Professional Documents

Culture Documents

KEYNESIAN ECONOMICS AND THE KEYNESIAN SYNTHESIS

Uploaded by

Ellie Belly0 ratings0% found this document useful (0 votes)

10 views1 pageThis document provides a historical overview of the emergence and development of different schools of economic thought from 1710-2008. It traces the evolution from Physiocracy and Classical Economics in the 18th century, to Keynesianism in the mid-20th century, to more modern developments like Monetarism, New Classical Economics, New Keynesianism, and Behavioral Economics. Major events discussed include the Industrial Revolution, Great Depression, Bretton Woods agreement, and the 2008 financial crisis. The document aims to contextualize different economic theories in relation to the historical periods and circumstances that influenced their formation.

Original Description:

diss handouts for economics

Original Title

Historical Context of the Emergence of ECONOMICS

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides a historical overview of the emergence and development of different schools of economic thought from 1710-2008. It traces the evolution from Physiocracy and Classical Economics in the 18th century, to Keynesianism in the mid-20th century, to more modern developments like Monetarism, New Classical Economics, New Keynesianism, and Behavioral Economics. Major events discussed include the Industrial Revolution, Great Depression, Bretton Woods agreement, and the 2008 financial crisis. The document aims to contextualize different economic theories in relation to the historical periods and circumstances that influenced their formation.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views1 pageKEYNESIAN ECONOMICS AND THE KEYNESIAN SYNTHESIS

Uploaded by

Ellie BellyThis document provides a historical overview of the emergence and development of different schools of economic thought from 1710-2008. It traces the evolution from Physiocracy and Classical Economics in the 18th century, to Keynesianism in the mid-20th century, to more modern developments like Monetarism, New Classical Economics, New Keynesianism, and Behavioral Economics. Major events discussed include the Industrial Revolution, Great Depression, Bretton Woods agreement, and the 2008 financial crisis. The document aims to contextualize different economic theories in relation to the historical periods and circumstances that influenced their formation.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Historical context of the KEYNESIAN ECONOMICS AND SYNTHESIS

emergence of ECONOMICS KEYNESIANISM, Keynes, Tabin, Samuelson,

1710-The European enlightenment era provided a Mundell)

boost to the scientific inquiry. Thinkers began to

1944- Bretton Woods was established to create a

apply scientific principles not only to the natural

set rules of commercial and financial relations

world, but also to society. Scholars set out to

between the US, Canada, Western Europe, Australia

discover “laws” of human interaction, in order to be

and Japan, each nation was required to tie their

able to explain how human society works.

currency to gold, thus maintaining a stable

(PHYSIOCRACY, Quesnay and Cantillon)

exchange rate. The IMF was created to bridge

1735- Classical economics is widely regarded as the temporary imbalances of payments. (CAMBRIDGE

first modern school of economic thought. Classical SCHOOL, Robinson, Kaldor, Lerner and Sraffa)

economist shared the belief that markets regulate

1970- The 1970s saw a great period of Stagflation

themselves, when free of any intervention. ( Smith,

(unemployment plus inflation) which Keynesian

Say, Ricardo,Maithus and Mill)

theory could not explain. That’s because Keynesian

1820- Industrial Revolution, people moved away theory had argued inflation was caused by tight

from their farms and into the factory, where labor markets, and that mass unemployment

production as done with the use of machines that should be accompanied by price deflation, not

ran on steam power or coal. Although inequality inflation. This made it easy for the Chicago school

was brutally high, growth reached unprecedented to take over. (Monetarism and New Classical

levels. (Neoclassical Economics and Marginalism, Economics, Friedman and Lucas)

Marshall, Pareto, Jevons and Walras)

1976- The end of Bretton Woods was formally

1867-Marxism paints a dim picture of capitalism. ratified by the Jamaica Accords in 1976. By the early

Demonstrating the inevitable exploitation of the 1980s, all industrialized nations were using floating

working class, this school of thought inspired currencies. (NEW KEYNESIAN, Mankiw, Taylor,

workers around the world to unite. ( Marx and Krugman, Stiglitz)

Engels)

1981-Reanonomics alongside Thatcherism attempts

1914- The war itself was over in 1918, but the to promote low inflation, the small state and free

implications were not. Because the pound had markets though tight control of the money supply,

inflated, Britain went back to the gold standard in privatization and constraints on the labour

an attempt to restore the international purchasing movement. Both formed key part of the worldwide

power, but it did not work. (INSTITUTIONAL economic liberal movement.

