Professional Documents

Culture Documents

Pay Credit Card Bill Online

Uploaded by

Yusuf OmarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pay Credit Card Bill Online

Uploaded by

Yusuf OmarCopyright:

Available Formats

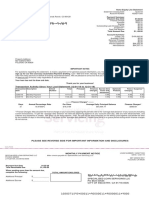

www.citicards.

com LEON LEWIS 5555 ROSWELL RD APT U6 ATLANTA GA 30342-1824 CITI CARDS PROCESSING CENTER DES MOINES, IA50363-0001 Account Member LEON LEWIS New Balance: $13.90 Minimum Payment Due: $13.90 Payment Due Date: 05/15/2011

5424 1808 5535 6975

How To Reach Us 1-800-633-7367 Customer Service BOX 6500 SIOUX FALLS, SD 57117

15424180855356975 0001390 0001390 0218900 1301

www.citicards.com

Account Activity Mar 18-Apr 19, 2011

date paid _____________ amount paid ______________ check # ____________ Detach and follow payment instructions on reverse

Account Number 5424 1808 5535 6975 Member Since 2010 Summary of Account Activity Previous Balance $2,153.74 Payments -$2,189.03 Other Credits -$0.00 Purchases +$49.19 Cash Advances +$0.00 Fees Charged +$0.00 Interest Charged +$0.00 New Balance $13.90 Past Due Amount Amt. Over Credit Limit Credit Limit Available Credit Cash Advance Limit Available Cash Limit Statement Closing Date Days in Billing Cycle $0.00 $0.00 $4,600 $4,586 $1,400 $1,400 04/19/2011 33 Standard Purchases Sale Post 03/28 03/28 03/31 03/31 Fees Sale

Minimum Payment Due: New Balance:

$13.90

Payment Due Date:

$13.90

Payment must be received by 5:00 PM local time on the payment due date.

05/15/2011

Total ThankYou Member Available Point Balance As Of 04/01/11:

3,098

Late Payment Warning: If we do not receive your minimum payment by the date listed above, you may have to pay a late fee of up to $35 and your APRs may be increased up to the variable Penalty APR of 29.99%.

For information about credit counseling services, call 1-877-337-8187.

Log on to www.thankyou.com today to check your latest point balance, redeem for great rewards, and earn more points. Payments, Credits and Adjustments Sale Post Description 03/31 CLICK-TO-PAY PAYMENT, THANK YOU

Amount -2,189.03

Description TARGET 00023333 ATLANTA GA ALMADINA FARMER MKT NORCROSS

GA

Amount 35.29 13.90

Post

Description TOTAL FEES FOR THIS PERIOD

Amount 0.00

Interest Charged Post

Description TOTAL INTEREST FOR THIS PERIOD 2011 Totals Year-to-Date

Amount 0.00

Amount Enclosed:

Payment must be received by 5:00 PM local time on the payment due date.

Make check payable to:

Total fees charged in 2011 Total interest charged in 2011

$0.00 $0.00

Citi Cards

1 of 2

Account Number **** **** **** 6975 Interest Charge Calculation

Your Annual Percentage Rate (APR) is the annual interest rate on your account.

How to Reach Us 1-800-633-7367 Customer Service BOX 6500 SIOUX FALLS, SD 57117 Access your account online: www.citicards.com

Please be sure to pay on time. If you submit your payment by mail, we suggest you mail it no later than 05/08/2011 to allow for enough time for regular mail to reach us.

Interest Charge

Type of Balance

Annual Percentage Rate (APR)

Balance Subject to Interest Rate

PURCHASES Standard Purch ADVANCES Standard Adv 25.240% (V) $0.00 (D) $0.00 16.990% (V) $0.00 (D) $0.00

ThankYou Bonus Points Card Member Bonus Points Purchase Activity Bonus Total Card Member Bonus Points Earned ThankYou Points Summary

ThankYou Points Earned This Period Category Merchant Bonus Bonus Base

49 49 Member ID: 8910233665175856

Card Member Bonus Payment Rewards Bonus Adjusted

49

49

Total ThankYou Points Earned This Period: 98

ThankYou Points Earned Year to Date Total Base Total Bonus Total Adjusted Total Earned

2,945

2,945

5,890

Go to www.thankyou.com to review your ThankYou Point balance and redeem! Bonus Points may take one to two billing cycles to appear on your statement. Please refer to the specific terms and conditions pertaining to the promotion for further details.

