Professional Documents

Culture Documents

Exercises

Uploaded by

Arzum EserOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercises

Uploaded by

Arzum EserCopyright:

Available Formats

Modeling problems: 1) Fox Enterprises is considering six projects for possible construction over the next four years.

The expected (present value) returns and cash outlays for the projects are given below. Fox can undertake any of the projects partially or completely.A partial undertaking of a project will prorat e both the return and cash outlays proportionatel y. Formulate the problem as a linear program, and determine the optimal project mix that maximizes the total return. Ignore the time value of money.

2) Tooleo has contracted with AutoMate to supply their automotive discount stores with wrenches and chisels.AutoMate's weekly demand consists of at least 1500 wrenches and 1200 chisels.Tooleo cannot produce all the requested units with its present one-shift capacity and must use overtime and possibly subcontract with other tool shops. The result is an increase in the production cost per unit, as shown in the following table. Market demand restricts the ratio of chisels to wrenches to at least 2:1. Formulate the problem as a linear program, and determine the optimum production schedule for each tool.

3) A hardware store packages handyman bags of screws, bolts, nuts, and washers. Screws come in l00-lb boxes and cost $110 each, bolts come in l00-lb boxes and cost $150 each, nuts come in 80-lb boxes and cost $70 each, and washers come in 30-lb boxes and cost $20 each. The handyman package weighs at least lIb and must include, by weight, at least 10% screws and 25% bolts, and at most 15% nuts and 10% washers. To balance the package, the number of bolts cannot exceed the number of nuts or the number of washers. A bolt weighs 10 times as much as a nut and 50 times as much as a washer. Determine the optimal mix of the package.

Graphical solution problems: 1) A company produces two products,A and B. The sales volume for A is at least 80% of the total sales of both A and B. However, the company cannot sell more than 100 units of A per day. Both products use one raw material, of which the maximum daily availability is 240 lb.The usage rates of the raw material are 2 lb per unit of A and 4 lb per unit of B. The profit units for A and B are $20 and $50, respectively. Determine the optimal product mix for the company. 2) Show & Sell can advertise its products on local radio and television (TV).1l1e advertising budget is limited to $10,000 a month. Each minute of radio advertising costs $15 and each minute ofTY commercials $300. Show & Sell likes to advertise on radio at least twice as much as on TV. In the meantime, it is not practical to use more than 400 minutes of radio advertising a month. From past experience, advertising on TV is estimated to be 25 times as effective as on radio. Determine the optimum allocation of the budget to radio and TV advertising. 3) OilCo is building a refinery to produce four products: diesel, gasoline, lubricants, and jet fuel. The minimum demand (in bblJday) for each of these products is 14,000,30,000, 10,000, and 8,000, respectively. Iran and Dubai are under contract to ship crude to OilCo. Because of the production quotas specified by OPEC (Organization of Petroleum Exporting Countries) the new refinery can receive at least 40% of its crude from Iran and the remaining amount from Dubai. Oileo predicts that the demand and crude oil quotas will remain steady over the next ten years. The specifications of the two crude oils lead to different product mixes: One barrel of Iran crude yields .2 bbl of diesel, .25 bbl of gasoline,.l bbl of lubricant, and .15 bbl of jet fuel. The corresponding yields from Dubai crude are .1, .6, .15, and .1, respectively. OilCo needs to determine the minimum capacity of the refinery (in bbl/ day).

Simplex Algorithm Problems: 1) Aadaki modeli, Simplex algoritmas ile znz.

Solutions for Modeling Problems: 1)

2)

3)

Solutions for Graphical solution problem: 1)

2)

3)

Solutions for Simplex algorithm: 1)

2)

You might also like

- UECM2043, UECM2093 Operations Research Tutorial 1Document5 pagesUECM2043, UECM2093 Operations Research Tutorial 1kamun00% (2)

- Operations ResearchDocument1 pageOperations ResearchKushal Bothra0% (1)

- (Quantitative Analysis) Linear ProgrammingDocument2 pages(Quantitative Analysis) Linear ProgrammingKiran BasuNo ratings yet

- Mid Term Problem 1 & 2-1-54877Document2 pagesMid Term Problem 1 & 2-1-54877Nehal NabilNo ratings yet

- Chapter 3 Resource PlanningDocument70 pagesChapter 3 Resource PlanningHieu TruongNo ratings yet

