Professional Documents

Culture Documents

425 1 d247289d425.htm FORM 425: Open in Browser PRO Version

Uploaded by

William HarrisOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

425 1 d247289d425.htm FORM 425: Open in Browser PRO Version

Uploaded by

William HarrisCopyright:

Available Formats

425 1 d247289d425.

htm FORM 425

FiledbyExelonCorporation PursuanttoRule425undertheSecuritiesActof1933 anddeemedfiledpursuanttoRule14a-12oftheSecuritiesExchangeActof1934 SubjectCompany:ConstellationEnergyGroup,Inc. (Reg.No.333-175162) OnOctober25,2011,ExelonbegantousethefollowingslidesconcerningtheproposedmergerandotherinformationinaseriesofmeetingswithMarylandstakeholders:

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Creating a Clean, Competitive Future

Exelon and Constellation Energy Merger Update October 26, 2011

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Cautionary Statements Regarding Forward-Looking Information

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Except for the historical information contained herein, certain of the matters discussed in this communication constitute forward-looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, both as amended by the Private Securities Litigation Reform Act of 1995. Words such as may, will, anticipate, estimate, expect, project, intend, plan, believe, target, forecast, and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding benefits of the proposed merger of Exelon Corporation (Exelon) and Constellation Energy Group, Inc. (Constellation), integration plans and expected synergies, the expected timing of completion of the transaction, anticipated future financial and operating performance and results, including estimates for growth. These statements are based on the current expectations of management of Exelon and Constellation, as applicable. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication regarding the proposed merger. For example, (1) the companies may be unable to obtain shareholder approvals required for the merger (2) the companies may be unable to obtain regulatory approvals required for the merger, or required regulatory approvals may delay the merger or result in the imposition of conditions that could have a material adverse effect on the combined company or cause the companies to abandon the merger (3) conditions to the closing of the merger may not be satisfied (4) an unsolicited offer of another company to acquire assets or capital stock of Exelon or Constellation could interfere with the merger (5) problems may arise in successfully integrating the businesses of the companies, which may result in the combined company not operating as effectively and efficiently as expected (6) the combined company may be unable to achieve cost-cutting synergies or it may take longer than expected to achieve those synergies (7) the merger may involve unexpected costs, unexpected liabilities or unexpected delays, or the effects of purchase accounting may be different from the companies expectations (8) the credit ratings of the combined company or its subsidiaries may be different from what the companies expect (9) the businesses of the companies may suffer as a result of uncertainty surrounding the merger (10) the companies may not realize the values expected to be obtained for properties expected or required to be divested (11) the industry may be subject to future regulatory or legislative actions that could adversely affect the companies and (12) the companies may be adversely affected by other economic, business, and/or competitive factors.

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Cautionary Statements Regarding Forward-Looking Information (Continued)

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Other unknown or unpredictable factors could also have material adverse effects on future results, performance or achievements of Exelon, Constellation or the combined company. Discussions of some of these other important factors and assumptions are contained in Exelons and Constellations respective filings with the Securities and Exchange Commission (SEC), and available at the SECs website at www.sec.gov, including: (1) Exelons 2010 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Managements Discussion and Analysis of Financial Condition and Results of Operations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 18 (2) Exelons Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2011 in (a) Part II, Other Information, ITEM 1A. Risk Factors, (b) Part 1, Financial Information, ITEM 2. Managements Discussion and Analysis of Financial Condition and Results of Operations and (c) Part I, Financial Information, ITEM 1. Financial Statements: Note 13 (3) Constellations 2010 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Managements Discussion and Analysis of Financial Condition and Results of Operations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 12 and (4) Constellations Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2011 in (a) Part II, Other Information, ITEM 1A. Risk Factors and ITEM 5. Other Information, (b) Part I, Financial Information, ITEM 2. Managements Discussion and Analysis of Financial Condition and Results of Operations and (c) Part I, Financial Information, ITEM 1. Financial Statements: Notes to Consolidated Financial Statements, Commitments and Contingencies. These risks, as well as other risks associated with the proposed merger, are more fully discussed in the definitive joint proxy statement/prospectus included in the Registration Statement on Form S-4 that Exelon filed with the SEC and that the SEC declared effective on October 11, 2011 in connection with the proposed merger. In light of these risks, uncertainties, assumptions and factors, the forward-looking events discussed in this communication may not occur. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this communication. Neither Exelon nor Constellation undertake any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this communication.

