Professional Documents

Culture Documents

NN

Uploaded by

MjhayeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NN

Uploaded by

MjhayeCopyright:

Available Formats

CHAPTER

BLUE NOTES

16 S

L

Property, Plant and Equipment are tangible assets that are held for use in production or supply of goods or services, for

rental to others, or for administrative purposes, and are expected to be used during more than one period.

Requisites:

a. Tangible, meaning with physical substance

b. Used in business

c. Expected to be used for more than one year. Hence they are classified as noncurrent assets.

Measurement

A. Initial Measurement = at Cost*

B. Subsequent Measurement

Either:

Cost Model = Cost less accumulated depreciation and accumulated impairment losses

Revaluation Model = Fair value at the revaluation date less any subsequent accumulated depreciation

and subsequent accumulated impairment loss.

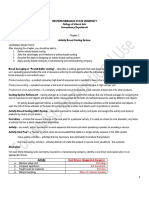

Cost* Includes Cost* Excludes

Purchase price including import duties and Cost of opening new facility

nonrefundable purchase taxes after deducting Costs of introducing a new product or service, like

trade discounts and rebate. advertising and promotions

Cost directly attributable to bringing the asset to Costs of conducting business in a new location or

the location and condition necessary for it to be with a new class of customer, including costs of

capable of operating in the manner intended by staff training

the management. Administrative and other general overhead costs

Cost of employee benefits arising directly Costs incurred while an item capable of operating

from the construction or acquisition of the in the manner intended by the management has

item of property, plant and equipment yet to be brought into use or is operated at less

Cost of site preparation than full capacity

Initial delivery and handling cost Initial operating losses

Installation and assembly cost Costs of relocating or reorganizing part or all of an

Professional fees entity’s operations

Costs of testing whether the asset is

functioning properly less net proceeds from

selling any items produced while bringing the

asset to that location and condition.

Initial estimate of costs of dismantling and

removing the item and restoring the site on which

it is located

Theory of Accounts Practical Accounting 1

60 USL Blue Notes Chapter 16 – Property, Plant and Equipment

Measurement of Cost*

A. Acquisition on a Cash Basis Cost = Cash Price

B. Acquisition on Account Cost = Purchase Price less Cash discount whether taken or not

C. Acquisition on Installment Basis Cost = Cash Price Equivalent

D. Issuance of Share Capital Cost = (in order of priority)

1. fair value of the property, plant and equipment received

2. fair value of the equity instrument issued

3. par or stated value of the equity instrument issued

E. Issuance of Bonds Payable Cost = (in order of priority)

1. Fair value of the bonds

2. Fair value of the asset

3. Face value of the bonds

F. Exchange

Either:

With Commercial Substance Without Commercial Substance

1. No cash is involved, cost of the asset a. On part of the payor – cost of asset

acquired shall be measured in the given plus cash payment

following order of priority: b. On part of the recipient – cost of asset

a. Fair value of property given given minus cash received

b. Fair value of property received

c. Book value of the property given Note: No gain or loss shall be recognized.

2. If cash is involved, the cost of the asset

acquired shall be measured in the

following:

a. On part of the payor - Fair value of

property given plus cash payment.

b. On part of the recipient - Fair value

of property given minus cash

received

G. Trade-in Cost = (in order of Priority)

1. Fair value of the asset given plus cash payment

2. Trade-in value of the asset given plus cash payment ( in effect,

this is the fair value of the asset received)

H. Donation Cost = Fair Value of the Property

Note: Expenses relating to the donation shall be charged against donated capital account.

Directly attributable costs incurred, such as installation and testing cost to bring the

donated asset to the location and condition for its intended use shall be capitalized.

Practical Accounting 1 Theory of Accounts

Chapter 16 – Property, Plant and Equipment USL Blue Notes 61

I. Construction Cost = Direct Materials

Direct Labor

Incremental overhead specifically identifiable or traceable to the

construction

Note: Savings from the construction shall not be recognized in the financial statements.

Cash flows from activities occurring before or during construction that are not necessary

in bringing the asset to condition for use shall not be included in determining the cost of

the asset.

The carrying amount of property, plant and equipment shall be derecognized upon:

a. Disposal

b. Or when no future economic benefits are expected from its use or disposal

Note:Gain or loss on derecognition shall be recognized in P/L.

Fully depreciated property shall not be removed from accounts.

