Professional Documents

Culture Documents

8MAS 08 ABC Balanced Scorecard Module

Uploaded by

Kathreen Aya Exconde0 ratings0% found this document useful (0 votes)

159 views4 pagesOriginal Title

8MAS-08-ABC-Balanced-Scorecard-module.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

159 views4 pages8MAS 08 ABC Balanced Scorecard Module

Uploaded by

Kathreen Aya ExcondeCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

MAS – 08: ABC & BALANCED SCORECARD (64 MCQs)

1. An objective of activity-based management (ABM) is to

a. Eliminate the majority of centralized activities in an organization

b. Institute responsibility accounting systems in decentralized organizations

c. Reduce or eliminate non-value added activities done to make a product or provide a service

d. All of the above

2. A tool that focuses on manufacturing processes and seeks to optimize the activities performed within the process is

a. Process value analysis c. Benchmarking

b. Re-engineering d. None of the above

3. What is a non-value-adding costs?

a. Usually direct to a product c. Unavoidable

b. The same as a discretionary cost d. Not essential to manufacturing a product

4. What would be a value-added employee in a construction firm?

a. An accountant c. A painter

b. A secretary d. All of the above

5. “Machine hours” is an example of a (n) ___________ activity.

a. Batch-level c. Product-level

b. Facility-level d. Unit-level

6. Machine setup is an example of a (n) ___________ activity.

a. Batch-level c. Product-level

b. Facility-level d. Unit-level

7. TV Advertisement is an example of a (n) __________ activity.

a. Batch-level c. Product-level

b. Facility-level d. Unit-level

8. Landscaping is an example of a (n) ___________ activity.

a. Batch-level c. Product-level

b. Facility-level d. Unit-level

9. Which level of costs should NOT be included in product costs (mainly because indirect to product line segment) for internal management

reports that are used for decision making?

a. Unit-level activities c. Product-level activities

b. Batch-level activities d. Facility-level activities

10. These activities arise because a company does or maintains a particular type of business or product.

a. Batch-level activities c. Sustaining activities

b. Facility-sustaining activities d. Unit-level activities

11. Property taxes and insurance is an example of a cost that would be considered to be

a. Unit-level c. Product-level

b. Batch-level d. Organization-sustaining

12. Which of the following is typically regarded as cost driver in traditional costing practices?

a. Number of purchase order processed c. Number of transactions processed

b. Number of customers served d. Number of direct labor hours worked

13. Activity-based costing(ABC)

a. Requires the identification of cost drivers

b. Is used only in just-in-time (JIT) operations

c. Applied only to discretionary fixed costs

d. Does not help to identify activities as value-adding or non-value-adding

14. A company using activity-based costing

a. Tries to identify cost drivers

b. Is probably using the JIT philosophy

c. Allocates all costs to individual products

d. Look for the activity with which total costs are most closely associated

15. What is driver cost?

a. An activity that can be used to predict cost changes

b. The attempt to control expenditures at a reasonable level

c. The person who gathers and transfers cost data to the management accountant

d. Any activity that causes costs to be incurred

16. What is a cost pool?

a. All costs of a production department

b. Over applied or under-applied overhead costs

c. The material and labor cost used on a particular job

d. A group of overhead costs driven by the same activity

17. In ABC, in preliminary costs allocations assign cost to

a. Departments c. Products

b. Processes d. Activities

18. In ABC in final cost allocations assign costs to

a. Departments c Products

b. Processes d. Activities

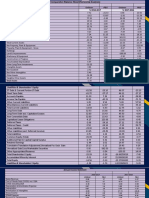

19. Lebanon manufacturer’s two versions of a product. Production and cost information show the following:

Model A Model B

Unit produced 100 200

Material moves 10 40

Direct labor hours per unit 1 2

Under ABC, what is the materials handling costs of P100,000 allocated to unit of Model A?

a. P10 c. P333

b. P200 d. P400

20. Iran Manufacturing produces three products. Production and cost information show the following:

Model F Model A Model Q

Units produced 1,000 3,000 6,000

Direct labor hours 2,000 1,000 2,000

Number of inspections 20 30 50

Using ABC, what would be the inspection costs of P50,000 allocated to each unit of Model F?

