Professional Documents

Culture Documents

Comparing DDM and FCFE Models: Two Stage Valuation: Inputs For FCFE Calculation

Uploaded by

Vijay ChotraniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comparing DDM and FCFE Models: Two Stage Valuation: Inputs For FCFE Calculation

Uploaded by

Vijay ChotraniCopyright:

Available Formats

Two-Stage FCFE Discount Model

Comparing DDM and FCFE Models: Two Stage Valuation

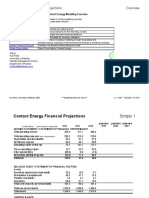

Inputs for FCFE Calculation Current Net Income = Current Dividends = Current Capital Expenditures = Current Depreciation Current Revenue = Current Working Capital = Net Debt Cashflow = $100.00 $30.00 $75.00 $50.00 $1,000.00 $50.00 $10.00 (in currency) (in currency) (in currency) (in currency) (in currency)

Enter length of extraordinary growth period = Enter growth rate for high growth period =

5 10.00%

(in years)

Inputs for cost of equity Beta of the stock = Riskfree rate= Risk Premium= 1 5.00% 4.00% (in percent) (in percent)

Enter growth rate in stable growth period?

4.00%

(in percent)

Page

Two-Stage FCFE Discount Model

Return on equity in stable growth = Will the beta to change in the stable period? If yes, enter the beta for stable period =

12.00% No 1 (Yes or No)

To reconcile the dividend discount model and the FCFE model, you have to input the following: Do you want to assume that the cash buildup that will occur if dividends < FCFE get reinvested at the cost of equity = If not, enter the rate of return you expect to earn on this cash (assuming that it is invested at current risk level) =

Output from the program

Cost of Equity = 9.00%

Net Income = Expected growth rate in net income =

$100.00 10.00%

Growth Rate in capital spending, depreciation and working capital High Growth Growth rate in capital spending = Growth rate in depreciation = Growth rate in revenues = 10.00% 10.00% 10.00% Stable Growth 4.00% 4.00% 4.00%

Working Capital as percent of revenues = Cash builds up gets invested at

5.00% 7.00%

(in percent)

The FCFE for the high growth phase are shown below (upto 6 years) 1 Net Income - (CapEx-Depreciation) - Change in Working Capital + Net Debt Cash flow Free Cashflow to Equity Dividends PV of FCFE PV of Dividends $110.00 $27.50 $5.00 $11.00 $88.50 $33.00 $81.19 $30.28 2 $121.00 $30.25 $5.50 $12.10 $97.35 $36.30 $81.94 $30.55 3 $133.10 $33.28 $6.05 $13.31 $107.09 $39.93 $82.69 $30.83 4 $146.41 $36.60 $6.66 $14.64 $117.79 $43.92 $83.45 $31.12

Page

Two-Stage FCFE Discount Model

Cash Build up (invested at specified rate)

$55.50

$120.44

$196.02

$283.61

FCFE Growth Rate in Stable Phase = FCFE (Dividends) in Stable Phase = Cost of Equity in Stable Phase = Price at the end of growth phase = Additional cash build up over high growth period = 4.00% $111.66 9.00% $2,233.24

DDM 4.00% $111.66 9.00% $2,233.24 $384.72

FCFE Present Value of FCFE in high growth phase = Present Value of Terminal Price = Present Value of Cash build up in terminal year = Value of the stock = $1,864.93 $413.48 $1,451.45

DDM $154.18 $1,451.45 $250.04 $1,855.68

Page

Two-Stage FCFE Discount Model

tage Valuation

Page

Two-Stage FCFE Discount Model

No 7%

5 $161.05 $40.26 $7.32 $16.11 $129.57 $48.32 $84.21 $31.40

Page

Two-Stage FCFE Discount Model

$384.72

$9.26

Page

Two-Stage FCFE Discount Model

Page

Two-Stage FCFE Discount Model

Terminal Year $167.49 $69.36 $3.22 $16.75 $111.66

Page

Two-Stage FCFE Discount Model

$384.72

Page

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- FcffvsfcfeDocument2 pagesFcffvsfcfePro ResourcesNo ratings yet

- FirmmultDocument2 pagesFirmmultPro ResourcesNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Degree Polynomial:: Generic Yield Interpolation ChartDocument9 pagesDegree Polynomial:: Generic Yield Interpolation Chartapi-3763138No ratings yet

- Bond Duration - Dynamic ChartDocument3 pagesBond Duration - Dynamic Chartapi-3763138No ratings yet

- EuroTunnDCFDocument11 pagesEuroTunnDCFNgọc Hiền Nguyễn PhanNo ratings yet

- Year FCFF Terminal Value Present Value 1 2 3 4 5 6 7 8 9 10 $318.13 $60,899.33 $19,986.47 $16,041.34Document19 pagesYear FCFF Terminal Value Present Value 1 2 3 4 5 6 7 8 9 10 $318.13 $60,899.33 $19,986.47 $16,041.34api-3763138No ratings yet

