Professional Documents

Culture Documents

17002

Uploaded by

Alvin YercCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

17002

Uploaded by

Alvin YercCopyright:

Available Formats

College of Accounting Education

3/F F. Facundo Hall, B & E Bldg.

Matina, Davao City Philippines

Phone No.: (082) 305-0645

Applied Auditing

Quizzer 18

Revaluation and Impairment

Problem 1

William Company owned a building on January 1, 2013 with historical cost of P40,000,000. The property

is depreciated over 40 years on a straight line basis with no residual value. The entity adopted the

revaluation model of measuring property, plant and equipment. The building has so far been revalued

at fair value as follows:

January 1, 2014 46,800,000

January 1, 2016 45,500,000

January 1, 2018 30,000,000

January 1, 2020 50,000,000

Questions:

1. What is the revaluation surplus on December 31, 2014?

2. What is the revaluation surplus on December 31, 2015?

3. What is the Depreciation of the building on December 31, 2016?

4. How much is the impairment loss at January 1, 2018, if any?

5. How much is the gain on recovery of impairment at January 1, 2020, if any?

Problem 2

Honesto Company has one division that performs machinery operations on parts that are sold to

contractors. A group of machines have an aggregate cost and accumulated depreciation on January 1,

2018 as follows:

Machinery 90,000,000

Accumulated depreciation 25,000,000

Carrying amount 65,000,000

The machines have an average remaining life of 4 years and it has been determined that this group of

machines constitutes a cash generating unit. The fair value less cost to sell of this group of machines

in an active market is determined to be P48,000,000.

Based on supportable and reasonable assumptions, the financial forecast for this group of machines

reveals the following cash inflows and cash outflows for the next four years:

Cash inflows Cash outflows

2018 30,000,000 15,000,000

2019 42,500,000 17,500,000

2020 27,500,000 17,500,000

2021 18,000,000 4,000,000

It is believed that a discount rate of 8% is reflective of time value of money and the risks specific to

the group of machines.

On December 31, 2019, the fair market value of the machinery totaled P65 million pesos. The pre-

impairment depreciation of the machinery amounted to P5,000,000.

Questions:

1. How much is the recoverable cost the machinery on January 1, 2018?

2. How much is the depreciation of the machinery on December 31, 2018?

3. How much is the carrying value of the machinery had no impairment been in the records on

December 31, 2019?

4. How much is the gain on recovery of impairment, if any, on December 31, 2019?

5. How much is the depreciation of the machinery on December 31, 2019?

College of Accounting Education

3/F F. Facundo Hall, B & E Bldg.

Matina, Davao City Philippines

Phone No.: (082) 305-0645

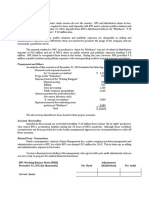

Problem 3

Mark Company ha the following information on January 1, 2010 related to its property, plant, and

equipment:

Land 30,000,000

Building 300,000,000

Accumulated Depreciation—building (37,500,000)

Machinery (2 machines) 400,000,000

Accumulated depreciation—machinery (100,000,000)

Carrying Amount 592,500,000

There were no additions nor disposals during 2010. Depreciation is computed using straight line over

20 years for building and 10 years for machinery. On June 30, 2010, all the property, plant, and

equipment were revalued as follows:

Replacement Cost Sound Value

Land 40,000,000 40,000,000

Building 500,000,000 425,000,000

Machinery 650,000,000 455,000,000

On June 20, 2011, building was revalued at 300,000,000, its fair market value at that time. one of the

machines was sold on December 31, 2011 at P250,000,000

Questions:

1. What is the revaluation surplus on June 30, 2010?

2. What is the total depreciation for 2010?

3. What is the revaluation surplus on December 31, 2010?

4. What is the impairment loss on December 31, 2011?

5. What is the revaluation surplus on December 31, 2011?

6. Gain on sale on December 31, 2011?

You might also like

- Wholesale Real Estate Purchase Agreement PSA1Document1 pageWholesale Real Estate Purchase Agreement PSA1Charles Gonzales100% (6)

