Professional Documents

Culture Documents

Results Tracker: Tuesday, 25 Oct 2011

Uploaded by

Mansukh Investment & Trading SolutionsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Results Tracker: Tuesday, 25 Oct 2011

Uploaded by

Mansukh Investment & Trading SolutionsCopyright:

Available Formats

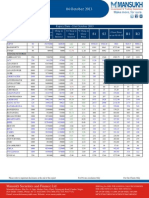

Results Tracker

Tuesday, 25 Oct 2011

make more, for sure.

Q2FY12

Results to be Declared on 25th Oct 2011

COMPANIES NAME

Agro Tech Foods

Alkyl Amines

Blue Chip Tex

CHOLAFIN

Gravity India

Gruh Finance

Maral Overseas

Mayur Floorings

Rajkamal Syn

Sesa Goa

Alstom Projects

Cityman

Indian Info

Mirc Elect

Sita Enter

Apcotex Inds

Dr Reddys Lab

Jay Shree Tea

Mirza Intl

SMIFS Capital

Apte Amalg

BA PACK

Empire Inds

Engineers India

Kalyani Invest

Kalyani Steel

Munjal Showa

Nicco Parks

Sugal & Damani Shr

Suraj Products

Banaras Beads

English Indian

KEC Intl

NTPC

TIL

BASF India

ETP Corporation

Kotak Mah Bank

Oracle Fin

Tivoli Constr

Bervin Invest

BHILWRA TEC

Blue Chip India

Forbes & Co

Futuristic Offs

Ganesh Benz

Leena Consl

LIBORD FIN

Libord Sec

Punit Comm

Rain Commodities

Rajasthan Tube

Wellness Noni

Results Announced on 24th Oct 2011 (Rs Million)

ITC

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

60852.2

1808

23997.9

141.8

23856.1

1701.3

22154.8

7011.7

0

15143.1

51756.4

1244.9

20046.5

106.3

19940.2

1639.9

18300.3

5832.9

0

12467.4

Equity

PBIDTM(%)

7773

39.44

7677.4

38.73

% Var

17.57

Year ended

201109

201009

45.23

19.71

33.4

19.64

3.74

21.06

20.21

0

21.46

119454

3246.4

45197.2

306.3

44890.9

3365.8

41525.1

13054.8

0

28470.3

100358.9

2229.7

37468.3

230.4

37237.9

3236.7

34001.2

10830.7

0

23170.5

1.25

1.82

7773

37.84

7677.4

37.33

% Var

19.03

201103

201003

45.6

20.63

32.94

20.55

3.99

22.13

20.54

0

22.87

214682.5

5181.7

79722.8

481.3

79241.5

6559.9

72681.6

22805.5

0

49876.1

183923.7

3755.6

66887.7

647.5

66240.2

6087.1

60153.1

19543.1

0

40610

1.25

1.35

7738.1

37.14

3818.2

36.37

% Var

16.72

37.97

19.19

-25.67

19.63

7.77

20.83

16.69

0

22.82

102.66

2.11

The revenue zoomed 17.57% to Rs. 60852.20 millions for the quarter ended September 2011 as compared to Rs. 51756.40 millions during

the corresponding quarter last year.A slim rise of 21.46% was recorded in the Net profit for the quarter ended September 2011 to Rs.

15143.10 millions From Rs. 12467.40 millions.OP of the company witnessed a marginal growth to 23997.90 millions from 20046.50

millions in the same quarter last year.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

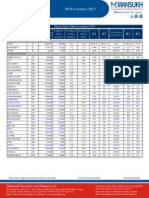

Results Tracker

Q2FY12

make more, for sure.

Suzlon Energy

Quarter ended

Year to Date

Year ended

Sales

201109

19435.7

201009

10695.1

% Var

81.73

201109

31004.8

201009

15740.1

% Var

96.98

201103

43663.9

201003

35089.3

% Var

24.44

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

858.4

2341

2078.1

262.9

456.8

-193.9

0

0

-193.9

1065.1

772.3

1290.4

-518.1

372.4

-890.5

0

0

-890.5

-19.41

203.12

61.04

-150.74

22.66

-78.23

0

0

-78.23

1657.5

5355.4

3650.4

1705

798.2

906.8

0

0

906.8

1732.3

-991.2

2888.1

-4252.1

714.7

-4966.8

0

0

-4966.8

-4.32

-640.29

26.39

-140.1

11.68

-118.26

0

0

-118.26

3316.7

5117.2

5780.4

-1036

1568.9

-2604.9

-748.3

0

-1856.6

2532.5

-198.1

6535.9

-11124.2

1262.7

-12386.9

1754

0

-14140.9

30.97

-2683.14

-11.56

-90.69

24.25

-78.97

-142.66

0

-86.87

Equity

PBIDTM(%)