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Additional Information and Where to Find It

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

In connection with the proposed merger between Exelon and Constellation, Exelon filed with the SEC a Registration Statement on Form S-4 that included the definitive joint proxy statement/prospectus. The Registration Statement was declared effective by the SEC on October 11, 2011. Exelon and Constellation mailed the definitive joint proxy statement/prospectus to their respective security holders on or about October 12, 2011. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, BECAUSE THEY CONTAIN IMPORTANT INFORMATION about Exelon, Constellation and the proposed merger. Investors and security holders may obtain copies of all documents filed with the SEC free of charge at the SEC's website, www.sec.gov. In addition, a copy of the definitive joint proxy statement/prospectus may be obtained free of charge from Exelon Corporation, Investor Relations, 10 South Dearborn Street, P.O. Box 805398, Chicago, Illinois 60680-5398, or from Constellation Energy Group, Inc., Investor Relations, 100 Constellation Way, Suite 600C, Baltimore, MD 21202.

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Transaction Overview

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Transaction Overview

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Company Name

Exelon Corporation 100% stock 0.930 shares of EXC for each share of CEG $2.10 per share Exelon dividend maintained

Consideration

Pro Forma Ownership

78% Exelon shareholders 22% Constellation shareholders Corporate headquarters: Chicago, IL Constellation headquarters: Baltimore, MD No change to utilities headquarters Significant employee presence maintained in IL, PA and MD Executive Chairman: Mayo Shattuck President and CEO: Chris Crane Board of Directors: 16 total (12 from Exelon, 4 from Constellation) Expect to close in early 1Q 2012 Exelon and Constellation shareholder approvals in 4Q 2011 Regulatory approvals including FERC, DOJ, MD, NY, TX (1)

5

Headquarters

Governance

Approvals & Timing

(1) Secured approval from Texas PUCT on August 3, 2011

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

This Combination Is Good for Maryland

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Maintains employee presence and platform for growth in Maryland Exelons Power Team will be combined with Constellations wholesale and retail business under the Constellation brand and will be headquartered in Baltimore Constellation and Exelons renewable energy business headquartered in Baltimore in new or substantially refurbished office center BGE maintains independent operations headquartered in Baltimore No involuntary merger-related job reductions at BGE for two years after close Supports Marylands economic development and clean energy infrastructure $4 million to support EmPower Maryland Energy Efficiency Act 25 MWs of renewable energy development in Maryland (>$50 million) Charitable contributions maintained for at least 10 years (~$10 million per year) Provides direct benefits to BGE customers $15 million commitment for the Maryland PSC to use directly for the benefit of BGE customers Over $110 million to BGE residential customers from $100 one-time rate credit

We will bring direct benefits to the State of Maryland, the City of Baltimore and BGE customers. Total direct investment in excess of $250 million.

6

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Expertise Across the Energy Value Chain

Upstream

Reserves (gas) 266 b cf Owned Generating Capacity 35 GWs(1)

Downstream

Electric Transmission 7,350 miles Electric & Gas Dist. 6.6 million customers Retail & Wholesale Volumes(2) (Electric & Gas) ~191 TWh, 372 b cf

open in

Note: Data as of 9/30/11 unless stated otherw ise. (1) Generation capacity net of physical market mitigation assumed to be 2,648 MW consisting of Brandon Shores (1,273 MW), H.A. Wagner (976 MW) and CP Crane (399 MW). (2) Electric load includes all booked 2011E competitive retail sales, w holesale sales, and sales to load serving entities including ComEd sw ap as of 9/30/11. Gas load includes all booked and forecasted 2011E competitive retail sales as of 9/30/11. browser PRO version Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