a. P5.00 c. P20.00

b. P10.00 d. Some other number

21. A company using activity-based overhead rates

a. Will usually have higher budget variances than one using a single rate

b. Will usually have higher volume variances than one using a single rate

c. Cannot compute fixed and variable components of overhead cost

d. Should have better information for planning and control than one using a single rate

22. The resource utilized by a given product divided by the total amount of the resource available is called

a. Activity driver c. Cost object

b. Consumption ratio d. Sustaining activity

23. Syria Inc. produces three products. Production and cost information is as follows:

Model Y Model O Model U

Units produced 2,000 6,000 12,000

Direct labor hours 4,000 2,000 4,000

Number of setups 100 150 250

What would be the consumption ratio for the number of setups?

Y O U Y O U

a. 40% - 20% - 40% c. 10% - 30% - 60%

b. 20% - 30% - 50% d. Some other numbers

24. Iraq Company uses activity-based costing to determine unit product costs for external reports. The company has two products: A and B. The

annual production and sales of Product A is 10,000 units and Product B is 4,000 units. There are three overhead activity centers, with

estimated overhead costs and expected activity as follows:

Activity Center Estimated Overhead Costs Product A activity Product B activity

Activity 1 P25,000 150 100

Activity 2 P65,000 800 200

Activity 3 P90,000 1,000 2,000

What is the overhead cost per unit of Product A under activity-based costing (ABC)?

a. P6.00 c. P1.50

b. P9.70 d. P3.00

Items 25 and 26 are based on the following information

Zaire Company is preparing its annual profit plan. As part of its analysis of the profitability of individual products, the controller estimates the

amount of overhead that should be allocated to the individual product lines from the information given as follows:

Wall Mirrors Specialty Windows

Units produced 25 25

Materials moves per product line 5 15

Direct labor hours per unit 200 200

Budgeted materials handling costs P50,000

25. Under a costing system that allocates overhead on the basis of direct labor hours, what would be the materials handling costs allocated to

one unit of wall mirrors?

a. P500 c. P2,000

b. P1,000 d. P5,000

26. Under ABC, what would be the materials handling costs allocated to one unit of wall mirrors?

a. P500 c. P1,500

b. P1,000 d. P2,500

27. Somalia Co. has used a traditional cost accounting system to apply quality costs uniformly to all products at a rate of 15% of direct labor cost.

Monthly direct labor cost for its main product is P30,000. In an attempt to distribute quality control cost more equitably, Somalia is

considering ABC. The monthly data shown below have been gathered for the main product. The three activities are (1) income materials

inspection (2) in-process inspection and (3) product certification. Cost are allocated to each activity on the basis of cost drivers.

Activity Cost Driver Cost Rate Quantity for Main Product

(1) Number of types of materials P12 per type 12 types

(2) Number of units P0.14 per unit 17,500 units

(3) Number of orders P77 per unit 30 orders

What is the monthly quality control cost assigned to the main product using ABC?

a. P150 per order c. P404 lower than using the traditional system

b. P4,500 d. P404 higher than using the traditional system

28. Assigning overhead to jobs using a predetermined overhead rate is called

a. Application c. Product costing

b. Budgeting d. Job-order costing

29. A company allocates overhead to jobs in process using direct labor cost, raw material costs, and machine hours.

The overhead application rates for the current year are

100% of direct labor

20% of raw materials

P117 per machine hours

A particular production run incurred the following costs:

Direct labor, P8,000

Raw materials, P2,000

A total of 140 machine hours were required for the production run

What is the total cost that would be charged to the production run?

a. P18,000 c. P24,780

b. P18,400 d. P34,780

30. Afghanistan Company uses ABC to compute product costs for external reports. The company has three activity centers and applied overhead

using predetermined overhead rates for each activity center. Estimated costs and activities for the current year are presented below for the

three activity centers:

Estimated overhead cost Expected activity

Activity 1 P61,387 2,300

Activity 2 P34,076 2,800

Activity 3 P69,075 2,500

Actual costs and activities for the current year were as follows:

Actual overhead cost Actual activity

Activity 1 P61,392 2,290

Activity 2 P33,941 2,795

Activity 3 P69,080 1,340

What was the amount of overhead over or under-applied for activity 1 during the year?

