Professional Documents

Culture Documents

Weekly Market Outlook 14.05.12

Uploaded by

Mansukh Investment & Trading SolutionsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Market Outlook 14.05.12

Uploaded by

Mansukh Investment & Trading SolutionsCopyright:

Available Formats

Weekly Market Outlook

12 May 2012

make more, for sure.

DATA MATRIX FOR THE WEEK 7th May 2012 - 11th May 2012 Weekly Markets

Sensex Nifty Gold(US$/oz) Re/US$ Dow Nasdaq FX Res (US$ Bn) 16,293 4,929 1,580.0 53.63 12,821 2,934 293.173 -3.20% -3.11% -3.84% 0.30% -1.66% -0.74% -0.74%

SNAPSHOT

Turbulence remained constant companion for D-street in the week gone by, where in the barometer gauges sliding for 4 out of 5 trading sessions, concluded the week with a nasty nick of over 3 percent. Barometer gauges, after showcasing dead cat bounce on GAAR deferment in the first trading session, pulsated with cut of close to percentage point on the last trading session of the week. Stock markets in Indian have extended the downtrend for the second week in a row as investors at large continued to square of hefty positions across the board amid an increasingly vulnerable domestic as well as global setup. The frontline equity indices got thrashed in four of the five session and suffered colossal damage of over three percentage points, settling around the important psychological 4,900 (Nifty) and 16,300 (Sensex) levels. The worries from money market showed little signs of dying down as the anemic rupee slipped closer to 54 against the US dollar despite recent measures from the central bank to support the beleaguered currency. Meanwhile, the unexpectedly discouraging industrial activity data, which contracted 3.5% in March for the first time in five months, indicated marked slowdown in the economy.

1500 1000 500 0 27-Apr 30-Apr 2-May *NSE 3-May 4-May 7-May 8-May F & O Volume (Rs bn) 9-May 10-May 11-May Volatility Index % Volume* & Volatility Index (Nifty - Apr & May 2012) 25 20 15 10 5 0

Net FII / DII Equity Activity (Rs Cr) Upto 11.05.12

Total May 2012 Total 2012

FIIs

439.8 39,672

DIIs

-522.8 -22,285

Cash Volume (Rs bn)

Weekly Sector Movement

Sectors

Auto Bankex CD CG FMCG Healthcare IT Metal Oil & Gas PSU Realty

WEEK AHEAD

Close

9,779 10,836 6,607 8,809 4,618 6,574 5,482 10,107 7,548 6,711 1,562

%

-2.45 -3.97 -0.05 -1.12 -2.04 -3.36 -4.38 -4.31 -2.45 -3.12 -4.07

The Bombay Stock Exchange (BSE) Sensex shaved off 538.10 points or 3.20% to 16292.98 during the week ended May 11, 2012. The BSE Mid-cap index was down by 152.09 points or 2.49% to 5948.71 and the Smallcap index down by 192.88 points or 2.93% to 6395.38. The S&P CNX Nifty plunged by 157.95 points or 3.11% to 4928.90. On the National Stock Exchange (NSE), Bank Nifty down 404.25 points or 4.12% to 9398.10, CNX IT down 269.55 points or 4.42% to 5830.80 while CNX mid- cap down 229.70 points or 3.18% to 6985.75 and CNX Nifty Junior down 284.20 points or 2.86% to 9663.80.

Release of April month's inflation data will set the tone for Dalal Street in the coming week, as wholesale price index (WPI) data for April will be announced on Monday, i.e. May 14, 2012. On the result front, L&T announces FY 2012 results on Monday, 14 May 2012. Bajaj Auto announces FY 2012 results on Thursday, 17 May 2012. State Bank of India, Tata Steel and Coal India will announce their FY 2012 results on Friday, 18 May 2012. Additionally, in the coming week the momentum of Indian rupee coupled with the mood of foreign institutional investors will also be eyed. On the global front, investor's will be eying the release of few economic data from US, starting from Consumer Price Index and Retail Sales data on May 15, 2012, followed by Housing Starts data, Industrial Production and FOMC Minutes release on May 16,2012 and finally the Jobless Claims and Philadelphia Fed Survey data on May 17,2012. For the upcoming week we are maintaining our negative view in spot index though we still believe any further downside will open only after a breach of 4880-4900 level with good volumes. In that case we might see another sharp downfall of 100-120 points near to 4730-4750. On the flip side any consolidation around 4950-4970 level may reap indices towards 5100 where sell on rally approach is highly advisable. HAPPY TRADING...

Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834 NSE: INB 230781431, F&O: INF 230781431, DP: IN-DP-CDSL-73-2000, INDP-NSDL-140-2000 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

Weekly Market Outlook

make more, for sure.

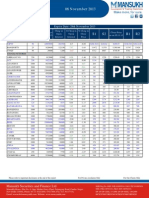

SENSEX 30-TECHNICAL LEVELS FOR THE UPCOMING WEEK ENDED 18th May 2012

SUPPORT SCRIP

Bajaj Auto Ltd Bharat Heavy Electricals Ltd. Bharti Airtel Ltd. Cipla Ltd. Coal India Ltd. DLF Ltd. GAIL (India) Ltd. HDFC Bank Ltd. Hero MotoCorp Ltd. Hindalco Industries Ltd. Hindustan Unilever Ltd. Housing Development Finance Corporation Ltd. ICICI Bank Ltd. Infosys Ltd. ITC Ltd. Jindal Steel & Power Ltd. Larsen & Toubro Ltd. Mahindra & Mahindra Ltd. Maruti Suzuki India Ltd. NTPC Ltd. Oil & Natural Gas Corpn. Ltd. Reliance Industries Ltd. State Bank Of India Sterlite Industries (India) Ltd. Sun Pharmaceutical Inds. Ltd. Tata Consultancy Services Ltd. Tata Motors Ltd. Tata Power Company Ltd. Tata Steel Ltd. Wipro Ltd.

CLOSE PRICE 1st 11.05.12 1555.20 221.15 307.10 318.90 314.45 187.30 318.50 510.80 1843.30 113.50 430.95 645.90 812.95 2311.85 233.80 457.50 1138.85 655.15 1234.00 148.35 254.65 697.30 1852.20 95.10 569.70 1231.50 297.40 92.45 411.75 400.80 1st

RESISTANCE 2nd 1611 228 315 337 326 196 333 524 1896 119 436 657 833 2388 241 478 1185 673 1264 153 261 711 1917 98 609 1246 310 100 424 416 3rd 1687 235 321 352 336 205 345 535 1940 124 440 666 852 2454 248 499 1227 692 1295 158 266 726 1981 101 640 1262 324 107 435 429

INCLINATION

3rd 1381 207 296 292 297 168 297 489 1765 106 423 630 774 2189 221 415 1059 614 1173 139 243 667 1723 89 516 1197 268 80 392 377

2nd 1458 214 302 307 307 177 309 501 1809 110 427 639 794 2255 228 436 1101 634 1203 144 249 682 1788 92 547 1214 282 87 403 390

1506 218 305 313 311 182 314 506 1826 112 429 642 803 2283 231 447 1120 644 1219 146 252 690 1820 94 558 1223 290 90 407 396

1583 225 311 328 320 192 326 517 1870 116 433 652 823 2350 238 468 1162 664 1249 151 258 704 1885 96 589 1239 304 96 418 409

Positive Neutral Neutral Neutral Negative Neutral Neutral Neutral Negative Negative Positive Negative Negative Negative Negative Neutral Negative Negative Negative Negative Negative Neutral Negative Negative Negative Neutral Positive Negative Negative Neutral

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834 NSE: INB 230781431, F&O: INF 230781431, DP: IN-DP-CDSL-73-2000, INDP-NSDL-140-2000 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

Weekly Market Outlook

make more, for sure.