A Leader in Operating Regulated Utilities in Large Metropolitan Areas

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

3.8 million electric customers Service Territory: 11,300 square miles Peak Load(1): 23,753 MW

1.6 million electric customers 0.5 million gas customers Service Territory: 2,100 square miles Peak Load(1): 8,983 MW

1.2 million electric customers 0.7 million gas customers Service Territory: 2,300 square miles Peak Load(1): 7,236 MW

8

(1) Peak load represents all-time peak load.

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Current Merger Status

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Exelon Has Strengthened its Merger Proposal

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Additional safeguards for BGE

New governance measures to ensure BGE is locally managed and has the resources to ensure safe, reliable delivery of power Ring-fencing measures to stay in place MPSC to receive notification on a wide range of financial metrics, to monitor BGEs financial health

Resolution of market power concerns

Settlement with PJM market monitor limits universe of potential buyers of coal plants slated for divestiture, provides assurances on how merged company will bid into PJM

BGE will remain locally managed, will have the same accountability to the PSC as it currently does, and will have a strong voice at Exelon. As part of Exelon, BGE will continue to provide safe and reliable service to its customers at just and reasonable rates Ken DeFontes, BGE CEO

10

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Some Conditions Proposed by Other Parties to the Merger are Unnecessary and Harmful

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Dramatic increase in renewable requirement

Proposal would require Exelon to build >400 megawatts of renewable energy Unnecessary and would create estimated $1 billion burden to be borne by shareholders or customers

Limitations on future growth

Proposals would limit potential of the combined company or require divestiture of BGE

Rate freeze

Would jeopardize BGEs ability to make needed capital investments Exelons 25 MW renewable proposal is 5x greater than First Energy/Allegheny commitment

11

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Path Forward

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

On Track for Merger Close in Early 2012

2011 Q3 2012 Q1

Approvals Texas PUC SEC Shareholder vote New York PSC FERC Maryland PSC NRC DOJ

Q4

Secured approval from Texas PUC on August 3, 2011 Joint proxy statement declared effective October 11, 2011 Record Date October 7, 2011

Expect decision in Q4 2011 Filed merger approval application related filings on May 20, 2011. Settlement agreement filed with PJM Market Monitor on October 11, 2011 Rebuttal testimony filed October 12, 2011

Shareholder vote November 17, 2011

FERC order expected by November 16, 2011 January 5, 2012 Statutory deadline

Evidentiary hearings begin October 31, 2011

Filed for indirect transfer of Constellation Energy licenses on May 12, 2011 Submitted HSR filing on May 31, 2011 for review under U.S. antitrust laws and certified compliance with second request

Regulatory proceedings are progressing as planned and we are on track to close in early 2012

Note : On September 26th t 2011, the Department of Public Utilities in Massachusetts concluded that it does not have jurisdiction over the proposed transaction between Exelon and Constellation.

13

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Questions?

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

You might also like

- 425 1 d233443d425.htm FORM 425Document12 pages425 1 d233443d425.htm FORM 425Anonymous Feglbx5No ratings yet

- Constellation Energy Group Inc: FORM 425Document19 pagesConstellation Energy Group Inc: FORM 425Anonymous Feglbx5No ratings yet

- Constellation Energy Group Inc: FORM 425Document18 pagesConstellation Energy Group Inc: FORM 425William HarrisNo ratings yet

- Constellation Energy Group Inc: FORM 425Document7 pagesConstellation Energy Group Inc: FORM 425Anonymous Feglbx5No ratings yet

- Constellation Energy Group Inc: FORM 425Document9 pagesConstellation Energy Group Inc: FORM 425Anonymous Feglbx5No ratings yet

- Investor & Analyst Day Presentation: October 13, 2021Document36 pagesInvestor & Analyst Day Presentation: October 13, 2021Lodewijk KleijnNo ratings yet