ECONOMICS AND OLD INSTITUTIONALIST, Veblen , (BEHAVIORAL ECONOMICS,Kahnermann, Thaler

Galbraith, Kuznets and List) and Rabin)

1929- Great Depression, after stock prices started 2008-The great recession, bad mortages,

falling in the US, the market crashed globally on inaccurate, credit rating and fraudulent banking

Black Tuesday. The Great depression had practices fuelled a housing bubble and a vast web

devastating effects in countries rich and poor. of bad debt, which came to collapse in 2008. The

Personal income, tax revenue, profits and price result was the greatest economic downturn since

dropped, international trade plunged by more than the great depression in 1929.

50% and unemployment in the US, rose to 25%.

(NEW INSTITUTIONALIST).

1939- The gold standard was intended to keep

government spending and inflation in check. If the

global gold supply could only grow slowly then so

would spending levels and prices. But with time, it

became clear that the gold standard significantly

restricts the possibilities for policy making.(

You might also like

- AGB101 - Chapter 1Document14 pagesAGB101 - Chapter 1Rene Aubert MbonimpaNo ratings yet

- Economic School of ThoughtsDocument13 pagesEconomic School of Thoughtspakhi rawatNo ratings yet

- economic-structureDocument123 pageseconomic-structureCanadian LNo ratings yet

- Economic TheoriesDocument4 pagesEconomic TheoriesGlaiza AdelleyNo ratings yet

- Defence EconomicsDocument40 pagesDefence Economicspsn19843014No ratings yet

- " The Great Thinkers": ADAM SMITH (1723-1790)Document8 pages" The Great Thinkers": ADAM SMITH (1723-1790)Amor Vinsent AquinoNo ratings yet

- History of Emergence of EconomistsDocument25 pagesHistory of Emergence of EconomistsSanzhar KenzhekhanulyNo ratings yet

- History of Economics: Quesnay, Cantillon, TourgotDocument2 pagesHistory of Economics: Quesnay, Cantillon, TourgotИрина КашкароваNo ratings yet

- Economics EvolutionDocument5 pagesEconomics EvolutionSamuel EnajeroNo ratings yet

- Economic History U1Document5 pagesEconomic History U1socrativeanaNo ratings yet

- 3 - MercantilismDocument7 pages3 - MercantilismmayankNo ratings yet

- MicroeconomicsDocument22 pagesMicroeconomicsVic Gerome Dela CruzNo ratings yet

- Classical Economics ExplainedDocument13 pagesClassical Economics ExplainedEmer SalenNo ratings yet

- ECO 402new ClassicalsDocument27 pagesECO 402new ClassicalsEUTHEL JHON FINLACNo ratings yet

- Summary Of "For A New Economy" By Paul Ormerod: UNIVERSITY SUMMARIESFrom EverandSummary Of "For A New Economy" By Paul Ormerod: UNIVERSITY SUMMARIESNo ratings yet

- Key figures who shaped economic thought from Adam Smith to Amartya SenDocument13 pagesKey figures who shaped economic thought from Adam Smith to Amartya SenWoohyun143No ratings yet

- David RicardoDocument22 pagesDavid RicardoY D Amon GanzonNo ratings yet

- TAGOLOAN Community College: BAC 101/BAC 202/ECON 101: Basic Micro EconomicsDocument12 pagesTAGOLOAN Community College: BAC 101/BAC 202/ECON 101: Basic Micro EconomicsRyan Olaer BalateroNo ratings yet

- Economics: and Money (1935), by The British Economist John Maynard Keynes. His Explanation of ProsperityDocument11 pagesEconomics: and Money (1935), by The British Economist John Maynard Keynes. His Explanation of ProsperityAbigail TNo ratings yet

- Mixed economy modelDocument3 pagesMixed economy modelRohit KumarNo ratings yet

- Evolution of Modern EconomicsDocument13 pagesEvolution of Modern EconomicsRohan AhmedNo ratings yet

