Professional Documents

Culture Documents

Treasury's Role in Bank ALM

Uploaded by

Christian Cedrick OlmonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Treasury's Role in Bank ALM

Uploaded by

Christian Cedrick OlmonCopyright:

Available Formats

Treasury’s Role in the Bank’s ALM Process

10.00%

8.00%

6.00%

4.00%

1 2 3 4 5 6 7 8 9 10 11 12 18 24 36 48 60

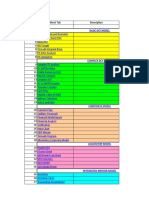

Scenario 1: P100M 36 mos Term Loan @ 11.00%

P100M 36 mos Time Deposit @ 4.50%

Asset Liability Treasury Bank

Loan Rate 11.00% 11.00%

Depo Rate 4.50% 4.50%

TP Liability 8.50% 8.50%

TP Asset 8.50% 8.50%

NRFF 2.50% 4.00% 0.00% 6.50%

10.00%

9.00%

8.00%

7.00%

6.00%

5.00%

4.00%

1 2 3 4 5 6 7 8 9 10 11 12 18 24 36 48 60

Scenario 2: P100M 36 mos Term Loan @ 11.00%

P100M 12 mos Time Deposit @ 4.50%

Asset Liability Treasury Bank

Loan Rate 11.00% 11.00%

Depo Rate 4.50% 4.50%

TP Liability 7.00% 7.00%

TP Asset 8.50% 8.50%

NRFF 2.50% 2.50% 1.50% 6.50%

• How is the Transfer Pool Rate determined:

– The Asset & Liability Management Committee (ALCO) composed of senior officers,

President, Head of Lending, Head of Branches, Head of Risk Management, Head of

Compliance, Chief Finance Officer, and Treasurer, meets on a monthly basis, or weekly,

if needed, to review the current asset and liability mix of the institution.

– In said meeting, the TPR, among others, is determined/agreed for dissemination to all

business units.

– The formula for the TPR is the TD board rate, grossed up to factor the reserve

requirement.

Illustration of determining the TPR:

Assumed Time Deposit Rate: 7.00%

Reserve Requirement : 19.00%

TPR

7.00%

----------

(1 – 19%)

= 8.64 or 8.75%

• In summary:

– Treasury plays an important role in the bank’s asset and liability management to enable

the business units to focus on its mandated tasks: generating funds for branch units and

lending funds for lending units.

– Treasury is the one exposed to market risk and incurs cost either thru interbank

borrowing or unexpected sale of securities to fund unexpected huge deposit

withdrawal or loan drawdowns, or both.

You might also like

- qWJjS5V0iTI StressTesting v01Document4 pagesqWJjS5V0iTI StressTesting v01Manal R-iNo ratings yet

- Determining Optimal Financing Mix: Approaches and AlternativesDocument68 pagesDetermining Optimal Financing Mix: Approaches and AlternativesPavan NagendraNo ratings yet

- Mercer-Capital Bank Valuation AKG PDFDocument60 pagesMercer-Capital Bank Valuation AKG PDFDesmond Dujon HenryNo ratings yet

- Project FşnanceDocument2 pagesProject FşnanceAhmet ErNo ratings yet

- Disclaimer: International Financial Reporting Standards (IFRS) 17 Insurance Contracts ExampleDocument41 pagesDisclaimer: International Financial Reporting Standards (IFRS) 17 Insurance Contracts ExampleYen HoangNo ratings yet

- Sleeping Beauties Bonds - Walt Disney CompanyDocument15 pagesSleeping Beauties Bonds - Walt Disney CompanyThùyDương Nguyễn100% (2)

- Bank Management ProjectDocument20 pagesBank Management ProjectK M Tanveer AhmedNo ratings yet

- Banking and ManagementDocument9 pagesBanking and ManagementDevlent OmondiNo ratings yet

- HDFC Asset Allocator Fund of Funds - NFO LeafletDocument4 pagesHDFC Asset Allocator Fund of Funds - NFO LeafletJignesh PatelNo ratings yet

