Professional Documents

Culture Documents

Project Report Swati-Sip

Uploaded by

swatit13Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project Report Swati-Sip

Uploaded by

swatit13Copyright:

Available Formats

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

SUMMER PROJECT A STUDY OF RISK PERCEPTION OF THE INVESTORS:

A CASE STUDY OF MUMBAI CITY

Submitted To: Dr. Amarjeet Singh Khalsa

Submitted By: Swati Tiwari Trim-3 IPER-PGDM

1 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

CHAPTERISATION

CHAPTER 1: CONCEPTUAL OVERVIEW CHAPTER 2: RESEARCH METHODOLOGY

2.1 Objective 2.2 Methodology 2.3 Limitations 2.4 Significance

- 3 - 4

CHAPTER 3: THEORITICAL BACKGROUND - 5

3.1 Capital Market 3.2 Equity And Derivatives 3.3 Other Financial Instruments Which Are In Market

CHAPTER 4: COMPANY OVERVIEW CHAPTER 5: DATA ANALYSIS CHAPTER 6: FINDINGS QUESTIONNAIRE BIBILIOGRAPHY ANNEXURES

- 21 - 25 - 117 - 118 - 119

2 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

CONCEPTUAL OVERVIEW

Being a PGDM student of Finance specialization my interest is prone towards investment opportunities. Reason behind choosing this topic is that how different investors put their money in equity and derivatives and what risk perception they carry in their mindset, and what are the techniques they adopt to minimize their risk to earn maximum profit out of the principal amount. The study is based upon stock market broadly about equity and derivatives reason being these two are mostly traded and mostly known in stock market. In stock market there is a saying HIGHER RISK HIGHER RETURN;LOWER RISK LOWER RETURN. So investment opportunities are available for every type of investor but it is upon the investor to look for best opportunity. Rationale for selecting this area of equity & derivative is attraction of different kinds of

investors to invest and to face high risk and get high returns. The major findings of the project are to overview of the comparison of equity cash segment and equity derivative segment, overview of the equity and F & O segment from May 2011 to July 2011 and comparison of stock market with other investment instruments.

3 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

RESEARCH METHODOLOGY

2.1 OBJECTIVE: a) To know the investors risk perception towards investment in stock market. b) To study risk perception towards equity and derivatives in specific.

2.2 METHODOLOGY: a) Study on equity and derivative has been done with the help of risk perception of investors. b) A questionnaire has been designed. c) Convenience Sampling has been done. d) Responses have been analyzed by the help of Microsoft Excel tools. e) Interpretations have been drawn by the help of Pivot table and graphical representation. f) Findings have been given. 2.3 SEGMENTATION: Segmentation is done on the basis of the occupation, income and age of the people in Mumbai region. 2.3 LIMITATION: Sample size, period and segmentation might be a limiting factor. 2.3 SIGNIFICANCE: The study is related to behavioral finance that how an investor takes risk for getting different returns, also importance from the point of view that selection of financial instruments i.e., equity and derivatives to maximize return.

4 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

THEROTICAL BACKGROUND

Capital market

Meaning and Concept of Capital Market Capital Market is one of the significant aspects of every financial market. Hence it is necessary to study its correct meaning. Broadly speaking the capital market is a market for financial assets which have a long or indefinite maturity. Unlike money market instruments the capital market instruments become mature for the period above one year. It is an institutional arrangement to borrow and lend money for a longer period of time. It consists of financial institutions like IDBI, ICICI, UTI, LIC, etc. These institutions play the role of lenders in the capital market. Businessunits and corporate are the borrowers in the capital market. Capital market involves various instruments which can be used for financial transactions. Capital market provides long term debt and equity finance for the government and the corporate sector. Capital market can be classified into primary and secondary markets. The primary market is a market for new shares, where as in the secondary market the existing securities are traded. Capital market institutions provide rupee loans, foreign exchange loans, consultancy services and underwriting

SIGNIFICANCE, ROLE OR FUNCTIONS OF CAPITAL MARKET Like the money market capital market is also very important. It plays a significant role in the national economy. A developed, dynamic and vibrant capital market can immensely contribute for speedy economic growth and development.

Let us get acquainted with the important functions and role of the capital market. 1. Mobilization of Savings: Capital market is an important source for mobilizing idle savings from the economy. It mobilizes funds from people for further investments in the productive 5 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY channels of an economy. In that sense it activates the ideal monetary resources and puts them in proper investments. 2. Capital Formation: Capital market helps in capital formation. Capital formation is net addition to the existing stock of capital in the economy. Through mobilization of ideal resources it generates savings; the mobilized savings are made available to various segments such as agriculture, industry, etc. This helps in increasing capital formation. 3. Provision of Investment Avenue: Capital market raises resources for longer periods of time. Thus it provides an investment avenue for people who wish to invest resources for a long period of time. It provides suitable interest rate returns also to investors. Instruments such as bonds, equities, units of mutual funds, insurance policies, etc. definitely provides diverse investment avenue for the public. 4. Speed up Economic Growth and Development: Capital market enhances production and productivity in the national economy. As it makes funds available for long period of time, the financial requirements of business houses are met by the capital market. It helps in research and development. This helps in, increasing production and productivity in economy by generation of employment and development of infrastructure. 5. Proper Regulation of Funds: Capital markets not only helps in fund mobilization, but it also helps in proper allocation of these resources. It can have regulation over the resources so that it can direct funds in a qualitative manner. 6. Service Provision: As an important financial set up capital market provides various types of services. It includes long term and medium term loans to industry, underwriting services, consultancy services, export finance, etc. These services help the manufacturing sector in a large spectrum. 7. Continuous Availability of Funds: Capital market is place where the investment avenue is continuously available for long term investment. This is a liquid market as it makes fund available on continues basis. Both buyers and seller can easily buy and sell securities as they are continuously available. Basically capital market transactions are related to the stock exchanges. Thus marketability in the capital market becomes easy.

These are the important functions of the capital market. 6 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

PRIMARY MARKET Primary Market, also called the new issue market, is the market for issuing new securities. Many companies, especially small and medium scale, enter the primary market to raise money from the public to expand their businesses. They sell their securities to the public through an initial public offering. The securities can be directly bought from the shareholders, which is not the case for the secondary market. The primary market is a market for new capitals that will be traded over a longer period. In the primary market, securities are issued on an exchange basis. The underwriters, that is, the investment banks, play an important role in this market: they set the initial price range for a particular share and then supervise the selling of that share.

Investors can obtain news of upcoming shares only on the primary market. The issuing firm collects money, which is then used to finance its operations or expand business, by selling its shares. Before selling a security on the primary market, the firm must fulfill all the requirements regarding the exchange.

After trading in the primary market the security will then enter the secondary market, where numerous trades happen every day. The primary market accelerates the process of capital formation in a country's economy.

The primary market categorically excludes several other new long-term finance sources, such as loans from financial institutions. Many companies have entered the primary market to earn profit by converting its capital, which is basically a private capital, into a public one, releasing securities to the public. This phenomena is known as "public issue" or "going public."