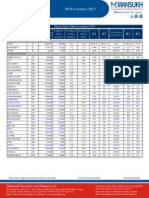

NSE MIDCAP 50-TECHNICAL LEVELS FOR THE UPCOMING WEEK ENDED 11th May 2012

SCRIP 3rd SUPPORT 2nd

702 50 808 140 335 98 25 105 795 510 1371 309 259 437 801 162 234 11 60 88 73 165 57 72 571 12 377 34 18 439 166 2533 211 135 435 42 280 90 52 55 87 322 103 596 195 20 114 51 102 115

CLOSE PRICE 1st

711 51 821 144 340 101 26 107 800 519 1385 317 262 442 811 165 238 12 62 90 76 172 58 74 599 12 383 35 18 446 169 2551 215 137 437 44 287 91 54 57 89 327 106 617 200 20 117 52 105 116

11.05.12

719.65 52.10 835.05 148.00 345.20 104.40 26.85 109.40 804.80 527.45 1399.90 324.10 265.50 447.25 821.95 167.70 242.05 12.05 64.40 92.00 79.05 179.60 58.60 75.55 627.50 12.15 388.25 35.75 18.00 453.30 172.85 2569.10 218.80 138.95 439.75 45.15 294.40 92.35 55.35 58.45 90.45 333.00 108.45 637.20 205.80 20.45 119.20 52.80 107.30 117.40

1st

732 54 846 152 350 107 28 112 812 533 1419 335 269 456 832 170 246 13 66 94 84 191 60 78 662 12 397 37 18 464 176 2586 223 141 442 46 300 94 58 60 92 342 112 661 209 21 121 54 111 119

RESISTANCE 2nd

744 55 858 156 355 109 29 115 820 539 1439 345 273 465 842 173 249 13 68 95 88 203 61 80 696 13 405 38 18 475 179 2603 228 142 445 48 305 96 60 61 94 351 115 685 212 22 123 54 114 121

Market Cap

3rd

765 57 883 164 365 115 31 120 833 553 1473 363 281 479 863 179 257 14 72 99 96 222 63 83 758 13 419 40 19 494 186 2638 237 146 449 50 318 99 64 64 98 365 121 729 221 23 128 56 120 124

(Rs Crore)

15250 11358 9479 7400 2314 5842 7144 3185 8957 2197 11199 7545 3317 12398 10910 1619 3686 1903 2698 11761 2428 7719 4451 3061 14001 2925 8155 917 22141 27249 4188 21574 6384 10421 7588 1499 7231 25905 2578 1596 5445 8483 6707 8125 11330 5350 5505 2616 3550 2674

ABB Ltd. 681 Adani Power Ltd. 48 Aditya Birla Nuvo Ltd. 783 Allahabad Bank 132 Alstom Projects India Ltd. 326 Andhra Bank 93 Ashok Leyland Ltd. 24 Aurobindo Pharma Ltd. 101 Bajaj Holdings & Investment Ltd 782 BEML Ltd. 496 Bharat Electronics Ltd. 1337 Bharat Forge Ltd. 291 CESC Ltd. 252 Cummins India Ltd. 423 DiviS Laboratories Ltd. 780 Educomp Solutions Ltd. 156 Great Eastern Shipping Company Ltd. 226 GVK Power & Infrastructure Ltd. 10 Housing Development & Infrastructure Ltd. 56 IDBI Bank Ltd 84 India Cements Ltd. 65 Indian Bank 147 Indian Hotels Company Ltd. 55 Jain Irrigation Systems Ltd. 68 JSW Steel Ltd. 509 Lanco Infratech Ltd. 11 Mphasis Ltd. 363 NCC Ltd. 32 NHPC Ltd. 17 Oil India Ltd 421 Opto Circuits (India) Ltd. 159 Oracle Financial Services Software Ltd 2498 Oriental Bank Of Commerce 202 Petronet LNG Ltd. 131 Piramal Healthcare Ltd. 430 Punj Lloyd Ltd. 39 Reliance Capital Ltd. 267 Reliance Power Ltd 87 Shipping Corpn. Of India Ltd. 49 Sintex Industries Ltd. 52 Syndicate Bank 84 Tata Chemicals Ltd. 307 Tata Global Beverages Ltd 97 Tech Mahindra Ltd. 552 Union Bank Of India 186 Unitech Ltd. 19 United Phosphorus Ltd. 109 Vijaya Bank Ltd 50 Voltas Ltd. 96 Welspun Corp Ltd. 111