- WSP Levered DCF Model VFDocument5 pagesWSP Levered DCF Model VFBlahNo ratings yet

- FCFF 2 STDocument24 pagesFCFF 2 STapi-3701114No ratings yet

- FCFFSTDocument10 pagesFCFFSTapi-3701114No ratings yet

- Valuing Amazon with FCFF ModelDocument16 pagesValuing Amazon with FCFF ModelEsteban Camilo Ortiz ZambranoNo ratings yet

- DCF Calculator - V2.2Document5 pagesDCF Calculator - V2.2MuhammadYahsyallahNo ratings yet

- EqmultDocument2 pagesEqmultPro ResourcesNo ratings yet

- Synergy Calculator For Mergers and AcquisitionsDocument6 pagesSynergy Calculator For Mergers and AcquisitionsRoopika PalukurthiNo ratings yet

- Synergy Valuation WorksheetDocument6 pagesSynergy Valuation WorksheetRishav AgarwalNo ratings yet

- Ch24sol PDFDocument5 pagesCh24sol PDFSandeep MishraNo ratings yet

- Dividend Discount Model ExplainedDocument31 pagesDividend Discount Model ExplainedRimpy SondhNo ratings yet

- Glob CrossDocument18 pagesGlob Crossminhthuc203No ratings yet

- FirmmultDocument2 pagesFirmmultapi-3763138No ratings yet

- Alternative A Alternative B Alternative CDocument9 pagesAlternative A Alternative B Alternative CMohitNo ratings yet

- Fcfe 2 STDocument13 pagesFcfe 2 STpawankumarsahu42No ratings yet

- DivginzuDocument34 pagesDivginzuveda20No ratings yet

- 2019-09-21T174353.577Document4 pages2019-09-21T174353.577Mikey MadRat100% (1)

- Time Value of Money: Professor XXX Course Name/numberDocument34 pagesTime Value of Money: Professor XXX Course Name/numbersumuewuNo ratings yet

- Group2 - Assignment 1Document9 pagesGroup2 - Assignment 1RiturajPaulNo ratings yet

- A General FCFF Valuation Model An N-Stage ModelDocument17 pagesA General FCFF Valuation Model An N-Stage Modelapi-3763138No ratings yet

- Two Stage Dividend Growth ModelDocument11 pagesTwo Stage Dividend Growth ModelmichaelwainsteinNo ratings yet

- Two-Stage FCFE Model ValuationDocument14 pagesTwo-Stage FCFE Model ValuationAnkita HandaNo ratings yet

- FcffevaDocument6 pagesFcffevaShobhit GoyalNo ratings yet

- Inputs For Valuation Current InputsDocument6 pagesInputs For Valuation Current InputsÃarthï ArülrãjNo ratings yet

- Inputs For Valuation Current InputsDocument6 pagesInputs For Valuation Current Inputsapi-3763138No ratings yet

- Connection Between Dividends and Stock Values, Equity MarketsDocument57 pagesConnection Between Dividends and Stock Values, Equity MarketsPramod Vasudev0% (1)

- WSP Terminal Value VFDocument5 pagesWSP Terminal Value VFShane BrooksNo ratings yet

- Two-Stage FCFF Model Excel FileDocument2 pagesTwo-Stage FCFF Model Excel FilenadeemamNo ratings yet

- DivginzuDocument20 pagesDivginzuapi-3763138No ratings yet

- Lesson 2Document55 pagesLesson 2Anh MinhNo ratings yet

- Fcfe Stable Growth ModelDocument5 pagesFcfe Stable Growth ModelJagrNo ratings yet

- Fcfe Stable Growth ModelDocument5 pagesFcfe Stable Growth ModelDread NoughtNo ratings yet

- FcfestDocument5 pagesFcfestPro ResourcesNo ratings yet

- Inverse relationship between bond prices and interest ratesDocument10 pagesInverse relationship between bond prices and interest ratesNidhi AshokNo ratings yet

- FCFE Discount Model: AssumptionsDocument39 pagesFCFE Discount Model: Assumptionsrobidey08No ratings yet

- Inputs: FCFF Stable Growth ModelDocument12 pagesInputs: FCFF Stable Growth ModelKojiro FuumaNo ratings yet

- Facebook IPO caseHBRDocument29 pagesFacebook IPO caseHBRCrazy Imaginations100% (1)

- Div GinzuDocument42 pagesDiv GinzujenkisanNo ratings yet

- DCF Analysis Discounted Cash Flow ValuationDocument4 pagesDCF Analysis Discounted Cash Flow ValuationChristopher GuidryNo ratings yet

- Firm Multiples: Current InputsDocument2 pagesFirm Multiples: Current InputszNo ratings yet

- Firm Multiples: Current InputsDocument2 pagesFirm Multiples: Current InputssambarocksNo ratings yet

- 04. TVPI, DPI, RVPI -Venture Capital ValuationsDocument21 pages04. TVPI, DPI, RVPI -Venture Capital Valuationsharshit.dwivedi320No ratings yet

