Professional Documents

Culture Documents

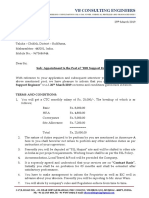

Preference Shares - May 11 2020

Uploaded by

Lisle Daverin Blyth0 ratings0% found this document useful (0 votes)

14 views1 pagePreference Shares - May 11 2020

Original Title

Preference Shares - May 11 2020

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPreference Shares - May 11 2020

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views1 pagePreference Shares - May 11 2020

Uploaded by

Lisle Daverin BlythPreference Shares - May 11 2020

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Markets and Commodity figures

11 May 2020

Company Close (cents)

Day move (cents)

Day move (%)

High Low Volume trade

12m

(000)

% move12m high 12m low Market cap Yield

(R'm) P/E ratio

KRUGER RANDS 0 0 0 0 0 0 0 0 0 0 0 0 0

KR 2400000 -35000 -1.4 2400000 2400000 0 29.7 2510000 1840000 0 0 0 0

KRHALF 1080000 0 0 0 0 0 35 1105000 800000 0 0 0 0

KRQRTR 570000 0 0 0 0 0 37.3 600000 400000 0 0 0 0

KRTENTH 160000 0 0 0 0 0 0 160000 160000 0 0 0 0

EXCHANGE TRADED PRODUCTS

0 0 0 0 0 0 0 0 0 0 0 0 0

1NVEST 4261 -39 -0.9 4328 4226 1 -17.5 6485 4218 193.4 0 0 9.8

1NVESTBOND 7361 26 0.4 7382 7361 0 6.6 7382 6887 7.3 0 0 3.9

1NVESTG7GOVT 8429 -17 -0.2 8530 8425 11 17.5 9000 7125 16.2 0 0 1.1

1NVESTGLOBAL 2080 -22 -1 2130 2080 62 19.6 2280 1736 91 0 0 4

1NVESTGOLDET 23024 -205 -0.9 23287 23020 1 32.8 23481 17206 1614.4 0 0 0

1NVESTMSCI 4692 -30 -0.6 4713 4552 0 31.4 4722 3570 96.2 0 0 0

1NVESTPALLAD 33209 -341 -1 33906 32735 9 84.5 37117 12022 3766.7 0 0 0

1NVESTPLATIN 14122 62 0.4 14129 13950 2 30.7 16000 10620 2372.6 0 0 0

1NVESTRHODIU 147568 818 0.6 154500 147568 1 352.7 154500 22222 800.6 0 0 0

1NVESTS&P500 24088 -175 -0.7 24240 24088 0 35.4 24838 17706 24.2 0 0 0

1NVESTSWIX40 1074 -4 -0.4 1074 1056 1 8.5 1164 950 1838.9 0 0 1

1NVESTTOP40 4992 103 2.1 5050 4992 1 4.9 5353 4600 1220.4 0 0 2.2

2YRDOLLARCST 149230 -640 -0.4 149930 149230 0 11.5 156000 133150 68.9 0 0 1.1

AMIBIG50EX-S 1253 -10 -0.8 1280 1225 1 3.3 1501 1102 24.9 0 0 0

AMIRLSTTEX-S 3031 0 0 3062 3031 0 -13.7 6900 1998 0.8 0 0 0

AMSSBP 12 1 9.1 12 12 0 -50 31 4 11 0 0 0

AMSSBQ 45 2 4.7 45 45 0 55.2 49 4 86 0 0 0

ANGSBX 7 0 0 7 7 0 -75.9 36 7 7 0 0 0

ANGSBY 31 1 3.3 31 31 0 -8.8 35 30 60 0 0 0

ASHBURTONGBL 5265 114 2.2 5395 5126 29 31.2 5395 4000 610.3 0 0 1.5

ASHBURTONINF 1986 0 0 1995 1977 3 -2.2 2143 1910 318.5 0 0 2.9