- Allstate Declaration - 20221110 - 0001Document4 pagesAllstate Declaration - 20221110 - 0001Shilyn KaufmanNo ratings yet

- Basic Accounting Ballada Solution ManualDocument4 pagesBasic Accounting Ballada Solution ManualAlvin Yerc9% (55)

- English Mandarin Pinyin DictionaryDocument23 pagesEnglish Mandarin Pinyin DictionarySuhail Gattan100% (2)

- Procurement Process Cycle Procure To Pay Process P2PDocument3 pagesProcurement Process Cycle Procure To Pay Process P2PSdev123No ratings yet

- CPAR87 Final PB - AFARDocument15 pagesCPAR87 Final PB - AFARLJ AggabaoNo ratings yet

- Final Requirement in AdvaccDocument143 pagesFinal Requirement in AdvaccShaina Kaye De Guzman100% (1)

- Handouts PDFDocument374 pagesHandouts PDFVicky Danila Albano60% (5)

- 1st Exam - TaxDocument4 pages1st Exam - TaxAlvin YercNo ratings yet

- Long-Term Construction Contracts (Pfrs 15) : Start of DiscussionDocument3 pagesLong-Term Construction Contracts (Pfrs 15) : Start of DiscussionErica DaprosaNo ratings yet

- Mastercard PDFDocument433 pagesMastercard PDFliyuqingNo ratings yet

- Quizzer 16 FinalDocument14 pagesQuizzer 16 FinalCamelle ArellanoNo ratings yet

- Installment accounting revenue recognitionDocument222 pagesInstallment accounting revenue recognitionMichael Brian Torres100% (1)

- Mt103 Deutsche Bank 500euroDocument2 pagesMt103 Deutsche Bank 500eurorasool mehrjoo100% (1)

- Quiz 3 ProblemsDocument11 pagesQuiz 3 ProblemsRiezel PepitoNo ratings yet

- The Professional CPA Review School - Auditing Problems First Preboard ExamDocument18 pagesThe Professional CPA Review School - Auditing Problems First Preboard ExamRodmae VersonNo ratings yet

- Synthesis - AudProb (Q)Document8 pagesSynthesis - AudProb (Q)Anna Gian SobrevillaNo ratings yet

- Multiple Choice Problems 21 Lark Corp. Has Contract To Construct A P5,000,000 Cruise Ship at An Estimated Cost ofDocument12 pagesMultiple Choice Problems 21 Lark Corp. Has Contract To Construct A P5,000,000 Cruise Ship at An Estimated Cost ofRie Cabigon100% (1)

- Test Bank Law 1 CparDocument26 pagesTest Bank Law 1 CparJoyce Kay Azucena73% (22)

- CASH AND CASH EQUIVALENTS QuizDocument6 pagesCASH AND CASH EQUIVALENTS QuizAlvin Yerc0% (1)

- CASH AND CASH EQUIVALENTS QuizDocument6 pagesCASH AND CASH EQUIVALENTS QuizAlvin Yerc0% (1)

- File 7595477826281120346Document13 pagesFile 7595477826281120346sunshineNo ratings yet

- Ap105 InvestmentsDocument5 pagesAp105 InvestmentsVandix100% (1)

- Problem 1Document6 pagesProblem 1novyNo ratings yet

- Audit of Investments - Set ADocument4 pagesAudit of Investments - Set AZyrah Mae SaezNo ratings yet

- Cpar - Ap 09.15.13Document18 pagesCpar - Ap 09.15.13KamilleNo ratings yet

- CBS Corporation Purchased 10Document12 pagesCBS Corporation Purchased 10Stella SabaoanNo ratings yet

- Physically Distanced but Academically Engaged: Management Science SIMDocument119 pagesPhysically Distanced but Academically Engaged: Management Science SIMHazel PachecoNo ratings yet

- Practice Problems Corporate LiquidationDocument2 pagesPractice Problems Corporate LiquidationAllira OrcajadaNo ratings yet

