Professional Documents

Culture Documents

Acknowledgement

Uploaded by

Bhavnesh BhadauriyaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acknowledgement

Uploaded by

Bhavnesh BhadauriyaCopyright:

Available Formats

ACKNOWLEDGEMENT We are hardly indebted to, who gave us approving chance of implying ourselves in such a project assignment.

We are grateful to whole finance department for making us feel as one of them during the entire training period and particularly we deeply thankful to our guidance Ms. our college staff, and director of our college. We are also indebted to Mr. Indravadan A. Modi, Chairman of Cadila Pharmaceutical Ltd. Dr. Rajiv I. Modi, Managing Director of Cadila Pharmaceutical Ltd. Dr. Nitin Naik (DGM. HR) and Mr. Anil Nair (Dy. Manager, HR). We are also thankful to Mr. Sunil Updhyay, from finance department for their support to us. Finally we thank all other Cadilians who directly or indirectly supported us. Working on a project is hard, need hard work and concentration. What makes it possible is the support we get from those around us. The purpose is to study how an organization functions and how to apply our academic knowledge in the corporate life. As a practical point of view Cadila Pharmaceuticals Limited, which is one of the leading pharmaceutical companies in India, has provided us such a great opportunity of summer training in their organization. It helps us to get better understanding and working of various theories of financial management. We have prepared the project report, which contains following parts: 1) To study Working Capital Assessment & Maximum Permissible Bank Finance 2) To study the various forms of CMA (Credit Monetary Assessment) data for the purpose of availing Bank Finance prescribed by Reserve Bank of India 3) To find out the ratio related the CMA

We learned a lot from this training about the corporate life, which will be useful to us in future. But as there is one limitation that we cant disclose all the financial and other information about Cadila Pharmaceuticals as per the company policy, we have not shown all the data in the project report. EXECUTIVE SUMMARIES This project is focused on the study of working capital management of Cadila Pharmaceutical Ltd. Working capital management involves not only the managing the different components of current assets but also managing the current liabilities or to be more precise financially the current assets. Working capital can be viewed as the amount of capital required for the smooth and uninterrupted functioning of the normal business operation of the company ranging from the procurement of raw materials, converting the some in to finished products for the sale of finished goods. Cadila Pharmaceuticals Ltd is Gujarat Company and its dealing with manufacturing and supply of all types of medicines. This training provides golden opportunity to us for getting a perfect knowledge and experience. We have made our best efforts to get knowledge and experience during this training. We collected necessary information and the present all the necessary information to understand the working of the organization. Table of content

Serial no. Particulars Objective of the report 1 Company Profile 2 Working capital & Working capital Sources 3 Types of Working Capital 4 Principals Of Working Capital Management / Policy 5 Introduction of working capital management 6 Definition of working capital management 7 Component of Working Capital Management 8 Short-Term Financing 9 Types of Loans 10 Tandon committee report 11 MBPF Method 12 Chore committee method Report 13 CMA (Credit Monetaring Assessment) 14 Working Capital Assessment 15 Company Profile 16 CMA Forms ( Form no.: II,III,IV,V,VI ) 17 Working For CMA Forms 18 Comments of Financials 19 Basis of Assumptions 20 Conclusion 21 SWOT Analysis 22 Bibliography

COMPANY PROFILE JOURNEY OF THOUSAND MILES BEGINS WITH ONE FOOTSTEP On 13th March, 1950 Mr. Ramanbhai B. Patel, Mr. Indravadan A. Modi, & Mr. Ramanbhai Patel had started small pharmaceutical company, they named it Cadila Laboratories Ltd. with initial capital investment of Rs.25000. Mr. Ramanbhai Patel left Cadila Laboratories and started new company in 1965. They have started production in their own premises at Azad society, in Ahmedabad. Their 1st products were Gripe water & Cadimalt. In 1965 they started factory at Ghodasar in Ahmedabad. At Ghodasar factory production of full Pharmaceutical range was started. After growth of business, they started various departments like Distribution, Marketing, Human Resources, Research & Development, and Animal House etc. They have stated Export Oriented Unit at Kandla. That unit was inaugurated by Prime minister Shrimati Indira Gandhi and was visited by many central ministers. By now, Mr. Pankaj R. Patel & Dr. Rajiv I. Modi had taken charge of company. They had made company known internationally. Cadila was known for its unique and new products. Research & Development was the Strength of company. At that time Mr. T. P. Gandhi and Mr. Ambubhai Patel was handling. R&D department. By the early 90's Cadila was ranked as the 3rd largest Pharmaceuticals Company in India, with a turnover of Rs. 4000 million. The decade also marked the beginning of a new economic framework and a shift in the Government policies. To

thrive in a changing business environment, the group decided to restructure its operations in 1995.

INTRODUCTION TO CADILA PHARMACEUTICALS Cadila Pharmaceuticals Ltd. is one of the largest privately held pharmaceutical companies in India, headquartered at Ahmedabad, in the state of Gujarat. Over the last five decades, it has been developing and manufacturing pharmaceutical products and selling and distributing these in over 50 countries around the world. An integrated healthcare solutions provider with pharmaceutical product basket, it caters to over 50 therapeutic areas that include cardiovascular, gastrointestinal, analgesics, haematinics, anti-infective and antibiotics, respiratory agents, anti-diabetics and immunological. The company focuses on providing high quality, appropriately priced products to its customers and supports all these with dedicated customer service. Cadila Pharmaceuticals has a multicultural, multilingual, and multinational workforce of more than four thousand employees including over two hundred people outside India in forty-nine countries of Africa, CIS, Japan, and USA. The company has one of the best Research and Development (R&D) setups in India, manned by more than three hundred and fifty scientists and engineers from various disciplines including biology, pharmacology, clinical research, chemistry, toxicology, photochemistry and different disciplines of engineering. The company also participates in Public-Private partnerships for developing diagnostic, preventive, and curative pharmaceutical and diagnostic products..

A responsible corporate citizen conscious of its duty towards various sections of the society; Cadila Pharmaceuticals nurtures young talents; runs an ultra-modern charitable hospital in a remote area with facilities like Telemedicine in association with Apollo Ahmedabad; works closely with NGOs by way of assistance and support for midday meal programmers, among other initiatives.

"Our vision is to be a leading pharmaceutical company in India and to become a significant global player by providing high quality, affordable and innovative solutions in medicine and treatment. Mission "We will discover, develop, and successfully market pharmaceutical products to prevent, diagnose, alleviate, and cure diseases. We shall provide total customer satisfaction and achieve leadership in chosen markets, products, and services across the globe, through excellence in technology, based on world-class research and development. We are responsible to the society. We shall be good corporate citizens and will be driven by high ethical standards in our practices." Financial Management The management of the finances of a business / organization in order to achieve financial objectives Taking a commercial business as the most common organisational structure, the key objectives of financial management of the company is to: Create wealth for the business Generate cash, and Provide an adequate return on investment bearing in mind the risks that the

business is taking and the resources invested (1) Financial Planning Management need to ensure that enough funding is available at the right time to meet the needs of the business. In the short term, funding may be needed to invest in equipment and stocks, pay employees and fund sales made on credit. In the medium and long term, funding may be required for significant additions to the productive capacity of the business or to make acquisitions. (2) Financial Control Financial control is a critically important activity to help the business ensure that the business is meeting its objectives. Financial control addresses questions such as: Are assets being used efficiently? Are the businesses assets secure? Do management act in the best interest of shareholders and in accordance with business rules? (3) Financial Decision-making The key aspects of financial decision-making relate to investment, financing and dividends: Investments must be financed in some way however there are always financing alternatives that can be considered. A key financing decision is whether profits earned by the business should be retained rather than distributed to shareholders via dividends. If dividends are too high, the business may be starved of funding to reinvest in growing revenues and profits further. Research and development Research often refers to basic experimental research; development refers to the exploitation of discoveries. Research involves the identification of possible chemical