a. P271.90 over-applied c. P5.00 over-applied

b. P271.90 under-applied d. P5.00 under-applied

31. The use of activity-based costing normally results in

a. Greater unit costs for low-volume products than is reported than is reported by traditional product costing

b. Lower unit costs for low-volume products than is reported by traditional product costing

c. Decreased setup costs being charged to volume products

d. Equalizing setup costs for all product lines

32. Predetermined overhead rates are based on activity measured by

a. Actual overhead cost and actual activity c. Budgeted overhead cost and actual activity

b. Actual overhead cost and budgeted activity d. Budgeted overhead cost and budgeted activity

33. What is the numerator in computing a predetermined overhead rate?

a. Budgeted manufacturing overhead cost c. Budgeted activity

b. Actual manufacturing overhead cost d. Fixed manufacturing overhead cost

34. What is the denominator in computing a predetermined overhead rate?

a. Budgeted manufacturing overhead cost c. Budgeted activity

b. Actual manufacturing overhead cost d. Fixed manufacturing overhead cost

35. A predetermined overhead rate cannot be used

a. If a company does not budget its overhead costs

b. By a company that uses job-order costing

c. In a multi-product company

d. By a highly automated company where labor is a minor part of product cost

36. Angola applies overhead based on direct labor cost. It had budgeted factory overhead of P500,000 and budgeted direct labor of P250,00.

Actual overhead was P525,000 while actual labor cost was P270,000. Overhead was:

a. Over-applied by P15,000 c. Over-applied by P25,000

b. Over-applied by P20,000 d. Under-applied by P20,000

37. Sudan Company applies overhead at P4 per machine hour. During March, it worked 10,000 hours and over-applied overhead by P3,000.

Actual overhead was:

a. P43,000 c. P37,000

b. P40,000 d. P35,000

38. Rwandan Company applies overhead at P8 per direct labor hour, of which P3 is variable overhead. Budgeted direct labor hours were 90,000.

Budgeted fixed overhead was:

a. P270,000 c. P720,000

b. P450,000 d. P810,000

39. Sahara Company applied overhead at P6 per direct labor hour. In March, Sahara incurred overhead of P144,000. Under-applied overhead

was P6,000. How many direct labor hours did Sahara work?

a. 25,000 c. 23,000

b. 24,000 d. 22,000

40. Machine hours used to set the predetermined overhead rate were 50,000, actual hours were 48,000, and overhead applied was P120,000.

Budgeted overhead for the year was:

a. P115,200 c. P120,000

b. P118,000 d. P125,000

41. The appropriate method for the disposition of under-applied or over-applied factory overhead

a. Is to cost of goods sold only

b. Is to finished goods inventory only

c. Is apportioned to cost of goods sold and finished goods inventory

d. Depends on the significance of the amount

42. A report that measures financial and non-financial performance measures for various units in a single report is a (n):

a. Balanced scorecard c. Imbalanced scorecard

b. Financial report scorecard d. Unbalanced scorecard

43. Customer-satisfaction measures are example of

a. Goal-congruence approach c. Financial report scorecard approach

b. Balanced scorecard approach d. Investment success approach

44. In balanced scorecard, a survey of employee satisfaction is a potential measure in which of the four perspectives?

a. Financial c. Internal business processes

b. Customer d. Learning and growth

45. Which is considered to be a performance measurement that is a non-financial rather than a financial measure?

a. Return on investment c. Customer satisfaction

b. Economic value added d. Profit margin

46. Which of the following is an example of an efficiency measure?

a. The rate of absenteeism

b. The goal of becoming a leader manufacturer

c. The number of insurance of insurance claims processed per day

d. The rate of customer complaints

47. Which performance measure would be part of those used for internal business processes perspective?

a. Cycle time c. Hours of training per employee

b. Employee satisfaction d. Customer retention

48. Which of the following represents value-added time in the manufacturing cycle?

a. Inspection time c. Move time

b. Queue time d. Process time

Items 49 to 51 are based on the following information

China Manufacturing Corporation has the following information:

Moving time 8 days

Inspection time 2 days

Processing time 10 days

Storage time 30 days

49. What is the total amount of value-added time?

a. 10 days c. 40 days

b. 30 days d. 50 days

50. What is the product’s cycle time?

a. 10 days c. 40 days

b. 30 days d. 50 days

51. What is the manufacturing cycle efficiency (MCE)?

a. 25.0% c. 20.0%

b. 80.0% d. 60.0%

52. These are quality costs incurred to determine whether particular units of product meet quality standards.

a. Appraisal costs c. Internal failure costs

b. Prevention costs d. External failure costs

53. These are quality costs incurred when company determines units that do not meet quality standards.

a. Appraisal costs c. Internal failure costs

b. Prevention costs d. External failure costs

54. These are quality costs incurred when a unit of product fails to perform to customer expectations.

a. Appraisal costs c. Internal failure costs

b. Prevention costs d. External failure costs

55. The cost of disposing of defective units would be classified as a (n):

a. Preventive cost c. Internal failure costs

b. Appraisal costs d. External failure costs

56. The cost of statistical quality control in a product quality cost system is categorized as a(n)

a. Internal failure cost c. External failure cost

b. Training cost d. Appraisal cost

57. The cost of scrap, rework, and tooling changes in a product quality cost system is categorized as a (n)

a. Training cost c. Internal failure cost

b. External failure cost d. Prevention cost

58. The cost of processing customer complaints

a. Appraisal costs c. Internal failure costs

b. Prevention costs d. External failure costs

59. As prevention costs increase, other costs of quality generally

a. Are not affected c. Decrease

b. Increase but a slower pace d. Change, but the direction cannot be predicted

60. An increase in appraisal costs in a quality improvement would usually have the following initial effects on (I) internal failure costs and (II)

external failure costs:

a. (I) Increase (II) Increase c. (I) Decrease (II) Increase

b. (I) Increase (II) Decrease d. (I) Decrease (II) Decrease

61. All of the following would generally be included in a cost-of-quality report, EXCEPT

a. Warranty claims c. Supplier evaluations

b. Design engineering d. Lost contribution margin

62. Management of a company is attempting to build a reputation as a world-class manufacturer of quality products. Which of the following

measures would NOT be used by the firm to measure quality?

a. The percentage of shipments returned by customers because of poor quality

b. The number of parts shipped per day

c. The number of defective parts per million

d. The percentage of products passing quality tests the first time

63. The primary reason for adopting TQM was to achieve

a. Greater customer satisfaction c. Reduced delivery charges

b. Reduced delivery time d. Greater employee participation

64. What is the ultimate test of a quality product or service?

a. Whether the product is able to reduce the conformance costs

b. Whether the product is able to reduce the non-conformance costs

c. Whether the product is able to reduce the conformance and non-conformance costs

d. Whether the product meets or exceeds the customer’s expectation

65. Quality is achieved more economically if the company focuses on

a. Appraisal costs c. Internal failure costs

b. Prevention costs d. External failure costs

66. Quality cost index is often to measure and analyse cost of maintaining a given level of quality. One example of a quality cost index, which

uses a direct labor base, is computed as:

Quality cost index = (Total quality costs/ Direct labor costs) X 100

The following quality cost data were collected for May and June:

May June

Prevention costs P4,000 5,000

Appraisal costs 6,000 5,000

Internal failure costs 12,000 15,000

External failure costs 14,000 11,000

Direct labor costs 90,000 100,000

Based upon these cost data, the quality cost index

a. Decrease 4 points from May to June c. Increase 10 points from May to June

b. Was unchanged from May to June d. Decreased 10 points from May to June

You might also like

- Pom Exam Part 2 PDFDocument11 pagesPom Exam Part 2 PDFREIGN EBONY ANNE AGUSTINNo ratings yet

- ABC Costing Lecture NotesDocument12 pagesABC Costing Lecture NotesMickel AlexanderNo ratings yet

- Cost Accounting Systems A. Traditional Cost Accounting TheoriesDocument47 pagesCost Accounting Systems A. Traditional Cost Accounting TheoriesalabwalaNo ratings yet

- CH 04Document9 pagesCH 04jaysonNo ratings yet

- S 20A Specification Forms PDFDocument15 pagesS 20A Specification Forms PDFAlfredo R Larez0% (1)