3554.7

12.04

3490.7

7.22

1.83

66.8

3554.7

17.27

3490.7

-6.3

1.83

-374.29

3554.7

11.72

3113.5

-0.56

14.17

-2175.72

An increase of about 81.73% to Rs. 19435.70 millions in the topline was observed for the quarter ended September 2011. The topline stood

at Rs. 10695.10 millions during the similar quarter previous year.The Net Loss for the quarter ended September 2011 is Rs. -193.90

millions as compared to Net Loss of Rs. -890.50 millions of corresponding quarter ended September 2010OP of the company witnessed a

marginal growth to 2341.00 millions from 772.30 millions in the same quarter last year.

Sterlite Inds. (I)

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

48017.5

3935.2

7024.7

2882.5

4142.2

375.1

3767.1

1195.4

0

2571.7

29057

4473.4

5887.2

40.3

5846.9

382.2

5464.7

1456

0

4008.7

Equity

PBIDTM(%)

3361.2

14.63

3361.2

20.26

% Var

65.25

Year ended

201109

201009

-12.03

19.32

7052.61

-29.16

-1.86

-31.06

-17.9

0

-35.85

89743.8

8129

13435

4023.5

9411.5

753.5

8658

2657.7

0

6000.3

60951.5

9965.3

12663.6

679.6

11984

762.9

11221.1

3018.1

0

8203

0

-27.79

3361.2

14.97

3361.2

20.78

% Var

47.24

201103

201003

-18.43

6.09

492.04

-21.47

-1.23

-22.84

-11.94

0

-26.85

153102.9

16887.2

23008.4

2739.1

20269.3

1526.5

18742.8

4545.7

0

14197.1

131245

13866.3

16284.1

2564.4

10984.4

1506.4

9478

1163

0

8315

0

-27.95

3361.2

15.03

1680.8

12.41

% Var

16.65

21.79

41.29

6.81

84.53

1.33

97.75

290.86

0

70.74

99.98

21.12

The turnover zoomed to Rs. 48017.50 millions, up 65.25% for the September 2011 quarter as against Rs. 29057.00 millions during the yearago period.Profit after Tax for the quarter ended September 2011 saw a decline of -35.85% from Rs. 4008.70 millions to Rs. 2571.70

millions.Operating Profit saw a handsome growth to 7024.70 millions from 5887.20 millions in the quarter ended September 2011.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Piramal Glass

Quarter ended

Year to Date

201109

201009

Sales

1974.6

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

0

613.2

105.4

507.8

193.1

314.7

92.4

0

222.3

Equity

PBIDTM(%)

804.3

31.05

Year ended

201109

201009

1962.2

% Var

0.63

201103

201003

3653

% Var

8.08

7718.8

6812.7

% Var

13.3

3948

16.8

532.8

102.2

430.6

182.9

247.7

67.7

0

180

0

15.09

3.13

17.93

5.58

27.05

36.48

0

23.5

43.8

1185.8

215.7

970.1

373.9

596.2

181.6

0

414.6

16.8

932

201.8

730.2

360.5

369.7

98.8

0

270.9

160.71

27.23

6.89

32.85

3.72

61.27

83.81

0

53.05

47.1

2109.2

448.3

1660.9

740.1

920.8

234.8

0

686

0

1544.5

610.3

934.2

723.8

210.4

52.7

0

157.7

0

36.56

-26.54

77.79

2.25

337.64

345.54

0

335

804.3

27.15

0

14.37

804.3

30.04

804.3

25.51

0

17.72

804.3

27.33

804.3

22.67

0

20.53

A minor change in the total revenue was seen in the September 2011 quarter. The total revenue for the quarter stood at Rs. 1974.60

millions against Rs. 1962.20 millions during year ago period.Profit saw a slight increase of 23.50%to Rs. 222.30 millions from Rs. 180.00

millions.Operating profit surged to 613.20 millions from the corresponding previous quarter of 532.80 millions.

