Professional Documents

Culture Documents

Exercises: Job Order Costing: Q1: Lamonda Corp. Uses A Job Order Cost System. On April 1, The Accounts Had The Following

Uploaded by

Cynthia WongOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercises: Job Order Costing: Q1: Lamonda Corp. Uses A Job Order Cost System. On April 1, The Accounts Had The Following

Uploaded by

Cynthia WongCopyright:

Available Formats

Exercises: Job Order Costing

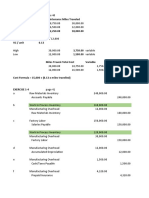

Q1: Lamonda Corp. uses a job order cost system. On April 1, the accounts had the following

balances:

Raw Materials Inventory Work in Process Inventory Finished Goods Inventory

Bal. 25,000 Bal. 55,000 Bal. 60,000

136,000 122,000 94,000 375,000

131,000

402,000

39,000 81,850 33,000

Manufacturing Overhead Cost of Goods Sold

28,000 402,000

24,000 176,850

26,000

30,000

24,000

overapplied

44,850

Sales Revenue Non-Manufacturing

Expenses

500,000 44,000

15,000

The following transactions occurred during April:

a. Purchased materials on account at a cost of $136,000. DM= 122000-28000=

94000

b. Requisitioned materials at a cost of $122,000, of which $28,000 was for general factory use.

c. Recorded factory labor of $155,000, of which $24,000 was indirect. DL= 155,000-24,000

d. Incurred other costs =131,000

Selling expense $44,000

Factory utilities $26,000

Administrative expenses $15,000

Factory rent $30,000

Factory depreciation $24,000

e. Applied overhead at a rate equal to 135 percent of direct labor cost. 131000 x 135%=

f. Completed jobs costing $375,000. 176,850

g. Sold jobs costing $402,000.

h. Recorded sales revenue of $500,000.

Required:

1. Post the April transactions to the T-accounts. (Note: Some transactions will affect other

accounts not shown; e.g., Cash, Accounts Payable, Accumulated Depreciation. You do not need

to show the offsetting debit or credit to those accounts.)

2. Compute the balance in the accounts at the end of April.

3. Compute over- or underapplied manufacturing overhead. If the balance in the Manufacturing

Overhead account is closed directly to Cost of Goods Sold, will Cost of Goods Sold increase or

decrease? decrease COGS

4. Prepare Lamonda’s cost of goods manufactured report for April.

Lamonda Corp.

Cost of Goods Manufactured Report

For the Month of April

Beginning raw materials inventory $ 25,000

Plus: Raw material purchases 136,000

28,000

Less: Indirect materials 39,000

Less: Ending raw materials inventory

Direct materials used 94,000

131,000

Direct labor

Manufacturing overhead applied 167,850

Total current manufacturing costs 401,850

Plus: Beginning WIP inventory 55,000

Less: Ending WIP inventory 81,850

COGS manfactured 375,000

5. Prepare Lamonda’s April income statement. Include any adjustment to Cost of Goods

Sold needed to dispose of over- or underapplied manufacturing overhead.

Lamonda Corp.

Income Statement

For the Month of April

Sales revenue $500,000

Cost of goods sold

Beginning finished goods inventory 60,000

Plus: Cost of goods manufactured 375,000

33,000

Less Ending finished goods inventory

402,000

Unadjusted Cost of goods sold 44,850

Less: Overapplied manufacturing overhead

Adjusted Cost of Goods Sold 357,150

Gross profit 142,850

Selling and administrative expenses

59,000

Net Income from Operations

83,850

Q2. Marsha Design is an interior design and consulting firm. The firm uses a job order cost

system in which each client represents an individual job. Marsha Design traces direct labor and

travel costs to each job (client). It assigns indirect costs to clients at a predetermined overhead

rate based on direct labor hours. At the beginning of the year, the managing partner, Marsha

Cain, prepared the following budget:

Direct labor hours(professional) 5,000 estimated activity

Direct labor costs(professional) 500,000

Support staff salaries 50,000

Office rent 55,000

Office supplies 20,000

Total expected indirect costs $125,000 etimated overhead

Later that same year, in March, Marsha Design served several clients. Records for two clients

appear below:

Oliverio McComb

Direct labor cost(professional) $4,000 $3,000

Travel costs 500 100

Direct labor hours 40 hours 30 hours

Required:

1. Compute Marsha Design’s predetermined overhead rate for the current year.

2. Compute the total cost of serving the clients listed.

3. Assume that Marsha charges clients $250 per hour for interior design services. How much

gross profit would she earn on each of the clients above, ignoring any difference between actual

and applied overhead?

