Professional Documents

Culture Documents

BC

Uploaded by

PrankyJellyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BC

Uploaded by

PrankyJellyCopyright:

Available Formats

Aang Inc. is employing a sophisticated JIT system.

The company uses Backflush costing for recording

its production. The following transactions occurred for the Period ended 20x1:

Purchased P170,000 raw materials on account.

All materials purchased were requisitioned for production.

Incurred direct labor costs of P80,000.

Actual factory overhead costs amounted to P122,000.

Applied conversion costs totaled P202,000 including direct labor cost of P80,000.

All units were completed and sold.

What is the cost of goods sold for the year ended December 31, 20x1?

A. 372,000

B. 202,000

C. 250,000

D. 292,000

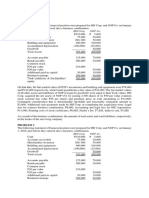

Zuko Co. is using JIT production system and Backflush Cost Accounting System for the year ended

December 31, 20x1. The following information was provided for the year 20x1:

Raw materials purchased for the year totaled P1,000,000.

Direct labor for the year totaled P500,000.

Actual overhead for the year is P300,000 and the standard overhead rate is 50% of direct labor cost.

The production report showed that the finished goods inventory at year end was P200,000 consisting

of 11% of materials purchased, 12% of direct labor used, and 10% of the actual factory overhead.

What is the Cost of Goods Sold for the year ended December 31, 20x1?

A. P1,600,000

B. P1,550,000

C. P1,800,000

D. P1,750,000

Sokka has a cycle of 3 days, uses a Raw and In Process Accounts (RIP) and charges all conversion

costs to cost of goods sold. At the end of each month, all inventories are counted, conversion costs

components are estimated and inventory account balances are adjusted raw material cost is

backflushed from Raw and In Process (RIP) Account to finished goods. The following information is

provided for the month of August:

Beginning balance of RIP account, including P1,000 of conversion cost P 5,000

Beginning balance of finished goods account, including P6,000 of conversion

10,000

cost

Raw materials received on credit 400,000

Direct labor cost (10,000 hrs) 300,000

Actual factory overhead 492,000

Ending RIP inventory per physical count, including P7,000 conversion cost

6,200

estimate

Ending finished goods inventory per physical count, including P4,000

4,900

conversion cost estimate

Sokka applies factory overhead based on its budget at P50.00 per direct labor hour.

iWhat is the amount of conversion cost included in cost of goods sold?

A. 802,00

B. 796,000

C. 794,000

D. 788,000

What is the amount of direct materials backflushed from RIP to Finished Goods?

A. 391,000

B. 404,000

C. 387,000

D. 395,000

what is the amount of direct materials backflushed from finished goods to cost of goods sold?

A. 395,000

B. 404,000

C. 387,000

D. 395,000

The Katara Manufacturing Company has a cycle time of 1.5 days, uses a Raw and In Process (RIP)

account, and charges all conversion costs to Cost of Goods Sold. At the end of each month, all

inventories are counted, their conversion cost components are estimated, and inventory account

balances are adjusted. Raw material cost is backflushed from RIP to Finished Goods. The following

information is for May:

Beginning balance of RIP account, including P600 of conversion cost P 5,500

Beginning balance of finished goods account, including P2,000 of conversion

6,000

cost

Raw materials received on credit 173,000

Ending RIP inventory per physical count, including P850 conversion cost

6,200

estimate

Ending finished goods inventory per physical count, including P1,550

4,900

conversion cost estimate

iiHow much material cost is backflushed from Raw and In Process Inventory to Finished Goods?

A. 177,900

B. 178,550

C. 172,300

D. 172,550

iiiHow much material cost is backflushed from Finished Goods to Cost of Goods Sold.?

