Professional Documents

Culture Documents

NBP Financial Sector Income Fund (Nfsif)

Uploaded by

HIRA -Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NBP Financial Sector Income Fund (Nfsif)

Uploaded by

HIRA -Copyright:

Available Formats

NBP FINANCIAL SECTOR INCOME FUND (NFSIF)

(FORMERLY: NAFA FINANCIAL SECTOR INCOME FUND)

MONTHLY REPORT (MUFAP's Recommended Format) April 2020

Unit Price (30/04/2020): Rs.11.7349

Performance %

Since Launch

FYTD - Rolling 12 FY - FY - FY - FY - FY - Last 3 Last 5

Performance Period Apr-2020 October 28,

2020 Months 2019 2018 2017 2016 2015 Years* Years*

2011*

NBP FINANCIAL SECTOR INCOME

FUND (FORMERLY: NAFA FINANCIAL 15.8% 13.9% 13.7% 9.3% 6.0% 8.4% 6.4% 10.9% 9.3% 8.6% 9.2%

SECTOR INCOME FUND)

BENCHMARK 9.4% 13.1% 13.0% 10.2% 6.3% 6.0% 5.9% 8.3% 9.5% 8.1% 8.6%

* Annualized Return Based on Morning Star Methodology. All other returns are Annualized Simple Return.

The performance reported is net of management fee & all other expenses and based on dividend reinvestment gross of with-holding tax where applicable.

General Information Investment Objective

Launch Date: October 28, 2011 To provide income enhancement and preservation of capital by investing in prime

Fund Size: Rs. 11,106 million quality Financial Sector TFCs/Sukuks, Bank deposits and short-term money market

Type: Open-end - Income Fund instruments.

Dealing Days: Daily – Monday to Saturday Fund Manager Commentary

Dealing Time: (Mon - Thr) 9:00 A.M to 5:00 P.M The Fund generated an annualized return of 15.8% p.a. in the month of April 2020

(Friday) 9:00 A.M to 5:30 P.M versus the Benchmark return of 9.4% p.a. Since its launch in October 2011, the Fund

(Saturday) 9:00 A.M to 1:00 P.M has generated an annualized return of 9.2% p.a. against the Benchmark return of 8.6%

Settlement: 2-3 business days p.a., hence an out-performance of 0.6% p.a. This out-performance is net of

Pricing Mechanism: Forward Pricing management fee and all other expenses.

Load: Front End Load (Individual without life insurance):

1% (Nil on investment above Rs. 26 million) Front The Fund is unique as it invests a minimum 70% of its assets in Financial Sector

End Load (Individual with life insurance): Amount (mainly banks) debt securities, instruments or deposits. Minimum entity rating of

upto Rs.5 million: 3%, Amount over and above issuers of debt securities is "AA-". This minimizes credit risk and at the same time

Rs.5 million: 1% Front End Load (Other): 1% (Nil enhances liquidity of the Fund. Duration of the overall portfolio cannot be more than

on investment above Rs. 16 million) one year. This minimizes interest rate or pricing risk.

Back End Load: NIL

Exposure in TFCs/Sukuks was around 25% of net assets at the end of the month with

Management Fee: 6% of Net Income (min: 0.5% p.a., max: 1.5% p.a.) average time to maturity of around 3.4 years. The TFC portfolio of the Fund is

w.e.f 12-July-19. 0.89% p.a. of average net assets predominantly floating rate linked to KIBOR. The weighted average time-to-maturity of

during the month the Fund is 1 year.

Total Expense Ratio: 2.18% p.a (including 0.41% government levies)

We will rebalance the allocation of the Fund proactively based on the capital market

Selling & Marketing Expenses: 0.7% per annum outlook.

Risk Profile: Low

Fund Stability Rating: ‘A+(f)’ by PACRA

Listing: Pakistan Stock Exchange Credit Quality of the Portfolio as of April 30 , 2020 (% of Total Assets)

Custodian & Trustee: Central Depository Company (CDC) Government Securities (AAA rated) 13.0%