compounds or theoretical mechanisms. In the United States, universities are the main provider of research level products. In the United States, corporations buy licences from universities or hire scientists directly when economically solid research level products emerge and the development phase of drug delivery is almost entirely managed by private enterprise. Development is concerned with proof of concept, safety testing, and determining ideal levels and delivery mechanisms. Development often occurs in phases that are defined by drug safety regulators in the country of interest.. In a challenging market environment after manufacturing now companies are eyeing to reduce the development cost where R&D needs to justify its existence as an independent profit center with increased productivity and reduced operational costs. This can only be achieved through collaboration and trade-offs. Formation of horizontal collaborative network is challenging because it incorporates the issues of adaptability, security, cultural differences, varying standards, trust and ownership. Globalization is pushing R&D to concentrate on global design approach with the design flexibility where products can be tailored as per different geographic markets . Spread over more than 1,05,000 sq. ft. area, Cadila Pharmaceuticals R & D facilities, recognized by the Department of Science & Technology, Government of India, are manned by a 150-strong scientists pool. A centralized Quality Control & Analytical Research Laboratory has been set up to meet the domestic and international quality standards. The Company has expanded operations by building further on already existing set-up by investing in new premises, to

include modern, state-of-the-art amenities.

One of the few companies in the country carrying out collaborative research, Cadila Pharmaceuticals taps the best scientific talent in the country and has collaborations with more than 30 leading Research and Development centers in India. Human Resource management may be defined as strategy for acquisition, utilization, improvement and preservation of the human resources of an enterprise. The objective is to provide right personnel for the right work and optimum utilization of the existing human resources. HRP exists as a part of the planning process of business. This is the activity of the management which is aimed at co-ordinating requirements for and the availability of different types of employers. The major activities of HRP include: forecasting (future requirements), inventorying (present strength), anticipating (comparison of present and future requirements) and planning (necessary programmed to meet future requirements). Marketing Management Marketing Management is the art and science of choosing target markets and getting, keeping, and growing customers through creating, delivering, and communicating superior customer value. developing marketing strategies & plans capturing marketing insights connecting with customers building strong brands shaping the market offerings delivering value

communicating value creating long-term growth Business & Marketing changes changing technology globalization deregulation: greater competition & growth opportunities privatization: increasing efficiency customer empowerment customization heightened competition industry convergence retail transformation Disintermediation Objective of Project Report 1) To study Working Capital Assessment & Maximum Permissible Bank Finance 2) To study the various forms of CMA (Credit Monetary Assessment) data for the purpose of availing Bank Finance prescribed by Reserve Bank of India 3) To find out the ratio related the CMA

Working capital Working capital, also known as net working capital, is a financial metric which represents operating liquidity available to a business. Along with fixed assets such as plant and equipment, working capital is considered a part of operating capital. It is calculated as current assets minus current liabilities. The diagram below illustrates the working capital cycle The upper portion of the diagram above shows in a simplified form the chain of

events in a manufacturing firm. Each of the boxes in the upper part of the diagram can be seen as a tank through which funds flow. These tanks, which are concerned with daytoday activities, have funds constantly flowing into and out of them.

The chain starts with the firm buying raw materials on credit. In due course this stock will be used in production, work will be carried out on the stock, and it will become part of the firms work in progress (WIP) Work will continue on the WIP until it eventually emerges as the finished product As production progresses, labor costs, and overheads will need to be met Of course at some stage trade creditors will need to be paid When the finished goods are sold on credit, debtors are increased They will eventually pay, so that cash will be injected into the firm Each of the areas stocks (raw materials, work in progress and finished goods), trade debtors, cash (positive or negative) and trade creditors can be viewed as tanks into and from which funds flow. Working capital is clearly not the only aspect of a business that affects the amount of cash: What are Working Capital Sources? Own funds Bank borrowings Sundry Creditors Advances from customers Deposits due in a year Other current liabilities TYPES OF WORKING CAPITAL

FACTORS DETERMINING WORKING CAPITAL 1) Nature of the Industry 2) Demand of Industry 3) Cash requirements 4) Nature of the Business 5) Manufacturing time 6) Volume of Sales 7) Terms of Purchase and Sales 8) Inventory Turnover 9) Business Cycle 10) Current Assets requirements 11) Production Cycle 12) Credit control 13) Inflation or Price level changes WORKING CAPITAL BASIS OF CONCEPT BASIS OF TIME Gross Working Capital Net Working Capital

Permanent / Fixed WC Temporary / Variable WC Regular WC Reserve WC Special WC Seasonal WC 14) Profit planning and control 15) Repayment ability 16) Cash reserves 17) Operation efficiency 18) Change in Technology 19) Firms finance and dividend policy 20) Attitude towards Risk

THE WORKING CAPITAL CYCLE (OPERATING CYCLE T TH HE E W WO OR RK KI IN NG G C CA AP PI IT TA AL L

C CY YC CL LE E ( (O OP PE ER RA AT TI IN NG G C CY YC CL LE E) ) Accounts Payable Cash Raw Materials W I P Finished Goods Value Addition Accounts Receivable SALES R.B.INSTITUTE OF MANAGEMENT STUDIES 19

INTRODUCTION OF WORKING CAPITAL MANAGEMENT

Working capital refers to the firms investment in short-term assets (cash, marketable securities, accounts receivable, and inventories). Net working capital is the difference between a firms current assets and its current liabilities. Working capital management involves administering to both short-term assets and short-term liabilities. Assets and liabilities must be matched and coordinated in order to keep costs to a

minimum and to control risks. Generally, we want to match the firms financing with the lives of its assets. If we consider a company that is growing over time, then its assets can be decomposed into three categories fixed assets, permanent current assets and fluctuating current assets.

Short-term Fluctuating

Current Assets

Permanent Current Assets Long-term

Fixed Assets

R.B.INSTITUTE OF MANAGEMENT STUDIES 20 Fixed assets should be financed long-term, either equity or long-term debt, since the assets are long-lived and need financing for a long period of time. The current assets

can be broken down into two portions, permanent current assets, and fluctuating current assets. The permanent current assets represent base levels of inventories, receivables, etc., that will always be on hand. The fluctuating current assets represent the seasonal build-ups that occur, such as inventories before Christmas and receivables after Christmas. The fluctuating current asset levels should be financed short-term since we dont want to pay financing charges all year if we only need the money for a fourmonth period.

Definition of Working Capital Management

Working capital management is concerned with current assets and current liabilities and their relationship to the rest of the firm. Working capital policies affect the future returns and risk of the company; consequently, they have an ultimate bearing on shareholder wealth. COMPONENTS OF WORKING CAPITAL Cash Cash is probably the least productive asset you can have. Not only does it not earn anything, it actually loses purchasing power as a consequence of inflation. So why do firms hold cash? The three Keynesian motives for holding cash balances are

Transactions motive to conduct day-to-day business of paying for purchases,

labor, etc. Precautionary motive to cover unexpected expenditures. If the delivery truck breaks down, it must be repaired or replaced if you want to stay in business. R.B.INSTITUTE OF MANAGEMENT STUDIES 21 Speculative motive unusually good opportunities occasionally arise. If you have the money available, you can take advantage of these opportunities.