2 of 2

Information About Your Account.

How to Avoid Paying Interest on Purchases. Your due date is at least 23 days after the close of each billing cycle. We will not charge you any interest on purchases if you pay your New Balance by the due date each month. This is called a grace period on purchases. If you do not pay the New Balance in full by the due date, you will not get a grace period on purchases until you pay the New Balance in full for two billing periods in a row. Certain balance transfer offers may take away the grace period on purchases. If that is the case, the balance transfer offer will describe what happens. We will begin charging interest on cash advances and balance transfers on the transaction date. How We Calculate Your Balance Subject to Interest Rate. We calculate it separately for each balance shown in the Interest Charge Calculation table. We use the daily balance method (including current transactions) if the Balance Subject to Interest Rate is followed by (D). We figure the interest charge by multiplying the daily balance by its daily periodic rate each day in the billing period. To get a daily balance, we take the balance at the end of the previous day, add the interest on the previous days balance and new charges, subtract new credits or payments, and make adjustments. The Balance Subject to Interest Rate is the average of the daily balances. We use the average daily balance method (including current transactions) if the Balance Subject to Interest Rate is followed by (A). To get an average daily balance, we take the balance at the end of the previous day, add new charges, subtract new credits or payments, and make adjustments. We add all the daily balances and divide by the number of days in the billing period. We figure the interest charge by multiplying the average daily balance by the monthly periodic rate, or by the daily periodic rate and by the number of days in the billing period, as applicable. Balance Transfers. Balance Transfer amounts are included in the Purchases line in the Summary of Account Activity. Variable APRs. APRs followed by (V) may vary. Minimum Interest Charge. If you are charged interest, the charge will be no less than 50 cents. Membership Fee. To avoid paying this fee, notify us that you are closing your account within 30 days of the mailing or delivery date of the statement on which the fee is billed. Credit Reporting Disputes. If you think we reported inaccurate information to a credit bureau, write us at the Customer Service address shown on the front. Report a Lost or Stolen Card Immediately. Call the Customer Service number shown on the front.

Notification of Disputed Item

Please call Customer Service before completing this form. Please sign and return this form (or a copy) to the Customer Service address on this statement. If you use this form, record the information on the reverse for your records. Dont mail the form with your payment. You authorize us to send information you provide regarding this dispute to the merchant. Please print in blue or black ink.

CASE ID:

Name (Please Print) Signature/Date Account # Reference # Merchant Amount of Dispute $

What To Do if You Think You Find a Mistake on Your Statement If you think there is an error on your statement, write to us at the Customer Service address shown on the front. If you use the form below, please call Customer Service for assistance. In your letter, give us the following information: Account information: Your name and account number. Dollar amount: The dollar amount of the suspected error. Description of Problem: If you think there is an error on your bill, describe what you believe is wrong and why you believe it is a mistake. You must contact us within 60 days after the error appeared on your statement. You must notify us of any potential errors in writing. You may call us, but if you do we are not required to investigate any potential errors and you may have to pay the amount in question. While we investigate whether or not there has been an error, the following are true: We cannot try to collect the amount in question, or report you as delinquent on that amount. The charge in question may remain on your statement, and we may continue to charge you interest on that amount. But, if we determine that we made a mistake, you will not have to pay the amount in question or any interest or other fees related to that amount. While you do not have to pay the amount in question, you are responsible for the remainder of your balance. We can apply any unpaid amount against your credit limit. Your Rights if You Are Dissatisfied With Your Credit Card Purchases If you are dissatisfied with the goods or services that you have purchased with your credit card, and you have tried in good faith to correct the problem with the merchant, you may have the right not to pay the remaining amount due on the purchase. To use this right, all of the following must be true: 1. The purchase must have been made in your home state or within 100 miles of your current mailing address, and the purchase price must have been more than $50. (Note: Neither of these are necessary if your purchase was based on an advertisement we mailed to you, or if we own the company that sold you the goods or services.) 2.You must have used your credit card for the purchase. Purchases made with cash advances from an ATM or with a check that accesses your credit card account do not qualify. 3.You must not yet have fully paid for the purchase. If all of the criteria above are met and you are still dissatisfied with the purchase, contact us in writing at the Customer Service address shown on the front. While we investigate, the same rules apply to the disputed amount as discussed above. After we finish our investigation, we will tell you our decision. At that point, if we think you owe an amount and you do not pay we may report you as delinquent.

Important Payment Instructions.