There are three methods though which securities can be issued on the primary market: rights issue, Initial Public Offer (IPO), and preferential issue. A company's new offering is placed on the primary market through an initial public offer. 7 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

SECONDARY MARKET Secondary Market is the market where, unlike the primary market, an investor can buy a security directly from another investor in lieu of the issuer. It is also referred as "after market". The securities initially are issued in the primary market, and then they enter into the secondary market. All the securities are first created in the primary market and then, they enter into the secondary market. In the New York Stock Exchange, all the stocks belong to the secondary market.

In other words, secondary market is a place where any type of used goods is available. In the secondary market shares are maneuvered from one investor to other, that is, one investor buys an asset from another investor instead of an issuing corporation. So, the secondary market should be liquid. Example of Secondary market:

In the New York Stock Exchange, in the United States of America, all the securities belong to the secondary market.

Importance of Secondary Market:

Secondary Market has an important role to play behind the developments of an efficient capital market. Secondary market connects investors' favoritism for liquidity with the capital users' wish of using their capital for a longer period. For example, in a traditional partnership, a partner can not access the other partner's investment but only his or her investment in that partnership, even on an emergency basis. Then if he or she may breaks the ownership of equity into parts and sell his or her respective proportion to another investor. This kind of trading is facilitated only by the secondary market 8 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY CONCLUSION ON CAPITAL MARKET The lack of an advanced and vibrant capital market can lead to underutilization of financial resources. The developed capital market also provides access to the foreign capital for domestic industry. Thus capital market definitely plays a constructive role in the over all development of an economy.

EQUITY AND DERIVATIVES

Equity

Equities are a type of security that represents the ownership in a company. Equities are traded (bought and sold) in stock markets. Alternatively, they can be purchased via the Initial Public Offering (IPO) route, i.e. directly from the company. Investing in equities is a good long-term investment option as the returns on equities over a long time horizon are generally higher than most other investment avenues. However, along with the possibility of greater returns comes greater risk.

Shares or stock options in a company entitle the buyer the ownership rights in a company. As a unit of ownership the stock/share holder gets a voting right in the company. The total of these shares is what contributes to the capital of the company.

Equity shares are the equally divided capital of a company. Total capital contribution for a company comprises of investments through equity share holdings by small and big investors. The investors who have a stake in a company are referred to as shareholders. The equity shares are therefore documents issued by a company and floated in the open market for purchase by shareholders which entitle them to be one of the owners of the company.

The profits of equity shareholders depend on the profit making capability of the company that they have invested in. In a situation where the company has made huge profits the benefits are 9 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY passed over to the equity share holders by way of dividends. The equity shareholders also enjoy voting rights in the company

Equity shares are those shares which are ordinary in the course of company's business. They are also called as ordinary shares. These share holders do not enjoy preference regarding payment of dividend and repayment of capital. Equity shareholders are paid dividend out of the profits made by a company. Higher the profits, higher will be the dividend and lower the profits, lower will be the dividend. Features of Equity Shares:

(1) Owned capital: Equity share capital is owned capital because it is the money of the shareholders who are actually the owners of the company.

(2)Fixed value or nominal value: Every share has fixed value or a nominal value. For example, the price of a share is Rs. 10/- which indicates a fixed value or a nominal value.

(3) Distinctive number: Every share is given a distinct number just like a roll number for the purpose of identification.

(4) Attached rights: A share gives its owner the right to receive dividend, the right to vote, the right to attend meetings, the right to inspect the books of accounts.

(5) Return on shares: Every shareholder is entitled to a return on shares which is known as dividend. Dividend depends on the profits made by a company. Higher the profits, higher will be the dividend and vice versa.

(6) Transfer of shares: Equity shares are easily transferable, that is if a person buys shares of a particular company and he does not want them, he can sell them to any one, thereby transferring the shares in the name of that person.

(7) Benefit of right issue: When a company makes fresh issue of shares, the equity shareholders 10 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY are given certain rights in the company. The company has to offer the new shares first to the equity shareholders in the proportion to their existing share holding. In case they do not take up the shares offered to them, the same can be issue to others. Thus, equity shareholders get the benefits of the right issue.

(8) Benefit of Bonus shares: Joint stock companies which make huge profits, issue bonus shares to their ordinary shareholders out of the accumulated profits. These shares are issued free of cost in proportion to the number of existing equity share holding. In case they do not take up the shares offered to them, the same can be issued to others. Thus, equity shareholders get the benefits of the right issue.

(9) Irredeemable: Equity shares are always irredeemable. This means equity capital is not returnable during the life time of a company.

(10)Capital appreciation: The nominal or par value of equity shares is fixed but the market value fluctuates. The market value mainly depends upon profitability and prosperity of the company. High rate of dividend is paid with high rate of profit, the shareholders capital is appreciated through an appreciation in the market value of shares. (i.e. higher the rate of dividend, higher the market value of the shares.)

Derivatives

A derivative is a financial instrument whose characteristics and value depend upon the characteristics and value of some underlying asset typically commodity, bond, equity, currency, index, event etc. Advanced investors sometimes purchase or sell derivatives to manage the risk associated with the underlying security, to protect against fluctuations in value, or to profit from periods of inactivity or decline. Derivatives are often leveraged, such that a small movement in the underlying value can cause a large difference in the value of the derivative. 11 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY The term "Derivative" indicates that it has no independent value, i.e. its value is entirely "derived" from the value of the underlying asset. The underlying asset can be securities, commodities, bullion, currency, live stock or anything else. In other words, Derivative means a forward, future, option or any other hybrid contract of pre determined fixed duration, linked for the purpose of contract fulfillment to the value of a specified real or financial asset or to an index of securities.

With Securities Laws (Second Amendment) Act,1999, Derivatives has been included in the definition of Securities. The term Derivative has been defined in Securities Contracts (Regulations) Act, as:A Derivative includes: a. A security derived from a debt instrument, share, loan, whether secured or unsecured, risk instrument or contract for differences or any other form of security; b. A contract which derives its value from the prices, or index of prices, of underlying securities; Derivatives are usually broadly categorized by: The relationship between the underlying and the derivative (e.g. forward, option, swap) The type of underlying (e.g. equity derivatives, foreign exchange derivatives and credit derivatives) The market in which they trade (e.g., exchange traded or over-the-counter). Futures A financial contract obligating the buyer to purchase an asset, (or the seller to sell an asset), such as a physical commodity or a financial instrument, at a predetermined future date and price. Futures contracts detail the quality and quantity of the underlying asset; they are standardized to facilitate trading on a futures exchange. Some futures contracts may call for physical delivery of the asset, while others are settled in cash. The futures markets are characterized by the ability to use very high leverage relative to stock markets. Some of the most popular assets on which futures contracts are available are equity stocks, 12 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY indices, commodities and currency. Options A financial derivative that represents a contract sold by one party (option writer) to another party (option holder). The contract offers the buyer the right, but not the obligation, to buy (call) or sell (put) a security or other financial asset at an agreed-upon price (the strike price) during a certain period of time or on a specific date (exercise date). A call option gives the buyer, the right to buy the asset at a given price. This 'given price' is called 'strike price'. It should be noted that while the holder of the call option has a right to demand sale of asset from the seller, the seller has only the obligation and not the right. For example: - if the buyer wants to buy the asset, the seller has to sell it. He does not have a right.

