Professional Documents

Culture Documents

Senate Committee Code Revisions From Karen

Uploaded by

YubaNetCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Senate Committee Code Revisions From Karen

Uploaded by

YubaNetCopyright:

Available Formats

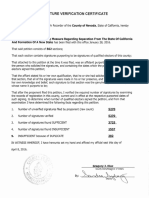

Karen D.

Adams, CPA

Tre a s u WT ax Col l ecto

r-

c l e tu

COUNTY CLERK Reg istra r of Vo te rs TREAsURER - TAX COLLECfOR

2222 "M" Stteel Merced, CA 95340 (209) 38$7307 (209) 72$3905 (Fax)

Karen D. Adams, CPA

March 23, 2010

www.mercedtaxcollgclor.org

www.mercedeleclions. org

TO: FOR:

California Senate Local Government Committee Incompatible Consolidation of Treasurer and Auditor Code Recommendations for Prudence and Economy: Rethinking State Limits on County Offices

Thank you again for the opportunity to testify during your committee meeting on March 17, 2010. In addition to my responses to your outlined questions I previously submitted; please find my recommendations for revising the current code specifically addressing the incompatible consolidation of Treasurer and

Auditor.

./ Keep intact the

Government Code S 24000 list of acceptable consolidations which does not permit the consolidation of Treasurer and Auditor. Maintain the elected status of all elected offices including both

Treasurer-Tax Collector and Auditor-Controller.

In some cases a consolidation may be practical and benefit the citizens if

second, incompatible office automatically vacates the first office". Therefore the consolidation of Auditor with Treasurer would cause the Auditor to vacate his Auditor status to legally accept the Treasurer

authority or vice versa.

no "incompatibility of authority" exists. Clearly the Auditor and Treasurer are not compatible and a clash of duties does so exist. California legislature recognizes the incompatibility and dictates that if the dual office holding would be improper "A person who assumes the duties of a

Treasurer-Tax Collector

Page2

Good governance can only be accomplished with a separation of the Treasurer and Auditor authority along with all other incompatible offices. The doctrine of incompatible offices should be upheld as intended by law and never abrogated.

fnsert "compatible" in Government Code $ 24300, "By ordinance the board of supervisors may consolidate the duties of certain of the [compatible] county offices in one or more of these combinations:...". As mentioned in Government Code S 24000, the Treasurer and Auditor are not listed as permissible ofiices for consolidation under Government Code $ 24300. Keep intact the list of office combinations for the board

of supervisors to enact by ordinance.

Eliminate the contradiction between Government Code $ 24300.5 and 24300 to cease the opportunity for consolidations of auditor, treasurer, and director of finance. Lack of uniformity erodes the intent of the law over time. Clearly legislation recognized the clash of duties that exist between Treasurer and Auditor when excluding the offices on the list of acceptable consolidations. Eliminate the inconsistencies in the present law that does not uphold the common law incompatibility doctrine adopted by the Legislature in 2005.

Eliminate any future privileges in Government Code $ 24304.2 and 24300.5 to the counties seeking to abrogate the incompatibility doctrine recognized in both Government Code $ 24OOO and 24300 that granted Sonoma and Tulare counties permission to consolidate the offices of Treasurer and Auditor. Currently the ten counties that have consolidated will be exempt from the elimination of this privilege to consolidate and I defer to the committee on defining the proper

remedy.

Eliminate the exceptions made to counties based on county population, size, region, or any other characteristic provided in Government Code $ 24304.1, 24305, 24306, 24306.5, 24307 and 24308. Charter counties are defined by the charter adopted by their voters and requires no mention. Legislation should not provide

Treasurer-Tax

Collector

all the regional

Page 3

guidance when considering

uniquely define a county.

characteristics that

It is my hope that the committee provides legislation that will prevent any future

consolidations of incompatible offices with focus on the financial aspects of Treasurer and Auditor. I am honored to have been granted this opportunity to participate in the process.

