Professional Documents

Culture Documents

Green Dot Eductational Project AKA Green Dot Public Schools 2008 Form 990

Uploaded by

Robert D. Skeels0 ratings0% found this document useful (0 votes)

46 views30 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

46 views30 pagesGreen Dot Eductational Project AKA Green Dot Public Schools 2008 Form 990

Uploaded by

Robert D. SkeelsCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 30

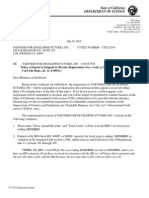

[site GRAPHIC print DO NOT PROCESS [As Filed bata—[ DIN; 9349314101130]

990 Return of Organization Exempt From Income Tax [ome Ne 1545-0047

6

ee | 9008

See eens

Pen

I> The organization may have to use a copy of tis return to satisty state reporting requirements

(07-01-2008 are ending 06-30-3008

TF datress change 95-4579611

Dong BST S Tielephone number

Tame change

een aR ae FT wl Ces we TT paiuenens

ame tos avsetes, ca 90071

F Name and address of Principal Mice? Hla) ts this» group return for

MaRco PETRUZZI CEO aiintes? ves Fn

LOS ANGELES,CA 9007].

1b) Avot atatsincidea? yee Fe

7 Torcentme F501 (3) (310) 748-1014

Nay the TRS discuss this return wth the preparer shown above? (See matructions) vs ys Tver Pwo

Sea ear Sa a ae eee aia ane

Form 990 (2008)

[EIIER statement of Program Ser

1 tety desde the organzatons mission

=e Accomplishments (See the instruchons.)

2B he orgrvzatin undertake any sanricatpronram services during the year which ware no sted on

thepnorFerm 990 0r990-E27 ve se ey et ge eee ne en FYe8 No

I¢-Yes,"desenbe these new services on Schedule O

3. 01d the organization cease conducting or make significant changes in how it conducts any progrem

Sevicesy ee eee Kes FF No

1F-Yes,"desenbe these changes on Schedule O

4 Describe the exempt purpose achievements for each ofthe organisation's three largest program services by exps

Section $01 (¢)(3) and (4) organizations and 4947/(a)(1) tusts are required to report the amount of grants and a

others, the total expenses, and revenve, any, foreach program service reported

ae (Cove 1 (xpos § 7693768 _wcvding gaeeoF 0) (Revene 0

‘a (Cove Vxpeees § vraag aos Vevenie s 7

ae (Code V(Expeses § vechaing gars of 7 Revenie 7

‘4d Other program services (Describe in Schedule O )

(expenses $ including grants of 0 ) (Revenue $ 2

‘de Total program service expenses § 76,193,765 _Nust equal Par 1X, une 25, column (8)

ae ae

Form 990 (2008)

Checklist of Required Schedules

10

n

2

16

y

1

20

a

6

Page 3

15 the organization geseribed in section 501(€)(3) oF 4947(a}(1) (other than 8 private foundation)? 1f "Yes,"

yy ae ee ee

15 the organization required to complete Schedule 8, Schedule of Contributors? . - 2. we

Did the organization engage in direct or indirect political campaign activities on behalf of o in opposition to

candidates for public office? If "Yes,"complete Schedule, FatI ive + ts tet tw

Section 501 (e)(3) organizations Did the organization engage in lobbying activities? 1f"¥es,"complete Schedule C,

facie te cee ee eee eee ee ee

Section 501(¢)(4), 504(c)(5), and 501(c)(6) organizations Is the organization subject to the section 6033(¢)

notice and reporting requirement and proxy tax? If "Yee,"complete Schedule, Part IIT. .

Did the organization maintain any donor advised funds or any accounts where donors have the right to provide

fdvice on the distnbutien or investment of amounts in such funds or aecounte? 1f “Yes,” complete

Schedule, PartT se ee ee te

Did the organization receive of hold a conservation easement, including easements to preserve open space,

fhe environment, histone land areas or historic structures? If Yes, complete Schedule, Pat Il +

Did the organization maintain collections of works of ar, historical treasures, or ther sumllar assets? If "Yes,"

complete ScheduleD, Pat HIT ve ve tet ee te ee

Did the organization report an amount n Part X, line 24, serve as a custodian for amounts not listed in Part X, or

provide eredit counseling, debt management, erect repair, or debt negetiation services? ff "Yes,"

complete ScheduleD, Pat IV ve te te et et ee et tne

id the organization hold assets in term, permanent.or quasi-endowments? If "Yes," complete Schedule D, Part V

id the organization report an amount in PartX, lings 10, 12,13, 15, or 25? IF "Yes,”complete Schedule D,

Parts VI, VIE, VIEL, 1%, er Xs applicable. sv ee ee ee

Did the organization raceive an audited financial statement for the year for which tse completing this return

that was prepared in accordance with GAAP? If "Yes," complete Schedule 0, Parte XI, XII, and XIE.