You might also like

- The Cost of Doing Business Study, 2022 EditionFrom EverandThe Cost of Doing Business Study, 2022 EditionNo ratings yet

- Copper Creek Hoa Form Lennar Homes Glades Vut Off RoadDocument3 pagesCopper Creek Hoa Form Lennar Homes Glades Vut Off Roadapi-449359098No ratings yet

- VP Business Development in Minneapolis ST Paul MN Resume Marc AndersonDocument1 pageVP Business Development in Minneapolis ST Paul MN Resume Marc AndersonMarcAnderson1No ratings yet

- Financial Projections TemplateDocument66 pagesFinancial Projections TemplateVigneshwari VeeNo ratings yet

- Sample Logistics PlanDocument27 pagesSample Logistics Planvinicius100% (1)

- LMC Pipeline 8Document1 pageLMC Pipeline 8api-523902606No ratings yet

- Lennar CNWS Red-Letter Term SheetDocument70 pagesLennar CNWS Red-Letter Term SheetBill Gram-ReeferNo ratings yet

- Promissory Note Simple FormDocument1 pagePromissory Note Simple FormRheneir MoraNo ratings yet

- Commercial Property Management Director in Los Angeles CA Resume Michael KeurjianDocument3 pagesCommercial Property Management Director in Los Angeles CA Resume Michael KeurjianMichaelKeurjian2No ratings yet

- VP Director Multi Family Construction in Dallas FT Worth TX Resume Gary HoltDocument2 pagesVP Director Multi Family Construction in Dallas FT Worth TX Resume Gary HoltGaryHoltNo ratings yet

- Economic and Socialized Housing Projects: and Its Rules & Regulations Design & StandardsDocument40 pagesEconomic and Socialized Housing Projects: and Its Rules & Regulations Design & Standardsclary yanNo ratings yet

- NAHB Economic Impacts 3-10Document49 pagesNAHB Economic Impacts 3-10Mike ReicherNo ratings yet

- Residential Lease or Rental Agreement CA NEWDocument4 pagesResidential Lease or Rental Agreement CA NEWSeasoned_SolNo ratings yet

- VP Real Estate Land Development in Maryland Florida Resume Norman LutkefedderDocument2 pagesVP Real Estate Land Development in Maryland Florida Resume Norman LutkefedderNormanLutkefedderNo ratings yet

- Common Area Maintenance GuidelinesDocument8 pagesCommon Area Maintenance GuidelinesSukumar Varma UppalapatiNo ratings yet

- Planned Unit Development GuidelinesDocument6 pagesPlanned Unit Development GuidelinesHara TalaNo ratings yet

- New Tenant OrientationDocument4 pagesNew Tenant Orientationapi-515926784No ratings yet

- Audit ReportDocument1 pageAudit ReportIso CertificationNo ratings yet

- Director Commercial Real Estate in Columbus OH Resume Richard WolneyDocument2 pagesDirector Commercial Real Estate in Columbus OH Resume Richard WolneyRichardWolneyNo ratings yet

- Management AgreementDocument6 pagesManagement AgreementButch KhanNo ratings yet

- Depreciation & Income TaxDocument44 pagesDepreciation & Income TaxLee Boon HongNo ratings yet

- Proposed Apartment Building For 1139 Water St. in PeterboroughDocument26 pagesProposed Apartment Building For 1139 Water St. in PeterboroughPeterborough ExaminerNo ratings yet