Similarly a 'put' option gives the buyer a right to sell the asset at the 'strike price' to the buyer.

Here the buyer has the right to sell and the seller has the obligation to buy. So in any options contract, the right to exercise the option is vested with the buyer of the contract. The seller of the contract has only the obligation and no right. As the seller of the contract bears the obligation; he is paid a price called as 'premium'. Therefore the price that paid for buying an option contract is called as premium. The primary difference between options and futures is that options give the holder the right to buy or sell the underlying asset at expiration, while the holder of a futures contract is obligated to fulfill the terms of his/her contract. is

Index Futures and Index Option Contracts

Futures contract based on an index i.e. the underlying asset is the index, are known as Index Futures Contracts. For example, futures contract on NIFTY Index and BSE-30 Index. These contracts derive their value from the value of the underlying index. Similarly, the options contracts, which are based on some index, are known as Index options contract. However, unlike Index Futures, the buyer of Index Option Contracts has 13 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY only the right but not the obligation to buy / sell the underlying index on expiry. Index Option Contracts are generally European Style options i.e. they can be exercised / assigned only on the expiry date. An index, in turn derives its value from the prices of securities that constitute the index and is created to represent the sentiments of the market as a whole or of a particular sector of the economy. Indices that represent the whole market are broad based indices and those that represent a particular sector are sectoral indices. In the beginning futures and options were permitted only on S&P Nifty and BSE Sensex. Subsequently, sectoral indices were also permitted for derivatives trading subject to fulfilling the eligibility criteria. Derivative contracts may be permitted on an index if 80% of the index constituents are individually eligible for derivatives trading. However, no single ineligible stock in the index shall have a weightage of more than 5% in the index. The index is required to fulfill the eligibility criteria even after derivatives trading on the index has begun. If the index does not fulfill the criteria for 3 consecutive months, then derivative contracts on such index would be discontinued. By its very nature, index cannot be delivered on maturity of the Index futures or Index option contracts therefore, these contracts are essentially cash settled on Expiry.

OTHER INSTRUMENTS TRADED IN THE MARKET

There are various other financial instruments which are traded in the market some are as follows:-

COMMODITY Commodities are products that are found naturally or are grown. Gold, lumber, cattle, platinum, wheat, cotton, orange juice, oil, sugar and pork bellies are all commodities. Commodities trading are a sophisticated form of investing. It is similar to stock trading but instead of buying and selling shares of companies, an investor buys and sells commodities. Like stocks, commodities are traded on exchanges where buyers and sellers can work together to either get the products they need or to make a profit from the fluctuating prices.

14 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY Many industries need commodities to run their business and buy and sell commodities in the marketplace. For example, clothing manufacturers need cotton, builders need lumber, and restaurants and supermarkets need beef.

Size of the market The trading of commodities consists of direct physical trading and derivatives trading. Exchange traded commodities have seen an upturn in the volume of trading since the start of the decade. This was largely a result of the growing attraction of commodities as an asset class and a proliferation of investment options which has made it easier to access this market. The global volume of commodities contracts traded on exchanges increased by a fifth in 2010, and a half since 2008, to around 2.5 billion million contracts. During the three years up to the end of 2010, global physical exports of commodities fell by 2%, while the outstanding value of OTC commodities derivatives declined by two-thirds as investors reduced risk following a fivefold increase in value outstanding in the previous three years. Trading on exchanges in China and India has gained in importance in recent years due to their emergence as significant commodities consumers and producers. China accounted for more than 60% of exchange-traded commodities in 2009, up on its 40% share in the previous year. Commodity assets under management more than doubled between 2008 and 2010 to nearly $380bn. Inflows into the sector totalled over $60bn in 2010, the second highest year on record, down from the record $72bn allocated to commodities funds in the previous year. The bulk of funds went into precious metals and energy products. The growth in prices of many commodities in 2010 contributed to the increase in the value of commodities funds under management. COMMODITY TRADING

Spot trading Spot trading is any transaction where delivery either takes place immediately, or with a minimum lag between the trade and delivery due to technical constraints. Spot trading normally involves visual inspection of the commodity or a sample of the commodity, and is carried out in 15 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY markets such as wholesale markets. Commodity markets, on the other hand, require the existence of agreed standards so that trades can be made without visual inspection. Forward contracts A forward contract is an agreement between two parties to exchange at some fixed future date a given quantity of a commodity for a price defined today. The fixed price today is known as the forward price. Futures contracts A futures contract has the same general features as a forward contract but is transacted through a futures exchange. Commodity and futures contracts are based on whats termed forward contracts. Early on these forward contracts agreements to buy now, pay and deliver later were used as a way of getting products from producer to the consumer. These typically were only for food and agricultural products. Forward contracts have evolved and have been standardized into what we know today as futures contracts. Although more complex today, early forward contracts for example, were used for rice in seventeenth century Japan. Modern forward, or futures agreements, began in Chicago in the 1840s, with the appearance of the railroads. Chicago, being centrally located, emerged as the hub between Midwestern farmers and producers and the east coast consumer population centers. In essence, a futures contract is a standardized forward contract in which the buyer and the seller accept the terms in regards to product, grade, quantity and location and are only free to negotiate the price. Hedging Hedging, a common practice of farming cooperatives, insures against a poor harvest by purchasing futures contracts in the same commodity. If the cooperative has significantly less of its product to sell due to weather or insects, it makes up for that loss with a profit on the markets, since the overall supply of the crop is short everywhere that suffered the same conditions. Delivery and condition guarantees In addition, delivery day, method of settlement and delivery point must all be specified. Typically, trading must end two (or more) business days prior to the delivery day, so that the routing of the shipment can be finalized via ship or rail, and payment can be settled when the contract arrives at any delivery point.

16 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

INITIAL PUBLIC OFFER (IPO)

An initial public offering (IPO), referred to simply as an "offering" or "flotation", is when a company (called the issuer) issues common stock or shares to the public for the first time. They are often issued by smaller, younger companies seeking capital to expand, but can also be done by large privately owned companies looking to become publicly traded. In an IPO the issuer obtains the assistance of an underwriting firm, which helps determine what type of security to issue (common or preferred), best offering price and time to bring it to market.