15 the organization a schoo! as desenbed in section 170(b)(1)(R)(u)? If "Yes," complete Schedule ©

Did the organization maintain an office, employees, or agents outside oftheUS? 2 2 2 2 2 ee

Did the organization have eggregate revenues or expenses of more than $10,000 from grantmaking, fundraising,

busmess, and program service activities outside the US? If “Yes,” complete Schedule, Part!»

id the organization report on Part IX, column (A), line 3, more than $5,000 af grants or assistance to any

organization or entity located out ide the United States? If "Yes," compete Schedule F, Par

id the organization report on Part IX, column (A), line 3, more than $5,000 of aggregate grants or assistance

foindividuals located outside the United States? If Yes," complete Schedule F, Pat 111 «=

Did the organization report more than $15,000 on Part IX, column (A), line 116? IF "Yes,“complete Schedule 6,

isthe organization report more then $15,000 total an Part VIII, lines 1 and 8a? IF “Yee, "complete Schedule 6,

id the organization report more then $15,000 on Part VIII, line 987 IF "Yee," complete Schedule G, Part 111

isthe organization operate one at mote hospitals? IF Yes, complete Schedule...

id the organization report more than $5,000 on Part IX, column (A), ine 1? If "Yes," complete Schedule I, Parts 1

and

id the organi

and 1

Won report mare then $5,000 on Part IX, column (A), line 27 IF "es, complete Schedule f, Parts T

on answer "Yes" to Part VII, Section &, questions 3, 4, or 5? ZF "Yes, "complete Schedule

id the organization have a tax-exempt bond issue with an outstanding principal amount of more than $100,000

fa of the ast day of the Year, that was issued after December 33, 2002? If “Yes, anewer questions 240-24d and

complete Schedule K If"Mo,"gotoquestion 25 vt en te te he te

Did the organization invest any proceeds of tax-exempt bonds bayond a temporary period exception? -.-

id the organization maintain an escrow account other than a refunding escrow at any time duning the year

te detente say tas exempt Bondee Stein sees at aera ete erate asada a

id the organization act as an “on behalf of issuer for bonds outstanding at any time during the year? sss

Section 502 (¢)(3) and 503 (c)(4) organizations Did the erganzation engage in an excess benefit transaction wit

a disqualified person during the year? IF "Yes,"complete SchedvleL, Pat Ts ve +s et

id the organization become aware that it had engaged in an excess benefit transaction with a disqualified person|

froma por year? If Yee, complete Schedule, Partly cvs sv sr tt et

Was a loan to or by a current or former officer, director, trustee, key employee, highly compensated employee, oF

disqualited person autstending as of the end ofthe organization’ tax year? If "Yes," complete Schedule L,

re Fe ea ee egy

id the organization provide # grantor ather assistance to an officer, director, trustee, key employee, oF

substantial contribute, or to @ person related to such an individual? If “Yes,” complete Schedule L, Part IT

4

5

‘ Ne

: No

: No

: no

10 Wo

ua | ve

13 | ves

oa ne

= ne

= no

7 Ne

= we

7 Ne

as | ver

24a 7

24

24e

24d

25a no

250 no

26 | ves

27 No

eae

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Reducing Truancy and Improving Attendance Using Restorative Conferencin1 PDFDocument14 pagesReducing Truancy and Improving Attendance Using Restorative Conferencin1 PDFRobert D. SkeelsNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Meet and Confer LetterDocument5 pagesMeet and Confer LetterRobert D. Skeels100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- AEI and The Center For American Progress (CAP) Hosted A School Privatization EventDocument3 pagesAEI and The Center For American Progress (CAP) Hosted A School Privatization EventRobert D. SkeelsNo ratings yet

- Aclu Car ReportonlineDocument104 pagesAclu Car ReportonlineRobert D. Skeels100% (1)

- Professors Solórzano and Krashen: Student Empowerment Through Culture and LanguageDocument1 pageProfessors Solórzano and Krashen: Student Empowerment Through Culture and LanguageRobert D. SkeelsNo ratings yet

- Yolie Flores Aguilar Email Colluding With Charter School ExecutivesDocument6 pagesYolie Flores Aguilar Email Colluding With Charter School ExecutivesRobert D. Skeels100% (1)