- BlackRock 2023 Investor DayDocument138 pagesBlackRock 2023 Investor DayDaniele Pronestì100% (1)

- XBRL: Enabling Faster, More Transparent Financial ReportingDocument12 pagesXBRL: Enabling Faster, More Transparent Financial ReportingPrasad VeeraNo ratings yet

- United States Securities and Exchange CommissionDocument233 pagesUnited States Securities and Exchange CommissionjsvrolykNo ratings yet

- BB Anual Report 2010Document127 pagesBB Anual Report 2010Shakeel AhmedNo ratings yet

- Form 11-K: United States Securities and Exchange CommissionDocument15 pagesForm 11-K: United States Securities and Exchange CommissionSurya PermanaNo ratings yet

- Urban Air MobilityDocument46 pagesUrban Air MobilityabrahamzapruderNo ratings yet

- Document Research: MorningstarDocument49 pagesDocument Research: MorningstarGuneet Singh SahniNo ratings yet

- Elliott Management's BMC PresentationDocument36 pagesElliott Management's BMC PresentationDealBookNo ratings yet

- SEC FORM 10-K TITLEDocument76 pagesSEC FORM 10-K TITLEAlok PatelNo ratings yet

- Capital Source 2011 Form 10-KDocument212 pagesCapital Source 2011 Form 10-KrgaragiolaNo ratings yet

- BankUnited Form 10-K Provides Financial Statements and Supplementary DataDocument367 pagesBankUnited Form 10-K Provides Financial Statements and Supplementary DataMelike84No ratings yet

- Devon Energy Corporation Form 10-K Table of ContentsDocument182 pagesDevon Energy Corporation Form 10-K Table of Contentsbmichaud758No ratings yet

- TriQuint RFMD Merger Investor PresentationDocument11 pagesTriQuint RFMD Merger Investor PresentationspeedybitsNo ratings yet

- Ar 13Document112 pagesAr 13ckiencrm_lvNo ratings yet

- ELNK-2013 12 31-10k-FinalDocument110 pagesELNK-2013 12 31-10k-Finalpillsbury44No ratings yet

- Overview of Business Plan: Cost Structure and 5-Year Financial ProjectionsDocument42 pagesOverview of Business Plan: Cost Structure and 5-Year Financial ProjectionsBic BickieNo ratings yet

- Sune 2013 10-KDocument508 pagesSune 2013 10-KChad Thayer VNo ratings yet

- CC Project Cheddar Management Presentation VF PDFDocument43 pagesCC Project Cheddar Management Presentation VF PDFmdorneanu100% (1)

- EnergyRecoveryInc 8K 20111103Document9 pagesEnergyRecoveryInc 8K 20111103harpoon11No ratings yet

- Chevron 10K 20110224Document160 pagesChevron 10K 20110224Arti SharmaNo ratings yet

- KKR Investor PresentationDocument229 pagesKKR Investor Presentationcjwerner100% (1)

- Koss 2010Document133 pagesKoss 2010Lê Thùy LinhNo ratings yet

- Origin Materials, Inc. Reports Financial Results For Third Quarter 2021Document5 pagesOrigin Materials, Inc. Reports Financial Results For Third Quarter 2021Rafael JimenezNo ratings yet

- Chevron 10K 2010Document208 pagesChevron 10K 2010Marius-Mihail MihaiNo ratings yet

- Improper Expense Capitalization ExamplesDocument4 pagesImproper Expense Capitalization ExamplessupersethNo ratings yet

- News Release - Ener1 Restructuring - 012612 - FINALDocument3 pagesNews Release - Ener1 Restructuring - 012612 - FINALpandorasboxofrocksNo ratings yet

- Article On Coca ColaDocument145 pagesArticle On Coca ColaJhe LoNo ratings yet

- Research Paper On Lockheed MartinDocument6 pagesResearch Paper On Lockheed Martingz8zw71w100% (1)

