Professional Documents

Culture Documents

Stock Market Reports For The Week (9th - 13th May '11)

Uploaded by

Dasher_No_1Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stock Market Reports For The Week (9th - 13th May '11)

Uploaded by

Dasher_No_1Copyright:

Available Formats

WEEKLY REPORT

09th May - 13th May 2011

Global Research Limited

STOCKS

R E P O R T

BEARS HAD UPPER HAND, BULLS TRY TO SNEAK !!

WEEK WRAP

The markets received a battering during the week as the policy action by the RBI resurrected lurking fears of unbriddled inflation and its effect on India Inc.

Bajaj Auto which was also the top loser in the auto pack, corrected by 9.8% at Rs 1319. Reliance Infra, Sterlite and Bharti Airtel lost around 7% each.

In the midcap space, Triveni Engineering plunged by 61% at Rs 39, SKS Microfinance corrected by 27% at Rs 331 and OnMobile Global lost 19.4% at Rs 112. And

the smallcap space saw the likes of Allied Digital plunging by 26% at Rs 66, Mastek losing 19% at Rs 94 and Money Matters losing 15% at Rs 52.

ASIAN & EMERGING MARKET

Asian markets saw selling pressure in early trade on Friday following weak US markets. At 8 hours IST, China's Shanghai Composite was trading at 2,849.22, down

23.18 points or 0.81%.

China's main stock index ended down 0.3 per cent on Friday at a more than two-month low, weighed down by energy shares as investors cut positions after a

sharp sell-off in commodities.

Australia Prepares to Tighten Fiscal Policy in Hit to Consumers Aiding RBA: Australia's government next week will unveil spending cuts aimed at assuring a return

to a budget surplus, helping the nation's central bank contain inflation at the expense of growth in the economy's 20th year of expansion.

US MARKET

The US equity markets declined as investors took profits ahead of a key government jobs report on Friday, and as energy shares extended losses after crude oil

plunged below USD 100 a barrel.

It was carnage across the commodity space, oil collapsed into free-fall diving more than 10% & the Nymex crude prices slipping below the USD 100 a barrel

mark. The resurgent dollar, coupled with demand concerns & disappointing economic da ta weighed on sentiment. Brent prices too dropped to USD 111 a barrel

levels.

Copper too nosedived more than 3% to its lowest level since December as fears about sputtering global growth and growing inflation risk triggered a vicious

cross-commodity crash.

MICRO ECONOMIC FRONT

Food inflation falls to 8.53% : Food inflation fell to 8.53% for the week ended April 23 on the back of fall in prices of pulses, reversing the upward trend seen in

the previous fortnight. Food inflation in the previous week was 8.76%.

Fruits and protein-based items continued to become more costly. Fruits became dearer by 32.69% year-on-year, while milk was up by 5.16% and eggs, meat and

fish by 5.13%.

Basu-led panel on inflation to meet tomorrow: Amid rising prices, the inter- ministerial group (IMG) on inflation will meet tomorrow to review the price rise

situation in the country. "The IMG will meet tomorrow," Chief Economic Advisor Kaushik Basu, who chairs the panel, said.

1 | APRIL 2011 | www.capitalvia.com

Global Research Limited

WEEKLY REPORT

09th May - 13th May 2011

BEARS HAD UPPER HAND, BULLS TRY TO SNEAK !!