ASHBURTONMID 746 -5 -0.7 755 734 440 6.3 808 636 409.3 0 0 1.7

ASHBURTONTOP 4998 -24 -0.5 5072 4985 373 5.5 5576 4701 1498.5 0 0 1.8

ASHBURTONWOR 762 2 0.3 766 753 416 15.8 801 650 122.6 0 0 1.3

BATSBP 39 0 0 39 39 0 44.4 39 27 39 0 0 0

BHPSBP 16 2 14.3 16 16 0 -48.4 34 4 14 0 0 0

CLSSBP 21 0 0 21 21 0 0 36 14 21 0 0 0

CORE DIVTRAX 2450 -6 -0.2 2472 2440 2 -4.5 2790 2309 303.5 0 0 1.3

CORE GLPROP 4074 -27 -0.7 4125 4058 14 15.8 4235 3500 517.6 0 0 2.1

CORE PREF 926 5 0.5 930 919 77 6.3 1010 865 356.2 0 0 6.3

CORE S&P500 4865 -28 -0.6 4892 4817 22 33.2 4999 3623 977.3 0 0 1.2

CORE TOP50 2225 -10 -0.4 2240 2221 2 1.5 2421 2114 1387.5 0 0 1.4

CORESHARESGL 1361 -14 -1 1376 1356 57 25.3 1450 1070 555.7 0 0 1.5

CORESHARESSA 1364 -17 -1.2 1390 1361 33 -19.7 1729 1361 369 0 0 10.1

CORESHARESSC 4290 -46 -1.1 4322 4272 5 -4.5 4787 4208 121.6 0 0 2.2

DOLLARCSTDL 153020 -850 -0.6 154140 153020 0 20.6 159000 126130 130.8 0 0 1.3

DSYSBP 25 0 0 25 25 0 0 40 18 25 0 0 0

ERAFI 0 0 0 0 0 0 0 0 0 28.2 0 0 0

ERAFIOVRLL 0 0 0 0 0 0 0 0 0 93.9 0 0 0

EXXSBP 15 2 15.4 15 15 0 0 28 7 13 0 0 0

FSRSBX 40 0 0 40 40 0 0 40 25 40 0 0 0

GFISBR 5 0 0 5 5 0 -84.4 35 1 5 0 0 0

GFISBS 10 0 0 10 10 0 0 34 10 10 0 0 0

GFISBT 23 0 0 23 23 0 -28.1 32 23 46 0 0 0

HARSBV 8 1 14.3 8 8 0 -75 39 6 7 0 0 0

HARSBW 33 2 6.5 33 33 0 -2.9 36 29 62 0 0 0

IMPSBT 4 0 0 4 4 0 -87.1 35 4 4 0 0 0

IMPSBV 4 -1 -20 4 4 0 0 35 4 5 0 0 0

IMPSBW 35 0 0 35 35 0 2.9 43 27 70 0 0 0

KRCSTDLCRTFC 2419500 -20050 -0.8 2441200 2419500 0 33 2443450 1150398 768.8 0 0 0

MRPSBP 26 0 0 26 26 0 -52.7 55 19 26 0 0 0

MTNSBR 44 0 0 44 44 0 41.9 49 31 44 0 0 0

MTNSBS 34 0 0 34 34 0 6.3 34 31 68 0 0 0

MTNSBX 0 0 0 0 0 0 0 0 0 0 0 0 0

NEWFUNDSEQUI 3608 -35 -1 3618 3600 4 18.7 3812 3029 218.2 0 0 2.6

NEWFUNDSGOVI 6842 5 0.1 6905 6796 10 8.7 7390 6085 1054.2 0 0 8

NEWFUNDSILBI 6981 -27 -0.4 7016 6945 1 3.1 7016 6643 63.1 0 0 2.6

NEWFUNDSMAPP 2176 -3 -0.1 2186 2174 14 5.3 2294 2042 39.4 0 0 2.7

NEWFUNDSS&P 3917 -43 -1.1 3927 3917 2 0.8 4406 3712 81.5 0 0 2.3

NEWFUNDSSHAR 320 -5 -1.5 323 320 15 3.2 350 298 50.6 0 0 1.8

NEWFUNDSTRAC 2648 4 0.2 2652 2642 8 7.2 2705 2460 219.9 0 0 6.6

NEWGOLD 14016 67 0.5 14016 13833 14 30.5 14607 10536 14507 0 0 0

NEWGOLDISSUE 22048 -192 -0.9 22276 22040 174 33 22570 16524 14651.3 0 0 0

NEWGOLDPLLDM 33342 -68 -0.2 33350 32624 5 85.4 36000 17760 1229.4 0 0 0

