Professional Documents

Culture Documents

PR Rata Distri Utions From Art Ershi M Le e S o Erty, F L Ow

Uploaded by

El Sayed Abdelgawwad0 ratings0% found this document useful (0 votes)

6 views3 pages34sdgh567

Original Title

Scan 0010

Copyright

© © All Rights Reserved

Available Formats

RTF, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document34sdgh567

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesPR Rata Distri Utions From Art Ershi M Le e S o Erty, F L Ow

Uploaded by

El Sayed Abdelgawwad34sdgh567

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

You are on page 1of 3

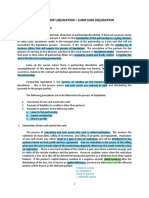

532 MODULE 35 TAXES: PARTNERSHIPS

11. Pro Rata Distributions from Partnership

12. Partnership recognizes no gain or loss on a distribution.

13. If a single distribution consists of multiple items of property, the distributed property reduces

the

partner's basis for the partnership interest in the following order:

14. Money,

15. Adjusted basis of unrealized receivables and inventory, and

16. Adjusted basis of other property.

17. Partner recognizes gain only to the extent money received exceeds the partner's partnership basis.

18. Relief from liabilities is deemed a distribution of money.

19. Gain is capital except for gain attributable to unrealized receivables and substantially appreciated

inventory.

20. The receipt of property (other than money) will not cause the recognition of gain.

EXAMPLE: Casey had a basis of $9,000 for his partnership interest at the time that he received a nonliquidating

partnership distribution consisting of $5,000 cash and other property with a basis of $3,000·and a FMV of $8,000.

No gain is recognized by Casey since the cash received did not exceed his partnership basis. Casey's $9,000 basis

for his partnership interest is first reduced by the $5,000 cash, and then reduced by the $3,000 basis of other prop-

erty, to $1,000. Casey will have a basis for the other property received of $3,000.

21. Partner recognizes loss only upon complete liquidation of a partnership interest through receipt

of

only money, unrealized receivables, or inventory.

22. The amount of loss is the basis for the partner's partnership interest less the money and the part-

nership's basis in the unrealized receivables and inventory received by the partner.

23. The loss is generally treated as a capital loss.

24. If property other than money, unrealized receivables, or inventory is distributed in complete liq-

uidation of a partner's interest, no loss can be recognized.

EXAMPLE: Day had a basis of $20,000 for his partnership interest before receiving a distribution in complete

liquidation of his interest. The liquidating distribution consisted of $6,000 cash and inventory with a basis of

$11,000. Since Day's liquidating distribution consisted of only money and inventory, Day will recognize a loss on

the liquidation of his partnership interest. The amount of loss is the $3,000 difference between the $20,000 basis

for his partnership interest, and the $6,000 cash and the $11,000 basisfor the inventory received. Day will have

an $11,000 basis for the inventory.

EXAMPLE: Assume the same facts as in the preceding example except that Day's liquidating distribution consists

of $6,000 cash and a parcel of land with a basis of $11,000. Since the liquidating distribution now includes

property other than money, receivables, and inventory, no loss can be recognized on the liquidation of Day's

partnership interest. The basisfor Day's partnership interest isfirst reduced by the $6,000 cash to $14,000. Since

no loss can be recognized, the parcel of land must absorb all of Day's unrecovered partnership basis. As a result,

the land will have a basis of $14,000. .

25. In nonliquidating (current) distributions, a partner's basis in distributed property is generally the

same part-

as the nership interest less any money received.

partne EXAMPLE: Sara receives a current distribution from her partnership at a time when the basis for her partnership in-

rship'S terest is $10,000. The distribution consists of $7,000 cash and Sec. 1231 property with an adjusted basis of $5,000 and

former a FMV of $9,000. No gain is recognized by Sara since the cash received did not exceed her basis. After being reduced

by the cash, her partnership basis of $3,000 is reduced by the basis of the property (but not below zero). Her basis for

basis the property is limited to $3,000.

in the

proper 26. If multiple properties are distributed in a liquidating distribution, or if the partnership's basis for

distributed properties exceed the partner's basis for the partnership interest, the partner's basis for the

ty; but

partnership interest is allocated in the following order:

is

limite 27. Basis is first allocated to unrealized receivables and inventory items in an amount equal to their

d to adjusted basis to the partnership. If the basis for the partner's interest to be allocated to the assets

the is less than the total basis of these properties to the partnership, a basis decrease is required and is

basis determined under (1) below.

for the 28. To the extent a partner's basis is not allocated to assets under a. above, basis is allocated to other

partne distributed properties by assigning to each property its adjusted basis in the hands of the partner-

r's ship, and then increasing or decreasing the basis to the extent required in order for the adjusted ba-

sis of the distributed properties to equal the remaining basis for the partner's partnership interest.