- Practice Problem 2Document3 pagesPractice Problem 2rajatchikuNo ratings yet

- Introduction To Linear ProgrammingDocument27 pagesIntroduction To Linear Programmingmuskaan bhadada100% (1)

- ProblemDocument3 pagesProblemPePe' Tiamo100% (1)

- Optimal Warehouse Leasing ModelDocument88 pagesOptimal Warehouse Leasing Modelcarlette110% (1)

- MG314 Operations Management Assignment SolutionsDocument2 pagesMG314 Operations Management Assignment Solutionsdip_g_007No ratings yet

- Linear Programming Formulation - 40 StepsDocument27 pagesLinear Programming Formulation - 40 StepsLinita MariaNo ratings yet

- EMGT 501 HW Solutions Linear Programming ProblemsDocument12 pagesEMGT 501 HW Solutions Linear Programming Problemsroberto tumbacoNo ratings yet

- Multiple Choice: Circle One Answer For Each Question. Transfer All You Answer To The Attached Answer Sheet and Email Back To Me On April 16Document3 pagesMultiple Choice: Circle One Answer For Each Question. Transfer All You Answer To The Attached Answer Sheet and Email Back To Me On April 16Joshua RamirezNo ratings yet

- Replacement AnalysisDocument34 pagesReplacement AnalysisShamsul AffendiNo ratings yet

- Linear ProgrammingDocument13 pagesLinear ProgrammingAira Cannille LalicNo ratings yet

- Solution QA Ch7Document15 pagesSolution QA Ch7Erica Naranjo Rosella100% (1)

- MSIS 511 Operations Management Problem SetsTITLEMSIS 511 Operations Management Problem Set SolutionsDocument8 pagesMSIS 511 Operations Management Problem SetsTITLEMSIS 511 Operations Management Problem Set SolutionsjarjonaeNo ratings yet

- Linear ProgrammingDocument15 pagesLinear Programmingjogindra singh100% (1)

- Modelling With Linear ProgDocument22 pagesModelling With Linear ProgvijaydhNo ratings yet

- SYS6001 - Car Buying Decision Analysis Problem Setup and Teaching NotesDocument13 pagesSYS6001 - Car Buying Decision Analysis Problem Setup and Teaching NotesDouglas FraserNo ratings yet

- Linear Programming ProjectDocument5 pagesLinear Programming Projectapi-267005931No ratings yet

- PowerPoint Presentation (3036922) - 2Document164 pagesPowerPoint Presentation (3036922) - 2Naga LakshmaiahNo ratings yet

- Ch08 Linear Programming SolutionsDocument26 pagesCh08 Linear Programming SolutionsVikram SanthanamNo ratings yet

- Mintendo Game Girl case study solution and analysisDocument5 pagesMintendo Game Girl case study solution and analysisSaqibnaeeNo ratings yet

- Project Charter ExampleDocument2 pagesProject Charter ExampleJohnNo ratings yet

- Transportation Problem A Special Case For Linear Programming Problems PDFDocument36 pagesTransportation Problem A Special Case For Linear Programming Problems PDFCaz Tee-NahNo ratings yet

- Mixed Integer Prog - Excel Solver Practice ExampleDocument22 pagesMixed Integer Prog - Excel Solver Practice Exampleendu wesenNo ratings yet

- Goal ProgrammingDocument26 pagesGoal ProgrammingDiniya Khanza NidaNo ratings yet

- CH 08 Internet Case Drink at HomeDocument2 pagesCH 08 Internet Case Drink at HomeAce Lalicon33% (6)

- Math 125 Final Exam Practice SolutionsDocument9 pagesMath 125 Final Exam Practice SolutionscarrotraisinNo ratings yet

- Sensitivity Analysis InterpretationDocument8 pagesSensitivity Analysis Interpretationronit brahmaNo ratings yet

- Linear Program 1Document52 pagesLinear Program 1ChaOs_Air75% (4)

- Unbalanced Transportation ModelDocument4 pagesUnbalanced Transportation ModelSunil Prasanna PatraNo ratings yet

- Quantitative Techniques - Paper 2 PDFDocument11 pagesQuantitative Techniques - Paper 2 PDFTuryamureeba JuliusNo ratings yet

- Tutorial Material Discrete Random Variables: International University Semester 1, Academic Year 2018-2019Document3 pagesTutorial Material Discrete Random Variables: International University Semester 1, Academic Year 2018-2019Nguyễn BìnhNo ratings yet

