ordinary Share deposited with

Citibank, N.A. —London, as custodian for Citibank, N.A., as

depositary.

consisting of (i) 3,032,727 GDRs representing Ordinary Shares

There is a dual share

structure - GDRs represent

Ordinary Shares, but Class A

shares have 25 votes

with Russian law and other jurisdictions outside the United States in

Over-allotment Option . . . . . . . . 3,162,429 additional GDRs representing Ordinary Shares at the

............ The company will have net cash

US$23.70 to US$27.70 per GDR.

Shares issued depend

Shares Outstanding Prioron to price

the

of around $85 million, this

. . . . around

in market, but . . . . . . . 205

...... means company

40,824,000 Ordinary Shares and 151,698,000 valued

Class A Shares.

million shares will be issued, so (simplistically) at 2011 24x

values the equity of company Ev/Ebitda and 17.5x 2012 (not

at $4.85Bn to $5.70Bn accounting for minorities)

Shares Outstanding After the

................. 78,596,528 Ordinary Shares and 117,688,545 Class A Shares

assuming no exercise of the Over-allotment Option and an issue

price at the midpoint of the range shown on the front cover hereof.

The Company has authorized up to 4,081,341 Ordinary Shares to be

Ordinary Shares to be issued upon Admission pursuant to options

exercised on a cashless basis by senior managers and employees of

Voting . . . . . . . . . . . . . . . . . . . . Each GDR carries the right to vote one Ordinary Share, subject to

the provisions of the Deposit Agreements and applicable BVI law.

Each Ordinary Share carries one vote. Each Class A Share carries

25 votes.

Use of Proceeds

Mostly owners selling down, representing new Ordinary Shares to fund a portion of its acquisition

of an additional 7.5% interest in VK. The Company will receive no

but company also raising cash proceeds from the sale of GDRs by Selling Shareholders.

Listing and Trading .......... Application has been made for the GDRs to be admitted to trading

on the London Stock Exchange ’s regulated market for listed

securities. Neither the Ordinary Shares nor the Class A Shares are

listed or traded on any stock exchange.

Lock-up . . . . . . . . . . . . . . . . . . . Until 180 days after the Closing Date, applicable to the Company,

the Selling Shareholders, the Senior Managers and certain

non-selling shareholders, subject to certain exceptions. In addition,

we have instructed the Depositary not to accept deposit of Ordinary

Shares, or issue GDRs, for 180 days after the date hereof (other than

© 2010 Dow Jones & Company

Dow Jones Investment Banker

Major Shareholders and Related

Party Transactions . . . . . . . . . Our three largest shareholder groups are (i) three companies

controlled by Alisher Usmanov, (ii) MIH Russia Internet BV (part

So the dual class of of the Naspers Group) and (iii) the Company s founders.

’ Following

the Offering and conversion of certain Class A Shares to Ordinary

shares mean that the Shares, these shareholders will together beneficially own and control

original owners have close to 98% of the votes cast at the general meeting.

98% of the votes The Company has entered into a Relationship Agreement with its

affiliate, DST Global ( ‘‘DSTG ’’) governing the relationship between

the Company and DSTG. The Relationship Agreement includes

tag-along rights in the event DSTG or any affiliated transferee sells

certain shares in Facebook and Zynga.

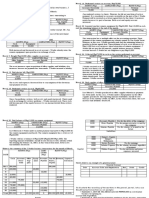

Consolidated Financial Statement Data Six months

Year ended December 31, ended June 30,

2007 2008 2009 2009 2010

(in millions of US$)

(audited) (unaudited)

Income Statement Data

Online advertising . . . . . . . . . .Just . . . . gone

. . . . . . profitable

. . . . . . . . . . at

. . . the — — 62.8 24.5 38.6

IVAS . . . . . . . . . . . . . . . . . . . . . . . . . . . operating

. . . . . . . . . . .level

..... — — 63.4 20.2 56.0

Payment processing services . . . . . . . . . . . . . . . . . . . . . . . . . . 16.6 — —

Online recruitment services . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 17.5 8.2 11.4

Dividend revenue from venture capital investments . . . . . . . . . — 0.1 1.6 0.6 1.2