NFEQUITYVALU 899 -10 -1.1 902 899 0 -7.4 1038 876 109.2 0 0 2.7

NFLOWVLTLTY 1048 -7 -0.7 1052 1043 6 12.2 1103 928 128.2 0 0 2.1

NFNAM10BONDS 1405 3 0.2 1405 1405 0 0 1405 1375 250.4 0 0 0

NFVMDFNSV 945 -4 -0.4 945 944 0 0 997 939 49.2 0 0 2.7

NFVMHIGH 1081 -14 -1.3 1091 1081 4 13.8 1149 917 58.9 0 0 2.7

NFVMMDRT 962 -7 -0.7 964 962 0 0 1017 879 53.9 0 0 1.7

NPNSBP 25 -2 -7.4 25 25 0 -19.4 32 25 54 0 0 0

NPNSBZ 15 -2 -11.8 15 15 0 -57.1 51 15 17 0 0 0

PREFEXSCRTS 0 0 0 0 0 0 0 0 0 225.4 0 0 0

PRXSBP 21 -2 -8.7 21 21 0 -43.2 46 17 23 0 0 0

RMBINFLTN 0 0 0 0 0 0 0 0 0 381.1 0 0 0

RMBMID 0 0 0 0 0 0 0 0 0 130.9 0 0 0

RMBTOP40 0 0 0 0 0 0 0 0 0 601.9 0 0 0

SATRIX40PRTF 4989 -22 -0.4 5061 4987 255 5.3 5375 4700 8653.6 0 0 1.9

SATRIXDIVIPL 229 0 0 229 224 1484 -5.4 267 224 1512.3 0 0 2.6

SATRIXFINI 1474 -9 -0.6 1489 1469 46 -13.4 1811 1437 699 0 0 4

SATRIXILBI 579 -1 -0.2 582 579 2 1 601 563 58.1 0 0 3.5

SATRIXINDI 6872 5 0.1 6927 6830 43 9.5 7299 6249 1836.1 0 0 1.3

SATRIXMMNTM 1055 -8 -0.8 1063 1055 4 9.1 1126 962 29.8 0 0 1.1

SATRIXMSCI 4699 -26 -0.6 4774 4676 88 31.4 4806 3560 2847.8 0 0 0

SATRIXMSCIEM 4276 -2 0 4321 4260 44 14.1 4599 3725 696.1 0 0 0

SATRIXNASDAQ 7598 -64 -0.8 7748 7567 50 47.3 7748 5125 752.5 0 0 0

SATRIXPRTFL 1328 -17 -1.3 1356 1323 55 -22.6 1818 1323 220.2 0 0 6.1

SATRIXQLTY 789 -9 -1.1 799 783 26 -5.8 930 746 112.8 0 0 2.6

SATRIXRAFI40 1420 -9 -0.6 1428 1416 106 2.2 1554 1322 932.8 0 0 1.6

SATRIXRESI 4768 -75 -1.5 4891 4744 18 11.1 5189 4220 425.6 0 0 1

SATRIXS&P500 4823 -37 -0.8 4895 4792 216 35.7 4994 3501 897.8 0 0 0

SATRIXSWIXTO 1060 -2 -0.2 1067 1058 65 2.7 1180 999 362.3 0 0 1.6

SBKSBP 41 -1 -2.4 41 41 0 156.3 46 4 42 0 0 0

SBKSBQ 34 0 0 34 34 0 -5.6 37 5 34 0 0 0

SGLSBT 1 0 0 1 1 0 -97.1 49 1 1 0 0 0

SGLSBU 12 1 9.1 12 12 0 -58.6 29 11 11 0 0 0

SOLSBT 36 2 5.9 36 36 0 0 36 13 34 0 0 0

SOLSBU 57 2 3.6 57 57 0 67.6 57 34 110 0 0 0

SYGNIAITRIX 2953 -17 -0.6 2970 2926 31 37.2 3075 2080 634.1 0 0 0.2

SYGNIAITRIXG 4179 -24 -0.6 4202 4177 10 16.6 4390 3583 262 0 0 1.9

SYGNIAITRIXS 4897 -34 -0.7 4926 4895 45 34.6 5039 3623 1157.4 0 0 1.3

SYGNIAITRIXT 5015 -22 -0.4 5043 5015 0 5.7 5402 4717 221.6 0 0 3.1

TOPSBV 3 -1 -25 3 3 0 -86.4 45 2 4 0 0 0

TOPSBW 17 0 0 17 17 0 0 31 7 17 0 0 0

TOPSBX 24 1 4.3 24 24 0 -25 35 15 23 0 0 0

TOPSBY 36 1 2.9 36 35 100 38.5 38 20 35 0 0 0

TOPSKR 1019 44 4.5 1019 1019 0 62.5 1396 457 975 0 0 0