Pratibha Industries

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

2909.74

10.01

429.66

167.07

262.59

45.2

217.39

53.93

0

163.46

2457.16

0

370.96

144.06

226.9

35.9

191

54.91

0

136.09

Equity

PBIDTM(%)

0

14.77

166.85

15.1

% Var

18.42

Year ended

201109

201009

0

15.82

15.97

15.73

25.91

13.82

-1.78

0

20.11

5932.85

10.01

903.75

349.49

554.26

87.6

466.66

116.83

0

349.83

5522.01

0.98

773.26

294.24

479.02

69.6

409.42

110.86

0

298.56

0

-2.19

198.85

15.23

166.85

14

% Var

7.44

201103

201003

921.43

16.88

18.78

15.71

25.86

13.98

5.39

0

17.17

11751.35

12.44

1719.26

617.72

1101.54

143.39

958.15

243.81

0

714.33

9349.06

0

1366.17

493.1

873.07

108.59

764.47

199.34

0

565.13

19.18

8.78

198.85

14.63

166.85

14.61

% Var

25.7

0

25.85

25.27

26.17

32.05

25.34

22.31

0

26.4

19.18

0.12

The Revenue for the quarter ended September 2011 of Rs. 2909.74 millions grew by 18.42 % from Rs. 2457.16 millions.Modest increase of

20.11% in the Net Profit was reported from. 136.09 millions to Rs. 163.46 millions.OP of the company witnessed a marginal growth to

429.66 millions from 370.96 millions in the same quarter last year.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Kalpataru PowerTrans

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

5833.4

137.5

845.1

242

603.1

120.6

482.5

140

0

342.5

6428.6

138.2

869.8

186.4

683.4

113.3

570.1

156.4

0

413.7

Equity

PBIDTM(%)

306.9

14.49

306.9

13.53

% Var

-9.26

Year ended

201109

201009

-0.51

-2.84

29.83

-11.75

6.44

-15.37

-10.49

0

-17.21

11679.2

281.9

1656.7

462.7

1194

238

956

277.5

0

678.5

11888.6

221.9

1673.4

376.2

1297.2

224.1

1073.1

290.8

0

782.3

0

7.07

306.9

14.19

306.9

14.08

% Var

-1.76

201103

201003

27.04

-1

22.99

-7.96

6.2

-10.91

-4.57

0

-13.27

28786.9

464.4

3826.9

801.5

3025.4

459.3

2566.1

660.2

0

1905.9

26329.4

332.9

3380.9

722.5

2658.4

382.4

2276

571.4

0

1704.6

0

0.78

306.9

13.29

265

12.84

% Var

9.33

39.5

13.19

10.93

13.81

20.11

12.75

15.54

0

11.81

15.81

3.53

The sales is pegged at Rs. 5833.40 millions for the September 2011 quarter. The mentioned figure indicates decline with the sales recorded

at Rs. 6428.60 millions during the year-ago period.The Company's Net profit for the September 2011 quarter have declined marginally to

Rs. 342.50 millions as against Rs. 413.70 millions reported during the corresponding quarter ended.The company reported a degrowth in

operating Profit to 845.10 millions from 869.80 millions.

Union Bank Of India

Quarter ended

201109

Year to Date

201009

% Var

51104.4

39522.4

29.3

Other Income

5009.3

5096.4

-1.71

Interest Expended

34492.2

24164

42.74

Operating Expenses

9570.9

9570.9

4.62

6228

5988.9

Tax

2297.4

2283.5

PAT

3525.2

3033.9

Equity

6353.3

5051.2

OPM

23.58

28.61

Interest Earned

Operating Profit

Prov.& Contigencies

201109

Year ended

201009

% Var

201103

201003

% Var

76379.1

31.27

164526.2

133026.8

23.68

9848.9

9446.3

4.26

20387.8

19747.4

3.24

67747.3

47540.4

42.5

102364.2

91102.7

12.36

18654.6

16541.8

12.77

39499.9

25078.4

57.51

3.99

10511.8

7961.6

32.03

13495.9

8263.9

63.31

0.61

16.19

5027.4

4733.5

8734.5

7580

8169.4

9048.1

6.21

-9.71

20819.5

20749.2

15.23

0.34

25.78

-17.57

6353.3

5051.2

6353.3

5051.2

23.65

28.47

26.17

27.51

100261.6

25.78

-16.93

25.78

-4.88

A decent increase of about 29.30% in the sales to Rs. 51104.40 millions was observed for the quarter ended September 2011. The sales

figure stood at Rs. 39522.40 millions during the year-ago period.A humble growth in net profit of 16.19% reported in the quarter ended

September 2011 to Rs. 3525.20 millions from Rs. 3033.90 millions.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Data Source : ACE Equity

NAME

DESIGNATION

Varun Gupta

Head - Research

varungupta@moneysukh.com

Pashupati Nath Jha

Research Analyst

pashupatinathjha@moneysukh.com

Vikram Singh

Research Analyst

vikram_research@moneysukh.com

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you.

Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and

has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form.

The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or

employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information

contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding

any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and noninfringement. The recipients of this report should rely on their own investigations.

MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This

information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be

required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be

happy to provide information in response to specific client queries.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

You might also like

- Tata Steel Complete Financial ModelDocument64 pagesTata Steel Complete Financial Modelsiddharth.nt923450% (2)

- Financial Modeling of TCS LockDocument62 pagesFinancial Modeling of TCS LocksharadkulloliNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Results Tracker: Wednesday, 02 Nov 2011Document8 pagesResults Tracker: Wednesday, 02 Nov 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Wednesday, 19 Oct 2011Document6 pagesResults Tracker: Wednesday, 19 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Tuesday, 24 July 2012Document7 pagesResults Tracker: Tuesday, 24 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Thursday, 03 Nov 2011Document6 pagesResults Tracker: Thursday, 03 Nov 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Saturday, 21 July 2012Document10 pagesResults Tracker: Saturday, 21 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Q2FY12 - Results Tracker 28.10.11Document7 pagesQ2FY12 - Results Tracker 28.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Friday, 20 July 2012Document7 pagesResults Tracker: Friday, 20 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Tuesday, 01 Nov 2011Document13 pagesResults Tracker: Tuesday, 01 Nov 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Tuesday, 18 Oct 2011Document4 pagesResults Tracker: Tuesday, 18 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Thursday, 02 Aug 2012Document7 pagesResults Tracker: Thursday, 02 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Thursday, 26 July 2012Document7 pagesResults Tracker: Thursday, 26 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Thursday, 20 Oct 2011Document6 pagesResults Tracker: Thursday, 20 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Tuesday, 07 Aug 2012Document7 pagesResults Tracker: Tuesday, 07 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Wednesday, 08 Aug 2012Document4 pagesResults Tracker: Wednesday, 08 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Tuesday, 15 Nov 2011Document12 pagesResults Tracker: Tuesday, 15 Nov 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Friday, 21 Oct 2011Document8 pagesResults Tracker: Friday, 21 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Thursday, 19 July 2012Document4 pagesResults Tracker: Thursday, 19 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 18 August 2011Document3 pagesResults Tracker 18 August 2011Mansukh Investment & Trading SolutionsNo ratings yet

- AFS Agriculture Sector: by Ankit Chudawala-70 Jason Misquitta-88 Vikas Sarnobat-102 Mayur Sonawane-110 Swapnil Khot-120Document7 pagesAFS Agriculture Sector: by Ankit Chudawala-70 Jason Misquitta-88 Vikas Sarnobat-102 Mayur Sonawane-110 Swapnil Khot-120Mayur SonawaneNo ratings yet

- Results Tracker: Saturday, 14 July 2012Document4 pagesResults Tracker: Saturday, 14 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- HDFC Bank Capital Computation and Key FinancialsDocument46 pagesHDFC Bank Capital Computation and Key FinancialsJhonny BoyeeNo ratings yet

- Q1FY12 Results Tracker 17th August-Mansukh Investment and TradingDocument5 pagesQ1FY12 Results Tracker 17th August-Mansukh Investment and TradingMansukh Investment & Trading SolutionsNo ratings yet

- Economic Financial Company AnalysisDocument6 pagesEconomic Financial Company AnalysisJaya SudhakarNo ratings yet

- Results Tracker 22.10.11Document14 pagesResults Tracker 22.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Q2FY12 Results Tracker 13.10.11Document2 pagesQ2FY12 Results Tracker 13.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- FY 2069-70 Ten Month14Document5 pagesFY 2069-70 Ten Month14Roshan ManandharNo ratings yet

- Profit and Loss Account For The Year Ended March 31, 2010: Column1 Column2Document11 pagesProfit and Loss Account For The Year Ended March 31, 2010: Column1 Column2Karishma JaisinghaniNo ratings yet