- Practical Accounting 1: 2011 National Cpa Mock Board ExaminationDocument7 pagesPractical Accounting 1: 2011 National Cpa Mock Board Examinationcacho cielo graceNo ratings yet

- Audit of InvestmentsDocument3 pagesAudit of InvestmentsJasmine Marie Ng Cheong50% (2)

- Quiz - Act 07A: I. Theories: ProblemsDocument2 pagesQuiz - Act 07A: I. Theories: ProblemsShawn Organo0% (1)

- Problem 1Document4 pagesProblem 1Live LoveNo ratings yet

- RFBT AssessmentDocument9 pagesRFBT AssessmentJirah Bernal100% (1)

- Chapter 2 PDFDocument25 pagesChapter 2 PDFZi VillarNo ratings yet

- Father Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #4)Document10 pagesFather Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #4)marygraceomacNo ratings yet

- TERMINAL OUTPUT FOR THE FINAL TERM (2ND SY 2018-2019Document3 pagesTERMINAL OUTPUT FOR THE FINAL TERM (2ND SY 2018-2019Millen Austria0% (1)

- Quiz 405Document3 pagesQuiz 405Shaika HaceenaNo ratings yet

- Thery of AccountsDocument13 pagesThery of AccountsTerrence Von KnightNo ratings yet

- What A ProblemDocument4 pagesWhat A ProblemEleazar SalazarNo ratings yet

- Chapter 1-4 QuizDocument11 pagesChapter 1-4 Quizspur iousNo ratings yet

- ProblemsDocument9 pagesProblemsMark Angelo AlvarezNo ratings yet

- REVENUE RECOGNITION LONG TERM CONSTRUCTIONDocument4 pagesREVENUE RECOGNITION LONG TERM CONSTRUCTIONCee Gee BeeNo ratings yet

- Auditing ProblemsDocument4 pagesAuditing ProblemsCristineJoyceMalubayIINo ratings yet

- CH 17Document32 pagesCH 17Aldrin CabangbangNo ratings yet

- SW - NpoDocument1 pageSW - NpoGwy HipolitoNo ratings yet

- AP.2906 InvestmentsDocument6 pagesAP.2906 InvestmentsmoNo ratings yet

- Tiger Corporation (Contributed by Oliver C. Bucao)Document4 pagesTiger Corporation (Contributed by Oliver C. Bucao)Pia Corine RuitaNo ratings yet

- 11.11.2017 Audit of PPEDocument9 pages11.11.2017 Audit of PPEPatOcampoNo ratings yet

- TX 1102 Deductions from Gross Income Itemized and Special DeductionsDocument10 pagesTX 1102 Deductions from Gross Income Itemized and Special DeductionsJulz0% (1)

- Quiz 2 - Corp Liqui and Installment SalesDocument8 pagesQuiz 2 - Corp Liqui and Installment SalesKenneth Christian WilburNo ratings yet

- EXAM About INTANGIBLE ASSETS 2Document3 pagesEXAM About INTANGIBLE ASSETS 2BLACKPINKLisaRoseJisooJennieNo ratings yet

- Comprehensive Examinations 2 (Part II)Document4 pagesComprehensive Examinations 2 (Part II)Yander Marl BautistaNo ratings yet

- Audit of Liabilities Exercise 1: SolutionDocument14 pagesAudit of Liabilities Exercise 1: SolutionCharis Marie UrgelNo ratings yet

- Ap-1403 ReceivablesDocument18 pagesAp-1403 Receivableschowchow123No ratings yet

- Into To World of CPAsDocument22 pagesInto To World of CPAsKristine WaliNo ratings yet

- Problem 4Document6 pagesProblem 4jhobsNo ratings yet

- PRTC 1st Preboard Solution GuideDocument48 pagesPRTC 1st Preboard Solution GuideAnonymous Lih1laax100% (2)

- Accounts Receivable Accounts Payable: A. P19,500 GainDocument6 pagesAccounts Receivable Accounts Payable: A. P19,500 GainTk KimNo ratings yet