Marketable Securities Marketable securities are a way of holding cash but with the attribute of earning interest. Market securities have three characteristics:

1. Short-term maturity (less than one year, or money market instruments 2. High marketability 3. Virtually no risk of default

Several types of marketable securities exist, the major ones being

U.S. Treasury bills Treasury bills are auctioned every Monday by the government. Most have maturities of 91 or 181 days, although some 9-month (270 days) and 12month (360 days) bills are sold. The t-bills, generally with a face value of $10,000 each, are sold at a discount to the highest bidders. The difference between the amount paid and the face value at maturity represents the interest that is earned.

Anticipation notes Anticipation notes are issued by municipalities and school districts. Since their revenues come from tax sources, the notes are in anticipation of future tax receipts.

Commercial paper Commercial paper is the promissory notes of a major national firms. Most of the firms that issue commercial paper sell it directly to investors (insurance companies, money market funds, pension funds) although

R.B.INSTITUTE OF MANAGEMENT STUDIES 22

Sometimes it will be sold through investment bankers. Commercial paper is a substitute for bank debt, but at a rate of interest that is one-fourth to on-half of a percent higher than t-bills (currently about 4.3%) but significantly less than what banks would charge (prime is currently about 8.5%).

Bankers Acceptances A bankers acceptance is a time draft that evolves from international export/import financing. An exporter is paid by a time draft issued by a foreign bank. Since the draft is not payable until some future date (1-3 months, typically) the company that receives it will often sell it to its local bank at a discount. The local bank bundles the discounted drafts (bankers

acceptances) and then resells them in the money markets.

Accounts Receivable

Accounts receivable are generated when a firm offers credit to its customers. The first thing that needs to be addressed when establishing a credit policy is to set the standards by which a firm is judged in determining whether or not credit will be extended. There is whats known as the 5 Cs of credit:

1. Character the willingness of the borrower to repay the obligation 2. Capacity the capability of the borrower to earn the money to repay the obligation 3. Capital sufficient assets available to support operations (as opposed to a firm that is undercapitalized). Sometimes capital is interpreted to mean equity capital; i.e., to make sure the owners of the firm have sufficient money at R.B.INSTITUTE OF MANAGEMENT STUDIES 23 stake to give them proper incentive to repay the loan and not let the company go bankrupt. 4. Collateral assets to support the loan which can be liquidated if default occurs 5. Conditions current and future anticipated conditions of the firm and the industry.

These costs include

The time value of money tied up in accounts receivable Bad debts that occur Credit checks (to minimize bad debts) Collection costs Discounts for early payment (reduces revenues) Clerical costs associated with maintaining a credit department

Competitors will respond very quickly to a change in price. How many times have we seen the claims that We will meet or beat any advertised price? A change in credit policy, on the other hand, is a more subtle means of competing for customers and one that the competition will not necessarily respond to. In fact, many firms base their business on easy credit. How many times have we seen the advertisements where they tell us Good credit? Bad credit? No credit? We dont care! Of course, these firms will have larger bad debt expenses and larger financing costs, etc. Obviously, they will also need to have higher prices (higher gross profit margins) in order to cover these costs.

Inventories

Inventories (raw materials, work-in-process, finished goods) make up a large

portion of most firms current assets, and for many, total assets. As such, the extent to R.B.INSTITUTE OF MANAGEMENT STUDIES 24 which a firm efficiently manages its inventories can have a large influence on its profitability. Thus, keeping abreast of inventory policy is critical to the profitability (and value) of the firm. Several factors influence the amount of inventory that a firm maintains. The most important of these include Short-term Financing Trade Credit

The major source of short-term financing for firms is that of trade credit. While it is an account payable on our balance sheet, it is an account receivable on the balance sheet of our supplier.

The terms of credit can vary quite a bit:

1. Cash on Delivery (i.e., no credit) 2. Net amount due within a certain period of time 3. Net amount with a discount if paid within a certain period of time, net amount within another period. Commercial Banks

The second major source of short-term financing for firms is commercial banks.

A firm wants to establish a close relationship with its bank and obtain a line of credit. In order to get a credit line, you will want to show them your income statements, balance sheets, financial ratios, etc. The bank will then allow a certain amount of credit with a set rate of interest (usually prime plus). This can be renegotiated every year. In fact, commercial banks bread and butter are their business accounts and they are very competitive with one another in trying to attract corporate clients. The amount of the credit line is

R.B.INSTITUTE OF MANAGEMENT STUDIES 25

Types of Loans

Loans come in a variety of shapes. A simple loan requires that the firm maintain a non-interest-bearing account at the bank. While compensating balances are not used as much as they have been in the past, they are still encountered frequently. The true cost of debt of any loan is the internal rate of return between what you receive and what you have to pay back. Suppose we use our calculators and determine the IRR of this interest add-on loan. We determine that the IRR is 1.2%. But remember that his is 1.2% per month. Using simple interest, 1.2%*12 = 14.4% annual rate of interest.

Security for Bank Loans

Banks like some sort of collateral for loans to ensure repayment of the loan, at least in part. The preferred collateral for bank loans is accounts receivable. The reason, of course, is that collecting money is what banks do. Typically, a bank will loan up to 75-80% of the receivables that are not over 60 days. There are two ways to obtain financing with receivables:

Securities Loans A borrower can pledge their inventories of securities of another company (bonds, notes payable) as collateral for a loan as well. Thus, if you hold a note payable from a creditworthy firm, many lenders will loan money against it. (This is similar, in a sense, to what happens with a margin purchase.) In short, if a firm has assets of virtually any kind, it can use them as collateral for short-term loans to meet its short-term cash needs.

R.B.INSTITUTE OF MANAGEMENT STUDIES 26 Tandon committee

Like many other activities of the banks, method and quantum of short-term finance that can be granted to a corporate was mandated by the Reserve Bank of India till 1994. This control was exercised on the lines suggested by the

recommendations of a study group headed by Shri Prakash Tandon. The study group headed by Shri Prakash Tandon, the then Chairman of Punjab National Bank, was constituted by the RBI in July 1974 with eminent personalities drawn from leading banks, financial institutions and a wide crosssection of the Industry with a view to study the entire gamut of Bank's finance for working capital and suggest ways for optimum utilization of Bank credit. This was the first elaborate attempt by the central bank to organize the Bank credit. Most banks in India even today continue to look at the needs of the corporate in the light of methodology recommended by the Group. As per the recommendations of Tandon Committee, the corporate should be discouraged from accumulating too much of stocks of current assets and should move towards very lean inventories and receivable levels. The committee even suggested the maximum levels of Raw Material, Stock-in-process, and Finished Goods which a corporate operating in an industry should be allowed to accumulate these levels were termed as inventory and receivable norms. First Method of Lending: Banks can work out the working capital gap, i.e. total current assets less current liabilities other than bank borrowings (called Maximum Permissible Bank Finance or MPBF) and finance a maximum of 75 per cent of the gap; the balance to come out of long-term funds, i.e., owned funds and term borrowings. This approach was considered suitable only for very small borrowers i.e. where the requirements of credit were less than Rs.10 lacks

R.B.INSTITUTE OF MANAGEMENT STUDIES 27 Second Method of Lending: Under this method, it was thought that the borrower should provide for a

minimum of 25% of total current assets out of long-term funds i.e., owned funds plus term borrowings. A certain level of credit for purchases and other current liabilities will be available to fund the buildup of current assets and the bank will provide the balance (MPBF). Consequently, total current liabilities inclusive of bank borrowings could not exceed 75% of current assets. RBI stipulated that the working capital needs of all borrowers enjoying fund based credit facilities of more than Rs. 10 lacks should be appraised (calculated) under this method.