Crediting Payments. If we receive your payment in proper form at our processing facility by 5 p.m. local time there, it will be credited as of that day. A payment received there in proper form after that time will be credited as of the next day. Allow 5 to 7 days for payments by regular mail to reach us. There may be a delay of up to 5 days in crediting a payment we receive that is not in proper form or not sent to the correct address. The correct address for regular mail is the address on the front of the payment coupon. The correct address for courier or express mail is the Express Payments Address shown below. Proper Form. For a payment sent by mail or courier to be in proper form, you must: Enclose a valid check or money order. No cash or foreign currency please. Include your name and account number on the front of your check or money order. If you send an eligible check with this payment coupon, you authorize us to complete your payment by electronic debit. If we do, the checking account will be debited in the amount on the check. We may do this as soon as the day we receive the check. Also, the check will be destroyed. Copy Fee. We charge $3 for each copy of a billing statement that dates back 3 months or more. We waive the fee if your request for the copy relates to a billing error or disputed purchase.

I examined the charges on my account and dispute a charge for the following reason: J 1. Neither I nor anyone authorized by me made the charge listed above or received the goods and services represented by this charge. (If you dont recognize a sale, choose this option and call Customer Service immediately). J 2. I participated in a transaction with the merchant, but was billed for _____ transaction(s) totaling $_________ that I didnt engage in, nor did anyone else authorized by me. I have all my cards in my possession. Enclose copy of Authorized sales slip. J 3. I havent received the merchandise. Expected delivery date was ___/___/_____. I contacted the merchant on ___/___/_____. The response was _________________________________________ ___________________________________________________________. (You must contact the merchant.) J 4. I returned/canceled(circle one) merchandise on ___/___/_____ because________________________________. Enclose copy of return receipt, postal receipt or proof of refund. J 5. The attached credit slip was listed as a charge. J 6. I was issued a credit slip for $_____________ on ___/___/_____. It was not shown on my statement. Enclose copy of credit slip. J 7. Merchandise shipped to me arrived damaged and/or defective on ___/___/_____. I returned it on ___/___/_____. Merchant response was ____________________________________________. Enclose copy of postal receipt and/or credit slip. J 8. My account was charged $_____________, but I should have been billed $_____________. Enclose copy of sales receipt and/or other documents showing correct amount. J 9. Other Attach a letter describing the dispute.

Payment Options Other Than Regular Mail.

Online Bill Payment Service. If you enroll in this service, you can make payments online. Sign on to Account Online every month and pay your bill electronically using your checking or savings account. If we receive your request to make an Online Bill Payment by 5 p.m. Eastern time, we will credit your payment as of that day. If we receive your request to make an Online Bill Payment after that time, we will credit your payment as of the next day. For security reasons, you may be unable to pay your entire New Balance with your first Online Bill Payment. AutoPay Service. If you enroll in this service, your payment amount will be deducted automatically from the account you pick. Your card account will be credited on the due date with that amount. To enroll in AutoPay, visit Account Online today. Pay by Phone Service. You may use this service any time to make a payment by phone. You will be charged $14.95 if a representative of ours helps expedite your payment. Call by 5 p.m. Eastern time to have your payment credited as of that day. If you call after that time, your payment will be credited as of the next day. We may process your payment electronically after we verify your identity. Express Payments. You can send payment by courier or express mail to the Express Payments Address. This address is: Citi Cards, Attention: Payments Department, 1500 Boltonfield Street, Columbus, OH 43228. Payment must be received in proper form at the proper address by 5 p.m. Eastern time to be credited as of that day. All payments received in proper form at the proper address after that time will be credited as of the next day.

ST1C0610

You might also like

- New Balance: Minimum Payment Due: Payment Due Date:: Account Activity Account Member How To Reach Us Customer ServiceDocument3 pagesNew Balance: Minimum Payment Due: Payment Due Date:: Account Activity Account Member How To Reach Us Customer ServiceChadd ThompsonNo ratings yet

- Jan 28-Feb 24, 2010: Account ActivityDocument3 pagesJan 28-Feb 24, 2010: Account ActivityAna OdenNo ratings yet

- Payment Information Summary of Account ActivityDocument3 pagesPayment Information Summary of Account ActivityTyrone J PalmerNo ratings yet

- Dcoument7 AMEXStatement Mar 2015Document11 pagesDcoument7 AMEXStatement Mar 2015Daniel TaylorNo ratings yet