Auditors: KPMG Taseer Hadi & Co, Chartered Accountants

AAA 2.2%

Benchmark: 6-Month KIBOR AA+ 19.6%

Fund Manager: Muhammad Ali Bhabha, CFA, FRM AA 3.6%

Minimum: Growth Unit: Rs. 10,000/- AA- 1.9%

Subscription: Income Unit: Rs. 100,000/- A+ 29.6%

Asset Manager Rating: AM1 by PACRA (Very High Quality) A 11.5%

Asset Allocation (% of Total Assets) 30-Apr-20 31-Mar-20 A- 15.1%

TFCs / Sukuk 24.3% 25.3% Un-rated 0.1%

PIBs 2.1% 2.1% Others including Receivables 3.4%

T-Bills 10.9% 9.6% Total 100.0%

Bank Deposits 59.3% 60.8%

Others including Receivables 3.4% 2.2%

Total 100.0% 100.0%

Leverage Nil Nil Name of the Members of Investment Committee

Dr. Amjad Waheed, CFA

Sajjad Anwar, CFA

Top TFC (as at April 30 , 2020) (% of Total Assets) Muhammad Ali Bhabha, CFA, FRM

HUBCO Suk-2 Rev 22-AUG-19 22-AUG-23 7.4%

Hassan Raza, CFA

KE Sukuk (Pre-IPO) 27-DEC-19 27-DEC-26 4.4%

Hub Power Company Limited 19-MAR-20 19-MAR-24 2.2%

Askari Commercial Bank Limited 17-MAR-20 17-MAR-30 2.1%

HBL TFC 19-FEB-16 19-FEB-26 1.8%

Jahangir Siddiqui and Company Ltd. 06-MAR-18 06-MAR-23 1.4%

BANK ALFALAH LTD - V - REVISED 20-FEB-13 20-FEB-21 1.4%

JS Bank Limited 14-DEC-16 14-DEC-23 1.0%

JS Bank Limited 29-DEC-17 29-DEC-24 0.9%

Jahangir Siddiqui and Company Ltd. 18-JUL-17 18-JUL-22 0.8%

Sindh Workers' Welfare Fund (SWWF)

The scheme has maintained provisions against Sindh Workers' Welfare Fund's liability

to the tune of Rs. 29,229,475/-. If the same were not made the NAV per unit/last one

year return of scheme would be higher by Rs. 0.0309/0.3%. For details investors are

advised to read note 12.1 of the latest financial statements of the Scheme.

Notes: 1) The calculation of performance does not include cost of front end load.

2) Taxes apply. Further, tax credit also available as per section 62 of the Income Tax Ordinance, 2001.

Disclaimer: This publication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell any fund. All investments in mutual funds are subject to market risks. Past performance is

not necessarily indicative of future results. Please read the offering Document to understand investment policies and the risks involved.

Page 09

You might also like

- NBP Riba Free Savings Fund (NRFSF)Document1 pageNBP Riba Free Savings Fund (NRFSF)HIRA -No ratings yet

- NBP Savings Fund (NBP-SF) : MONTHLY REPORT (MUFAP's Recommended Format) April 2020 Unit Price (30/04/2020) : Rs.10.7997Document1 pageNBP Savings Fund (NBP-SF) : MONTHLY REPORT (MUFAP's Recommended Format) April 2020 Unit Price (30/04/2020) : Rs.10.7997HIRA -No ratings yet

- NBP Mahana Amdani Fund (Nmaf) : MONTHLY REPORT (MUFAP's Recommended Format) July 2020 Unit Price (31/07/2020) : Rs.10.2426Document1 pageNBP Mahana Amdani Fund (Nmaf) : MONTHLY REPORT (MUFAP's Recommended Format) July 2020 Unit Price (31/07/2020) : Rs.10.2426Kiran SheikhNo ratings yet

- NBP Sarmaya Izafa Fund (Nsif) : MONTHLY REPORT (MUFAP's Recommended Format) April 2020 Unit Price (30/04/2020) : Rs.15.6356Document1 pageNBP Sarmaya Izafa Fund (Nsif) : MONTHLY REPORT (MUFAP's Recommended Format) April 2020 Unit Price (30/04/2020) : Rs.15.6356HIRA -No ratings yet

- NBP Income Opportunity Fund (Niof)Document1 pageNBP Income Opportunity Fund (Niof)HIRA -No ratings yet

- NBP Balanced Fund monthly report April 2020Document1 pageNBP Balanced Fund monthly report April 2020HIRA -No ratings yet

- NIOF-Dec 2020Document1 pageNIOF-Dec 2020chqaiserNo ratings yet

- NBP Islamic Mahana Amdani Fund (Nimaf)Document1 pageNBP Islamic Mahana Amdani Fund (Nimaf)Afnan TariqNo ratings yet

