Professional Documents

Culture Documents

Example, Straight Line Depreciation

Uploaded by

kinnera mOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Example, Straight Line Depreciation

Uploaded by

kinnera mCopyright:

Available Formats

GAAP

Depreciation is a systematic and rational process of distributing the cost of tangible assets over the life of assets.

Depreciation is a process of allocation.

Cost to be allocated = acquisition cot - salvage value

Allocated over the estimated useful life of assets.

Allocation method should be systematic and rational.

Depreciation Methods

Depreciation methods based on time

Straight line method

Declining balance method

Sum-of-the-years'-digits method

Depreciation based on use (activity)

Straight Line Depreciation Method

Depreciation = (Cost - Residual value) / Useful life

[Example, Straight line depreciation]

On April 1, 2011, Company A purchased an equipment at the cost of $140,000. This equipment is estimated to have 5 year useful life. At the

end of the 5th year, the salvage value (residual value) will be $20,000. Company A recognizes depreciation to the nearest whole month. Calculate

the depreciation expenses for 2011, 2012 and 2013 using straight line depreciation method.

Depreciation for 2011

= ($140,000 - $20,000) x 1/5 x 9/12 = $18,000

Depreciation for 2012

= ($140,000 - $20,000) x 1/5 x 12/12 = $24,000

Depreciation for 2013

= ($140,000 - $20,000) x 1/5 x 12/12 = $24,000

Declining Balance Depreciation Method

Depreciation = Book value x Depreciation rate

Book value = Cost - Accumulated depreciation

Depreciation rate for double declining balance method

= Straight line depreciation rate x 200%

Depreciation rate for 150% declining balance method

= Straight line depreciation rate x 150%

[Example, Double declining balance depreciation]

On April 1, 2011, Company A purchased an equipment at the cost of $140,000. This equipment is estimated to have 5 year useful life. At the

end of the 5th year, the salvage value (residual value) will be $20,000. Company A recognizes depreciation to the nearest whole month. Calculate

the depreciation expenses for 2011, 2012 and 2013 using double declining balance depreciation method.

Useful life = 5 years --> Straight line depreciation rate = 1/5 = 20% per year

Depreciation rate for double declining balance method

= 20% x 200% = 20% x 2 = 40% per year

Depreciation for 2011

= $140,000 x 40% x 9/12 = $42,000

Depreciation for 2012

= ($140,000 - $42,000) x 40% x 12/12 = $39,200

Depreciation for 2013

= ($140,000 - $42,000 - $39,200) x 40% x 12/12 = $23,520

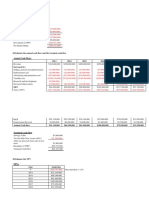

Double Declining Balance Depreciation Method

Book Value

Year Depreciation Rate Depreciation Expense Book Value at the year-end

at the beginning

2011 $140,000 40% $42,000 (*1) $98,000

2012 $98,000 40% $39,200 (*2) $58,800

2013 $58,800 40% $23,520 (*3) $35,280

2014 $35,280 40% $14,112 (*4) $21,168

2015 $21,168 40% $1,168 (*5) $20,000

(*1) $140,000 x 40% x 9/12 = $42,000

(*2) $98,000 x 40% x 12/12 = $39,200

(*3) $58,800 x 40% x 12/12 = $23,520

(*4) $35,280 x 40% x 12/12 = $14,112

(*5) $21,168 x 40% x 12/12 = $8,467

--> Depreciation for 2015 is $1,168 to keep book value same as salvage value.

--> $21,168 - $20,000 = $1,168 (At this point, depreciation stops.)

[Example, 150% declining balance depreciation]

On April 1, 2011, Company A purchased an equipment at the cost of $140,000. This equipment is estimated to have 5 year useful life. At the

end of the 5th year, the salvage value (residual value) will be $20,000. Company A recognizes depreciation to the nearest whole month. Calculate

the depreciation expenses for 2011, 2012 and 2013 using double declining balance depreciation method.

