Professional Documents

Culture Documents

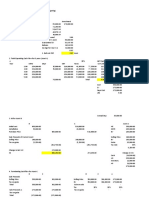

Charge To Income

Uploaded by

chavansuryakant1991Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Charge To Income

Uploaded by

chavansuryakant1991Copyright:

Available Formats

edit] Income from Other Sources

This is a residual head, under this head income which does not meet criteria to go to other heads

is taxed. There are also some speciIic incomes which are to be taxed under this head.

1. ncome by way oI Dividends

2. ncome Irom horse races

3. ncome Irom winning bull races

4. Any amount received Irom key man insurance policy an donation.

5. ncome Irom shares (dividend)

edit] Income Exempt from Tax

$ections 10,10A, 10AA, 10B, 10BA, and 13A deal with income which does not Iorm part oI an

assessee's total income. While section 10 provides a list oI income absolutely exempt Irom tax,

sections 10A, 10AA, 10B, 10BA, and 13A deal with speciIic exemptions available to newly

established industrial undertakings in Iree trade zones, and political parties. These exemptions

are provided Irom social, political, Constitutional considerations, Ior avoiding double taxation,

on the basis oI casual and non-recurring nature ,on the basis oI non-residents and non-citizens

status, on the basis oI Certain speciIic securities, bonds, certiIicates, Iunds and the like, on the

basis oI Education, science, research, achievements, rewards, sports, charity, on the basis oI

certain types oI bodies, Iunds and institutions, $ubsidies to promote business, and international,

economic, and other considerations. $ikkim is the only state oI ndia where citizens do not pay

income tax. Residents oI $ikkim are eligible Ior this exemption but excluding the non-$ikkimese

spouse oI a $ikkimese.thats why Center Gov. does not pay any revenue to $ikkim $tate Irom

ncome tax.Gujrat is number state who collect maximum revenue Irom Center report oI

2007.center Gov is now may change revenue oI state in coming year. Center Gov s liable to

pay minimum Iix revenue to state beIore next year Irom income tax collected Irom state.

|5|

.

Agricultural ncome |$ection 10(1)| Eligible Assesses :- All assesses Exempt income :-

Agricultural income Other points :- Agricultural income means as it is deIined in $ection 2(1A)

n case oI individual, HUF, AOP, BO, unregistered Iirms and artiIicial juridical persons,

agricultural income is to be aggregated Ior the purpose oI determining the rate oI tax on Non-

Agricultural income and they would get tax rebate or relieI.

edit] Dividends

Dividend income (as reIerred u/s 115-O oI the .Tax Act) paid by Companies and Mutual Funds

are exempt Irom tax. A 15 dividend distribution tax and surcharge oI 3 is paid by companies

beIore distribution. Equity mutual Iunds (with more than 65 oI assets invested in equities) do

not pay a dividend distribution tax, though other Iunds do. Liquid and Money Market Iunds pay

25 dividend distribution tax.01123

edit] Other Exempt Income

The ndian ncome tax act speciIically exempts certain income Irom tax:

O Money received Irom an nsurance company as proceeds oI an insurance policy (by way

oI an insurance claim, or by maturity) is generally exempt. However there are three types

oI payments under liIe insurance policy that are not tax Iree . These are :

O any sum received under sub-section (3) oI section 80DD or sub-section (3) oI

section 80DDA - this reIers to speciIic policies Ior disabled dependants; or

O any sum received under a Keyman insurance policy; or

O any sum received under policies issued on or aIter 1 April 2003 where premium

paid is greater than 1/5th the sum assured

O Maturity proceeds oI a Public Provident Fund (PPF) account.

edit] Deduction

While exemptions is on income some deduction in calculation oI taxable income is allowed Ior

certain payments.

edit] Section 80C Deductions

$ection 80C oI the ncome Tax Act |1| allows certain investments and expenditure to be tax-

exempt. The total limit under this section is Rs. 100,000 (Rupees One lac) which can be any

combination oI the below:

O Contribution to Provident Fund or Public Provident Fund

O Payment oI liIe insurance premium

O nvestment in pension Plans

O nvestment in Equity Linked $avings schemes (EL$$) oI mutual Iunds

O nvestment in National $avings CertiIicates (interest oI past N$Cs is reinvested every

year and can be added to the $ection 80 limit)

O Payments towards principal repayment oI housing loans.Also any registration Iee or

stamp duty paid.

O Payments towards tuition Iees Ior children to any school or college or university or

similar institution. (Only Ior 2 children)or towards coaching Iee oI various competitive

exams.

Post oIIice investments The investment can be Irom any source and not necessarily Irom income

chargeable to tax.

rom April, 1 2010, a maximum of Rs. 20,000 is deductible under section 80CC provided

that amount is invested in infrastructure bonds.

edit] Section 80D: Medical Insurance Premiums

Health insurance, popularly known as Mediclaim Policies, provides a deduction oI upto Rs.

