Professional Documents

Culture Documents

Carter V Deutsche Bank Foreclosure TRUSTEE

Uploaded by

choyen20008019Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Carter V Deutsche Bank Foreclosure TRUSTEE

Uploaded by

choyen20008019Copyright:

Available Formats

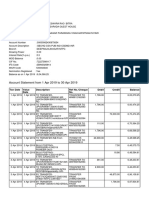

Carter v. Deutsche Bank National Trust Co.

, Slip Copy (2010)

(1) “debt collectors” that (2) violate the statute. Plaintiffs

2010 WL 1875718

allege that Republic is a “debt collector” and that its “principal

Only the Westlaw citation is currently available.

business” is to “collect debts which are secured by deeds of

United States District Court,

trust on real estate in California.” Compl. ¶ 24. Specific to this

N.D. California.

case, “Old Republic was hired after this [plaintiffs'] default

for the specific purpose of collecting on the obligation.” Id.

Demonfort R. CARTER and Republic disputes that it is a debt collector but, once again,

Leandra L. Carter, Plaintiff(s), such a factual dispute cannot be resolved on a motion to

v. dismiss.

Republic does not dispute that plaintiffs have adequately

DEUTSCHE BANK NATIONAL TRUST alleged a violation of the Act and instead argues that the

COMPANY, as Trustee, et al., Defendant(s). FDCPA can never apply to foreclosure trustees. Republic

relies on cases such as Scott v. Wells Fargo Home Mortgage,

No. C09-3033 BZ. May 7, 2010. Inc., 326 F.2d 709, 718 (E.D.V 2003), which hold that

someone who acquires the right to foreclose on property

Attorneys and Law Firms before default does not thereafter act as a debt collector

when foreclosing. See 15 U.S.C. § 1692a(4). Here however

Glenn Lee Moss, Marcia Ann Murphy, Moss & Murphy, plaintiff has specifically alleged the “Republic was hired

Hayward, CA, for Plaintiff(s). after this default for the specific purpose of collecting on the

obligation.” (¶ 24).

Christina Danielle Rovira, T. Robert Finlay, Wright Finlay

& Zak, LLP, Newport Beach, CA, Michael James Fox, Pite The bright line rule Republic asserts does not exist. There is

Duncan, LLP, Santa Ana, CA, for Defendant(s). no controlling Ninth Circuit authority on this issue. However,

some district courts in this Circuit, and courts in other circuits

Opinion have held that a foreclosure trustee may be sued under the Act.

See e.g., Wilson v. Draper & Goldberg PLLC, 443 F.3d 373

(4th Cir.2006); Kaltenback v. Richards, 464 F.3d 524, 528-29

ORDER GRANTING IN PART AND DENYING (5th Cir.2006). For example, in Allen v. United Financial

IN PART REPUBLIC'S MOTION TO DISMISS Mortgage Corp., the court held that a plaintiff adequately

stated a debt collection claim against a foreclosure trustee.

BERNARD ZIMMERMAN, United States Magistrate Judge. 2010 WL 1135787 (N.D.Cal.2010); but see Hulse v. Ocwen

Fed. Bank, FSB, 195 F.Supp 2d 1188 (D.Or.2002) (holding

*1 Before the Court is defendant Old Republic Default that foreclosure is not debt collection under the FDCPA).

Management Services' (“Republic”) motion to dismiss four

claims from plaintiffs' second amended complaint. The *2 Inasmuch as the complaint will proceed toward trial, this

parties are well aware of the factual background of this claim will not be dismissed. It will not greatly add to the

litigation. See Doc. No. 49. Plaintiffs, whose home was sold burden of litigating this case and the Ninth Circuit may yet

at a foreclosure sale, allege that defendants Deutsche Bank rule on whether the Act applies to foreclosure trustees.

and Old Republic wrongfully foreclosed on their property in

violation of several statutes. WRONGFUL TRUSTEE SALE

RESPA The Court has already ruled on many of the arguments raised

against this cause of action by Order dated January 27,

Republic argues that it cannot be held liable under RESPA 2010. Doc. No. 49. As to the remaining arguments, Republic

because it is a foreclosure trustee, not a loan servicer.1 misunderstands plaintiffs' claim. Plaintiffs have not alleged