- Audit of PPE ExercisesDocument3 pagesAudit of PPE ExercisesMARCUAP Flora Mel Joy H.No ratings yet

- MA2E Relevant Cost ExercisesDocument6 pagesMA2E Relevant Cost ExercisesRolan PalquiranNo ratings yet

- AP - TestbankDocument22 pagesAP - TestbankRamon Jonathan SapalaranNo ratings yet

- Correction of Errors: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesCorrection of Errors: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionmaurNo ratings yet

- Let's Analyze: Pacalna, Anifah BDocument2 pagesLet's Analyze: Pacalna, Anifah BAnifahchannie PacalnaNo ratings yet

- Applied Auditing Review Course Pre-Board - FinalDocument13 pagesApplied Auditing Review Course Pre-Board - FinalROMAR A. PIGANo ratings yet

- Sde WRDocument10 pagesSde WRNitinNo ratings yet

- An SME Prepared The Following Post Closing Trial Balance at YearDocument1 pageAn SME Prepared The Following Post Closing Trial Balance at YearRaca DesuNo ratings yet

- Exercises - Percentage TaxesDocument2 pagesExercises - Percentage TaxesMaristella GatonNo ratings yet

- IAS 36 Impairment Out of Class Practice EN PrintDocument11 pagesIAS 36 Impairment Out of Class Practice EN PrintDAN NGUYEN THENo ratings yet

- Fra 300 January - June 2016 Mid - Semester Exams - QuestionsDocument3 pagesFra 300 January - June 2016 Mid - Semester Exams - QuestionsTissie MkumbadzalaNo ratings yet

- FR11 Intangibles&Impairment (Practice)Document5 pagesFR11 Intangibles&Impairment (Practice)duong duongNo ratings yet

- Assignment 2Document5 pagesAssignment 2Baburam AdNo ratings yet

- FEU Intermediate Accounting 2 Activity 04 NCA Held for SaleDocument3 pagesFEU Intermediate Accounting 2 Activity 04 NCA Held for SaleEstiloNo ratings yet

- School Activity Funds Acctg Manual 03312015 PDFDocument97 pagesSchool Activity Funds Acctg Manual 03312015 PDFAlvin YercNo ratings yet

- Wisdom Islamic School HistoryDocument13 pagesWisdom Islamic School HistoryAlvin YercNo ratings yet

- 2012 Edition: Management Advisory Services Suggested Key Answers in Multiple Choice and True-False QuestionsDocument9 pages2012 Edition: Management Advisory Services Suggested Key Answers in Multiple Choice and True-False QuestionsAlvin YercNo ratings yet

- As 1 AvDocument1 pageAs 1 AvAlvin YercNo ratings yet

- VisionDocument3 pagesVisionAlvin YercNo ratings yet

- VisionDocument3 pagesVisionAlvin YercNo ratings yet

- UC Student Tuition Audit ProgramDocument8 pagesUC Student Tuition Audit ProgramAlvin YercNo ratings yet

- Utilization of Consulting Engagement and Financial Performance Among Manufacturing Businesses in Davao CityDocument6 pagesUtilization of Consulting Engagement and Financial Performance Among Manufacturing Businesses in Davao CityAlvin YercNo ratings yet

- Audit - Exam1Document3 pagesAudit - Exam1Mark Angelo ArceoNo ratings yet

- Acc Man Part 2Document13 pagesAcc Man Part 2Alvin YercNo ratings yet

- Substantive Test For Property, Plant, and EquipmentDocument9 pagesSubstantive Test For Property, Plant, and EquipmentAlvin YercNo ratings yet

- Just Close Your EyesDocument1 pageJust Close Your EyesAlvin YercNo ratings yet

- DocumentDocument1 pageDocumentAlvin YercNo ratings yet

- CompEd Quiz Bee 5b5c6464a989dDocument27 pagesCompEd Quiz Bee 5b5c6464a989dAlvin YercNo ratings yet