- NBP Government Securities Savings Fund (NGSSF)Document1 pageNBP Government Securities Savings Fund (NGSSF)HIRA -No ratings yet

- NBP Savings Fund (NBP-SF) : MONTHLY REPORT (MUFAP's Recommended Format) February 2020 Unit Price (29/02/2020) : Rs.10.6043Document1 pageNBP Savings Fund (NBP-SF) : MONTHLY REPORT (MUFAP's Recommended Format) February 2020 Unit Price (29/02/2020) : Rs.10.6043HaseebPirachaNo ratings yet

- NBP Funds: NBP Savings Fund (NBP-SF)Document1 pageNBP Funds: NBP Savings Fund (NBP-SF)Mian Abdullah YaseenNo ratings yet

- NBP Stock Fund (NSF) : MONTHLY REPORT (MUFAP's Recommended Format) December 2020 Unit Price (31/12/2020) : Rs.15.2704Document1 pageNBP Stock Fund (NSF) : MONTHLY REPORT (MUFAP's Recommended Format) December 2020 Unit Price (31/12/2020) : Rs.15.2704Kiran SheikhNo ratings yet

- NBP Funds: NAFA Savings Plus Fund (NSPF)Document1 pageNBP Funds: NAFA Savings Plus Fund (NSPF)Doarka DasNo ratings yet

- NBP Government Securities Liquid Fund (NGSLF)Document1 pageNBP Government Securities Liquid Fund (NGSLF)HIRA -No ratings yet

- NBP Government Securities Liquid Fund (NGSLF)Document1 pageNBP Government Securities Liquid Fund (NGSLF)Sohail AhmedNo ratings yet

- NMMF May 2022Document1 pageNMMF May 2022chqaiserNo ratings yet

- NIMAF Fund Outperforms Benchmark by 5.8% in JanuaryDocument1 pageNIMAF Fund Outperforms Benchmark by 5.8% in JanuaryMuhammad MudassirNo ratings yet

- PIATAFDocument1 pagePIATAFEileen LauNo ratings yet

- NBP Government Securities Savings Fund (NGSSF)Document1 pageNBP Government Securities Savings Fund (NGSSF)Ali RazaNo ratings yet

- Axis Equity FundDocument44 pagesAxis Equity FundyogeshgharpureNo ratings yet

- NAFA Stock June 2017Document1 pageNAFA Stock June 2017jeb38293No ratings yet

- NAFA GIPS Jun 2016 ReportDocument26 pagesNAFA GIPS Jun 2016 ReportHIRA -No ratings yet

- NAFA Pension Fund November 2016Document1 pageNAFA Pension Fund November 2016chqaiserNo ratings yet

- NAFA Stock Fund October 2016Document1 pageNAFA Stock Fund October 2016jeb38293No ratings yet

- Managing Your Savings: NBP Funds Report November 2019Document17 pagesManaging Your Savings: NBP Funds Report November 2019Taha SaleemNo ratings yet

- April2016 PDFDocument1 pageApril2016 PDFjeb38293No ratings yet

- NAFA Stock Fund May 2016Document1 pageNAFA Stock Fund May 2016jeb38293No ratings yet

- NBP Funds: NBP Aitemaad Mahana Amdani Fund (NAMAF)Document1 pageNBP Funds: NBP Aitemaad Mahana Amdani Fund (NAMAF)Sajid rasoolNo ratings yet

- NBP Stock Fund (NSF) : MONTHLY REPORT (MUFAP's Recommended Format) February 2021 Unit Price (28/02/2021) : Rs.16.1513Document1 pageNBP Stock Fund (NSF) : MONTHLY REPORT (MUFAP's Recommended Format) February 2021 Unit Price (28/02/2021) : Rs.16.1513Ali RazaNo ratings yet

- Niddf PDFDocument1 pageNiddf PDFMuhammad MudassarNo ratings yet

- NAFA Stock Fund September 2016Document1 pageNAFA Stock Fund September 2016jeb38293No ratings yet

- Affin Hwang Aiiman Growth Fund: Performance Record As at 29 May 2020 Performance Table As at 29 May 2020Document1 pageAffin Hwang Aiiman Growth Fund: Performance Record As at 29 May 2020 Performance Table As at 29 May 2020NURAIN HANIS BINTI ARIFFNo ratings yet