Other revenue .................................... 4.5 — 3.1 1.0 1.5

Total Revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21.0 0.1 148.3 54.6 108.7

Cost of revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (16.4) — (34.3) (12.2) (25.7)

Gross margin . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.7 0.1 114.0 42.4 83.0

Net gain/(loss) on venture capital investments and associated

derivative financial assets and liabilities . . . . . . . . . . . . . . . . (10.9) (12.7) 1.5 1.2 1.6

Research and development expenses . . . . . . . . . . . . . . . . . . . . — — (1.0) — (1.3)

Selling, general and administrative expenses (1) . . . . . . . . . . . . . (9.7) (54.6) (96.8) (33.6) (53.2)

Impairment of intangible assets . . . . . . . . . . . . . . . . . . . . . . . . — — (1.8) — —

Depreciation and amortisation (2) . . . . . . . . . . . . . . . . . . . . . . . (0.1) — (29.9) (11.4) (22.4)

Operating profit (loss) .............................. (16.0) (67.2) (14.0) (1.4) 7.7

Finance income ................................... 1.9 1.2 1.5 0.8 0.4

The sell-side analysts are

Finance costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3.4) (3.3) — — —

Net gain/(loss) on derivative going

financial for around

assets $220over

and liabilities

million Ebitda next. . year

the equity of strategic investees . . . . . . . . . . . ......... 0.3 0.5 (3.6) (1.1) (0.7)

Net gain on acquisition of control in strategic associates . . . . . . — 91.9 14.8 14.8 —

Net gain/(loss) on disposal and of shares approximately

in strategic associates $300. . . . 20.4 (0.1) 113.1 113.1 —

million

Net gain/(loss) on loss of control in 2012 . . . . . . . . . . . .

in subsidiaries 167.8 — (7.1) — —

Net loss on disposals of intangible assets . . . . . . . . . . . . . . . . . (0.3) — — — 0.7

Net foreign exchange gains/(losses) . . . . . . . . . . . . . . . . . . . . . (0.2) 34.7 13.5 12.1 10.7

(Impairment losses)/reversal of impairment losses related to

associates and available for sales investments . . . . . . . . . . . . — (53.1) 46.7 — —

Share of profit/(loss) of equity method investees . . . . . . . . . . . 3.9 (16.5) 18.0 7.3 (12.4)

Gain on bargain purchase . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — — — 0.7

Other gains/(losses) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 0.1 — (1.1)

Profit/(loss) before income tax expense . . . . . . . . . . . . . . . . . . 174.5 (11.9) 183.0 145.6 5.4

Income tax expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.8) (0.1) (17.3) (10.6) (8.6)

Net profit/(loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 173.7 (12.0) 165.7 135.1 (3.1)

© 2010 Dow Jones & Company

Dow Jones Investment Banker

Selected Segment Data

which are the segments that (together with ICQ) will form the core of our consolidated operations after

ownership interest in and consolidation of all key subsidiaries and associates composing the segments in

attributable to the group for the applicable segment would have been had all applicable IFRS adjustments

been applied for the periods indicated.

Mail.ru Segment

The following table sets forth the Mail.ru segment income statement for the periods indicated. This

the respective dates at which we acquired control in 2009.

The mail.ru division had a poor Year ended

December 31,

Six months

ended June 30,

(in millions of US$)

2009 as did many similar 2007 2008 2009 2009 2010

Revenue

companies, but is rebounding (audited) (unaudited)

Online advertising: strongly this year. Sell-side con-

Display advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37.8 44.4 44.5 17.1 26.7

Context advertising . . sensus

. . . . . . . . expects

. . . . . . . . .group

. . . . . . .revenue

. . . . . . . . .30%. . . . 7.0 17.8 16.0 6.8 11.0

Total On-line advertising CAGR . . . . . . . growth

. . . . . . . . . . for

. . . . . . next

. . . . . . . three

. . . . . 44.8 62.2 60.5 24.0 37.8

IVAS: years.

