Professional Documents

Culture Documents

Corpfin 4

Uploaded by

Lê Chấn PhongOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corpfin 4

Uploaded by

Lê Chấn PhongCopyright:

Available Formats

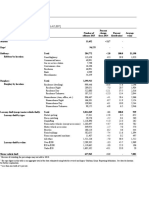

In December 2015, Apple had cash of $38.54 billion, current assets of $75.

86

billion, and current liabilities of $76.58 billion. It also had inventories of $2.45 billion.

a. What was Apple's current ratio?

b. What was Apple's quick ratio?

c. In January 2016, Hewlett-Packard had a quick ratio of 0.66 and a current ratio of 0.90.

What can you say about the asset liquidity of Apple relative toHewlett-Packard?

a. What was Apple's current ratio?

Apple's current ratio was

. 99 .

(Round to two decimal places.)

b. What was Apple's quick ratio?

Apple's quick ratio was

. 96 .

(Round to two decimal places.)

c. In January 2016, Hewlett-Packard had a quick ratio of

0.66 and a current ratio of 0.90

What can you say about the asset liquidity of Apple relative toHewlett-Packard? (Select the best

choice below.)

A.

Apple's higher current and quick ratios demonstrate that it has much higher asset liquidity than

does Hewlett-Packard. This means that in a pinch, Apple has less liquidity to draw on than

does Hewlett-Packard.

B.

Apple's lower current and quick ratios demonstrate that it has much higher asset liquidity than

does Hewlett-Packard. This means that in a pinch, Apple has more liquidity to draw on than

does Hewlett-Packard.

C.

Apple's higher current and quick ratios demonstrate that it has much lower asset liquidity than

does Hewlett-Packard. This means that in a pinch, Apple has more liquidity to draw on than

does Hewlett-Packard.

D.

Apple's higher current and quick ratios demonstrate that it has much higher asset liquidity

than does Hewlett-Packard. This means that in a pinch, Apple has more liquidity to draw

on than does Hewlett-Packard.

Local Co. has sales of $10.8 million and cost of sales of $ 5.6 million. Its selling, general and

administrative expenses are $510,000 and its research and development is

$ 1.4 million. It has annual depreciation charges of $ 1.2million and a tax rate of 35 %

a. What is Local's gross margin?

b. What is Local's operating margin?

c. What is Local's net profita. What is Local's gross margin?

Local's gross margin is

48.1

(Round to one decimal place.)

b. What is Local's operating margin?

Local's operating margin is

19.4 .

(Round to one decimal place.)

c. What is Local's net profit margin?

Local's net profit margin is

12.58

(Round to two decimal places.)

You might also like

- Apple's Financial Analysis Reveals Growth Potential Despite HeadwindsDocument19 pagesApple's Financial Analysis Reveals Growth Potential Despite HeadwindsSharonNo ratings yet

- Financial Statement AnalysisDocument61 pagesFinancial Statement Analysisrajesh shekarNo ratings yet

- Apple Financial Ratios Analysis: NameDocument18 pagesApple Financial Ratios Analysis: NameBrian MaruaNo ratings yet

- Apple Financial Ratios AnalysisDocument16 pagesApple Financial Ratios AnalysisBrian MaruaNo ratings yet

- Ratio Analysis Practice QuestionsDocument4 pagesRatio Analysis Practice Questionswahab_pakistan100% (1)

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisHenry WaribuhNo ratings yet

- Vlerick AppleDocument4 pagesVlerick AppleAnant BothraNo ratings yet

- Quiz 2Document40 pagesQuiz 2MAYANK JAINNo ratings yet

- Apple Conference Call Notes 3Q 2011Document6 pagesApple Conference Call Notes 3Q 2011andrewbloggerNo ratings yet

- Expand Your Critical ThinkingDocument5 pagesExpand Your Critical ThinkingISLAM KHALED ZSCNo ratings yet

- Third Point Outlines Path to Unlock Yahoo's $20 Per Share ValueDocument13 pagesThird Point Outlines Path to Unlock Yahoo's $20 Per Share Valuetail_riskNo ratings yet

- Managerial Accounting Principles Applied in Apple Inc.Document7 pagesManagerial Accounting Principles Applied in Apple Inc.Vruhali Soni100% (4)

- Famba5e Mod2Document48 pagesFamba5e Mod2Lamont ClintonNo ratings yet

- The Goal of Shareholder Wealth Maximization Must Be Viewed As A Long-Run GoalDocument7 pagesThe Goal of Shareholder Wealth Maximization Must Be Viewed As A Long-Run GoalHương LýNo ratings yet

