Professional Documents

Culture Documents

2018091800024

Uploaded by

Gunjan Shah0 ratings0% found this document useful (0 votes)

306 views3 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

306 views3 pages2018091800024

Uploaded by

Gunjan ShahCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

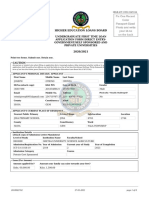

SANCTION LETTER

Sanction Date :25 Sep 2018

Application Reference No:2018091800024

Gunjan Shah & Puspita Shadangi

C 104, Palladio,

Tathawade,

Near Bhumkar Chowk, Chafekar Chowk,

Chinchwad,Maharashtra,

INDIA, 411033

Dear Sir/Madam

With reference to your loan application, we are pleased to inform you that your loan request has been approved in principle by Piramal Capital

& Housing Finance Limited (PCHFL), on the following terms and conditions:

Nature of Facility Home Loan

Purpose of Loan Direct Builder

Amount of Loan Home Loan Upto Rs.72,13,000

Life Insurance Premium Amount

General Insurance Premium Amount Rs.37,015

Interest Rate Type Floating

RPLR 15.50% p.a.

Rate of interest 8.40% p.a.

Rest Frequency Monthly Rest

Term of Loan 300 months

Equated Monthly Installment (EMI) Rs.57,891

Processing Fees Rs.8,511 (Inclusive of GST)

Mode of payment -

1 All Property owners to be on loan structure

2 Case proposed under normal scheme

3 Co-applicant Puspita Work experience of Year 2015-16 is reqd.

4 Dual Sign affidavit of applicant is reqd.

5 Interest Certificate under Section 80 (c) and 24 (b)of Income Tax Act would be issued for HL Loan Amount only

6 Letter from SBI / Document reflecting no Overdues in AL to be documented.

7 LTV on the Proposed collateral to be restricted to 80% of MV.

8 OCR Receipts & Clearance to be documented

9 Official mail confirmation of applicant & co-applicant to be documented

10 Property Insurance to be taken mandatory.

11 Repayment to be via NACH mode from HDFC Bank Salary A/c - 4047.

12 Subject to Positive Legal, Technical and other verification as per the PHFL norms.

If the above terms and conditions and the General Terms and Conditions printed overleaf are acceptable to you, please return the duplicate

copy of this Sanction Letter duly signed by all applicants as a token of your acceptance.

We look forward to disbursing this Loan and request you to complete all the formalities in this regard.

Yours Faithfully,

For Piramal Capital & Housing Finance Limited

Authorised Signatory

Accepted by :

(Gunjan Shah & Puspita Shadangi )

General Terms & Conditions:

1. Loan amount will be subject to valuation of the Property (being offered to PCHFL as a security) as assessed by PCHFL.

2. Repayment of the Loan in EMIs will be from your primary operating/salary account, through the National Automated Clearing House

(NACH) system. You will be required to provide a NACH Mandate Form duly signed by y ou and all the other bank account holders,

authorizing your above bank to debit the above mentioned account with the amount of the EMI.

3. The rate of interest mentioned overleaf, is based on the current prevailing Retail Prime Lending Rate (RPLR) of PCHFL and the same may

vary at the time of disbursement of the Loan or during the subsiste nce of the Loan as specified in the terms of the Loan Agreement.

4. As a result of variations in the Rate of Interest, the amount of the EMI and / or the number of EMIs is liable to vary from time to time.

5. Processing fees are not refundable.

6. The Loan together with interest and other charges shall be secured by:

a. Exclusive first charge of PCHFL on the Property by way of Equitable Mortgage, unless otherwise specified in Special Conditions.

b. Such other security as PCHFL may stipulate.

7. Any disbursement under this Sanction Letter shall be made only after you have fully invested your own contribution.

8. The Loan shall not exceed such percentage of the documented cost or market value of the Property whichever is lower, as prescribed

under the applicable regulatory norms.

9. Disbursement of the Loan is subject to completion of legal and technical due diligence of the Property, compliance of KYC requirements

& execution/submission of necessary documents as required by PCHFL.