You might also like

- Taxation of Partnership DistributionsDocument3 pagesTaxation of Partnership DistributionsAnonymous JqimV1ENo ratings yet

- K. Pro Rata Distributions From Partnership: Module 35 Taxes: PartnershipsDocument2 pagesK. Pro Rata Distributions From Partnership: Module 35 Taxes: PartnershipsAnonymous JqimV1ENo ratings yet

- Partnership Distributions Part 1: Gain Loss and Basis IssuesDocument12 pagesPartnership Distributions Part 1: Gain Loss and Basis IssuesWenting WangNo ratings yet

- Chapter 11Document42 pagesChapter 11Dyllan Holmes50% (2)

- Module 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CDocument3 pagesModule 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CZeyad El-sayedNo ratings yet

- CH 10 CsolDocument47 pagesCH 10 Csolxuzhu5No ratings yet

- Tax Assignment 5Document3 pagesTax Assignment 5Monis KhanNo ratings yet

- Ea Ea2 Su10 OutlineDocument16 pagesEa Ea2 Su10 OutlineAdil AliNo ratings yet

- Se Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossDocument3 pagesSe Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossZeyad El-sayedNo ratings yet

- SM CH10Document32 pagesSM CH10Judz SawadjaanNo ratings yet

- TAXES: GIFT AND ESTATE - DNI, SIMPLE/COMPLEX TRUSTS, GRANTOR TRUSTSDocument3 pagesTAXES: GIFT AND ESTATE - DNI, SIMPLE/COMPLEX TRUSTS, GRANTOR TRUSTSEl-Sayed MohammedNo ratings yet

- Ch16 Beams12ge SMDocument46 pagesCh16 Beams12ge SMverlyarin81% (16)

- Liquidation 2Document3 pagesLiquidation 2Kenneth CuencaNo ratings yet

- Pearsons Federal Taxation 2019 Corporations Partnerships Estates Trusts 32nd Edition Anderson Solutions ManualDocument45 pagesPearsons Federal Taxation 2019 Corporations Partnerships Estates Trusts 32nd Edition Anderson Solutions Manualsmiletadynamia7iu4100% (22)

- Basis Decrease: Module 35 Taxes: PartnershipsDocument3 pagesBasis Decrease: Module 35 Taxes: PartnershipsEl Sayed AbdelgawwadNo ratings yet

- Test QuestionsDocument24 pagesTest Questionsjmp8888No ratings yet

- Taxes: Transactions in PropertyDocument2 pagesTaxes: Transactions in PropertyEl Sayed AbdelgawwadNo ratings yet

- Allocation of Partnership Liabilities (Full Version)Document3 pagesAllocation of Partnership Liabilities (Full Version)forbesadmin86% (37)

- Tax Rules for Partnership FormationDocument2 pagesTax Rules for Partnership FormationEl Sayed AbdelgawwadNo ratings yet

- Nielson & Co V Lepanto Consolidated Mining CoDocument16 pagesNielson & Co V Lepanto Consolidated Mining Covmanalo16No ratings yet

- Module 35 Ta Es: P RT R Hips: X A NE SDocument3 pagesModule 35 Ta Es: P RT R Hips: X A NE SEl Sayed AbdelgawwadNo ratings yet

- Final Exam Outline Full Ver1263165054Document22 pagesFinal Exam Outline Full Ver1263165054LawNerdNYCNo ratings yet

- Wassim Zhani Income Taxation of Corporations (Chapter 9)Document38 pagesWassim Zhani Income Taxation of Corporations (Chapter 9)wassim zhaniNo ratings yet

- Lect.7 Withdrawals of PatnerDocument20 pagesLect.7 Withdrawals of PatnerHany RagabNo ratings yet

- Partnership & LLP Davidian TaxDocument47 pagesPartnership & LLP Davidian TaxbornkellerNo ratings yet

- November 2014 Powerpoint PDFDocument29 pagesNovember 2014 Powerpoint PDFYeppeuddaNo ratings yet

- Lecture On Lump Sum LiquidationDocument10 pagesLecture On Lump Sum LiquidationKim Nicole ReyesNo ratings yet