- (U E in - Ppa) NotesDocument28 pages(U E in - Ppa) NotesSumedh Kakde100% (1)

- MSS - CHP 3 - Linear Programming Modeling Computer Solution and Sensitivity Analysis PDFDocument10 pagesMSS - CHP 3 - Linear Programming Modeling Computer Solution and Sensitivity Analysis PDFNadiya F. ZulfanaNo ratings yet

- LINEAR PROGRAMMING PORTFOLIO OPTIMIZATIONDocument7 pagesLINEAR PROGRAMMING PORTFOLIO OPTIMIZATIONAnshul SahniNo ratings yet

- Assignment PDFDocument4 pagesAssignment PDFDark LightNo ratings yet

- MIT 2.810 Homework 9 Solutions Process Control ChartsDocument8 pagesMIT 2.810 Homework 9 Solutions Process Control ChartsWinpee SacilNo ratings yet

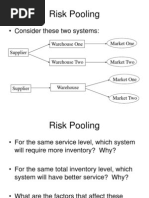

- Risk PoolingDocument11 pagesRisk PoolingAshok100% (1)

- Decision Analysis Tutorial 1Document24 pagesDecision Analysis Tutorial 1AAAAANo ratings yet

- Operations Research I: Dr. Bill CorleyDocument147 pagesOperations Research I: Dr. Bill Corleydiyar cheNo ratings yet

- Graphical Method of LPDocument16 pagesGraphical Method of LPsleshiNo ratings yet

- Linear Programming ExamplesDocument7 pagesLinear Programming ExamplesgoforjessicaNo ratings yet

- Decision Modeling Applications and Spreadsheet SolutionsDocument25 pagesDecision Modeling Applications and Spreadsheet SolutionsaniketkaushikNo ratings yet

- Ch5 Capacity PlanningDocument8 pagesCh5 Capacity PlanningJess JerinnNo ratings yet

- SampleFINAL KEY 205 TaylorDocument9 pagesSampleFINAL KEY 205 Tayloraskar_cbaNo ratings yet

- ACTIVITY AND PROCESS CHARTSDocument23 pagesACTIVITY AND PROCESS CHARTSKübra AkNo ratings yet

- Solutions Manual to Accompany Introduction to Quantitative Methods in Business: with Applications Using Microsoft Office ExcelFrom EverandSolutions Manual to Accompany Introduction to Quantitative Methods in Business: with Applications Using Microsoft Office ExcelNo ratings yet

- Documents - MX Exercises-5584627649d72Document9 pagesDocuments - MX Exercises-5584627649d72Fady AbboudNo ratings yet

- Maximizing Profit and Efficiency with Linear Programming ModelsDocument6 pagesMaximizing Profit and Efficiency with Linear Programming ModelsNavneet GuptaNo ratings yet

- Maximising Profits and Setting Optimal Price for Abel LtdDocument4 pagesMaximising Profits and Setting Optimal Price for Abel Ltdnicksilvester1991No ratings yet

- Math 180 FormulationprobsDocument3 pagesMath 180 FormulationprobsWilmar S Salvador LptNo ratings yet

- Cost Volume Profit Analysis For Paper 10Document6 pagesCost Volume Profit Analysis For Paper 10Zaira Anees100% (1)

- Handout LPDocument3 pagesHandout LPSohail AjmalNo ratings yet

- Maximize Advertising Exposure for Biggs Department StoreDocument3 pagesMaximize Advertising Exposure for Biggs Department StoreSumit SharmaNo ratings yet

- Ateneo Cost Accounting problem set on inventory valuation and relevant costingDocument7 pagesAteneo Cost Accounting problem set on inventory valuation and relevant costingMegan LoNo ratings yet

- Tutorial - II: Date-19/08/2023Document2 pagesTutorial - II: Date-19/08/2023Mahesh SNo ratings yet

- +rostrupnielsen1984 - (Catalytic Steam Reforming)Document117 pages+rostrupnielsen1984 - (Catalytic Steam Reforming)Faris Hamidi100% (1)

- School of Chemistry SOP For Operation of Vacuum Pumps and Evacuated Apparatus V18.04Document3 pagesSchool of Chemistry SOP For Operation of Vacuum Pumps and Evacuated Apparatus V18.04Anand HSNo ratings yet