- Theory of Accounts - Exam2Document1 pageTheory of Accounts - Exam2Alvin YercNo ratings yet

- Attachments - Rainbow RowellDocument29 pagesAttachments - Rainbow RowellAlvin Yerc0% (1)

- Nfjpia Mockboard 2011 APDocument11 pagesNfjpia Mockboard 2011 APShin GuevarraNo ratings yet

- Audit - Exam1Document3 pagesAudit - Exam1Mark Angelo ArceoNo ratings yet

- Dont CrybabyDocument1 pageDont CrybabyAlvin YercNo ratings yet

- My Tips On VerbsDocument2 pagesMy Tips On VerbsHaffiz AtingNo ratings yet

- Auditing Theory 2014 Ed Salosagcol Answer Key PDFDocument3 pagesAuditing Theory 2014 Ed Salosagcol Answer Key PDFAlvin YercNo ratings yet

- Jungheinrich Spare Parts List Tool Jeti Et v4!37!496!06!2023Document43 pagesJungheinrich Spare Parts List Tool Jeti Et v4!37!496!06!2023kennethrobbins120300yxq100% (133)

- Alpha Prefix List Reg-PremDocument3 pagesAlpha Prefix List Reg-Premseattlecarol0% (1)

- International Commercial Terms (INCOTERMS)Document9 pagesInternational Commercial Terms (INCOTERMS)albertNo ratings yet

- Where To Get HeyaDocument16 pagesWhere To Get HeyaaznhqmNo ratings yet

- Borang TNB - Checklist Tutup AkaunDocument1 pageBorang TNB - Checklist Tutup Akaunazwarfahmi0725% (4)

- 4019 Poste Numerique AlcatelDocument3 pages4019 Poste Numerique Alcatelissam hmirouNo ratings yet

- AccountStatement01-10-2022 To 24-02-2023Document27 pagesAccountStatement01-10-2022 To 24-02-2023Amit KumarNo ratings yet

- 3Gpp Ts 24.501Document1,141 pages3Gpp Ts 24.501Darketel DarketelNo ratings yet

- ReportsDocument3 pagesReportsashish sharmaNo ratings yet

- Data Flow DiagramDocument7 pagesData Flow Diagramcalliezx13No ratings yet

- Clayton's CaseDocument2 pagesClayton's CaseMiscellaneous100% (1)

- Amit SaralDocument7 pagesAmit SaralAmit KumarNo ratings yet

- Starter GuideDocument5 pagesStarter GuideKonrad PalusNo ratings yet

- CCB International Se CCBIS China E Commerce All in For e Com 1Document112 pagesCCB International Se CCBIS China E Commerce All in For e Com 1Man Ho LiNo ratings yet

- Dessler 13Document14 pagesDessler 13Victoria EyelashesNo ratings yet

- E StatementDocument4 pagesE StatementMuhammad Basit Mujahid. 105No ratings yet

- Langkawi - AcommodationDocument8 pagesLangkawi - AcommodationSaidahMohamedNo ratings yet

- IC-F3G F4G Instruction ManualDocument16 pagesIC-F3G F4G Instruction ManualViorel AldeaNo ratings yet

- Banker CHQ ChargesDocument2 pagesBanker CHQ ChargesAbhinav PandeyNo ratings yet

- Acc101 RevCh1 3 PDFDocument29 pagesAcc101 RevCh1 3 PDFWaqar AliNo ratings yet

- 1eg S4hana2023 BPD en SaDocument32 pages1eg S4hana2023 BPD en SaA V SrikanthNo ratings yet

- 001 2012 4 eDocument365 pages001 2012 4 eShiran Mahadeo100% (1)

- Inz 1183Document2 pagesInz 1183nad.liveNo ratings yet

- 46488c92945cff600df3a8126a600189Document3,052 pages46488c92945cff600df3a8126a600189sandeepNo ratings yet

- Lembar Jawab Buku BesarDocument16 pagesLembar Jawab Buku BesarArii BelenNo ratings yet