NIFTY WORLD INDICES

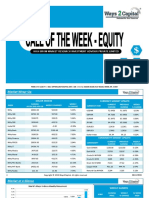

NIFTY Properties Values World Indices Close Weekly Chg Points % Chg

Weekly Open 5766.90 Sensex 18518.81 -617.15 -3.22%

Weekly High 5775.25 Nifty 5551.45 -215.45 -3.73%

Weekly Low 5443.65 DOW Jones 12638.74 -172 -1.34%

Weekly Close 5551.45 Shanghai Comp. 2864.15 -47.36 -1.62%

Weekly Chg Points -215.45 Nikkei 9859.20 +9.46 +0.09%

Weekly Chg% -3.73% CAC 40 4058.01 -48.9 1.19%

FTSE 5976.77 -93.13 -1.53%

SECTORIAL INDICES

Indices Open High Low Close

BANK NIFTY 11509.30 11543.35 10677.30 11145.10

CNX NIFTY JUNIOR 11385.05 11435.50 10746.70 10993.70

S&P CNX 500 4624.75 4632.90 4379.55 4460.45

CNX IT 6740.55 5772.40 6484.85 6627.00

CNX MIDCAP 8201.30 8237.35 7817.85 7965.40

CNX 100 5663.60 5674.45 5347.60 5455.40

GAINERS LOSERS

Scrip GAINERS

Current Close Change Chg % Scrip Current Close Change Chg %

BHARAT RASYAN 145.90 87.70 66.36 TRIVENI ENG 39.95 108.80 -63.28

MAN INDS 98.40 78.80 24.87 SHILPI CABLE 24.50 34.80 -29.59

PAPER PRODUCT 68.80 57.15 20.38 SHRIRAM TRNS 608.60 809.05 -24.77

MAN ALUMIN 62.70 52.10 20.34 CONSOL.CONST 38.75 51.45 -24.68

CAROL INFO 168.30 142.70 17.93 DHUN.INVEST 65.25 85.30 -23.50

DII’S INVESTMENTS FII’S INVESTMENTS

Indices Buy Value Sell Value Net Value Indices Buy Value Sell Value Net Value

05-May-2011 499.60 288.40 211.10 06-May-2011 1,990.70 2,613.60 -622.80

04-May-2011 759.90 513.40 246.50 05-May-2011 2,449.00 3,149.00 -700.00

03-May-2011 480.40 566.50 -86.10 04-May-2011 2,693.00 3,944.80 -1,251.80

02-May-2011 252.10 702.10 -450.00 03-May-2011 1,875.30 1,863.70 11.60

02-May-2011 3,239.70 3,434.50 -194.80

1 | DECEMBER 2010 | www.capitalvia.com

2 | APRIL 2011 | www.capitalvia.com

Global Research Limited

WEEKLY REPORT

09th May - 13th May 2011

BEARS HAD UPPER HAND, BULLS TRY TO SNEAK !!

WEEK AHEAD SPOT NIFTY

TECHNICALS

Properties Values

Support 1 5415

Support 2 5310

Resistance 1 5595

Resistance 2 5730

Figure: 1 Nifty Weekly

The Nifty futures closed and settled finally at 5555, down by 96.60 or -1.77 %. It is looking bullish in the coming trading session if it

manages to trade above the resistance level of 5595 else below support level of 5415 it would be in a downward trend.

WEEK AHEAD BANK NIFTY

TECHNICALS

Properties Values

Support 1 10788

Support 2 10520

Resistance 1 11775

Resistance 2 12050

Figure: Bank Nifty Weekly

Bank Nifty Futures shut stop at 11143.90 up by 395.45 points or 3.68 % It is looking bullish in the coming trading session if it

manages to trade above the resistance level of 11775 else below support level of 10788 it would be in a downward trend.

3 | APRIL 2011 | www.capitalvia.com

Global Research Limited

WEEKLY REPORT

09th May - 13th May 2011

BEARS HAD UPPER HAND, BULLS TRY TO SNEAK !!

STOCK OF THE WEEK - MCLEOD RUSSEL BUY

TECHNICAL PICTURE

MCLEOD RUSSEL IS IN CONSOLIDATION PHASE FROM LAST FEW TRADING SESSION. IF IT MANAGES TO SUSTAIN ABOVE 269 IT WILL

TAKE UP MOVE .WE RECOMMEND TO BUY MCLEOD RUSSEL IN CASH ABOVE 269 TARGET 273,278 WITH STOP LOSS OF 262.90.

MCLEOD RUSSEL LTD. Indices MCLEOD RUSSEL

Support 262.90

Resistance 269

Symbol MCLEODRUSS (NSE)

Company Name MCLEOD RUSSEL LTD.

