Professional Documents

Culture Documents

Labor Advisory No. 27 20 Payment of Wages For The Special Non Working Day On August 21 2020 and Regular Holiday On August 31 2020

Uploaded by

TheSummitExpress100%(2)100% found this document useful (2 votes)

7K views2 pagesDOLE pay rules

Original Title

Labor Advisory No. 27 20 Payment of Wages for the Special Non Working Day on August 21 2020 and Regular Holiday on August 31 2020

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDOLE pay rules

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

100%(2)100% found this document useful (2 votes)

7K views2 pagesLabor Advisory No. 27 20 Payment of Wages For The Special Non Working Day On August 21 2020 and Regular Holiday On August 31 2020

Uploaded by

TheSummitExpressDOLE pay rules

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

Intramuros, Manila

Republic of the Philippines (|

DEPARTMENT OF LABOR AND EMPLOYMENT

| AIA) VAB

oo

Mose Thaw fobs!

Ws dace ple Cente AS

LABOR ADVISORY NO. 1)

Series of 2020

Payment of Wages for the

Special (Non-Working) Day on August 21, 2020 and

Regular Holiday on August 31, 2020

Pursuant to Proclamation No. 845 issued by President Rodrigo Roa

Duterte on November 15, 2019, the following rules for pay on special (non-

working) days and regular holidays shall apply:

1. Special (Non-Working) Day - August 21, 2020 (Ninoy Aquino Day)

1.1. If the employee did not work, the "no work, no pay" principle shall

apply unless there is a favorable company policy, practice or

collective bargaining agreement (CBA) granting payment on a

special day;

1.2. For work done during the special day, he/she shall be paid an

additional 30% of his/her basic wage on the first eight hours of work

[(Basic wage x 130%) + COLA];

1.3 For work done in excess of eight hours (overtime work), he/she shall

be paid an additional 30% of his/her hourly rate on said day (Hourly

rate of the basic wage x 130% x 130% x number of hours worked);

1.4. For work done during a special day that also falls on his/her rest day,

he/she shall be paid an additional 50% of his/her basic wage on the

first eight hours of work [(Basic wage x 150%) + COLA]; and

1.5 For work done in excess of eight hours (overtime work) during a

special day that also falls on his/her rest day, he/she shall be paid

an additional 30% of his/her hourly rate on said day (Hourly rate of

the basic wage x 150% x 130% x number of hours worked).

2. Regular Holiday - August 31, 2020 (National Heroes Day)

2.1 If the employee did not work, he/she shall be paid 100% of his/her

wage for that day, subject to certain requirements under the

implementing rules and regulations of the Labor Code, as

amended. [(Basic wage + COLA) x 100%]';

2.2. For work done during the regular holiday, the employee shall be

paid 200% of his/her wage for that day for the first eight hours [(Basic

wage + COLA) x 200%]';

2.3. For work done in excess of eight hours (overlime work), he/she shall

be paid an additional 30% of his/her hourly rate on said day [Hourly

tate of the basic wage x 200% x 130% x number of hours worked];

2.4 For work done during a regular holiday that also falls on his/her rest

day, he/she shall be paid an additional 30% of his/her basic wage.

of 200% [(Basic wage + COLA) x 200%] + [30% (Basic wage x 200%)];

and

2.5 For work done in excess of eight hours (overtime work) during a

regular holiday that also falls on his/her rest day, he/she shall be

paid an additional 30% of his/her hourly rate on said day (Hourly

rate of the basic wage x 200% x 130% x 130% x number of hours

worked).

However, In view of the existence of a national emergency arising from

the Coronavirus Disease 2019 (COVID-19) situation, employers are allowed to

defer payment of the holiday pay on August 31, 2020, until such time that the

present emergency situation has been abated and the normal operations of

the establishment is in place.

Establishments that have totally closed or ceased operation during the

community quarantine period are exempted from the payment of the holiday

pay under this Advisory.

Be guided accordingly.