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834 NSE: INB 230781431, F&O: INF 230781431, DP: IN-DP-CDSL-73-2000, INDP-NSDL-140-2000 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

Weekly Market Outlook

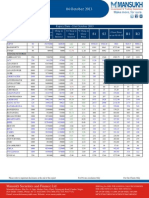

make more, for sure. FORTHCOMING CORPORATE ACTIONS

Ex-Date Company Name NSE- Symbol

STAR BATAINDIA LLOYDSTEEL DBCORP SBBJ RAYMOND DICIND INDOCO KPRMILL INDIAINFO SHREECEM DCB ALBK INFY OILCOUNTUB RIIL VTMLTD ICICIBANK RELIANCE RSYSTEMS HCC GRUH THOMASCOOK NAVINFLUOR ASIANPAINT KANSAINER SESAGOA MRO-TEK INDORAMA JSWENERGY PNB HOVS AXISBANK VSTIND PRISMCEM CMC TTKPRESTIG UNIVCABLES SRTRANSFIN IOB MEGASOFT SOBHA GRANULES HDFC STER

Purpose

AGM AND DIVIDEND RS.2/- PER SHARE AGM /FINAL DIVID RS.5/- P/S & SPECIAL DIVID RE.1/- P/S ANNUAL GENERAL MEETING

2ND INTERIM DIVIDEND RS.1.75 PER SHARE

14-May-12 Strides Arcolab Limited 14-May-12 Bata India Limited 14-May-12 Lloyds Steel Industries Limited 15-May-12 D.B.Corp Limited 15-May-12 State Bank of Bikaner and Jaipur 16-May-12 Raymond Limited 17-May-12 DIC India Limited 17-May-12 Indoco Remedies Limited 18-May-12 K.P.R. Mill Limited 18-May-12 India Infoline Limited 18-May-12 Shree Cements Limited 23-May-12 Development Credit Bank Limited 24-May-12 Allahabad Bank 24-May-12 Infosys Limited 24-May-12 Oil Country Tubular Limited 28-May-12 Reliance Industrial Infrastructure Limited 30-May-12 VTM Limited 31-May-12 ICICI Bank Limited 31-May-12 Reliance Industries Limited 1-Jun-12 1-Jun-12 6-Jun-12 6-Jun-12 7-Jun-12 7-Jun-12 8-Jun-12 8-Jun-12 R Systems International Limited Hindustan Construction Company Limited Gruh Finance Limited Thomas Cook (India) Limited Navin Fluorine International Limited Asian Paints Limited Kansai Nerolac Paints Limited Sesa Goa Limited

