Professional Documents

Culture Documents

Market Outlook 16th January 2012

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Outlook 16th January 2012

Uploaded by

Angel BrokingCopyright:

Available Formats

Market Outlook

India Research

January 16, 2012

Dealers Diary

Indian markets are expected to edge lower following weak opening of most of the Asian bourses. The market closed on an upbeat note on Friday following renewed buying by FIIs which lifted Indian shares notably higher. With the rupee firming up and concerns easing over inflation and growth, FIIs have been stepping up buying in recent sessions. Global cues turned fragile after S&P downgraded France, Austria among seven others. European stocks trimmed their weekly gains on Friday and ended on a negative note. US bourses also ended with losses following renewed concerns about the financial situation in Europe. A negative reaction to quarterly results from JP Morgan also exacerbated some selling pressure, with the financial giant reporting a drop in fourth quarter earnings on weaker than expected revenues. With mixed cues, the markets are likely to struggle for direction. With the onset of corporate earnings season, the expectations of weak earnings are likely to weigh on the markets. Investors will also closely watch the inflation data after Dr. Rangarajan, asserted that the RBI's decision on CRR cut will depend largely on the extent of decline in December inflation numbers.

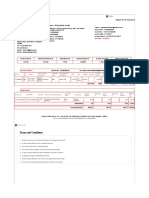

Domestic Indices BSE Sensex Nifty MID CAP SMALL CAP BSE HC BSE PSU BANKEX AUTO METAL OIL & GAS BSE IT Global Indices Dow Jones NASDAQ FTSE Nikkei Hang Seng Straits Times Shanghai Com

Chg (%) 0.7 0.7 1.1 1.4 0.0 1.6 0.5 0.0 3.2 (0.4) (0.0) Chg (%) (0.4) (0.5) (0.5) 1.4 0.6 1.8 (1.3)

(Pts) 34.8 62.8 87.5 1.8 107.8 50.9 2.2 (29.8) (2.0) (Pts) (49.0) (14.0) (25.8) 114.4 47.9 (30.4)

(Close) 4,866 5,582 6,172 6,128 7,083 10,300 8,466 7,822 5,482 (Close) 12,422 2,711 5,637 8,500 2,792 2,245

117.1 16,155

334.3 10,756

Markets Today

The trend deciding level for the day is 16,154 / 4,866 levels. If NIFTY trades above this level during the first half-an-hour of trade then we may witness a further rally up to 16,258 16,361 / 4,899 4,931 levels. However, if NIFTY trades below 16,154 / 4,866 levels for the first half-an-hour of trade then it may correct up to 16,050 15,946 / 4,834 4,802 levels.

Indices SENSEX NIFTY S2

15,946 4,802

109.0 19,204

Indian ADRs Infosys Wipro ICICI Bank HDFC Bank

Chg (%) (1.5) (0.9) 2.2 (0.8)

(Pts) (0.8) (0.1) 0.7 (0.2)

(Close) $51.1 $9.9 $30.6 $27.9

S1

16,050 4,834

R1

16,154 4,866

R2

16,258 4,899

News Analysis

S&P downgrades nine Eurozone countries Coal India agrees for wage hike of 25% LICHF to raise `500cr through preference shares to LIC 3QFY2012 Result Review Sintex 3QFY2012 Result Preview South Indian Bank

Refer detailed news analysis on the following page

Advances / Declines Advances Declines Unchanged

BSE 1,897 903 96

NSE 1048 468 46

Net Inflows (January 12, 2012)

` cr FII MFs ` cr Index Futures Stock Futures Purch

2,527 522

Sales

2,001 943

Net

526 (421)

MTD

2,559 (572)

YTD

2,559 (572)

Volumes (` cr) BSE NSE 2,792 12,075

FII Derivatives (January 13, 2012)

Purch

1,672 2,736

Sales

1,276 2,407

Net

396 328

Open Interest

12,217 26,764

Gainers / Losers

Gainers Company

JSW Ispat JPPOWER Lanco Infra Suzlon Energy Motherson Sumi

Losers Company

Indraprastha Gas United Brew Petronet LNG Gail India Sun TV Network

Price (`)

12 39 15 22 155

chg (%)

12.5 10.9 9.8 8.7 8.3

Price (`)

349 445 157 373 288

chg (%)

(8.1) (5.8) (5.0) (3.2) (3.2)

Please refer to important disclosures at the end of this report

Sebi Registration No: INB 010996539

Market Outlook | India Research

S&P downgrades nine Eurozone countries

Credit rating agency Standard & Poors (S&P) in its review on Friday downgraded Frances and Austrias credit rating from AAA to AA+. The agency also downgraded Italy to BBB+ from A, Spain to A from AA- and Portugal by two notches to BB. While Germany, Netherlands, Finland and Luxembourg held their AAA rating. The review received a backlash from several political parties in the Eurozone. The downgrade followed the assessment of policy initiatives taken by policymakers in recent weeks, which in their view may be insufficient to fully tackle the ongoing systemic stresses in the Eurozone. However, the downgrade will further aggravate European debt crisis by making borrowing more expensive for Eurozone countries.