REASONS FOR LISTING

When a company lists its securities on a public exchange, the money paid by investors for the newly-issued shares goes directly to the company (in contrast to a later trade of shares on the exchange, where the money passes between investors). An IPO, therefore, allows a company to tap a wide pool of investors to provide it with capital for future growth, repayment of debt or working capital. A company selling common shares is never required to repay the capital to investors. Once a company is listed, it is able to issue additional common shares via a secondary offering, thereby again providing itself with capital for expansion without incurring any debt. This ability to quickly raise large amounts of capital from the market is a key reason many companies seek to go public. There are several benefits to being a public company, namely:

Bolstering and diversifying equity base Enabling cheaper access to capital Exposure, prestige and public image Attracting and retaining better management and employees through liquid equity participation Facilitating acquisitions Creating multiple financing opportunities: equity, convertible debt, cheaper bank loans, etc. 17 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Increased liquidity for equity holder DISADVANTAGES OF AN IPO

There are several disadvantages to completing an initial public offering, namely:

Significant legal, accounting and marketing costs Ongoing requirement to disclose financial and business information Meaningful time, effort and attention required of senior management Risk that required funding will not be raised Public dissemination of information which may be useful to competitors, suppliers and customers. PROCEDURE IPOs generally involve one or more investment banks known as "underwriters". The company offering its shares, called the "issuer", enters a contract with a lead underwriter to sell its shares to the public. The underwriter then approaches investors with offers to sell these shares. The sale (allocation and pricing) of shares in an IPO may take several forms. Common methods include:

Best efforts contract Firm commitment contract All-or-none contract Bought deal Dutch auction A large IPO is usually underwritten by a "syndicate" of investment banks led by one or more major investment banks (lead underwriter). Upon selling the shares, the underwriters keep a commission based on a percentage of the value of the shares sold (called the gross spread). Usually, the lead underwriters, i.e. the underwriters selling the largest proportions of the IPO, take the highest commissionsup to 8% in some cases. 18 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY Multinational IPOs may have many syndicates to deal with differing legal requirements in both the issuer's domestic market and other regions. For example, an issuer based in the E.U. may be represented by the main selling syndicate in its domestic market, Europe, in addition to separate syndicates or selling groups for US/Canada and for Asia. Usually, the lead underwriter in the main selling group is also the lead bank in the other selling groups. Because of the wide array of legal requirements and because it is an expensive process, IPOs typically involve one or more law firms with major practices in securities law, such as the Magic Circle firms of London and the white shoe firms of New York City. Public offerings are sold to both institutional investors and retail clients of underwriters. A licensed securities salesperson (Registered Representative in the USA and Canada ) selling shares of a public offering to his clients is paid a commission from their dealer rather than their client. In cases where the salesperson is the client's advisor it is notable that the financial incentives of the advisor and client are not aligned. In the US sales can only be made through a final Prospectus cleared by the Securities and Exchange Commission. Investment Dealers will often initiate research coverage on companies so their Corporate Finance departments and retail divisions can attract and market new issues. The issuer usually allows the underwriters an option to increase the size of the offering by up to 15% under certain circumstance known as the green shoe or overallotment option. CURRENCY MARKET Overview Currently in India, there are 3 major exchanges offering Currency future trading NSE, MCXSX & USE . SMC Global Securities is a trading cum clearing member of all these exchanges for the currency segment. We believe in the tremendous potential of currency future to become a dominant force of the Indian financial market with a turnover which can outperform even equity and commodity segment. We firmly believe that wider market participation will bring more strength to the market & this can be achieved through disseminating education & information 19 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY among various market participants. For us, currency is not just any other segment of business; it is "the business of future".

20 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

COMPANY OVERVIEW

ABOUT EDELWEISS

Edelweiss Capital is a financial services company based in Mumbai, India. Edelweiss Capital Limited provides investment banking, institutional equities, private client broking, asset management, wealth management, insurance broking and wholesale financing services to corporate, institutional and high net worth individual clients. It operates from 43 other offices in 19 Indian cities. Since its commencement of business in 1996, it has grown into a diversified Indian financial services company organized under agency and capital business lines operated by the Company and its thirteen subsidiaries.

SENIOR MANAGEMENT TEAM

Rashesh Shah Venkat Ramaswamy

Chairman & CEO

Deepak Mittal

Executive Director

Himanshu Kaji

CEO, Edelweiss Tokio Life Insurance Company Limited

Naresh Kothari

President & Group COO

Rujan Panjwani

President & Head, Treasury

Ravi Bubna

President & Head, Equities Capital Market

Vikas Khemani

President & Head, Wholesale Financing

President & Head, Institutional Equities

21 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

APPROACH

Client Focus Edelweiss is driven by the emphasis they place on building long-term relationships with clients. They work closely with clients to equip them with the ability to address large, fast-growing market opportunities. Their emphasis on long-term relationships also means that they have a significant ongoing involvement with almost all of the clients that they work with.

Execution Orientation They focus obsessively on delivering high quality execution through their experienced team of professionals. Each team is led by senior personnel and is highly research and ideas driven. They place strong emphasis on confidentiality and integrity in a sensitive business environment.

Culture Edelweiss fosters a culture that is entrepreneurial and results-driven and that emphasizes teamwork and intellectual rigour. Team is encouraged to display higher levels of initiative, drive, and hunger for learning and taking on additional responsibility.

Professional Integrity Company places a strong emphasis on confidentiality, honesty and integrity in their business dealings. They expect their people to maintain high ethical standards, both in their professional and personal lives. They strive to be fair in all our dealings.

Research Driven All their businesses are built on a research and analytics foundation. Their understanding of underlying market trends and strong analytical expertise has resulted in a demonstrated ability to identify emerging trends and themes early. They seek to provide the highest quality research and investment opinions to the clients.

22 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

BUSINESS PRINCIPLES

Ideas create, values protect is how we define what Edelweiss believes in. But when we say values protect what do we mean? Heres a handy guide to the values and principles we will live by and live up to.

We will be a Thinking Organization. We will constantly bring thought to everything we do. Our clients and our own success depends on our ability to use greater ideation and more imagination in our approach.

We will be fair to our clients, our employees and all stake holders. We want our clients and our employees to be richer for their relationship with us.

We will take care of our People seriously. Our policies in spirit and in letter will ensure transparency and equal opportunity for all. We will go beyond the normal goals of attracting, recruiting, retaining and rewarding fine talent: We will ensure that every individual in Edelweiss has an opportunity to achieve their fullest potential.

We will operate as a Partnership, internally and externally. Though individuals are very often brilliant, we believe teamwork and collaboration will always ensure a better and more balanced organization. We will also treat our clients as partners and show them the same respect and consideration that we would toward our internal team members.

We will focus on the Long Term. Though the world will change a lot in the coming years and our assumptions for the future may not hold up, we will reflect on the long-term implications of our actions. Even when making short-term decisions we will be aware of the long-term implications.

23 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY We will focus on Growth for our clients, employees and shareholders.

Our Reputation and image is more important than any financial reward. Reputation is hard to build and even harder to rebuild. Reputation will be impacted by our ability to think for our clients, maintain confidentiality and by our adherence to our value system.

We will Obey and Comply with the rules of the land. We will maintain the highest standard of integrity and honesty. When we are unclear we will seek clarifications.

We will respect Risk. Our business is going to be a constant challenge of balancing risk and reward. Our ability to constantly keep one eye on risk will guide us through this fine balance.

Our Financial Capital is a critical resource for growth. We will endeavour to grow, protect, and use our financial capital wisely.