- EFT Agreement Sets Up Recurring Direct Debit PaymentsDocument2 pagesEFT Agreement Sets Up Recurring Direct Debit Paymentssputnik3000_100% (1)

- Statements 20210314Document5 pagesStatements 20210314kevinzhuxd102No ratings yet

- Deposit Account EssentialsDocument30 pagesDeposit Account EssentialsmattloyaltyNo ratings yet

- Virtual Wallet Fine PrintDocument32 pagesVirtual Wallet Fine PrintStewart Kelvin100% (1)

- Fresh N Rebel Twins 2 Tip GrijsDocument4 pagesFresh N Rebel Twins 2 Tip Grijs76xzv4kk5vNo ratings yet

- Jul 15 - Aug 14 PDFDocument5 pagesJul 15 - Aug 14 PDFpat orantezNo ratings yet

- $CASHOUTDocument22 pages$CASHOUTEnz DavieNo ratings yet

- Autocheque: Electronic Payment ProgramDocument3 pagesAutocheque: Electronic Payment ProgramNicholas GarrisonNo ratings yet

- New Balance $21,391.51 Minimum Payment Due $214.00 Payment Due Date 07/23/22Document15 pagesNew Balance $21,391.51 Minimum Payment Due $214.00 Payment Due Date 07/23/22Rahul SharmaNo ratings yet

- Credit ScoreDocument2 pagesCredit ScoreMatthew DawsonNo ratings yet

- Pa 8 Cs SHBK 2 LVWZ1 JL847 Ur 9 JDocument9 pagesPa 8 Cs SHBK 2 LVWZ1 JL847 Ur 9 JMorenita ParelesNo ratings yet

- Regional Acceptance Ach Draft Form-OneDocument2 pagesRegional Acceptance Ach Draft Form-Onejohnlove720% (1)

- Chime Spending Statement May 2023Document2 pagesChime Spending Statement May 2023Konami bossmanNo ratings yet

- 2019-11-28Document14 pages2019-11-28David JudgeNo ratings yet

- New Balance CR$46.79 Amount Due $0.00 Payment Not Required: American Express® Gold CardDocument10 pagesNew Balance CR$46.79 Amount Due $0.00 Payment Not Required: American Express® Gold CardJohn RoyNo ratings yet

- Chase Auto TemplateDocument4 pagesChase Auto TemplateHillarie MeenachNo ratings yet

- ELECTRONIC PAYMENT SYSTEM GUIDEDocument13 pagesELECTRONIC PAYMENT SYSTEM GUIDEVamshi100% (1)

- Statements New 1Document4 pagesStatements New 1Bhuwesh SinghNo ratings yet

- SCCU Member Statement SummaryDocument4 pagesSCCU Member Statement Summaryshahzad afzalNo ratings yet

- Account Number: 4147 2021 9255 2790: The Past Due Amount of $40.00 Is Included in Your Minimum PaymentDocument4 pagesAccount Number: 4147 2021 9255 2790: The Past Due Amount of $40.00 Is Included in Your Minimum PaymentEnna ReillyNo ratings yet

- Citizens Bank Credit Card Statement: Account SummaryDocument1 pageCitizens Bank Credit Card Statement: Account SummaryMira KarkiNo ratings yet

- Credit - Report ZMDocument3 pagesCredit - Report ZMEric CartmanNo ratings yet

- Hilton Credit Card Authorization Form TemplateDocument1 pageHilton Credit Card Authorization Form TemplateSam BojanglesNo ratings yet

- Nordstrom Card November Statement SummaryDocument4 pagesNordstrom Card November Statement Summaryytprem agu100% (1)

- Consolidated Balance SummaryDocument4 pagesConsolidated Balance SummaryJulissa Marie SanchezNo ratings yet

- PDFDocument2 pagesPDFDonna SmithNo ratings yet

- Sen. John Kerry's Statement To The U.S. Senate Foreign Relations Committee On His Nomination As Secretary of State.Document9 pagesSen. John Kerry's Statement To The U.S. Senate Foreign Relations Committee On His Nomination As Secretary of State.Southern California Public RadioNo ratings yet

- Document PDFDocument7 pagesDocument PDFAnonymous oZc5cIxeevNo ratings yet

- PDF VDocument1 pagePDF VClint ArnimNo ratings yet

- Please Use The Checking and Savings Account Application ToDocument3 pagesPlease Use The Checking and Savings Account Application ToGulrana AlamNo ratings yet