- How To Review Your Investment PortfolioDocument7 pagesHow To Review Your Investment PortfolioRatnaPrasadNalamNo ratings yet

- Cash Reserve Ratios and Interest Rates Over TimeDocument2 pagesCash Reserve Ratios and Interest Rates Over Timeankushdureja88No ratings yet

- Edgestone Capital Equity FundDocument2 pagesEdgestone Capital Equity Fund/jncjdncjdnNo ratings yet

- Investor Presentation FY13 v1Document16 pagesInvestor Presentation FY13 v1Shakti ShuklaNo ratings yet

- Restructuring Debt and Equity - Problems and SolutionsDocument5 pagesRestructuring Debt and Equity - Problems and SolutionsGjmNo ratings yet

- Manage interest rate risk and protect bank profitabilityDocument38 pagesManage interest rate risk and protect bank profitabilityAbdullah Al FaisalNo ratings yet

- 3.1 Balance Sheet Management TemplateDocument3 pages3.1 Balance Sheet Management TemplateChristian Cedrick OlmonNo ratings yet

- Capital Budgeting-ClassDocument91 pagesCapital Budgeting-ClassAditi AgrawalNo ratings yet

- Inventory c1Document10 pagesInventory c1chien8avhNo ratings yet

- Week 2 Treasury Management by LCLEJARDEDocument34 pagesWeek 2 Treasury Management by LCLEJARDEErica CadagoNo ratings yet

- Keys Company WACC CalculationDocument4 pagesKeys Company WACC CalculationHarley BuctolanNo ratings yet

- Reno 8series Scheme-November2022 406Document1 pageReno 8series Scheme-November2022 406Love ForeverNo ratings yet

- Alfa Beta DailybkuplDocument1,369 pagesAlfa Beta DailybkuplCardoso PenhaNo ratings yet

- 2018 Tutorials - Chapter 12 - Session 3 - MoodleDocument27 pages2018 Tutorials - Chapter 12 - Session 3 - Moodlewandile majoziNo ratings yet

- Chap 004Document32 pagesChap 004Hyunjoo NohNo ratings yet

- Corporate Valuation ConceptsDocument810 pagesCorporate Valuation ConceptsSupplies DepotNo ratings yet

- The Warren Buffett Spreadsheet - PreviewDocument350 pagesThe Warren Buffett Spreadsheet - PreviewbysqqqdxNo ratings yet

- ETF Investments - Blog 6 Deel 1Document230 pagesETF Investments - Blog 6 Deel 1Thibaut Van DoorselaereNo ratings yet

- Investment Appraisal: Pacific Grove Spice CompanyDocument9 pagesInvestment Appraisal: Pacific Grove Spice CompanyPrabir PujariNo ratings yet

- Tcs Buyback Opportunity: Clients Purchases 44 Shares @CMP 3,900 Acceptance RatioDocument4 pagesTcs Buyback Opportunity: Clients Purchases 44 Shares @CMP 3,900 Acceptance RatioNirbhay JainNo ratings yet

- HBL Asset Management FM LTD - PPTX UpdatedDocument16 pagesHBL Asset Management FM LTD - PPTX UpdatedMisbah Khan100% (1)

- Mini Case of Cost of CapitalDocument16 pagesMini Case of Cost of Capitaljalpa33% (3)

- INTRODUCCIÓN A LAS FINANZAS CORPORATIVASDocument10 pagesINTRODUCCIÓN A LAS FINANZAS CORPORATIVASJavier VidalNo ratings yet

- The Warren Buffett Spreadsheet Final-Version - PreviewDocument335 pagesThe Warren Buffett Spreadsheet Final-Version - PreviewHari ganesh RNo ratings yet

- Chapter 4: Bond and Stock Valuation: Answers To End of Chapter QuestionsDocument10 pagesChapter 4: Bond and Stock Valuation: Answers To End of Chapter QuestionsAn HoàiNo ratings yet