Useful life = 5 years --> Straight line depreciation rate = 1/5 = 20% per year

Depreciation rate for double declining balance method

= 20% x 150% = 20% x 1.5 = 30% per year

Depreciation for 2011

= $140,000 x 30% x 9/12 = $31,500

Depreciation for 2012

= ($140,000 - $31,500) x 30% x 12/12 = $32,550

Depreciation for 2013

= ($140,000 - $31,500 - $32,550) x 30% x 12/12 = $22,785

150% Declining Balance Depreciation Method

Book Value

Year Depreciation Rate Depreciation Expense Book Value at the year-end

at the beginning

2011 $140,000 30% $31,500 (*1) $108,500

2012 $108,500 30% $32,550 (*2) $75,950

2013 $75.950 30% $22,785 (*3) $53,165

2014 $53,165 30% $15,950 (*4) $37,216

2015 $37,216 30% $11,165 (*5) $26,051

2016 $26,051 30% $6,051 (*6) $20,000

(*1) $140,000 x 30% x 9/12 = $31,500

(*2) $108,500 x 30% x 12/12 = $32,550

(*3) $75,950 x 30% x 12/12 = $22,785

(*4) $53,165 x 30% x 12/12 = $15,950

(*5) $37,216 x 30% x 12/12 = $11,165

(*6) $26,051 x 30% x 12/12 = $7,815

--> Depreciation for 2016 is $6,051 to keep book value same as salvage value.

--> $26,051 - $20,000 = $6,051 (At this point, depreciation stops.)

Sum-of-the-years'-digits method

Depreciation expense = (Cost - Salvage value) x Fraction

Fraction for the first year = n / (1+2+3+...+ n)

Fraction for the second year = (n-1) / (1+2+3+...+ n)

Fraction for the third year = (n-2) / (1+2+3+...+ n)

...

Fraction for the last year = 1 / (1+2+3+...+ n)

n represents the number of years for useful life.

[Example, Sum-of-the-years-digits method]

Company A purchased the following asset on January 1, 2011.

What is the amount of depreciation expense for the year ended December 31, 2011?

Acquisition cost of the asset --> $100,000

Useful life of the asset --> 5 years

Residual value (or salvage value) at the end of useful life --> $10,000

Depreciation method --> sum-of-the-years'-digits method

Calculation of depreciation expense

Sum of the years' digits = 1+2+3+4+5 = 15

Depreciation for 2011 = ($100,000 - $10,000) x 5/15 = $30,000

Depreciation for 2012 = ($100,000 - $10,000) x 4/15 = $24,000

Depreciation for 2013 = ($100,000 - $10,000) x 3/15 = $18,000

Depreciation for 2014 = ($100,000 - $10,000) x 2/15 = $12,000

Depreciation for 2015 = ($100,000 - $10,000) x 1/15 = $6,000

Sum of the years' digits for n years

= 1 + 2 + 3 + ...... + (n-1) + n = (n+1) x (n / 2)

Sum of the years' digits for 500 years

= 1 + 2 + 3 + ...... + 499 + 500

= (500 + 1) x (500 / 2) = (501 x 500) / 2 = 125,250

You might also like

- Example, Straight Line DepreciationDocument12 pagesExample, Straight Line DepreciationKhadija Karim100% (2)

- Joint VentureDocument23 pagesJoint VentureArun MishraNo ratings yet

- Wire Reciept For DaveDocument9 pagesWire Reciept For DaveNicoleNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Excel Drill Exercise 1 MDLDocument16 pagesExcel Drill Exercise 1 MDLEugine AmadoNo ratings yet

- Chapter 19 CPA Exam SolutionsDocument13 pagesChapter 19 CPA Exam SolutionsreginaNo ratings yet

- Sneakers 2013Document5 pagesSneakers 2013Felicia FrancisNo ratings yet

- Chapter 11 Supplemental Questions: E11-3 (Depreciation Computations-SYD, DDB-Partial Periods)Document9 pagesChapter 11 Supplemental Questions: E11-3 (Depreciation Computations-SYD, DDB-Partial Periods)Dyan Novia67% (3)

- T 4Document3 pagesT 4Muntasir AhmmedNo ratings yet

- 02 Task Performance 1Document3 pages02 Task Performance 1Ralph Louise PoncianoNo ratings yet

- Solutions On Capital Budgeting AssignmentsDocument3 pagesSolutions On Capital Budgeting AssignmentsjakezzionNo ratings yet

- CRMO Basic RiskDocument29 pagesCRMO Basic RiskPASCA/51421120226/ARLINGGA K100% (1)

- Hedge 17: by Mr. Nitish Kumar, NK Hedge SchoolDocument7 pagesHedge 17: by Mr. Nitish Kumar, NK Hedge SchoolRakesh Kumar100% (1)

- HOSP2110 04 DepreciationDocument4 pagesHOSP2110 04 DepreciationVtgNo ratings yet

- Depreciation Methods: (Example, Straight Line Depreciation)Document5 pagesDepreciation Methods: (Example, Straight Line Depreciation)munnag01No ratings yet

- Depreciation Chapter No 09Document4 pagesDepreciation Chapter No 09salwaburiroNo ratings yet

