Professional Documents

Culture Documents

51 ATM With An Eye

Uploaded by

Brijesh Chowdary LavuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

51 ATM With An Eye

Uploaded by

Brijesh Chowdary LavuCopyright:

Available Formats

ATM WITH AN EYE ABSTRACT There is an urgent need for improving region.

security With in the The rise of technology in India has brought into force many types of equipment that aim at more customer satisfaction. ATM is one such machine which made money transactions easy for customers to bank. The other side of this improvement is the enhancement of the culprits probability unauthentic Traditionally, handled by combination of requiring a to get security his share. is the INTRODUCTION banking institutions alike from fraud and other breaches of security.

advent of ATM though banking became a lot easier it even became a lot vulnerable. The chances of misuse of this much hyped insecure baby product (ATM) are manifold due to the exponential growth of intelligent criminals day by day. ATM systems today use no more than an access card and PIN for identity verification. This situation is unfortunate since tremendous progress has been made in biometric techniques, iris scanning. This paper proposes the development of a system that integrates Facial recognition and Iris scanning technology into the identity verification process used in ATMs. The development of such a system would serve to and protect financial consumers identification including finger

physical

access card and a PIN or other password in order to access a customers model account. This invites fraudulent

printing, facial recognition, and

attempts through stolen cards, badly-chosen or automatically assigned PINs, cards with little or no encryption customer schemes, account employees with access to nonencrypted failure. information and other points of

www.seminarcollections.com

ATM WITH AN EYE Our security combine paper model a proposes that an checking -- is unique to every person, more so than fingerprints. 2. LITERATURE REVIEW For most of the past ten years, the majority IBMs of ATMs used OS/2. worldwide ran under now-defunct However, IBM hasnt issued a major update to the operating system in over six years. Movement in the banking world is now going in two directions: Windows and Linux. NCR, a leading worldwide ATM manufacturer, recently announced an agreement to use Windows XP Embedded in its next generation In this paper , we will also look into an automatic teller machine providing security the model a customers of personalized ATMs (crmdaily.com.) Windows XP Embedded allows OEMs to pick and choose from the thousands of components that make up Windows XP Professional, including multimedia, integrated

automatic

teller physical

machine would access

card, a PIN, and electronic facial recognition. By forcing the ATM to match a live image of a customers face with an image stored in is a bank database that associated

with the account number, the damage to be caused by stolen cards and PINs is effectively neutralized. Only when the PIN matches the account and the live image and stored image match would a user be considered fully verified. A system can examine just the eyes, or the eyes nose and mouth, or ears, nose, mouth and eyebrows, and so on.

cardless, password-free way to get their money out of an ATM. Just step up to the camera while your eye is scanned. The iris -- the colored part of the eye the camera will be

networking and database

www.seminarcollections.com

ATM WITH AN EYE management functionality. bulk of transaction processing (linux.org.) This model would also work well for the proposed system if the ATMs processors were not powerful enough to quickly and the perform the facial recognition algorithms. In terms of the improvement of security standards, MasterCard is spearheading an Kalignite effort to heighten the encryption used at ATMs. For the past few decades, many machines have used the Data that Encryption Standard developed by IBM in the mid 1970s that uses a 56-bit key. . DES has been shown to be rather easily cracked, however, given proper computing hardware. In recent years, a Triple DES scheme has been put forth that uses three such keys, for an effective 168-bit key length. MasterCard now requires new or relocated ATMs to use the Triple DES scheme, and by April, 2005, both Visa and MasterCard will require that any ATM that supports to