- FYLSX FlowchartDocument1 pageFYLSX FlowchartRobert D. SkeelsNo ratings yet

- Multilingualism For All California StudentsDocument1 pageMultilingualism For All California StudentsRobert D. SkeelsNo ratings yet

- Proposition 47 Qualification Flowchart Assistant (Draft)Document1 pageProposition 47 Qualification Flowchart Assistant (Draft)Robert D. SkeelsNo ratings yet

- Adl Implementation DodDocument117 pagesAdl Implementation DodRobert D. SkeelsNo ratings yet

- No Friend of Immigrants - Jacobin MagazineDocument3 pagesNo Friend of Immigrants - Jacobin MagazineRobert D. SkeelsNo ratings yet

- General California Spousal Support InformationDocument3 pagesGeneral California Spousal Support InformationRobert D. SkeelsNo ratings yet

- Support California Kids YES On Prop 58Document1 pageSupport California Kids YES On Prop 58Robert D. SkeelsNo ratings yet

- LAUSD's Board President, Monica Garcia, Spoke at Pacifica Institute (September 13, 2012) - Pacifica Institute - Los AngelesDocument2 pagesLAUSD's Board President, Monica Garcia, Spoke at Pacifica Institute (September 13, 2012) - Pacifica Institute - Los AngelesRobert D. SkeelsNo ratings yet

- Lesser Evil? The Democrats and Immigration Policy in The Era of NeoliberalismDocument23 pagesLesser Evil? The Democrats and Immigration Policy in The Era of NeoliberalismRobert D. SkeelsNo ratings yet

- Open House Invite From LAUSD Board Member Scott M. SchmerelsonDocument1 pageOpen House Invite From LAUSD Board Member Scott M. SchmerelsonRobert D. SkeelsNo ratings yet

- Gülenist Caprice Young's Association With Al SeckelDocument30 pagesGülenist Caprice Young's Association With Al SeckelRobert D. SkeelsNo ratings yet

- Proposition 47 Qualification Flowchart Assistant (Draft)Document1 pageProposition 47 Qualification Flowchart Assistant (Draft)Robert D. SkeelsNo ratings yet

- A&A - The Brown Act and Charter Schools - First Amendment CoalitionDocument6 pagesA&A - The Brown Act and Charter Schools - First Amendment CoalitionRobert D. SkeelsNo ratings yet

- Prop 47 Interview SheetDocument2 pagesProp 47 Interview SheetRobert D. SkeelsNo ratings yet

- Hellen Quan Lopez Et Al. v. Dan Schwartz, in His Official Capacity As Treasurer of The 21 State of NevadaDocument19 pagesHellen Quan Lopez Et Al. v. Dan Schwartz, in His Official Capacity As Treasurer of The 21 State of NevadaRobert D. SkeelsNo ratings yet

- Knapp Case 020707Document3 pagesKnapp Case 020707Robert D. SkeelsNo ratings yet

- Protest Against Eli Broad's Charter Putsch by Voices Against Privatizing Public EducationDocument1 pageProtest Against Eli Broad's Charter Putsch by Voices Against Privatizing Public EducationRobert D. SkeelsNo ratings yet

- 2015 June CalBar FYLSX Essays - Robert D. SkeelsDocument13 pages2015 June CalBar FYLSX Essays - Robert D. SkeelsRobert D. SkeelsNo ratings yet

- Great Public Schools Los Angeles Dark Money SuperPAC - Articles of IncorporationDocument29 pagesGreat Public Schools Los Angeles Dark Money SuperPAC - Articles of IncorporationRobert D. SkeelsNo ratings yet

- Great Public Schools Los Angeles Dark Money SuperPAC - Tax-Exempt Organization Complaint (Referral) FormDocument1 pageGreat Public Schools Los Angeles Dark Money SuperPAC - Tax-Exempt Organization Complaint (Referral) FormRobert D. SkeelsNo ratings yet

- Ref Rodriguez Non-Profit Receives Notice of Intent To Suspend or Revoke RegistrationDocument3 pagesRef Rodriguez Non-Profit Receives Notice of Intent To Suspend or Revoke RegistrationRobert D. SkeelsNo ratings yet

- Contra Corporate Candidate Alex JohnsonDocument6 pagesContra Corporate Candidate Alex JohnsonRobert D. SkeelsNo ratings yet

- Guide To The Brown ActDocument3 pagesGuide To The Brown ActRobert D. SkeelsNo ratings yet

- Reed's Revenue RocketshipDocument5 pagesReed's Revenue RocketshipRobert D. SkeelsNo ratings yet