Third Method of Lending: Under this method, the borrower's contribution from long term funds will be to the extent of the entire CORE CURRENT ASSETS, which has been defined by the Study Group as representing the absolute minimum level of raw materials, process stock, finished goods and stores which are in the pipeline to ensure continuity of production and a minimum of 25% of the balance current assets should be financed out of the long term funds plus term borrowings.

R.B.INSTITUTE OF MANAGEMENT STUDIES 28

MPBF Method (Tandon's II method of lending) Excess borrowing (short fall in NWC) shall be ensured by additional funds to be brought in by the applicant or by additional bank finance over MPBF.

A Current Assets B Current Liability. other than Bank Borrowings C Working Capital gap (A-B) D Minimum Stipulated NWC (25% of CA excluding export receivables) E Actual/projected NWC (CA-CL with BB) F CD G CE H MPBF (F or G whichever is less) I Excess borrowings/short fall in NWC (D-E)

Important Aspects of MPBF method

Production/Sales estimates Profitability estimates Inventory/receivables norms Build up of Net Working Capital

Credit Monetary Assessment What is the meaning of credit monitoring assessment? It is nothing but the bank financing for working capital.

It is earlier known as Credit Authorization Scheme. R.B.INSTITUTE OF MANAGEMENT STUDIES 29 RBI prescribed certain forms to be filled for applying that is called as CMA Data Base. Calculation is done according to Tendon Committee. CMA Data is an useful tool, consisting of financials of past two years, estimates of current year and projections of next year of a company seeking debt, generally insisted by bank to assess the CMA data is a detailed analysis of the working of any company. To run a business smoothly business strategy required & to get live financial strategy is required. so, They create a financial strategy plan to give it live that is nothing but CMA This is required to be submitted by the company who has to take more than Rupee One crore of working capital loan from any Bank. This is consisting of six parts commonly known as six forms details are as under:-

Form -I - Assessment of working capital required. Form -II - Operating statement of the company Form-III - Analysis of Balance sheet Form-IV -Comparative statement of current asset and current liability Form-V -Computation of Flexible Bank Finance Form-VI -Fund flow analysis

R.B.INSTITUTE OF MANAGEMENT STUDIES 30

Working Capital Assessment

Any enterprise whether industrial, trading or other acquires two types of assets to run its business as has already been emphasised time and again. It requires fixed assets which are necessary for carrying on the production/business such as land and buildings, plant and machinery, furniture and fixtures etc. For a going concern these assets are of permanent nature and are not to be sold. The other types of assets required for day to day working of a unit are known as current assets which are floating in nature and keep changing during the course of business.

The total current assets with the firm may be taken as gross working capital whereas the net working capital with the unit may be calculated as under:

Net Working Capital = (NWC) (GWC)

Current Assets - Current Liabilities

(Including bank borrowings)

This net working capital is also sometimes referred to as 'liquid surplus' with the firm and has been margin available for working capital requirements of the unit.

The current assets in the example given in the earlier paragraph are financed asunder:

Current Assets

= Current liabilities + Working capital limits from banks

+ Margin from long-term liabilities

The assessment of working capital may involve two aspects as under

R.B.INSTITUTE OF MANAGEMENT STUDIES 31 The level of current assets required to be held by any unit which is adequate for its day to day functioning, and The mode of financing of these current assets.

Different forms adopting different techniques is thus in circulation for assessment of working capital depending upon the size and category of projects as under:

(1) Form for assessment of requirements of SSI units up to credit limits of Rs.2, 00,000/- (including composite loans) (2) Form for assessment of requirements of SSI units for credit limits of above Rs.2, 00,000 and up to Rs. 15.00 lacks. (3) Form for assessment of requirements for units with credit limits above Rs.15.00 lacks and up to Rs. 1.00 crore (4) Form for assessment of requirements for units with credit limits above Rs.100 crore.

(5) CMA Data form for assessment of requirements for units with credit limits above Rs. 10.00 lacks or as per the cut off point fixed by individual banks. (6) Assessment of limits for projects falling under various segments of priority sector.

Key elements of the working capital assessment include: Review current working capital requirements based on internal processes impacting receivables, payables and inventory, as well as external and strategic drivers: o Geographic footprint o Product mix, and sales channels o Regulatory and financial covenants R.B.INSTITUTE OF MANAGEMENT STUDIES 32 o Strength in the value chain o Organizational review of the management of working capital through policies, processes, systems, people and metrics

Our operations Existing CIS - Russia, Ukraine, Latvia, Belarus, Lithuania, Kazakhstan, Georgia, Armenia, Moldova, Uzbekistan Africa - SA, Kenya, Nigeria, Mauritius, Zimbabwe, Zambia, RDC, Cameroon, IVC, Tanzania, Uganda, Ethiopia, Sudan, Mozambique and Franco fone

countries. South-East Asia/Pacific - Sri Lanka, Thailand, Vietnam, Myanmar, Maldives, Philippines, Macau, Singapore, Maldives, Fiji, Papua New-Guinea, New Zealand, Australia, Taiwan Middle East -Oman, Yemen, Bahrain, Iran, Iraq, Egypt, Syria North America - USA, Canada Europe - Denmark, Hungary, France Bulgaria Latin America - Brazil, West Indies, Dominican Republic, Mexico Far East - Japan, South Korea

R.B.INSTITUTE OF MANAGEMENT STUDIES 33

Future Plans Saudi Arabia Angola Estonia Czech Republic Romania Slovakia Slovenia Bosnia Croatia

Yugoslavia Albania Chile Venezuela Columbia Paraguay Hong Kong China Jordan Lebanon

Group companies 1. Casil Industries Limited (CIL) 2. Casil health products Limited (CHPL)

3. Veterinary - Extending care towards animals 4. Green Channel Travel Services

5. Green Channel America

6. Karnavati Engineering Ltd. R.B.INSTITUTE OF MANAGEMENT STUDIES 34 1. Karnavati Americ 2. CPL Inc, USA

CADILA PHARMACEUTICALS

DHOLKA

ANKLESHWAR

CHEMICAL FORMULATION CHEMICAL

DOMESTIC

INTERNAT

R.B.INSTITUTE OF MANAGEMENT STUDIES 35

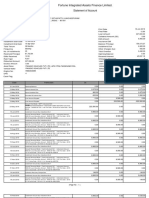

ASSESSMENT OF WORKING CAPITAL REQUIREMENTS FORM - II OPERATING STATEMENT Particular 2008-09 Actual Actual 2009-10 2010-11 Projection 2011-12

Estimates

Gross Sales a. Domestic Sales 1,183.82

1,230.31

1,799.55

2,159.46 b. Export Sales 601.99

608.09

649.22

779.06 Total 1,785.80

1,838.40

2,448.77

2,938.52 Less : Excise duty 77.80

38.10

215.95

259.14

Net Sales (1 - 2) 1,708.00

1,800.30

2,232.82

2,679.39

% age rise (+) or fall (-) in net sales as compared to previous year (annualsied)

5.40% 24.03% 20.00% Cost of Sales i Raw materials (including stores & other items used in the process of mfg.)