- Dell Inc.: Form 10-KDocument146 pagesDell Inc.: Form 10-KgeeetabhishekNo ratings yet

- Syntel 10kDocument143 pagesSyntel 10kTara MontoyaNo ratings yet

- Shell's Forward-Looking Non-GAAP Measures and ScenariosDocument1 pageShell's Forward-Looking Non-GAAP Measures and ScenariosJUNAID IQBALNo ratings yet

- ELBIT SYSTEMS - PRESS RELEASE - Flight Training Program of The Hellenic Air ForceDocument2 pagesELBIT SYSTEMS - PRESS RELEASE - Flight Training Program of The Hellenic Air ForceturandotNo ratings yet

- Dewey 401k NoticeDocument2 pagesDewey 401k Noticedavid_latNo ratings yet

- Analyst Day Deck Review 01.18.22 Master VFF SiteDocument61 pagesAnalyst Day Deck Review 01.18.22 Master VFF SitelukaNo ratings yet

- 2013.3.1 - Exelis Q4 2012 TranscriptDocument19 pages2013.3.1 - Exelis Q4 2012 Transcriptjenkins-sacadonaNo ratings yet

- Waste Connections & Progressive Waste Merger PresentationDocument24 pagesWaste Connections & Progressive Waste Merger PresentationDavid BodamerNo ratings yet

- Eos Investor Presentation VFDocument31 pagesEos Investor Presentation VFlobetine taylorNo ratings yet

- OfficeDepotInc 10KDocument390 pagesOfficeDepotInc 10KBianca HorvathNo ratings yet

- United States Securities and Exchange Commission Form 10-QDocument92 pagesUnited States Securities and Exchange Commission Form 10-QAA3322No ratings yet

- Report OnDocument7 pagesReport OnJOJITNo ratings yet

- Inpixon XTI Investor Webcast Presentation 2023-08-14 FinalDocument28 pagesInpixon XTI Investor Webcast Presentation 2023-08-14 FinalpcmurreNo ratings yet

- Exxon Mobil Corporation: 2012 United States Securities and Exchange Commission FORM 10-KDocument155 pagesExxon Mobil Corporation: 2012 United States Securities and Exchange Commission FORM 10-Krahul84803No ratings yet

- Navios Maritime Holdings Inc - Form 20-F (Apr-06-2011)Document261 pagesNavios Maritime Holdings Inc - Form 20-F (Apr-06-2011)charliej973No ratings yet

- ExxonMobilCorporation 10K 20120224Document175 pagesExxonMobilCorporation 10K 20120224Redaksi KasbiNo ratings yet

- ExxonMobilCorporation 10K 2011Document176 pagesExxonMobilCorporation 10K 2011Priya Ranjan SinghNo ratings yet

- BIR EAccReg System Walkthrough For TP Users - RZMDocument121 pagesBIR EAccReg System Walkthrough For TP Users - RZMMark Lord Morales BumagatNo ratings yet

- Lantronix Inc: Current Report Filing Filed On 02/01/2012 Filed Period 02/01/2012Document29 pagesLantronix Inc: Current Report Filing Filed On 02/01/2012 Filed Period 02/01/2012shahrahulocNo ratings yet

- HCM US Ceridian Tax Filing White Paper v7.3Document9 pagesHCM US Ceridian Tax Filing White Paper v7.3yurijapNo ratings yet

- Collier CreekDocument49 pagesCollier Creekadem akcaliNo ratings yet

- PFIZER INC (Form - 10-K, Received - 02 - 28 - 2013 16 - 58 - 46)Document375 pagesPFIZER INC (Form - 10-K, Received - 02 - 28 - 2013 16 - 58 - 46)daniellskNo ratings yet

- Teneco Federal MergerDocument29 pagesTeneco Federal Mergerdont-want100% (1)

- 2023 Fast 500 Winners List v1.1Document16 pages2023 Fast 500 Winners List v1.1William HarrisNo ratings yet

- Market Report 2023 Q1 Full ReportDocument17 pagesMarket Report 2023 Q1 Full ReportKevin ParkerNo ratings yet