MMO Games . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.7 38.9 64.9 25.0 44.4

Community IVAS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.6 3.6 7.1 3.0 9.3

Other IVAS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.8 6.7 5.8 2.4 2.6

Total IVAS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.1 49.3 77.9 30.5 56.4

Other revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.7 — — — —

Total revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 60.5 111.5 138.4 54.5 94.2

OK Segment

The following table sets forth the OK segment income statement for the periods indicated. Our OK

segment includes OK and its subsidiaries for all periods presented, assuming 100% ownership. In contrast,

June 30, 2010.

Year ended Six months

December 31, ended June 30,

(in millions of US$)

Obviously should grow as 2007 2008 2009 2009 2010

economy rebounds. (audited) (unaudited)

Revenue

Online advertising:

Display advertising ................................ 1.2 14.4 13.0 6.0 8.0

Context advertising ................................ 0.3 2.1 1.6 0.9 0.8

Total On-line advertising ............................ 1.5 16.5 14.6 6.9 8.7

Community IVAS ................................... — 4.2 29.7 12.9 21.5

Other revenue ..................................... — 0.3 — — —

Total revenue ....................................... 1.5 20.9 44.3 19.8 30.2

© 2010 Dow Jones & Company

Dow Jones Investment Banker

Group Structure

strategic minority investments, international investments and other Russian and Ukrainian investments.

Facebook is being valued at $35

billion in the grey market,

implying $833 million holding

Mail.ru Group Limited

(Founded in 2005) for company.

Strategic Core Concolidated Subsidiaries International

Minority Investments

Investments Mail.ru Internet NV (available-for-sale

(equity (100% equity interest) accounting)

method (My World Social Network, Agent IM,

accounting) Email, Games, Mail.ru Portal) Facebook Inc.

(Consolidated since December 2008) (2.38% equity

VK.com interest) (3)

(32.49% Odnoklassniki Limited

Zynga Game

equity (100% equity interest)

Network Inc.

interest) (1) (OK Social Network)

(1.47% equity

(Consolidated since August 2010)

interest) (4)

QIWI Newton Rose Limited Groupon

Investments (91% equity interest) (2) Inc.

(25.09% (Headhunter Online Recruitment Services) (5.13% equity

equity (Consolidated since February 2009) interest) (5)

interest)

ICQ LLC

(100% equity interest) Other Russian and

(ICQ IM network) Ukrainian

(Consolidated since July 2010) Investments

(fair value through

Zynga and Groupon valued at $5.6 billion and

accounting)

$1.46 billion on grey market.

15 Russian and

Ukrainian venture

capital investments

If we assume the international minorities are worth

$900 million, the rest of the business is then valued at

19x Ev/Ebitda for 2011 and 14.5x 2012

On a P/E basis, if we back out minorities, valuation becomes 30x 2011 and 20x the

year after. This valuation is close to that for the Chinese players, so the shares become

a macro play on both China and Russia

US peers such as Google or Yahoo trade P/Es of on 19x and 16x 2011 and then 15x

and 13.5x the year after. But the Chinese peers such as Alibaba.com, Tencent and

CTrip are much higher and are on 25x, 30x and 33x P/E 2011 respectively.

© 2010 Dow Jones & Company

Dow Jones Investment Banker

About Us

The Dow Jones Investment Banker columnist team brings years of

experience of corporate finance and strategic insight, being a mix of financial

professionals drawn from investment banks, hedge funds and research

houses and proven journalists.

Our exclusive insight is totally independent and adheres to Dow Jones’

standards of editorial ethics

Our focus is exclusively on the interests of investment bankers

Contact Us

dowjonesinvestmentbanker@dowjones.com

(+44) 20 7842 9343 (London)

(+1) 212 416 2101 (New York)

Twitter: twitter.com/dowjonesibanker

Our content is available only to subscribers.