A. 173,200

B. 172,950

C. 179,200

D. 178,550

i

ii

Material in May 1 RIP balance .................................................................................. P 4,900

Material received during May ..................................................................................... 173,000

P 177,900

Material in May 31 RIP, per physical count ................................................................. 5,350

Amount to be backflushed .......................................................................................... P 172,550

iii Material in May 1 finished goods ............................................................................. P 4,000

Material backflushed from RIP .................................................................................... 172,550

P 176,550

Material in May 31 finished goods, per physical count ............................................... 3,350

Amount to be backflushed .......................................................................................... P 173,200

You might also like

- Cost Accounting Exercises on Journalizing Transactions, Calculating Cost of Goods Manufactured & SoldDocument4 pagesCost Accounting Exercises on Journalizing Transactions, Calculating Cost of Goods Manufactured & SoldMhico MateoNo ratings yet

- Midterms 201 NotesDocument6 pagesMidterms 201 NotesLyn AbudaNo ratings yet

- Standard Costing - Answer KeyDocument6 pagesStandard Costing - Answer KeyRoselyn LumbaoNo ratings yet

- Cost AccountingDocument9 pagesCost Accountingnicole friasNo ratings yet

- EXAMDocument41 pagesEXAMJoebet Balbin BonifacioNo ratings yet

- Process Costing MethodsDocument12 pagesProcess Costing MethodsYckzCasera100% (9)

- Cost AccountingDocument16 pagesCost AccountingKezia SantosidadNo ratings yet

- SD PD PD PD SD SD SD PD PD PD: Easy Dif: EasyDocument3 pagesSD PD PD PD SD SD SD PD PD PD: Easy Dif: EasyLouina Yncierto100% (1)

- Quiz - Joint and by Products Costing ABC SystemDocument11 pagesQuiz - Joint and by Products Costing ABC Systempaolo pallesNo ratings yet

- Quiz Joint CostDocument4 pagesQuiz Joint CostKIM RAGA100% (1)

- CH 06Document30 pagesCH 06AudreyMaeNo ratings yet

- DocDocument8 pagesDocJAY AUBREY PINEDANo ratings yet

- QuizzerDocument34 pagesQuizzerJoshua ReyesNo ratings yet

- Joint by Products CostingDocument5 pagesJoint by Products CostingJenelyn FloresNo ratings yet

- AC56 Cost Accounting for Factory OverheadDocument3 pagesAC56 Cost Accounting for Factory OverheadGwyneth Hannah Sator RupacNo ratings yet

- Process1 Process2 Process3Document2 pagesProcess1 Process2 Process3Darwin Competente LagranNo ratings yet

- 10 Acct 1abDocument16 pages10 Acct 1abJerric Cristobal100% (1)

- Activity Based Costing ReviewerDocument1 pageActivity Based Costing ReviewerJonna LynneNo ratings yet

- Final Term Quiz 3 On Cost of Production Report - FIFO CostingDocument4 pagesFinal Term Quiz 3 On Cost of Production Report - FIFO CostingYhenuel Josh LucasNo ratings yet

- Accounting Sample TestDocument6 pagesAccounting Sample TestDin Rose GonzalesNo ratings yet

- Key answers and process costing calculationsDocument6 pagesKey answers and process costing calculationsJessica Shirl Vipinosa100% (1)

- Final Quiz 1Document4 pagesFinal Quiz 1maysel qtNo ratings yet

- ACCRETION and EVAPORATION LOSSDocument17 pagesACCRETION and EVAPORATION LOSSVon Andrei MedinaNo ratings yet

- Cost ch03Document25 pagesCost ch03Ahmed ShoushaNo ratings yet

- Pa2.M-1403 Process CostingDocument16 pagesPa2.M-1403 Process CostingJeric Israel0% (3)

- Cost Acctg. - HO#9Document5 pagesCost Acctg. - HO#9JOSE COTONER0% (1)

- Admas University Bishoftu Campus: Course Title - Maintain Inventory RecordsDocument6 pagesAdmas University Bishoftu Campus: Course Title - Maintain Inventory RecordsTilahun GirmaNo ratings yet

- Purchasing-Related 120,000 Set-Up-Related 210,000 Total Overhead Cost P 440,000Document6 pagesPurchasing-Related 120,000 Set-Up-Related 210,000 Total Overhead Cost P 440,000Pamela Galang100% (3)

- COST ACCOUNTING-Allocation of Joint Cost (Quiz With Answers)Document9 pagesCOST ACCOUNTING-Allocation of Joint Cost (Quiz With Answers)Alex Comeling100% (1)