35,000.00 (Rs. 15,000.00 Ior premium payments towards policies on selI, spouse and children

and (read as in addition to) Rs. 15,000.00 Ior premium payment towards non-senior citizen

dependent parents or Rs. 20,000.00 Ior premium payment towards senior citizen dependent).

This deduction is in addition to Rs. 1,00,000 savings under T deductions clause 80C. For

consideration under a senior citizen category, the incumbent's age should be 65 years during any

part oI the current Iiscal, eg. Ior the Iiscal year 2010-11, the incumbent should already be 65 as

on March 31,2011), This deduction is also applicable to the cheques paid by proprietor Iirms.

edit] Interest on Housing Loans Section

For selI occupied properties, interest paid on a housing loan up to Rs 150,000 per year is exempt

Irom tax.(Excluding Rs.1,00,000/p.a. u/s 80c $aving) However, this is only applicable Ior a

residence constructed within three Iinancial years aIter the loan is taken and also the loan iI taken

aIter April 1, 1999.

I the house is not occupied due to employment, the house will be considered selI occupied.

For let out properties, the entire interest paid is deductible under section 24 oI the ncome Tax

act. However, the rent is to be shown as income Irom such properties. 30 oI rent received and

municipal taxes paid are available Ior deduction oI tax.

The losses Irom all properties shall be allowed to be adjusted against salary income at the source

itselI. ThereIore, reIund claims oI T.D.$. deducted in excess, on this count, will no more be

necessary.

|6|

edit] Tax Rates

n ndia, ndividual income tax is a progressive tax with three slabs. About 10 per cent oI the

population meets the minimum threshold oI taxable income

|7||8|

From April 1, 2010 new tax slabs apply, which are as Iollows:

O No income tax is applicable on all income up to Rs. 1,60,000 per year. (Rs. 1,90,000 Ior

women and Rs. 2,40,000 Ior senior citizens oI 65 and above and must be resident oI

india)

O From 1,60,001 to 5,00,000 : 10 oI amount greater than Rs. 1,60,000 (Lower limit

changes appropriately Ior women and senior citizens)

O From 5,00,001 to 8,00,000 : 20 oI amount greater than Rs. 5,00,000 34,000 ( Rs.

31,000 Ior women and Rs. 26,000 Ior senior citizens)

O Above 8,00,000 : 30 oI amount greater than Rs. 8,00,000 94,000 ( Rs. 91,000 Ior

women and Rs. 86,000 Ior senior citizens)

edit] Surcharge

$urcharge has been abolished Ior Personal income tax in the Iinancial year 2009-10.

A 7.5 surcharge (tax on tax) is applicable iI the taxable income (taking into consideration all

the deductions) is above Rs. 10 lakh (Rs. 1 million). The limit oI 10 lacs was increased to Rs. 1

crore (Rs. 10 million) with eIIect Irom 1 June 2007

All taxes in ndia are subject to an education cess, which is 3 oI the total tax payable. With

eIIect Irom assessment year 2009-10, $econdary and Higher $econdary Education Cess oI 1 is

applicable on the subtotal oI taxable income. Mainly education cess is applicable on excise duty

and service tax

edit] Tax Rate for non-Individuals

There are special rates prescribed Ior Firms, Corporates, Local Authorities & Co-operative

$ocieties.

|9|

edit] Refund Status for Salaried tax payers

The ncome Tax Department has put on its website the list oI income tax reIunds oI all salary tax

payers which could not be sent to the concerned persons Ior want oI correct address. (link to

check reIund)

$alary taxpayers who have not received reIunds Ior assessment years 2003\04 to 2006\07 can

click on the link below and query using the PAN number and assessment year whether any

reIund due to them has been returned undelivered.

|10|

.

edit] Corporate Income tax

For companies, income is taxed at a Ilat rate oI 30 Ior ndian companies, with a 10 surcharge

applied on the tax paid by companies with gross turnover over Rs. 1 crore (10 million). Foreign

companies pay 40.

|11|

.An education cess oI 3 (on both the tax and the surcharge) are payable,

yielding eIIective tax rates oI 33.99 Ior domestic companies and 41.2 Ior Ioreign companies.

From 2005-06, electronic Iiling oI company returns is mandatory.

|12|

edit] Tax Penalties

"I the Assessing OIIicer or the Commissioner (Appeals) or the Commissioner in the course oI

any proceedings under this Act, is satisIied that any person-

(b) has Iailed to comply with a notice under sub-section (1) oI section 142 or sub-section (2) oI

section 143 or Iails to comply with a direction issued under sub-section (2A) oI section 142, or

(c) has concealed the particulars oI his income or Iurnished inaccurate particulars oI such

income,

he may direct that such person shall pay by way oI penalty,-

(ii) in the cases reIerred to in clause (b), in addition to any tax payable by him, a sum oI ten

thousand rupees Ior each such Iailure;