- Dispositions of Partnership Interests and Partnership Distributions Solutions Manual Discussion QuestionsDocument49 pagesDispositions of Partnership Interests and Partnership Distributions Solutions Manual Discussion QuestionsHarsh Khandelwal100% (2)

- Taxes: Corporate: Sec. S OcDocument2 pagesTaxes: Corporate: Sec. S OcAnonymous JqimV1ENo ratings yet

- Chapter 16 Solution ManualDocument54 pagesChapter 16 Solution ManualJose Matalo67% (3)

- Partnership Tax RulesDocument3 pagesPartnership Tax RulesEl Sayed AbdelgawwadNo ratings yet

- Partnership Formation and Ownership Changes MCQDocument16 pagesPartnership Formation and Ownership Changes MCQkylicia bestNo ratings yet

- Module 4 - Partnership LiquidationDocument10 pagesModule 4 - Partnership LiquidationJhanella Faith FagarNo ratings yet

- Advance Financial Accounting and Reporting 2 Notes CompressDocument35 pagesAdvance Financial Accounting and Reporting 2 Notes CompressthegreatNo ratings yet

- B. Woods Chapter 15Document42 pagesB. Woods Chapter 15Ludia Daniel100% (1)

- Outline Taxation of PartnershipsDocument22 pagesOutline Taxation of PartnershipsHardeep ChauhanNo ratings yet

- Florence L. Rogers, and Joe W. Stout and Eudora Stout v. Commissioner of Internal Revenue, 281 F.2d 233, 4th Cir. (1960)Document7 pagesFlorence L. Rogers, and Joe W. Stout and Eudora Stout v. Commissioner of Internal Revenue, 281 F.2d 233, 4th Cir. (1960)Scribd Government DocsNo ratings yet

- Partnership Tax IssuesDocument2 pagesPartnership Tax IssuesZeyad El-sayedNo ratings yet

- Partnership Liquidation StatementDocument16 pagesPartnership Liquidation StatementAisea Juliana VillanuevaNo ratings yet

- Liquidating Partnerships and Distributing CashDocument54 pagesLiquidating Partnerships and Distributing Cashthriu86% (7)

- Pope Phft2017 Corp SM 09Document44 pagesPope Phft2017 Corp SM 09David PadillaNo ratings yet

- Lee Jr. V CADocument3 pagesLee Jr. V CAVianca MiguelNo ratings yet

- Chap 10 PartnershipDocument24 pagesChap 10 PartnershipIvhy Cruz Estrella100% (2)

- Taxation of Business Entities 8th Edition Spilker Solutions ManualDocument48 pagesTaxation of Business Entities 8th Edition Spilker Solutions Manualpricking.carryallmbtgco100% (21)

- Lesson 8 Case BriefDocument3 pagesLesson 8 Case BriefMonis KhanNo ratings yet

- Chapter 20 PartnershipsDocument10 pagesChapter 20 PartnershipsJessica Garcia100% (1)

- Lecture 14 Raising FinanceDocument23 pagesLecture 14 Raising FinanceNick WilliamNo ratings yet

- Partnership Liquidation and Incorporation Joint Ventures: ©the Mcgraw Hill Companies, Inc. 2006 Mcgraw Hill/IrwinDocument29 pagesPartnership Liquidation and Incorporation Joint Ventures: ©the Mcgraw Hill Companies, Inc. 2006 Mcgraw Hill/Irwinmahmoud ragabNo ratings yet

- BAC 112 Midterm Examination With QuestionsDocument11 pagesBAC 112 Midterm Examination With Questionsjanus lopezNo ratings yet

- Acctg 2 QuizDocument4 pagesAcctg 2 QuizSyril Sarientas100% (2)

- Lesson 1. Introduction To PartnershipDocument4 pagesLesson 1. Introduction To Partnershipangelinelucastoquero548No ratings yet

- CIR Rules on Taxability of Stock Redemptions and DividendsDocument4 pagesCIR Rules on Taxability of Stock Redemptions and DividendsKristian AguilarNo ratings yet

- Partnership Liquidation and Termination ProcessDocument34 pagesPartnership Liquidation and Termination ProcessclevereuphemismNo ratings yet

- 4.1.1. Partnership LiquidationDocument73 pages4.1.1. Partnership LiquidationJhaister Ashley LayugNo ratings yet

- Finals - Financial AccountingDocument6 pagesFinals - Financial AccountingAlyssa QuiambaoNo ratings yet

- Prentice Halls Federal Taxation 2013 Corporations Partnerships Estates and Trusts 26th Edition Pope Solutions ManualDocument44 pagesPrentice Halls Federal Taxation 2013 Corporations Partnerships Estates and Trusts 26th Edition Pope Solutions Manualresedaouchylrq100% (28)