- Rotating Equipment Chapter 6Document19 pagesRotating Equipment Chapter 6Mohamad SleimanNo ratings yet

- Downhole Chemical Injection Lines Why Do They Fail Experiences Challenges and Application of New Test MethodsDocument11 pagesDownhole Chemical Injection Lines Why Do They Fail Experiences Challenges and Application of New Test MethodsAcbal AchyNo ratings yet

- Er.1302) Galal M. Zaki Rahim K. Jassim Majed M. Alhazmy - Brayton Refrigeration Cycle For Gas Turbine Inlet Air CooliDocument15 pagesEr.1302) Galal M. Zaki Rahim K. Jassim Majed M. Alhazmy - Brayton Refrigeration Cycle For Gas Turbine Inlet Air CooliidigitiNo ratings yet

- BEB801 Engineering Project Literature SearchDocument9 pagesBEB801 Engineering Project Literature SearchAaron PalmNo ratings yet

- Vorecon ApplicationsDocument46 pagesVorecon ApplicationslancasaNo ratings yet

- Maintain Centrifugal PumpDocument22 pagesMaintain Centrifugal Pumphany mohamed100% (1)

- #1 Pedestal Pipe Support PDFDocument3 pages#1 Pedestal Pipe Support PDFBayu Adi DharmaNo ratings yet

- Hybrid Electric Vehicle: Seminar PresentationDocument20 pagesHybrid Electric Vehicle: Seminar PresentationAnonymous kTrTwOlURNo ratings yet

- Hero Honda Splender ProDocument91 pagesHero Honda Splender ProSubramanya Dg100% (1)

- MCRS Fuel System Overview PDFDocument100 pagesMCRS Fuel System Overview PDFAnonymous ABPUPbK91% (11)

- 302 Lubricants and Lubrication Course DescriptionDocument2 pages302 Lubricants and Lubrication Course DescriptionAhmed El-ShafeiNo ratings yet

- HSE Unloading Petrol From Road TankersDocument24 pagesHSE Unloading Petrol From Road Tankersgjbishopgmail100% (2)

- Winkie Parts 1Document9 pagesWinkie Parts 1Inkanata SacNo ratings yet

- Ready For Take Off? Aviation Biofuels Past, Present, and FutureDocument40 pagesReady For Take Off? Aviation Biofuels Past, Present, and FutureThe Atlantic CouncilNo ratings yet

- 750HP DW PDFDocument6 pages750HP DW PDFilkerkozturkNo ratings yet

- Flywheel Mass for Fluctuating Speed EngineDocument78 pagesFlywheel Mass for Fluctuating Speed EngineKrish NarayananNo ratings yet

- Kuliah 4 Fluida Komplesi AHDocument99 pagesKuliah 4 Fluida Komplesi AHGhea Tiarasani Sondakh100% (1)

- Gambu PaperDocument11 pagesGambu PaperashameensNo ratings yet

- LPG Global Technology Conference2006 PresentationDocument10 pagesLPG Global Technology Conference2006 PresentationIqra AngelsNo ratings yet

- Alarmas y Paros Waukesha s-8382-03 PDFDocument3 pagesAlarmas y Paros Waukesha s-8382-03 PDFmdo100% (1)

- EDL SDA Pilot Plant PDFDocument8 pagesEDL SDA Pilot Plant PDFProcess EngineerNo ratings yet

- Pipe Inspection SpecificationDocument49 pagesPipe Inspection SpecificationRama Krishna Reddy DonthireddyNo ratings yet

- Air Powered Cars OriginalDocument32 pagesAir Powered Cars OriginalAnonymous WPSS3vENo ratings yet

- ART Engineers Detail Key Hydrotreater VariablesDocument6 pagesART Engineers Detail Key Hydrotreater Variablesrohl55No ratings yet

- Spring Final Study GuideDocument6 pagesSpring Final Study Guideteenwolf4006No ratings yet

- Heat EnginesDocument3 pagesHeat EnginesUzoma UwanamodoNo ratings yet

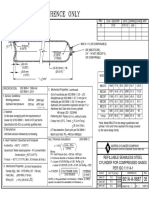

- Refillable Seamless Steel Cylinder For Compressed Gases PER ISO 11114-1Document1 pageRefillable Seamless Steel Cylinder For Compressed Gases PER ISO 11114-1bkprodhNo ratings yet