- Fund Fact SheetDocument4 pagesFund Fact SheetSizweNo ratings yet

- NIMAF NBP Islamic Mahana Amdani Fund PerformanceDocument1 pageNIMAF NBP Islamic Mahana Amdani Fund PerformanceZohaib Alam WarraichNo ratings yet

- NBP Islamic Energy Fund (Nief) : MONTHLY REPORT (MUFAP's Recommended Format) March 2020 Unit Price (31/03/2020) : Rs.6.7643Document1 pageNBP Islamic Energy Fund (Nief) : MONTHLY REPORT (MUFAP's Recommended Format) March 2020 Unit Price (31/03/2020) : Rs.6.7643HIRA -No ratings yet

- Hpam Ultima Ekuitas 1Document2 pagesHpam Ultima Ekuitas 1Serly MarcelinaNo ratings yet

- Discovery Fund April 23Document1 pageDiscovery Fund April 23Satyajeet AnandNo ratings yet

- Fund Fact Sheet June 2020Document21 pagesFund Fact Sheet June 2020Devi TinawatiNo ratings yet

- PNB Peso Fixed Income Fund PDFDocument3 pagesPNB Peso Fixed Income Fund PDFJj PahudpodNo ratings yet

- RHB Islamic Global Developed Markets FundDocument2 pagesRHB Islamic Global Developed Markets FundIrfan AzmiNo ratings yet

- 12FMR - December 2010Document1 page12FMR - December 2010Rashid AhmadaniNo ratings yet

- PUBLIC ISLAMIC ASIA LEADERS EQUITY FUND (PIALEFDocument1 pagePUBLIC ISLAMIC ASIA LEADERS EQUITY FUND (PIALEFEileen LauNo ratings yet

- Discovery DecDocument1 pageDiscovery DecGauravNo ratings yet

- P Smallcap Ar EngDocument27 pagesP Smallcap Ar EngxiaokiaNo ratings yet

- About Parag Parikh Flexi Cap Fund: Foreign Equity InvestmentDocument10 pagesAbout Parag Parikh Flexi Cap Fund: Foreign Equity InvestmentTunirNo ratings yet

- NAFA GIPS Dec 2015 ReportDocument26 pagesNAFA GIPS Dec 2015 ReportHIRA -No ratings yet

- Capital Growth FundDocument1 pageCapital Growth FundHimanshu AgrawalNo ratings yet

- Allianz Malaysia Berhad: Net Profit Grew 48.5% YoY - 26/08/2010Document3 pagesAllianz Malaysia Berhad: Net Profit Grew 48.5% YoY - 26/08/2010Rhb InvestNo ratings yet

- Fund Fact Sheet Jan 2021Document21 pagesFund Fact Sheet Jan 2021Yunus MohamadNo ratings yet

- HDFC Opportunities FundDocument1 pageHDFC Opportunities FundManjunath BolashettiNo ratings yet

- USD Fixed Income Fund Fact SheetDocument20 pagesUSD Fixed Income Fund Fact SheetAfthon Ilman Huda Isyfi100% (1)

- EPF Records RM34.05 Billion Investment Income 1H 2021Document4 pagesEPF Records RM34.05 Billion Investment Income 1H 2021Calvin YeohNo ratings yet

- Peso Powerhouse Fund - Fund Fact Sheet - December - 2020Document2 pagesPeso Powerhouse Fund - Fund Fact Sheet - December - 2020Jayr LegaspiNo ratings yet

- DINASTI EQUITY FUND 3-YEAR VOLATILITYDocument2 pagesDINASTI EQUITY FUND 3-YEAR VOLATILITYAhmad RafiqNo ratings yet

- Motilal Oswal PVR Q2FY21 Result UpdateDocument12 pagesMotilal Oswal PVR Q2FY21 Result Updateumaj25No ratings yet

- INF204K01HY3 - Reliance Smallcap FundDocument1 pageINF204K01HY3 - Reliance Smallcap FundKiran ChilukaNo ratings yet

- MIEF-factsheet 230320 152602Document3 pagesMIEF-factsheet 230320 152602ryanbud96No ratings yet

- Icici Prudential Thematic Advantage Fund (Fof)Document2 pagesIcici Prudential Thematic Advantage Fund (Fof)Ankita GargNo ratings yet