TOPSKS 1217 44 3.8 1223 1204 1 50.2 1584 645 1173 0 0 0

TOPSKT 687 44 6.8 687 631 10 -10.7 1031 62 643 0 0 0

DEBT 0 0 0 0 0 0 0 0 0 0 0 0 0

AECI5,5% 1487 0 0 0 0 0 6.2 1500 1275 44.6 0 0 7

AFRICANOVER 1000 0 0 0 0 0 0 1000 1000 2.8 0 0 1.2

BARWORLD6%PR 120 0 0 0 0 0 -2.4 123 120 0.5 0 0 10

CAPITEC-P 10799 0 0 0 0 0 8 11000 9510 89 0 0 7.8

CAXTON-P 14700 0 0 0 0 0 -22.6 19000 14700 7.4 0 0 3.3

DISC-B-P 9680 15 0.2 9680 9680 2 8.9 10000 8860 773.2 0 0 10.5

ELB-P 0 0 0 0 0 0 0 0 0 0 0 0 0

FIRSTRANDB-P 8420 20 0.2 8450 8375 30 2.7 9100 7800 3780 0 0 9.1

FOSCHINI 122 0 0 0 0 0 -1.6 126 122 0.2 0 0 10.7

GRINDRODPREF 7900 -98 -1.2 7900 7900 0 5.3 9000 7236 591.9 0 0 11.3

IBRDMBLPRF1 100510 90 0.1 100610 100510 1 0 101740 100271 343.2 0 0 5.6

INVESTEC 8620 10 0.1 8699 8610 16 14.9 9500 7400 1330 0 0 9.8

INVESTECPREF 8500 0 0 0 0 0 -11.5 10500 8500 234.1 0 0 3.9

INVICTA-P 7700 -1 0 7700 7700 1 -12.5 9400 7500 577.6 0 0 14.3

LIBERTY11C 106 0 0 0 0 0 1 120 101 15.9 0 0 10.4

NAMPAK6%PREF 126 0 0 0 0 0 4.1 126 120 0.5 0 0 4.8

NAMPAK6,5%PR 131 0 0 0 0 0 8.3 131 131 0.1 0 0 5

NEDBANKPREF 935 5 0.5 938 920 76 2.6 1000 900 3332 0 0 9

NETCAREPREF 8100 0 0 0 0 0 6.4 8722 7550 526.5 0 0 10.3

PSGSERV 8525 0 0 8525 8525 9 11 9500 7450 1484.7 0 0 9.9

RECMANDCLBR 1445 -54 -3.6 1500 1445 9 -19.3 1805 1441 710.5 0 0 0

REUNERT55%PR 0 0 0 0 0 0 0 0 0 0.7 0 0 0

REXTRFRM 127 0 0 0 0 0 -2.3 130 127 0.2 0 0 9.4

SASFIN-P 7950 0 0 0 0 0 10.4 8500 7125 142.9 0 0 10.5

STANDARD-P 8695 -5 -0.1 8700 8685 19 7.5 9100 8020 4609.5 0 0 9

STD 73 -24 -24.7 73 73 1 -18.9 308 68 7.8 0 0 8.9

STEINHOFF-P 4401 0 0 0 0 0 0 0 0 660.2 0 0 19

TDHPB 0 0 0 0 0 0 0 0 0 0 0 0 0

ZAMBEZIRF 8501 -55 -0.6 8600 8500 2 30.8 9000 6405 13681.5 0 0 0

OTHER 0 0 0 0 0 0 0 0 0 0 0 0 0

ABLSIRESET 0 0 0 0 0 0 0 0 0 0 0 0 0

ABMBSN396-04 95676 -735 -0.8 95676 95676 0 0 101347 95676 53.1 0 0 0

ABMBSN411-29 97198 -575 -0.6 97198 97198 0 0 97773 97198 9.1 0 0 0

ABSA 106923 -1373 -1.3 106923 106923 0 0 112068 80210 27.8 0 0 0

ASN408 96831 -321 -0.3 96831 96831 0 0 97152 96831 44.7 0 0 0

IBOMLC 0 0 0 0 0 0 0 0 0 583.3 0 0 0

INVLTD 1049344 -4364 -0.4 1049344 1049344 0 -1 1150676 1037409 11.6 0 0 0

STANDARD 87 0 0 87 87 0 -25 116 75 24.8 0 0 0

UBGPAA 103206 -22 0 103206 103206 0 3.2 105122 100000 51614 0 0 0

ASSET BACKED SECURITIES

0 0 0 0 0 0 0 0 0 0 0 0 0

DBGLOBE 0 0 0 0 0 0 0 0 0 2 0 0 0

DBHAVEN 0 0 0 0 0 0 0 0 0 3.1 0 0 0