This makes the use of off-theshelf facial recognition code more desirable because it could easily be compiled for the Windows XP environment networking and database tools will already be in place. For less powerful ATMs, KAL, a software company based in Scotland, provides CE, which is a modification of the Windows CE platform. This allows developers target older machines to more easily develop complex user-interaction systems Many financial institutions are relying on a third choice, Windows NT, because of its stability and maturity as a platform. On an alternative front, the largest bank in the south of Brazil, Banrisul, has installed a custom version of Linux in its set of two thousand ATMs, replacing legacy MS-DOS systems. The ATMs send database requests bank servers which do the development

www.seminarcollections.com

ATM WITH AN EYE their cards must use Triple DES. ATM manufacturers are now developing newer models that support Triple DES natively; such redesigns may make them more amenable to also including snapshot cameras and facial recognition software, more so than they to are would be in regards There proposed retrofitting hundreds and preof environment would all be controlled robust unnecessary facial class is called image template based. This method attempts to capture global features of facial images into facial templates. Neural networks, among other methods, are often used to construct these templates for all later matching use. An alternative method, called geometry-based, is to explicitly examine geometrical between into account, though, are certain key factors that may change across live images: illumination, expression, and pose (profile.) A study was of recently leading conducted one those the individual relationship features features of a face and the actual .One recognition within certain software leading algorithm narrow limits, making hugely

existing machines .

implementations of facial recognition technology from all manner of vendors for manner of uses. However, for the model proposed in this paper, we are interested only in the process of facial verification matching a live image to a predefined image to verify a claim of identity not in the process of facial evaluation matching a live image to any image in a database. Further, the environmental conditions under which the verification takes place the lighting, the imaging system, the image profile, and the processing

(Gross.) What must be taken

recognition algorithms, notably

www.seminarcollections.com

ATM WITH AN EYE developed by two researchers at MIT, Baback Moghaddam and Alex Pentland, and one a commercial product from Identix called FaceIt. The MIT program is based on Principal Feature Analysis, an adaptation of template based recognition. FaceIts approach uses geometrybased local feature analysis. Both algorithms have to be initialized by providing the locations of the eyes in the database image, from which they can create an internal representation of the normalized face. It is this representation to which future live images will be compared . In the study, it was found that both programs handled changes in illumination well. This is important because ATM use occurs day and night, with or without artificial illumination. Likewise, the programs allowed general expression changes while maintaining However, matching extreme success. scream profile, or squinted

eyes, dropped the recognition rates significantly. Lastly, matching profile changes worked reasonably well when the initial training image(s) were frontal, which allowed 7080% success rates for up to 45 degrees of profile change success however, isnt 70-80% to amenable

keeping ATM users content with the system. The natural conclusion to draw, then, is to take a frontal image for the bank database, and to provide a prompt to the user, verbal or otherwise, to face the camera directly when the ATM verification process is to begin, so as to avoid the need to account for profile changes. With this and other accommodations, recognition verification can rates rise for above

90%. Also worth noting is that FaceIts local feature analysis method handled variations in the test cases slightly better than the PGA system used by the MIT researchers .

expressions, such as a

www.seminarcollections.com

ATM WITH AN EYE Another paper in shows using more local analysis facial verification

advantages

program that can be used on a variety of platforms, including behavior match / non-match cases. 3. OUR METHODOLOGY The first and most important protocols embedded for the

feature analysis systems. For internal representations of faces, LFA stores them topographically; that is, it maintains feature relationships explicitly. Template based systems, such as PGA, do not. The advantages of LFA are that analysis can be done on varying levels of object grouping, and that analysis methods can be independent of the topography. In other words, a system can examine just the eyes, or the eyes nose and mouth, or ears, nose, mouth and eyebrows, and so on, and that as better analysis algorithms are developed, they can fit within the data framework provided by LFA The conclusion to be drawn for this project, then, is that facial verification software is currently up to the task of providing high match rates for use in ATM transactions. What remains is to find an appropriate opensource local feature

processors, and to determine

step of this project will be to locate a powerful open-source facial recognition program that uses local feature analysis and that is targeted at facial verification. This program should be compilable on multiple systems, including Linux and Windows variants, and should be customizable to the extent of allowing for variations in processing power of the machines onto which it would be deployed. We will then need to familiarize ourselves with the internal workings of the program so that we can learn its strengths and limitations. Simple testing of this

www.seminarcollections.com

ATM WITH AN EYE program occur Several sample images will be taken of several individuals to be used as test cases one each for account images, and several each for live images, each of which would vary pose, lighting conditions, and expressions. Once chosen, program. a final we will program develop is a will so evaluate will its also need we to will be necessary, of course, because software. Both pieces of software will be compiled and run on a Windows XP and a Linux system. Once they are both functioning properly, they will be tweaked as much as possible to increase performance (decreasing the time spent matching) and to decrease memory footprint. Following that, the black boxes will be broken into two components a server and a client to be used in a will two-machine interface, network. all The input client code will act as a user passing data to the server code, which will handle the calls to the facial recognition software, further reducing the memory footprint and processor load required on the client end. level In this sense, the thin client architecture of many ATMs will be emulated. We will then investigate the process of using the black box program to control a we will not have access to an actual ATM or its

that

could

effectiveness.