- History of Economic ThoughtDocument9 pagesHistory of Economic Thoughtabhinav iyerNo ratings yet

- LIT Quiz 02 Economics - ArticlesDocument22 pagesLIT Quiz 02 Economics - ArticlesSatyadeep SinghNo ratings yet

- Phelps Lecture2006Document26 pagesPhelps Lecture2006Tuan HoangNo ratings yet

- Capitalism and Its Economics: A Critical HistoryFrom EverandCapitalism and Its Economics: A Critical HistoryRating: 4 out of 5 stars4/5 (9)

- Classical EconomicsDocument54 pagesClassical EconomicsAlionie FreyNo ratings yet

- Summary Of "The Age Of Empire (1875-1914)" By Eric Hobsbawm: UNIVERSITY SUMMARIESFrom EverandSummary Of "The Age Of Empire (1875-1914)" By Eric Hobsbawm: UNIVERSITY SUMMARIESRating: 1 out of 5 stars1/5 (1)

- ECON 2K03 1 IntroductionDocument5 pagesECON 2K03 1 Introductionmail4meNo ratings yet

- The Global EconomyDocument33 pagesThe Global EconomyRed MurNo ratings yet

- Lesson 1Document46 pagesLesson 1Maurice ZorillaNo ratings yet

- Adam Smith's Invisible Hand & Foundations of Economic ThoughtDocument12 pagesAdam Smith's Invisible Hand & Foundations of Economic ThoughtShiv DewanNo ratings yet

- Evolution of International Economic SystemDocument36 pagesEvolution of International Economic SystemShantanu SinghNo ratings yet

- Economics ReviewerDocument13 pagesEconomics ReviewerJenna EnrileNo ratings yet

- Adam SmithDocument2 pagesAdam SmithChristopher GabumpaNo ratings yet

- David Ricardo: Summarized Classics: SUMMARIZED CLASSICSFrom EverandDavid Ricardo: Summarized Classics: SUMMARIZED CLASSICSNo ratings yet

- The End of Theory: Financial Crises, the Failure of Economics, and the Sweep of Human InteractionFrom EverandThe End of Theory: Financial Crises, the Failure of Economics, and the Sweep of Human InteractionRating: 5 out of 5 stars5/5 (2)

- Paradigm Shift Final DraftDocument12 pagesParadigm Shift Final Draftapi-608480634No ratings yet

- Major Economists and Schools of Thought from 1730-1800Document13 pagesMajor Economists and Schools of Thought from 1730-1800PramodNairNo ratings yet

- Industrial RevolutionDocument9 pagesIndustrial RevolutionAbhinav Ashok ChandelNo ratings yet

- Microeconomic Theory - Lect-1Document49 pagesMicroeconomic Theory - Lect-1Mudassir HanifNo ratings yet

- Worldly Philosophers SummaryDocument43 pagesWorldly Philosophers Summaryskerikaaa100% (1)

- ECON 101 Introduction to Economics with Taxation and Land ReformDocument26 pagesECON 101 Introduction to Economics with Taxation and Land ReformShainah Melicano SanchezNo ratings yet

- Shifting Sands: Assessing What Ended and What Did Not in the 2008 Financial CrisisDocument23 pagesShifting Sands: Assessing What Ended and What Did Not in the 2008 Financial Crisiscowley75No ratings yet

- The Industrial Revolution and Latin America in The 19th CDocument8 pagesThe Industrial Revolution and Latin America in The 19th CKarlos SamestaNo ratings yet

- History of EconomicsDocument21 pagesHistory of Economicsmailk jklmnNo ratings yet

- Adam Smith's Contributions and Early Economic TheoristsDocument3 pagesAdam Smith's Contributions and Early Economic TheoriststyroneNo ratings yet

- Founders of Modern Economics: Adam Smith, Karl Marx, John Maynard KeynesDocument2 pagesFounders of Modern Economics: Adam Smith, Karl Marx, John Maynard KeynestyroneNo ratings yet

- John Kenneth Galbraith2Document19 pagesJohn Kenneth Galbraith2Mauricio Gutierrez QuezadaNo ratings yet