CLIENT ADVISORY SERVICE

At Edelweiss Client Advisory Services, their team is driven not just by the quality of their ideas, but also professional ethics and integrity. They take pride in our philosophy of offering advice which is in the best interest of their clients. Their emphasis on building long term relationship ensures that they work closely with their clients empowering them to gain from market opportunities through our online portal www.edelweiss.in

www.edelweiss.in is a product that offers a unique online investment experience that is intuitive, information rich and a hassle-free way to trade online. It defines the next level in online trading technology. It enables intelligent investing with market strategies custom suited to the clients investment profile and current portfolio.

24 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

DATA ANALYSIS

The population of Mumbai has been analyzed on various factors on the basis of different questions which are as follows: ANALYSIS ON THE BASIS OF OCCUPATION: 1) How do you trade in market? a) Intraday b) Delivery c) Cover order d) Portfolio

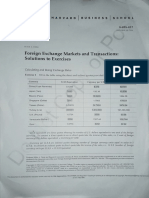

QUESTION-1 OCCUPATION Business Men Others Private Service Public Service Grand Total COVER ORDER Grand DELIVERY INTRADAY PORTFOLIO Total 7 5 6 7 25 5 11 7 2 25 6 4 22 11 13 40 6 5 24 2 3 14 25 25 100

Business Men

COVER ORDER DELIVERY INTRADAY PORTFOLIO

28%

28%

24%

20%

Most of the business men in Mumbai like portfolio and cover order, type of trading, as it can be seen through this chart that comparatively many people in Mumbai like to invest on portfolio and 25 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY cover order. Around 20% of investors like to trade in intraday and 24% prefer to invest their money for long term there fore they use to trade in delivery. 28% of business men like to trade in cover order as they want to trade with the help of exposure they are getting from their broking firm and 28% trades in portfolio as they have large amount of money to invest so they prefer PMS to invest their amount. 20% of investors trades in delivery as they want to invest their amount for long term and 24% invest there money for trading so they use to invest their money in intraday.

Others

COVER ORDER DELIVERY INTRADAY PORTFOLIO

8% 28%

20%

44%

Others, including senior citizen and students most of the senior citizen believes to invest there money for long term so they use to invest there money for delivery. The people who are students and doing part time job prefer to trade in intraday so that to make some sort of investment. So 44% of the people likes to trade in delivery and around 28% of the people use to trade in intraday.

26 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Private Service

COVER ORDER DELIVERY INTRADAY PORTFOLIO

8% 24% 24%

44%

The person who are in private service, most of them trades in delivery and only few percentage of investors like to trade on portfolio. 8% of the investors invest in portfolio because they dont have huge amount to invest. Most of the private service people believe in investing their money for long term so they trade in delivery so, 44% of the people invest there money in delivery.

Public Service

COVER ORDER DELIVERY INTRADAY PORTFOLIO

12% 20%

16%

52%

The people who are in public service likes to trade in delivery because they invest there money for long term so that they can have some future investment. Only few people those who are in public service like to do intraday.

27 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

2) Whats your preferable area of investment? a) Equity share c) Both equity and derivatives b) Derivatives d) Others

QUESTION-2 OCCUPATION Business Men Others Private Service Public Service Grand Total BOTH EQUITY AND DERIVATIVES 3 2 3 5 13 DERIVATIVES 3 5 5 6 19 EQUITY SHARE 19 18 15 11 63 2 3 5 OTHERS GRAND TOTAL 25 25 25 25 100

Business Men

BOTH EQUITY AND DERIVATIVES DERIVATIVES EQUITY SHARE OTHERS

0% 12% 12%

76%

Most of the businessmen prefer equity share as compare to derivatives. Only 12% of the businessmen prefer derivatives and both equity and derivatives. They want to invest for long term that is the reason they prefer derivatives for trading.

28 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Others

BOTH EQUITY AND DERIVATIVES DERIVATIVES EQUITY SHARE OTHERS

0% 8% 20%

72%

Other like senior citizen and students also prefer equity share as compare to derivatives and other financial products. They prefer equity shares more as compare to both equity and derivatives as they can invest small amount in equity share but to invest in others or derivatives it involves lots of amount to invest. Only 20% invest in derivatives.

Private Service

BOTH EQUITY AND DERIVATIVES DERIVATIVES EQUITY SHARE OTHERS

8%

12%

20%

60%

Even private sector people prefer to trade in equity share. 60% of the people according to the research say that they find equity share more preferable then derivates and other instruments. 20% of private sector working people say that they trade in derivatives as they have long term investment planning for future.

29 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Public Service

BOTH EQUITY AND DERIVATIVES DERIVATIVES EQUITY SHARE OTHERS

12%

20%

44%

24%

For the public service people there is a mixed kind of a response regarding equity share and derivates but then too most of them prefer equity when compared to derivatives or other financial products. Even 12% of them feels that its better to invest both equity and derivatives. 24% of them prefer derivates.

3) Whats your purpose of investment? a) Tax saving b) Return c) Only saving

d) Both taxes saving & return

QUESTION-3 Occupation Business Men Others Private Service Public Service Grand Total Both taxes saving & return 6 7 7 7 27 1 1 Only saving RETURN 11 16 15 14 56 Tax saving 8 2 3 2 15 GRAND TOTAL 25 25 25 24 99

30 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Business Men

Both taxes saving & return Only saving RETURN Tax saving

32%

24% 0% 44%

Most of the people among business men invest there money to get the return out of their investment. Few expect both tax saving and also they can get return out of their investment. According to the research 44% of the business class people invest there money to get return out of there investments and 34% people invest just for saving there taxes.

Others

Both taxes saving & return Only saving RETURN Tax saving

8% 28% 0% 64%

According to the research others like senior citizen and students or youngsters invest there money to get return out of there investments. 28% of them feels that they should get both tax and savings from there investments.

31 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Public Service

Both taxes saving & return Only saving RETURN Tax saving

8% 29%

59%

4%

For the public service class employees return is important whenever they invest there money. Some people those who are in public service wants to have both i.e. return and tax saving. Around 29% of public service class people expect both things out of there investments.

Private Service

Both taxes saving & return Only saving RETURN Tax saving

12% 28% 0% 60%

More then half of the people think that they should get return out of there investments. Most of the people think that they should save taxes and they should save return when ever they made any investments. Around 60% of the people think that they invest there money to get return out of this.

32 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

4) What is your time horizon of investment? a) 1-3 years d) Daily b) 3-5 years c) 5-10years

QUESTION-4 OCCUPATION Business Men Others Private Service Public Service Grand Total 10-15 years 1-3 years 5 13 8 8 5 23 3-5 years 7 12 3 22 Daily 13 12 13 9 47 GRAND TOTAL 25 25 25 25 100

Business Men

10-15 years 1-3 years 3-5 years Daily

0% 20%

52% 28%

Most of the business men prefer the time horizon in which they can trade daily; they use to trade in intraday. Few think that they can made there investment and can hold there investment for around 1-3 years and even 3-4 years. They think that they can wait for long time so that they can get proper return out of there investments.

33 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Others

10-15 years 1-3 years 3-5 years Daily

0%

48% 52%

0%

Others like senior citizen and youngsters especially students believes that they should hold there investments for around 1-3 years. Youngsters or students believe that they should trade daily so that they can get the return daily out of there investments.

