Professional Documents

Culture Documents

Benefits

Uploaded by

Sumit SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Benefits

Uploaded by

Sumit SinghCopyright:

Available Formats

n the banking system, high level of NPAs can be serious drag on overall performance of economy on account of diversion of its

management and financial resources towards recovery of NPAs. Greater the resources needed by banks to reserve for losses, lesser is the amount of capital they can leverage. Consequently it makes the banks risk averse in providing new loans leading to credit crunch in the financial market, amounting to economic and financial degradation. ARCs are established to acquire, manage, and recover illiquid or NPAs from lenders, unlocking value trapped in them via an institutional platform. Benefits

Relieving banks of the burden of NPAs would allow them to focus better on managing the core business including new business opportunities. The transfer should help restore depositor and investor confidence by ensuring the lenders financial health. ARCs are meant to maximise recovery value while minimizing costs. ARCs can also help build industry expertise in loan resolution, besides serving as a catalyst for important legal reforms in bankruptcy procedures and loan collection. ARCs can play an important role in developing capital markets through secondary asset instruments.

ARC Ownership Models Different countries have tried out varying models of ownership of ARCs. The options range from asset workout departments or units of banks, bank-owned subsidiaries or affiliated companies, private companies, and government owned asset management agencies. The severity or systemic nature of a countrys NPA problem usually dictates the NPA resolution strategy and the parameters for judging its success. A countrys institutional, legal, and market conditions also influence the decision. Typically, the primary goal is to maximise net present value recovery in order to minimise losses to either the selling bank or the government, depending on the ARC model used. Government-based ARCs may have additional challenges such as minimising adverse market impact from the asset recovery process or helping to rehabilitate troubled banks and distressed borrowers. In general, most bank resolution programs involve removing NPA from normal bank operations. ARCs usually operate through one of the two basic models namely bank based model, which is a decentralised approach or a government based model, centralised approach. Government Based ARCs In a government based model, an agency is sponsored by government which acquires and resolves the bad assets. The NPAs are owned by the government and managed by the ARC or partially contracted out to private managers. The ARC can be a special-purpose organisation which will be entrusted to acquire, manage and recover NPAs. It can also have other operations like deposit insurance or bank recapitalisation. Moreover in this model, centralisation of NPA provides effective asset packaging and marketing, ensuring consistency and transparency within the ARC. In addition, the risk of decrease in sale values of assets by the competing bank based ARCs is also reduced. Bank based ARCs A bank based model has two approaches viz workout units and bad banks. In workout units, NPAs are moved to a separate bank department but remain in the banks books. On the other hand, the bad bank approach includes the transfer of NPAs to a separate affiliated organisation i.e. ARC, which specialises in the management of bad assets. However, a government based model is more effective in an economy where the NPA problem is more pervasive and business environment or legal infrastructure is less developed. A bank based model is generally appropriate when the NPA problems are limited and concentrated. Valuing Distressed Asset Valuation techniques are needed in order to make informed decisions regarding asset purchase price as well as the timing and the nature of sales transactions and other sales strategies. The valuation process can also influence other decisions, such as whether or not to provide seller financing or to fund asset enhancements (or even the operations of a business). Valuation should play a major role in deciding whether or not to engage in debt-for-equity swaps with borrowers or in determining the funding cost of

providing equity participation. Additionally, asset valuation procedures are necessary in monitoring and reporting on the financial condition of the ARC. The first step in valuation is to collect the necessary information about the loan and then to stratify and segment the asset pool by size, industry, operating condition, and location. Sources of information include loan files, bank files, service providers, bankruptcy procedures, the trustee/ receiver, feasibility studies, appraisals, industry and sector details. The ARC specifies the minimum level of information desired for each category of loans, based on the availability of information and asset value. It should require selling banks to furnish asset information to guide betterthan -liquidation pricing. The type of information that is necessary for analysis may include rescheduled loan payment and workout plans, payment history, rank of obligation in priority of claims, property descriptions, and description and value of collateral. With this information, the ARC should determine a valuation methodology, based on asset categories and recovery strategies, and then develop an appropriate model to derive the investment value. The more significant an asset, the more rigorous the valuation effort should be. The AMC should develop due-diligence material, ideally in a standard format, taking the asset information into account. Resolution Strategy for NPA After acquiring the NPA from the sellers, the ARC will implement the resolution strategy for the underlying assets of the non performing loan. The ARC has been given powers by the SARFAESI Act to execute the resolution of NPA whereby it can:

Restructure the loan. Sell or lease part/whole of the assets or the business to a third party. Change the management structure by introducing its own personnel in the management. (presently this section has been kept in abeyance by the regulator) Restructure the business operations including diversification of business operations or discontinue the loss making business segment.

Disposition Strategies A number of sales techniques are possible. These include -

Portfolio sales Open outcry and sealed-bid auctions Securitisation Equity participation transactions

Transaction Structures Stage 1: Initially, an ARC acquires NPA by floating an SPV which acts as a trust whereby the ARC is a trustee and manager. NPA are acquired from banks/FIs at fair value based on assessment of realisable amount and time to resolution. The banks/FIs may receive cash/bonds/debentures as consideration or may invest in securities issued by the ARCs. The trust acquires NPAs from banks/FIs and raises resources by formulating schemes for the financial assets taken over. Accordingly, it issues securities to the investors which are usually QIBs. Securities represent undivided right, title and interest in the trust fund. Subsequently, the ARC redeems the investment to the bank/FIs out of the funds received from the issued securities. After acquiring the NPA, the trust becomes the legal owner and the security holders its immediate beneficiaries. The NPAs acquired are held in an asset specific or portfolio trust scheme. In the portfolio approach, due to the small size of the aggregate debt the ARC makes a portfolio of the loan assets from different banks and FIs. Whereas when the size of the aggregate debt of a bank/FI is large, the trust takes asset specific approach.

Stage 2: Thereafter, different fund schemes are pooled together in a master trust scheme and sold to other investors. The ARC periodically declares the NAV of respective schemes.

You might also like

- Banking - Unit - Assets and Liability ManagmentDocument54 pagesBanking - Unit - Assets and Liability ManagmentDarshini Thummar-ppmNo ratings yet

- Credit AppraisalDocument6 pagesCredit AppraisalAnjali Angel ThakurNo ratings yet

- Claims and Recoveries: Fide Claims Against The Bank. This Paper Considers The Major ObjectivesDocument11 pagesClaims and Recoveries: Fide Claims Against The Bank. This Paper Considers The Major Objectivesdsmile1No ratings yet

- Leveraged BuyoutsDocument12 pagesLeveraged BuyoutsLeonardo100% (1)

- Ailing Banks Where Is AMCDocument3 pagesAiling Banks Where Is AMCMohammad Shahjahan SiddiquiNo ratings yet

- Managemnt of Capital in BanksDocument8 pagesManagemnt of Capital in Banksnrawat12345No ratings yet

- Explain The Scope, Importance, Features, Advantages and Disadvantages of Securitization (Special Purpose Vehicle)Document6 pagesExplain The Scope, Importance, Features, Advantages and Disadvantages of Securitization (Special Purpose Vehicle)somilNo ratings yet

- Financial Statement Anlysis 10e Subramanyam Wild Chapter 4Document43 pagesFinancial Statement Anlysis 10e Subramanyam Wild Chapter 4Muhammad HamzaNo ratings yet

- Bank Liquidity Management GuideDocument60 pagesBank Liquidity Management GuideRomil Parikh100% (1)

- NPA Management: - Role of Asset Reconstruction CompaniesDocument6 pagesNPA Management: - Role of Asset Reconstruction CompaniestapanrNo ratings yet

- ch10Document20 pagesch10NGỌC ĐẶNG HỒNGNo ratings yet

- Financial Statement Anlysis 10e Subramanyam Wild Chapter 4 PDFDocument43 pagesFinancial Statement Anlysis 10e Subramanyam Wild Chapter 4 PDFRyan75% (4)