FRKBONDGOLD 2439000 -19000 -0.8 2439000 2439000 0 8.2 2458050 2182000 1087.6 0 0 0

FRSFRPT9JUN1 151750 700 0.5 151750 151750 0 33.4 155850 111950 1111.3 0 0 0

GOLDCMMDTY-L 25035 -220 -0.9 25195 25035 0 30.8 25615 14588 252.6 0 0 0

IBETNT1CT46 0 0 0 0 0 0 0 0 0 48.6 0 0 0

IBLUSDZAROCT 149397 -617 -0.4 149397 149397 0 10.8 156989 134709 525 0 0 2.3

IBSWX40TR2ET 18208 -47 -0.3 18277 18208 0 5.6 19548 17092 912.8 0 0 0

IBVR2ETN 102878 19 0 102878 102878 0 0 102878 100019 1542.9 0 0 0

IBVR3ETN 102990 19 0 102990 102990 0 0 102990 100020 1544.6 0 0 0

NEWWAVEETN 14163 92 0.7 14379 14163 0 29.3 14741 10503 29.3 0 0 0

NEWWAVEEUROE 1610 4 0.2 1622 1610 0 2.7 1728 1474 36.2 0 0 0

NEWWAVEGBPET 1905 -2 -0.1 1916 1904 1 5.4 1960 1567 43.1 0 0 0.4

NEWWAVESLVET 252 -5 -1.9 259 252 119 20.6 283 199 42.5 0 0 0

NEWWAVEUSDET 1473 8 0.5 1482 1465 88 6.4 1561 1340 400.5 0 0 2

PALADIUMCOMM 92647 -2893 -3 95662 92647 1 83.5 99991 48206 477.7 0 0 0

PLATINUMCOMM 11800 62 0.5 11813 11800 0 30.7 12105 8707 234.8 0 0 0

SBACMMDTYIND 1400 4 0.3 1407 1400 0 13.1 1475 1223 139.6 0 0 0

SBAFRICAEQUI 1166 4 0.3 1182 1166 0 16.6 1190 965 232.4 0 0 0

SBCOPPERETN 1384 -17 -1.2 1406 1384 0 3.3 1559 1324 140.1 0 0 0

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

You might also like

- Preference Shares - March 31 2020Document1 pagePreference Shares - March 31 2020Lisle Daverin BlythNo ratings yet

- Preference Shares - May 26 2020Document1 pagePreference Shares - May 26 2020Lisle Daverin BlythNo ratings yet

- Preference Shares - July 30 2020Document1 pagePreference Shares - July 30 2020Lisle Daverin BlythNo ratings yet

- Preference Shares - October 31 2019Document1 pagePreference Shares - October 31 2019Lisle Daverin BlythNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Preference Shares - June 11 2018Document1 pagePreference Shares - June 11 2018Tiso Blackstar GroupNo ratings yet

- PreferenceShares - February 22 2018Document1 pagePreferenceShares - February 22 2018Tiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Preference Shares - September 26 2019Document1 pagePreference Shares - September 26 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - October 3 2019Document1 pagePreference Shares - October 3 2019Tiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Preference Shares - July 31 2019Document1 pagePreference Shares - July 31 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - October 9 2019Document1 pagePreference Shares - October 9 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - February 27 2018Document1 pagePreference Shares - February 27 2018Tiso Blackstar GroupNo ratings yet