- 18 x12 ABC A Traditional Cost AccountingDocument11 pages18 x12 ABC A Traditional Cost AccountingJeh EusebioNo ratings yet

- TEST BANK Cost Accounting 14E by Carter Ch08 TEST BANK Cost Accounting 14E by Carter Ch08Document16 pagesTEST BANK Cost Accounting 14E by Carter Ch08 TEST BANK Cost Accounting 14E by Carter Ch08mEOW SNo ratings yet

- Cost2 TestbankDocument29 pagesCost2 TestbankannewilsonNo ratings yet

- Service and Production Department Cost AllocationDocument58 pagesService and Production Department Cost AllocationLorena TudorascuNo ratings yet

- Seatwork Answer KeyDocument6 pagesSeatwork Answer KeyKathreen Aya Exconde100% (1)

- Cost Old DeptalsDocument9 pagesCost Old Deptalsyugyeom rojas0% (1)

- C ProgrammingDocument205 pagesC ProgrammingSrinivasan RamachandranNo ratings yet

- Primary Checkpoint - Science (0846) October 2016 Paper 2 MSDocument12 pagesPrimary Checkpoint - Science (0846) October 2016 Paper 2 MSdinakarc78% (9)

- Tax Lecture Estate Tax Part 2Document7 pagesTax Lecture Estate Tax Part 2Kathreen Aya ExcondeNo ratings yet

- Abinitio Interview QuesDocument30 pagesAbinitio Interview QuesVasu ManchikalapudiNo ratings yet

- Mas ReviewDocument4 pagesMas ReviewCarl AngeloNo ratings yet

- Multiple Choice Cost Accounting ExamDocument31 pagesMultiple Choice Cost Accounting ExamJustine AlcantaraNo ratings yet

- Accounting For LaborDocument6 pagesAccounting For LaborBernard FernandezNo ratings yet

- Advance Accounting 2 by GuerreroDocument23 pagesAdvance Accounting 2 by Guerreromarycayton80% (5)

- The Revised Corporation Code of The Philippines: Changes and Developments in Corporation LawDocument10 pagesThe Revised Corporation Code of The Philippines: Changes and Developments in Corporation LawKathreen Aya ExcondeNo ratings yet

- CHAPTER13 Home Office and Branch - Special ProblemsDocument21 pagesCHAPTER13 Home Office and Branch - Special ProblemsAlgifariAdityaNo ratings yet

- CH 18Document39 pagesCH 18Ja RedNo ratings yet

- MAS BSA - Activity Based CostingDocument4 pagesMAS BSA - Activity Based CostingJanellaReanoReyesNo ratings yet

- Stracos Module 1 Quiz Cost ConceptsDocument12 pagesStracos Module 1 Quiz Cost ConceptsGemNo ratings yet

- Assignment - Cost BehaviorsDocument11 pagesAssignment - Cost BehaviorsMary Antonette LastimosaNo ratings yet

- Activity Based CostingDocument5 pagesActivity Based CostingCassandra Dianne Ferolino MacadoNo ratings yet

- Quiz Process CostingDocument3 pagesQuiz Process CostingBonnie Kim VillavendeNo ratings yet

- Chapter Review Guide QuestionsDocument1 pageChapter Review Guide QuestionsRick RanteNo ratings yet

- Conversion CycleDocument2 pagesConversion Cyclejoanbltzr0% (1)

- Cost Classifications As To Product and BehaviourDocument2 pagesCost Classifications As To Product and BehaviourJimbo ManalastasNo ratings yet

- Standard Costing ExercisesDocument3 pagesStandard Costing ExercisesNikki Garcia0% (2)

- Name: - Section: - Schedule: - Class Number: - DateDocument13 pagesName: - Section: - Schedule: - Class Number: - Datechristine_pineda_2No ratings yet

- 18 x12 ABC ADocument12 pages18 x12 ABC AKM MacatangayNo ratings yet

- Standard Costs and Variance Analysis Mcqs by Hilario TanDocument18 pagesStandard Costs and Variance Analysis Mcqs by Hilario TanAhmadnur JulNo ratings yet

- CAT Level 2 QuestionnairesDocument16 pagesCAT Level 2 QuestionnairesRona Amor MundaNo ratings yet