ANNUAL GENERAL MEETING AGM AND DIVIDEND RS.2.50 PER SHARE DIVIDEND - RS.4/- PER SHARE BONUS 1:2 AND FACE VALUE SPLIT FROM RS.10 TO RS.2 INTERIM DIVIDEND INTERIM DIVIDEND INTERIM DIVIDEND ANNUAL GENERAL MEETING AGM AND DIVIDEND - RS.6/- PER SHARE AGM / DIVIDEND - FINAL RS 22 + SPECIAL RS 10 AGM AND DIVIDEND RS.2/- PER SHARE AGM AND DIVIDEND RS.3.50 PER SHARE AGM AND DIVIDEND RS.4/- PER SHARE AGM AND DIVIDEND RS.16.50 PER SHARE AGM AND DIVIDEND RS.8.50 PER SHARE SPECIAL DIVIDEND ANNUAL GENERAL MEETING AGM /DIVIDEND RS 11.50 PER SHARE DIVIDEND - RS.0.375/- PER SHARE FINAL DIVID RS.6.50 P/S & SPECIAL DIVID RS.60 P/S AGM AND DIVIDEND - RS.30.50 PER SHARE AGM AND DIVIDEND RS.11/- PER SHARE AGM AND DIVIDEND RS.2/- PER SHARE ANNUAL GENERAL MEETING AGM AND DIVIDEND RE.1/- PER SHARE AGM AND DIVIDEND RE.0.50 PER SHARE AGM AND DIVIDEND RS.22/- PER SHARE ANNUAL GENERAL MEETING AGM AND DIVIDEND RS.16/- PER SHARE AGM AND DIVIDEND RS.65/- PER SHARE AGM AND DIVIDEND - RS.0.50 PER SHARE AGM & DIVID RS.12.50 PER SHARE (BC END DATE REVISED) AGM AND DIVIDEND RS.15/- PER SHARE ANNUAL GENERAL MEETING AGM AND DIVIDEND - RS.4/- PER SHARE AGM AND DIVIDEND RS.4.50 PER SHARE ANNUAL GENERAL MEETING AGM AND DIVIDEND - RS.5/- PER SHAR AGM AND DIVIDEND RS.2/- PER SHARE AGM AND DIVIDEND - RS.11/- PER SHARE AGM AND DIVIDEND RE.1/- PER SHARE

12-Jun-12 MRO-TEK Limited 12-Jun-12 Indo Rama Synthetics (India) Limited 14-Jun-12 JSW Energy Limited 14-Jun-12 Punjab National Bank 14-Jun-12 HOV Services Limited 14-Jun-12 Axis Bank Limited 15-Jun-12 VST Industries Limited 15-Jun-12 Prism Cement Limited 19-Jun-12 CMC Limited 20-Jun-12 TTK Prestige Limited 20-Jun-12 Universal Cables Limited 21-Jun-12 Shriram Transport Finance Company Ltd 21-Jun-12 Indian Overseas Bank 21-Jun-12 Megasoft Limited 21-Jun-12 Sobha Developers Limited 22-Jun-12 Granules India Limited 22-Jun-12 Housing Development Finance Corp. 25-Jun-12 Sterlite Industries ( India ) Limited

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834 NSE: INB 230781431, F&O: INF 230781431, DP: IN-DP-CDSL-73-2000, INDP-NSDL-140-2000 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

Weekly Market Outlook

make more, for sure.

EQUITY CALLS PERFORMANCE FOR THE WEEK ENDED 11th May 2012

Total No. of Calls

19

Profitable Calls

15

Positional/Hold

2

Exit/Stop Loss

2

Success Rate

88.24%

NAME

Varun Gupta Pashupati Nath Jha Vikram Singh

DESIGNATION

Head - Research Research Analyst Research Analyst

E-MAIL

varungupta@moneysukh.com pashupatinathjha@moneysukh.com vikram_research@moneysukh.com

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form. The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations. MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be happy to provide information in response to specific client queries.

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 / NSE: INB230781431 SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834 NSE: INB 230781431, F&O: INF 230781431, DP: IN-DP-CDSL-73-2000, INPMS Regn No. INP000002387 DP-NSDL-140-2000 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

You might also like

- Results Tracker 08.11.2013Document3 pagesResults Tracker 08.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 09.11.2013Document3 pagesResults Tracker 09.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 07.11.2013Document3 pagesResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 07 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 07 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 08 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 08 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 31 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 31 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 30 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 30 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 08 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 08 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 25 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 25 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 28 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 28 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 24 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 24 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Line Follower Robot ProjectDocument8 pagesLine Follower Robot ProjectPuneeth ShettigarNo ratings yet

- Coronavirus Disease 2019-Situation Report 51Document9 pagesCoronavirus Disease 2019-Situation Report 51CityNewsTorontoNo ratings yet