10. Loan will be disbursed in lump sum or in suitable instalments, considering the need and progress of construction as determined by

PCHFL.

11. Interest on the amounts partially disbursed (Pre-EMI Interest) will be payable till the Loan is fully disbursed.

12. You shall fully insure the Property against all losses, damages on account of fire, riots and other hazards like earthquake, floods and any

other insurable risk as required by PCHFL for cost of the property and such insurance pol icy obtained by you will be assigned in favour

of PCHFL.You shall submit the insurance policy to PCHFL.

13. This offer is valid for a period of 90 days from the date of this letter and on the expiry of this validity period this sanction shall

automatically stand cancelled with no prior intimation from PCHFL. Restoring the sanction will be at the sole discretion of PCHFL

including but not limited to any new conditions that PCHFL may require and payment of any additional fees for such restoration.

14. You will be required to bear and pay applicable stamp duty, CERSAI charges and all statutory and regulatory charges /taxes/GST, wherever

imposed, levied, collected, withheld or assessed by any government authority, whether on Loan approved herein, transaction

documents,acquisition or provision of Property, or otherwise, pursuant to the applicable laws, during the pendency of the Loan. These

charges are non-refundable in nature and payable at the time of disbursement as and when due.

15. This Sanction Letter is in supersession of any other Sanction Letter that may have been issued by PCHFL for this purpose.

16. Kindly make payment of the balance processing fees as indicated overleaf through a cheque marked "Account Payee only" drawn on and

payable at any bank in India in the name of "Piramal Capital & Housing Finance Limited" (If already paid, please ignore)

This sanction shall stand cancelled and revoked if:

i. There is any material change in the opinion of PCHFL on the basis of which the Loan had in principle, been sanctioned.

ii. Any material facts regarding your income, employment, or ability to repay, or any other relevant aspect of your application for the Loan is

suppressed, concealed misrepresented or not made known to us.

iii. Any statement made in the loan application or otherwise is found to be misleading, untrue or incorrect.

You might also like

- Certificate of Registration-Form 23Document1 pageCertificate of Registration-Form 23Joy GudivadaNo ratings yet

- Leave and License Agreement: Particulars Amount Paid GRN/Transaction Id DateDocument6 pagesLeave and License Agreement: Particulars Amount Paid GRN/Transaction Id DateAnonymous eCmTYonQ84No ratings yet

- E Sign DocDocument26 pagesE Sign DocShaik ShabanaNo ratings yet

- Bajaj Finserv Loan ApprovalDocument2 pagesBajaj Finserv Loan Approvalprsnjt11No ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeJerry LamaNo ratings yet

- ULIP Pension PlansDocument5 pagesULIP Pension PlanskammapurathanNo ratings yet

- Lony3004 00000037809338867 HDocument1 pageLony3004 00000037809338867 HlimcysebastinNo ratings yet

- Policy Doc PDFDocument4 pagesPolicy Doc PDFGajen SinghNo ratings yet

- Tax Certificate - of Anjali Lalwani PDFDocument2 pagesTax Certificate - of Anjali Lalwani PDFBasant GakhrejaNo ratings yet

- 1865362Document1 page1865362Bhavesh ParekhNo ratings yet

- Loan Details: TWO - Wheeler Sandhya Automotives, KURNOOLDocument1 pageLoan Details: TWO - Wheeler Sandhya Automotives, KURNOOLmohammed rafiNo ratings yet

- Maha Super Housing LoanDocument4 pagesMaha Super Housing Loansakshishree09No ratings yet

- Declaration 80EEDocument1 pageDeclaration 80EERanga.SathyaNo ratings yet

- Registration Certificate of Vehicle: Issuing Authority: Madhubani, BiharDocument1 pageRegistration Certificate of Vehicle: Issuing Authority: Madhubani, Bihartabrez alamNo ratings yet

- Self - 16sep22 - ELSS StatementDocument1 pageSelf - 16sep22 - ELSS Statementaju3167No ratings yet