- Cost Accounting ReviewerDocument6 pagesCost Accounting ReviewerAngela AcompañadoNo ratings yet

- Abc Costing IllustratedDocument2 pagesAbc Costing IllustratedBryan FloresNo ratings yet

- Assignment 1Document2 pagesAssignment 1Betheemae R. MatarloNo ratings yet

- Managerial Accounting Mid-term Exam Break-even Analysis & Costing MethodsDocument3 pagesManagerial Accounting Mid-term Exam Break-even Analysis & Costing MethodsjaeNo ratings yet

- CA Assignment No. 5 Part 2 ABCDocument6 pagesCA Assignment No. 5 Part 2 ABCMethlyNo ratings yet

- Prelim Quiz No 1Document4 pagesPrelim Quiz No 1regent galokrNo ratings yet

- 15 Activity Based Management and Costing IM May 2014Document10 pages15 Activity Based Management and Costing IM May 2014erjan nina bombayNo ratings yet

- Strat Cost Man Acctg ExamDocument12 pagesStrat Cost Man Acctg ExamPam G.No ratings yet

- Chapter 5 Job Order Costing: Multiple ChoiceDocument16 pagesChapter 5 Job Order Costing: Multiple ChoiceRandy AsnorNo ratings yet

- Andrea Florence G. Vidal Bsa 4 Acctg 16: Exercise 2: Multiple ChoiceDocument4 pagesAndrea Florence G. Vidal Bsa 4 Acctg 16: Exercise 2: Multiple ChoiceAndrea Florence Guy VidalNo ratings yet

- Job Order Costing System ExplainedDocument47 pagesJob Order Costing System Explainedslow dancerNo ratings yet

- Standard Costing and Flexible Budget 10Document5 pagesStandard Costing and Flexible Budget 10Lhorene Hope DueñasNo ratings yet

- Process Costing Module ExplainedDocument24 pagesProcess Costing Module ExplainedUchayyaNo ratings yet

- Activity-Based Costing Systems: Benefits, Concepts & ImplementationDocument11 pagesActivity-Based Costing Systems: Benefits, Concepts & ImplementationKeach Harrel CabagayNo ratings yet

- Kuis Perbaikan UTS AKbi 2016-2017Document6 pagesKuis Perbaikan UTS AKbi 2016-2017Rizal Sukma PNo ratings yet

- Quiz 1Document8 pagesQuiz 1alileekaeNo ratings yet

- COst TypeDocument7 pagesCOst TypeBenzon OndovillaNo ratings yet

- Exam 1Document19 pagesExam 1김현중No ratings yet

- Cost Concept Exercises PDFDocument2 pagesCost Concept Exercises PDFAina OracionNo ratings yet

- Quiz 2 Cost AccountingDocument1 pageQuiz 2 Cost AccountingRocel DomingoNo ratings yet

- 08 Costing by Products Joint ProductsDocument15 pages08 Costing by Products Joint ProductsMichael Brian TorresNo ratings yet

- Standard Costing and Variance Analysis ExplainedDocument45 pagesStandard Costing and Variance Analysis ExplainedMohan RaviNo ratings yet

- Ex3 Accounting For FOHDocument7 pagesEx3 Accounting For FOHLemuel ReñaNo ratings yet

- ABC and Standard CostingDocument16 pagesABC and Standard CostingCarlo QuinlogNo ratings yet

- Realizable Value ApproachDocument10 pagesRealizable Value ApproachAbby MendozaNo ratings yet

- Multiple Choice - JOCDocument14 pagesMultiple Choice - JOCMuriel MahanludNo ratings yet

- Practice Set - A3Document6 pagesPractice Set - A3Dayanara VillanuevaNo ratings yet

- Managerial Accounting Review Variable Costing Absorption CostingDocument4 pagesManagerial Accounting Review Variable Costing Absorption CostingdamdamNo ratings yet

- AFDM - Assign 4Document1 pageAFDM - Assign 4Tausif IlyasNo ratings yet

- Answers To 11 - 16 Assignment in ABC PDFDocument3 pagesAnswers To 11 - 16 Assignment in ABC PDFMubarrach MatabalaoNo ratings yet

- ABC-BASED COST MANAGEMENTDocument8 pagesABC-BASED COST MANAGEMENTapremsNo ratings yet