- Apple Financial ReportDocument3 pagesApple Financial ReportBig ManNo ratings yet

- Managerial Accounting in Apple IncDocument21 pagesManagerial Accounting in Apple IncVruhali Soni100% (2)

- 1 Which Inventory Costing Method Generally Results in Less CurrentDocument1 page1 Which Inventory Costing Method Generally Results in Less Currenthassan taimourNo ratings yet

- Apple's Operating Exposure Issues During Trade WarDocument4 pagesApple's Operating Exposure Issues During Trade WarAlonso Beltran100% (1)

- Apple's supply chain performance and improvement opportunitiesDocument2 pagesApple's supply chain performance and improvement opportunitiesCHENGRUI LIAONo ratings yet

- Financial Statement Analysis of Apple IncDocument56 pagesFinancial Statement Analysis of Apple IncnephilleNo ratings yet

- Question #2: A. Both The Current and Acid-Test Ratios. B. Only The Current RatioDocument11 pagesQuestion #2: A. Both The Current and Acid-Test Ratios. B. Only The Current Ratioiceman2167No ratings yet

- Quiz 2: Spring 1996Document40 pagesQuiz 2: Spring 1996Vivek AnandanNo ratings yet

- Risk and Return in Practice - ProblemsDocument6 pagesRisk and Return in Practice - ProblemsKinNo ratings yet

- Ratio Analysis: Liquidity RatiosDocument16 pagesRatio Analysis: Liquidity RatiosYamen SatiNo ratings yet

- Financial Analysis of Yahoo IncDocument28 pagesFinancial Analysis of Yahoo IncSrinu GattuNo ratings yet

- Financial Statement Analysis Test 1 Part1: Answer The Following Short Questions (2 10 20marks) Q1Document3 pagesFinancial Statement Analysis Test 1 Part1: Answer The Following Short Questions (2 10 20marks) Q1Usman BalochNo ratings yet

- Accounting Research PaperDocument9 pagesAccounting Research PaperpossoNo ratings yet

- Apple ReportDocument21 pagesApple Reportapi-555390406No ratings yet

- Business Analysis Part IIDocument7 pagesBusiness Analysis Part IIArneko HarrisNo ratings yet

- Maximizing Stock Value Through Agency ProblemsDocument19 pagesMaximizing Stock Value Through Agency ProblemsHương NguyễnNo ratings yet

- F2019 Final Exam Review With AnswersDocument16 pagesF2019 Final Exam Review With AnswersRob WangNo ratings yet

- A Financial Analysis of Alibaba Group Holding LTDDocument26 pagesA Financial Analysis of Alibaba Group Holding LTDSrinu Gattu50% (4)

- CF1 Exercise FDocument21 pagesCF1 Exercise FHai Anh PhamNo ratings yet

- Finman4e ch02Document52 pagesFinman4e ch02Mitchell JohnsonNo ratings yet

- Assignment 9-Shawanna LumseyDocument14 pagesAssignment 9-Shawanna LumseyShawanna ButlerNo ratings yet

- Voss Capital On BlucoraDocument4 pagesVoss Capital On BlucoraCanadianValueNo ratings yet

- Of Apple Inc. and The Coca-Cola CompanyDocument11 pagesOf Apple Inc. and The Coca-Cola CompanyLinh Nguyễn Hoàng PhươngNo ratings yet

- Apple IncDocument20 pagesApple Incsailesh_misriNo ratings yet

- Market Leader Intermediate Reading Homework - Unit 6Document4 pagesMarket Leader Intermediate Reading Homework - Unit 6HafiniNo ratings yet

- Portable Alpha Theory and Practice: What Investors Really Need to KnowFrom EverandPortable Alpha Theory and Practice: What Investors Really Need to KnowNo ratings yet

- Problems-Finance Fall, 2014Document22 pagesProblems-Finance Fall, 2014jyoon2140% (1)

- Corpfin8 PDFDocument3 pagesCorpfin8 PDFLê Chấn PhongNo ratings yet

- 1determine A FirmDocument50 pages1determine A FirmCHATURIKA priyadarshaniNo ratings yet

- Common Size Balance SheetDocument16 pagesCommon Size Balance SheetNinaMartirezNo ratings yet

- Taller 1 2020-III EnglishDocument2 pagesTaller 1 2020-III EnglishJhoseph MoraNo ratings yet