Private Service

10-15 years 1-3 years 3-5 years Daily

0% 0%

48% 52%

The time horizon which most of the private sector people prefer is more of daily trading i.e. is intraday. And also most of the people feel that 3-5 years is the best time horizon for the investment for long term. 34 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

5) What is your risk appetite? a) Low b) Moderate c) High

QUESTION-5 OCCUPATION Business Men Others Private Service Public Service Grand Total HIGH 8 10 12 8 38 LOW GRAND MODERATE TOTAL 10 7 6 9 6 6 28 7 11 34

25 25 25 25 100

Business Men

HIGH LOW MODERATE

28%

32%

40%

Most of the business men think that they can bear low risk. But few business men can bear a high risk because being in a business has given them an idea that how much risk they can bear. And few of them can bra moderate risk.

35 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY Around 40% business men can bear high risk and 28% of them can bear moderate risk and 32% believes that they can bear low risk in there investments.

Others

HIGH LOW MODERATE

36%

40%

24%

Others like students or senior citizen who are investing there money, most of them can bear high risk i.e. around 40% and comparatively very few can bear low risk i.e. 24%. The person those who can bear high risk are mostly students or the one who are youngsters and has just started earning. Only 36% can bear moderate risk i.e. neither low nor high.

Private Service

HIGH LOW MODERATE

28% 48%

24%

36 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY Mostly the person with private service is able to bear high risk as they expect more returns therefore they have the capability of taking high risk. And rest of them i.e. 24% and around 28% people are able to bear low risk and moderate risk. Maximum of them can bear high risk for there investments.

Public Service

HIGH LOW MODERATE

32% 44%

24%

According to the research most of the people who are in public service can bear moderate risk i.e. neither high nor low. And few of them i.e. around 32% of the public service class people can bear high risk. 44% of them can bear moderate risk they want to invest there money on safer place where there is not much risk. And 28% people believes that they can bear low risk whenever they made any investments.

6) What proportion of your investment contributes to equity share? a) Up to 10% c) 20-30% b) 10-20% d) More than 30

37 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

QUESTION-6 OCCUPATION Business Men Others Private Service Public Service Grand Total More than 10-20% 20-30% 30 Up to 10% 3 15 5 4 12 5 3 3 13 6 12 45 10 6 26 GRAND TOTAL 2 4 6 4 16 25 25 25 25 100

Business Men

10-20% 20-30% More than 30 Up to 10%

8%

12%

20%

60%

Most of the investors who are business men contributes up to 20 -30% of investment into equity shares. Above all 20% of them are contributing more then 30% of there money into equity shares. Only 8% of the business men are contributing there investments into equity shares.

38 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Others

10-20% 20-30% More than 30 Up to 10%

16%

16%

20% 48%

According to the research the people who are senior citizen and students contribute maximum part of investing in equity i.e. around 48%. Around 20% of them are contributing more then 30% in equity shares. Only 16% of them are contributing there investment amount up to 10% and between 10 -20%.

Public Service

10-20% 20-30% More than 30 Up to 10%

16%

12%

24% 48%

The public service class people mostly contributes 20-30% of there investments into equity shares. Few of them invest more then 30% of there investments into equity shares.

39 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY Very few public service class people invest up to 10% and between 10-20% of there investment amount into equity shares.

Private Service

10-20% 20-30% More than 30 Up to 10%

12% 24% 24%

40%

Private Service employees are more into equity shares. Around 40% of the private service employee are contributing there investments into equity shares. 24% of the people contributes between 20-30% and up to 10%of there investments into equity shares.

7) What proportion of your investment contributes to derivatives? a) Up to 10% c) 20-30% b) 10-20% d) More than 30

40 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

QUESTION-7 OCCUPATION Business Men Others Private Service Public Service Grand Total more than UP TO GRAND 10-20% 20-30% 30 10% TOTAL 7 12 5 1 25 4 7 10 4 25 8 5 24 9 12 40 7 5 27 1 3 9 25 25 100

Business Men

10-20% 20-30% more than 30 UP TO 10%

4%

20%

28%

48%

Most of the amount of investment done by business men constitutes of derivatives. Around 48% of business men invest around 20-30% of there money into equity shares. 10-20% of the investment contributes in derivatives of the business class people.

41 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Others

10-20% 20-30% more than 30 UP TO 10%

16%

16%

28% 40%

Around 40% of the people who are senior citizens or student are contributing more then 30% of the share on there income in derivatives. And after that most of them contributes around 20-30% of there investments in to derivatives i.e. about 28% people are investing there 20-30% of there money into derivatives.

Public Service

10-20% 20-30% more than 30 UP TO 10%

12% 20%

20%

48%

About 48% of the people are investing there 20-30% of there money into derivatives, most of them contributes around 20-30% of there investments in to derivatives. And 20% of the public service class people invest more then 30% and between 10-20% of there money into derivatives. 42 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Private Service

10-20% 20-30% more than 30 UP TO 10%

4%

28%

32%

36%

According to the research public service class people are majorly contributing around 20-30% and more then 30% of there money into derivatives. They think that they can get maximum return when they invest in derivatives. Only 4% people are there who contributes just 10% of there investments into derivatives.

8) How often do you monitor your investment? a) Daily c) Monthly

QUESTION-8 OCCUPATION Business Men Others Private Service Public Service Grand Total GRAND DAILY Monthly Occasionally WEEKLY TOTAL 14 3 3 5 15 3 1 6 16 16 61 4 2 12 5 3 19

b) Weekly d) Occasionally

25 25 25 25 100

4 8

43 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Business Men

DAILY Monthly Occasionally WEEKLY

20% 12% 12%

56%

Most of the business men monitor there investment daily and few of them monitors weekly. As business men usually use personal computers for there work so this helps them to monitor them daily or weekly. Few business men who trade in delivery i.e. for long term they trade for long term.

Others

DAILY Monthly Occasionally WEEKLY

24%

4% 12% 60%

Others like students or senior citizen monitor there investment daily and few of them monitors weekly. As they usually use personal computers for there work so this helps them to monitor them daily or weekly. Few of them who trade in delivery i.e. for long term monitors there investments monthly or occasionally.

44 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Private Service

DAILY Monthly Occasionally WEEKLY

20% 0% 16% 64%

People who are working in private sector monitors there investment daily and few of them monitors weekly, around 64% of them are able to monitor there investments weekly As they usually use personal computers for there work so this helps them to monitor them daily or weekly. Few of them who trade in delivery i.e. for long term monitors there investments weekly or monthly.

Public Service

DAILY Monthly Occasionally WEEKLY

12% 16% 8% 64%

45 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY People who are working in private sector monitors there investment daily and few of them monitors weekly, around 64% of them are able to monitor there investments weekly As they usually use personal computers for there work so this helps them to monitor them daily or weekly. Few of them who trade in delivery i.e. for long term there investments weekly or monthly.