- ABC - ReviewerDocument9 pagesABC - ReviewerAndrea Nicole MASANGKAYNo ratings yet

- CH 04Document20 pagesCH 04Chronos ChronosNo ratings yet

- Multiple Choice THEORY: Choose The Letter of The Correct AnswerDocument4 pagesMultiple Choice THEORY: Choose The Letter of The Correct AnswerMohammadNo ratings yet

- Dalubhasaan NG Lunsod NG San Pablo Brgy. San Jose, San Pablo CityDocument3 pagesDalubhasaan NG Lunsod NG San Pablo Brgy. San Jose, San Pablo CityKathreen Aya Exconde100% (1)

- CPALE Syllabi 2018 PDFDocument32 pagesCPALE Syllabi 2018 PDFLorraine TomasNo ratings yet

- Overview of Audit ProcessDocument3 pagesOverview of Audit ProcessCristy Estrella0% (1)

- 5 6224131361138016410Document6 pages5 6224131361138016410Kathreen Aya ExcondeNo ratings yet

- FINANCIAL ACCOUNTING - INVESTMENT IN EQUITYDocument2 pagesFINANCIAL ACCOUNTING - INVESTMENT IN EQUITYKathreen Aya ExcondeNo ratings yet

- 5 6116244325283135666Document2 pages5 6116244325283135666Kathreen Aya ExcondeNo ratings yet

- OBLICON SummaryDocument13 pagesOBLICON SummaryKathreen Aya ExcondeNo ratings yet

- Research Title: Merits and Demerits: Cpas' CPD Units Raised To 120 Personal InformationDocument1 pageResearch Title: Merits and Demerits: Cpas' CPD Units Raised To 120 Personal InformationKathreen Aya ExcondeNo ratings yet

- CPD updates in accounting professionDocument5 pagesCPD updates in accounting professionKathreen Aya ExcondeNo ratings yet

- EquityDocument2 pagesEquityKathreen Aya ExcondeNo ratings yet

- Weekly Accomplishment Report: Dalubhasaan NG Lunsod NG San PabloDocument6 pagesWeekly Accomplishment Report: Dalubhasaan NG Lunsod NG San PabloKathreen Aya ExcondeNo ratings yet

- CPDDocument2 pagesCPDKathreen Aya ExcondeNo ratings yet

- VAT calculations and transactionsDocument2 pagesVAT calculations and transactionsKathreen Aya ExcondeNo ratings yet

- CHAPTER 13 - Home Office and Branch - Special ProblemsDocument21 pagesCHAPTER 13 - Home Office and Branch - Special ProblemsKathreen Aya ExcondeNo ratings yet

- What Is Subject-Verb Agreement?Document4 pagesWhat Is Subject-Verb Agreement?Venus PalmencoNo ratings yet

- Unilever P&G Unilever P&G Assets: Add A Footer 1Document4 pagesUnilever P&G Unilever P&G Assets: Add A Footer 1Kathreen Aya ExcondeNo ratings yet

- Everyone Writes! Royals Never Quit!Document1 pageEveryone Writes! Royals Never Quit!Kathreen Aya ExcondeNo ratings yet

- ENTREP2Document14 pagesENTREP2Kathreen Aya ExcondeNo ratings yet

- Theories of Global Stratification and Globalization and Trade and PovertyDocument2 pagesTheories of Global Stratification and Globalization and Trade and PovertyKathreen Aya ExcondeNo ratings yet

- CHAPTER 13 - Home Office and Branch - Special ProblemsDocument21 pagesCHAPTER 13 - Home Office and Branch - Special ProblemsKathreen Aya ExcondeNo ratings yet

- Screenshot To PrintDocument6 pagesScreenshot To PrintKathreen Aya ExcondeNo ratings yet

- CHAPTER 16 Consolidated Financial Statements PAS 27 Subsequent ToDate of Purchase Type of BDocument3 pagesCHAPTER 16 Consolidated Financial Statements PAS 27 Subsequent ToDate of Purchase Type of BKathreen Aya ExcondeNo ratings yet

- Crash Course Economics No.16: Globalization and Trade and PovertyDocument2 pagesCrash Course Economics No.16: Globalization and Trade and PovertyKathreen Aya ExcondeNo ratings yet