- Sessions 5 & 6Document33 pagesSessions 5 & 6Bhavya JainNo ratings yet

- Valuation - FCFF and FCFEDocument9 pagesValuation - FCFF and FCFESiraj ShaikhNo ratings yet

- Profitability and solvency ratios show Varun Beverages' strong financial performanceDocument8 pagesProfitability and solvency ratios show Varun Beverages' strong financial performancesanket patilNo ratings yet

- Toys R Us LBO Model BlankDocument34 pagesToys R Us LBO Model BlankCatarina AlmeidaNo ratings yet

- HullOFOD11eSolutionsCh08 GEDocument3 pagesHullOFOD11eSolutionsCh08 GE陳昱玲No ratings yet

- Commission Structure - May 2019Document16 pagesCommission Structure - May 2019Sabuj MollaNo ratings yet

- A01683999 T7Document10 pagesA01683999 T7Bryam CárdenasNo ratings yet

- w6 - Cost of Capital - Capital StructureDocument3 pagesw6 - Cost of Capital - Capital StructureMooqyNo ratings yet

- Mridul Tiwari - Mridul Tiwari - PGPGM03 - 13 - IE - FMDocument4 pagesMridul Tiwari - Mridul Tiwari - PGPGM03 - 13 - IE - FMekta agarwalNo ratings yet

- Chapter 4 - Cost of CapitalDocument8 pagesChapter 4 - Cost of CapitalParth GargNo ratings yet

- Holdberg Corp cost of capital based on market value with floatation costsDocument9 pagesHoldberg Corp cost of capital based on market value with floatation costsDhairya ShahNo ratings yet

- Future Contract:: Ch. 33: Derivatives For Managing Financial RiskDocument6 pagesFuture Contract:: Ch. 33: Derivatives For Managing Financial RiskMukul KadyanNo ratings yet

- Chapter 8Document41 pagesChapter 8phuphong777No ratings yet

- Session-1 CF-2Document13 pagesSession-1 CF-2rajyalakshmiNo ratings yet

- Shareholder Funds Net Fixed Assets Equity Capital (10 Crore Shares of Rs 10 Each) Net Working CapitalDocument4 pagesShareholder Funds Net Fixed Assets Equity Capital (10 Crore Shares of Rs 10 Each) Net Working CapitalSudhanshu Kumar SinghNo ratings yet

- Accord Capital Equities Corporation:: First Philippine Holdings, Inc (Pse: FPH)Document1 pageAccord Capital Equities Corporation:: First Philippine Holdings, Inc (Pse: FPH)JC CalaycayNo ratings yet

- Intermediate Financial Management 12th Edition Brigham Solutions Manual DownloadDocument46 pagesIntermediate Financial Management 12th Edition Brigham Solutions Manual DownloadPreston Warfield100% (30)

- CH 4 - in ClassDocument3 pagesCH 4 - in ClassJOSEPH MICHAEL MCGUINNESSNo ratings yet

- Dividend PolicyDocument74 pagesDividend PolicyNithin KsNo ratings yet

- MD Abdullah Al Mamun - ID-17102049 - Major Accounting.Document44 pagesMD Abdullah Al Mamun - ID-17102049 - Major Accounting.Abdullah Al MamunNo ratings yet

- Model Formule - ExerciseDocument8 pagesModel Formule - Exercisemaxball53000No ratings yet

- TUT2TRMDocument17 pagesTUT2TRMQuynh Ngoc DangNo ratings yet

- ABC company cost of equity and expansion project cost calculationDocument24 pagesABC company cost of equity and expansion project cost calculationMohite GouravNo ratings yet

- Capital Structure and Leverage (D. Bañas)Document6 pagesCapital Structure and Leverage (D. Bañas)DAISYBELLE S. BAÑASNo ratings yet

- Bai Many AssetsDocument3 pagesBai Many AssetsGia Linh Nguyen HoangNo ratings yet

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- How English Is EvolvingDocument2 pagesHow English Is EvolvingChristian Cedrick OlmonNo ratings yet