Secretary

wiv

J8_ August 2020

* Cost of Living Allowance (COLA) is included in the computation of holiday pay

You might also like

- Exam Program Real Estate Brokers April 2024Document4 pagesExam Program Real Estate Brokers April 2024geraldinelacambra34No ratings yet

- Exam Program Nov 2023 (Civil Engg)Document4 pagesExam Program Nov 2023 (Civil Engg)Darwin GundaleNo ratings yet

- Program April 2024 ECE ECT Board ExamDocument4 pagesProgram April 2024 ECE ECT Board ExamTheSummitExpressNo ratings yet

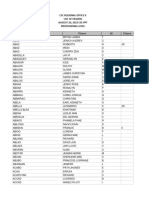

- R13 - List of Passers - 08202023 Pro - ForDocument234 pagesR13 - List of Passers - 08202023 Pro - ForTOPNOTCHER Philippines67% (3)

- Cscro2 Professional Level PassersDocument76 pagesCscro2 Professional Level PassersTheSummitExpress100% (1)

- SMFI Partner Schools SY 2024 2025Document3 pagesSMFI Partner Schools SY 2024 2025Sizzy SkincareNo ratings yet

- February 2024 Licensure Examination For Criminologists ResultsDocument314 pagesFebruary 2024 Licensure Examination For Criminologists ResultsRappler70% (10)

- PRC Nurse ALPHADocument516 pagesPRC Nurse ALPHARappler84% (19)

- Exam Program September 2023 LETDocument4 pagesExam Program September 2023 LETTheSummitExpress100% (1)

- LET Passers SecondaryDocument1,080 pagesLET Passers SecondaryTheSummitExpress92% (12)

- LET ElementaryDocument476 pagesLET ElementaryTheSummitExpress100% (5)

- Region 3 - 08202023 List of Passers SubDocument18 pagesRegion 3 - 08202023 List of Passers SubTheSummitExpressNo ratings yet

- R9 SUBPROF-List of Passers 08-20-2023Document2 pagesR9 SUBPROF-List of Passers 08-20-2023TOPNOTCHER PhilippinesNo ratings yet

- R7 List of Passers 08202023 ProfDocument56 pagesR7 List of Passers 08202023 ProfTheSummitExpress100% (1)

- 13 - 08202023 List of Passers SubDocument44 pages13 - 08202023 List of Passers SubTOPNOTCHER PhilippinesNo ratings yet

- Proclamation No. 359 Barangay Elections HolidayDocument1 pageProclamation No. 359 Barangay Elections HolidayTheSummitExpress100% (1)

- R7 List of Passers SubDocument6 pagesR7 List of Passers SubTheSummitExpress100% (1)

- R10 List of Passers 08202023 Professional LevelDocument55 pagesR10 List of Passers 08202023 Professional LevelTheSummitExpress100% (3)

- PRC Schedule of Licensure Examinations For The Year 2024Document11 pagesPRC Schedule of Licensure Examinations For The Year 2024TheSummitExpress100% (7)

- 20 August 2023 Prof Bicol PassersDocument50 pages20 August 2023 Prof Bicol PassersTheSummitExpress100% (1)

- R9 PROF-List of Passers 08-20-2023Document25 pagesR9 PROF-List of Passers 08-20-2023TOPNOTCHER Philippines100% (5)

- 08202023cseppt Prof PasserDocument104 pages08202023cseppt Prof PasserTOPNOTCHER Philippines100% (2)

- R9 PROF-List of Passers 08-20-2023Document25 pagesR9 PROF-List of Passers 08-20-2023TOPNOTCHER Philippines100% (5)

- Proclamation No. 368 Holidays 2024Document3 pagesProclamation No. 368 Holidays 2024TheSummitExpress75% (4)

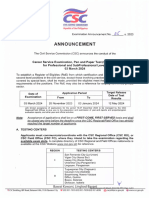

- ExamAnnouncement05s2023 - Conduct of 2024-0303 CSEDocument8 pagesExamAnnouncement05s2023 - Conduct of 2024-0303 CSETheSummitExpress100% (1)

- Exam Program September 2023 LETDocument4 pagesExam Program September 2023 LETTheSummitExpress100% (1)

- National Capital Region (NCR) : List of Passers Civil Service Exam - Pen and Paper TestDocument289 pagesNational Capital Region (NCR) : List of Passers Civil Service Exam - Pen and Paper TestRalph A. PastranaNo ratings yet

- DO - s2023 - 022 DepEd School Calendar 2023-2024Document15 pagesDO - s2023 - 022 DepEd School Calendar 2023-2024TheSummitExpress96% (50)

- Program CPALE September 2023Document4 pagesProgram CPALE September 2023TheSummitExpressNo ratings yet

- DM - s2023 - 036 Deped Memorandum Buwan NG WikaDocument4 pagesDM - s2023 - 036 Deped Memorandum Buwan NG WikaTheSummitExpressNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)