Price `267.50

Change `5

Volume 148390

52 Week High 286.70

% From High -6.69%

Day High 269

EPS 21.40

4 | APRIL 2011 | www.capitalvia.com

Global Research Limited

WEEKLY REPORT

09th May - 13th May 2011

BEARS HAD UPPER HAND, BULLS TRY TO SNEAK !!

KEY STATISTICS

C Current Quarter Earning per Share. The Higher The Better.

WHY CAN SLIM?

Primary Factors

Almost 32.69% decrease in Q o Q Earnings.

A Annual Earnings Increases: Look for a significant growth.

Primary Factors

Annual Earnings showed an increase of 170.68% Y o Y.

N New Products, New Management, New Highs, Buying at

Right Time.

Primary Factors

MCLEOD RUSSEL LTD. is set to have a breakout as it is being

consolidating with positive biasness after a sharp fall previously.

“CAN SLIM is a formula created by

William J. O'Neil, who is the founder

of the Investor's Business Daily and

author of the book How to Make S Supply and Demand: Shares Outstanding Plus Big Volume

Demand.

Money in Stocks - A Winning System Primary Factors

in Good Times or Bad.

MCLEOD RUSSEL LTD. is a midcap stock consisting of Rs. 2840.80

crores Shares Outstanding (Total Public Shareholding)

Each letter in CAN SLIM stands for

one of the seven chief

characteristics that are commonly

found in the greatest winning

stocks. The C-A-N-S-L-I-M.

L Leader or Laggard: Which is your stock?

Primary Factors

MCLEOD RUSSEL LTD. is a leading stock with a relative strength

above 61.54% in Weekly and 51.72% in Daily.

characteristics are often present

prior to a stock making a significant

rise in price, and making huge

profits for the shareholders! I Institutional Sponsorship: Follow the Leaders.

Primary Factors

Approximately 45.67% of Shares are held by the Institutional

O'Neil explains how he conducted Investors (FII”s, Mutual Funds etc.)

an intensive study of 500 of the

biggest winners in the stock market

from 1953 to 1990. A model of each

of these companies was built and

M Market Direction

Primary Factors

studied. Again and again, it was

noticed that almost all of the If Market continues to remain in a secular uptrend, hence overall

biggest stock market winners had conditions are appropriate to initiate long position in the stock: A Big

very similar characteristics just plus for the Stock.

before they began their big moves.”

Sources: Sihl.in

5 | APRIL 2011 | www.capitalvia.com

Global Research Limited

WEEKLY REPORT

09th May - 13th May 2011

DISCLAIMER

The information and views in this report, our website & all the service we provide are believed to be reliable, but we do not accept any responsibility (or

liability) for errors of fact or opinion. Users have the right to choose the product/s that suits them the most.

Investment in Stocks has its own risks. Sincere efforts have been made to present the right investment perspective. The information contained herein is

based on analysis and up on sources that we consider reliable. We, however, do not vouch for the accuracy or the completeness thereof. This material is

for personal information and we are not responsible for any loss incurred based upon it & take no responsibility whatsoever for any financial profits or

loss which may arise from the recommendations above.

The stock price projections shown are not necessarily indicative of future price performance. The information herein, together with all estimates and

forecasts, can change without notice.

CapitalVia does not purport to be an invitation or an offer to buy or sell any financial instrument.

Analyst or any person related to CapitalVia might be holding positions in the stocks recommended.

It is understood that anyone who is browsing through the site has done so at his free will and does not read any views expressed as a recommendation for

which either the site or its owners or anyone can be held responsible for.

Our Clients (Paid Or Unpaid), Any third party or anyone else have no rights to forward or share our calls or SMS or Report or Any Information Provided by

us to/with anyone which is received directly or indirectly by them. If found so then Serious Legal Actions can be taken.

Any surfing and reading of the information is the acceptance of this disclaimer.

All Rights Reserved.

Contact Number:

Hotline: +91-91790-02828

Landline: +91-731-668000

Fax: +91-731-4238027

C O N TA C T U S

Corporate Office Address:

India: No. 99, 1st Floor, Surya Complex

CapitalVia Global Research Limited R. V. Road, Basavangudi

No. 506 West, Corporate House Opposite Lalbagh West Gate

169, R. N. T. Marg, Near D. A. V. V. Bangalore - 560004

Indore - 452001

Singapore:

CapitalVia Global Research Pvt. Ltd.