simple ATM black box This program server as the theoretical ATM with which the facial recognition software interact. It will take in a name and password, and then look in a folder for an image that is associated with that name. It will then take in an image from a separate folder of live images and use the facial recognition program to generate a match between the two. Finally it will use the match level to decide whether or not to allow access, at which point it will terminate. All of this

www.seminarcollections.com

ATM WITH AN EYE USB camera attached to the computer to avoid the use of the folder of live images. Lastly, it may be possible to add some sort of DES encryption to the client end to encrypt the input data and decrypt the output data from the server knowing that this will increase the processor load, but better allowing us to gauge the time it takes to process. for in most cases. Further, a positive visual match would cause the live image to be stored in the database so that future transactions would have a broader base from which to compare if the original account image fails to provide a match thereby decreasing false negatives. When a match is made with the PIN but not the images, the bank could limit transactions in a manner agreed upon by the customer when the account was opened, and could store the image of the user for later ATM SYSTEMS Our ATM system would only attempt to match two (and later, a few) discrete images, searching candidates unnecessary. through a large be process database of possible matching would The examination by bank officials. In regards to bank employees gaining PINs would for access use to in this customer fraudulent system that

transactions, likewise

reduce

threat to exposure to the low limit imposed by the bank and agreed to by the customer on visually transactions. In the case of credit card use at ATMs, such a verification system would not currently be feasible without creating an overhaul for the unverifiable

would effectively become an exercise in pattern matching, which great would deal not of require time. a With slight

appropriate lighting and robust learning software, variations could be accounted

www.seminarcollections.com

ATM WITH AN EYE entire positive significant credit card issuing (read: reduction) withdrawn from an account. The bank accounts were not (at that time) connected by a computer network to the ATM. Therefore, banks were at first very exclusive about who they is gave ATM privileges to. Giving them holders good modern only to credit cards card were In by (credit banking ATMs,

industry, but it is possible that results fraud

achieved by this system might motivate such an overhaul. The last consideration that consumers may be wary of the privacy concerns raised by maintaining images of customers in a bank database, encrypted or otherwise, due to possible hacking attempts or employee misuse. However, one could argue that having the image compromised by a third party would have far less dire consequences than the account ATMs information videotape itself. Furthermore, since nearly all customers engaging in transactions, it is no broad leap to realize that banks already build an archive of their customer images, even if they are not with necessarily account grouped information. HISTORY The first ATMs were off-line machines, was not meaning money automatically

used before ATM cards) with records. customers

authenticate magnetic encodes account called

themselves stripe, the

using a plastic card with a which and by customer's

number, a PIN

entering a numeric passcode (personal identification number), which in some cases may be changed using the machine. Typically, if the number is entered incorrectly several times in a row, most ATMs will retain the card as a security precaution to prevent an unauthorised user from working out the PIN by pure guesswork..

www.seminarcollections.com

ATM WITH AN EYE HARDWARE SOFTWARE ATMs contain secure generally AND with Linux. RMX Other 86, platforms OS/2 and

include

Windows 98 bundled with Java. The newest ATMs use Windows XP or Windows XP embedded. RELIABILITY ATMs are generally cryptoprocessors,

within an IBM PC compatible host computer in a secure enclosure. The security of the machine relies mostly on the integrity software of often the the runs secure host on a cryptoprocessor: commodity reliable, but if they do go wrong customers will be left without cash until the following morning or whenever they can get to the bank during opening hours. Of course, not all errors are to the detriment of customers; there have been cases of machines giving out money without debiting the account, or giving out higher value notes as a result of In moving are addition, away on and ATMs are incorrect denomination of from Intel into such custom 8086 fullas banknote being loaded in the money cassettes. Errors that can occur may be mechanical (such as card transport hard mechanisms; keypads;

operating

system.In-store ATMs typically connect directly to their ATM Transaction modem move Processor via a a dedicated Internet over

telephone line, although the towards connections is under way.