Property Classified as Held for Sale

an item of property, plant and equipment is classified as “held for sale” if the asset is available for immediate

sale in its present condition within one year from the date of classification as held for sale.

an entity shall measure a noncurrent asset classified as held for sale at the lower of its carrying amount or fair

value less cost to sell. Any writedown is charged to impairment loss.

no depreciation shall be recognized anymore.

reflected in the statement of financial position separately as current asset

Note: an entity shall not classify as held for sale a noncurrent asset that is to be abandoned.

Illustrative Problems

1. Raynum Corporation had the following transactions regarding its property plant and equipment:

a. Issued P5 par 200, 000 ordinary shares out of its 400, 000 authorized sharesin exchange for 4, 000, 000

cash and land with a fair market value of 2, 500, 000. On the same date, the shares of Raynum Corporation

are selling at P26.

b. Incurred the following expenses for the construction of building:

Direct Materials 1, 000, 000

Site Labor Cost 2, 500, 000

Incremental Costs Incurred 250, 000

Interest imputed from financing the construction 400, 000

Wasted Materials (300, 000 normal) 800, 000

Total Costs Incurred 4, 950, 000

Building could have been purchased from outside parties at 5, 250, 000

c. Purchased machinery for 250, 000 cash.

d. Purchased truck #1 for 500, 000 3/10, n/30. The discount was not availed.

e. Purchased truck #2 at an installment price of 600, 000 by issuing notes. The installment will be payable in 3

equal installment. The cash price equivalent of the purchase is 450, 000.

f. Issued 8% 1, 000 bonds of 1, 000par to finance the purchase of equipment. The bonds are selling in the

market at 98. The equipment’s fair value at that time was 900, 000.

g. An investment in equity security valued at the market for 700, 000 and costing 800, 000 was exchanged for

an equipment with a fair value of 750, 000. Additional cash payment was made by Raynum for 30, 000.

Theory of Accounts Practical Accounting 1

62 USL Blue Notes Chapter 16 – Property, Plant and Equipment

h. Raynum entity traded an old equipment with a dealer of a new model. The following data are available:

Old equipment:

Cost 1, 000, 000

Accumulated depreciation 750, 000

Book Value 250, 000

Fair Value 300, 000

Trade-in Value 400, 000

New equipment:

List Price 2, 000, 000

Trade-in value of old equipment (400, 000)

Cash Payment 1, 600, 000

The following journal entries shall be made in the books of Raynum Corporation regarding its transaction involving

property, plant and equipment:

ACCOUNT TITLE Debit Credit

a. Cash 4, 000, 000

Land 2, 500, 000

Share Capital – ordinary shares 1, 000, 000

Share Premium – ordinary shares 5, 500, 000

b. Building 4, 650, 000

Abnormal wastes 300, 000

Cash 4, 950, 000

c. Machinery 250, 000

Cash 250, 000

d. Truck No. 1 485, 000

Accounts Payable 485, 000

Accounts Payable 98, 000

Purchase Discount Lost 2, 000

Cash 100, 000

e. Truck No. 2 450, 000

Discount on Notes Payable 150, 000

Notes Payable 600, 000

f. Equipment 980, 000

Discount on Bonds Payable 20, 000

Bonds Payable 1, 000, 000

Practical Accounting 1 Theory of Accounts

Chapter 16 – Property, Plant and Equipment USL Blue Notes 63

g. Equipment 730, 000

Loss on Exchange 100, 000

Investment in Equity Security 800, 000

Cash 30, 000

h. Equipment – new 1, 900, 000

Accumulated Depreciation 750, 000

Equipment – old 1, 000, 000

Cash 1, 600, 000

Gain on exchange 50, 000

Note:

The discount on the notes and bonds shall be amortized through the credit term using simple amortization method since no effective

interest rate is given.

In journal entry (g), fair value of the asset given is determinable and therefore shall be used in measuring the value of the asset

received.

Using journal entry (g), in case the transaction lacks commercial substance, the value of the asset received shall be the cost of asset

given plus the cash payment.

In journal entry (h), fair value approach is used since the fair value of the asset given is determinable. However, if the fair value is not

determinable, then trade-in value approach shall be used. Under trade-in value approach, the list price of the asset acquired shall be

the cost measurement of the asset to be recorded.

