Professional Documents

Culture Documents

Raphite: by Rustu S. Kalyoncu

Uploaded by

Jaideep RajeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Raphite: by Rustu S. Kalyoncu

Uploaded by

Jaideep RajeCopyright:

Available Formats

GRAPHITE

By Rustu S. Kalyoncu

Graphite, one of three known forms of carbon, occurs naturally in the Earths crust in metamorphic rocks such as crystalline limestones, schists, and gneiss. It may be found in large crystalline hexagonal plates or disseminated in small flakes. A third class, so-called amorphous graphite is commonly found in microcrystalline formthus the amorphous character in weakly metamorphosed rocks, such as slates and shales. Artificial, or synthetic, graphite is manufactured on a large scale in electric furnaces using anthracite or petroleum coke as raw feed. Graphite is an excellent thermal and electrical conductor. The high melting point of graphite, in absence of oxygen, 3,500 C, makes it suitable for a number of refractory applications. Excellent acid resistance and general chemical inertness make its use ideal in acid environments and other chemical applications. Graphite fibersdrawn from organic precursors, such as rayon, polyacrilonitrile and tar-pitchare used as the reinforcing components in polymer composites. Domestic graphite production information is developed by the U.S. Geological Survey from a voluntary survey of the U.S. producers. Out of 179 companies surveyed, 132 (74%) responded, an increase of 10% over the l995 figures. Three plants no longer produce and were removed from the list. Synthetic graphite figures were not tabulated for l996 as less than one-half of the producers responded to the survey. There was no mining of natural graphite in the United States in 1996, thus all natural graphite is from foreign sources. Imports of natural graphite in 1996 were 53,400 metric tons at a value of $28.6 million. In 1996, the United States consumption of natural graphite was 32,400 tons at a value of $37.9 million, whereas the exports of manufactured goods from artificial and natural graphite were 92,500 tons, amounting to a dollar value of $68 million. (See table 3.) Legislation and Government Programs Total graphite inventories, excluding nonstock grade, reached 20,227 tons with a dollar value of about $5 million. This total amount was the inventory of stockpile natural graphiteSri Lankaas uncommitted inventory was reported to be 4,930 tons valued at $2.57 million, none of it authorized for disposal. Madagascar natural graphite inventories reached 14,400 tons with a $2.22 million value. (See table 2.) Production As was the case in previous years, there was no natural graphite mining in the United States in l996, hence all the

U.S. GEOLOGICAL SURVEYMINERALS INFORMATION

natural graphite processed was obtained through import channels. Principal import sources of natural graphite were Canada, China, and Madagascar. Mexico supplied the most of the amorphous graphite, and Sri Lanka providing the chip and lump graphite. In addition to the above four major countries, a number of other producers supplied various types and grades of graphite to the United States, among the more notable ones being Brazil, Germany, India, Japan, and South Africa. (See table 6.) Graphite is mined from open pit and underground mine operations. Open pit operations are more economical and, thus, are preferred where the overburden is thin enough to remove. Madagascar mines are mostly open pit type. In the Republic of Korea, Mexico, and Sri Lanka, however, where the deposits are deep, underground mining is usually developed. Higher purity material is obtained by further crushing, grinding, and flotation steps. Consumption U.S. consumption of natural graphite declined significantly from 39,400 tons to 32,400 tons. (See table 3.) The largest decline is reflected in the amorphous grade which decreased 30%, from 18,800 to 13,100 tons. The refractories industry was the major consumer of crystalline graphite followed by brake lining manufacturers and lubricants. Refractory applications of graphite include both castable ramming and gunning mixtures, and shaped carbon-bonded brick. Carbon-magnesite brick containing crystalline flake graphite has applications in hightemperature corrosive environments, such as steel furnaces, ladles, and blast furnaces. Carbon-alumina linings are principally employed in continuous steel casting operations. Both magnesite- and alumina-carbon refractory bricks require fine particle size 100 meshand high purity95% to 99% graphite. Graphite as a substitute for asbestos in brake lining manufacture, with its lubricating character and high thermal conductivity, significantly reduces the heat generated due to friction, thus enhancing brake life. Other significant uses of graphite include the manufacture of long-life batteries furnishing low currents, steelmaking, rubber manufacture, and powder metallurgy. The use of graphite in low-current batteries is gradually giving way to carbon black, which is more economical and more efficient. The three major uses, refractories, brake linings, and foundries accounted for over one-half the graphite consumed by the U.S. industry in l996. (See table 3.)