- Multifamily Outlook Issue 14 U2023!4!27Document28 pagesMultifamily Outlook Issue 14 U2023!4!27William HarrisNo ratings yet

- QR 3 - FinalDocument20 pagesQR 3 - FinalWilliam HarrisNo ratings yet

- Let'S Talkinteractive Executive SummaryDocument5 pagesLet'S Talkinteractive Executive SummaryWilliam HarrisNo ratings yet

- 2023 ASI Impact ReportDocument43 pages2023 ASI Impact ReportWilliam HarrisNo ratings yet

- Q1 2023 AcquisitionsDocument28 pagesQ1 2023 AcquisitionsWilliam HarrisNo ratings yet

- 2022 Abell Foundation Short Form Report 8yrDocument36 pages2022 Abell Foundation Short Form Report 8yrWilliam HarrisNo ratings yet

- Development: Washington, DCDocument96 pagesDevelopment: Washington, DCWilliam HarrisNo ratings yet

- Development: Washington, DCDocument96 pagesDevelopment: Washington, DCWilliam HarrisNo ratings yet

- Development: Washington, DCDocument96 pagesDevelopment: Washington, DCWilliam HarrisNo ratings yet

- Pebblebrook Update On Recent Operating TrendsDocument10 pagesPebblebrook Update On Recent Operating TrendsWilliam HarrisNo ratings yet

- DSB Q3Document8 pagesDSB Q3William HarrisNo ratings yet

- Atlanta 2022 Multifamily Investment Forecast ReportDocument1 pageAtlanta 2022 Multifamily Investment Forecast ReportWilliam HarrisNo ratings yet

- Performance Summary: Market OutlookDocument2 pagesPerformance Summary: Market OutlookKevin ParkerNo ratings yet

- Manhattan RetailDocument9 pagesManhattan RetailWilliam HarrisNo ratings yet

- Industry Update H2 2021 in Review: Fairmount PartnersDocument13 pagesIndustry Update H2 2021 in Review: Fairmount PartnersWilliam HarrisNo ratings yet

- Copt 2021Document44 pagesCopt 2021William HarrisNo ratings yet

- 2021 Q1 Multifamily Houston Report ColliersDocument4 pages2021 Q1 Multifamily Houston Report ColliersWilliam HarrisNo ratings yet

- 3Q21 I81 78 Industrial MarketDocument5 pages3Q21 I81 78 Industrial MarketWilliam HarrisNo ratings yet

- 3Q21 Philadelphia Office Market ReportDocument6 pages3Q21 Philadelphia Office Market ReportWilliam HarrisNo ratings yet

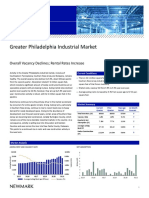

- 3Q21 Greater Philadelphia Industrial MarketDocument5 pages3Q21 Greater Philadelphia Industrial MarketWilliam HarrisNo ratings yet

- JobCreation MarylandLifeSciences MilkenDocument20 pagesJobCreation MarylandLifeSciences MilkenWilliam HarrisNo ratings yet

- Strong Fundamentals Remain in NYC Industrial Market: New York City Industrial, Q1 2021Document6 pagesStrong Fundamentals Remain in NYC Industrial Market: New York City Industrial, Q1 2021William HarrisNo ratings yet

- FP Pharmaceutical Outsourcing Monitor 08.30.21Document30 pagesFP Pharmaceutical Outsourcing Monitor 08.30.21William HarrisNo ratings yet

- For Important Information, Please See The Important Disclosures Beginning On Page 2 of This DocumentDocument5 pagesFor Important Information, Please See The Important Disclosures Beginning On Page 2 of This DocumentWilliam HarrisNo ratings yet

- FP - CTS Report H1.21Document13 pagesFP - CTS Report H1.21William HarrisNo ratings yet

- FP - CTS Report Q3.20Document13 pagesFP - CTS Report Q3.20William HarrisNo ratings yet