- ABC Oil Company Chart of AccountsDocument2 pagesABC Oil Company Chart of Accountsfavou5No ratings yet

- Newbury Homeowners Association DocumentsDocument71 pagesNewbury Homeowners Association DocumentsfiremancreativeNo ratings yet

- Spring Issue of The Dirt 2010Document24 pagesSpring Issue of The Dirt 2010Vermont Nursery & Landscape AssociationNo ratings yet

- Step by Step RV Winterizing Updated-2017Document7 pagesStep by Step RV Winterizing Updated-2017Buckyver100% (1)

- Lambton Shores Community Association Submission To The OLTDRAFTDocument13 pagesLambton Shores Community Association Submission To The OLTDRAFTLambton Shores Community AssociationNo ratings yet

- Development Construction Project Manager in Seattle WA Resume Michael SayreDocument5 pagesDevelopment Construction Project Manager in Seattle WA Resume Michael SayreMichaelSayreNo ratings yet

- Gudavalli John Raja Abhishek: MoosarambaghDocument2 pagesGudavalli John Raja Abhishek: MoosarambaghG. John Raja AbhishekNo ratings yet

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- Costing Sem V - CHP 5 (Illustrations) - 70693Document12 pagesCosting Sem V - CHP 5 (Illustrations) - 70693Preeti KumariNo ratings yet

- CMA Vol 1-1Document211 pagesCMA Vol 1-1Shahaer MumtazNo ratings yet

- Costcon 1Document3 pagesCostcon 1Frances Clayne GonzalvoNo ratings yet

- BA 7000 Study Guide 1Document11 pagesBA 7000 Study Guide 1ekachristinerebecaNo ratings yet

- Suggested Answer - Syl12 - Dec2014 - Paper - 19 Final Examination: Suggested Answers To QuestionsDocument16 pagesSuggested Answer - Syl12 - Dec2014 - Paper - 19 Final Examination: Suggested Answers To QuestionsRanadeep ReddyNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- HorngrenIMA14eSM ch04Document75 pagesHorngrenIMA14eSM ch04Zarafshan Gul Gul MuhammadNo ratings yet

- Acct1 8Document5 pagesAcct1 8kutipan raraNo ratings yet

- F.Y.B.B.A Sem 1 Financial Accounting Unit CostingDocument3 pagesF.Y.B.B.A Sem 1 Financial Accounting Unit CostingSamir ParekhNo ratings yet

- Assignment 3 Accounting PDFDocument11 pagesAssignment 3 Accounting PDFjgfjhf arwtr100% (1)

- Assignment 1Document2 pagesAssignment 1Betheemae R. MatarloNo ratings yet

- Normal Costing ProblemsDocument3 pagesNormal Costing Problemsrose llar67% (3)

- Cost Calculation Snowball ManufacturingDocument13 pagesCost Calculation Snowball ManufacturingBisma ShahabNo ratings yet

- Introduction to Manufacturing Costs and Financial StatementsDocument4 pagesIntroduction to Manufacturing Costs and Financial StatementsAshitero YoNo ratings yet

- AccountsDocument14 pagesAccountsgokulamaromal2001No ratings yet

- Assignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR MohsinDocument11 pagesAssignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR Mohsinjgfjhf arwtr100% (1)

- Test 1 ProblemsDocument48 pagesTest 1 ProblemsKaira Arora50% (2)

- Accounting For Managers Canadian 1st Edition Collier Solutions ManualDocument17 pagesAccounting For Managers Canadian 1st Edition Collier Solutions Manualnicholassmithyrmkajxiet100% (24)

- BACOSTMX Module 3 Self-ReviewerDocument5 pagesBACOSTMX Module 3 Self-ReviewerlcNo ratings yet

- Cost Accounting AssignmentDocument6 pagesCost Accounting AssignmentCharles BarcelaNo ratings yet

- CA Inter Costing Practical Questions With SolutionsDocument311 pagesCA Inter Costing Practical Questions With SolutionsAnkit KumarNo ratings yet