- Hippocratic Oath: Is Apple's Cash Hurting Its Stockholders?Document3 pagesHippocratic Oath: Is Apple's Cash Hurting Its Stockholders?Abhishek DattaNo ratings yet

- CFA Tai Lieu On TapDocument100 pagesCFA Tai Lieu On Tapkey4onNo ratings yet

- Running Head: Apple AnalysisDocument7 pagesRunning Head: Apple AnalysisCarlos AlphonceNo ratings yet

- Dell Case - Narmin MammadovaDocument12 pagesDell Case - Narmin MammadovaNarmin J. Mamedova100% (1)

- Scs 2331 You Are The Senior Auditor in Charge DecemberDocument4 pagesScs 2331 You Are The Senior Auditor in Charge DecemberDoreenNo ratings yet

- Apple Company AnalysisDocument3 pagesApple Company Analysisdew314100% (1)

- FY2011 Financial Results Exceed ExpectationsDocument5 pagesFY2011 Financial Results Exceed ExpectationsBestin JoseNo ratings yet

- Click Here To Search For Their Annual 10k: Financial Analysis Project Day 1Document2 pagesClick Here To Search For Their Annual 10k: Financial Analysis Project Day 1Nitin MalepatiNo ratings yet

- AFM Worksheet 1Document4 pagesAFM Worksheet 1Aleko tamiru100% (2)

- Ebay and Google A Coopetition PerspectiveDocument44 pagesEbay and Google A Coopetition PerspectivePatrick Breitenbach100% (2)

- The Well-Timed Strategy (Review and Analysis of Navarro's Book)From EverandThe Well-Timed Strategy (Review and Analysis of Navarro's Book)No ratings yet

- Creative Cash Flow Reporting: Uncovering Sustainable Financial PerformanceFrom EverandCreative Cash Flow Reporting: Uncovering Sustainable Financial PerformanceRating: 3.5 out of 5 stars3.5/5 (5)

- Guide to Management Accounting CCC (Cash Conversion Cycle) for managersFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for managersNo ratings yet

- Guide to Management Accounting CCC (Cash Conversion Cycle) for Managers 2020 EditionFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for Managers 2020 EditionNo ratings yet

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- Soa Exam Ifm: Study ManualDocument37 pagesSoa Exam Ifm: Study ManualLê Chấn PhongNo ratings yet

- Table 17 Rate Number of Crimes Per 100000 Inhabitants by Suburban and Nonsuburban Cities by Population Group 2015Document1 pageTable 17 Rate Number of Crimes Per 100000 Inhabitants by Suburban and Nonsuburban Cities by Population Group 2015Lê Chấn PhongNo ratings yet

- Gem Riverside To Support 2022 Growth Outlook: Dat Xanh Group (DXG) (BUY +56.0%) Update ReportDocument14 pagesGem Riverside To Support 2022 Growth Outlook: Dat Xanh Group (DXG) (BUY +56.0%) Update ReportLê Chấn PhongNo ratings yet

- Job SummaryDocument1 pageJob SummaryLê Chấn PhongNo ratings yet

- Table 16 Rate Number of Crimes Per 100000 Inhabitants by Population Group 2015Document1 pageTable 16 Rate Number of Crimes Per 100000 Inhabitants by Population Group 2015Lê Chấn PhongNo ratings yet

- Number and Percent Change, 2014-2015 (14,420 Agencies 2015 Estimated Population 283,415,007)Document1 pageNumber and Percent Change, 2014-2015 (14,420 Agencies 2015 Estimated Population 283,415,007)Lê Chấn PhongNo ratings yet

- Table 9 Offenses Known To Law Enforcement by State by University and College, 2015Document20 pagesTable 9 Offenses Known To Law Enforcement by State by University and College, 2015Lê Chấn PhongNo ratings yet

- Table 15 Crime Trends Additional Information About Selected Offenses by Population Group 2014-2015Document1 pageTable 15 Crime Trends Additional Information About Selected Offenses by Population Group 2014-2015Lê Chấn PhongNo ratings yet

- Table 13 Crime Trends by Suburban and Nonsuburban Cities by Population Group 2014-2015Document1 pageTable 13 Crime Trends by Suburban and Nonsuburban Cities by Population Group 2014-2015Lê Chấn PhongNo ratings yet

- Table 19 Rate Number of Crimes Per 100000 Inhabitants Additonal Information About Selected Offenses by Population Group 2015Document1 pageTable 19 Rate Number of Crimes Per 100000 Inhabitants Additonal Information About Selected Offenses by Population Group 2015Lê Chấn PhongNo ratings yet