- Credit Card Securitization RisksDocument18 pagesCredit Card Securitization RisksRahmi Elsa DianaNo ratings yet

- AIFsDocument10 pagesAIFs20ba092No ratings yet

- Rating Methodology and Functions of Investment BankersDocument20 pagesRating Methodology and Functions of Investment BankersNikhilNo ratings yet

- Chapter - 9 Investment Portfolio and Liquidity ManagementDocument16 pagesChapter - 9 Investment Portfolio and Liquidity Managementsahil ShresthaNo ratings yet

- Role of Merchant BankingDocument10 pagesRole of Merchant BankingAadil KakarNo ratings yet

- Trial Exam Spring 2017Document3 pagesTrial Exam Spring 2017Mega Pop LockerNo ratings yet

- A Study On Credit Appraisal For Working Capital Finance To Smes at Ing Vysya BankDocument22 pagesA Study On Credit Appraisal For Working Capital Finance To Smes at Ing Vysya Bankprincejac4u2478894No ratings yet

- Real Estate Securitization Exam NotesDocument33 pagesReal Estate Securitization Exam NotesHeng Kai Li100% (1)

- Commercial Banks Funding and LendingDocument5 pagesCommercial Banks Funding and LendingHeri LimNo ratings yet

- Bank RegulationDocument6 pagesBank RegulationAndre WestNo ratings yet

- Director, Division of Trading and Markets U.S. Securities and Exchange CommissionDocument12 pagesDirector, Division of Trading and Markets U.S. Securities and Exchange CommissionrlindseyNo ratings yet

- Non-Performing Assets Asset and Liability Management by The: BanksDocument15 pagesNon-Performing Assets Asset and Liability Management by The: BanksCeline StuartNo ratings yet

- ARC - Role of Asset Reconstruction Companies in India in Reduction of NPAsDocument6 pagesARC - Role of Asset Reconstruction Companies in India in Reduction of NPAsGreeshma ChittilappillyNo ratings yet

- Leveraged Lending GuidanceDocument15 pagesLeveraged Lending GuidancetrantuanlinhNo ratings yet

- Reforms in Banking SectorDocument3 pagesReforms in Banking SectorVyoma ReenuNo ratings yet

- Liquidity ManagementDocument51 pagesLiquidity Managementnikhil198924100% (2)

- Current Market ConditionsDocument9 pagesCurrent Market ConditionsNguyễn Thảo MyNo ratings yet

- Credit ManagementDocument29 pagesCredit ManagementShane DiestroNo ratings yet

- Credit Risk Management CourseDocument4 pagesCredit Risk Management CoursePradeep GautamNo ratings yet

- Treasury FunctionsDocument2 pagesTreasury Functionssunshine9016No ratings yet

- UNIT 2 MbfsDocument24 pagesUNIT 2 MbfsKarthikeyan NagarajanNo ratings yet

- Role of Merchant BankersDocument7 pagesRole of Merchant Bankersshiva7363No ratings yet

- ALM Management in Icici BankDocument85 pagesALM Management in Icici BankSrikanth BheemsettiNo ratings yet

- ASSET LIABILITIES Mnagament in BanksDocument25 pagesASSET LIABILITIES Mnagament in Bankspriyank shah100% (6)

- Frequently Asked Questions (FAQ) For Implementing March 2013 Interagency Guidance On Leveraged LendingDocument8 pagesFrequently Asked Questions (FAQ) For Implementing March 2013 Interagency Guidance On Leveraged Lendinged_nycNo ratings yet

- Securitization of DebtDocument52 pagesSecuritization of Debtnjsnghl100% (1)

- CENTRAL BANKING & MONETARY POLICY Short NoteDocument11 pagesCENTRAL BANKING & MONETARY POLICY Short NoteDipayan_luNo ratings yet

- Assignment - Retail BankingDocument6 pagesAssignment - Retail BankingShivam GoelNo ratings yet