- Baya - Exercise 4 Job Order Costing, Accounting For MaterialDocument12 pagesBaya - Exercise 4 Job Order Costing, Accounting For MaterialAngelica BayaNo ratings yet

- Direct Materials Direct Labor: Exercise 2 - Job Order Cost SheetDocument7 pagesDirect Materials Direct Labor: Exercise 2 - Job Order Cost SheetNile Alric AlladoNo ratings yet

- Cost Accounting Chapter 3Document5 pagesCost Accounting Chapter 3Jenefer DianoNo ratings yet

- Cost Activity 1Document12 pagesCost Activity 1Dark Ninja100% (1)

- Varnish Company Cost AnalysisDocument4 pagesVarnish Company Cost AnalysisAmiee Laa PulokNo ratings yet

- CostDocument3 pagesCostKyle Vincent SaballaNo ratings yet

- Unit II Cost Terms, Concepts, Classification, Behavior, Cost Flows in A Trading and Manufacturing BusinessDocument5 pagesUnit II Cost Terms, Concepts, Classification, Behavior, Cost Flows in A Trading and Manufacturing BusinessKiana Lyndel Mancanes MolinaNo ratings yet

- Product CostDocument10 pagesProduct CostApple BaldemoroNo ratings yet

- GNB13 e CH 03 ExamDocument6 pagesGNB13 e CH 03 ExamAnne Dorcas S. DomingoNo ratings yet

- TI-Nspire CX Prem TS Guidebook EN PDFDocument621 pagesTI-Nspire CX Prem TS Guidebook EN PDFCynthia WongNo ratings yet

- 01) Intro and Overview - 13 Feb 20Document95 pages01) Intro and Overview - 13 Feb 20Cynthia WongNo ratings yet

- FINA 1303: Foundations of Financial InstitutionsDocument32 pagesFINA 1303: Foundations of Financial InstitutionsCynthia WongNo ratings yet

- FINA 1303: Foundations of Financial InstitutionsDocument32 pagesFINA 1303: Foundations of Financial InstitutionsCynthia WongNo ratings yet

- L 2 Anthropogenic Impact On Natural Systems (Required Reading) - L3Document96 pagesL 2 Anthropogenic Impact On Natural Systems (Required Reading) - L3Cynthia WongNo ratings yet

- 03) FINA 1303 - Foundations of Interest Rates - Part - 2 - 7 Feb 20 - With AnswersDocument85 pages03) FINA 1303 - Foundations of Interest Rates - Part - 2 - 7 Feb 20 - With AnswersCynthia WongNo ratings yet

- 02) FINA1303 - Foundations of Interest Rates - Part - 1 - 7 Feb 20 - With AnswersDocument103 pages02) FINA1303 - Foundations of Interest Rates - Part - 1 - 7 Feb 20 - With AnswersCynthia WongNo ratings yet

- 05) FINA 1303 - Commercial - Banks - 18 Mar 20Document48 pages05) FINA 1303 - Commercial - Banks - 18 Mar 20Cynthia WongNo ratings yet

- L 2 Anthropogenic Impact On Natural Systems (Required Reading) - L3Document96 pagesL 2 Anthropogenic Impact On Natural Systems (Required Reading) - L3Cynthia WongNo ratings yet

- ECON 2123 - Fall2018 - PS2 - SolDocument10 pagesECON 2123 - Fall2018 - PS2 - SolCynthia WongNo ratings yet

- ECON 2123 - Fall2018 - PS2 - SolDocument10 pagesECON 2123 - Fall2018 - PS2 - SolCynthia WongNo ratings yet

- Practice Exam FallDocument9 pagesPractice Exam FallCynthia WongNo ratings yet

- PracticeExamFinal SolDocument5 pagesPracticeExamFinal SolCynthia WongNo ratings yet

- Chapter 6 - ProblemsDocument6 pagesChapter 6 - ProblemsDeanna GicaleNo ratings yet

- Term Plan 65yeras PDFDocument5 pagesTerm Plan 65yeras PDFRohit KhareNo ratings yet