- Depriciation and AccountingDocument3 pagesDepriciation and AccountingGurkirat TiwanaNo ratings yet

- Accounting Study Guide: Depreciation MethodsDocument4 pagesAccounting Study Guide: Depreciation MethodsMis LailaNo ratings yet

- Chapter 11 Exercises and Problems SolutionsDocument23 pagesChapter 11 Exercises and Problems SolutionsHazel Rose CabezasNo ratings yet

- Year Depreciable Base ($) Depreciation Rate Per Year Depreciation ($)Document3 pagesYear Depreciable Base ($) Depreciation Rate Per Year Depreciation ($)K N V S SIVA KUMARNo ratings yet

- Solutions to Depreciation ExercisesDocument38 pagesSolutions to Depreciation ExercisesHira Farooq100% (1)

- Depreciation CH 10Document5 pagesDepreciation CH 10Bitta Saha HridoyNo ratings yet

- Chapter 10 DepreciationDocument3 pagesChapter 10 Depreciationyoussef walidNo ratings yet

- Depreciation Methods Explained in 40 CharactersDocument26 pagesDepreciation Methods Explained in 40 CharactersNurulHidayahNo ratings yet

- Unit 5Document14 pagesUnit 5bharath_skumarNo ratings yet

- Corporate Finance 2Document5 pagesCorporate Finance 2Murat OmayNo ratings yet

- A) Year 0 Year 1 Year 2 Year 3Document13 pagesA) Year 0 Year 1 Year 2 Year 3Usman KhiljiNo ratings yet

- Group B Assignment Week 13Document6 pagesGroup B Assignment Week 13fghhjjjnjjnNo ratings yet

- (W3) ANS-Tutorial PPE Initial RecognitionDocument3 pages(W3) ANS-Tutorial PPE Initial RecognitionMUHAMMAD ADAM MOHD DEFIHAZRINo ratings yet

- Sheena Burns Chapter 10 Practice Problems: 1. Straight Line MethodDocument5 pagesSheena Burns Chapter 10 Practice Problems: 1. Straight Line MethodDanicia TillettNo ratings yet

- CH 10Document26 pagesCH 10EmadNo ratings yet

- P 7-15 Common Stock Value: All Growth ModelsDocument8 pagesP 7-15 Common Stock Value: All Growth ModelsAlvira FajriNo ratings yet

- Presentation 1Document12 pagesPresentation 1Hashir KhanNo ratings yet

- Chapter 9 Exercises - Plant AssetsDocument7 pagesChapter 9 Exercises - Plant Assetsmohammad khataybehNo ratings yet

- Solution Assignment 4 Chapter 7Document9 pagesSolution Assignment 4 Chapter 7Huynh Ng Quynh NhuNo ratings yet

- Depreciation ExercisesDocument21 pagesDepreciation Exercisesgiezele ballatan100% (2)

- ACTG1054 Answers To Practice Exercises From Course Outline and Learning Activities On MoodleDocument8 pagesACTG1054 Answers To Practice Exercises From Course Outline and Learning Activities On MoodleCoc AndreiNo ratings yet

- Assigment VI (Retno Novia Mallisa - 484542)Document3 pagesAssigment VI (Retno Novia Mallisa - 484542)Vania OlivineNo ratings yet

- Mining Company Financial AnalysisDocument17 pagesMining Company Financial AnalysismisbahtambangNo ratings yet

- Class Exercise CH 10Document5 pagesClass Exercise CH 10Iftekhar AhmedNo ratings yet

- Assignment 4 - Introduction To Quantitative MethodsDocument8 pagesAssignment 4 - Introduction To Quantitative MethodsM IsmailNo ratings yet

- Depreciation Methods GuideDocument3 pagesDepreciation Methods GuideGhulam-ullah KhanNo ratings yet

- Solution ManualDocument11 pagesSolution ManualIjup CupidaNo ratings yet

- Executive Summary: A. The North American Dermatology Division's 2017 EVADocument2 pagesExecutive Summary: A. The North American Dermatology Division's 2017 EVAAtul Anand bj21135No ratings yet

- Full Download Introduction To Management Accounting Horngren 16th Edition Solutions Manual PDF Full ChapterDocument36 pagesFull Download Introduction To Management Accounting Horngren 16th Edition Solutions Manual PDF Full Chapterhomelingcomposedvqve100% (16)

- Problem 10-3A: InstructionsDocument2 pagesProblem 10-3A: InstructionsAhmad KafaNo ratings yet

- Depreciation SlidesDocument12 pagesDepreciation Slidesirene oriarewoNo ratings yet