Block 2 Balestier Road

#04-665 Balestier Hill

Shopping Centre

Singapore - 320002

6 | APRIL 2011 | www.capitalvia.com

You might also like

- Stock Market Reports For The Week (21st - 25th March - 2011)Document6 pagesStock Market Reports For The Week (21st - 25th March - 2011)Dasher_No_1No ratings yet

- Stock Market Reports For The Week (16th - 20th May '11)Document6 pagesStock Market Reports For The Week (16th - 20th May '11)Dasher_No_1No ratings yet

- Equity Reports For The Week (25th - 29th April '11)Document6 pagesEquity Reports For The Week (25th - 29th April '11)Dasher_No_1No ratings yet

- Equity Reports For The Week (2nd - 6th May '11)Document6 pagesEquity Reports For The Week (2nd - 6th May '11)Dasher_No_1No ratings yet

- Equity Market Reports For The Week (18th - 22nd April 11)Document6 pagesEquity Market Reports For The Week (18th - 22nd April 11)Dasher_No_1No ratings yet

- Equity Reports For The Week (11th - 15th April 11)Document6 pagesEquity Reports For The Week (11th - 15th April 11)Dasher_No_1No ratings yet

- Equity Research Report 27 November 2018 Ways2CapitalDocument17 pagesEquity Research Report 27 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Equity Research Report 13 November 2018 Ways2CapitalDocument17 pagesEquity Research Report 13 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Equity Research Report 06 November 2018 Ways2CapitalDocument17 pagesEquity Research Report 06 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Equity Research Report 14 August 2018 Ways2CapitalDocument17 pagesEquity Research Report 14 August 2018 Ways2CapitalWays2CapitalNo ratings yet

- Stock Trading Analysis by Mansukh Investment and Trading Solutions 10/5/2010Document5 pagesStock Trading Analysis by Mansukh Investment and Trading Solutions 10/5/2010MansukhNo ratings yet

- Moneysukh Market Insight Report 25/3/2010Document5 pagesMoneysukh Market Insight Report 25/3/2010MansukhNo ratings yet

- Morning Notes 12 AUG, 10: Mansukh Securities and Finance LTDDocument5 pagesMorning Notes 12 AUG, 10: Mansukh Securities and Finance LTDMansukhNo ratings yet

- Equity Research Report 20 November 2018 Ways2CapitalDocument17 pagesEquity Research Report 20 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Money Maker Research Pvt. LTD.: Daily Equity ReportDocument6 pagesMoney Maker Research Pvt. LTD.: Daily Equity ReportMoney Maker ResearchNo ratings yet

- Equity Reports For The Week (4th October '10)Document10 pagesEquity Reports For The Week (4th October '10)Dasher_No_1No ratings yet

- Watch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Document11 pagesWatch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Damini CapitalNo ratings yet

- Weekly Special Report of CapitalHeight 23 July 2018Document11 pagesWeekly Special Report of CapitalHeight 23 July 2018Damini CapitalNo ratings yet

- Derivative Report 02 May UpdateDocument6 pagesDerivative Report 02 May UpdateDEEPAK MISHRANo ratings yet

- Daily Technicals (08-Dec-2023)Document18 pagesDaily Technicals (08-Dec-2023)drtohogNo ratings yet

- Stock Trading Report by Mansukh Investment & Trading Solutions 19/07/2010Document5 pagesStock Trading Report by Mansukh Investment & Trading Solutions 19/07/2010MansukhNo ratings yet

- Stock Trading Report by Mansukh Investment & Trading Solutions 1/07/2010Document5 pagesStock Trading Report by Mansukh Investment & Trading Solutions 1/07/2010MansukhNo ratings yet

- Stock Market Outlook by Mansukh Investment & Trading Solutions 06/08/2010Document5 pagesStock Market Outlook by Mansukh Investment & Trading Solutions 06/08/2010MansukhNo ratings yet