621.00

623.00

714.50

857.40 a Imported

124.00

107.50

142.90

171.48 b Indigeneous 497.00

515.50

571.60

685.92 ii. Other Spares 22.60

17.20

22.33

26.79 a Imported 4.90

0.40

4.47

5.36 b Indigeneous 17.70

16.80

17.86

21.44 iii. Power and Fuel 41.90

46.30

55.82

66.98 iv. Direct Labour ( wages & Salary) 165.70

180.60

223.28

267.94 v. Other manufacturing expenses 32.40

33.50

39.07

46.89 vi. Depreciation 73.40

82.60

90.04

90.04 vii. Sub-total (i to v) 957.00

983.20

1,145.05

1,356.05 R.B.INSTITUTE OF MANAGEMENT STUDIES 36 viii. Add : Opening Stock-in-process 83.10

70.60

52.60

55.00 viii. Sub-total (vii + viii) 1,040.10

1,053.80

1,197.65

1,411.05 ix. Deduct : Closing Stock-in-process 70.60

52.60

55.00

55.00

x. Cost of Production 969.50

1,001.20

1,142.65

1,356.05 xi. Add : Op. Stock of finished goods 128.40

136.90

136.20

136.20 Sub-total (x + xi) 1,097.90

1,138.10

1,278.85

1,492.25 xii. Deduct : Cl. Stock of finished goods 136.90

136.20

136.20

136.20 xiii. Sub-total (Total Cost of Sales) 961.00

1,001.90

1,142.65

1,356.05 Selling, general and administrative expenses 456.30

547.80

625.19

750.23 Sub-total ( 5 + 6) 1,417.30

1,549.70

1,767.84

2,106.28 Operating Profit Before Interest ( 3 - 6) 290.70

250.60

464.98

573.11 Interest & Financial Charges 32.60

88.00

49.91

47.18 Interest on Term Loan 18.00

67.80

31.26

25.18 Interest of W. C. Loan 10.10

11.70

13.65

16.50 Bank Charges 4.50

8.50

5.00

5.50 Operating Profit After Interest ( 7 - 8 ) 258.10

162.60

415.08

525.93

i. Add : Other non-operating Income a Partner's Remuneration 15.30

126.40

145.00

145.00 b Dividend Income 39.60

40.50

50.00

50.00 c Others 9.50

19.00

25.00

25.00 d Misc. Income

13.90

10.90

15.00

15.00 Sub - total (income) 78.30

196.80

235.00

235.00 ii. Deduct : Other non-operating expenses

R.B.INSTITUTE OF MANAGEMENT STUDIES 37 a. Exchange rate difference -

b. Misc. expenses 61.90

63.00

25.00

25.00 c. Loss on Sales of Assets 0.80

Sub - total (expenses) 62.70

63.00

25.00

25.00 iii. Net of other non-operating income/expenses

15.60

133.80

210.00

210.00 Profit before tax/loss [ 9 + 10 (iii)] 273.70

296.40

625.08

735.93 Provisions for taxes (Mat 19%) 37.50

30.50

118.76

139.83 Net Profit / Loss 236.20

265.90

506.31

596.10 a. Equity dividend 6.61

71.90

71.88

71.88 b. Dividend Rate (Including tax on dividend)

10.53%

10.54%

10.54%

10.54% Retained Profit ( 13 -14 ) 229.59

194.00

434.43

524.22 Retained Profit / Net Profit 97%

73%

86%

88% Add : Composite scheme of agreement 3.80

Less : Proposed dividend and tax 71.90

71.88

71.88 Less : Amount transger to Gen Reserves 157.60

Amount Transfer to Balance Sheet (P&L A/c) 40.20

434.43

524.22

R.B.INSTITUTE OF MANAGEMENT STUDIES 38 FORM -III ANALYSIS OF BALANCE SHEET LIABILITIES (Rs in Crores) 2008-09 2009-10 2010-11 2011-12

Year

Actual

Actual

Estimates

Projection CURRENT LIABILITIES 01. Short-term borrowing from banks (including B/P, discounted & excess borrowing placed on repayment basis)

i. From applicant bank 164.90

205.00

250.00

300.00 ii. From other banks iii. (of which BP & BD) Sub-total [ i + ii ] (A) 164.90

205.00

250.00

300.00

02. Short-term borrowings from others 136.20

139.70

175.00

175.00 03. Sundry Creditors (Trade) 258.20

278.10

149.00

178.50 04. Advance payments from customers/deposits from dealers

5.40

5.10

10.00

20.00 05. Provision for taxation 13.10

17.30

59.38

69.91 06. Dividend payable 66.10

71.90

71.88

71.88 07. Other statutory liabilities (due within 1 year) 17.50

12.80

25.00

35.00 08. Deposits/installments of term loans / DPGs/debentures etc. ( due within 1 yr.)

44.70

82.00

69.94

69.94 09. Other current liabilities & Provisions ( due within 1 yr.) -specify major items.

7.30

8.50

56.75

60.00 a. Outstanding Liabilities 7.30

8.50

35.00

60.00 b. Creditors For expenses

c. Others 21.75 -

Sub-total [ 2 to 9 ] ( B ) 548.50

615.40

616.96

680.24

10. Total current liabilities [ A + B ] 713.40

820.40 866.96 980.24

R.B.INSTITUTE OF MANAGEMENT STUDIES 39 TERM LIABILITIES 11. Debentures 12. Preference Shares (redeemable after 1 yr) 13. Term Loans (excluding installments payable within 1 yr)

349.70

349.70

279.76

209.82 14. Deferred Payment Credits (excluding installments payable within 1 yr.)

15. Term Deposits/Unsecured Loan(repayable after 1 yr.) 43.40

43.50

21.75 16. Other term liabilities 8.30

5.10

10.00

35.00 17. Total term liabilities [ 11 + 16 ] 401.40

398.30

311.51

244.82 18. Total outside liabilities [ 10 + 17 ] 1,114.80

1,218.70

1,178.47

1,225.06 NET WORTH 19. Equity Share capital/ Partners' Capital 62.80 68.20

68.20

68.20 20. General Reserve 600.00

750.00

750.00

750.00 21. Revaluation reserve -

22. Other reserves (excluding provisions) 228.20

211.60

211.60

211.60 23. Surplus (+) or deficit (-) in Profit & Loss a/c. 162.80

203.00

637.43

1,161.65 23. Others - Deferred Tax Liability 122.40

125.90

125.90

125.90

24. Net worth 1,176.20

1,358.70

1,793.13

2,317.35 25. TOTAL LIABILITIES [ 18 + 24 ] 2,291.00

2,577.40

2,971.60

3,542.41 CURRENT ASSETS 26. Cash & Bank Balances 19.00

25.60

45.99

20.37 27. Investments (other than long term) I. Govt. & other trustee securities 100.51

ii. Fixed Deposits with banks 28. i. Receivables other than deferred & exports (incldg.bills purchased & discounted by banks)

183.63

248.24

300.00

360.00 ii. Export receivables (incldg.bills purchased &

R.B.INSTITUTE OF MANAGEMENT STUDIES 40 discounted by banks) 98.88 133.67 162.50 195.00

29. Installments of deferred receivables (due withing 1 yr.) Loans & Advances

30. Inventory : 331.00

349.00

375.87

447.20 i. Raw materials (Including stores & other items used in the process of manufacture)