To secure a trial please visit our website: dowjones.com/ib/

© 2010 Dow Jones & Company

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- SFAD Final Term Report - E-InteriorsDocument16 pagesSFAD Final Term Report - E-Interiorsstd32794No ratings yet

- BussinessPlan ManlilykhaDocument27 pagesBussinessPlan ManlilykharolyniletoNo ratings yet

- Topic 6 - ACCA Cash Flow Q SDocument8 pagesTopic 6 - ACCA Cash Flow Q SGeorge Wang100% (1)

- Act130 Testbank FinalsDocument220 pagesAct130 Testbank FinalsMelanie SamsonaNo ratings yet

- Security Selection and Asset AllocationDocument14 pagesSecurity Selection and Asset AllocationUzoamaka Okenwa-OkoyeNo ratings yet

- Acquirer Obtains Control of One or More Businesses.: ConceptDocument6 pagesAcquirer Obtains Control of One or More Businesses.: ConceptJohn Lexter MacalberNo ratings yet

- Slide AKT 405 Teori Akuntansi 8 GodfreyDocument30 pagesSlide AKT 405 Teori Akuntansi 8 GodfreypietysantaNo ratings yet

- 29 01 Mint ChennaiDocument14 pages29 01 Mint ChennaiMurali KalidasanNo ratings yet

- Ba 3 Chapter 4Document22 pagesBa 3 Chapter 4Mohamed Amadu BambaNo ratings yet

- Comparative analysis of performance metrics for selected Indian life insurance companiesDocument7 pagesComparative analysis of performance metrics for selected Indian life insurance companiesAnwar AdemNo ratings yet

- Dissenting Stockholders Right to PaymentDocument6 pagesDissenting Stockholders Right to PaymentCharisse MunezNo ratings yet

- EDHEC Valuation Manual PDFDocument40 pagesEDHEC Valuation Manual PDFradhika1992No ratings yet

- PRTC AP 1405 Final PreboardDocument14 pagesPRTC AP 1405 Final PreboardLlyod Francis LaylayNo ratings yet

- Yukos Annual Report 2002Document57 pagesYukos Annual Report 2002ed_nycNo ratings yet

- CHP 20 Fin 13Document11 pagesCHP 20 Fin 13Player OneNo ratings yet

- 3.2 Accounting For Corporation Reviewer With Sample ProblemDocument82 pages3.2 Accounting For Corporation Reviewer With Sample Problemlavender hazeNo ratings yet

- Financial Statement AnalysisDocument26 pagesFinancial Statement Analysissagar7No ratings yet

- Small BusinessDocument17 pagesSmall BusinessShakif ShariarNo ratings yet

- (Haque & McNeal) UPS Group Trust Corporate Pension DilemmaDocument21 pages(Haque & McNeal) UPS Group Trust Corporate Pension DilemmarlindseyNo ratings yet

- FR Ind As 113Document37 pagesFR Ind As 113Dheeraj TurpunatiNo ratings yet

- Accounting Concepts and Applications 11th Edition Albrecht Test Bank Full Chapter PDFDocument67 pagesAccounting Concepts and Applications 11th Edition Albrecht Test Bank Full Chapter PDFKristenGilbertpoir100% (12)

- L2 CFA Schedule - Jun 2011Document28 pagesL2 CFA Schedule - Jun 2011mengcheeNo ratings yet

- Exercise Module 2Document7 pagesExercise Module 2AríesNo ratings yet

- Fabm Nites PrintDocument3 pagesFabm Nites Printwiz wizNo ratings yet

- Preview of Chapter 17: ACCT2110 Intermediate Accounting II Weeks 8 & 9Document91 pagesPreview of Chapter 17: ACCT2110 Intermediate Accounting II Weeks 8 & 9Chi IuvianamoNo ratings yet

- FABM 2 - Module 5Document9 pagesFABM 2 - Module 5Joshua Acosta100% (4)

- Cumberland's Financial ReportsDocument8 pagesCumberland's Financial ReportsAaisha AnsariNo ratings yet

- Establish and Maintain Cash Based Accounting SystemDocument31 pagesEstablish and Maintain Cash Based Accounting SystemTegene Tesfaye100% (1)

- 01 - Illustrative Examples - Illustrative Financial Statements For Small and Medium-Sized Entities (SMEs)Document15 pages01 - Illustrative Examples - Illustrative Financial Statements For Small and Medium-Sized Entities (SMEs)michaelodigieNo ratings yet

- Chapter 9 - Supplementary ProblemsDocument6 pagesChapter 9 - Supplementary ProblemsMichaela Francess Abrasado AbalosNo ratings yet