However, the complaint alleges that “Deutsche Bank was a procedural irregularity with the foreclosure sale; rather,

servicing the loan and transferred at least some of these plaintiffs alleged that Republic (1) demanded excessive,

servicing obligations to Old Republic.2” Compl. ¶ 21. unwarranted amounts in the notice of default, (2) did not have

Republic has provided no authority which states that a the legal right to conduct the sale, and (3) did so collusively

foreclosure trustee cannot also be a loan servicer under and fraudulently. As discussed at a hearing on December 2,

RESPA. Plaintiffs' factual allegations are presumed true for 2009 that Republic declined to attend, the Court is unaware

this motion to dismiss and Republic has given no reason, by of any requirement, and Republic has cited to none, that

a plaintiff must tender if the complaint alleges fraud or a

judicial notice3 or otherwise, why it cannot be held liable substantive irregularity. While a tender may be required when

under RESPA as a matter of law. See Ashcraft v. Iqbal, --- a plaintiff alleges a procedural irregularity, that is not the

U.S. ----, ----, 129 S.Ct. 1937, 1949, 173 L.Ed.2d 868 (2009). theory that plaintiffs advance in their complaint.

FDCPA SECTION 17200

Republic next argues that the Fair Debt Collections Practices Republic's motion to dismiss plaintiffs' Section 17200 claims

Act (“the Act”) claim should be dismissed because the Act is GRANTED as unopposed.

does not apply to foreclosure trustees. The Act applies to

© 2010 Thomson Reuters. No claim to original U.S. Government Works. 1

Carter v. Deutsche Bank National Trust Co., Slip Copy (2010)

motion to dismiss the remaining causes of action is DENIED.

CONCLUSION

Republic SHALL file an answer by MAY 19, 2010.

IT IS ORDERED that Republic's motion to dismiss

plaintiffs' SIXTH cause of action is GRANTED. Republic's

Footnotes

1 “The term ‘servicer’ means the person responsible for servicing of a loan .... The term ‘servicing’ means receiving any scheduled

periodic payments from a borrower pursuant to the terms of any loan, including amounts for escrow accounts described in section

2609 of this title, and making the payments of principal and interest and such other payments with respect to the amounts received

from the borrower as may be required pursuant to the terms of the loan.” 12 U.S.C.A. § 2605(i)(2), (3).

2 Republic's allegations that plaintiffs are “fabricating its status as a sub servicer” are better addressed on a motion for summary judgment.

Many of Republic's arguments are factual in nature, which render them unsuitable for disposition on a motion to dismiss.

3 The Court takes judicial notice of the exhibits submitted by Republic. However, plaintiffs are correct in asserting that if the truth of

the contents of the documents is in dispute, then the Court should not presume their truth, especially documents to which plaintiffs

are not parties, such as Exhibit C.

End of Document © 2010 Thomson Reuters. No claim to original U.S. Government Works.

© 2010 Thomson Reuters. No claim to original U.S. Government Works. 2

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Project Preparation and Appraisal of Hotel ResortDocument81 pagesProject Preparation and Appraisal of Hotel ResortJatin RamaniNo ratings yet

- In Gold We Trust 2016-Extended VersionDocument144 pagesIn Gold We Trust 2016-Extended VersionZerohedgeNo ratings yet

- QA SIPACKS in Business Finance Q3 W1 7Document91 pagesQA SIPACKS in Business Finance Q3 W1 7Roan DiracoNo ratings yet

- Products and Services of Meezan BankDocument15 pagesProducts and Services of Meezan Bankkakakus100% (1)

- SWOT of BFSIDocument3 pagesSWOT of BFSIsumit athwani100% (1)

- Second Draft of Rhetorical Analysis EssayDocument4 pagesSecond Draft of Rhetorical Analysis Essayapi-383880833No ratings yet