- 4.1 Liquidity and Reserve ManagementDocument1 page4.1 Liquidity and Reserve ManagementChristian Cedrick OlmonNo ratings yet

- 3.1 Balance Sheet Management TemplateDocument3 pages3.1 Balance Sheet Management TemplateChristian Cedrick OlmonNo ratings yet

- 11 Business Cycles and Aggregate DemandDocument7 pages11 Business Cycles and Aggregate DemandChristian Cedrick OlmonNo ratings yet

- Imperfect Competition Market FailureDocument6 pagesImperfect Competition Market FailureChristian Cedrick OlmonNo ratings yet

- 2.1 Interest Rates and Reserve RequirementDocument3 pages2.1 Interest Rates and Reserve RequirementChristian Cedrick OlmonNo ratings yet

- 1.1 Financial Intermediation ProcessDocument2 pages1.1 Financial Intermediation ProcessChristian Cedrick OlmonNo ratings yet

- 9 Overview of MacroeconomicsDocument24 pages9 Overview of MacroeconomicsChristian Cedrick OlmonNo ratings yet

- Module 2 - PPT - 2 - The Classical Macroeconomic Model Part IIDocument16 pagesModule 2 - PPT - 2 - The Classical Macroeconomic Model Part IIChristian Cedrick OlmonNo ratings yet

- Module 2 - PPT - 1 - The Classical Macroeconomic Model - Part I PDFDocument15 pagesModule 2 - PPT - 1 - The Classical Macroeconomic Model - Part I PDFChristian Cedrick OlmonNo ratings yet

- Perfectly Competitive MarketsDocument8 pagesPerfectly Competitive MarketsChristian Cedrick OlmonNo ratings yet

- Chapter 21 Consumption and InvestmentDocument9 pagesChapter 21 Consumption and InvestmentChristian Cedrick OlmonNo ratings yet

- Chapter 7 - Biological VariationDocument16 pagesChapter 7 - Biological VariationChristian Cedrick OlmonNo ratings yet

- Math problem set solutions under 40 charactersDocument2 pagesMath problem set solutions under 40 charactersChristian Cedrick OlmonNo ratings yet

- 6 Production Behavior and Analysis of CostsDocument11 pages6 Production Behavior and Analysis of CostsChristian Cedrick OlmonNo ratings yet

- Line Up For May 19Document3 pagesLine Up For May 19Christian Cedrick OlmonNo ratings yet

- 1.1 Equivalence RelationsDocument17 pages1.1 Equivalence RelationsChristian Cedrick Olmon100% (1)

- Sets Handout BreakdownDocument5 pagesSets Handout BreakdownChristian Cedrick OlmonNo ratings yet

- RC-20 Retro Color Manual PDFDocument11 pagesRC-20 Retro Color Manual PDFTavorshNo ratings yet

- Recreating a Vacuum Cleaner with System Units FansDocument10 pagesRecreating a Vacuum Cleaner with System Units FansChristian Cedrick OlmonNo ratings yet

- 1 Proof TechniquesDocument9 pages1 Proof TechniquesChristian Cedrick OlmonNo ratings yet

- Recreating a Vacuum Cleaner with System Units FansDocument10 pagesRecreating a Vacuum Cleaner with System Units FansChristian Cedrick OlmonNo ratings yet

- King Kenneth Gaborne Resume - Fast Learner, Flexible Worker, Cubao GraduateDocument1 pageKing Kenneth Gaborne Resume - Fast Learner, Flexible Worker, Cubao GraduateChristian Cedrick OlmonNo ratings yet

- Line Up For May 19Document3 pagesLine Up For May 19Christian Cedrick OlmonNo ratings yet

- IMS PolicyDocument1 pageIMS PolicySandeep MazumdarNo ratings yet

- Income Statement QuestionsDocument2 pagesIncome Statement QuestionsMarc Eric RedondoNo ratings yet