- Exercise 1: Assignment: Accounitng For Materials (Adapted)Document2 pagesExercise 1: Assignment: Accounitng For Materials (Adapted)Charles TuazonNo ratings yet

- Process Costing Quiz Spoiled UnitsDocument3 pagesProcess Costing Quiz Spoiled UnitsRafael Capunpon VallejosNo ratings yet

- Final Quiz 3 - Standard Costing and Back Flush CostingDocument10 pagesFinal Quiz 3 - Standard Costing and Back Flush Costingpaolo pallesNo ratings yet

- Cost Accounting and ManagementDocument7 pagesCost Accounting and ManagementCris Tarrazona CasipleNo ratings yet

- Cost Accounting 1 7 FinalDocument19 pagesCost Accounting 1 7 FinalAlyssa Platon MabalotNo ratings yet

- Pomelo Company service and operating department cost allocationDocument3 pagesPomelo Company service and operating department cost allocationPamela Galang60% (5)

- Backflush Costing1Document3 pagesBackflush Costing1Mitzi EstelleroNo ratings yet

- Assignment 3: Spoilage in Weighted Average and FIFO Cost Flow MethodDocument3 pagesAssignment 3: Spoilage in Weighted Average and FIFO Cost Flow MethodKelvin CulajaráNo ratings yet

- Process Costing Methods Explained for Continuous ProductionDocument10 pagesProcess Costing Methods Explained for Continuous Productionnicah shayne madayag100% (1)

- Joint & by ProductsDocument10 pagesJoint & by Productsharry severino0% (1)

- Topic 6 Activity Based Costing Practice Questions With AnsDocument5 pagesTopic 6 Activity Based Costing Practice Questions With AnsRupert John Lenin Garcia100% (1)

- Backflush Costing and Activity-Based CostingDocument14 pagesBackflush Costing and Activity-Based CostingEilen Joyce BisnarNo ratings yet

- Process Costing Formulas and CalculationsDocument4 pagesProcess Costing Formulas and CalculationsJehny AbelgasNo ratings yet

- Management Accounting I 0105Document29 pagesManagement Accounting I 0105api-26541915100% (1)

- Assignment 4 - CVPDocument12 pagesAssignment 4 - CVPAlyssa BasilioNo ratings yet

- Cost Accounting RefresherDocument16 pagesCost Accounting RefresherDemi PardilloNo ratings yet

- PROBLEM1Document25 pagesPROBLEM1Marvin MarianoNo ratings yet

- Marvin Manufacturing Cost of Goods Sold StatementDocument3 pagesMarvin Manufacturing Cost of Goods Sold StatementRowena TamboongNo ratings yet

- COST ACCOUNTING 1-5 FinalDocument12 pagesCOST ACCOUNTING 1-5 FinalChristian Blanza LlevaNo ratings yet

- AC56 Labor Cost AccountingDocument4 pagesAC56 Labor Cost AccountingJoan Tanto MagdalenoNo ratings yet

- Inventories Opening ClosingDocument16 pagesInventories Opening ClosingKristine PunzalanNo ratings yet

- Discussion of Assignment - Just in Time and Backflush CostingDocument4 pagesDiscussion of Assignment - Just in Time and Backflush CostingRoselyn Lumbao100% (1)

- ACCO 20073 Backflush CostingDocument2 pagesACCO 20073 Backflush CostingMaria Kathreena Andrea AdevaNo ratings yet

- Chapter 6 7 TestDocument5 pagesChapter 6 7 TestYza GesmundoNo ratings yet

- Test for JIT Costing & Backflush CostingDocument6 pagesTest for JIT Costing & Backflush CostingJerome MonserratNo ratings yet

- Backflush - Costing - System - and - Activity - Based - Costing Answer KeyDocument14 pagesBackflush - Costing - System - and - Activity - Based - Costing Answer KeyAbegail A. AraojoNo ratings yet

- JitDocument6 pagesJitJuanNo ratings yet

- Advance Financial Accounting and Reporting (AFAR) : Cost Accounting Cost AccumulationDocument18 pagesAdvance Financial Accounting and Reporting (AFAR) : Cost Accounting Cost AccumulationGwen Sula LacanilaoNo ratings yet