- Equity DailyDocument4 pagesEquity DailyArvsrvNo ratings yet

- Report On Stock Trading Report by Mansukh Investment & Trading Solutions 6/07/2010Document5 pagesReport On Stock Trading Report by Mansukh Investment & Trading Solutions 6/07/2010MansukhNo ratings yet

- Report On Stock Trading Report by Mansukh Investment & Trading Solutions 22/06/2010Document5 pagesReport On Stock Trading Report by Mansukh Investment & Trading Solutions 22/06/2010MansukhNo ratings yet

- Stock Market Analysis by Mansukh Investment & Trading Solutions 27/8/2010Document5 pagesStock Market Analysis by Mansukh Investment & Trading Solutions 27/8/2010MansukhNo ratings yet

- Daily Market Sheet 1-5-10Document2 pagesDaily Market Sheet 1-5-10chainbridgeinvestingNo ratings yet

- Morning Notes 23 July: Mansukh Securities and Finance LTDDocument5 pagesMorning Notes 23 July: Mansukh Securities and Finance LTDMansukhNo ratings yet

- Market Outlook by Mansukh Investment & Trading Solutions 13/08/2010Document5 pagesMarket Outlook by Mansukh Investment & Trading Solutions 13/08/2010MansukhNo ratings yet

- Stock Trading Report by Mansukh Investment & Trading Solutions5/07/2010Document5 pagesStock Trading Report by Mansukh Investment & Trading Solutions5/07/2010MansukhNo ratings yet

- Analysis On Stock Trading by Mansukh Investment & Trading Solutions 12/5/2010Document5 pagesAnalysis On Stock Trading by Mansukh Investment & Trading Solutions 12/5/2010MansukhNo ratings yet

- Weekly Newsletter Equity 30-SEPT-2017Document7 pagesWeekly Newsletter Equity 30-SEPT-2017Market Magnify Investment Adviser & ResearchNo ratings yet

- Most Market Outlook Most Market Outlook Most Market Outlook: Morning UpdateDocument7 pagesMost Market Outlook Most Market Outlook Most Market Outlook: Morning Updatevikalp123123No ratings yet

- Derivative Report 6march2017Document6 pagesDerivative Report 6march2017ram sahuNo ratings yet

- Article On Stock Trading by Mansukh Investment & Trading Solutions 28/05/2010Document5 pagesArticle On Stock Trading by Mansukh Investment & Trading Solutions 28/05/2010MansukhNo ratings yet

- Daily FNO Overview: Retail ResearchDocument5 pagesDaily FNO Overview: Retail ResearchjaimaaganNo ratings yet

- Article On Stock Trading by Mansukh Investment & Trading Solutions 08/06/2010Document5 pagesArticle On Stock Trading by Mansukh Investment & Trading Solutions 08/06/2010MansukhNo ratings yet

- Report On Stock Trading Report by Mansukh Investment & Trading Solutions 25/06/2010Document5 pagesReport On Stock Trading Report by Mansukh Investment & Trading Solutions 25/06/2010MansukhNo ratings yet

- Morning Notes 14 July 2010: Mansukh Securities and Finance LTDDocument5 pagesMorning Notes 14 July 2010: Mansukh Securities and Finance LTDMansukhNo ratings yet

- Analysis On Market Outlook by Mansukh Investment & Trading Solutions 11/08/2010Document5 pagesAnalysis On Market Outlook by Mansukh Investment & Trading Solutions 11/08/2010MansukhNo ratings yet

- Equity Report 6 To 10 NovDocument6 pagesEquity Report 6 To 10 NovzoidresearchNo ratings yet

- A Report On Stock Market Trading by Mansukh Investment and Trading Solutions 26/4/2010Document5 pagesA Report On Stock Market Trading by Mansukh Investment and Trading Solutions 26/4/2010MansukhNo ratings yet

- Daily Market Sheet 12-7-09Document2 pagesDaily Market Sheet 12-7-09chainbridgeinvestingNo ratings yet