circuit boards (most of which based architecture) operating

fledged PCs with commodity systems Windows 2000 and Linux. An example of this is Banrisul, the largest bank in the South of Brazil, which has replaced the MS-DOS operating systems in its automatic teller machines www.seminarcollections.com

disk failures); software (such as operating system; device driver; communications; application); or purely

down to operator error.

10

ATM WITH AN EYE SECURITY Early ATM security focused on making the ATMs invulnerable to physical attack; they with were effectively safes dispenser mechanisms. Keep you PINconfidential. Memorize Identification your Personal (PIN); Number when you're alone, leave the area.

ATMs are placed not only near banks, but also in locations such as malls, grocery stores, and restaurants. The other side of this improvement is the enhancement of the culprits probability to get his unauthentic share. ATMs are a quick and convenient way to get cash. They when are also you're Follow public and

don't write it on your card or leave it in your wallet or purse. Keep your number to yourself. Never provide your PIN over the telephone, even if a caller identifies himself as a bank employee or police officer. Neither person would call you to obtain your number. Conduct transactions in

visible, so it pays to be careful making these transactions. safety. Stay alert. If an ATM is

private. Stay squarely in front of the ATM when completing your transaction so people waiting behind you won't have an opportunity to see your PIN being entered or to view any account information. Similarly, fill out your deposit/withdrawal slips privately. Dont flash your cash. If you must count your money, do it at the ATM, and place your cash into your wallet or purse before stepping away. Avoid making excessively large

general tips for your personal

housed in an enclosed area, shut the entry door completely behind you. If you drive up to an ATM, keep your car doors locked and an eye on your surroundings. If you feel uneasy or sense something may be wrong while you're at an ATM, particularly at night or

www.seminarcollections.com

11

ATM WITH AN EYE withdrawals. If you think you're being followed as you leave the ATM, go to a public area near other people and, if FACIAL RECOGNITION necessary, ask for help. Save receipt. Your ATM The main issues faced in developing such a model are keeping the time elapsed in the verification process to a negligible amount, allowing for an when appropriate compared image, level to and of the that variation in a customers face database station for more personal

safety information.

receipts provide a record of your transactions that you can later reconcile bank with your If monthly on your statement.

you notice any discrepancies statement, contact your bank as soon as possible. Leaving receipts at an ATM can also let others know how much money you've withdrawn and how much you have in your account. Guard your card. Don't lend your card or provide your PIN to others, or discuss your bank account stolen, with contact friendly your bank strangers. If your card is lost or immediately.

credit cards which can be used at ATMs to withdraw funds are generally issued by institutions that do not have in-person contact with the customer, and hence no opportunity to acquire a photo. Because the system would only attempt to match two (and large later, a few) of discrete possible process images, searching through a database matching candidates would be unnecessary. The

Immediately the

report Of

any Public

would effectively become an exercise in pattern matching, which great would deal not of require time. a With

crime to the police. Contact Department Security or your local police

www.seminarcollections.com

12

ATM WITH AN EYE appropriate lighting and robust learning software, slight variations could be accounted for in most cases. Further, a positive visual match would cause the live image to be stored in the database so that future transactions would have a broader base from which to compare if the original account image fails to provide a match thereby decreasing false The last consideration is that consumers may be wary of the When a match is made with the PIN but not the images, the bank could limit transactions in a manner agreed upon by the customer when the account was opened, and could store the image of the user for later examination by bank officials. In regards to bank employees gaining PINs would for access use to in this customer fraudulent system that privacy concerns raised by of maintaining images negatives. In the case of credit card use at ATMs, such a verification system would not currently be feasible without creating an overhaul for the entire positive significant credit card issuing (read: reduction) industry, but it is possible that results fraud

achieved by this system might motivate such an overhaul.