Coal India agrees for wage hike of 25%

Media reports suggest that Coal India has agreed to hike the wages of its non-executive staff by 25%. This is in-line with our estimates and managements guidance. Coal Indias wage bill for its workers stood at `15,000cr in FY2011 (total staff costs `18,211cr). The hike is expected to increase Coal Indias wage costs to `18,750cr per year. The new wage agreement is also expected to provide a 3% hike annually for the coming five years. We maintain our total staff cost estimates at `22,085 and `23,899cr for FY2012 and FY2013, respectively. At current price levels, we recommend a Neutral rating on the stock.

LICHF to raise `500cr through preference shares to LIC

LIC Housing Finance (LICHF) is planning to raise up to `500cr through preferential issue of shares to LIC and qualified institutional placement. The capital raising is expected to support business growth over FY2013, while also beefing up tier-I of the company, which currently stands at 8.6% (as of 3QFY2012) to 10-12%. Capital adequacy requirements currently are relatively less strict for HFCs (12% CAR required with no specific requirement for tier-1 capital) as compared to NBFCs (15% CAR required, 10% minimum tier-1 in case of IFCs). At the CMP, the stock is trading at a P/ABV multiple of 1.8x FY2013E ABV. We remain Neutral on the stock.

January 16, 2012

Market Outlook | India Research

Result Review

Sintex

Sintex Industries announced its 3QFY2012 consolidated results. The companys net sales came in flat on a qoq basis but declined marginally by 2.1% yoy to `1,161cr. The plastic segments revenue witnessed a 2.3% yoy decline and a 0.3% qoq increase to `1,046cr. EBITDA declined by 17.1% yoy to `163cr (`197cr). EBITDA margin declined by 253bp yoy to 14.1% (16.6%), largely due to slower execution in the monolithic segment and lower utilization in the custom moulding segment. The company reported forex gain of `13cr during the quarter. PAT declined by 27.1% to `82cr on the back of EBITDA margin compression during the quarter. PAT margin also declined by 243bp to 7.1%. We continue to maintain our Buy rating on the stock.

Result Preview

South Indian Bank

South Indian Bank is scheduled to announce its 3QFY2012 results. The bank is expected to post strong 31.0% yoy growth in its net interest income. Non-interest income is expected to increase by muted 1.7% yoy (down 4.8% qoq); however, overall operating income growth is expected to be healthy at 25.3% yoy. A considerable expected decline in provisioning expenses (29.4% yoy) is likely to lead to healthy profit growth of 33.2% yoy to `100cr. At the CMP, the stock is trading at 1.1x FY2013E ABV. We maintain our Neutral rating on the stock.

Quarterly Bloomberg Brokers Consensus Estimates

TCS Ltd - Consolidated (17/01/2012)

Particulars (` cr) Net sales Net profit 3QFY12E 13,141 2,877 3QFY11 9,663 2,370 y-o-y (%) 36 21 2QFY12 11,633 2,439 q-o-q (%) 13 18

HCL Tech Ltd - Consolidated (17/01/2012)

Particulars (` cr) Net sales EBITDA EBITDA margin (%) Net profit 3QFY12E 5,199 931 17.9 548 3QFY11 3,888 635 16.3 400 37 y-o-y (%) 34 47 2QFY12 4,651 795 17.1 497 10 q-o-q (%) 12 17

January 16, 2012

Market Outlook | India Research

Jindal Steel & Power Ltd - Consolidated (18/01/2012)

Particulars (` cr) Net sales EBITDA EBITDA margin (%) Net profit 3QFY12E 4,305 1,804 41.9 1,015 3QFY11 y-o-y (%) 3,168 1,599 50.5 951 7 36 13 2QFY12 q-o-q (%) 4,407 1,704 38.7 875 16 (2) 6

Economic and Political News

India's forex reserves slump by $3.14 billion 400% rise in fake currency circulation: Finance Ministry RBI to allow FDI in LLPs

Corporate News

PM likely to meet chiefs of power firms on Jan 18 Government plans to raise prices of urea by steep 40% RIL plans to pick up 26% stake in leading cable operators DCB defers `150cr QIP plan to June Apollo Tyres fined `30cr in South Africa on cartelisation charge

Source: Economic Times, Business Standard, Business Line, Financial Express, Mint

Results Calendar

16/01/2012 South Indian Bank 17/01/2012 TCS, HCL Technologies, Automotive Axle 18/01/2012 MindTree, Infotech Enterprises, Jindal Steel 19/01/2012 HDFC Bank, Bajaj Auto, Hero Motocorp Reliance Industries, ITC, Wipro, Hind. Zinc, Axis Bank, JSW Steel , United Spirits, Exide Industries, Syndicate Bank, Rallis, HT 20/01/2012 Media, Bank of Maharashtra, Hind. Const., NIIT