- 1563614521775Document1 page1563614521775JatinderPalNo ratings yet

- AEGON RELIGARE Premium Payment Receipt PDFDocument1 pageAEGON RELIGARE Premium Payment Receipt PDFe2arvindNo ratings yet

- PrmPayRcptSign PR0445228800021011Document1 pagePrmPayRcptSign PR0445228800021011dipakpd100% (1)

- Branch Code 05999 Home Loan Interest CertificateDocument1 pageBranch Code 05999 Home Loan Interest CertificateKRIS BARSAGADE100% (1)

- Loan Documentation PDFDocument16 pagesLoan Documentation PDFMuhammad Akmal HossainNo ratings yet

- Star HealthDocument1 pageStar HealthpalanivelNo ratings yet

- Dengue Ns1 Antigen Test (Elisa/Elfa) - 600.00 0.00: DuplicateDocument1 pageDengue Ns1 Antigen Test (Elisa/Elfa) - 600.00 0.00: DuplicateAbhishek GoelNo ratings yet

- Bill For BusDocument2 pagesBill For BusAjay J RaoNo ratings yet

- Premium Paid AcknowledgementDocument1 pagePremium Paid AcknowledgementArpit SinghalNo ratings yet

- Tax Certificate - 008927742 - 131310Document2 pagesTax Certificate - 008927742 - 131310Vignesh MahadevanNo ratings yet

- Higher Education Loans BoardDocument8 pagesHigher Education Loans BoardDON ONNYANGONo ratings yet

- 4 PDFDocument4 pages4 PDFsatish sharmaNo ratings yet

- Premium Paid Certificate: Date: 14-DEC-2017Document1 pagePremium Paid Certificate: Date: 14-DEC-2017zuhebNo ratings yet

- Sanction LetterDocument3 pagesSanction Lettern5b859ryf6No ratings yet

- ICICI Health InsuranceDocument1 pageICICI Health Insurancecanjiatp76260% (1)

- Reg No: Dl8Cav0116: Registration Certificate For VehicleDocument1 pageReg No: Dl8Cav0116: Registration Certificate For Vehicleh4ckerNo ratings yet

- Policy DetailDocument1 pagePolicy DetailJeyavel NagarajanNo ratings yet

- MR Parmar Krishnarajsinh 554/1, Satyam Society, Sector-22, Gandhinagar, GANDHINAGAR-382021Document1 pageMR Parmar Krishnarajsinh 554/1, Satyam Society, Sector-22, Gandhinagar, GANDHINAGAR-382021parmarkrishnarajsinh100% (1)

- LIC Sikha PDFDocument1 pageLIC Sikha PDFsikha singh100% (1)

- Declaration For Housing LoanDocument2 pagesDeclaration For Housing LoanjasNo ratings yet

- Renewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaDocument1 pageRenewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaYT ENTERTAINMENTNo ratings yet

- Gym FeesDocument1 pageGym FeesMrityunjay AryanNo ratings yet

- 80D SelfDocument1 page80D Selfnikhil nadakuditiNo ratings yet

- Duplicate: 1 of Page No: File No: / 1 / 2Document2 pagesDuplicate: 1 of Page No: File No: / 1 / 2Anand AdkarNo ratings yet

- MedicalimDocument1 pageMedicalimsaurabhNo ratings yet

- Sanction Letter SpecimenDocument25 pagesSanction Letter SpecimenJoyson JoyNo ratings yet

- Pvss Dav Public School: ReceiptDocument1 pagePvss Dav Public School: ReceiptSanjeevNo ratings yet

- Provisional Certificate 2018-2019Document1 pageProvisional Certificate 2018-2019RohanNo ratings yet

- SBI FormDocument16 pagesSBI Formapi-373588783% (6)

- Welcome LetterDocument4 pagesWelcome LetterChetan ChoudharyNo ratings yet

- D JavaApps EMAIL-SERVERv1 (1) .1 Temp 111116095854219Document2 pagesD JavaApps EMAIL-SERVERv1 (1) .1 Temp 111116095854219amardeepjassal85No ratings yet