customers in a bank database, encrypted or otherwise, due to possible hacking attempts or employee misuse. However, one could argue that having the image compromised by a third party would have far less dire consequences than the account ATMs information videotape itself. Furthermore, since nearly all customers engaging in transactions, it is no broad leap to realize that banks already build an archive of their customer images, even if they are not necessarily

transactions, likewise

reduce

threat to exposure to the low limit imposed by the bank and agreed to by the customer on visually transactions. unverifiable

www.seminarcollections.com

13

ATM WITH AN EYE grouped information. SOFTWARE SPECIFICATION For most of the past ten years, the majority of ATMs used IBMs worldwide ran under OS/2. now-defunct Many financial institutions are relying on Windows NT, because of its stability and maturity as a platform.The ATMs send database requests to bank servers which do the bulk of transaction processing (linux.org.) This model would also work well for the proposed system if the ATMs processors were not powerful enough to quickly perform the facial recognition algorithms. SECURITY In terms of an of the security is to effort with account could easily be compiled for the Windows XP environment and the networking and database tools will already be in place.

However, IBM hasnt issued a major update to the operating system in over in six years. banking Movement the

world is now going in two directions: Windows and Linux. NCR, a leading world-wide ATM manufacturer, recently announced an agreement to use Windows XP Embedded in its next generation Windows from Windows of ATMs XP the XP personalized (crmdaily.com.) and make choose up

Embedded allows OEMs to pick thousands of components that Professional, integrated networking management and including multimedia, database functionality.

improvement standards, spearheading

MasterCard

heighten the encryption used at ATMs. For the past few decades, many machines have used the Data Encryption Standard developed by IBM in the mid 1970s that uses a 56bit key. DES has been shown

This makes the use of off-theshelf facial recognition code more desirable because it

www.seminarcollections.com

14

ATM WITH AN EYE to be rather easily cracked, however, given proper computing hardware. In recent years, a Triple DES scheme has been put forth that uses three such keys, for an effective 168-bit key length. ATM manufacturers are now developing newer models that support Triple DES natively; such redesigns may make them more amenable to also including and would snapshot facial be in cameras recognition regards to verification matching a live image to a predefined image to verify a claim of identity not in the process of facial evaluation matching a live image to any image in a the database. environmental Further,

conditions

under which the verification takes place the lighting, the imaging profile, system, and the within the image processing certain software .One leading algorithm recognition

environment would all be controlled robust unnecessary facial narrow limits, making hugely

software, more so than they retrofitting machines . pre-existing

class is called image template based. This method attempts to capture global features of FACIALRECOGNITION TECHNIQUE: There proposed are hundreds and of of facial images What into facial be templates. must

taken into account, though, are certain key factors that may change across live images: illumination, actual facial for all

implementations manner of

recognition technology from all vendors manner of uses. However, for the model proposed in this paper, we are interested only in the process of facial

expression, and pose (profile.)

The natural conclusion to draw, then, is to take a frontal

www.seminarcollections.com

15

ATM WITH AN EYE image for the bank database, and to provide a prompt to the user, verbal or otherwise, to face the camera directly when the ATM verification process is to begin, so as to avoid the need to account for profile changes. With this and other accommodations, above 90%. A recognition system can rates for verification can rise examine just the eyes, or the eyes nose and mouth, or ears, nose, mouth and eyebrows, and so on . The conclusion to be drawn for this project, then, is that facial verification software is currently up to the task of providing high match rates for use in ATM transactions. What remains feature be used is to find an facial of appropriate open-source local analysis on a verification program that can variety platforms, including embedded processors, and to determine behavior protocols for the match / non-match cases. OUR METHODOLOGY We internal will then need of to the familiarize ourselves with the workings program so that we can learn its strengths and limitations. Simple testing of this program will also need to occur so that we could evaluate its effectiveness. Several sample images will be taken of several individuals to be used as test cases one each for account images, and several each for live images, each of which The first and most important step of this project will be to locate a powerful open-source facial recognition program that uses local feature analysis and that is targeted at facial verification. This program on should be compilable multiple

systems, including Linux and Windows variants, and should be customizable to the extent of allowing for variations in processing be deployed. power of the machines onto which it would

www.seminarcollections.com

16

ATM WITH AN EYE would vary pose, lighting functioning properly, they will be tweaked as to much as possible Once a final program is chosen, simple program. with we ATM This will develop black program the software a will facial will box Following that, the black boxes will be broken into two components a server and a client to be used in a twomachine network. The client code will act as a all user input interface, passing increase

conditions, and expressions.