Prices Prices of graphite have remained constant over the last 3 years. Crystalline flake graphite concentrates command higher prices than the amorphous (microcrystalline) type. Carbon content, flake and crystal size, size distribution, and ash content affect the price of graphite. Natural graphite prices are often subject to negotiations between the buyer and the seller, leading to a wide price range throughout the year. (See table 4.) Foreign Trade Total imports of natural graphite (flake crystalline and amorphous) decreased 12% from l995 levels (from 60,700 tons in l995 to 53,400 tons in l996). Most imports were from Mexico, Canada, and Taiwan. Total exports, on the other hand, showed an increase of 2.1%, from 90,600 tons to 92,500 tons. (See tables 5, 6, and 7.) World Review World production of graphite is estimated to be 644,000 tons, showing a significant decrease from the 1995 value of 741,000 tons. The most significant decrease in production was in China. China, however, continued to be the leading producer, followed by India, North Korea, Brazil, and Mexico. These countries accounted for almost three-quarters of total world production of graphite. (See table 8.) Brazils dominant graphite producer, Nacional de Grafite Ltda., started a new flake graphite operation at Salto da Davisa in Minas Gerais, about 200 kilometers east of companys large graphite mining operations at Pedra Azul. Commissioning of the plant was expected to be late in 1996. Around 90% of the production will be targeted at export markets, particularly in North America (Industrial Minerals, l996, p. 9). Current Research and Technology That new technologies for graphite products are being constantly developed is due, for the most part, to the advances in graphite thermal technology. The ability to refine and modify graphite and carbon products will be the key to future growth in the graphite industry. Innovative refining techniques have enabled the use of improved graphite in friction materials, electronics, foil, and lubrication applications (Hand, l997, p. 34). Some of the new application areas include electrically conductive asphalt for heated runways at airports and roadway

bridges with capability of melting an inch of snow per hour. Such rate would prevent any accumulation of snow on the ground under almost any conditions. Outlook The general trend in materials and service is toward just-intime (JIT) delivery. Customers would like to reduce their inventories to the lowest acceptable levels. They expect immediate delivery and appropriate technical assistance from the supplier. Joint cooperation with the allied industries is also a growing trend. In the past, suppliers developed the best product they could and went about trying to market it. Today, industries work together to engineer the best possible products to match the application requirements. Industry trends that appear to be common to advances in graphite technology and markets include higher purity, consistency in specifications and supply sources. Production of higher purity graphite for specific applications, primarily through thermal processing and acid leaching appears to be the current trend. The opportunities for the graphite industry and carbon products are numerous and promising. The need for high-tech graphite or carbon composites, be it in sporting goods manufacture or high temperature applications, will continue to fuel the development of high purity and high consistency products. Use of synthetic graphite in antilock break applications, where it is used as friction modifier to provide sufficient lubrication to prevent locking up of brakes, is another area where significant growth may take place. References Cited

Hand, G.P., 1997, Outlook for graphite and graphite technology: Mining Engineering, v. 49, no. 2, February, p. 34-36. Industrial Minerals, 1996, New mine plant for Nacional de Grafite: p. 9.

SOURCES OF INFORMATION U.S. Geological Survey Publication Graphite. Ch. In Mineral Commodity Summaries, annual. Other Chemical Week. European Chemical News. Industrial Minerals (London).

U.S. GEOLOGICAL SURVEYMINERALS INFORMATION

TABLE 1 SALIENT NATURAL GRAPHITE STATISTICS 1/ 1992 United States: Production metric tons Apparent consumption 2/ do. Exports do. Value thousands Imports for consumption metric tons Value thousands World: Production metric tons e/ Estimated. r/ Revised. 1/ Data are rounded to three significant digits. 2/ Domestic production plus imports minus exports. -29,500 20,200 $12,200 49,700 $25,500 670,000 1993 1994 1995 1996

----34,800 32,900 23,500 27,400 17,400 20,300 37,300 26,000 $11,100 $13,100 $17,900 $14,600 52,200 53,100 60,700 53,400 $29,900 $26,900 $30,100 $28,600 670,000 r/ 552,000 r/ 741,000 r/ 644,000 e/

TABLE 2 U.S. GOVERNMENT STOCKPILE GOALS AND YEAREND STOCKS OF NATURAL GRAPHITE IN 1996, BY TYPE (Metric tons) National stockpile inventory 14,400 4,930 945 126

Type Madagascar crystalline flake Sri Lanka amorphous lump Crystalline, other than Madagascar and Sri Lanka Nonstockpile-grade, all types 1/ This commodity no longer has a goal.