120.80

155.00

154.70

185.80 Imported 24.16

31.00

35.70

42.80 Indigeneous 96.64

124.00

119.00

143.00 ii. Stocks-in-process 70.60

52.60

67.00

79.00 iii. Finished goods 136.90

136.20

143.00

169.00 iv. Other Consumable spares 2.70

5.20

11.17

13.40 31. Advances to suppliers of raw materials 32. Advance payment of taxes -

33. Other current assets (specify major items) 335.50

240.90

271.79

285.43 a. Interest Receivable 1.00

1.00

1.10

1.21 b. Advances 178.80

114.60

120.33

126.35 c. Deposiots with ONGC, Excise etc. 43.40

41.80

45.98

48.28 d. Other Loans and Advances, Interest receivables 112.30

83.50

104.38

109.59 34. Total Current Assets (26 to 33) 968.00

1,097.91

1,156.15

1,308.00 FIXED ASSETS

35. Gross Block (land,building,machnery, work-inprogress)

1,337.40

1,475.80

1,475.80

1,475.80 36. Depreciation to date 457.10

521.60

611.64

701.68 37. Net Block ( 35-36 ) 880.30

954.20

864.16

774.12 OTHER NON-CURRENT ASSETS 38. Investments/book debts/advances/deposits which are not current assets

442.70

494.89

494.89

494.89 i. Investments in subsidiary companies/affiliates 320.40

449.00

499.00

549.00 R.B.INSTITUTE OF MANAGEMENT STUDIES 41

ii. Advances to suppliers of capital goods & contractors

iii. Deferred receivables (maturity exceeding 1 yr.) iv. Others 122.30

45.89

920.89

1,429.89 a. Deposits 755.00

1,094.00 b. Investment in Other Companies 122.30

45.89

165.89

335.89

39. Non-consumable stores and spares

40. Other non-current assets including dues from directors 41. Total Other Non-current Assets (38 to 40) 442.70

494.89

920.89

1,429.89 42. Intangible Assets (patents, goodwill, prelim.exp., bad debts not provided for. 30.40

30.40

30.40 43. Total Assets (34+37+41+42) 2,291.00

2,577.40

2,971.60

3,542.41

44. Tangible Net Worth ( 24 - 42 ) 1,176.20

1,328.30

1,762.73

2,286.95 45. Net working Capital ( 34 -10 ) 254.60

277.51

289.19

327.76

R.B.INSTITUTE OF MANAGEMENT STUDIES 42

COMPERETIVE STATEMENT OF CURRENT ASSETS AND LIABILITIES

PARTICULAR 2008-09

2009-10

2010-11

2011-12

Actual

Actual

Estimates

Projection CURRENT ASSETS CURRENT ASSETS Raw materials (incl. Stores & other items used in the process of manufacture)

a. Imported 24.16 31.00 35.70

42.80 Month's Consumption (2.34) (3.46) (3.00) (3.00) b. Indigeneous 96.64 124.00 119.00

143.00 Month's Consumption (2.33) (2.89) (2.50) (2.50) Other Consumable spares, excluding those included on 1 above

2.70 5.20 11.17

13.40 Month's Consumption (1.43) (3.63) (6.00) (6.00) Stock-in-process Stock-in-process 70.60 52.60 67.00 79.00 Month's Consumption (0.87) (0.63) (0.70) (0.70) Finished goods (months' cost of production) Finished goods (months' cost of production)

136.90 136.20 143.00

169.00 Month's Consumption (1.71) (1.63) (1.50) (1.50) Receivables other than export & deferred receivables (Incl. Bills purchased & discounted by bankers)

183.63 248.24 300.00

360.00 Month's Domestic Sales (1.86) (2.42) (2.00) (2.00) Export receivables 98.88 133.67 162.50

195.00 Month's export sales (1.97) (2.64) (3.00) (3.00) Advances to suppliers of raw materials & stores / spares, consumables -

Other current assets incl. Cash & bank bal. & deferred receivables due within 1 yr.

354.50 367.01 317.78

305.80 i. Cash & Bank Balances 19.00 25.60 45.99

20.37 ii. Fixed Deposits with banks 100.51 -

iii. Advance Payment of Taxes -

R.B.INSTITUTE OF MANAGEMENT STUDIES 43

iv. Other current assets 335.50 240.90 271.79

285.43 Total Current Assets (To agree with item 34 in Form III)

968.00 1,097.91 1,156.15

1,308.00 Creditors for purchase of raw materials, stores & consumable spares

258.20 278.10 149.00

178.50 Month's purchases (4.99) (5.36) (2.50) (2.50) Advances from customers 5.40 5.10 10.00

20.00 Statutory liabilities 17.50 12.80 25.00

35.00 Other current liabilities : 267.40 319.40 432.96

446.74 Short term borrowings 136.20

139.70 175.00

175.00 Provision for taxation 13.10 17.30 59.38

69.91 Dividend payable 66.10 71.90 71.88

71.88 Deposits/installments of term loans/DPGs/ debentures etc. (due within 1 yr.)

44.70 82.00 69.94

69.94 Other current liabilities & provisions (due within 1 yr.) 7.30

8.50 56.75

60.00 Total (To agree with total B of Form-III) 548.50 615.40 616.96

680.24 R.B.INSTITUTE OF MANAGEMENT STUDIES 44 FORM - V COMPUTATION OF MAXIMUM PERMISSIBLE BANK FINANCE FOR WORKING CAPITAL Particular 2008-09 Actual Actual 2009-10 2010-11 Projection 2011-12

Estimates

TOTAL CURRENT ASSETS (9 in form IV) 968.00

1097.91

1156.15

1308.00 Other Current liabilities other than bank

borrowing (14 of form IV)

548.50

615.40

616.96

680.24 working capital gap (WCG) [1-2] 419.50

482.51

539.19

627.76 Minimum stipulated net w.c. i.e. 25% of total c.a. as the case may be depending upon the method of lending being applied. (export receivables to be excluded under both methods)

242.00

274.48

289.04

327.00 Actual/Projected net w.c. (45 in form III) 254.60

277.51

289.19

327.76 Item 3 minus item 4 177.50

208.03

250.15

300.76 Item 3 minus item 5 164.90

205.00

250.00

300.00 Maximum permissible bank finance (item 6 or 7 whichever is lower)

164.90

205.00

250.00

300.00 Excess borrowings representing - short fall in NWC -

R.B.INSTITUTE OF MANAGEMENT STUDIES 45

FUNDFLOW STATEMENT

Particulars 2009-10

Actual 2010-11

Estimates 2011-12

Projection

Sources Retained Profit (item 15 of Form II) 194.00

434.43 524.22 Add : Composite Scheme of Agreement Depreciation (item 5(vii) in Form II) 64.50 3.80 -

90.04 90.04 Gross funds generated 262.30

524.47 614.26 Less : Trfd. To General and Other reserves Less : Prior Period Adjustments Net funds generated 104.70 157.60 -

524.47 614.26 Increase in Capital Increase in Reserves 5.40 150.00 -

Increase in Revaluation Reserves Increase in Other Reserves Increase in Deferred Tax Liability Increase in Term Liabilities Decrease in Fixed Assets -

3.50 -

Decrease in Investments and other non current assets Decrease in other non-current assets Decrease in Intengible Assets Total 263.60

524.47 614.26

Net Loss: (item 10 in Form II) Uses Net Funds Lost 138.40 16.60 -

Increase in Fixed Assets

Decrease in Other reserves

Decrease in Deferred Tax Liability Decrease in Debentures Decrease in Preference Shares Decrease in Term Liabilities 3.10

86.79

66.69 Decrease in Term Deposits repayable after one year Decrease in Deferred Payment Credits Decrease in Unsecured Loans from Shareholders and Directors Decrease in Trade Deposits from Stockists and Dealers R.B.INSTITUTE OF MANAGEMENT STUDIES 46 Increase in Investments Increase in Other Non Current Assets 52.19