- California Passes Significant Protections Against Illegal Foreclosure ProcessesDocument3 pagesCalifornia Passes Significant Protections Against Illegal Foreclosure Processeschoyen20008019No ratings yet

- Aclu Foia No 1Document60 pagesAclu Foia No 1choyen20008019No ratings yet

- Brian Davies Debtor's ObjectionsToLiftOfStay Wins Twice Against OneWestDocument10 pagesBrian Davies Debtor's ObjectionsToLiftOfStay Wins Twice Against OneWesttraderash1020No ratings yet

- RestDocument12 pagesRestchoyen20008019No ratings yet

- LS ManualDocument62 pagesLS Manualchoyen20008019No ratings yet

- 15624702052231UoGssBO9TQOUnD5 PDFDocument5 pages15624702052231UoGssBO9TQOUnD5 PDFvenkateshbitraNo ratings yet

- What Is Roshan Digital AccountDocument1 pageWhat Is Roshan Digital AccountShah Jee0% (1)

- 2017 - KPMG - Pesquisa Sobe o Sector BancarioDocument29 pages2017 - KPMG - Pesquisa Sobe o Sector BancariohernanimacamitoNo ratings yet

- UCT Handbook 12 2019 StudentFees PDFDocument132 pagesUCT Handbook 12 2019 StudentFees PDFNjabulo DlaminiNo ratings yet

- Dir DepDocument1 pageDir Depfazlah8106No ratings yet

- Formats & Procedures for STP/EHTP UnitsDocument16 pagesFormats & Procedures for STP/EHTP Unitsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Banccassurance Project For Banking & InsuranceDocument32 pagesBanccassurance Project For Banking & Insuranceramprabu88No ratings yet

- S T NS T N: District & Sessions Court Karachi SouthDocument3 pagesS T NS T N: District & Sessions Court Karachi SouthIndulgent EagleNo ratings yet

- Indian Overseas Bank PO 2009 Solved Question PaperDocument8 pagesIndian Overseas Bank PO 2009 Solved Question Paperkapeed_supNo ratings yet

- Abhishek Kumar Department of Management Studies Kumaun University, NainitalDocument69 pagesAbhishek Kumar Department of Management Studies Kumaun University, NainitalAarav AroraNo ratings yet

- HSBC BankDocument40 pagesHSBC BankPrasanjeet PoddarNo ratings yet

- Issue of Shares at DiscountDocument2 pagesIssue of Shares at DiscountOberoi MalhOtra MeenakshiNo ratings yet

- 2005 11 03 - DR3Document1 page2005 11 03 - DR3Zach EdwardsNo ratings yet

- pdfGenerateNewCustomer SAOAO1020618564Reciept SAOAO1020618564ResidentAccountOpenFormDocument11 pagespdfGenerateNewCustomer SAOAO1020618564Reciept SAOAO1020618564ResidentAccountOpenFormpavan reddyNo ratings yet

- Syllabus in Commercial ReviewDocument17 pagesSyllabus in Commercial ReviewMarielle GarboNo ratings yet

- Problem SolvingDocument4 pagesProblem SolvingsunflowerNo ratings yet

- Journal or Day BookDocument42 pagesJournal or Day BookRaviSankar100% (1)

- 201244WAR1Document716 pages201244WAR1Sam MaurerNo ratings yet

- Loans and Deposits ExplainedDocument8 pagesLoans and Deposits ExplainedVsgg NniaNo ratings yet

- Forward Rate CalculationDocument128 pagesForward Rate CalculationalexNo ratings yet

- Ecf 320 - Money, Banking and Financial MarketsDocument22 pagesEcf 320 - Money, Banking and Financial MarketsFredrich KztizNo ratings yet

- Apply for TAN number onlineDocument1 pageApply for TAN number onlineNIKUL DARJINo ratings yet

- Money MarketDocument17 pagesMoney MarketAbid faisal AhmedNo ratings yet

- PDM YumbeDocument18 pagesPDM YumbeAkimu sijaliNo ratings yet