- Expect Some Materialistic Cushions Around 6000 Level - Market Outlook For 12 Oct 2010Document5 pagesExpect Some Materialistic Cushions Around 6000 Level - Market Outlook For 12 Oct 2010MansukhNo ratings yet

- January 25th, 2019: Currency Spot Expiry Open High Low Close % CHG OI % CHG in OIDocument2 pagesJanuary 25th, 2019: Currency Spot Expiry Open High Low Close % CHG OI % CHG in OISachin GuptaNo ratings yet

- Analysis On Stock Market Outlook by Mansukh Investment 16 Aug, 2010Document5 pagesAnalysis On Stock Market Outlook by Mansukh Investment 16 Aug, 2010MansukhNo ratings yet

- Daily Market Sheet 12-11-09Document2 pagesDaily Market Sheet 12-11-09chainbridgeinvestingNo ratings yet

- Morning Breifing 27-01-2020Document17 pagesMorning Breifing 27-01-2020afnaniqbalNo ratings yet

- Analysis On Stock Market Outlook by Mansukh Investment & Trading Solutions 23aug, 2010Document5 pagesAnalysis On Stock Market Outlook by Mansukh Investment & Trading Solutions 23aug, 2010MansukhNo ratings yet

- Daily Technicals (31-May-2023) - 230531 - 090018Document19 pagesDaily Technicals (31-May-2023) - 230531 - 090018ajayNo ratings yet

- Analysis On Stock Trading by Mansukh Investment & Trading Solutions 31/05/2010Document5 pagesAnalysis On Stock Trading by Mansukh Investment & Trading Solutions 31/05/2010MansukhNo ratings yet

- How Power Bi Will Help in Visual Representation of DataDocument4 pagesHow Power Bi Will Help in Visual Representation of DatadevalankaratharvaNo ratings yet

- Morning Notes 13 July 2010: Mansukh Securities and Finance LTDDocument5 pagesMorning Notes 13 July 2010: Mansukh Securities and Finance LTDMansukhNo ratings yet

- Stock Market Outlook by Mansukh Investment & Trading Solutions 29/07/2010Document5 pagesStock Market Outlook by Mansukh Investment & Trading Solutions 29/07/2010MansukhNo ratings yet

- Nifty Daily Movement and Stocks Technical AnalysisDocument5 pagesNifty Daily Movement and Stocks Technical AnalysisNiraj KumarNo ratings yet

- 5 Dec 16Document3 pages5 Dec 16asifNo ratings yet

- Index Movement:: National Stock Exchange of India LimitedDocument36 pagesIndex Movement:: National Stock Exchange of India LimitedTrinadh Kumar GuthulaNo ratings yet

- Securities Operations: A Guide to Trade and Position ManagementFrom EverandSecurities Operations: A Guide to Trade and Position ManagementRating: 4 out of 5 stars4/5 (3)

- Stock Market Reports For The Week (16-20th August '11)Document5 pagesStock Market Reports For The Week (16-20th August '11)Dasher_No_1No ratings yet

- Bullion Commodity Reports For The Week (16-20th August '11)Document8 pagesBullion Commodity Reports For The Week (16-20th August '11)Dasher_No_1No ratings yet

- Stock Market Reports For The Week (8th - 12th August '11)Document5 pagesStock Market Reports For The Week (8th - 12th August '11)Dasher_No_1No ratings yet

- Bullion Commodity Reports For The Week (1st - 5th August '11)Document8 pagesBullion Commodity Reports For The Week (1st - 5th August '11)Dasher_No_1No ratings yet

- Bullion Commodity Reports For The Week (8th - 12th August '11)Document8 pagesBullion Commodity Reports For The Week (8th - 12th August '11)Dasher_No_1No ratings yet

- Stock Market Reports For The Week (1st - 5th August '11)Document5 pagesStock Market Reports For The Week (1st - 5th August '11)Dasher_No_1No ratings yet

- Nifty 50 Reports For The Week (16-20th August '11)Document52 pagesNifty 50 Reports For The Week (16-20th August '11)Dasher_No_1No ratings yet