- Preference Shares - September 18 2019Document1 pagePreference Shares - September 18 2019Anonymous MPsxhBNo ratings yet

- Preference Shares - October 2 2019Document1 pagePreference Shares - October 2 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - July 29 2019Document1 pagePreference Shares - July 29 2019Lisle Daverin BlythNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Preference Shares - July 22 2019Document1 pagePreference Shares - July 22 2019Tiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Preference Shares - July 30 2018Document1 pagePreference Shares - July 30 2018Tiso Blackstar GroupNo ratings yet

- Preference Shares - July 27 2018Document1 pagePreference Shares - July 27 2018Tiso Blackstar GroupNo ratings yet

- Preference Shares - April 11 2018Document1 pagePreference Shares - April 11 2018Tiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Preference Shares - September 16 2019Document1 pagePreference Shares - September 16 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - September 17 2019Document1 pagePreference Shares - September 17 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - May 10 2018Document1 pagePreference Shares - May 10 2018Tiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- PreferenceShares - June 26 2017Document1 pagePreferenceShares - June 26 2017Tiso Blackstar GroupNo ratings yet

- PreferenceShares - June 23 2017Document1 pagePreferenceShares - June 23 2017Tiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Preference Shares - October 25 2019Document1 pagePreference Shares - October 25 2019Anonymous MZp9gEGg6No ratings yet

- PreferenceShares - March 28 2018Document1 pagePreferenceShares - March 28 2018Tiso Blackstar GroupNo ratings yet

- Preference Shares - March 25 2019Document1 pagePreference Shares - March 25 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - September 2 2019Document1 pagePreference Shares - September 2 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - June 28 2018Document1 pagePreference Shares - June 28 2018Tiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Preference Shares - March 14 2018Document1 pagePreference Shares - March 14 2018Tiso Blackstar GroupNo ratings yet