performance (decreasing the time spent matching) and to decrease memory footprint.

server as the theoretical ATM which recognition

interact. It will take in a name and password, and then look in a folder for an image that is associated with that name. It will then take in an image from a separate and a folder use of the live facial to level images generate

data to the server code, which will handle the calls to the facial recognition software, further reducing the memory footprint and processor load required on the client end. In this sense, the thin client architecture of many ATMs will be emulated. We will then investigate the process of using the black box program camera to control a to USB the attached

recognition

program match

between the two. Finally it will use the match level to decide whether or not to allow access, at which point it will terminate. All of this will be necessary, of course, because we will not have access to an actual ATM or its software. Both pieces of software will be compiled and run on a Windows XP and a Linux system. Once they are both

computer to avoid the use of the folder of live images. Lastly, it may be possible to add some sort of DES encryption to the client end to

www.seminarcollections.com

17

ATM WITH AN EYE encrypt the input data and decrypt the output data from the server knowing that this will increase the processor load, but better allowing us to gauge the time it takes to process. IRIS RECOGNITION: HOW THE SYSTEM WORKS. Inspite security technology developed. United of has Bank to all a United offer these new been of iris at a When a customer puts in a bankcard, a stereo camera locates the face, finds the eye and takes a digital image of the iris at a distance of up to three feet. The "iris with resulting code" one is the computerized compared features, remember identification back of their personal or or

number cards

password and scratch it on the their somewhere that a potential thief can find, no more fear of having an account cleaned out if the card is lost or stolen.

Texas became the first in the States recognition automatic providing technology teller the customers

machines,

cardless, password-free way to get their money out of an ATM. There's customer discomfort. no card to show, or a there's no fingers to ink, no inconvenience It's just

customer will initially provide the bank. The ATM won't work if the two codes don't match. The entire process takes less than two seconds. The wearing system glasses or works contact

photograph of a Bank United customer's eyes. Just step up to the camera while your eye is scanned. The iris -- the colored part of the eye the camera will be checking -- is unique to every person, more so than fingerprints. And, for the customers who can't

equally well with customers lenses and at night. No special lighting is needed. The camera also does not use any kind of beam. Instead, a special lens has been developed that will not only blow up the image of

www.seminarcollections.com

18

ATM WITH AN EYE the iris, but provide more When the system is fully operational, a bank customer will have an iris record made for will comparison have the when option an of account is opened. The bank identifying either the left or Scientists have identified right eye or both. It requires no intervention by the customer. They will simply get a letter telling them they no longer have to use the PIN number. And, scam artists beware, a picture of the card holder won't pass muster. The first thing the camera will check is whether the eye is pulsating. If we don't see blood flowing through your eye, you're either dead or it's a picture. 250 features unique to each person's iris -- compared with about 40 for fingerprints -- and it remains constant through a person's life, unlike a voice or a face. Fingerprint and hand patterns can be changed through alteration or injury. The iris is the best part of the eye to use as a identifier because there are no known diseases of the iris and eye surgery is not performed on the iris. Iris identification is the most secure, robust and stable form of identification known to man. It is far safer, faster, more secure and accurate than DNA testing. Even identical twins do not have identical irises. The iris remains the same from 18 months after birth until five minutes after death. firstdata.com Retail ATM Program Triton RL5000 Model The (ATM) brings a superior level of performance, reliability and customization options to the embedded PC ATM industry. Triton RL5000 teller model machine automatic

detail when it does. Iris scans are much more accurate than other high-tech that ID scan systems voices, available

faces and fingerprints.

www.seminarcollections.com

19

ATM WITH AN EYE This durable ATM solution installation, comprehensive

allows merchants to offer their customers the convenience of an on-site ATM, which may lead and to an increased additional customer revenue traffic, increased sales volume source. From small specialty stores to larger petroleum and convenience stores, the Triton RL5000 ATM is easily configured to meet the needs of merchants of all sizes. The Triton RL5000 ATM features the user-friendly Microsoft Windows CE 5.0 operating system and has a large capacity for for storing improved The journal records or downloading graphics marketing prominent 10.4" LCD display and sleek profile make the ATM an eye-catching Many and difficult to implement, while the Triton RL5000 ATM offered by First Data is a complete ATM solution that includes other component on-site of ATM any merchant location. programs can be expensive efforts.