- Please Detach Coupon and Return Payment Using The Enclosed Envelope - Allow 5 Days For Mail DeliveryDocument4 pagesPlease Detach Coupon and Return Payment Using The Enclosed Envelope - Allow 5 Days For Mail DeliveryAnatoliy PopikNo ratings yet

- Rewarding Excellence Visa Prepaid Card FaqsDocument4 pagesRewarding Excellence Visa Prepaid Card FaqsjudahNo ratings yet

- HK GRCC Platinum - Transfer-In App FormDocument1 pageHK GRCC Platinum - Transfer-In App FormpercysmithNo ratings yet

- Amex EstatementDocument2 pagesAmex Estatementjohn vikNo ratings yet

- Lockboxes753745incoming Payments20051093print PDFDocument1 pageLockboxes753745incoming Payments20051093print PDFSavka SavkaNo ratings yet

- Your Statement: Business Transaction AccountDocument7 pagesYour Statement: Business Transaction AccountFine GalleriaNo ratings yet

- SCR Banking GJKJ - HJHDocument31 pagesSCR Banking GJKJ - HJHamitguptaujjNo ratings yet

- Non-Federal Direct Deposit FormDocument1 pageNon-Federal Direct Deposit Formken frostNo ratings yet

- Distinctions Between Checks and Bills of ExchangeDocument3 pagesDistinctions Between Checks and Bills of ExchangeCaren deLeonNo ratings yet

- Rewards Summary: Online BankingDocument1 pageRewards Summary: Online Bankingcarol0garber-99560No ratings yet

- Bank Statement Template 1 - TemplateLabDocument3 pagesBank Statement Template 1 - TemplateLabHasanNo ratings yet

- Basic Housing Solutions statement summaryDocument1 pageBasic Housing Solutions statement summarycyrusNo ratings yet

- What is a Check? - A Guide to Checks, Checking Accounts, and How They WorkDocument8 pagesWhat is a Check? - A Guide to Checks, Checking Accounts, and How They WorkDanica BalinasNo ratings yet

- ReceiptDocument4 pagesReceipttop gNo ratings yet

- Bank Statement 4 2023Document1 pageBank Statement 4 2023nickNo ratings yet

- Your Account Statement: Payment Information Summary of Account ActivityDocument4 pagesYour Account Statement: Payment Information Summary of Account ActivityEduardo PerezNo ratings yet

- Payment Information Summary of Account Activity: Rewards Summary Tier Status SummaryDocument4 pagesPayment Information Summary of Account Activity: Rewards Summary Tier Status SummaryimeeNo ratings yet

- October, 2023 10092023Document6 pagesOctober, 2023 10092023liquiventas01No ratings yet

- DCU Bank StatementDocument3 pagesDCU Bank StatementKate YehNo ratings yet

- Statement of Account: Credit Limit Rs Available Credit Limit RsDocument2 pagesStatement of Account: Credit Limit Rs Available Credit Limit RsGanesh KumarNo ratings yet

- Summary of Account Activity Payment Information: Protecting What Matters MostDocument4 pagesSummary of Account Activity Payment Information: Protecting What Matters MostJames BergmanNo ratings yet

- Initiate Business Checking: August 31, 2022 Page 1 of 4Document5 pagesInitiate Business Checking: August 31, 2022 Page 1 of 4Alexander Barno AlexNo ratings yet

- BillSTMT 4588260000514267Document3 pagesBillSTMT 4588260000514267Fahad AhmedNo ratings yet

- CARDHOLDER DISPUTE FORM-Gift 060910Document2 pagesCARDHOLDER DISPUTE FORM-Gift 060910Joseph StricklerNo ratings yet

- DocumentDocument4 pagesDocumentMichele PadillaNo ratings yet

- MANAGEMENT 3360 ORGANIZATION THEORYDocument6 pagesMANAGEMENT 3360 ORGANIZATION THEORYYusuf OmarNo ratings yet

- Chapter Fourteen Review MaterialsDocument3 pagesChapter Fourteen Review MaterialsYusuf OmarNo ratings yet

- Exercise 1 Conflict ResolutionDocument15 pagesExercise 1 Conflict ResolutionYusuf OmarNo ratings yet

- Mjangda 1Document4 pagesMjangda 1Yusuf OmarNo ratings yet

- System of Government in the American PeriodDocument11 pagesSystem of Government in the American PeriodDominique BacolodNo ratings yet