- Acknowledgement Slip: Fixed DepositDocument1 pageAcknowledgement Slip: Fixed DepositAneesh BangiaNo ratings yet

- Interest Certificate Nov06 205111Document1 pageInterest Certificate Nov06 205111Sambasivarao ChindamNo ratings yet

- New - Life Insurance Corporation of India - Sowmya - 2023Document1 pageNew - Life Insurance Corporation of India - Sowmya - 2023boddu sowmyaNo ratings yet

- Max Bupa Premium Reeipt ParentDocument1 pageMax Bupa Premium Reeipt ParentsanojcenaNo ratings yet

- Name Policy Number Plan Policy Term Premium Paying Term Commencement Date Instalment Premium Mode of Premium Payment Reference CodeDocument1 pageName Policy Number Plan Policy Term Premium Paying Term Commencement Date Instalment Premium Mode of Premium Payment Reference CodeVikrant BhaleraoNo ratings yet

- PNB - Oriental Royal MEDICLAIM ProspectusDocument10 pagesPNB - Oriental Royal MEDICLAIM ProspectusKkaran SinghNo ratings yet

- Gade Sanction LetterDocument1 pageGade Sanction LetterSwapnil Gade007No ratings yet

- Interest Certificate: Shivam Garg and Ramkrishna GargDocument1 pageInterest Certificate: Shivam Garg and Ramkrishna GargShivamNo ratings yet

- PremiumRept MDS - RameshDocument2 pagesPremiumRept MDS - Rameshnavengg521No ratings yet

- Consolidated Premium Paid STMT 2020-2021 PDFDocument1 pageConsolidated Premium Paid STMT 2020-2021 PDFSHITESH KUMARNo ratings yet

- Loan AgreementDocument20 pagesLoan AgreementRANJIT BISWAL (Ranjit)No ratings yet

- WELCOME LETTER FOR TWO WHEELER LOANDocument3 pagesWELCOME LETTER FOR TWO WHEELER LOANDeepak DevasiNo ratings yet

- Loan Sanction_LetterDocument2 pagesLoan Sanction_LetterDaMoN0% (1)

- Sanction Letter V2Document3 pagesSanction Letter V2SRINIVASREDDY PIRAMALNo ratings yet

- List of grocery and household itemsDocument2 pagesList of grocery and household itemsGunjan ShahNo ratings yet

- Conference Brouchre PDFDocument6 pagesConference Brouchre PDFGunjan ShahNo ratings yet

- Comm - Cir - 311 Tariff From 01092018Document87 pagesComm - Cir - 311 Tariff From 01092018Amber HudsonNo ratings yet

- Austin Park CO-OP Housing Society Ltd.532 PDFDocument3 pagesAustin Park CO-OP Housing Society Ltd.532 PDFGunjan ShahNo ratings yet

- Ashwini Kumar Builder Details - 1 - Ashwini Kumar Builder Details PDFDocument1 pageAshwini Kumar Builder Details - 1 - Ashwini Kumar Builder Details PDFGunjan ShahNo ratings yet

- Commercial Circular For MYT Order-3Document75 pagesCommercial Circular For MYT Order-3sdn1325 sdo1325No ratings yet

- Containmment Zone निरस्त आदेश दि.३०.५.२०२०Document2 pagesContainmment Zone निरस्त आदेश दि.३०.५.२०२०Gunjan ShahNo ratings yet

- Online foreign language courses for childrenDocument6 pagesOnline foreign language courses for childrenGunjan ShahNo ratings yet

- Receipt 172040002842 24-Mar-20 1063654168 PDFDocument1 pageReceipt 172040002842 24-Mar-20 1063654168 PDFGunjan ShahNo ratings yet

- Receipt 172040002842 24-Mar-20 1063654168 PDFDocument1 pageReceipt 172040002842 24-Mar-20 1063654168 PDFGunjan ShahNo ratings yet