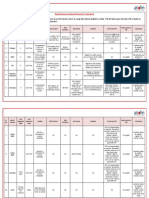

training, technical support, service and reporting features. RL5000 firstdata.com 301-333 Retail ATM Program Triton RL5000 Model Features JJMonitor - 10.4" VGA color screen JJAdvertising Potential - Decals and signage - Couponing - Display graphics JJPrinter - 80mm thermal printer with graphics capabilities JJKeypad - Encrypting PIN Pad (EPP) - PCI compliant JJCommunications - Standard dial JJSmall Footprint JJBacklit Topper Mid-topper standard increases visibility JJCard Reader - Dip standard JJADA Compliant - Americans with Disabilities Act

www.seminarcollections.com

20

ATM WITH AN EYE (ADA) compliant and audio Relative humidity: 20% to 80% non-condensing Power consumption: 2.0A @ 115 VAC at 60 Hz; 1.0A @ 230 VAC at 50 Hz A Global Leader in Electronic Commerce First Data powers the global economy by making it easy, fast and secure for people and businesses around the world form of payment. Serving millions of and/or from merchant locations and thousands of card issuers, we volume have the expertise and insight to help you accelerate your business. Put our intelligence to work for you. For more information, contact your First Data Sales Representative or visit firstdata.com. 2009 First Data Corporation. All marks 10 to rights and reserved. trade All trademarks, service names referenced in this material are the property of their respective owners. to buy using goods virtually and any services revenue memory,

compliant JJTechnical Specs - RISC microprocessor - Microsoft WIndows CE 5.0 128 MB flash expandable - 128 MB RAM - Multilingual capabilities - Cassette options available JJSecurity - Electronic lock standard Benefits JJSupplementary source (potential profit from ATM surcharge interchange) JJHigher sales more in-store purchases JJIncreased store traffic JJSuperior convenience JJImproved customer loyalty Dimensions Height: 64.9" (with mid-topper) Width: 16.9" Depth: 25.6" Weight: 245 lbs. Color: Bayou Bronze Operating Environment Temperature range: 40C / 50 to 104F customer

www.seminarcollections.com

21

ATM WITH AN EYE CONCLUSION: We thus develop an ATM model that is more reliable in providing security by using facial recognition software. By keeping the time elapsed in the verification process to a negligible amount we even try to maintain the efficiency of this ATM system to a greater degree. One could argue that having would account ATMs have the far less than image Gross, Ralph, Shi, Jianbo, and Cohn, Jeffrey F. Quo vadis Face ThirdWorkshop Evaluation Computer Recognition. on Empirical in Kauai: Methods Vision. dire the itself. compromised by a third party consequences Bone, James Duane. FacialRecognition ONDCP Counterdrug Mike, L., Wayman, and Dr.

Blackburn, Evaluating Technology International Technology

for Drug Control Applications.

Symposium: Facial Recognition Vendor Test. Department of Defense Technology Counterdrug Development

Program Office, June 2001.

information videotape

Furthermore, since nearly all customers engaging in transactions, it is no broad leap to realize that banks already build an archive of their customer images, even if they are not with necessarily account grouped information. BIBILOGRAPHY: All, Anne. Triple DES dare you. ATM Marketplace.com.

December 2001. Penev, Penio S., and Atick, Joseph Analysis: J. Local A for in Feature General Object Network: Neural

StatisticalTheory Representation. Computation 477-500, 1996.

Systems, Vol. 7, No. 3, pp.

Wrolstad, Jay. NCR To Deploy New Microsoft OS in ATMs.