- DCF Template: Exit MultipleDocument11 pagesDCF Template: Exit MultipleShane BrooksNo ratings yet

- FcfestDocument5 pagesFcfestJagrNo ratings yet

- Fcfe Stable Growth ModelDocument5 pagesFcfe Stable Growth Modelapi-3763138No ratings yet

- Revised ModelDocument27 pagesRevised ModelAnonymous 0CbF7xaNo ratings yet

- DCF Template Key Assumptions and Projected Cash FlowsDocument11 pagesDCF Template Key Assumptions and Projected Cash FlowsBrian DongNo ratings yet

- Synergy ValuationDocument2 pagesSynergy ValuationrobinkapoorNo ratings yet

- What Is Leveraged Buyout Model Aka LBO Model?Document5 pagesWhat Is Leveraged Buyout Model Aka LBO Model?bhumiklalka999No ratings yet

- Abc CompanyDocument3 pagesAbc CompanyJOHN MITCHELL GALLARDONo ratings yet

- Calculate Break-Even Point Using Accounting Profit FormulaDocument5 pagesCalculate Break-Even Point Using Accounting Profit FormulagiangphtNo ratings yet

- Lesson 3Document29 pagesLesson 3Anh MinhNo ratings yet

- I. Income StatementDocument27 pagesI. Income StatementNidhi KaushikNo ratings yet

- Personal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyFrom EverandPersonal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Stiglitz Weiss 1981 Implementation by Kurt HessDocument20 pagesStiglitz Weiss 1981 Implementation by Kurt Hessapi-3763138No ratings yet

- Cody - Smith - Chap 5Document24 pagesCody - Smith - Chap 5api-3763138No ratings yet

- Cody - Smith - Chap 4Document36 pagesCody - Smith - Chap 4api-3763138100% (1)

- Refresh Worksheet ListDocument14 pagesRefresh Worksheet Listapi-3763138No ratings yet

- Optimal Portfolio Assignment FINA 515 2005 Ray Guo (P)Document76 pagesOptimal Portfolio Assignment FINA 515 2005 Ray Guo (P)api-3763138No ratings yet

- SchwartzMoon (2000) Rational Pricing Internet CpyDocument14 pagesSchwartzMoon (2000) Rational Pricing Internet Cpyapi-3763138No ratings yet

- Optimal Portfolio Assignment Solution StrudwickDocument10 pagesOptimal Portfolio Assignment Solution Strudwickapi-3763138No ratings yet

- Relative Value Models (Feb04)Document18 pagesRelative Value Models (Feb04)api-3763138No ratings yet

- Endowment - Warrant - Valuer (McVerry) DDocument244 pagesEndowment - Warrant - Valuer (McVerry) Dapi-3763138No ratings yet

- Spline Basis Function Approximating Discount Function Fitting Bond UniverseDocument5 pagesSpline Basis Function Approximating Discount Function Fitting Bond Universeapi-3763138No ratings yet

- Estimating Growth Rates (Teaching Model)Document4 pagesEstimating Growth Rates (Teaching Model)api-3763138No ratings yet

- Contact - Main 2006Document89 pagesContact - Main 2006api-3763138No ratings yet

- Δr=α b−r Δt+σε Δt: Simulation of short-term interest ratesDocument19 pagesΔr=α b−r Δt+σε Δt: Simulation of short-term interest ratesapi-3763138No ratings yet

- Term Structure JP Morgan Model (Feb04)Document7 pagesTerm Structure JP Morgan Model (Feb04)api-3763138No ratings yet

- BbandsDocument12 pagesBbandsapi-3763138No ratings yet

- Stock Price Random ProcessesDocument63 pagesStock Price Random Processesapi-3763138No ratings yet

- RV YTM Model PDFDocument47 pagesRV YTM Model PDFAllen LiNo ratings yet

- Converts PrimerDocument6 pagesConverts Primerjunjun07_01No ratings yet

- Longstaff Schwartz (95) Risky Debt (P)Document18 pagesLongstaff Schwartz (95) Risky Debt (P)api-3763138No ratings yet

- Bond Price With Excel FunctionsDocument6 pagesBond Price With Excel Functionsapi-3763138No ratings yet

- Bond Pricing - Dynamic ChartDocument4 pagesBond Pricing - Dynamic Chartapi-3763138No ratings yet

- Bond Pricing - Dynamic ChartDocument4 pagesBond Pricing - Dynamic Chartapi-3763138No ratings yet

- Bond Pricing - System of Five Bond VariablesDocument2 pagesBond Pricing - System of Five Bond Variablesapi-3763138No ratings yet

- Bond Pricing - by Yield To MaturityDocument3 pagesBond Pricing - by Yield To Maturityapi-3763138No ratings yet

- Bond Duration - Price Sensitivity Using DurationDocument3 pagesBond Duration - Price Sensitivity Using Durationapi-3763138No ratings yet

- Bond Pricing - BasicsDocument2 pagesBond Pricing - Basicsapi-3763138No ratings yet