- Celent Buy Side Risk Impact NoteDocument20 pagesCelent Buy Side Risk Impact Noteimnowhere62No ratings yet

- Duke Fed Speech 9.14.09Document7 pagesDuke Fed Speech 9.14.09mrericwangNo ratings yet

- Chapter 2Document8 pagesChapter 2Pradeep RajNo ratings yet

- Credit appraisal techniques: A forward-looking approachDocument9 pagesCredit appraisal techniques: A forward-looking approachMragank Dixit0% (2)

- Va Sudha ProjectDocument28 pagesVa Sudha ProjectPranjal SrivastavaNo ratings yet

- Back To Basics: Non-Determinant DepositsDocument4 pagesBack To Basics: Non-Determinant DepositskalamayaNo ratings yet

- AFM Important TheoryDocument25 pagesAFM Important TheorygirishpawarudgirkarNo ratings yet

- Liquidity Risk ManagementDocument3 pagesLiquidity Risk Managementsawantrohan214No ratings yet

- Babu KPCL Final ProjectDocument95 pagesBabu KPCL Final ProjectLucky Yadav100% (1)

- Retail Banking S ST WyvhdeDocument8 pagesRetail Banking S ST WyvhdeAlimo shaikhNo ratings yet

- Eman 2021 43Document6 pagesEman 2021 43Danijela VukosavljevicNo ratings yet

- Module 1Document30 pagesModule 1Laxmi JLNo ratings yet

- Agencies of Cash Flow: How to Raise and Invest Long-Term Money for Foundations and EndowmentsFrom EverandAgencies of Cash Flow: How to Raise and Invest Long-Term Money for Foundations and EndowmentsNo ratings yet

- The Finace Master: What you Need to Know to Achieve Lasting Financial FreedomFrom EverandThe Finace Master: What you Need to Know to Achieve Lasting Financial FreedomNo ratings yet

- Investment Valuation: Learn Proven Methods For Determining Asset Value And Taking The Right Investing DecisionsFrom EverandInvestment Valuation: Learn Proven Methods For Determining Asset Value And Taking The Right Investing DecisionsNo ratings yet

- How to Create and Maintain a Diversified Investment Portfolio: A Comprehensive Guide on Investment and Portfolio ManagementFrom EverandHow to Create and Maintain a Diversified Investment Portfolio: A Comprehensive Guide on Investment and Portfolio ManagementNo ratings yet

- Unlocking Capital: The Power of Bonds in Project FinanceFrom EverandUnlocking Capital: The Power of Bonds in Project FinanceNo ratings yet

- Banking TerminologyDocument10 pagesBanking TerminologySumit SinghNo ratings yet

- New Microsoft Office Power Point PresentationDocument4 pagesNew Microsoft Office Power Point PresentationSumit SinghNo ratings yet

- Term Paper ON Event Management: Topic:"Ka-Boom" - A Hockey MatchDocument17 pagesTerm Paper ON Event Management: Topic:"Ka-Boom" - A Hockey MatchSumit SinghNo ratings yet

- Term Paper of Banking & Insurance: Topic: Micro Finance Development Overview and ChallengesDocument18 pagesTerm Paper of Banking & Insurance: Topic: Micro Finance Development Overview and ChallengesSumit SinghNo ratings yet

- Graphics 2Document7 pagesGraphics 2Ankur Singh100% (1)

- Term Paper of Banking & Insurance: Topic: Micro Finance Development Overview and ChallengesDocument18 pagesTerm Paper of Banking & Insurance: Topic: Micro Finance Development Overview and ChallengesSumit SinghNo ratings yet

- MachinesDocument2 pagesMachinesSumit SinghNo ratings yet

- (Final) Acco 30013 - Accounting For Special TransactionsDocument20 pages(Final) Acco 30013 - Accounting For Special TransactionsJona kelssNo ratings yet

- Sec-Ogc Opinion No. 14-10: Sebastian Liganor Galinato & AlamisDocument4 pagesSec-Ogc Opinion No. 14-10: Sebastian Liganor Galinato & AlamisFrances EsteronNo ratings yet