- Partnership ReviewerDocument15 pagesPartnership ReviewerApril CaringalNo ratings yet

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- Module 22 Federal Securities Acts and Antitrust LawDocument2 pagesModule 22 Federal Securities Acts and Antitrust LawEl Sayed AbdelgawwadNo ratings yet

- Example On Implementing IFRS 16181Document4 pagesExample On Implementing IFRS 16181El Sayed AbdelgawwadNo ratings yet

- Agency: I. Formation of The Agency RelationshipDocument7 pagesAgency: I. Formation of The Agency RelationshipEl Sayed AbdelgawwadNo ratings yet

- Scan 0015Document2 pagesScan 0015El Sayed AbdelgawwadNo ratings yet

- M Dule 22 Federal Securities Acts and Antitrust LawDocument2 pagesM Dule 22 Federal Securities Acts and Antitrust LawEl Sayed AbdelgawwadNo ratings yet

- P L N L U N N T MP: Sarbanes-Ox Eyactof2 2Document2 pagesP L N L U N N T MP: Sarbanes-Ox Eyactof2 2El Sayed AbdelgawwadNo ratings yet

- Module 22 Federal Securities Acts and Antitrust LawDocument2 pagesModule 22 Federal Securities Acts and Antitrust LawEl Sayed AbdelgawwadNo ratings yet

- Federal Securities Acts and Antitrust LawDocument3 pagesFederal Securities Acts and Antitrust LawEl Sayed AbdelgawwadNo ratings yet

- Scan 0020Document2 pagesScan 0020El Sayed AbdelgawwadNo ratings yet

- Scan 0022Document2 pagesScan 0022El Sayed AbdelgawwadNo ratings yet

- Federal Securities Acts and Antitrust Law: C o C eDocument2 pagesFederal Securities Acts and Antitrust Law: C o C eEl Sayed AbdelgawwadNo ratings yet

- Scan 0021Document2 pagesScan 0021El Sayed AbdelgawwadNo ratings yet

- J .T/DTD: Tjrrji?"Document1 pageJ .T/DTD: Tjrrji?"El Sayed AbdelgawwadNo ratings yet

- Federal Securities Acts and Antitrust Law ExplainedDocument2 pagesFederal Securities Acts and Antitrust Law ExplainedEl Sayed AbdelgawwadNo ratings yet

- Scan 0019Document2 pagesScan 0019El Sayed AbdelgawwadNo ratings yet

- Scan 0014Document2 pagesScan 0014El Sayed AbdelgawwadNo ratings yet

- Contracts: D Still Owes CTDocument2 pagesContracts: D Still Owes CTEl Sayed AbdelgawwadNo ratings yet

- Revocation and Termination of Contract OffersDocument2 pagesRevocation and Termination of Contract OffersEl Sayed AbdelgawwadNo ratings yet

- Contracts Module SummaryDocument2 pagesContracts Module SummaryEl Sayed AbdelgawwadNo ratings yet

- Cont A: R CTSDocument2 pagesCont A: R CTSEl Sayed AbdelgawwadNo ratings yet

- J .T/DTD: Tjrrji?"Document1 pageJ .T/DTD: Tjrrji?"El Sayed AbdelgawwadNo ratings yet

- Scan 0011Document2 pagesScan 0011El Sayed AbdelgawwadNo ratings yet

- Scan 0010Document2 pagesScan 0010El Sayed AbdelgawwadNo ratings yet

- Contracts Module SummaryDocument2 pagesContracts Module SummaryEl Sayed AbdelgawwadNo ratings yet

- S S S T I E: ContractsDocument2 pagesS S S T I E: ContractsEl Sayed AbdelgawwadNo ratings yet

- Contracts Module SummaryDocument2 pagesContracts Module SummaryEl Sayed AbdelgawwadNo ratings yet

- Scan 0002Document2 pagesScan 0002El Sayed AbdelgawwadNo ratings yet

- J .T/DTD: Tjrrji?"Document1 pageJ .T/DTD: Tjrrji?"El Sayed AbdelgawwadNo ratings yet

- Cont Acts: G A A yDocument1 pageCont Acts: G A A yEl Sayed AbdelgawwadNo ratings yet

- Contracts Module SummaryDocument2 pagesContracts Module SummaryEl Sayed AbdelgawwadNo ratings yet

- Writ of Continuing Mandamus (FIL)Document33 pagesWrit of Continuing Mandamus (FIL)Ronnie RimandoNo ratings yet