19 Apr. 2002.

www.seminarcollections.com

22

ATM WITH AN EYE CRMDailyDotCom. 2001 29Nov.

www.seminarcollections.com

23

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- ATM Simulation Code: Operation Description FormsDocument35 pagesATM Simulation Code: Operation Description FormsClaudia StefaniaNo ratings yet

- ATM SecurityDocument87 pagesATM SecurityHristo Dokov100% (1)

- UPI QR Code AcceptanceDocument22 pagesUPI QR Code AcceptanceIssaNo ratings yet

- Service Manual: Monimax5600 SystemDocument154 pagesService Manual: Monimax5600 Systemdat_151153878No ratings yet

- FASTest For ATMs Training GuideDocument136 pagesFASTest For ATMs Training GuideSelma Citra NirmalaNo ratings yet

- Advisor Advanced Manager Manual3Document100 pagesAdvisor Advanced Manager Manual3vvvvmvaNo ratings yet

- SMS Internet Banking FormDocument4 pagesSMS Internet Banking FormSayed InsanNo ratings yet

- Software Requirements SpecificationDocument17 pagesSoftware Requirements SpecificationAditya SajjaNo ratings yet

- Ad2000 - Kullanım KılauzuDocument8 pagesAd2000 - Kullanım Kılauzuyunuska3233% (3)

- JR MGOAEXM0 Z5 Ys XWDocument5 pagesJR MGOAEXM0 Z5 Ys XWTathagata DasNo ratings yet

- Atalla A10160Document4 pagesAtalla A10160FERNANDO JOSE GARCIA FIGUEROANo ratings yet

- OAAR Hrworkways WalkthroughDocument34 pagesOAAR Hrworkways WalkthroughKrishnaReddy SeelamNo ratings yet

- SEN Microproject FormatDocument26 pagesSEN Microproject FormatCo- 11 Kirtesh Gadhari100% (1)

- Nti Isaac Kofi AtmDocument126 pagesNti Isaac Kofi AtmMohammed Jibril100% (1)

- "They Brought in The Horrible Key Ring Thing!" Analysing The Usability of Two-Factor Authentication in UK Online BankingDocument10 pages"They Brought in The Horrible Key Ring Thing!" Analysing The Usability of Two-Factor Authentication in UK Online BankingAmit SathvaraNo ratings yet

- Shadow NDocument3 pagesShadow Ndiscordmoron8No ratings yet

- Youhe Yh2000c Rfid Access Control User ManualDocument1 pageYouhe Yh2000c Rfid Access Control User ManualJohn LeeNo ratings yet

- ADC Exam2 PDFDocument3 pagesADC Exam2 PDFrahulpatel1202No ratings yet

- Nokia 225 Dual Sim - Schematic DiagarmDocument23 pagesNokia 225 Dual Sim - Schematic DiagarmZainNo ratings yet

- S2 TechNote37 Blackboard 05Document9 pagesS2 TechNote37 Blackboard 05xxxElxxxNo ratings yet

- Pers Info Folder-DairyDocument58 pagesPers Info Folder-DairyNavshinder SinghNo ratings yet

- Test 53Document24 pagesTest 53Alex PpnNo ratings yet

- Bharat Interface For Money (BHIM)Document7 pagesBharat Interface For Money (BHIM)Ajay BharuleNo ratings yet

- At Command Interface GuideDocument936 pagesAt Command Interface GuideEliezer VillegasNo ratings yet

- Onboarding Instruction GuideDocument15 pagesOnboarding Instruction Guide186 Reem ChhabraNo ratings yet

- Bank Process To Obtain PasscodeDocument4 pagesBank Process To Obtain Passcodenakul19a_007No ratings yet

- Display and manage Purolator delivery dataDocument11 pagesDisplay and manage Purolator delivery dataganeshthangam.e3324No ratings yet

- Tec 6076 2 User Manual Prizrak 510 520Document16 pagesTec 6076 2 User Manual Prizrak 510 520Tchotcho TchotchomaryNo ratings yet

- SIM868 Series Hardware Design V1.06Document72 pagesSIM868 Series Hardware Design V1.06Армен ХачатурянNo ratings yet

- Pyronix Enforcer User Manual99889Document28 pagesPyronix Enforcer User Manual99889SteveNo ratings yet