- EE - Assignment Chapter 9-10 SolutionDocument11 pagesEE - Assignment Chapter 9-10 SolutionXuân ThànhNo ratings yet

- Channel Evaluation MeasuresDocument5 pagesChannel Evaluation MeasuresNEHA HOTANo ratings yet

- Ferrero Rocher Co. Statement of Comprehensive Income AnalysisDocument7 pagesFerrero Rocher Co. Statement of Comprehensive Income AnalysisFiona IsabelaNo ratings yet

- Year Book Value End of The Year ($) Depreciation Rate Per Year Depreciation ($) Book Value End of The Year ($)Document2 pagesYear Book Value End of The Year ($) Depreciation Rate Per Year Depreciation ($) Book Value End of The Year ($)K N V S SIVA KUMARNo ratings yet

- FinancialDocument14 pagesFinancialRudy Setiawan KamadjajaNo ratings yet

- Seminar 3Document37 pagesSeminar 3hashtagjxNo ratings yet

- Chapter-3-Answers To Practice QuestionsDocument4 pagesChapter-3-Answers To Practice QuestionsqadirqadilNo ratings yet

- MTP Soln 1Document14 pagesMTP Soln 1Anonymous 8wg4eowIdzNo ratings yet

- Acctg 6 CH 13Document11 pagesAcctg 6 CH 13Bea TiuNo ratings yet

- C 40,000 T 5 Years S 25,000.00: Straight-Line MethodDocument11 pagesC 40,000 T 5 Years S 25,000.00: Straight-Line MethodBlessie PangilinanNo ratings yet

- Chapter3 SolutionsDocument6 pagesChapter3 SolutionsjamalcrawfordNo ratings yet

- Solution Assignment Chapter 9 10 1Document14 pagesSolution Assignment Chapter 9 10 1Huynh Ng Quynh NhuNo ratings yet

- Exam 2019 Questions and AnswersDocument19 pagesExam 2019 Questions and AnswersĐạt NguyễnNo ratings yet

- MarketingDocument54 pagesMarketingKal KenzoNo ratings yet

- BAI GIAI Ex 1 2 3 and 5.3Document4 pagesBAI GIAI Ex 1 2 3 and 5.3nhuhuyen.01112003No ratings yet

- Rangga Fakhrurriza - Kelompok 6 Konflik Dan NegosiasiDocument6 pagesRangga Fakhrurriza - Kelompok 6 Konflik Dan NegosiasiRangga FakhrurrizaKls AAkt 2021No ratings yet

- Depreciation CompleteDocument29 pagesDepreciation CompleteAnushka JindalNo ratings yet

- Interview Questions & Answers - SET 1 - SAP S4HANA EWMDocument6 pagesInterview Questions & Answers - SET 1 - SAP S4HANA EWMkinnera mNo ratings yet

- Grade 5 ch-10Document3 pagesGrade 5 ch-10kinnera mNo ratings yet

- Grade 5 ch-16Document4 pagesGrade 5 ch-16kinnera mNo ratings yet

- Ch-11 The Coastal Plains and The IslandsDocument4 pagesCh-11 The Coastal Plains and The Islandskinnera mNo ratings yet

- Grade 5 ch-12Document4 pagesGrade 5 ch-12kinnera mNo ratings yet

- Grade 5 ch-15Document3 pagesGrade 5 ch-15kinnera mNo ratings yet

- Grade 5 ch-14Document3 pagesGrade 5 ch-14kinnera mNo ratings yet

- Ch-25 Protecting Plants and AnimalsDocument3 pagesCh-25 Protecting Plants and Animalskinnera mNo ratings yet

- Charts On Different Topics: Business Areas (BA) According To Line of Business/ IndustryDocument3 pagesCharts On Different Topics: Business Areas (BA) According To Line of Business/ Industrykinnera mNo ratings yet

- Grade 5 ch-26Document4 pagesGrade 5 ch-26kinnera mNo ratings yet

- Ch-24 Help I Can’t Breathe - Types of Pollution & EffectsDocument3 pagesCh-24 Help I Can’t Breathe - Types of Pollution & Effectskinnera mNo ratings yet

- Is Mandatory Field in G/L Creation. You Use This Field To Define Which Fields Are Displays When U PostsDocument4 pagesIs Mandatory Field in G/L Creation. You Use This Field To Define Which Fields Are Displays When U Postskinnera mNo ratings yet