Theory of Accounts Practical Accounting 1

You might also like

- Contracts Chapter 2Document5 pagesContracts Chapter 2Daniel Levi AgullanaNo ratings yet

- Activity-Based Costing System DesignDocument5 pagesActivity-Based Costing System Designchelsea kayle licomes fuentesNo ratings yet

- Income Taxation Ind PracticeDocument3 pagesIncome Taxation Ind PracticeJanine Tividad100% (1)

- CPA Review: Introduction to Regular Income TaxDocument3 pagesCPA Review: Introduction to Regular Income TaxJennifer ArcadioNo ratings yet

- Drill 2 CorporationDocument2 pagesDrill 2 CorporationweqweqwNo ratings yet

- Tax On Compensation, Dealings in Properties and CorporationDocument6 pagesTax On Compensation, Dealings in Properties and CorporationOG FAM0% (1)

- Auditing: Internal Control David N. RicchiuteDocument57 pagesAuditing: Internal Control David N. RicchiuteWaye EdnilaoNo ratings yet

- Home Office, Branch, and Agency AccountingDocument48 pagesHome Office, Branch, and Agency AccountingCHERYL MORADANo ratings yet

- Nfjpiancr Ncrcup6 AFAR EliminationRound QuestionsDocument19 pagesNfjpiancr Ncrcup6 AFAR EliminationRound QuestionsIvan DorosanNo ratings yet

- Ais CH5Document30 pagesAis CH5MosabAbuKhater100% (1)

- Taxation: Far Eastern University - ManilaDocument4 pagesTaxation: Far Eastern University - ManilacamilleNo ratings yet

- WRITTEN ACTIVITY 6: Inventory ManagementDocument4 pagesWRITTEN ACTIVITY 6: Inventory ManagementDaena NicodemusNo ratings yet

- Estate TaxDocument2 pagesEstate Taxucc second yearNo ratings yet

- Joint Arrangement - Short SummaryDocument20 pagesJoint Arrangement - Short SummaryIvan BendiolaNo ratings yet

- Acquisition of Stocks Date of AcquisitionDocument9 pagesAcquisition of Stocks Date of Acquisitiondom baldemorNo ratings yet

- AFAR 2 SyllabusDocument11 pagesAFAR 2 SyllabusLawrence YusiNo ratings yet

- BA 118.1 SME Exercise Set 5Document1 pageBA 118.1 SME Exercise Set 5Ian De DiosNo ratings yet

- Chapter 3 - Gross EstateDocument6 pagesChapter 3 - Gross EstateKatrina AngelicaNo ratings yet

- Full Pfrss Vs Pfrs For Smes Vs Pfrs For Small Entities: Gato, Abdul Barri IndolDocument4 pagesFull Pfrss Vs Pfrs For Smes Vs Pfrs For Small Entities: Gato, Abdul Barri IndolBheybi ZianNo ratings yet

- Costing Accounting Practice SetDocument2 pagesCosting Accounting Practice SetKristel SumabatNo ratings yet

- Tax 3 Mid Term 2016-2017 - RawDocument16 pagesTax 3 Mid Term 2016-2017 - RawPandaNo ratings yet

- Audit of Shareholders EquityDocument10 pagesAudit of Shareholders Equityaira nialaNo ratings yet

- ADVANCED FINANCIAL ACCOUNTING AND REPORTING EXAMDocument8 pagesADVANCED FINANCIAL ACCOUNTING AND REPORTING EXAMSharmaineMirandaNo ratings yet

- CE On Quasi-ReorganizationDocument1 pageCE On Quasi-ReorganizationalyssaNo ratings yet

- Direct Costing and CVP AnalysisDocument25 pagesDirect Costing and CVP AnalysisQueeny Mae Cantre ReutaNo ratings yet

- PART I: True or False: Management Accounting Quiz 1 BsmaDocument4 pagesPART I: True or False: Management Accounting Quiz 1 BsmaAngelyn SamandeNo ratings yet

- Law On SalesDocument13 pagesLaw On SalesYves Lawrence Ivan OardeNo ratings yet

- Cost Acctg. Problems 1Document8 pagesCost Acctg. Problems 1Cheese ButterNo ratings yet

- Q3 Capital Gains TaxDocument7 pagesQ3 Capital Gains TaxNhajNo ratings yet

- Intermediate Accounting 3 - Statement of Financial PositionDocument6 pagesIntermediate Accounting 3 - Statement of Financial PositionLuisitoNo ratings yet