- Results Tracker: Saturday, 28 July 2012Document13 pagesResults Tracker: Saturday, 28 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Q2FY12 Results Tracker 14.10.11Document3 pagesQ2FY12 Results Tracker 14.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Oil and Natural Gas Corporation Limited (2007 Fortune Most Admired Companies)Document16 pagesOil and Natural Gas Corporation Limited (2007 Fortune Most Admired Companies)ravi198522No ratings yet

- HDFC Top 200 Fund holdings reportDocument3 pagesHDFC Top 200 Fund holdings reportVishwa Prasanna KumarNo ratings yet

- Income-: 2010-11 2009-10Document6 pagesIncome-: 2010-11 2009-10superjagdishNo ratings yet

- Annual Performance 2012Document3 pagesAnnual Performance 2012Anil ChandaliaNo ratings yet

- Results Tracker: Saturday, 04 Aug 2012Document7 pagesResults Tracker: Saturday, 04 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Thursday, 16 Aug 2012Document8 pagesResults Tracker: Thursday, 16 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Six Years Financial SummaryDocument133 pagesSix Years Financial Summarywaqas_haider_1No ratings yet

- Results Tracker 21.04.12Document3 pagesResults Tracker 21.04.12Mansukh Investment & Trading SolutionsNo ratings yet

- Atul LTD Pidilite All Figures in Rs - CR All Figures in Rs Cr. Common Size Common Size All Fig in Rs - CR Common SizeDocument2 pagesAtul LTD Pidilite All Figures in Rs - CR All Figures in Rs Cr. Common Size Common Size All Fig in Rs - CR Common Sizearav0607No ratings yet

- Important Highlights of PT Intiland Development Tbk Annual Report 2010Document2 pagesImportant Highlights of PT Intiland Development Tbk Annual Report 2010adityahrcNo ratings yet

- Asok 06 08Document1 pageAsok 06 08rahulbalujaNo ratings yet

- Audited Results 31.3.2012 TVSMDocument2 pagesAudited Results 31.3.2012 TVSMKrishna KrishnaNo ratings yet

- Financial Analysis of TCSDocument28 pagesFinancial Analysis of TCSPiyush SaraogiNo ratings yet

- Consensus Estimates AnalysisDocument12 pagesConsensus Estimates Analysisdc batallaNo ratings yet

- Q3 FY12 Results Review - Press Meet: 14 February, 2012Document27 pagesQ3 FY12 Results Review - Press Meet: 14 February, 2012Rishabh GuptaNo ratings yet

- Q2FY12 Results Tracker 09 November 2011 - Mansukh Investment and Trading SolutionDocument5 pagesQ2FY12 Results Tracker 09 November 2011 - Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Oil India Limited Financial and Physical Results for Q1-Q4 of FY 2010-11 and 2009-10Document7 pagesOil India Limited Financial and Physical Results for Q1-Q4 of FY 2010-11 and 2009-10aabid_chem3363No ratings yet

- Fie M Industries LimitedDocument4 pagesFie M Industries LimitedDavuluri OmprakashNo ratings yet

- Consolidated Balance Sheet: As at 31st December, 2011Document21 pagesConsolidated Balance Sheet: As at 31st December, 2011salehin1969No ratings yet

- Eastern Financiers LTD: EF Market TimesDocument7 pagesEastern Financiers LTD: EF Market TimesdarshanmaldeNo ratings yet

- BJE Q1 ResultsDocument4 pagesBJE Q1 ResultsTushar DasNo ratings yet

- Intoduction: - Tata Steel Formerly Known As TISCO and Tata Iron and Steel CompanyDocument7 pagesIntoduction: - Tata Steel Formerly Known As TISCO and Tata Iron and Steel Companyaamit87No ratings yet

- InfosysDocument9 pagesInfosysvibhach1No ratings yet

- Keynote: Adlabs Films Ltd.Document3 pagesKeynote: Adlabs Films Ltd.nitin2khNo ratings yet

- EPF Quarterly InvestmentDocument4 pagesEPF Quarterly InvestmentcsiewmayNo ratings yet

- Unaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Document1 pageUnaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Amar Mourya MouryaNo ratings yet

- Session 1 2021 SharedDocument44 pagesSession 1 2021 SharedPuneet MeenaNo ratings yet

- Performance Highlights: NeutralDocument10 pagesPerformance Highlights: NeutralAngel BrokingNo ratings yet

- PI Industries Q1FY12 Result 1-August-11Document6 pagesPI Industries Q1FY12 Result 1-August-11equityanalystinvestorNo ratings yet