- Berlin School Final Exam - Financial Accounting and MerchandisingDocument17 pagesBerlin School Final Exam - Financial Accounting and MerchandisingNarjes DehkordiNo ratings yet

- Articles of IncorporationDocument4 pagesArticles of IncorporationRuel FernandezNo ratings yet

- OBLICON - Chapter 1 ProblemDocument1 pageOBLICON - Chapter 1 ProblemArahNo ratings yet

- FAUJI MEAT LIMITED CONDENSED INTERIM FINANCIAL STATEMENTSDocument66 pagesFAUJI MEAT LIMITED CONDENSED INTERIM FINANCIAL STATEMENTSAbdurrehman ShaheenNo ratings yet

- Consolidation of Wholly Owned Subsidiaries Acquired at More Than Book ValueDocument66 pagesConsolidation of Wholly Owned Subsidiaries Acquired at More Than Book ValueNadeem TahaNo ratings yet

- Combining PCR With IV Is A Clever Way of Viewing ItDocument17 pagesCombining PCR With IV Is A Clever Way of Viewing ItKamNo ratings yet

- Goods and Services Tax (GST) in IndiaDocument30 pagesGoods and Services Tax (GST) in IndiarupalNo ratings yet

- Basic Accounting Worksheet ColumnsDocument26 pagesBasic Accounting Worksheet ColumnsApril Joy EspadorNo ratings yet

- Capital Structure and Firm Efficiency: Dimitris Margaritis and Maria PsillakiDocument23 pagesCapital Structure and Firm Efficiency: Dimitris Margaritis and Maria PsillakiRafael G. MaciasNo ratings yet

- Power of Attorney (General)Document3 pagesPower of Attorney (General)champakNo ratings yet

- A Generation of Sociopaths - Reference MaterialDocument30 pagesA Generation of Sociopaths - Reference MaterialWei LeeNo ratings yet

- Flame I - Jaideep FinalDocument23 pagesFlame I - Jaideep FinalShreya TalujaNo ratings yet

- Ark Israel Innovative Technology Etf Izrl HoldingsDocument2 pagesArk Israel Innovative Technology Etf Izrl HoldingsmikiNo ratings yet

- Chapter 5 MishkinDocument21 pagesChapter 5 MishkinLejla HodzicNo ratings yet

- BITS Pilani Course Handout on Fundamentals of Finance & AccountingDocument2 pagesBITS Pilani Course Handout on Fundamentals of Finance & Accountingbijesh9784No ratings yet

- Asset-Backed Commodity TradingDocument4 pagesAsset-Backed Commodity Tradingluca sacakiNo ratings yet

- Dawood Habib GroupDocument3 pagesDawood Habib GroupShuja HussainNo ratings yet

- N26 StatementDocument4 pagesN26 StatementCris TsauNo ratings yet

- Biz Cafe Operations Excel - Assignment - UIDDocument3 pagesBiz Cafe Operations Excel - Assignment - UIDJenna AgeebNo ratings yet

- Letter of Intent NotesDocument10 pagesLetter of Intent NotesJoe SchmoNo ratings yet

- Week 03 - Bank ReconciliationDocument6 pagesWeek 03 - Bank ReconciliationPj ManezNo ratings yet

- Template Excel Pengantar AkuntansiiDocument15 pagesTemplate Excel Pengantar AkuntansiiKim SeokjinNo ratings yet

- FX Fluctuations, Intervention, and InterdependenceDocument9 pagesFX Fluctuations, Intervention, and InterdependenceRamagurubaran VenkatNo ratings yet

- TaxSaleResearch OkDocument44 pagesTaxSaleResearch OkMarlon Ferraro100% (1)

- Multinational Capital BudgetingDocument20 pagesMultinational Capital BudgetingBibiNo ratings yet

- 2026 SyllabusDocument28 pages2026 Syllabussatkargulia601No ratings yet

- Insolvency LawDocument14 pagesInsolvency LawShailesh KumarNo ratings yet

- Basic Foreclosure Litigation Defense ManualDocument155 pagesBasic Foreclosure Litigation Defense ManualDiane Stern100% (2)