- Adam Smith's Wealth of Nations & Origins of Economic ThoughtDocument2 pagesAdam Smith's Wealth of Nations & Origins of Economic ThoughtAryan VtgNo ratings yet

- Economists Who Shaped Economic ThoughtDocument6 pagesEconomists Who Shaped Economic ThoughtCassandra VeeNo ratings yet

- Evolution of Economic Thinking from Mercantilism to KeynesianismDocument30 pagesEvolution of Economic Thinking from Mercantilism to KeynesianismAarya DoshiNo ratings yet

- Rizal Notes IntroDocument165 pagesRizal Notes IntroPrincess Mary NobNo ratings yet

- Group 1Document27 pagesGroup 1ChristianNo ratings yet

- 4 - Transitional Economic Thought - Physiocracy and OthersDocument6 pages4 - Transitional Economic Thought - Physiocracy and OthersmayankNo ratings yet

- The Classical School Began in 1776 When Adam Smith Published His Wealth of NationsDocument20 pagesThe Classical School Began in 1776 When Adam Smith Published His Wealth of NationsIka SuciNo ratings yet

- Introduction to EconomicsDocument19 pagesIntroduction to EconomicsThomas LeeNo ratings yet

- Theories of Economic Development from 1860s to 1960sDocument77 pagesTheories of Economic Development from 1860s to 1960sdigvijay909100% (2)

- Deirdre McCloskey - Publications - Industrial RevolutionDocument3 pagesDeirdre McCloskey - Publications - Industrial Revolutionverdi rossiNo ratings yet

- 1 R. Industrial y M. ObreroDocument6 pages1 R. Industrial y M. ObreroLucía Torres VizcaínoNo ratings yet

- School PoliciesDocument22 pagesSchool PoliciesEllie BellyNo ratings yet

- HUMSS - Disciplines and Ideas in Applied Social Sciences CGVVVVDocument7 pagesHUMSS - Disciplines and Ideas in Applied Social Sciences CGVVVVPaul Edward MacombNo ratings yet

- TOP 10 CertificateDocument1 pageTOP 10 CertificateEllie BellyNo ratings yet

- Online Design PrinciplesDocument11 pagesOnline Design PrinciplesEllie BellyNo ratings yet

- Island Survival Game PDFDocument17 pagesIsland Survival Game PDFEllie BellyNo ratings yet

- DISSDocument134 pagesDISSEllie BellyNo ratings yet

- Ep 2Document2 pagesEp 2Ellie BellyNo ratings yet

- TOP 10 CertificateDocument1 pageTOP 10 CertificateEllie BellyNo ratings yet

- ET#1Document1 pageET#1Ellie BellyNo ratings yet

- Tos 3iDocument1 pageTos 3iEllie BellyNo ratings yet

- ET#1Document1 pageET#1Ellie BellyNo ratings yet

- Finals DISSDocument2 pagesFinals DISSEllie Belly100% (1)

- Finals DISSDocument2 pagesFinals DISSEllie Belly100% (1)

- ET 2nd ExamDocument3 pagesET 2nd ExamEllie BellyNo ratings yet

- Handout For DISS-psychologyDocument1 pageHandout For DISS-psychologyEllie BellyNo ratings yet

- Behavioral Verbs For Effective Learning Objectives 2012Document1 pageBehavioral Verbs For Effective Learning Objectives 2012mcrosalesNo ratings yet

- DISS MidtermDocument3 pagesDISS MidtermEllie BellyNo ratings yet

- Handout For Empowerment-Types of TextDocument1 pageHandout For Empowerment-Types of TextEllie BellyNo ratings yet

- FX Markets Weekly: The Upcoming Presidential Election in France (Raphael Brun-Aguerre)Document44 pagesFX Markets Weekly: The Upcoming Presidential Election in France (Raphael Brun-Aguerre)nosternosterNo ratings yet

- Hacking CiphersDocument47 pagesHacking CiphersJay SagarNo ratings yet

- Fiscal Deficit and Macroeconomic PerformanceDocument50 pagesFiscal Deficit and Macroeconomic Performanceranjabati chakrabortiNo ratings yet

- National Income EquilibriumDocument54 pagesNational Income EquilibriumFazlynn Munira100% (1)