- Outlook Publishing (India) Private Limited: Summary of Rated InstrumentsDocument7 pagesOutlook Publishing (India) Private Limited: Summary of Rated InstrumentsKetan BhoiNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability in BangladeshFrom EverandFinancial Soundness Indicators for Financial Sector Stability in BangladeshNo ratings yet

- NAFA GIPS Jun 2016 ReportDocument26 pagesNAFA GIPS Jun 2016 ReportHIRA -No ratings yet

- NAFA GIPS Mar 2016 Report PDFDocument26 pagesNAFA GIPS Mar 2016 Report PDFHIRA -No ratings yet

- NAFA GIPS Dec 2015 ReportDocument26 pagesNAFA GIPS Dec 2015 ReportHIRA -No ratings yet

- NAFA GIPS Nov 2012 ReportDocument19 pagesNAFA GIPS Nov 2012 ReportHIRA -No ratings yet

- NAFA GIPS Dec 2013 ReportDocument23 pagesNAFA GIPS Dec 2013 ReportHIRA -No ratings yet

- NAFA GIPS Dec 2013 ReportDocument23 pagesNAFA GIPS Dec 2013 ReportHIRA -No ratings yet

- GIPS Compliant Performance Report: September 30, 2013Document23 pagesGIPS Compliant Performance Report: September 30, 2013HIRA -No ratings yet

- NAFA GIPS Dec 2012 ReportDocument19 pagesNAFA GIPS Dec 2012 ReportHIRA -No ratings yet

- GIPS Compliant Performance Report: June 30, 2013Document21 pagesGIPS Compliant Performance Report: June 30, 2013HIRA -No ratings yet

- GIPS Compliant Performance Report: March 31, 2013Document21 pagesGIPS Compliant Performance Report: March 31, 2013HIRA -No ratings yet

- NAFA GIPS Mar 2016 Report PDFDocument26 pagesNAFA GIPS Mar 2016 Report PDFHIRA -No ratings yet

- NAFA GIPS Mar 2015 Report PDFDocument26 pagesNAFA GIPS Mar 2015 Report PDFHIRA -No ratings yet

- NBP Balanced Fund monthly report April 2020Document1 pageNBP Balanced Fund monthly report April 2020HIRA -No ratings yet

- GIPS Compliant Performance Report: June 30, 2013Document21 pagesGIPS Compliant Performance Report: June 30, 2013HIRA -No ratings yet

- GIPS Compliant Performance Report: September 30, 2013Document23 pagesGIPS Compliant Performance Report: September 30, 2013HIRA -No ratings yet

- NBP Government Securities Liquid Fund (NGSLF)Document1 pageNBP Government Securities Liquid Fund (NGSLF)HIRA -No ratings yet

- GIPS Compliant Performance Report: March 31, 2013Document21 pagesGIPS Compliant Performance Report: March 31, 2013HIRA -No ratings yet

- NAFA GIPS Dec 2012 ReportDocument19 pagesNAFA GIPS Dec 2012 ReportHIRA -No ratings yet

- NBP Balanced Fund monthly report April 2020Document1 pageNBP Balanced Fund monthly report April 2020HIRA -No ratings yet

- NAFA GIPS Nov 2012 ReportDocument19 pagesNAFA GIPS Nov 2012 ReportHIRA -No ratings yet

- NBP Government Securities Savings Fund (NGSSF)Document1 pageNBP Government Securities Savings Fund (NGSSF)HIRA -No ratings yet

- NBP Government Securities Savings Fund (NGSSF)Document1 pageNBP Government Securities Savings Fund (NGSSF)HIRA -No ratings yet

- NBP Islamic Energy Fund (Nief) : MONTHLY REPORT (MUFAP's Recommended Format) March 2020 Unit Price (31/03/2020) : Rs.6.7643Document1 pageNBP Islamic Energy Fund (Nief) : MONTHLY REPORT (MUFAP's Recommended Format) March 2020 Unit Price (31/03/2020) : Rs.6.7643HIRA -No ratings yet

- NBP Government Securities Liquid Fund (NGSLF)Document1 pageNBP Government Securities Liquid Fund (NGSLF)HIRA -No ratings yet

- Marketing Strategies On Mercantile BankDocument53 pagesMarketing Strategies On Mercantile BankMD. Zakir Hossain AntorNo ratings yet

- Challenges and Solutions in Islamic MicrofinanceDocument16 pagesChallenges and Solutions in Islamic MicrofinancemairaNo ratings yet