- JIT and Backflush Costing - Sample Problems With SolutionsDocument2 pagesJIT and Backflush Costing - Sample Problems With SolutionsMarjorie NepomucenoNo ratings yet

- Just in TimeDocument3 pagesJust in TimeHenry SeeNo ratings yet

- Cost Accounting Mastery - 1Document4 pagesCost Accounting Mastery - 1Mark RevarezNo ratings yet

- 1st - LawDocument23 pages1st - LawPrankyJellyNo ratings yet

- Test I Test Ii Test IiiDocument2 pagesTest I Test Ii Test IiiPrankyJellyNo ratings yet

- CayDocument25 pagesCayPrankyJellyNo ratings yet

- Finance Can Be Defined AsDocument6 pagesFinance Can Be Defined AsPrankyJellyNo ratings yet

- Business Combination Problems Quiz 2Document7 pagesBusiness Combination Problems Quiz 2PrankyJellyNo ratings yet

- Dahon CompanyDocument2 pagesDahon CompanyPrankyJellyNo ratings yet

- Aud Rev ProblemsDocument12 pagesAud Rev ProblemsPrankyJellyNo ratings yet

- Time Value of MoneyDocument5 pagesTime Value of MoneyPrankyJellyNo ratings yet

- Preferential TaxationDocument2 pagesPreferential TaxationPrankyJellyNo ratings yet

- F Drill 1Document2 pagesF Drill 1PrankyJellyNo ratings yet

- Business Combination Problems Quiz 2Document7 pagesBusiness Combination Problems Quiz 2PrankyJellyNo ratings yet

- Drill Business CombinationDocument4 pagesDrill Business CombinationPrankyJellyNo ratings yet

- Salomon V. FrialDocument2 pagesSalomon V. FrialPrankyJellyNo ratings yet

- Stock AcquisitionDocument5 pagesStock AcquisitionPrankyJellyNo ratings yet

- Partnership Asset Investment, Appraisal, and Liquidation AccountingDocument1 pagePartnership Asset Investment, Appraisal, and Liquidation AccountingPrankyJellyNo ratings yet

- Isap Accountancy Promotion and Retention: ST NDDocument2 pagesIsap Accountancy Promotion and Retention: ST NDPrankyJellyNo ratings yet

- Case Consti BBBBDocument2 pagesCase Consti BBBBPrankyJellyNo ratings yet

- Answer KeyDocument3 pagesAnswer KeyPrankyJellyNo ratings yet

- QuizDocument3 pagesQuizPrankyJellyNo ratings yet

- Practice of law prohibition for government prosecutors collecting retainer feesDocument12 pagesPractice of law prohibition for government prosecutors collecting retainer feesPrankyJellyNo ratings yet

- Salomon V. FrialDocument2 pagesSalomon V. FrialPrankyJellyNo ratings yet

- PDocument9 pagesPPrankyJellyNo ratings yet

- CorpoDocument1 pageCorpoPrankyJellyNo ratings yet

- CENTRAL BANK EMPLOYEES ASSOC v. BSP discriminates rank-and-fileDocument6 pagesCENTRAL BANK EMPLOYEES ASSOC v. BSP discriminates rank-and-filePrankyJellyNo ratings yet

- INSTRUCTIONS: Shade The Letter of Your Choice On The Answer Sheet Provided. If Your Answer Is Not inDocument8 pagesINSTRUCTIONS: Shade The Letter of Your Choice On The Answer Sheet Provided. If Your Answer Is Not inPrankyJelly0% (1)

- Answer Q1 - AFAR ReviewDocument22 pagesAnswer Q1 - AFAR ReviewPrankyJellyNo ratings yet

- Investment in EquityDocument1 pageInvestment in EquityPrankyJellyNo ratings yet

- ADV FIN ACCOUNTING DERIVATIVES HEDGINGDocument3 pagesADV FIN ACCOUNTING DERIVATIVES HEDGINGPrankyJellyNo ratings yet

- Installment SaleDocument2 pagesInstallment SalePrankyJellyNo ratings yet

- Non Integrated AccountingDocument4 pagesNon Integrated AccountingbinuNo ratings yet