- Fischer - Pship LiquiDocument7 pagesFischer - Pship LiquiShawn Michael DoluntapNo ratings yet

- Business Tax Deductions & Estate PlanningDocument6 pagesBusiness Tax Deductions & Estate PlanningkaedelarosaNo ratings yet

- How To Tax An Individual 1Document25 pagesHow To Tax An Individual 1Lianna Xenia EspirituNo ratings yet

- ACCEPT OR REJECT A SPECIAL ORDERDocument4 pagesACCEPT OR REJECT A SPECIAL ORDERKHAkadsbdhsgNo ratings yet

- Rflib Chapter 4,5,6Document15 pagesRflib Chapter 4,5,6CJ TinNo ratings yet

- Buslaw2 Midterm ExamDocument5 pagesBuslaw2 Midterm ExamGwen Brossard100% (1)

- Accountancy Refresher Course on Quantitative TechniquesDocument4 pagesAccountancy Refresher Course on Quantitative Techniquesshamel marohom100% (2)

- ACFrOgC2r9bE9HvuYvxYtUf46A7BnwrhdqbDelEEwU ZdG-lkedjoc9wabHHL2kMRBzhHg1gW W7Document21 pagesACFrOgC2r9bE9HvuYvxYtUf46A7BnwrhdqbDelEEwU ZdG-lkedjoc9wabHHL2kMRBzhHg1gW W7Elizalen MacarilayNo ratings yet

- Notes To Consolidation Immediately After BusComDocument4 pagesNotes To Consolidation Immediately After BusComMelisa DomingoNo ratings yet

- ReportDocument4 pagesReportryan angelica allanicNo ratings yet

- Audit Exam QuestionnaireDocument12 pagesAudit Exam QuestionnaireKathleenNo ratings yet

- BSA181A Interim Assessment Bapaud3X: PointsDocument8 pagesBSA181A Interim Assessment Bapaud3X: PointsMary DenizeNo ratings yet

- Regulatory Framework For Business Transactions: ST NDDocument9 pagesRegulatory Framework For Business Transactions: ST NDMark Domingo MendozaNo ratings yet

- (Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #21 To 25Document1 page(Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #21 To 25John Carlos DoringoNo ratings yet

- Discuss The Components and Characteristics of Maximization and Minimization ModelDocument5 pagesDiscuss The Components and Characteristics of Maximization and Minimization ModelNicole AutrizNo ratings yet

- AFAR 3 - Revenue RecognitionDocument15 pagesAFAR 3 - Revenue RecognitionYae'kult VIpincepe QuilabNo ratings yet

- Calculating Donor's Tax for Various Property DonationsDocument12 pagesCalculating Donor's Tax for Various Property DonationsKathrine CruzNo ratings yet

- Consolidated Statement of Financial Position - Date of Acquisition AnalysisDocument2 pagesConsolidated Statement of Financial Position - Date of Acquisition AnalysisKharen Valdez0% (1)

- Exercises Absorption and Variable CostingPAUL ANTHONY DE JESUSDocument4 pagesExercises Absorption and Variable CostingPAUL ANTHONY DE JESUSMeng DanNo ratings yet

- M36 - Quizzer 1 PDFDocument8 pagesM36 - Quizzer 1 PDFJoshua DaarolNo ratings yet

- ACCO 20053 Lecture Notes 2 - Imprest System and Petty Cash FundDocument7 pagesACCO 20053 Lecture Notes 2 - Imprest System and Petty Cash FundVincent Luigil AlceraNo ratings yet

- Final Preboard May 08Document21 pagesFinal Preboard May 08Ray Allen PabiteroNo ratings yet

- PPE Cost MeasurementDocument5 pagesPPE Cost MeasurementRazel Tercino100% (1)

- IAS 16 PPE GuideDocument3 pagesIAS 16 PPE GuideRose MarieNo ratings yet

- Handout AP 2306 FDocument14 pagesHandout AP 2306 FDyosa MeNo ratings yet

- Capitalized Expensed: Whether Taken or NotDocument3 pagesCapitalized Expensed: Whether Taken or NotKaryl FailmaNo ratings yet

- 6904 PPT Materials For UploadDocument5 pages6904 PPT Materials For UploadAljur SalamedaNo ratings yet

- FINAC1 - Accounting For Property, Plant, and Equipment 1Document3 pagesFINAC1 - Accounting For Property, Plant, and Equipment 1Jerico DungcaNo ratings yet