- Preference Shares - June 19 2017Document1 pagePreference Shares - June 19 2017Tiso Blackstar GroupNo ratings yet

- PreferenceShares PDFDocument1 pagePreferenceShares PDFTiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- PreferenceShares - June 27 2018Document1 pagePreferenceShares - June 27 2018Tiso Blackstar GroupNo ratings yet

- Preference Shares - November 6 2019Document1 pagePreference Shares - November 6 2019Tiso Blackstar GroupNo ratings yet

- PreferenceShares - February 21 2018Document1 pagePreferenceShares - February 21 2018Tiso Blackstar GroupNo ratings yet

- Preference Shares - August 19 2019Document1 pagePreference Shares - August 19 2019Lisle Daverin BlythNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Preference Shares - August 7 2019Document1 pagePreference Shares - August 7 2019Lisle Daverin BlythNo ratings yet

- PreferenceShares PDFDocument1 pagePreferenceShares PDFTiso Blackstar GroupNo ratings yet

- Preference Shares - July 25 2018Document1 pagePreference Shares - July 25 2018Tiso Blackstar GroupNo ratings yet

- Preference Shares - August 5 2019Document1 pagePreference Shares - August 5 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - October 3 2018Document1 pagePreference Shares - October 3 2018Tiso Blackstar GroupNo ratings yet

- Government Publications: Key PapersFrom EverandGovernment Publications: Key PapersBernard M. FryNo ratings yet

- Speed Changers, Drives & Gears World Summary: Market Values & Financials by CountryFrom EverandSpeed Changers, Drives & Gears World Summary: Market Values & Financials by CountryNo ratings yet

- Sanlam Stratus Funds - July 15 2020Document2 pagesSanlam Stratus Funds - July 15 2020Lisle Daverin BlythNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesMatshepo SeletswaneNo ratings yet

- Markets and Commodity Figures: Liberty Excelsior InvestmentsDocument1 pageMarkets and Commodity Figures: Liberty Excelsior InvestmentsMatshepo SeletswaneNo ratings yet

- Fixed DepositsDocument1 pageFixed DepositsMatshepo SeletswaneNo ratings yet

- Markets and Commodity Figures: 21 January 2021Document2 pagesMarkets and Commodity Figures: 21 January 2021Matshepo SeletswaneNo ratings yet

- FuelPricesDocument1 pageFuelPricesMatshepo SeletswaneNo ratings yet

- Markets and Commodity Figures: 14 June 2017Document2 pagesMarkets and Commodity Figures: 14 June 2017Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsMatshepo SeletswaneNo ratings yet

- Markets and Commodity Figures: Liberty Excelsior InvestmentsDocument1 pageMarkets and Commodity Figures: Liberty Excelsior InvestmentsMatshepo SeletswaneNo ratings yet

- Sanlam Stratus Funds - July 15 2020Document2 pagesSanlam Stratus Funds - July 15 2020Lisle Daverin BlythNo ratings yet

- FuelPricesDocument1 pageFuelPricesMatshepo SeletswaneNo ratings yet

- Markets and Commodity Figures: 14 June 2017Document2 pagesMarkets and Commodity Figures: 14 June 2017Tiso Blackstar GroupNo ratings yet

- Fixed DepositsDocument1 pageFixed DepositsMatshepo SeletswaneNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsMatshepo SeletswaneNo ratings yet

- MSLI Avestruz EPHAvMararacDocument2 pagesMSLI Avestruz EPHAvMararacKent AvestruzNo ratings yet

- ANSI C12.20 Contents and ScopeDocument11 pagesANSI C12.20 Contents and Scoperguillermo210% (2)

- Union of India Vs Alok Kumar 2010Document7 pagesUnion of India Vs Alok Kumar 2010KHUSHI KATRENo ratings yet

- viewNitPdf 3919331Document4 pagesviewNitPdf 3919331riya paulNo ratings yet

- Creative Writing Quarter 2 Module 11Document37 pagesCreative Writing Quarter 2 Module 11TABAGAN, CHRIS ANDREW CARDIÑONo ratings yet