- Calleon v. HZSC RealtyDocument1 pageCalleon v. HZSC RealtyljhNo ratings yet

- Cable 504: US and Honduras Negotiate Intelligence Sharing and The Cerro La Mole Radar SystemDocument7 pagesCable 504: US and Honduras Negotiate Intelligence Sharing and The Cerro La Mole Radar SystemAndresNo ratings yet

- Amendment ResolutionDocument2 pagesAmendment ResolutionMark Lemuel Layones ArceoNo ratings yet

- Falklandskrigen - SRP - M.Kocan 3.m 1Document30 pagesFalklandskrigen - SRP - M.Kocan 3.m 1Kerry JohnsonNo ratings yet

- Letter of RequestDocument1 pageLetter of RequestJohn Rey Bantay RodriguezNo ratings yet

- Ing Bank v. CIR / G.R. No. 167679 / July 22, 2015Document1 pageIng Bank v. CIR / G.R. No. 167679 / July 22, 2015Mini U. Soriano100% (1)

- Fast Pass FingerprintsDocument1 pageFast Pass FingerprintsPrecious Peas Modern Day Care & Learning CenterNo ratings yet

- Pay To The Order of Puerto RicoDocument368 pagesPay To The Order of Puerto RicoJosé Celso Barbosa Statehood LibraryNo ratings yet

- Expanded Media Coverage RE: Bahena RiveraDocument4 pagesExpanded Media Coverage RE: Bahena RiveraLocal 5 News (WOI-TV)No ratings yet

- Jury Misconduct - MotionDocument3 pagesJury Misconduct - MotionObservererNo ratings yet

- Template With Cover PageDocument5 pagesTemplate With Cover PageChristine MannaNo ratings yet

- South Asia Tribune Weekly UKDocument32 pagesSouth Asia Tribune Weekly UKShahid KhanNo ratings yet

- Villanueva vs. DomingoDocument2 pagesVillanueva vs. DomingoKingNoeBadongNo ratings yet

- Union BugDocument12 pagesUnion BugCasey SeilerNo ratings yet

- Felony Complaint 22FE001489 WALTON, JermaineDocument3 pagesFelony Complaint 22FE001489 WALTON, JermaineGilbert CordovaNo ratings yet

- Villavicencio v. Lukban, G.R. No. L-14639Document12 pagesVillavicencio v. Lukban, G.R. No. L-14639Daryl CruzNo ratings yet

- ABYIP ResolutionDocument3 pagesABYIP Resolutionmichelle100% (5)

- Form No.15Document3 pagesForm No.15manojpavanaNo ratings yet

- Protecting Trademarks On The Internet, (Including Social Media) and Role of Internet Service ProvidersDocument15 pagesProtecting Trademarks On The Internet, (Including Social Media) and Role of Internet Service ProvidersCM ChiewNo ratings yet

- SB Order 28-2020 PassbooksDocument2 pagesSB Order 28-2020 PassbooksbhanupalavarapuNo ratings yet

- Medicard PH VAT liability on amounts paid to medical providersDocument2 pagesMedicard PH VAT liability on amounts paid to medical providersVon Lee De LunaNo ratings yet

- Luv N' Care v. Regent - Order Granting MSJDocument19 pagesLuv N' Care v. Regent - Order Granting MSJSarah BursteinNo ratings yet

- Ganapati TDS ChalanDocument3 pagesGanapati TDS ChalanPruthiv RajNo ratings yet

- 08 - Chapter 3 PDFDocument128 pages08 - Chapter 3 PDFAnonymous VXnKfXZ2PNo ratings yet

- General Sense - The Science of Moral Rules, Founded On The Rational Nature of Man, Which Governs His FreeDocument3 pagesGeneral Sense - The Science of Moral Rules, Founded On The Rational Nature of Man, Which Governs His FreeAmelyn BalanaNo ratings yet

- Lect 1 Overview of Taxation 2017Document68 pagesLect 1 Overview of Taxation 2017Devisudha ThanaseelanNo ratings yet

- Allied Bank (M) SDN BHD V Yau Jiok Hua - (20Document14 pagesAllied Bank (M) SDN BHD V Yau Jiok Hua - (20Huishien QuayNo ratings yet

- The FederalistDocument656 pagesThe FederalistMLSBU11No ratings yet

- Pradhan Mantri Ujjwala Yojana PDFDocument2 pagesPradhan Mantri Ujjwala Yojana PDFKhatana PervaizNo ratings yet