(iii) in the cases reIerred to in clause (c), in addition to any tax payable by him, a sum which

shall not be less than, but which shall not exceed three times, the amount oI tax sought to be

evaded by reason oI the concealment oI particulars oI his income or the Iurnishing oI inaccurate

particulars oI such income

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- ELECTION LAW Case Doctrines PDFDocument24 pagesELECTION LAW Case Doctrines PDFRio SanchezNo ratings yet

- Hse MomDocument4 pagesHse MomSamar Husain100% (2)

- High Treason and TreasonDocument6 pagesHigh Treason and Treasonapi-272053603No ratings yet

- Tumey V Ohio (Judge Compensation Issue) HTMDocument18 pagesTumey V Ohio (Judge Compensation Issue) HTMlegalmattersNo ratings yet

- Chattel Mortgage Registration ProceduresDocument2 pagesChattel Mortgage Registration ProceduresJan Roots100% (1)

- Manila Banking Co. vs. University of BaguioDocument2 pagesManila Banking Co. vs. University of BaguioMarianne Andres100% (2)

- CRIMINAL LAW 1 REVIEWER Padilla Cases and Notes Ortega NotesDocument110 pagesCRIMINAL LAW 1 REVIEWER Padilla Cases and Notes Ortega NotesrockaholicnepsNo ratings yet

- Court of Appeals Upholds Dismissal of Forcible Entry CaseDocument6 pagesCourt of Appeals Upholds Dismissal of Forcible Entry CaseJoseph Dimalanta DajayNo ratings yet

- Daniel Nyandika Kimori v V A O minor suit negligence caseDocument2 pagesDaniel Nyandika Kimori v V A O minor suit negligence casevusNo ratings yet

- LAW OF EVIDENCEDocument7 pagesLAW OF EVIDENCERajithha KassiNo ratings yet

- Realvce: Free Vce Exam Simulator, Real Exam Dumps File DownloadDocument16 pagesRealvce: Free Vce Exam Simulator, Real Exam Dumps File Downloadmario valenciaNo ratings yet

- Oracle Application Express Installation Guide PDFDocument221 pagesOracle Application Express Installation Guide PDFmarcosperez81No ratings yet

- Raquana Neptune 5S English A SBA CXCDocument15 pagesRaquana Neptune 5S English A SBA CXCraquan neptuneNo ratings yet

- AE 315 FM Sum2021 Week 3 Capital Budgeting Quiz Anserki B FOR DISTRIBDocument7 pagesAE 315 FM Sum2021 Week 3 Capital Budgeting Quiz Anserki B FOR DISTRIBArly Kurt TorresNo ratings yet

- LASC Case SummaryDocument3 pagesLASC Case SummaryLuisa Elena HernandezNo ratings yet

- Industrial Security ConceptDocument85 pagesIndustrial Security ConceptJonathanKelly Bitonga BargasoNo ratings yet

- Vol 4Document96 pagesVol 4rc2587No ratings yet

- LabReport2 Group6Document7 pagesLabReport2 Group6RusselNo ratings yet

- FNDWRRDocument2 pagesFNDWRRCameron WrightNo ratings yet

- Caram V CaDocument3 pagesCaram V Caherbs22221473No ratings yet

- Action Taken Report (ATR) - For Submission in Nov 2022 - Track With ExplanationDocument2 pagesAction Taken Report (ATR) - For Submission in Nov 2022 - Track With Explanationraghav joshiNo ratings yet

- Feast of TrumpetsDocument4 pagesFeast of TrumpetsSonofManNo ratings yet

- Land Acquisition Rehabilitation and ReseDocument19 pagesLand Acquisition Rehabilitation and Reseleela naga janaki rajitha attiliNo ratings yet

- SWANCOR 901-3: Epoxy Vinyl Ester ResinsDocument2 pagesSWANCOR 901-3: Epoxy Vinyl Ester ResinsSofya Andarina100% (1)

- Academic Test 147-2Document12 pagesAcademic Test 147-2Muhammad Usman HaiderNo ratings yet

- MC 2021-086 General Guidelines On The International Organization For Standardization ISO Certification of The PNP Office Units Revised 2021Document10 pagesMC 2021-086 General Guidelines On The International Organization For Standardization ISO Certification of The PNP Office Units Revised 2021Allysa Nicole OrdonezNo ratings yet

- BatStateU-FO-NSTP-03 - Parent's, Guardian's Consent For NSTP - Rev. 01Document2 pagesBatStateU-FO-NSTP-03 - Parent's, Guardian's Consent For NSTP - Rev. 01Gleizuly VaughnNo ratings yet

- 2019 Ford Ranger Owners Manual Version 2 - Om - EN US - 12 - 2018Document499 pages2019 Ford Ranger Owners Manual Version 2 - Om - EN US - 12 - 2018Charles MutetwaNo ratings yet

- Grade 8 Unit 1 L.3: Actions Are Judged by IntentionsDocument18 pagesGrade 8 Unit 1 L.3: Actions Are Judged by IntentionsAMNA MUJEEB tmsNo ratings yet

- Exposition TextDocument5 pagesExposition TextImam YusaNo ratings yet