- Property, Plant and Equipment (Pas 16)Document1 pageProperty, Plant and Equipment (Pas 16)Jhets CalumbayNo ratings yet

- Notes On Property, Plant and EquipmentDocument49 pagesNotes On Property, Plant and Equipmentcriszel4sobejanaNo ratings yet

- Tax EstateDocument9 pagesTax EstateMjhayeNo ratings yet

- Test Bank For Strategic Management 12th Edition by HillDocument20 pagesTest Bank For Strategic Management 12th Edition by HillMjhaye80% (5)

- 2010 - 2015 - Tax RemediesDocument23 pages2010 - 2015 - Tax RemediesramszlaiNo ratings yet

- A03 - Topic 2.0 Whole Topic - Budget ProcessDocument3 pagesA03 - Topic 2.0 Whole Topic - Budget ProcessMjhayeNo ratings yet

- Code of Ethics For Professional Accountants in The PhilippinesDocument6 pagesCode of Ethics For Professional Accountants in The PhilippinesMjhayeNo ratings yet

- DepletionDocument2 pagesDepletioncrookshanks100% (1)

- Acctg 106 Practice DrillDocument2 pagesAcctg 106 Practice DrillMjhayeNo ratings yet

- Tax 13BDocument11 pagesTax 13BMjhayeNo ratings yet

- Case Study - RFBT 4Document1 pageCase Study - RFBT 4MjhayeNo ratings yet

- Audit of Stockholders EquityDocument25 pagesAudit of Stockholders Equityxxxxxxxxx87% (39)

- The Political Sources of Solidarity in Diverse SocietiesDocument42 pagesThe Political Sources of Solidarity in Diverse SocietiesMjhayeNo ratings yet

- DocumentDocument1 pageDocumentMjhayeNo ratings yet

- Recto Law and Maceda LawDocument3 pagesRecto Law and Maceda Lawjulie cairo0% (1)

- Advanced Accounting Guerrero Peralta Volume 1 Solution Manual PDFDocument189 pagesAdvanced Accounting Guerrero Peralta Volume 1 Solution Manual PDFRegina Fuertes Padilla100% (2)

- Measures of Central Tendency and Dispersion: ExamplesDocument8 pagesMeasures of Central Tendency and Dispersion: ExamplesMjhayeNo ratings yet

- Fundamental Non-Locomotor SkillsDocument3 pagesFundamental Non-Locomotor SkillsDwi AnggareksaNo ratings yet

- Reviewer-Chapter 1Document10 pagesReviewer-Chapter 1MjhayeNo ratings yet

- Atty. D RFBT Notes PDFDocument28 pagesAtty. D RFBT Notes PDFRowell Bunan arevalo67% (3)

- Law 3Document1 pageLaw 3MjhayeNo ratings yet

- Sustainable Development Strategy - Borough ofDocument60 pagesSustainable Development Strategy - Borough ofMjhayeNo ratings yet

- Finals Quiz 1 Dealings in Properties Answer KeyDocument6 pagesFinals Quiz 1 Dealings in Properties Answer KeyMjhaye100% (1)

- CH 06Document38 pagesCH 06James Patrick Antonio100% (2)

- Midterm Quiz 1 Gross IncomeDocument3 pagesMidterm Quiz 1 Gross IncomeMjhayeNo ratings yet

- DarDocument1 pageDarMjhayeNo ratings yet

- Econ 3Document3 pagesEcon 3MjhayeNo ratings yet

- #20 Land, BLDG., & Machinery (Notes For 6204)Document3 pages#20 Land, BLDG., & Machinery (Notes For 6204)Zaaavnn VannnnnNo ratings yet

- BL - Corporation - Ultra Vires ActDocument2 pagesBL - Corporation - Ultra Vires Acthppddl100% (1)

- Cover Sheet DownloadDocument1 pageCover Sheet DownloadMjhayeNo ratings yet

- Ex13 3Document2 pagesEx13 3MjhayeNo ratings yet

- PFRS 10 Consolidation PrinciplesDocument3 pagesPFRS 10 Consolidation PrinciplesMjhayeNo ratings yet

- Rayner Teo - Notes On Ultimate Guide To Price Action Trading 18.12.21Document2 pagesRayner Teo - Notes On Ultimate Guide To Price Action Trading 18.12.21Joy Cheung100% (1)