Goal (1/) 12,200 (1/) (1/)

Source: Defense National Stockpile Center, Inventory of Stockpile Materials as of Dec. 31, 1996.

TABLE 3 U.S. CONSUMPTION OF NATURAL GRAPHITE, BY USE 1/ (Thousand metric tons and thousand dollars) Crystalline Quantity Value Amorphous 2/ Quantity Value Total Quantity Value W $8,570 1,930 880 1,350 2,080 1,700 4,360 8,860 778 600 13,900 45,000 W 5,630 1,770 839 824 2,380 1,130 1,210 9,700 662 76 13,700 37,900

End use

1995: Batteries W W --W Brake linings 2,530 $3,580 5,980 $4,980 8,510 Carbon products 3/ 544 1,580 281 352 824 Crucibles, retorts, stoppers, sleeves, and nozzles 969 861 10 19 980 Foundries 4/ 523 473 1,790 877 2,310 Lubricants 523 985 1,490 1,090 2,020 Pencils 1,100 1,100 642 600 1,740 Powdered metals 1,970 4,310 35 56 2,010 Refractories 5,770 5,310 4,180 3,550 9,950 Rubber 220 420 583 358 802 Steelmaking 125 178 1,100 422 1,220 Other 5/ 6,330 11,600 2,760 2,310 9,080 Total 20,600 30,400 18,800 14,600 39,400 1996: Batteries W W --W Brake linings 1,090 1,360 5,100 4,270 6,190 Carbon products 3/ 472 1,410 376 365 847 Crucibles, retorts, stoppers, sleeves, and nozzles 898 824 7 14 906 Foundries 4/ 560 478 724 346 1,280 Lubricants 434 942 1,620 1,440 2,050 Pencils 849 1,020 163 105 1,010 Powdered metals 511 1,170 19 42 530 Refractories 8,260 9,050 2,520 684 10,800 Rubber 168 326 584 336 753 Steelmaking 30 27 86 49 116 Other 5/ 6,000 11,700 1,910 1,980 7,910 Total 19,300 28,300 13,100 9,630 32,400 W Withheld to avoid disclosing company proprietary data; included with "Other." 1/ Data are rounded to three significant digits; may not add to totals shown. 2/ Includes mixtures of natural and manufactured graphite. 3/ Includes bearings and carbon brushes. 4/ Includes foundries (other) and foundry facings. 5/ Includes ammunition, antiknock and other compounds, drilling mud, electrical/electronic devices, industrial diamonds, magnetic tape, mechanical products, packings, paints and polishes, seed coating, small packages, soldering/welding, and other end-use categories.

TABLE 4 REPRESENTATIVE YEAREND GRAPHITE PRICES 1/ (Per metric ton) Type 1995 1996 Crystalline large flake, 85% to 90% carbon $450-$550 $450-$550 Crystalline medium flake, 85% to 90% carbon 330- 500 330- 500 Crystalline small flake, 80% to 95% carbon 270- 500 270- 500 Amorphous powder, 80% to 85% carbon 220- 300 220- 300 1/ Prices are normally "Cost, insurance, and freight" (c.i.f.) main European port. Source: Industrial Minerals; No. 339, Dec. 1995, p. 64 and No. 351, Dec. 1996, p. 72.

TABLE 5 U.S. EXPORTS OF NATURAL AND ARTIFICIAL GRAPHITE, BY COUNTRY 1/ 2/ Natural 3/ Quantity (metric tons) Value 5/ Artificial 4/ Quantity (metric tons) Value 5/ Total Quantity (metric tons)