- First Semester Business English Exams Agenla 2016-2017 Level II AccountingDocument2 pagesFirst Semester Business English Exams Agenla 2016-2017 Level II AccountingLysongo OruNo ratings yet

- AC - IntAcctg1 Quiz 04 With AnswersDocument2 pagesAC - IntAcctg1 Quiz 04 With AnswersSherri Bonquin100% (1)

- 250+ Imp AuditDocument289 pages250+ Imp Auditboring filesNo ratings yet

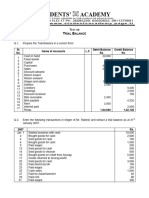

- Test On Trial BalanceDocument1 pageTest On Trial Balanceamitabhkumar1979No ratings yet

- IPO GuideDocument18 pagesIPO GuidetimevalueNo ratings yet

- David sm13 PPT 05Document17 pagesDavid sm13 PPT 05Muhammad Daudpota100% (1)

- 1 Cost Sheet TexbookDocument6 pages1 Cost Sheet TexbookVishal Kumar 5504No ratings yet

- Investment Planning (Asset Allocation - Concepts & Practices)Document40 pagesInvestment Planning (Asset Allocation - Concepts & Practices)mkpatidarNo ratings yet

- Finance Case StudyDocument4 pagesFinance Case StudyKelvin CharlesNo ratings yet

- Law of IbDocument12 pagesLaw of Ibmanish mishraNo ratings yet

- Tutorial 11Document2 pagesTutorial 11Vidya IntaniNo ratings yet

- ResultsresultsDocument2 pagesResultsresultsamanda.sunartoNo ratings yet

- Capital Markets - Final Exam (María Redondo)Document2 pagesCapital Markets - Final Exam (María Redondo)María Mercedes RedondoNo ratings yet

- JPM CreditDocument12 pagesJPM CredithushsterNo ratings yet

- Account Management & Client Services: Ashita Gupta 13PGDM136Document71 pagesAccount Management & Client Services: Ashita Gupta 13PGDM136Karan GuptaNo ratings yet

- Answer Key Chapter 1 Audit of Investments and Related AccountsDocument22 pagesAnswer Key Chapter 1 Audit of Investments and Related AccountsBazinga HidalgoNo ratings yet

- Laporan Keuangan Konsolidasian Q3 DPNSDocument105 pagesLaporan Keuangan Konsolidasian Q3 DPNSSyaifudin ZauhariNo ratings yet

- Capsim Final-Stockholders DebriefDocument27 pagesCapsim Final-Stockholders DebriefShama RoshanNo ratings yet

- Unit 5: Cash Book: Learning OutcomesDocument20 pagesUnit 5: Cash Book: Learning OutcomesMonica NallathambiNo ratings yet

- Capitalization of AssetsDocument3 pagesCapitalization of AssetsKavitaNo ratings yet

- Book 1 - Foundations of Risk Management PDFDocument19 pagesBook 1 - Foundations of Risk Management PDFmohamed0% (1)

- Strictly Confidential ModelDocument10 pagesStrictly Confidential Modelww weNo ratings yet

- Dfi 302 Mfi Lecture NotesDocument72 pagesDfi 302 Mfi Lecture NotesChristopher KipsangNo ratings yet

- Quiz Chapter+9 Income+Taxes+-+Document5 pagesQuiz Chapter+9 Income+Taxes+-+Rena Jocelle NalzaroNo ratings yet

- Financial Feasibility Study ChaptersDocument52 pagesFinancial Feasibility Study ChaptersDing RarugalNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument15 pagesCambridge International Advanced Subsidiary and Advanced LevelSaram Shykh PRODUCTIONSNo ratings yet

- A Valuer's Guide To The RICS Red Book 2014 PDFDocument42 pagesA Valuer's Guide To The RICS Red Book 2014 PDFKatharina Sumantri50% (2)

- Chapter 4 Lease vs. BuyDocument2 pagesChapter 4 Lease vs. Buymogibol791No ratings yet