- E Zobel, Inc. vs. CA CDDocument1 pageE Zobel, Inc. vs. CA CDJumen Gamaru TamayoNo ratings yet

- A Project Report On Ulips V S Mutual Funds Under Banking Sector With Reference To HDFC BankDocument17 pagesA Project Report On Ulips V S Mutual Funds Under Banking Sector With Reference To HDFC Bankblackpantherr2101No ratings yet

- Principles of Auditing and Other Assurance Services 20Th Edition Whittington Solutions Manual Full Chapter PDFDocument43 pagesPrinciples of Auditing and Other Assurance Services 20Th Edition Whittington Solutions Manual Full Chapter PDFAndrewRobinsonixez100% (8)

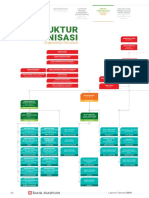

- Struktur Organisasi: Organization StructureDocument2 pagesStruktur Organisasi: Organization StructureRalila SejahteraNo ratings yet

- OutlineDocument9 pagesOutlineMARIA THERESA ABRIONo ratings yet

- Sanction DlaDocument17 pagesSanction DlaDomainNo ratings yet

- BIP 390 Investment Banking RegulationsDocument38 pagesBIP 390 Investment Banking RegulationsDuc Bui100% (2)

- Viking Insurance Endorsement Confirmation for Added 1994 CorvetteDocument10 pagesViking Insurance Endorsement Confirmation for Added 1994 Corvettemesa1965No ratings yet

- Emirates NBD - Dubai 12Document1 pageEmirates NBD - Dubai 12Adnan Nawaz100% (1)

- Chapter 6 Risk Assessment (PART 1)Document9 pagesChapter 6 Risk Assessment (PART 1)Aravinthan INSAF SmartClassNo ratings yet

- 5293 17017 1 PBDocument11 pages5293 17017 1 PBeferemNo ratings yet

- Ey Aarsrapport 2021 22 5Document1 pageEy Aarsrapport 2021 22 5Ronald RunruilNo ratings yet

- Advanced Accounting-III SuggestionDocument3 pagesAdvanced Accounting-III SuggestionIbrahim Arafat ZicoNo ratings yet

- Investing money options and stock market indexesDocument2 pagesInvesting money options and stock market indexesSeptian Pajrin MuktiNo ratings yet

- A Functional Perspective of Financial Intermediation Robert C. MertonDocument20 pagesA Functional Perspective of Financial Intermediation Robert C. Mertona lNo ratings yet

- Stocks and BondsDocument40 pagesStocks and BondsCharlie Anne PadayaoNo ratings yet

- Phoenix MillsDocument66 pagesPhoenix MillsNeel GaonwalaNo ratings yet

- 5.3 Income StatementDocument4 pages5.3 Income StatementHiNo ratings yet

- A Study of Fire Insurance With Refernce To Bajaj Allianz General InsuranceDocument88 pagesA Study of Fire Insurance With Refernce To Bajaj Allianz General InsuranceNinad Patil50% (2)

- Types of Business Organisation and StakeholdersDocument54 pagesTypes of Business Organisation and StakeholdersKhine Myo TintNo ratings yet

- Lee Delivery Company Inc Was Organized at The Beginning of PDFDocument1 pageLee Delivery Company Inc Was Organized at The Beginning of PDFTaimour HassanNo ratings yet

- Predstavitev NLBDocument101 pagesPredstavitev NLBFinanceNo ratings yet

- SAP FICO Create Vendor Master DataDocument13 pagesSAP FICO Create Vendor Master DataGiri RajNo ratings yet

- Customer Insurance & Finance Report-2017Document18 pagesCustomer Insurance & Finance Report-2017DINESH ISUZUNo ratings yet

- NHB Vishal GoyalDocument24 pagesNHB Vishal GoyalSky walkingNo ratings yet

- Mutual Funds in India - Wikipedia, The Free EncyclopediaDocument4 pagesMutual Funds in India - Wikipedia, The Free EncyclopediaShamik DebnathNo ratings yet

- Health Insurance Receipt 2022Document1 pageHealth Insurance Receipt 2022Vijay SekarNo ratings yet

- PROBLEM 6: CASH TO ACCRUAL: Enterprises Records All Transactions On The Cash BasisDocument4 pagesPROBLEM 6: CASH TO ACCRUAL: Enterprises Records All Transactions On The Cash Basischuchu tvNo ratings yet