Country Value 5/ 1995: Canada 3,560 $2,790,000 4,980 $9,810,000 8,540 $12,600,000 France 633 215,000 4,700 8,390,000 5,330 8,610,000 Japan 7,290 2,790,000 13,800 5,930,000 21,100 8,720,000 Korea, Republic of 393 323,000 8,680 4,530,000 9,070 4,860,000 Mexico 6,640 2,780,000 1,190 679,000 7,830 3,460,000 Netherlands 266 103,000 6,710 3,290,000 6,980 3,390,000 Taiwan 7,830 3,440,000 993 625,000 8,820 4,060,000 Other 10,600 5,370,000 12,300 15,200,000 22,900 20,700,000 Total 37,300 17,900,000 53,300 48,500,000 90,600 66,400,000 1996: Canada 3,830 3,290,000 6,770 9,410,000 10,600 12,700,000 France 324 151,000 8,280 8,830,000 8,610 8,980,000 Japan 811 642,000 17,700 8,200,000 18,500 8,860,000 Korea, Republic of 1,010 459,000 6,330 4,400,000 7,340 4,860,000 Mexico 9,250 3,510,000 3,950 2,130,000 13,200 5,640,000 Netherlands 366 186,000 7,690 3,470,000 8,050 3,650,000 Taiwan 2,390 1,520,000 1,100 1,110,000 3,490 2,630,000 Other 7,980 4,830,000 14,700 15,900,000 22,700 20,700,000 Total 26,000 14,600,000 66,600 53,400,000 92,500 68,000,000 1/ Data are rounded to three significant digits; may not add to totals shown. 2/ Numerous countries for which data were reported have been combined within the "Other" category under the "Country" list. 3/ Amorphous, crystalline flake, lump and chip and natural, not elsewhere classified. The applicable "Harmonized Tariff Schedule" (HTS) nomenclature title and code(s) are: "Natural graphite in powder or in flakes"/"Other;" HTS Nos. 2504.10/90.0000. 4/ Includes data from the applicable "Harmonized Tariff Schedule" (HTS) nomenclatures: "Artificial graphite" and "Colloidal or semicolloidal graphite;" their respective HTS code Nos. are 3801.10.20.0000. 5/ Values are f.a.s. Source: Bureau of the Census.

TABLE 6 U.S. IMPORTS FOR CONSUMPTION OF NATURAL GRAPHITE, BY COUNTRY 1/ 2/ Crystalline flake and flake dust Quantity Value 3/ (metric (thoutons) sands) Lump and chippy dust Quantity Value 3/ (metric (thoutons) sands) Other natural crude; high-purity; expandable Quantity Value 3/ (metric (thoutons) sands)

Country or territory 1995: Brazil ----3,100 $4,030 --3,100 $4,030 Canada 15,200 $10,300 --124 30 --15,400 10,300 China 3,450 1,720 --9,930 3,600 2,920 $676 16,300 5,990 Germany ----155 603 --155 603 Hong Kong ----(4/) 11 396 40 396 51 India 38 63 --256 259 --294 322 Japan ----4,700 2,080 --4,700 2,080 Madagascar 4,180 2,690 ------4,180 2,690 Mexico ------14,500 2,080 14,500 2,080 Mozambique ----------South Africa 117 87 --55 224 --172 311 Sri Lanka --746 $455 -----746 455 Zimbabwe 581 278 ------581 278 Other 5/ 149 502 --41 439 40 29 230 970 Total 23,700 15,600 746 455 18,400 11,300 17,900 2,830 60,700 30,100 1996: Brazil ----1,820 2,940 --1,820 2,940 Canada 13,800 9,740 --308 198 --14,200 9,940 China 2,270 1,080 --6,540 2,250 5,810 1,450 14,600 4,780 Germany ----144 669 --144 669 India ----155 223 --155 223 Japan ----789 2,050 --789 2,050 Madagascar 4,120 3,120 ------4,120 3,120 Mexico ------14,800 1,980 14,800 1,980 Mozambique 472 464 ------472 464 South Africa 76 70 --193 502 --269 572 Sri Lanka --1,400 945 ----1,400 945 Zimbabwe 448 298 ------448 298 Other 5/ 63 157 --79 263 80 166 222 586 Total 21,300 14,900 1,400 945 10,000 9,100 20,700 3,600 53,400 28,600 1/ Data are rounded to three significant digits; may not add to totals shown. 2/ The information framework from which data for this material were derived originated from Harmonized Tariff Schedule (HTS) base data. 3/ Customs values. 4/ Less than 1/2 unit. 5/ Includes Austria, Belgium (1995), Czech Republic (1995), France, Italy (1995), Kazakstan (1995), the Republic of Korea, the Netherlands, Poland, Russia (1996), Switzerland, Taiwan (1995), and the United Kingdom. Source: Bureau of the Census, adjusted by the U.S. Geological Survey.