January 16, 2012

Market Outlook | India Research

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

January 16, 2012

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingNo ratings yet

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingNo ratings yet

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingNo ratings yet

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingNo ratings yet

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingNo ratings yet

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Indian Express 08 April 2013 17Document1 pageIndian Express 08 April 2013 17ARSHAD JAMILNo ratings yet

- Daily Current Affairs: 20 January 2024Document17 pagesDaily Current Affairs: 20 January 2024YASH PANDEYNo ratings yet

- Managerial Economics and Organizational Architecture SolutionsDocument3 pagesManagerial Economics and Organizational Architecture SolutionsjbyuriNo ratings yet

- Dunong Consultancy Services Income Statement For The Month of July 2020Document4 pagesDunong Consultancy Services Income Statement For The Month of July 2020Denise MoralesNo ratings yet

- Practie-Test-For-Econ-121-Final-Exam 1Document1 pagePractie-Test-For-Econ-121-Final-Exam 1mehdi karamiNo ratings yet

- Polaroid Corporation Case Solution - Final PDFDocument8 pagesPolaroid Corporation Case Solution - Final PDFPallab Paul0% (1)

- Entrepreneur Management Questions and AnswersDocument24 pagesEntrepreneur Management Questions and AnswersArun DassiNo ratings yet

- Lack of Profit Loss Sharing in Islamic Banking Management and Control ImbalancesDocument27 pagesLack of Profit Loss Sharing in Islamic Banking Management and Control ImbalancesselkatibNo ratings yet

- Syllabus Mls Part 1 2Document18 pagesSyllabus Mls Part 1 2Fanatic AZNo ratings yet

- Renewal Premium Receipt - 00755988Document1 pageRenewal Premium Receipt - 00755988Tarun KushwahaNo ratings yet

- Default Profile Customer Level Account - FusionDocument1 pageDefault Profile Customer Level Account - FusionhuyhnNo ratings yet

- Preqin Latin America Report 2021Document35 pagesPreqin Latin America Report 2021Carlos ArangoNo ratings yet

- Calculate employee wagesDocument29 pagesCalculate employee wagesPrashanth IyerNo ratings yet

- Balance Sheet Accounts Income Statement Accounts: APPENDIX A: Company Chart of AccountsDocument27 pagesBalance Sheet Accounts Income Statement Accounts: APPENDIX A: Company Chart of Accountsrisc1No ratings yet

- Letter of Intent NotesDocument10 pagesLetter of Intent NotesJoe SchmoNo ratings yet

- Settings 1000 Pip Climber System EADocument11 pagesSettings 1000 Pip Climber System EAMUDRICK ACCOUNTSNo ratings yet

- SOLMAN-CHAPTER-14-INVESTMENTS-IN-ASSOCIATES_IA-PART-1B_2020ed (3)Document27 pagesSOLMAN-CHAPTER-14-INVESTMENTS-IN-ASSOCIATES_IA-PART-1B_2020ed (3)Meeka CalimagNo ratings yet

- Power Notes: BudgetingDocument46 pagesPower Notes: BudgetingfrostyangelNo ratings yet

- ContracrtDocument11 pagesContracrtroushan kumarNo ratings yet

- Stock Corp By-LawsDocument35 pagesStock Corp By-LawsAngelica Sanchez100% (3)

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- EAE0516 - 2022 - Slides 15Document25 pagesEAE0516 - 2022 - Slides 15Nicholas WhittakerNo ratings yet

- Educational Institution Tax Exemption CaseDocument1 pageEducational Institution Tax Exemption Casenil qawNo ratings yet

- Beam March 2018 PDFDocument2 pagesBeam March 2018 PDFShyam BhaskaranNo ratings yet

- Virginia's Annual Holder Report Forms & Instructions: Unclaimed Property DivisionDocument27 pagesVirginia's Annual Holder Report Forms & Instructions: Unclaimed Property DivisionWilliamsNo ratings yet

- Solutions To End-of-Chapter Three ProblemsDocument13 pagesSolutions To End-of-Chapter Three ProblemsAn HoàiNo ratings yet

- تجربة الأردن في العمل المصرفي الإسلامي من حيث كفاءة أداء البنوك الإسلامية -دراسة حالة بنكDocument11 pagesتجربة الأردن في العمل المصرفي الإسلامي من حيث كفاءة أداء البنوك الإسلامية -دراسة حالة بنكMortaza AlbadriNo ratings yet

- Corporate Management Accounting Merge Colour Deleted NotesDocument246 pagesCorporate Management Accounting Merge Colour Deleted Notesgautam shahNo ratings yet

- Denim Jeans Stitching UnitDocument25 pagesDenim Jeans Stitching UnitSaad NaseemNo ratings yet

- Notice of Annual General Meeting: Sunil Hitech Engineers LimitedDocument70 pagesNotice of Annual General Meeting: Sunil Hitech Engineers LimitedGaurang MehtaNo ratings yet