- Po 4510089832Document2 pagesPo 4510089832kareemNo ratings yet

- GST Question BankDocument14 pagesGST Question BankrupalNo ratings yet

- 1988 Cede Co V Technicolor Inc 542 A2d 1182Document17 pages1988 Cede Co V Technicolor Inc 542 A2d 1182Aastha JainNo ratings yet

- SOP-QA-013-00-corrective and Preventive ActionDocument10 pagesSOP-QA-013-00-corrective and Preventive ActionNgoc Sang HuynhNo ratings yet

- Job Application FormDocument3 pagesJob Application Formdodi maulanaNo ratings yet

- FM Logistic 2019 Annual Report Highlights Staying the CourseDocument64 pagesFM Logistic 2019 Annual Report Highlights Staying the CourseSherzod AxmedovNo ratings yet

- Managing Innovation for Turbulent TimesDocument31 pagesManaging Innovation for Turbulent TimesSelena ReidNo ratings yet

- Content Marketing MeronDocument16 pagesContent Marketing MeronMeron WasihunNo ratings yet

- Job Opportunities in The Film IndustryDocument7 pagesJob Opportunities in The Film Industryapi-496240163No ratings yet

- Customer Satisfaction in BankingDocument9 pagesCustomer Satisfaction in Bankingmasoom_soorat100% (3)

- AP Batch Gantung 300523Document19 pagesAP Batch Gantung 300523Dhoni KurniawanNo ratings yet

- FO-PR-03 Request For Proposal GENERAL Rev.02 - SLS - Access - Point - Project - at - Cikarang - 1Document17 pagesFO-PR-03 Request For Proposal GENERAL Rev.02 - SLS - Access - Point - Project - at - Cikarang - 1Awaludin NurNo ratings yet

- TRI-ZEN Provides Energy Consulting Services in AsiaDocument2 pagesTRI-ZEN Provides Energy Consulting Services in AsiayousufsalauddinNo ratings yet

- SPRING Singapore Annual ReportDocument90 pagesSPRING Singapore Annual ReportCarrieNo ratings yet

- CBS Digital Business Leadership Program 2020 Brochure PDFDocument28 pagesCBS Digital Business Leadership Program 2020 Brochure PDFAnamika ChauhanNo ratings yet

- Ui - Drafting Spa (Abnr)Document40 pagesUi - Drafting Spa (Abnr)benadika sariNo ratings yet

- Demutualisation of Stock ExchangesDocument2 pagesDemutualisation of Stock ExchangesnehaggsNo ratings yet

- Digital Entrepreneurship Interfaces Between Digital Technologies and Entrepreneurship 2019 PDFDocument208 pagesDigital Entrepreneurship Interfaces Between Digital Technologies and Entrepreneurship 2019 PDFvirusNo ratings yet

- HBL ApaDocument49 pagesHBL Apajunii8093No ratings yet

- Agri BusinessDocument132 pagesAgri Businesstedaa0% (1)

- ATOS Standard Quality PlanDocument18 pagesATOS Standard Quality PlanAkram FerchichiNo ratings yet

- 1 STND Cost Calculation CK11N and CK24 - PPC1 & ZPC2Document15 pages1 STND Cost Calculation CK11N and CK24 - PPC1 & ZPC2Mohammad Aarif100% (1)

- Evolution of Management TheoriesDocument20 pagesEvolution of Management TheoriesKanishq BawejaNo ratings yet

- ISIP4112 ILMU PENGANTAR EKONOMI INISIASI 5 Struktur PasarDocument32 pagesISIP4112 ILMU PENGANTAR EKONOMI INISIASI 5 Struktur Pasarmanik suciNo ratings yet

- Chapter - 5 - c.MCQs On Workmen Compensation Act 1923Document4 pagesChapter - 5 - c.MCQs On Workmen Compensation Act 1923S M Mandar100% (1)

- Bassel 3Document7 pagesBassel 3Afzal HossenNo ratings yet

- Solutions to Brief ExercisesDocument61 pagesSolutions to Brief ExercisesDang ThanhNo ratings yet

- Country Attractiveness 1Document17 pagesCountry Attractiveness 1Selena NguyenNo ratings yet