- Marginal-Costing 7dmZZc0Document78 pagesMarginal-Costing 7dmZZc0Hema LathaNo ratings yet

- CapstructDocument17 pagesCapstructPushpraj Singh BaghelNo ratings yet

- NCFM Module On Mutual FundsDocument123 pagesNCFM Module On Mutual Fundsanjusawlani86No ratings yet

- PT Semen Indonesia q3 2022 - FinalDocument112 pagesPT Semen Indonesia q3 2022 - FinalHaris MaulanaNo ratings yet

- Capital Structure UploadDocument17 pagesCapital Structure UploadLakshmi Harshitha mNo ratings yet

- Investment - 2019 Edition - Chapter 21Document1 pageInvestment - 2019 Edition - Chapter 21Lastine AdaNo ratings yet

- PPL Cup DifficultDocument8 pagesPPL Cup DifficultRukia Kuchiki100% (1)

- Edge Trading Secrets BookDocument80 pagesEdge Trading Secrets BookJorge Simoes100% (4)

- Bdpw3103introductory FinanceDocument12 pagesBdpw3103introductory Financedicky chongNo ratings yet

- Essay On Market EfficiencyDocument2 pagesEssay On Market EfficiencyKimkhorn LongNo ratings yet

- 관광산업 활성화를 위한 펀드조성 및 투자운용방안에 관한 연구Document164 pages관광산업 활성화를 위한 펀드조성 및 투자운용방안에 관한 연구Taekyeong OhNo ratings yet

- Merchant Banking Is A Combination of Banking and Consultancy ServicesDocument3 pagesMerchant Banking Is A Combination of Banking and Consultancy ServicessynayakNo ratings yet

- Share ValuationDocument7 pagesShare ValuationroseNo ratings yet

- BetterSystemTrader UltimateGuideToTradingBooksDocument180 pagesBetterSystemTrader UltimateGuideToTradingBooksSebastianCalle90% (10)

- AFAR8719 - Foreign Currency Transaction and TranslationDocument5 pagesAFAR8719 - Foreign Currency Transaction and TranslationSid TuazonNo ratings yet

- CA Inter Accounts A MTP 1 Nov 2022Document13 pagesCA Inter Accounts A MTP 1 Nov 2022smartshivenduNo ratings yet

- Turtle StrategyDocument31 pagesTurtle StrategyJeniffer Rayen100% (3)

- Module 1 and 2 (January 16, 2023)Document10 pagesModule 1 and 2 (January 16, 2023)The Brain Dump PHNo ratings yet

- NPV Analysis Comparing Investment in Two Machines for Production ProcessDocument19 pagesNPV Analysis Comparing Investment in Two Machines for Production Processdubbs21100% (2)

- 76920bos61942 1Document8 pages76920bos61942 1bhatjanardhan2000No ratings yet

- Solution Manual For Practical Management Science 5th EditionDocument2 pagesSolution Manual For Practical Management Science 5th EditionBeverly Baker100% (29)

- Emerging Markets Derivatives Activity Reduces FX ExposureDocument36 pagesEmerging Markets Derivatives Activity Reduces FX Exposurevan7911No ratings yet

- ASA Valuing Machinery and Equipment 4th Edition 2020-0620 PDFDocument589 pagesASA Valuing Machinery and Equipment 4th Edition 2020-0620 PDFLea Ann Cruz100% (1)

- Investments FINN 353 Quiz 1 KEY: Question # Answer 1 2 3 4 5 6 7 8 9 10Document6 pagesInvestments FINN 353 Quiz 1 KEY: Question # Answer 1 2 3 4 5 6 7 8 9 10Hashaam JavedNo ratings yet

- 10.annual Report FY 2023Document115 pages10.annual Report FY 2023faarehaNo ratings yet

- Chapter 18: Risk Management and DerivativesDocument14 pagesChapter 18: Risk Management and Derivativesarwa_mukadam03No ratings yet

- SAB 107 SEC Share Based PaymentsDocument64 pagesSAB 107 SEC Share Based PaymentsAlycia SkousenNo ratings yet

- Jtiasa 4Q 30 June 2016 ResultsDocument12 pagesJtiasa 4Q 30 June 2016 ResultskimNo ratings yet

- MNC Capital Structure and Cost of CapitalDocument21 pagesMNC Capital Structure and Cost of CapitalPhù Chi NguyênNo ratings yet