- Bb2 by Call of Cthulhu RPGDocument107 pagesBb2 by Call of Cthulhu RPGBurnedJeffersonNo ratings yet

- DLA Piper Guide To Going Global Corporate Hong Kong, SARDocument13 pagesDLA Piper Guide To Going Global Corporate Hong Kong, SARTun TunNo ratings yet

- 9 Teresa Electric Power v. PSCDocument2 pages9 Teresa Electric Power v. PSCJul A.No ratings yet

- Chapter - V Limitations of The Prevention of Corruption ActDocument33 pagesChapter - V Limitations of The Prevention of Corruption ActRAJARAJESHWARI M GNo ratings yet

- Appointment Letter - Nikhil KhedekarDocument3 pagesAppointment Letter - Nikhil KhedekarGajendra PatilNo ratings yet

- Castles & Crusades - Castle Zagyg - Yggsburgh - Storehouse DistrictDocument57 pagesCastles & Crusades - Castle Zagyg - Yggsburgh - Storehouse DistrictGabo218100% (7)

- Owais Mirchawala Faculty PagesDocument46 pagesOwais Mirchawala Faculty PagesLelouch100% (1)

- DAGOT Vs DASIA (Appeal)Document4 pagesDAGOT Vs DASIA (Appeal)Anthony MadrazoNo ratings yet

- OtherworlderDocument7 pagesOtherworlderGary M. Ciaramella100% (1)

- 5contract-II - Study Notes On Contract Law 2Document248 pages5contract-II - Study Notes On Contract Law 2Dinesh PhogatNo ratings yet

- Tan VSDocument3 pagesTan VSsalinaNo ratings yet

- Lake Opening BriefDocument74 pagesLake Opening BriefkmonclaNo ratings yet

- Republic Act No. 8792 "Electronic Commerce Act of 2000"Document4 pagesRepublic Act No. 8792 "Electronic Commerce Act of 2000"E.D.JNo ratings yet

- Gr3 Find Subordinate Clauses PDFDocument2 pagesGr3 Find Subordinate Clauses PDFlong vichekaNo ratings yet

- Revised Penal Code Chapter Two Article 25-39Document5 pagesRevised Penal Code Chapter Two Article 25-39sherluck siapnoNo ratings yet

- Batch Download 20Document75 pagesBatch Download 20atum capitalNo ratings yet

- PRINCIPLE OF COMPETENCE-COMPETENCEDocument17 pagesPRINCIPLE OF COMPETENCE-COMPETENCEMay RMNo ratings yet

- POWERS AND OBLIGATIONS OF MATHA and SheibaitDocument4 pagesPOWERS AND OBLIGATIONS OF MATHA and Sheibaitgurnoor mutrejaNo ratings yet

- Draft Construction AgreementDocument9 pagesDraft Construction AgreementJoshua James ReyesNo ratings yet

- ApspscDocument1 pageApspscMadhu MadhavaNo ratings yet

- Scientific Proof's Adequacy and Penal Judge's Estimation AuthorityDocument23 pagesScientific Proof's Adequacy and Penal Judge's Estimation AuthorityMimoun AznayNo ratings yet

- CECO Clause AnalysisDocument2 pagesCECO Clause AnalysisLeague UnitedNo ratings yet

- Introduction To Forensic ScienceDocument2 pagesIntroduction To Forensic ScienceRC SatyalNo ratings yet

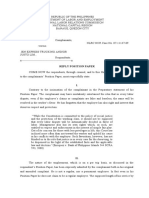

- Reply Position Paper For Jen ExpressDocument5 pagesReply Position Paper For Jen ExpressRamon Masagca100% (15)

- Candombe Del Adios BASSDocument3 pagesCandombe Del Adios BASSStewart AlvarezNo ratings yet