- Agri Commodity Reports For The Week (16-20th August '11)Document6 pagesAgri Commodity Reports For The Week (16-20th August '11)Dasher_No_1No ratings yet

- Stock Futures and Options Reports For The Week (8th - 12th August '11)Document4 pagesStock Futures and Options Reports For The Week (8th - 12th August '11)Dasher_No_1No ratings yet

- Nifty 50 Reports For The Week (1st - 5th August '11)Document52 pagesNifty 50 Reports For The Week (1st - 5th August '11)Dasher_No_1No ratings yet

- Agri Commodity Reports For The Week (1st - 5th August '11)Document6 pagesAgri Commodity Reports For The Week (1st - 5th August '11)Dasher_No_1No ratings yet

- Nifty 50 Reports For The Week (8th - 12th August '11)Document52 pagesNifty 50 Reports For The Week (8th - 12th August '11)Dasher_No_1No ratings yet

- Rollover Statistics (From July 2011 Series To September 2011 Series)Document10 pagesRollover Statistics (From July 2011 Series To September 2011 Series)Dasher_No_1No ratings yet

- Agri Commodity Reports For The Week (8th - 12th August '11)Document6 pagesAgri Commodity Reports For The Week (8th - 12th August '11)Dasher_No_1No ratings yet

- Stock Futures and Option Reports For The Week (25th - 29th July '11)Document4 pagesStock Futures and Option Reports For The Week (25th - 29th July '11)Dasher_No_1No ratings yet

- Bullion Commodity Reports For The Week (25th - 29th July '11)Document8 pagesBullion Commodity Reports For The Week (25th - 29th July '11)Dasher_No_1No ratings yet

- Stock Market Reports For The Week (25th - 29th July '11)Document5 pagesStock Market Reports For The Week (25th - 29th July '11)Dasher_No_1No ratings yet

- Nifty 50 Reports For The Week (25th - 29th July '11)Document52 pagesNifty 50 Reports For The Week (25th - 29th July '11)Dasher_No_1No ratings yet

- Nifty 50 Reports For The Week (11th - 15th July '11)Document52 pagesNifty 50 Reports For The Week (11th - 15th July '11)Dasher_No_1No ratings yet

- Agri Commodity Reports For The Week (25th - 29th July '11)Document6 pagesAgri Commodity Reports For The Week (25th - 29th July '11)Dasher_No_1No ratings yet

- Bulion Commodity Reports For The Week (11th - 15th July '11)Document8 pagesBulion Commodity Reports For The Week (11th - 15th July '11)Dasher_No_1No ratings yet

- Stock Market Reports For The Week (11th - 15th July '11)Document5 pagesStock Market Reports For The Week (11th - 15th July '11)Dasher_No_1No ratings yet

- Nifty 50 Reports For The Week (4th - 8th July '11)Document52 pagesNifty 50 Reports For The Week (4th - 8th July '11)Dasher_No_1No ratings yet

- Rollover Statistics (From June 2011 Series To July 2011 Series)Document10 pagesRollover Statistics (From June 2011 Series To July 2011 Series)Dasher_No_1No ratings yet

- Agri Commodity Reports For The Week (11th - 15th July '11)Document6 pagesAgri Commodity Reports For The Week (11th - 15th July '11)Dasher_No_1No ratings yet

- Stock Market Reports For The Week (4th - 8th July '11)Document5 pagesStock Market Reports For The Week (4th - 8th July '11)Dasher_No_1No ratings yet

- Agri Commodity Reports For The Week (4th - 8th July '11)Document6 pagesAgri Commodity Reports For The Week (4th - 8th July '11)Dasher_No_1No ratings yet

- Bullion Commodity Reports For The Week (4th - 8th July '11)Document8 pagesBullion Commodity Reports For The Week (4th - 8th July '11)Dasher_No_1No ratings yet

- Online Test 3: Cost of Capital AnalysisDocument16 pagesOnline Test 3: Cost of Capital AnalysisShereena FarhoudNo ratings yet

- How Much Is The Minimum Stock Investment in The Philippines?Document4 pagesHow Much Is The Minimum Stock Investment in The Philippines?Laws HackerNo ratings yet