- Grade 5 ch-21Document3 pagesGrade 5 ch-21kinnera mNo ratings yet

- Asap MethodologyDocument4 pagesAsap Methodologykinnera mNo ratings yet

- Is Mandatory Field in G/L Creation. You Use This Field To Define Which Fields Are Displays When U PostsDocument4 pagesIs Mandatory Field in G/L Creation. You Use This Field To Define Which Fields Are Displays When U Postskinnera mNo ratings yet

- Internet Home Group PasswordDocument1 pageInternet Home Group Passwordkinnera mNo ratings yet

- Internet Home Group PasswordDocument1 pageInternet Home Group Passwordkinnera mNo ratings yet

- Machinery Breakdown Loss of Profit Insurance Proposal FormDocument8 pagesMachinery Breakdown Loss of Profit Insurance Proposal FormPranjit DowarahNo ratings yet

- Chapter 3 Money MarketDocument17 pagesChapter 3 Money MarketJuanito Dacula Jr.No ratings yet

- Fair Practice Code-Valid Upto 31032024Document6 pagesFair Practice Code-Valid Upto 31032024Tejas JoshiNo ratings yet

- 2011 Q3 Call TranscriptDocument21 pages2011 Q3 Call TranscriptcasefortrilsNo ratings yet

- FINTECH REGULATIONS AND REGTECH: A COMPARISON OF INDIA AND GERMANYDocument10 pagesFINTECH REGULATIONS AND REGTECH: A COMPARISON OF INDIA AND GERMANYYash KhandelwalNo ratings yet

- Global Depository ReceiptsDocument4 pagesGlobal Depository ReceiptsSaiyam ChaturvediNo ratings yet

- Nature of ExpenseDocument7 pagesNature of ExpenseAayush SinghNo ratings yet

- CH 2Document62 pagesCH 2robel popNo ratings yet

- PT Edelweiss MelvinoDocument69 pagesPT Edelweiss MelvinoTrainingDigital Marketing BandungNo ratings yet

- Fairfax-Backed Fairchem Speciality To Restructure Business: Insolvency DemergerDocument40 pagesFairfax-Backed Fairchem Speciality To Restructure Business: Insolvency Demergerpriyanka valechhaNo ratings yet

- Reservation Form: (For Incoming Freshmen, Transferees & Returnees)Document1 pageReservation Form: (For Incoming Freshmen, Transferees & Returnees)LesterNo ratings yet

- Cash & Liquidity Management GroupsDocument19 pagesCash & Liquidity Management GroupsCMA RAMESHWARAM RAMNo ratings yet

- 103 162-34-102-PT PBI TBK Konsol Juni 2021 FinalDocument103 pages103 162-34-102-PT PBI TBK Konsol Juni 2021 FinalArio PramestiNo ratings yet

- Partnership Formation and Operations GuideDocument17 pagesPartnership Formation and Operations GuideJem BalanoNo ratings yet

- Review of The Literature: Ajit and BangerDocument18 pagesReview of The Literature: Ajit and BangertejasparekhNo ratings yet

- PPFCF PPFAS Monthly Portfolio Report January 31 2023Document15 pagesPPFCF PPFAS Monthly Portfolio Report January 31 2023Raghunatha ReddyNo ratings yet

- Project Report Table of Content: 1004 Financial Planning For Salaried Employee and Strategies For Tax SavingsDocument2 pagesProject Report Table of Content: 1004 Financial Planning For Salaried Employee and Strategies For Tax SavingsSai VarunNo ratings yet

- Verizon Investment ThesisDocument7 pagesVerizon Investment Thesisafksooisybobce100% (2)

- Activity Sheets Obj. 3Document7 pagesActivity Sheets Obj. 3BOBBY BRAIN ANGOSNo ratings yet

- Instant Download Ebook PDF Financial Management Concepts and Applications PDF ScribdDocument41 pagesInstant Download Ebook PDF Financial Management Concepts and Applications PDF Scribdcheryl.morgan378100% (40)

- APPLIED AUDITING INVENTORIESDocument6 pagesAPPLIED AUDITING INVENTORIESMicaela Betis100% (1)

- Long Quiz Fund. of AcctngDocument5 pagesLong Quiz Fund. of AcctngLorraine DomantayNo ratings yet

- Collection Receipt Cum Adjustment Voucher: The New India Assurance Co. Ltd. (Government of India Undertaking)Document1 pageCollection Receipt Cum Adjustment Voucher: The New India Assurance Co. Ltd. (Government of India Undertaking)Ravi KhetarpalNo ratings yet

- Chapter 22 ArensDocument12 pagesChapter 22 Arensrahmatika yaniNo ratings yet

- NGPF Activity Bank. EFDocument5 pagesNGPF Activity Bank. EFSanjay MehrotraNo ratings yet