- Annu Singhal: Professional ObjectiveDocument2 pagesAnnu Singhal: Professional ObjectiveKumaravel JaganathanNo ratings yet

- ch03 SolDocument12 pagesch03 SolJohn Nigz PayeeNo ratings yet

- PA1.M.1404 InventoriesDocument29 pagesPA1.M.1404 InventoriesRonnelson Pascual67% (3)

- Mother - Please Speak Out: Income Statement For The Year Ended March 31, 2019 ($000s) Net Sales 100,000Document3 pagesMother - Please Speak Out: Income Statement For The Year Ended March 31, 2019 ($000s) Net Sales 100,000Jayash Kaushal0% (2)

- Ch01 TB RankinDocument9 pagesCh01 TB RankinAnton VitaliNo ratings yet

- Fair Value Vs ConservatismDocument50 pagesFair Value Vs ConservatismIslammohsenNo ratings yet

- BS Accountancy Subjects CourseDocument6 pagesBS Accountancy Subjects CourseMhel DemabogteNo ratings yet

- Final Report - Payments ProcessDocument32 pagesFinal Report - Payments Processmrshami7754No ratings yet

- ITO-Paper-2-2023Document36 pagesITO-Paper-2-2023thealphaamongthepeakyblindersNo ratings yet

- Comunicare in Audit in Limba EnglezaDocument80 pagesComunicare in Audit in Limba EnglezacostajenitaNo ratings yet

- Problem SolvingDocument23 pagesProblem SolvingFery AnnNo ratings yet

- Code of Ethics for AuditorsDocument29 pagesCode of Ethics for Auditorsrajes wari50% (2)

- Financial Statement Analysis and Security ValuationDocument3 pagesFinancial Statement Analysis and Security Valuationmadhumitha_vaniNo ratings yet

- Chapter 2 Fundamentals of Accounting Module PDFDocument12 pagesChapter 2 Fundamentals of Accounting Module PDFCyrille Kaye TorrecampoNo ratings yet

- Primitive Accounting Middle Ages Industrial Revolution & Corporate Organization Information AgeDocument28 pagesPrimitive Accounting Middle Ages Industrial Revolution & Corporate Organization Information AgePhil Cahilig-GariginovichNo ratings yet

- Cpa in Transit: Time Code Description Title ProfessorDocument1 pageCpa in Transit: Time Code Description Title ProfessorAJHDALDKJANo ratings yet

- Chapter 10 Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Business 1Document36 pagesChapter 10 Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Business 1Charlyn galahanNo ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument10 pagesACCOUNTANCY (Code No. 055) : RationaleAshish GangwalNo ratings yet

- Quiz 2Document4 pagesQuiz 2zainabcomNo ratings yet

- Kunjaw Medika Adijaya 2021Document35 pagesKunjaw Medika Adijaya 2021NahmaKids100% (1)

- CAP-II Revision Test Paper Group I June 2023Document81 pagesCAP-II Revision Test Paper Group I June 2023Prashant Sagar GautamNo ratings yet

- Chapter 1 ReviewerDocument2 pagesChapter 1 ReviewerNica Jane MacapinigNo ratings yet

- Class 9 - LedgerDocument19 pagesClass 9 - Ledger04shubhgoelNo ratings yet

- AC2102 - Management Accounting Environment - Review Class - Answer KeyDocument9 pagesAC2102 - Management Accounting Environment - Review Class - Answer KeyJona FranciscoNo ratings yet

- Accounting Theory 7th Edition Godfrey PDFDocument7 pagesAccounting Theory 7th Edition Godfrey PDFNova TheresiaNo ratings yet

- CA QuestionsDocument407 pagesCA QuestionsNaisar ShahNo ratings yet

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2Art EuphoriaNo ratings yet

- Cash Flow Problem Solver - Depreciation, Taxes, NPV, IRRDocument45 pagesCash Flow Problem Solver - Depreciation, Taxes, NPV, IRRHannah Fuller100% (1)

- FAR08.01d-Presentation of Financial StatementsDocument7 pagesFAR08.01d-Presentation of Financial StatementsANGELRIEH SUPERTICIOSONo ratings yet