426.00 509.00 Increase in Intengible Assets 30.40 Total 240.69 -

512.79 575.69 Long Term Surplus/(Deficit) (1 - 2) 22.91

11.68 38.57 Increase/(Decrease) in Current Assets

129.91

58.24 151.85 Decrease/(Increase) in Current 66.90

1.56 63.28 liabilities (Other than Bank Borrowings) Increase/(Decrease) in Working Capital Gap (Total of item 4 & 5)

63.01

56.68 88.57

Net Surplus/(Deficit) (3 - 6) (40.10)

(45.00) (50.00) Increase/(Decrease) in Bank Borrowings 40.10

45.00 50.00

R.B.INSTITUTE OF MANAGEMENT STUDIES 47 RATIO ANALYSIS

1. Working capital ratio Working capital ratio: Inventory + Receivable Payable Net sales It indicates relationship between inventory amount of current assets and current liabilities in the organization. if ratio increases year by year than it show that the

company can meet its daily expenses and will not suffer from crises. 2008-09 2009-10 2010-11 2011-12 inventory 331 349 375.87 447.2 recievable 394.81 465.41 566.88 664.59 payable 393.1 393.2 301.51 209.82

0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00% 35.00% 40.00% 1234 ratio years working capital ratio R.B.INSTITUTE OF MANAGEMENT STUDIES 48

2. CURRENT RATIO

Current ration also known as working capital ratio is a measure of general liquidity and its most widely used to make the analysis of short term financial position or liquidity of a firm. It is defines as the relation between current assets and current liabilities thus,

Current ratio =current assets / current liabilities 2008-09 2009-10 2010-11 2011-12 current assets 968 1097.91 1156.15 1308 current liabilities 713.4 820.4 866.96 980.24

The two components of ratio are: 1. Current assets 2. Current liabilities Current assets include cash, marketable securities, bills receivable sundry debtors, and work in progress. Current liabilities include outstanding expenses, bills payable, dividend payable etc. R.B.INSTITUTE OF MANAGEMENT STUDIES 49

3. Working capital turnover ratio

This ratio establishes a relation between net sales and working capital. The working capital is taken as: Working capital= current assets-current liabilities. Working capital turnover ratio : Net sales Working capital

2008-09 2009-10 2010-11 2011-12 net sales 1708 1800 2233 2679 working capital 254.6 277.51 289.19 327.76

1.32 1.33 1.33 1.34 1.34 1.35 1.35 1.36 1.36 1234 ratio years current ratio

R.B.INSTITUTE OF MANAGEMENT STUDIES 50 Objectives: The objective of working capital turnover ratio is to indicate the velocity of the utilization of net working capital. This ratio indicates the number of times the working capital is turned over in the course of a year.

4. Fixed assets turnover ratio This ratio establishes a relation between net sales and fixed assets. Objective: The objective of computing this ratio is to deternine the efficiency with which the fixed assets are utilized. Fixed assets turnover ratio : 1.00 2.00 3.00 4.00 5.00 6.00 7.00

8.00 9.00 1234 ratio years working capital turn over ratio R.B.INSTITUTE OF MANAGEMENT STUDIES 51 Net sales Net total fixed assets 2008-09 2009-10 2010-11 2011-12 net sales 1708 1800 2233 2679 net totle assets 954.2 864.16 774.12 684.06

The formula is useful in analyzing growth companies to see if they are growing sales in proportion to their asset bases. The fixed assets turnover ratio really has little meaning except when it is put in the context of industrial averages, and consideration is made whether new capital expenditures recently undertaken were such that they could skew the ratio.

0.50

1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50 1234 ratio years fixed assets turn over ratio R.B.INSTITUTE OF MANAGEMENT STUDIES 52

5. Gross profit ratio This ratio measures the relationship between gross profit and net sales.

Objectives: It is calculated to know: 1. Whether the business is in a position to meet operating expenses or not 2. How much the share holders can get after meeting such expenses? Gross profit ratio: Gross profit * 100 Net sales 2008-09 2009-10 2010-11 2011-12 gross profit 747 798.1 1090.35 1322.95

net sales 1708 1800 2233 2679

Gross Profit Ratio provides guidelines to the concern whether it is earning sufficient profit to cover administration and marketing expenses and is able to cover its fixed expenses. The gross profit ratio of current year is compared to previous years ratios or it is compared with the ratios of the other concerns. The minor change in the ratio from year to year may be ignored but in case there is big change, it must be investigated. This investigation will be helpful to know about any departure from the standard mark-up and would indicate losses on account of theft, damage, bad stock system, bad sales policies and other such reasons.

R.B.INSTITUTE OF MANAGEMENT STUDIES 53

6. Net profit ratio This ratio measures the relationship between net profit and net sales. Objectives: To determine the overall profitability due to various factors such as operational efficiency, trading on equity, etc.

Net profit ratio: Net profit *100

Net sales 2008-09 2009-10 2010-11 2011-12 net profit 236 266 506 596 net sales 1708 1800 2233 2679

40.00% 41.00% 42.00% 43.00% 44.00% 45.00% 46.00% 47.00% 48.00% 49.00% 50.00% 1234 ratio(in %) years gross profit ratio R.B.INSTITUTE OF MANAGEMENT STUDIES 54 In order to work out overall efficiency of the concern Net Profit ratio is calculated. This ratio is helpful to determine the operational ability of the concern. While comparing the ratio to previous years ratios, the increment shows the efficiency of the concern.

7. Operating profit ratio This ratio measures the relationship between operating profit and net sales Objectives: To determined the operational efficiency of the management. Operating profit ratio: Operating profit * 100 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 1234 ratio(in %) years net profit ratio R.B.INSTITUTE OF MANAGEMENT STUDIES 55 Net sales 2008-09 2009-10 2010-11 2011-12 operating profit 258 163 415 526 net sales 1708 1800 2233 2679

Operating Profit Ratio indicates the earning capacity of the concern on the basis of its business operations and not from earning from the other sources. It shows whether the business is able to stand in the market or not

0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 1234 ratio(in %) years operating profit ratio R.B.INSTITUTE OF MANAGEMENT STUDIES 56

SWOT Analysis of Indian Pharmaceuticals Industry

SWOT stands for

- Strength

W - Weakness O - Opportunity T - Threat.

Strengths: Indian with a population of over a billion is a largely untapped market. In fact the

penetration of modern medicine is less than 30% in India. The growth of middle class in the country has resulted in fast changing lifestyles

in urban and to some extent rural centers. This opens a huge market for lifestyle drugs, which has a very low contribution in the Indian markets. Indian manufacturers are one of the lowest cost producers of drugs in the world.

With a scalable labor force, Indian manufactures can produce drugs at 40% to 50% of the cost to the rest of the world. In some cases, this cost is as low as 90%. Indian Pharmaceutical industry posses excellent chemistry and process

reengineering skills. This adds to the competitive advantage of the Indian companies. The strength in chemistry skill helps Indian companies to develop processes, which are cost effective.