- Table 16 Rate Number of Crimes Per 100000 Inhabitants by Population Group 2015Document1 pageTable 16 Rate Number of Crimes Per 100000 Inhabitants by Population Group 2015Lê Chấn PhongNo ratings yet

- Table 16 Rate Number of Crimes Per 100000 Inhabitants by Population Group 2015Document1 pageTable 16 Rate Number of Crimes Per 100000 Inhabitants by Population Group 2015Lê Chấn PhongNo ratings yet

- United States, 2011-2015: Table 7 Offense AnalysisDocument2 pagesUnited States, 2011-2015: Table 7 Offense AnalysisLê Chấn PhongNo ratings yet

- Table 14 Crime Trends by Metropolitan and Nonmetropolitan Counties by Population Group 2014-2015Document1 pageTable 14 Crime Trends by Metropolitan and Nonmetropolitan Counties by Population Group 2014-2015Lê Chấn PhongNo ratings yet

- Table 24 Property Stolen and Recovered by Type and Value 2015Document1 pageTable 24 Property Stolen and Recovered by Type and Value 2015Lê Chấn PhongNo ratings yet

- Table 16 Rate Number of Crimes Per 100000 Inhabitants by Population Group 2015Document1 pageTable 16 Rate Number of Crimes Per 100000 Inhabitants by Population Group 2015Lê Chấn PhongNo ratings yet

- Table 14 Crime Trends by Metropolitan and Nonmetropolitan Counties by Population Group 2014-2015Document1 pageTable 14 Crime Trends by Metropolitan and Nonmetropolitan Counties by Population Group 2014-2015Lê Chấn PhongNo ratings yet

- Table 20 Murder by State Types of Weapons 2015Document1 pageTable 20 Murder by State Types of Weapons 2015Lê Chấn PhongNo ratings yet

- Expanded Homicide Data Table 3 Murder Offenders by Age Sex and Race 2015Document1 pageExpanded Homicide Data Table 3 Murder Offenders by Age Sex and Race 2015Lê Chấn PhongNo ratings yet

- Expanded Homicide Data Table 7 Murder Types of Weapons Used Percent Distribution by Region 2015Document1 pageExpanded Homicide Data Table 7 Murder Types of Weapons Used Percent Distribution by Region 2015Lê Chấn PhongNo ratings yet

- Table 17 Rate Number of Crimes Per 100000 Inhabitants by Suburban and Nonsuburban Cities by Population Group 2015Document1 pageTable 17 Rate Number of Crimes Per 100000 Inhabitants by Suburban and Nonsuburban Cities by Population Group 2015Lê Chấn PhongNo ratings yet

- Table 19 Rate Number of Crimes Per 100000 Inhabitants Additonal Information About Selected Offenses by Population Group 2015Document1 pageTable 19 Rate Number of Crimes Per 100000 Inhabitants Additonal Information About Selected Offenses by Population Group 2015Lê Chấn PhongNo ratings yet

- Additional Information About Selected Offenses by Population Group, 2014-2015Document1 pageAdditional Information About Selected Offenses by Population Group, 2014-2015Lê Chấn PhongNo ratings yet

- Expanded Homicide Data Table 1 Murder Victims by Race Ethnicity and Sex 2015Document1 pageExpanded Homicide Data Table 1 Murder Victims by Race Ethnicity and Sex 2015Lê Chấn PhongNo ratings yet

- 09 SHRTBL 08Document1 page09 SHRTBL 08calfonzodalyNo ratings yet

- Arson Table 1 Arson Rate by Population Group 2015Document1 pageArson Table 1 Arson Rate by Population Group 2015Lê Chấn PhongNo ratings yet

- Expanded Homicide Data Table 6 Murder Race and Sex of Vicitm by Race and Sex of Offender 2015Document2 pagesExpanded Homicide Data Table 6 Murder Race and Sex of Vicitm by Race and Sex of Offender 2015True Crime ReviewNo ratings yet

- Expanded Homicide Data Table 5 Murder Age of Victim by Age of Offender 2015Document1 pageExpanded Homicide Data Table 5 Murder Age of Victim by Age of Offender 2015Lê Chấn PhongNo ratings yet

- Expanded Homicide Data Table 12 Murder Circumstances 2011-2015Document1 pageExpanded Homicide Data Table 12 Murder Circumstances 2011-2015True Crime ReviewNo ratings yet

- w99tbl2-16Document1 pagew99tbl2-16Lê Chấn PhongNo ratings yet