9) What factors you consider while investing in Equity? a) Risk b) Return c) Time period d) Volatility

QUESTION-9 OCCUPATION Business Men Others Private Service Public Service Grand Total RETURN 8 10 9 9 36 RISK 8 6 5 7 26 TIME PERIOD 5 4 4 3 16 VOLATILITY 4 5 7 6 22 GRAND TOTAL 25 25 25 25 100

46 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Business Men

RETURN RISK TIME PERIOD VOLATILITY

16% 32% 20%

32%

Most of the business men consider both return and risk as an important factor when they are investing in equity. Almost 32% of the business men consider both risk and return. Few of them also consider time period and volatility of market in consideration while trading in equity.

Others

RETURN RISK TIME PERIOD VOLATILITY

20% 40% 16%

24%

Most of the Senior citizens or students consider return as an important factor when they are investing in equity. Almost 40% of them consider return when they invest in derivatives. Few of them also consider time period and volatility of market in consideration while trading in equity. 47 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Public Service

RETURN RISK TIME PERIOD VOLATILITY

24% 36% 12%

28%

According to the research public service class people consider return as an important factor when they are investing in equity. Almost 36% of the public service employee considers return. Few of them also consider time period and volatility of market in consideration while trading in equity.

Private Service

RETURN RISK TIME PERIOD VOLATILITY

28% 36%

16% 20%

48 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

According to the research private service class people consider return as an important factor when they are investing in equity. Almost 36% of the private service employee consider return. Few of them also consider time period and volatility of market in consideration while trading in equity.

10) What factors you consider while investing in Derivatives? a) Risk b) Return c) Time period d) Volatility

QUESTION-10 OCCUPATION Business Men Others Private Service Public Service Grand Total RETURN 9 10 9 12 40 RISK 2 4 7 4 17 TIME HORIZON 7 7 4 3 21 VOLATILITY 7 4 5 6 22 GRAND TOTAL 25 25 25 25 100

49 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Business Men

RETURN RISK TIME HORIZON VOLATILITY

28%

36%

28%

8%

Most of the business men consider return as an important factor whenever they trade in derivatives. And according to the research 28% of the business men consider time horizon and volatility in the market when they invest there money in derivatives. Only few of them consider risk as an important factor while investing there money into derivatives.

Others

RETURN RISK TIME HORIZON VOLATILITY

16% 40% 28% 16%

50 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Senior citizens and students or youngsters who have just started earning consider return as an important factor whenever they trade in derivatives. And according to the research 28% of them considers time horizon when they invest in derivatives. Risk and volatility is also considered by few investors who trade in derivatives i.e. around 16% of them considers risk and volatility as an important factor.

Private Service

RETURN RISK TIME HORIZON VOLATILITY

20% 36% 16%

28%

Most of the private service people consider return as an important factor whenever they trade in derivatives. And according to the research 28% of them consider risk when they invest in derivatives. Time horizon is also considered by few investors who trade in derivatives i.e. around 51 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY 16% of them considers time horizon as an important factor. 20% of them think that volatility should be considered as an important factor when they are investing in derivatives.

Public Service

RETURN RISK TIME HORIZON VOLATILITY

24% 48% 12% 16%

Most of the public service people consider return as an important factor whenever they trade in derivatives. And according to the research only 16% of them consider risk when they invest in derivatives. Time horizon is also considered by few investors who trade in derivatives i.e. around 12% of them considers time horizon as an important factor. 24% of them think that volatility should be considered as an important factor when they are investing in derivatives

52 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY ANALYSIS ON THE BASIS OF AGE:

QUESTION-1 AGE Between 18-30 Between 30-40 Between 40-50 More then 50 Grand Total COVER ORDER 3 6 7 6 22 DELIVERY 6 15 8 11 40 INTRADAY 3 6 8 7 24 PORTFOLIO 2 7 3 2 14 Grand Total 14 34 26 26 100

Between 18-30

COVER ORDER DELIVERY INTRADAY PORTFOLIO

14%

22%

21%

43%

The person belongs to the age of 18 to 30 usually trades in delivery. They use to prefer there investments for long term. Around 20-21% of the people who belongs to 18-30 age group invest in cover order and intraday. Comparatively very few of them trade in portfolio.

53 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Between 30-40

COVER ORDER DELIVERY INTRADAY PORTFOLIO

20%

18%

18%

44%

The person belongs to the age of 30-40 usually trades in delivery. They use to prefer there investments for long term. 18% of the people who belongs to 30-40 age group invest in cover order and intraday. Comparatively very few of them trade in portfolio

54 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Between 40-50

COVER ORDER DELIVERY INTRADAY PORTFOLIO

11% 27%

31%

31%

The person belongs to the age of 40-50 usually trades in delivery. They use to prefer there investments for long term. 31% of the people who belongs to 40-50 age group trade in intraday. Few of them i.e. around 27% of them are trading in cover order. Comparatively very few of them trade in portfolio.

55 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

More then 50

COVER ORDER DELIVERY INTRADAY PORTFOLIO

8% 23% 27%

42%

The person belongs to the age of 40-50 usually trades in delivery. They use to prefer there investments for long term. 31% of the people who belongs to 40-50 age group trade in intraday. Few of them i.e. around 27% of them are trading in cover order. Comparatively very few of them trade in portfolio.

QUESTION-2 AGE Between 1830 Between 3040 Between 4050 More then 50 Grand Total BOTH EQUITY AND DERIVATIVES DERIVATIVES 7 5 3 5 13 5 3 4 19 EQUITY SHARE 6 23 18 16 63 OTHERS 1 1 2 1 5 Grand Total 14 34 26 26 100

56 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Between 18-30

BOTH EQUITY AND DERIVATIVES DERIVATIVES EQUITY SHARE OTHERS

7%

50% 43%

50% of the people who belongs to the age between 18-30 like to trade in derivatives and around 25% of them trade in equity and very few of them prefer other financial products that use to make investment. According to the research, between this age range no one use to prefer invest in both equity and derivatives.

Between 30-40

BOTH EQUITY AND DERIVATIVES DERIVATIVES 3% 15% EQUITY SHARE OTHERS

15%

67%

57 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY 67% of the people who belongs to the age between 30-40 like to trade in equity share and around 15% of them trade in both equity and derivatives and only in derivatives. Very few of them prefer other financial products for there investments.

Between 40-50

BOTH EQUITY AND DERIVATIVES DERIVATIVES EQUITY SHARE OTHERS

8%

11% 12%

69%

69% of the people who belongs to the age between 40-50 like to trade in equity share and around 12% of them trade in both equity and derivatives and only in derivatives Very few of them prefer other financial products for there investments.

58 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

More then 50

BOTH EQUITY AND DERIVATIVES DERIVATIVES 4% 19% EQUITY SHARE OTHERS

15% 62%

62% of the people who are more then 50 like to trade in equity share and around 15% of them trade derivatives and 19% in other financial products. Very few of them prefer other financial products for there investments.