Weaknesses: R.B.INSTITUTE OF MANAGEMENT STUDIES 57 The NPPA (National Pharmaceutical Pricing Authority), which is the authority to decide the various pricing parameters, sets prices of different drugs, which leads to lower profitability for the companies. The companies, which are lowest cost producers, are at advantage while those who cannot produce have either to stop

production or bear losses. In India Pharmaceutical sector has been marred by lack of product patent, which prevents global Pharmaceutical companies to introduce new drugs in the country and discourages innovation and drug discovery. But this has provided an upper hand to the Indian Pharmaceutical companies. Indian majors are relying on exports for growth. To put things in to perspective, India accounts for almost 16% of the world population while the total size of industry is just 1% of the global Pharmaceutical industry. Due to very low barriers to entry, Indian Pharmaceutical industry is highly fragmented with about 300 large manufacturing units and about 18,000 small units spread across the country. This makes Indian Pharmaceutical market increasingly competitive. Indian Pharmaceutical market is one of the least penetrated in the world. However, growth has been slow to come by. The industry witnesses price competition, which reduces the growth of the industry in value term. Opportunities: The new patent product regime will bring with it new innovative drugs. This will increase the profitability of MNC Pharmaceutical companies and will force domestic Pharmaceutical companies to focus more on R&D. This migration could result in consolidation as well. The migration into a product patent based regime is likely to transform industry fortunes in the long term. Opening up of health insurance sector and the expected growth in per capita income are key growth drivers from a long-term perspective. This leads to the R.B.INSTITUTE OF MANAGEMENT STUDIES 58 expansion of healthcare industry of which Pharmaceutical industry is an integral part.

Being the lowest cost producer combined with FDA approved plants; Indian companies can become a global outsourcing hub for Pharmaceutical products. Large number of drugs going off-patent in Europe and in the US between the 2005-2009 offers a big opportunity for the Indian companies to capture this market. Since generic drugs are commodities by nature, Indian producers have the competitive advantage, as they are the lowest cost producers of drugs in the world. Threats: Threats from other low cost countries like China and Israel exist. However, on the quality front, India is better placed relative to China. So, differentiation in the contract manufacturing side may wane. The short-term threat for the Pharmaceutical industry is the uncertainty regarding the implementation of GST. Though this is likely to have a negative impact in the short-term, the implications over the long-term are positive for the industry. There are certain concerns over the patent regime regarding its current structure. It might be possible that the new government may change certain provisions of the patent act formulated by the preceding government. Increase in over the counter medicines also create problem for medicines because people will buy it directly from market.

R.B.INSTITUTE OF MANAGEMENT STUDIES 59

CONCLUSION

The training at Cadila Pharmaceutical Limited. Was memorable experience I am fortunate to get opportunity to know about the working and functioning of the company. The management had a positive attitude towards us and they tried best to provide me with proper guidance and complete information .me show each and every unit completely. The unit people were very heritable and this encouraged working.

The supervisor unit co-ordination is simply versatile which a result of bright future is .there is co-ordinate between workers and staff. The future is clear of the unit because of its effective management.

Increasing turnover and high quality of its products so after observing such matters. I can say that the company has best delight, bright future for coming years.

R.B.INSTITUTE OF MANAGEMENT STUDIES 60

Bibliography Websites 1) http:// www.Cadila Phrema.com 2) http://www.banknetindia.com/banking/metlend.htm. 3) http://www. Google.co.in. .

A Special Thanks to

Ms. Heena thanki (HOD,RBIMS ), who has been our internal guide for our project report Mr. Sunil Upadhyay (Astt. Gen. Manager), who has been our guide for all these valuable learning.

R.B.INSTITUTE OF MANAGEMENT STUDIES 61

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Black Book of Copywriting SecretsDocument30 pagesThe Little Black Book of Copywriting SecretsJeeva2612100% (27)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 1 William Henry Scott - Prehispanic Filipino Concepts of Land Rights PDFDocument10 pages1 William Henry Scott - Prehispanic Filipino Concepts of Land Rights PDFRamon Guillermo100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Understanding Natural Gas and LNG OptionsDocument248 pagesUnderstanding Natural Gas and LNG OptionsTivani MphiniNo ratings yet

- Statement of Account for Mohansri ADocument2 pagesStatement of Account for Mohansri ASanthosh SehwagNo ratings yet

- Man Company investment income from Kind CorpDocument12 pagesMan Company investment income from Kind Corpbobo kaNo ratings yet

- Travel Agency Business Plan: Adventure Excursions Unlimited Executive SummaryDocument33 pagesTravel Agency Business Plan: Adventure Excursions Unlimited Executive SummaryjatinNo ratings yet

- 1 Use Worksheet 11 1 To Determine Whether The Woodsons HaveDocument2 pages1 Use Worksheet 11 1 To Determine Whether The Woodsons Havetrilocksp SinghNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument3 pages© The Institute of Chartered Accountants of IndiaDeepak KumarNo ratings yet

- Dissolution QuizDocument2 pagesDissolution QuizveriNo ratings yet

- BAM 026 Group 1Document8 pagesBAM 026 Group 1Maureen SanchezNo ratings yet

- CEO CFO CertificationDocument30 pagesCEO CFO CertificationAbhishek GhoshNo ratings yet

- Brien Bracco, ResumeDocument2 pagesBrien Bracco, ResumebrienNo ratings yet

- Income Tax Test BankDocument65 pagesIncome Tax Test Bankwalsonsanaani3rdNo ratings yet

- About Ushar & Zakat 000000000000034 PDFDocument3 pagesAbout Ushar & Zakat 000000000000034 PDFsyed Muhammad farrukh bukhariNo ratings yet

- Engineering Economic Analysis 11th Edition EbookDocument61 pagesEngineering Economic Analysis 11th Edition Ebookdebra.glisson665100% (48)

- NBFC MCQ QuizDocument2 pagesNBFC MCQ QuizZara KhanNo ratings yet

- IRS Publication Form 8594Document2 pagesIRS Publication Form 8594Francis Wolfgang UrbanNo ratings yet

- JURNAL INFORMATIKA UPGRIS Vol. 3, No. 2, (2017) Stock Price Prediction Using ANNDocument6 pagesJURNAL INFORMATIKA UPGRIS Vol. 3, No. 2, (2017) Stock Price Prediction Using ANNRebecca YohannaNo ratings yet

- Marketing Strategy of Master CardDocument36 pagesMarketing Strategy of Master CardParas GalaNo ratings yet

- EH Agreement & Payment Plan Form PDFDocument2 pagesEH Agreement & Payment Plan Form PDFJonathan GavantNo ratings yet

- About Mutual Funds Lakshmi SharmaDocument83 pagesAbout Mutual Funds Lakshmi SharmaYogendra DasNo ratings yet

- Insurance Black BookDocument44 pagesInsurance Black Booksupport NamoNo ratings yet

- Subject Outline FNCE20005 2018Document7 pagesSubject Outline FNCE20005 2018Claudia ChoiNo ratings yet

- Pre-Lecture Quiz 6 (For Session 7 - Chapter 10 and 11) - Corporate Finance-T323WSB-7Document6 pagesPre-Lecture Quiz 6 (For Session 7 - Chapter 10 and 11) - Corporate Finance-T323WSB-722003067No ratings yet

- Cash Flow StatementDocument16 pagesCash Flow Statementrajesh337masssNo ratings yet

- Assignment 8 Research PaperDocument5 pagesAssignment 8 Research Paperapi-193761397No ratings yet

- Accounting Conceptual FrameworkDocument4 pagesAccounting Conceptual FrameworkUmmu ZubairNo ratings yet

- IFCI: India's First Development Financial InstitutionDocument10 pagesIFCI: India's First Development Financial InstitutionDREAMING YTNo ratings yet

- Introduction to Climate Finance Economics of Climate Change Adaptation Training ProgrammeDocument78 pagesIntroduction to Climate Finance Economics of Climate Change Adaptation Training Programmeadinsmaradhana100% (1)

- Curriculam Vitae: Rohit Kumar GoyalDocument2 pagesCurriculam Vitae: Rohit Kumar GoyalRohit kumar goyalNo ratings yet