- Marc FaberDocument20 pagesMarc Faberapi-26094277No ratings yet

- What Is Economic RecessionDocument6 pagesWhat Is Economic RecessionAdediran DolapoNo ratings yet

- Agregate Demand and SupplyDocument22 pagesAgregate Demand and SupplysmsNo ratings yet

- Sudip Macro EPBM 16 1st PartDocument103 pagesSudip Macro EPBM 16 1st Partnravi39763No ratings yet

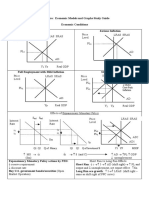

- AP Macroeconomic Models and Graphs Study GuideDocument23 pagesAP Macroeconomic Models and Graphs Study GuideGabriel Jimenez100% (7)

- D) Indirect Taxes and SubsidiesDocument7 pagesD) Indirect Taxes and SubsidiesnatlyhNo ratings yet

- 1 5 Mas - Lecture Notes Armin Glenn Araneta, Cpa EconomicsDocument5 pages1 5 Mas - Lecture Notes Armin Glenn Araneta, Cpa EconomicsDarelle Hannah MarquezNo ratings yet

- Macroeconomics EssayDocument7 pagesMacroeconomics EssayAchim EduardNo ratings yet

- 3 & 4 - National Income AccountingDocument27 pages3 & 4 - National Income AccountingAshish SinghNo ratings yet

- Intro Engineering EconomyDocument10 pagesIntro Engineering EconomyMax DrakeNo ratings yet

- Understanding Money Supply in IndiaDocument2 pagesUnderstanding Money Supply in IndiaAAMIR IBRAHIMNo ratings yet

- 6B: Classical and Neoclassical Theories of Money: Test Bank For Corporate Finance and Financial MarketsDocument9 pages6B: Classical and Neoclassical Theories of Money: Test Bank For Corporate Finance and Financial MarketsBabar Adeeb100% (1)

- Value-Based: Set - I Economics - Class XiiDocument4 pagesValue-Based: Set - I Economics - Class XiicthiruvazhmarbanNo ratings yet

- Presentation On Deficit FinancingDocument23 pagesPresentation On Deficit FinancingAshwani Mittal83% (6)

- Domingo Cavallo - Harvard Lecture NotesDocument54 pagesDomingo Cavallo - Harvard Lecture NotesKaligula GNo ratings yet

- L12: Actual and Constant DollarsDocument11 pagesL12: Actual and Constant DollarsSajid IqbalNo ratings yet

- Monetary and Fiscal PolicyDocument22 pagesMonetary and Fiscal PolicydhawalraginiNo ratings yet

- ECOC 514 Ques DoneDocument6 pagesECOC 514 Ques Doneshohab4nNo ratings yet

- Robert Kiyosaki Interview With Bert Dohmen June 22 2013Document3 pagesRobert Kiyosaki Interview With Bert Dohmen June 22 2013David ShimanaNo ratings yet

- 4 Basic Assumptions of EconomicsDocument2 pages4 Basic Assumptions of Economicssreekutty A SNo ratings yet

- Econ - Recession, Hyperinflation & StagflationDocument3 pagesEcon - Recession, Hyperinflation & StagflationGwyneth MalagaNo ratings yet

- Safety During Tyre InflatingDocument8 pagesSafety During Tyre InflatingGregoriusWinartoNo ratings yet

- MACROECON SyllDocument8 pagesMACROECON SyllRochel M RosalNo ratings yet

- Central Tire Inflation SystemDocument4 pagesCentral Tire Inflation SystemAnonymous 9xvU1FNo ratings yet

- I'm So Bearish, Even I'm Miserable - One Bank's Clients Crack... Yet The Real Selling Is Only Just Starting - ZeroHedgeDocument9 pagesI'm So Bearish, Even I'm Miserable - One Bank's Clients Crack... Yet The Real Selling Is Only Just Starting - ZeroHedgeGino78No ratings yet

- Served As An Economic Lifeline For The Spaniards in ManilaDocument2 pagesServed As An Economic Lifeline For The Spaniards in ManilaMarianne Cristy Toledo DeiparineNo ratings yet