- How To Do Magic That Works by Genevieve DavisDocument114 pagesHow To Do Magic That Works by Genevieve DavisFarzad ArabiNo ratings yet

- Metabolic AdaptationDocument17 pagesMetabolic AdaptationMozil Fadzil KamarudinNo ratings yet

- Erin Alles BipDocument39 pagesErin Alles Bipapi-270220688No ratings yet

- COACHING CLINIC WEEKLY 7 Dec 2020Document154 pagesCOACHING CLINIC WEEKLY 7 Dec 2020cleveretoNo ratings yet

- p640 1Document21 pagesp640 1Mark CheneyNo ratings yet

- Emergency Operations FormDocument1 pageEmergency Operations FormGlenn Gatiba100% (1)

- Air Compressor Trouble Shooting Guide - 4Document6 pagesAir Compressor Trouble Shooting Guide - 4Ashwin NarayanNo ratings yet

- CSP FlexDocument4 pagesCSP FlexBhoomaiah Sunkenapalli100% (1)

- Chap 011 NotesDocument10 pagesChap 011 Notesfree50No ratings yet

- Open Foam SlidesDocument43 pagesOpen Foam SlidesjahidNo ratings yet

- Proposal WorkDocument13 pagesProposal Workmolla derbewNo ratings yet

- Angle of Incidence and Reflection Intensity Through a PolarizerDocument23 pagesAngle of Incidence and Reflection Intensity Through a PolarizerSatyam GuptaNo ratings yet

- Preliminary Examination EvidenceDocument5 pagesPreliminary Examination EvidenceRA MlionNo ratings yet

- Literature Study of HospitalDocument18 pagesLiterature Study of HospitalJasleen KaurNo ratings yet

- ART Appropriation FINAL EXAM NOTESDocument3 pagesART Appropriation FINAL EXAM NOTESKate NalanganNo ratings yet

- SIEMENS - 1500 based - ET200SP PLC CPU 型錄Document10 pagesSIEMENS - 1500 based - ET200SP PLC CPU 型錄CHIENMAO WUNo ratings yet

- Gondar University 2022/23 Academic CalendarDocument8 pagesGondar University 2022/23 Academic CalendarFasil KebedeNo ratings yet

- RazorCMS Theme GuideDocument14 pagesRazorCMS Theme GuideAngela HolmesNo ratings yet

- News Lessons SnakebiteDocument5 pagesNews Lessons SnakebiteGuilherme SalvadoriNo ratings yet

- MULTIGRADE DLP in MathDocument6 pagesMULTIGRADE DLP in Mathwinnie bugawit75% (4)

- List EP EXPDocument2 pagesList EP EXPNader GhrabNo ratings yet

- Artificial Intelligence A Modern Approach 3rd Edition Russell Solutions ManualDocument36 pagesArtificial Intelligence A Modern Approach 3rd Edition Russell Solutions Manualsurnameballistah9g4ce100% (27)

- Impact of Using A Bilingual Model On Kazakh-Russian Code-Switching Speech RecognitionDocument6 pagesImpact of Using A Bilingual Model On Kazakh-Russian Code-Switching Speech RecognitionOnsamak MachineryNo ratings yet

- Syllabus For Undergraduate Course in History (Bachelor of Arts Examination)Document26 pagesSyllabus For Undergraduate Course in History (Bachelor of Arts Examination)Rojalin Mishra0% (1)

- Guide Antenna InstallationsDocument3 pagesGuide Antenna InstallationsYodi Hermawan100% (1)

- Cement Stinger Balanced PlugDocument13 pagesCement Stinger Balanced Plugjsever1No ratings yet

- A Study On Recruitment and Selection Procedures at M/S Ganges Internationale Pvt. LTD PuducherryDocument111 pagesA Study On Recruitment and Selection Procedures at M/S Ganges Internationale Pvt. LTD PuducherryHasnain KhalidNo ratings yet

- Bus Conductor Design and ApplicationsDocument70 pagesBus Conductor Design and ApplicationsJithinNo ratings yet