- Eriodic Ransaction Eport: Hon. Judy Chu MemberDocument9 pagesEriodic Ransaction Eport: Hon. Judy Chu MemberZerohedgeNo ratings yet

- PDF 05 EuroMedJeunesse Etude LEBANON 090325Document28 pagesPDF 05 EuroMedJeunesse Etude LEBANON 090325ermetemNo ratings yet

- Succession in General: A. Universal - This Is Very Catchy-It Involves The Entire Estate or Fractional or Aliquot orDocument9 pagesSuccession in General: A. Universal - This Is Very Catchy-It Involves The Entire Estate or Fractional or Aliquot orMYANo ratings yet

- Licensing AgreementDocument9 pagesLicensing AgreementberrolawfirmNo ratings yet

- Honda Cars ApplicationDocument2 pagesHonda Cars ApplicationHonda Cars RizalNo ratings yet

- CH 12 Fraud and ErrorDocument28 pagesCH 12 Fraud and ErrorJoyce Anne GarduqueNo ratings yet

- R PosDocument4 pagesR PosBirendra EkkaNo ratings yet

- Commercial Real Estate Case StudyDocument2 pagesCommercial Real Estate Case StudyKirk SummaTime Henry100% (1)

- Carey Alcohol in The AtlanticDocument217 pagesCarey Alcohol in The AtlanticJosé Luis Cervantes CortésNo ratings yet

- Comprehension and Essay Writing Junior Judicial Assistant Delhi High Court 2012Document2 pagesComprehension and Essay Writing Junior Judicial Assistant Delhi High Court 2012varaki786No ratings yet

- CFPB Your Money Your Goals Choosing Paid ToolDocument6 pagesCFPB Your Money Your Goals Choosing Paid ToolJocelyn CyrNo ratings yet

- Quotation for 15KW solar system installationDocument3 pagesQuotation for 15KW solar system installationfatima naveedNo ratings yet

- LR Procedure Hook ReleaseDocument4 pagesLR Procedure Hook Releasefredy2212No ratings yet

- Print Bus 100 CH 13 - QuizletDocument2 pagesPrint Bus 100 CH 13 - QuizletMac TorejaNo ratings yet

- Skippers United Pacific, Inc. v. DozaDocument2 pagesSkippers United Pacific, Inc. v. DozaAntonio BartolomeNo ratings yet

- Cod 2023Document1 pageCod 2023honhon maeNo ratings yet

- Nationalism in India - L1 - SST - Class - 10 - by - Ujjvala - MamDocument22 pagesNationalism in India - L1 - SST - Class - 10 - by - Ujjvala - Mampriyanshu sharmaNo ratings yet

- ADR R.A. 9285 CasesDocument9 pagesADR R.A. 9285 CasesAure ReidNo ratings yet

- 4IS1 - 01 - Que - 20210504 QP 2021Document28 pages4IS1 - 01 - Que - 20210504 QP 2021fmunazza146No ratings yet

- Amalgmation, Absorbtion, External ReconstructionDocument9 pagesAmalgmation, Absorbtion, External Reconstructionpijiyo78No ratings yet

- Paper On Society1 Modernity PDFDocument13 pagesPaper On Society1 Modernity PDFferiha goharNo ratings yet

- Connections: Mls To Sw1Document12 pagesConnections: Mls To Sw1gautamdipendra968No ratings yet

- Full Download Sociology Your Compass For A New World Canadian 5th Edition Brym Solutions ManualDocument19 pagesFull Download Sociology Your Compass For A New World Canadian 5th Edition Brym Solutions Manualcherlysulc100% (25)

- Commerce PROJECT For CLASS 11Document21 pagesCommerce PROJECT For CLASS 11jasdeep85% (67)

- Wee vs. de CastroDocument3 pagesWee vs. de CastroJoseph MacalintalNo ratings yet

- History of Agrarian ReformDocument3 pagesHistory of Agrarian ReformMaria Ferlin Andrin MoralesNo ratings yet

- Labour Laws Individual Assignment - Code On Wages Subject Code: MHR4CCHR05Document5 pagesLabour Laws Individual Assignment - Code On Wages Subject Code: MHR4CCHR05Seher BhatiaNo ratings yet

- Annex 3 Affidavit of Undertaking DO 3 2018Document1 pageAnnex 3 Affidavit of Undertaking DO 3 2018Anne CañosoNo ratings yet

- TVM - Time Value of Money ProblemsDocument1 pageTVM - Time Value of Money ProblemsperiNo ratings yet