Amorphous Quantity Value 3/ (metric (thoutons) sands)

Total Quantity Value 3/ (metric (thoutons) sands)

TABLE 7 U.S. IMPORTS FOR CONSUMPTION OF GRAPHITE ELECTRODES, BY COUNTRY 1/ 2/ Quantity (metric tons) Value 3/ (thousands)

Country

1995: Canada 11,200 $30,900 Germany 2,420 7,430 Italy 8,230 14,700 Japan 8,020 21,700 Mexico 11,600 16,100 Other 4/ 6,080 11,000 Total 47,500 101,800 1996: Canada 14,900 39,800 Germany 4,710 14,000 Italy 8,290 17,400 Japan 8,870 25,300 Mexico 14,600 22,600 Other 4/ 8,000 16,000 Total 59,300 135,000 1/ Data are rounded to three significant digits; may not add to totals shown. 2/ The applicable "Harmonized Tariff Schedule" (HTS) code and nomenclature title are: (HTS 8545.11.0000); "Electric Furnace Electrodes." 3/ Customs values. 4/ Includes data for countries reflecting less than 1,000 metric tons for yearly imports. Source: Bureau of the Census.

TABLE 8 GRAPHITE: WORLD PRODUCTION, BY COUNTRY 1/ 2/ (Metric tons) Country 1992 1993 1994 1995 1996 e/ Argentina 20 -- r/ -- r/ -- r/ -Austria 19,796 4,146 12,324 12,019 12,000 Brazil (marketable) 3/ 29,414 29,472 35,965 36,000 e/ 36,000 Canada (exports of natural graphite) 17,400 18,700 21,711 22,000 e/ 23,000 China e/ 300,000 310,000 183,000 r/ 350,000 250,000 Czech Republic e/ 4/ XX 27,000 25,000 27,000 r/ 25,000 Czechoslovakia 5/ 20,000 XX XX XX XX Germany (marketable) 11,963 8,363 4,369 r/ 5,000 r/ 4,000 India (run-of-mine) 6/ 72,996 82,398 93,597 r/ 114,959 r/ 120,000 Korea, North e/ 38,000 38,000 38,000 40,000 40,000 Korea, Republic of 8,412 5,910 4,300 1,938 r/ 2,000 Madagascar 8,910 11,182 r/ 7/ 12,715 r/ 7/ 16,522 r/ 7/ 16,000 Mexico: Amorphous 30,500 42,600 43,000 e/ 32,738 r/ 34,000 Crystalline flake 985 960 1,000 e/ 1,450 r/ 1,500 Mozambique ---4,100 e/ 4,100 Namibia 200 e/ ----Norway e/ 7,000 6,500 5,566 r/ 8/ 3,000 r/ 2,500 Romania 2,300 2,000 e/ 2,335 r/ 2,180 r/ 2,200 Russia e/ 15,000 10,000 8,000 8,000 6,000 Sri Lanka 3,307 5,163 2,950 3,000 e/ 3,000 Tanzania ----6,000 Turkey (run-of-mine) e/ 9/ 20,978 8/ 20,000 20,000 20,000 21,000 Ukraine e/ 50,000 40,000 30,000 30,000 25,000 Zimbabwe 12,346 7,142 7,890 11,381 r/ 11,000 Total 670,000 670,000 r/ 552,000 r/ 741,000 r/ 644,000 e/ Estimated. r/ Revised. XX Not applicable. 1/ World totals and estimated data have been rounded to three significant digits; may not add to totals shown. 2/ Table includes data available through May 13, 1997. 3/ Does not include the following quantities sold directly without beneficiation, in metric tons: 1992--8,957; 1993--9,960; 1994--9,670 (revised); 1995--10,000 (estimated); and 1996--10,000 (estimated). 4/ Formerly part of Czechoslovakia; data were not reported separately until 1993. 5/ Dissolved Dec. 31, 1992. 6/ Indian marketable production is 10% to 20% of run-of-mine production. 7/ Exports. Source: United Nations, Department of International Economic and Social Affairs, Statistical Office. 8/ Reported figure. 9/ Turkish marketable production averages approximately 5% of run-of-mine production. Almost all is for domestic consumption.