- Wally Considers Adding Income Stocks for Higher DividendsDocument18 pagesWally Considers Adding Income Stocks for Higher Dividendscathy evangelistaNo ratings yet

- Tutorial 6 - SolutionsDocument8 pagesTutorial 6 - SolutionsNguyễn Phương ThảoNo ratings yet

- Form2a Utkarshbnk NRDocument8 pagesForm2a Utkarshbnk NRzalak jintanwalaNo ratings yet

- Group Assignment 3 - Fall 2021 - Ashwin BaluDocument16 pagesGroup Assignment 3 - Fall 2021 - Ashwin Baluhalelz69No ratings yet

- CIMA F2 Course Notes PDFDocument293 pagesCIMA F2 Course Notes PDFganNo ratings yet

- Apple Cash Case StudyDocument2 pagesApple Cash Case StudyJanice JingNo ratings yet

- Daily MTR File Uploading & Client ReportingDocument37 pagesDaily MTR File Uploading & Client ReportingMohit DudheriaNo ratings yet

- Share MarketDocument3 pagesShare MarketxyyzzxxNo ratings yet

- Bangladesh Securities Laws and Market ScamsDocument415 pagesBangladesh Securities Laws and Market Scamsshakhawat HossainNo ratings yet

- Security MarketDocument30 pagesSecurity Marketashish_k_srivastavaNo ratings yet

- Project Report On Karvy Mutual Fund ServicesDocument71 pagesProject Report On Karvy Mutual Fund ServicesAkshay Singh88% (17)

- Pakistan Stock Exchange Limited: List of Office(s) /branch Office(s)Document55 pagesPakistan Stock Exchange Limited: List of Office(s) /branch Office(s)shaheerNo ratings yet

- The Three Point Reversal Method of Point & Figure Stock Market Trading by A.W. CohenDocument129 pagesThe Three Point Reversal Method of Point & Figure Stock Market Trading by A.W. CohenSal Cibus92% (26)

- Stock Valuation and Risk PDFDocument3 pagesStock Valuation and Risk PDFhenryNo ratings yet

- Zero To Billions - The Zerodha StoryDocument45 pagesZero To Billions - The Zerodha StoryVacancies ProfessionalsNo ratings yet

- List of Money Market Funds CompaniesDocument8 pagesList of Money Market Funds CompaniesKurt SoriaoNo ratings yet

- Enterprises v. SEC)Document3 pagesEnterprises v. SEC)Mike E DmNo ratings yet

- Sources of Savings and InvestmentsDocument10 pagesSources of Savings and InvestmentsFradel FragioNo ratings yet

- Cheat Sheet Earnings Per ShareDocument2 pagesCheat Sheet Earnings Per ShareJaneNo ratings yet

- Project BSEDocument13 pagesProject BSEakshitauna100No ratings yet

- Introduction To Finance: Stock ValuationDocument20 pagesIntroduction To Finance: Stock ValuationZenedel De JesusNo ratings yet

- Chapter 3 Solution Updated2 PDFDocument4 pagesChapter 3 Solution Updated2 PDFShakkhor ChowdhuryNo ratings yet

- Project On NJ India Invest PVT LTDDocument77 pagesProject On NJ India Invest PVT LTDrajveerpatidar69% (26)

- Artificial Neural Network Model For Forecasting Foreign Exchange RateDocument9 pagesArtificial Neural Network Model For Forecasting Foreign Exchange RateWorld of Computer Science and Information Technology JournalNo ratings yet

- Basics of Mutual Funds-By HDFC AMCDocument41 pagesBasics of Mutual Funds-By HDFC AMCRupanjali Mitra BasuNo ratings yet

- ch13 Corporations 1Document52 pagesch13 Corporations 1Pakistani ReactionNo ratings yet

- Wealth CreationDocument23 pagesWealth CreationSweta HansariaNo ratings yet

- Measure Asset & Financial Performance RatiosDocument3 pagesMeasure Asset & Financial Performance RatiosJhon Ray RabaraNo ratings yet