- Achieving DigitalDocument20 pagesAchieving DigitalWilliam HarrisNo ratings yet

- National Survey Media Roll-Out InfographicDocument1 pageNational Survey Media Roll-Out InfographicWilliam HarrisNo ratings yet

- Actuator PDFDocument34 pagesActuator PDFEnar PauNo ratings yet

- Nav MW (U-1)Document62 pagesNav MW (U-1)Navneet guptaNo ratings yet

- Steam Generator HDocument2 pagesSteam Generator HNoor NoorNo ratings yet

- NIT for EPC Bidding of Coal Fired Power ProjectDocument9 pagesNIT for EPC Bidding of Coal Fired Power ProjectLavu Anil ChowdaryNo ratings yet

- DCA0012601P0001 Dca0012601p0001Document7 pagesDCA0012601P0001 Dca0012601p0001Sakahi SharmaNo ratings yet

- DeforestationDocument4 pagesDeforestationPeggopoulouNo ratings yet

- Problem Sheet 3 - External Forced Convection - WatermarkDocument2 pagesProblem Sheet 3 - External Forced Convection - WatermarkUzair KhanNo ratings yet

- EasyPact CVS - LV510804Document3 pagesEasyPact CVS - LV510804Mouath AlraoushNo ratings yet

- Print TTTDocument36 pagesPrint TTTMoin ul IslamNo ratings yet

- Operation Guide 3159: Getting AcquaintedDocument6 pagesOperation Guide 3159: Getting AcquaintedhenkNo ratings yet

- Technical DiaryDocument127 pagesTechnical Diarytushar67100% (1)

- WaterDocument9 pagesWaterRakshit GhanghasNo ratings yet

- Swartland SDFDocument68 pagesSwartland SDFAerial ChenNo ratings yet

- Fluke 1651 User ManualDocument80 pagesFluke 1651 User ManualGraham DickensNo ratings yet

- Climate Change EssayDocument2 pagesClimate Change EssaySammNo ratings yet

- Greenlining and Bluelining of Ergon Energy Substation DrawingsDocument16 pagesGreenlining and Bluelining of Ergon Energy Substation DrawingsJarrett MathewsNo ratings yet

- 1 s2.0 S0196890422012195 MainDocument16 pages1 s2.0 S0196890422012195 MainAlex SmithNo ratings yet

- BV Webinar SlidesDocument64 pagesBV Webinar SlidessuinsasNo ratings yet

- Gledhill Stainless ES Issue 7 1Document32 pagesGledhill Stainless ES Issue 7 1anthonycmartin76No ratings yet

- Hatz ManualDocument53 pagesHatz ManualCubi Masinska ObradaNo ratings yet

- Applied Thermal EngineeringDocument11 pagesApplied Thermal EngineeringFabrizio RinaldiNo ratings yet

- Steering SysemDocument40 pagesSteering SysemDat100% (3)

- Catalogo PNRDocument115 pagesCatalogo PNRKaren Isabel Ambiado RivasNo ratings yet

- ALPAM DrakaDocument1 pageALPAM Drakaamir11601No ratings yet

- Submission Prime Coat (MC-30) Test ResultDocument2 pagesSubmission Prime Coat (MC-30) Test ResultAdyam YonasNo ratings yet

- Tesla meter,Gauss meter、Magnetic flux densimeter、Introduction Handy typeDocument2 pagesTesla meter,Gauss meter、Magnetic flux densimeter、Introduction Handy typesomkiat kongprasiatNo ratings yet

- Beam Powered PropulsionDocument19 pagesBeam Powered PropulsionSai Sushma100% (1)

- PedgkDocument32 pagesPedgkGokulakrishnanNo ratings yet

- Energy Recovery Heat Exchanger Steam Cogeneration Steam Turbine Combined CycleDocument4 pagesEnergy Recovery Heat Exchanger Steam Cogeneration Steam Turbine Combined CycleprathapNo ratings yet