You might also like

- All About PuneDocument79 pagesAll About PuneMichelle McdonaldNo ratings yet

- District Industrial Profile: Government of India Ministry of MSMEDocument21 pagesDistrict Industrial Profile: Government of India Ministry of MSMETimmaNo ratings yet

- Guidelines & Application Form: DigitalDocument26 pagesGuidelines & Application Form: DigitalAvinash KamuniNo ratings yet

- Tumkur Dist (Corrected)Document18 pagesTumkur Dist (Corrected)Manjunath GowdaNo ratings yet

- Karur II - Phone Call Daily Report - 16.09.2020Document3 pagesKarur II - Phone Call Daily Report - 16.09.2020kalaish123No ratings yet

- Internship Training Report Santhom Latex Co. KeralaDocument28 pagesInternship Training Report Santhom Latex Co. KeralaAnish Thomas100% (1)

- Regional Mineral Processing Labs & Pilot Plants LocationsDocument5 pagesRegional Mineral Processing Labs & Pilot Plants LocationsravishankarNo ratings yet

- MOUs List of MOUs Entered at Global Investors MeetDocument28 pagesMOUs List of MOUs Entered at Global Investors MeetAshish SharmaNo ratings yet

- Mining Sector in IndiaDocument6 pagesMining Sector in IndiaSAMAYAM KALYAN KUMARNo ratings yet

- Chittoor District PDFDocument35 pagesChittoor District PDFSuresh Kumar100% (1)

- GOI Ministry of Water Resources CGWB Ground Water Information Booklet North GoaDocument27 pagesGOI Ministry of Water Resources CGWB Ground Water Information Booklet North Goashubham100% (1)

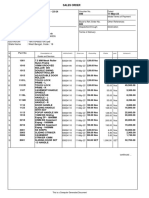

- Sales Order Summary for Hardware ProductsDocument4 pagesSales Order Summary for Hardware ProductsAnirban ChowdhuryNo ratings yet

- Toormoongurad11 06 18 PDFDocument51 pagesToormoongurad11 06 18 PDFSrinivas BoyapalliNo ratings yet

- 04242015160712officer Wise Target-Bangalore15-16-2Quarters PDFDocument8 pages04242015160712officer Wise Target-Bangalore15-16-2Quarters PDFRahulNo ratings yet

- KarurDocument150 pagesKarurAravindSamyNo ratings yet

- Permafrost Seed StorageDocument21 pagesPermafrost Seed StoragesathishsstNo ratings yet

- Hazardous Waste Recyclers ListDocument16 pagesHazardous Waste Recyclers ListUnitedWork ServiceNo ratings yet

- List of Mining Leases As On 31-03-2002Document108 pagesList of Mining Leases As On 31-03-2002Anand ArockiasamyNo ratings yet

- Mine List HasDocument7 pagesMine List HasShareit ShareitNo ratings yet

- Gim 2010 On 31.10.2014Document10 pagesGim 2010 On 31.10.2014SK Business groupNo ratings yet

- Profile DelegatowDocument26 pagesProfile Delegatowyudhvir_mscNo ratings yet

- List of Certified Manufacturer'S Under "Tested Product Certificate (TPC) " CategoryDocument4 pagesList of Certified Manufacturer'S Under "Tested Product Certificate (TPC) " CategoryArvind DharmarajNo ratings yet

- Organic Farmers and Farms of GujaratDocument29 pagesOrganic Farmers and Farms of GujaratHD SapphireNo ratings yet

- Korean Company ListDocument15 pagesKorean Company ListDilip ParmarNo ratings yet

- Central Region Voters List WebsiteDocument24 pagesCentral Region Voters List WebsiteYakshit JainNo ratings yet

- Coal WasheryDocument2 pagesCoal WasherynitunagrawalNo ratings yet

- Historiography 17-19CE MaghribDocument17 pagesHistoriography 17-19CE MaghribZakariya El HoubbaNo ratings yet

- Inside: Projects April 2014Document16 pagesInside: Projects April 2014Jai GauravNo ratings yet

- Chromium 2017 Attendance ListDocument4 pagesChromium 2017 Attendance ListSalah AyoubiNo ratings yet

- TraderslistDocument21 pagesTraderslistKumar K SNo ratings yet

- Guidelist Catb Part2Document41 pagesGuidelist Catb Part2Anonymous 8SNpyXNo ratings yet