- Equity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 09.11.2013Document3 pagesResults Tracker 09.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 08.11.2013Document3 pagesResults Tracker 08.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 07.11.2013Document3 pagesResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 08 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 08 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 30 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 30 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 07 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 07 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 31 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 31 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 28 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 28 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 08 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 08 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 25 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 25 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 24 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 24 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Ube Cheese Pandesal Business PlanDocument23 pagesUbe Cheese Pandesal Business PlanRamon Jr. LayaNo ratings yet

- VLS - GMBH FS FY 19 20Document44 pagesVLS - GMBH FS FY 19 20Elizabeth Sánchez LeónNo ratings yet

- Bsa Midterm Graded Exercises From Worksheet To Financial Statements FinalDocument4 pagesBsa Midterm Graded Exercises From Worksheet To Financial Statements FinalGarp BarrocaNo ratings yet

- Chap 006Document71 pagesChap 006Aufa RadityatamaNo ratings yet

- LSBF SBR+Class+Notes+September+2018+-+June+2019FINAL PDFDocument229 pagesLSBF SBR+Class+Notes+September+2018+-+June+2019FINAL PDFGunva TonkNo ratings yet

- Ap 9004-IntangiblesDocument5 pagesAp 9004-IntangiblesSirNo ratings yet

- WorksheetsDocument23 pagesWorksheetsoxygeniaxxNo ratings yet

- BAb 6Document75 pagesBAb 6kkamjonginnNo ratings yet

- What Are Financial StatementsDocument4 pagesWhat Are Financial StatementsJustin Era ApeloNo ratings yet

- FAR-02 Retained EarningsDocument5 pagesFAR-02 Retained EarningsKim Cristian MaañoNo ratings yet

- TUGAS DOSEN Chapter 5Document15 pagesTUGAS DOSEN Chapter 5novita sariNo ratings yet

- Acf MCQDocument3 pagesAcf MCQShahrukhNo ratings yet

- Financial and Managerial Accounting AssignmentDocument10 pagesFinancial and Managerial Accounting AssignmentAbdul AhmedNo ratings yet

- ACCY 201 Exam 1 Study GuideDocument48 pagesACCY 201 Exam 1 Study GuideKelly Williams100% (1)

- Presentation of Financial StatementsDocument44 pagesPresentation of Financial Statementsmukul3087_305865623No ratings yet

- Acc 577 Quiz Week 3 PDF FreeDocument12 pagesAcc 577 Quiz Week 3 PDF FreeWhalien 52No ratings yet

- AFST - Oct 17Document9 pagesAFST - Oct 17kimkimNo ratings yet

- Accounting and Finance for Bankers - Key ConceptsDocument89 pagesAccounting and Finance for Bankers - Key Conceptspremgaur007184100% (1)

- Issues in Partnership Accounts: Basic ConceptsDocument40 pagesIssues in Partnership Accounts: Basic Conceptsjsus22No ratings yet

- 3 - The Reformulation of Financial Statements - UnlockedDocument33 pages3 - The Reformulation of Financial Statements - Unlockedchirag0% (3)

- Comparitive Financial Statement of Reliance Industries For Last 5 YearsDocument33 pagesComparitive Financial Statement of Reliance Industries For Last 5 YearsPushkraj TalwadkarNo ratings yet

- QUIZ in AUDIT OF SHAREHOLDERS EQUITYDocument2 pagesQUIZ in AUDIT OF SHAREHOLDERS EQUITYLugh Tuatha DeNo ratings yet

- CCL Products India Standalone Balance SheetDocument2 pagesCCL Products India Standalone Balance SheetSaurabh RajNo ratings yet

- FA2 Syllabus and Study Guide 2021-22Document11 pagesFA2 Syllabus and Study Guide 2021-22Aleena MuhammadNo ratings yet

- Financial Accounting Mock Exam Multiple Choice QuestionsDocument4 pagesFinancial Accounting Mock Exam Multiple Choice QuestionsGeeta LalwaniNo ratings yet

- Intermediate Accounting Ifrs 3rd Edition Kieso Solutions ManualDocument38 pagesIntermediate Accounting Ifrs 3rd Edition Kieso Solutions Manualrococosoggy74yw6m100% (15)

- Lembar JWB PD ANGKASADocument53 pagesLembar JWB PD ANGKASAernyNo ratings yet

- Business Plan Outline 1Document7 pagesBusiness Plan Outline 1Cha SiTaoNo ratings yet

- Receivables AuditDocument32 pagesReceivables AuditCertified PANo ratings yet