- Basket Letter PDFDocument1 pageBasket Letter PDFGunjan ShahNo ratings yet

- Receipt 172040002842 26-Jul-20 SHDF9040250046 PDFDocument1 pageReceipt 172040002842 26-Jul-20 SHDF9040250046 PDFGunjan ShahNo ratings yet

- Receipt 172040002842 20-Dec-19 9939487516 PDFDocument1 pageReceipt 172040002842 20-Dec-19 9939487516 PDFGunjan ShahNo ratings yet

- Receipt 172040002842 09-Jun-19 BBPSHD0118972309 PDFDocument1 pageReceipt 172040002842 09-Jun-19 BBPSHD0118972309 PDFGunjan ShahNo ratings yet

- Receipt 172040002842 28-Jan-20 1009542577Document1 pageReceipt 172040002842 28-Jan-20 1009542577Gunjan ShahNo ratings yet

- Confiion - Workbook - EC - Employee - Data - ECM - v4Document67 pagesConfiion - Workbook - EC - Employee - Data - ECM - v4Gunjan ShahNo ratings yet

- Receipt 172040002842 26-Jul-20 SHDF9040250046 PDFDocument1 pageReceipt 172040002842 26-Jul-20 SHDF9040250046 PDFGunjan ShahNo ratings yet

- MSEDCL receipt for online bill payment of Rs. 2300Document1 pageMSEDCL receipt for online bill payment of Rs. 2300Gunjan ShahNo ratings yet

- IDP - Employee Central Payroll Migrating From ERP HCM Payroll To Employee Central Payroll V1.2 PDFDocument21 pagesIDP - Employee Central Payroll Migrating From ERP HCM Payroll To Employee Central Payroll V1.2 PDFGunjan Shah100% (1)

- Receipt 172040002842 09-Jun-19 BBPSHD0118972309 PDFDocument1 pageReceipt 172040002842 09-Jun-19 BBPSHD0118972309 PDFGunjan ShahNo ratings yet

- MSEDCL receipt for energy bill paymentDocument1 pageMSEDCL receipt for energy bill paymentGunjan ShahNo ratings yet

- Fac Dec 19 Circular 1 PDFDocument2 pagesFac Dec 19 Circular 1 PDFGunjan ShahNo ratings yet

- IDP - Employee Central Core Hybrid - Employee Identifiers V1.4 PDFDocument20 pagesIDP - Employee Central Core Hybrid - Employee Identifiers V1.4 PDFGunjan Shah100% (1)

- IDP - Employee Central Payroll Migrating From ERP HCM Payroll To Employee Central Payroll V1.2 PDFDocument21 pagesIDP - Employee Central Payroll Migrating From ERP HCM Payroll To Employee Central Payroll V1.2 PDFGunjan Shah100% (1)

- Sap HR Blueprint SampleDocument10 pagesSap HR Blueprint SampleRamar Boopathi SNo ratings yet

- IDP - Employee Central Core Hybrid Migrating Contigent Workforce V1.3Document13 pagesIDP - Employee Central Core Hybrid Migrating Contigent Workforce V1.3Gunjan ShahNo ratings yet

- IDP Employee Central Implementation Considerations For A Phased Rollout V1.2 PDFDocument31 pagesIDP Employee Central Implementation Considerations For A Phased Rollout V1.2 PDFGunjan ShahNo ratings yet

- Confiion - Workbook - EC - Employee - Data - ECM - v4Document67 pagesConfiion - Workbook - EC - Employee - Data - ECM - v4Gunjan ShahNo ratings yet

- 2BHK Contract Estimate Template Version 1.1Document12 pages2BHK Contract Estimate Template Version 1.1himmatchavanNo ratings yet

- Payment Report for Aug 2020Document1 pagePayment Report for Aug 2020Gunjan ShahNo ratings yet

- Assignment ON NEGOTIABLE INSTRUMENTS ACTDocument12 pagesAssignment ON NEGOTIABLE INSTRUMENTS ACTFarha RahmanNo ratings yet