- E - Waste CompaniesDocument4 pagesE - Waste CompaniesPraveenNo ratings yet

- BackupDocument690 pagesBackupnipaceNo ratings yet

- 202302060437297559005LATESTUPDATEupto06 02 2023 (Last5480)Document395 pages202302060437297559005LATESTUPDATEupto06 02 2023 (Last5480)ProConnect ConsultancyNo ratings yet

- 201911081054578838684valid List MTO 071119Document776 pages201911081054578838684valid List MTO 071119Dhruv ChandraNo ratings yet

- BunkerDocument7 pagesBunkerDhananjayan GopinathanNo ratings yet

- CuttackDocument6 pagesCuttackbaivabi priyadarshiniNo ratings yet

- Yamunanagar Stone Crusher ListDocument8 pagesYamunanagar Stone Crusher ListPrince ChaudharyNo ratings yet

- Details of mega food park projects accorded final approvalDocument12 pagesDetails of mega food park projects accorded final approvalSuhas Krishna100% (1)

- M/S. Secure Meters Limited - Three Phase 10-60A MetersDocument5 pagesM/S. Secure Meters Limited - Three Phase 10-60A MetersSARANYA CHANDRSEAKRNo ratings yet

- State Scan: Exim IBDocument26 pagesState Scan: Exim IBBharath KrishnakumarNo ratings yet

- Leading Mid-Corporates of India 2023 (SALES)Document72 pagesLeading Mid-Corporates of India 2023 (SALES)Manisha GuptaNo ratings yet

- 08052016113749list of Exploration AgenciesDocument10 pages08052016113749list of Exploration AgenciesNitesh SinghNo ratings yet

- METRO Member Directory and Delivery Roster - Spring 2012Document42 pagesMETRO Member Directory and Delivery Roster - Spring 2012Metropolitan New York Library Council (METRO)No ratings yet

- Mine Status PDFDocument31 pagesMine Status PDFankitgorNo ratings yet

- Section25 CompaniesDocument128 pagesSection25 CompaniesAnsh KashyapNo ratings yet

- Ludhiana Forging IndustriesDocument16 pagesLudhiana Forging IndustriesSourindra Mohan PandaNo ratings yet

- KOL16 RevDocument117 pagesKOL16 RevAman DubeyNo ratings yet

- Product Catalog: WWW - Stonepark.inDocument38 pagesProduct Catalog: WWW - Stonepark.inparulpaulNo ratings yet

- Staff Nomber ListDocument72 pagesStaff Nomber ListRamesh PatidarNo ratings yet

- Indian Minerals Yearbook 2016 - GraniteDocument14 pagesIndian Minerals Yearbook 2016 - GraniteWinterstone W. DiamantNo ratings yet

- Andhra Pradesh Part 3Document59 pagesAndhra Pradesh Part 3sayyedmustafa100% (2)

- Coimbatore WetlandsDocument62 pagesCoimbatore WetlandsNavin PrabaharanNo ratings yet

- New YorkDocument9 pagesNew YorkrashidasmiNo ratings yet

- Approved List of Firms for Manufacture and Supply of Electrical Signalling and Telecommunication ItemsDocument195 pagesApproved List of Firms for Manufacture and Supply of Electrical Signalling and Telecommunication ItemsMukul Kumar AgarwalNo ratings yet

- List of Approved Units - FFP ProductsDocument8 pagesList of Approved Units - FFP ProductsBajaj AlchemNo ratings yet

- Graphite SummaryDocument11 pagesGraphite SummaryFamiloni LayoNo ratings yet

- Raphite: by Rustu S. KalyoncuDocument11 pagesRaphite: by Rustu S. KalyoncudimasNo ratings yet

- Graphite High Tech Supply Sharpens Up Nov 00Document12 pagesGraphite High Tech Supply Sharpens Up Nov 00Familoni LayoNo ratings yet

- Solutions Manual to accompany Engineering Materials ScienceFrom EverandSolutions Manual to accompany Engineering Materials ScienceRating: 4 out of 5 stars4/5 (1)

- Reservoir Fluid Sampling & RecombinationDocument9 pagesReservoir Fluid Sampling & Recombinationdrojas70No ratings yet

- PDS RECECoat FINE GREYDocument2 pagesPDS RECECoat FINE GREYAmira RamleeNo ratings yet