QUESTION-3 AGE Between 18-30 Between 30-40 Between 40-50 More then 50 Grand Total Both taxes saving & return 4 11 5 8 28 1 1 Only saving RETURN 9 17 14 16 56 Tax saving 1 5 7 2 15 Grand Total 14 34 26 26 100

59 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Between 18-30

Both taxes saving & return Only saving RETURN Tax saving

7% 29%

64%

The age group who includes the people who belongs to the age from 18 30 expect return from there investment i.e. about 64% of the people think that return is there main purpose of investments. Around 29% of the people of this age group both tax saving and return as there main purpose of investment Very few of them has tax saving as there main purpose of there investments.

Between 30-40

Both taxes saving & return Only saving RETURN Tax saving

15% 32%

50%

3%

60 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY The age group who includes the people who belongs to the age from 30-40 expect return from there investment i.e. about 50% of the people think that return is there main purpose of investments. Around 32% of the people of this age group consider both tax saving and return as there main purpose of investment Very few of them has tax saving and only saving as there main purpose of there investments.

Between 40-50

Both taxes saving & return Only saving RETURN Tax saving

27%

19%

54%

The age group who includes the people who belongs to the age from 40-50 expect return from there investment i.e. about 54% of the people think that return is there main purpose of investments. Around 19% of the people of this age group consider both tax saving and return as there main purpose of investment 27% of the people of this age group has tax saving and as there main purpose of there investments.

61 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

More then 50

Both taxes saving & return Only saving RETURN Tax saving

8% 31%

61%

The age group who includes the people who belongs to the age more then 50 expect return from there investment i.e. about 61% of the people think that return is there main purpose of investments. Around 31% of the people of this age group consider both tax saving and return as there main purpose of investment Very few of them has tax saving and only saving as there main purpose of there investments.

QUESTION-4 AGE Between 1830 Between 3040 Between 4050 More then 50 Grand Total 10-15 years 1-3 years 5 6 3 5 8 5 7 23 3-5 years 3 15 3 1 22 Daily 6 13 15 13 47 Grand Total 14 34 26 26 100

62 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Between 18-30

10-15 years 1-3 years 3-5 years Daily

43%

36%

21%

The people from this age group mostly prefer daily time horizon for trading and investing as sometimes it is easy for them to monitor there investments daily. 36% people think that they should have a time horizon of 1-3 years for there investments. But most of the people i.e. 43% from this age group trade daily in the market.

63 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Between 30-40

10-15 years 1-3 years 3-5 years Daily

18% 38%

44%

The people from this age group mostly prefer 3-5 years of time horizon for trading and investing and only 18% people think that they should have a time horizon of 1-3 years for there

investments. But in this age group also 38% of them are consider daily time horizon comfortable for there trading.

Between 40-50

10-15 years 1-3 years 3-5 years Daily

11%

19% 58% 12%

64 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

The people from this age group mostly prefer daily time horizon for trading and investing as sometimes it is easy for them to monitor there investments daily. 19% people think that they should have a time horizon of 1-3 years for there investments. But most of the people i.e. 58% from this age group trade daily in the market and around 12% of them like to trade in the time horizon of 3-5 years.

More then 50

10-15 years 1-3 years 3-5 years Daily

19%

50% 27% 4%

The people from this age group mostly prefer daily time horizon for trading and investing as sometimes it is easy for them to monitor there investments daily. 19% people think that they should have a time horizon of 10-15 years for there investments. But most of the people i.e. 50% from this age group trade daily in the market and only 4% of them like to trade in the time horizon of 3-5 years.

65 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

QUESTION-5 AGE Between 18-30 Between 30-40 Between 40-50 More then 50 Grand Total HIGH 6 14 9 9 38 LOW 5 12 6 5 28 MODERATE 3 8 11 12 34 Grand Total 14 34 26 26 100

Between 18-30

HIGH LOW MODERATE

21% 43%

36%

The people from this age i.e. from 18-30 are very energetic in there working and in there thoughts. Therefore they have a high risk taking ability. 43% of the people can bear high risk in there investments.36% of them can take low risk in there investments and few of them i.e. round 21% of them think that they can bear moderate risk which is neither high nor low.

66 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Between 30-40

HIGH LOW MODERATE

24% 41%

35%

The people from this age i.e. from 30-40 have a high risk taking ability. 41% of the people can bear high risk in there investments.35% of them can take low risk in there investments and few of them i.e. round 24% of them think that they can bear moderate risk which is neither high nor low.

Between 40-50

HIGH LOW MODERATE

35% 42%

23%

67 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

The people from this age i.e. from 40-50 have a moderate risk taking ability. 35% of the people can bear high risk in there investments.35% of them can take high risk in there investments and few of them i.e. around 23% of them think that they can bear low risk which is neither high nor low.

More then 50

HIGH LOW MODERATE

35% 46%

19%

The people from this age i.e. more then 50 have a moderate risk taking ability. 35% of the people can bear high risk in there investments.35% of them can take high risk in there investments and few of them i.e. around 23% of them think that they can bear low risk which is neither high nor low.

QUESTION-6 AGE Between 18-30 Between 30-40 Between 40-50 More then 50 Grand Total 10-20% 3 6 2 2 13 20-30% 4 14 11 16 45 More than 30 2 8 10 6 26 Up to 10% 5 6 3 2 16 Grand Total 14 34 26 26 100

68 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

Between 18-30

10-20% 20-30% More than 30 Up to 10%

21% 36%

29% 14%

The age group of 18-30 contribute some of the part of there investment into equity share i.e. around 14% of the people contribute there income into equity share. Up to 10% of contribution is there from this age group i.e. around 36% and 29% feels that they contribute 20-30% of there into equity share.

Between 30-40

10-20% 20-30% More than 30 Up to 10%

18%

18%

23% 41%

The age group of 30-40 contribute most of the part of there investment into equity share i.e. around 41% of the people contribute maximum income into equity share. More then 30% of contribution into equity share is there i.e. 23% of the people from this age group. 69 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY And 18% of the people from this age group contribute up to 10% and between 10-20% of there income into equity shares.

Between 40-50

10-20% 20-30% More than 30 Up to 10%

12%

8%

38%

42%

The age group of 40-50 contribute most of the part of there investment into equity share i.e. around 42% of the people contribute maximum into equity share which is around 20-30% and more then 30%. And 12% of the people from this age group contribute up to 10% and between of there income into equity shares.

70 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH

PROJECT ON A STUDY OF RISK PRECETION OF INVESTORS- A CASE STUDY OF MUMBAI CITY

More then 50

10-20% 20-30% More than 30 Up to 10%

8%

8%

23%

61%

The age group of 40-50 contribute most of the part of there investment into equity share i.e. around 61% of the people contribute maximum into equity share which is around 20-30%. More then 30% of contribution into equity share is there i.e. 23% of the people from this age group. And 8% of the people from this age group contribute up to 10% and between 10-20% of there income into equity shares.

QUESTION-7 AGE Between 18-30 Between 30-40 Between 40-50 More then 50 Grand Total 10-20% 4 10 7 3 24 20-30% 4 13 11 12 40 more than 30 6 8 5 8 27 3 3 3 9 UP TO 10% Grand Total 14 34 26 26 100

71 INSTITUTE OF PROFESSIONAL EDUCATION AND RESEARCH