- Tips For Effective Presentation Design and DeliveryDocument2 pagesTips For Effective Presentation Design and DeliveryJames Manrique100% (1)

- De Thi Thu Tuyen Sinh Lop 10 Mon Anh Ha Noi Nam 2022 So 2Document6 pagesDe Thi Thu Tuyen Sinh Lop 10 Mon Anh Ha Noi Nam 2022 So 2Ngọc LinhNo ratings yet

- Crio - Copy Business Operations - Case Study AssignmentDocument3 pagesCrio - Copy Business Operations - Case Study Assignmentvaishnawnikhil3No ratings yet

- PuppetsDocument11 pagesPuppetsShar Nur JeanNo ratings yet

- Sles-55605 C071D4C1Document3 pagesSles-55605 C071D4C1rgyasuylmhwkhqckrzNo ratings yet

- A Final Project For The Course Title "Monetary Policy and Central Banking"Document11 pagesA Final Project For The Course Title "Monetary Policy and Central Banking"Elle SanchezNo ratings yet

- DrainHoles - InspectionDocument14 pagesDrainHoles - Inspectionohm3011No ratings yet

- Personality, Movie Preferences, and RecommendationsDocument2 pagesPersonality, Movie Preferences, and RecommendationsAA0809No ratings yet

- Active Sound Gateway - Installation - EngDocument9 pagesActive Sound Gateway - Installation - EngDanut TrifNo ratings yet

- Organized Educator Seeks New OpportunityDocument1 pageOrganized Educator Seeks New OpportunityCaren Pogoy ManiquezNo ratings yet

- GF26.10-S-0002S Manual Transmission (MT), Function 9.7.03 Transmission 716.6 in MODEL 639.601 /603 /605 /701 /703 /705 /711 /713 /811 /813 /815Document2 pagesGF26.10-S-0002S Manual Transmission (MT), Function 9.7.03 Transmission 716.6 in MODEL 639.601 /603 /605 /701 /703 /705 /711 /713 /811 /813 /815Sven GoshcNo ratings yet

- Liebert PEX+: High Efficiency. Modular-Type Precision Air Conditioning UnitDocument19 pagesLiebert PEX+: High Efficiency. Modular-Type Precision Air Conditioning Unitjuan guerreroNo ratings yet

- Physics Force and BuoyancyDocument28 pagesPhysics Force and BuoyancySohan PattanayakNo ratings yet

- ReadingDocument6 pagesReadingakhyar sanchiaNo ratings yet

- 1 FrameworkDocument26 pages1 FrameworkIrenataNo ratings yet

- Arsh Final Project ReportDocument65 pagesArsh Final Project Report720 Manvir SinghNo ratings yet

- OWASP Dependency-Check Plugin: DescriptionDocument10 pagesOWASP Dependency-Check Plugin: DescriptionFelipe BarbosaNo ratings yet

- Uses of The Internet in Our Daily LifeDocument20 pagesUses of The Internet in Our Daily LifeMar OcolNo ratings yet

- Unit 4 AE Scan OCRed PDFDocument44 pagesUnit 4 AE Scan OCRed PDFZia AhmedNo ratings yet

- The Act of Proclamation of The Independence of The Filipino PeopleDocument33 pagesThe Act of Proclamation of The Independence of The Filipino PeopleJULIANA RAE CONTRERASNo ratings yet

- Oxyacetylene Welding (OAW)Document26 pagesOxyacetylene Welding (OAW)athyrahNo ratings yet

- Food Sub Inspector Question PaperDocument12 pagesFood Sub Inspector Question PaperGoutam shitNo ratings yet

- Protección Fuego MetalDocument16 pagesProtección Fuego MetalTracy Mora ChNo ratings yet

- Uhde Painting SpecificationDocument34 pagesUhde Painting Specificationmohamed elmasryNo ratings yet

- Long Standoff Demolition Warheads For Armor, Masonry and Concrete TargetsDocument27 pagesLong Standoff Demolition Warheads For Armor, Masonry and Concrete Targetsahky7No ratings yet

- List of OperationsDocument3 pagesList of OperationsGibs_9122100% (3)