- IOGCA 2019 Conference Proceedings PDFDocument295 pagesIOGCA 2019 Conference Proceedings PDFadityamduttaNo ratings yet

- Lab Manual-Total AlkalinityDocument4 pagesLab Manual-Total AlkalinitySuvanka DuttaNo ratings yet

- Tappi Tip 0402-28Document16 pagesTappi Tip 0402-28Haries Bugarin Garcia100% (1)

- Pka TABLEDocument2 pagesPka TABLEsweetravina_angelNo ratings yet

- 1-Classification of Monomers and PolyreactionsDocument19 pages1-Classification of Monomers and PolyreactionsMohanraj ShanmugamNo ratings yet

- Accepted Manuscript: 10.1016/j.jddst.2018.04.020Document25 pagesAccepted Manuscript: 10.1016/j.jddst.2018.04.020kieu trinhNo ratings yet

- Simulation-No.-03 - EMF-of-Cell (1) DadaDocument10 pagesSimulation-No.-03 - EMF-of-Cell (1) DadaJoshua Te�osoNo ratings yet

- E50100d 160208 PWS RoctestDocument2 pagesE50100d 160208 PWS RoctestJohel Kevin Berrocal TabrajNo ratings yet

- Potential Alkali Reactivity of Cement-Aggregate Combinations (Mortar-Bar Method)Document5 pagesPotential Alkali Reactivity of Cement-Aggregate Combinations (Mortar-Bar Method)Ahmed AbidNo ratings yet

- Nitoseal MS100Document4 pagesNitoseal MS100talatzahoorNo ratings yet

- Revised NEQSDocument10 pagesRevised NEQSKhalid Masood GhaniNo ratings yet

- Class 11 - Physics - Mechanical Properties of SolidsDocument22 pagesClass 11 - Physics - Mechanical Properties of SolidsSha HNo ratings yet

- Synthesis of Copper Oxide Nanoparticles Using Simple Chemical Route PDFDocument3 pagesSynthesis of Copper Oxide Nanoparticles Using Simple Chemical Route PDFRobinsonNo ratings yet

- MADE EASY ONLINE TEST SERIES SOLUTIONSDocument26 pagesMADE EASY ONLINE TEST SERIES SOLUTIONSvenkateshNo ratings yet

- Evaluation of Rice Husk Ash and Bone Ash Mixed As Partial Replacement of Cement in ConcreteDocument7 pagesEvaluation of Rice Husk Ash and Bone Ash Mixed As Partial Replacement of Cement in ConcreteManuNo ratings yet

- Railway Acts, Codes and Manuals GuideDocument29 pagesRailway Acts, Codes and Manuals GuideuttamNo ratings yet

- Density of PlasticsDocument2 pagesDensity of PlasticsMutiara FajarNo ratings yet

- G S Earth WireDocument10 pagesG S Earth WiresaratNo ratings yet

- Toluene Vanadium Electrolytic OxidationDocument5 pagesToluene Vanadium Electrolytic Oxidationles_gaidzionis9376No ratings yet

- Sulfate Removal Technologies For Oil Fields Seawater Injection OperationsDocument18 pagesSulfate Removal Technologies For Oil Fields Seawater Injection OperationsFarzad sadeghzadNo ratings yet

- The First-Principles Phase Diagram of Monolayer Nanoconfined WaterDocument33 pagesThe First-Principles Phase Diagram of Monolayer Nanoconfined WaterNiNo ratings yet

- BoilerDocument3 pagesBoilerTerry YongNo ratings yet

- Molygraph-General EngineeringDocument6 pagesMolygraph-General Engineeringkominthitsar7474No ratings yet

- Chapter4 RetainingwallDocument55 pagesChapter4 RetainingwallNur HazwaniNo ratings yet

- Application of XRD technique on nano materials characterizationDocument36 pagesApplication of XRD technique on nano materials characterizationDuygu Deniz EryaşarNo ratings yet

- Strut and Tie ModelDocument7 pagesStrut and Tie ModelChaudharyShubhamSachanNo ratings yet

- Of Poly (Viny1: RheologyDocument6 pagesOf Poly (Viny1: Rheologyhost1000youtubNo ratings yet

- Pemisahan Katoda AnodaDocument11 pagesPemisahan Katoda AnodaHamdi Zae malikNo ratings yet