- 109 Ocejo Perez & Co. V International BankDocument4 pages109 Ocejo Perez & Co. V International Bankav783100% (1)

- Payment Instruction Form (Pif) : Davao CentralDocument1 pagePayment Instruction Form (Pif) : Davao Centralhue sageNo ratings yet

- OOSAD Final ProjectDocument28 pagesOOSAD Final ProjectSudipendra Pal90% (10)

- Purchase and Sale ContractDocument2 pagesPurchase and Sale Contractjacq hungNo ratings yet

- Application Form for Payment InstructionDocument1 pageApplication Form for Payment Instructionmtuanlatoi9704No ratings yet

- SC rules Atrium not a holder in due course but can still recover on crossed checksDocument2 pagesSC rules Atrium not a holder in due course but can still recover on crossed checkslarcia025No ratings yet

- Signed Copy Escrow Agreement Escrow International Services UgDocument15 pagesSigned Copy Escrow Agreement Escrow International Services UgKiki Saja100% (2)

- National Law University Odisha, Cuttack Apollo Pharmacy Accounting PrinciplesDocument55 pagesNational Law University Odisha, Cuttack Apollo Pharmacy Accounting PrinciplesAbhijeet SahooNo ratings yet

- Mba Project Report On Central BankDocument74 pagesMba Project Report On Central BankDeepak Mangal40% (5)

- HPD - 0502 - Mills EscrowDocument16 pagesHPD - 0502 - Mills EscrowUlisesNo ratings yet

- Sipoc-For Accounts DepartmentDocument3 pagesSipoc-For Accounts DepartmentSanjay .. SanjuNo ratings yet

- Í K T (È Petilla Emsonââââââââ M Ç14 (84xî Mr. Emson Macayanan PetillaDocument3 pagesÍ K T (È Petilla Emsonââââââââ M Ç14 (84xî Mr. Emson Macayanan PetillaJhade Ann CayanesNo ratings yet

- Money and Banking TerminologyDocument3 pagesMoney and Banking TerminologythamiztNo ratings yet

- BNPL Model PDFDocument19 pagesBNPL Model PDFSunnyNo ratings yet

- Communities Cagayan, Inc. v. Spouses NanolDocument19 pagesCommunities Cagayan, Inc. v. Spouses NanolGfor FirefoxonlyNo ratings yet

- Lodha Park-2Document50 pagesLodha Park-2Rohan BagadiyaNo ratings yet

- Creating Users and Defining ResponsibilitiesDocument46 pagesCreating Users and Defining ResponsibilitiesmaddiboinaNo ratings yet

- Law Case Study: G.R. No. 149756Document2 pagesLaw Case Study: G.R. No. 149756NathNo ratings yet

- CISM 4000 Sample Exam SuggestionsDocument1 pageCISM 4000 Sample Exam SuggestionsTony Nguyen0% (1)

- 01 AbgDocument3 pages01 AbgManish CarpenterNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument28 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit Balancesv netNo ratings yet

- Session 18Document32 pagesSession 18Sayantan 'Ace' DasNo ratings yet

- 2017 ICB Exam Entry FormDocument1 page2017 ICB Exam Entry FormBrilliantNo ratings yet

- For OIC LP CellDocument16 pagesFor OIC LP CellAshish AgarwalNo ratings yet

- Secure Acceptance SOPDocument121 pagesSecure Acceptance SOPBharathi AppachiappanNo ratings yet

- HSBC Advance Tariff ScheduleDocument5 pagesHSBC Advance Tariff Scheduleshine1975No ratings yet

- Statement 2020 04 10Document6 pagesStatement 2020 04 10BrendaNo ratings yet

- 48 PY WP I-1 Notes PayableDocument1 page48 PY WP I-1 Notes PayableMuhammad FarhanNo ratings yet

- Chapter 2 - Taxes, Tax Laws, and Tax AdministrationDocument7 pagesChapter 2 - Taxes, Tax Laws, and Tax Administrationreymardico100% (2)