Genuinely,

Karen D ;CPA T 'Tax Collector-Clerk

You might also like

- Senate Committee Prudence Response From Karen 3-2010Document8 pagesSenate Committee Prudence Response From Karen 3-2010YubaNetNo ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Government of The District of Columbia Office of The Attorney GeneralDocument9 pagesGovernment of The District of Columbia Office of The Attorney GeneralSusie CambriaNo ratings yet

- Kentucky League of Cities: City Officials Legal HandbookFrom EverandKentucky League of Cities: City Officials Legal HandbookNo ratings yet

- Memo On Proposed Riverside County Catalytic Converter Theft OrdinanceDocument3 pagesMemo On Proposed Riverside County Catalytic Converter Theft OrdinanceThe Press-Enterprise / pressenterprise.comNo ratings yet

- For The Following Reasons, We The 10-Year Ban Should Apply Only To Positions Involved in The Overall Governance of Counties and Municipalities. ElectedDocument9 pagesFor The Following Reasons, We The 10-Year Ban Should Apply Only To Positions Involved in The Overall Governance of Counties and Municipalities. Electedapi-25976402No ratings yet

- Texas Water Districts A General GuideDocument8 pagesTexas Water Districts A General GuideJamie HarrisNo ratings yet

- 123 - Atitiw vs. Zamora, G.R. No. 143374, September 30, 2005 Christian Brusola Digested CaseDocument8 pages123 - Atitiw vs. Zamora, G.R. No. 143374, September 30, 2005 Christian Brusola Digested CaseAmity Rose RiveroNo ratings yet

- City of Taylor, TIFA Lawsuit Against Wayne CountyDocument132 pagesCity of Taylor, TIFA Lawsuit Against Wayne CountyDavid KomerNo ratings yet

- MD Ag Opinion SB 842 2012Document5 pagesMD Ag Opinion SB 842 2012thekytikat100% (1)

- State of California - GOVERNMENT CODE SECTION 25000-25008Document3 pagesState of California - GOVERNMENT CODE SECTION 25000-25008mcharter946No ratings yet

- WCSD Chief Counsel Comment On Incline Village Tax RefundsDocument4 pagesWCSD Chief Counsel Comment On Incline Village Tax RefundsBen MargiottNo ratings yet

- Tower Amendment ResolutionDocument5 pagesTower Amendment Resolutionefx8xNo ratings yet

- TAXATION II-case DigestDocument54 pagesTAXATION II-case Digestleo.rosarioNo ratings yet

- Municipality of Candijay, Bohol v. CA and Municipality of Alicia, BoholDocument4 pagesMunicipality of Candijay, Bohol v. CA and Municipality of Alicia, BoholMDR Andrea Ivy DyNo ratings yet

- Proposal To Study Removing Coroner's Office From Riverside County Sheriff's DepartmentDocument2 pagesProposal To Study Removing Coroner's Office From Riverside County Sheriff's DepartmentThe Press-Enterprise / pressenterprise.comNo ratings yet

- Royals NegotiationsDocument2 pagesRoyals NegotiationsGreg DaileyNo ratings yet

- Pub Corp DigestsDocument6 pagesPub Corp DigestsBoysie Ceth GarvezNo ratings yet

- Consent Agreement Wayne CountyDocument12 pagesConsent Agreement Wayne CountyClickon DetroitNo ratings yet

- Admin Law MidtermsDocument18 pagesAdmin Law MidtermsAnny YanongNo ratings yet

- General American Tank Car Corp. v. Day, 270 U.S. 367 (1926)Document4 pagesGeneral American Tank Car Corp. v. Day, 270 U.S. 367 (1926)Scribd Government DocsNo ratings yet

- TCAD - Travis Central Appraisal District Reappraisal Plan 2015 - 2016Document110 pagesTCAD - Travis Central Appraisal District Reappraisal Plan 2015 - 2016cutmytaxesNo ratings yet

- Williams v. Hagood, 98 U.S. 72 (1878)Document4 pagesWilliams v. Hagood, 98 U.S. 72 (1878)Scribd Government DocsNo ratings yet

- Colonial Pipeline Company, and Other Persons Similarly Situated v. Marcus E. Collins, SR., 921 F.2d 1237, 11th Cir. (1991)Document14 pagesColonial Pipeline Company, and Other Persons Similarly Situated v. Marcus E. Collins, SR., 921 F.2d 1237, 11th Cir. (1991)Scribd Government DocsNo ratings yet

- ABAKADA GURO PARTY LIST VS EXECUTIVE SECRETARY VAT RATE CHALLENGEDocument3 pagesABAKADA GURO PARTY LIST VS EXECUTIVE SECRETARY VAT RATE CHALLENGEAnonymous s2jaDmP5FNo ratings yet

- Ia - Ep: Court Clerk'S Office - Okc Corporation Commission OF OklahomaDocument8 pagesIa - Ep: Court Clerk'S Office - Okc Corporation Commission OF OklahomaKFORNo ratings yet

- Bocea V TevesDocument2 pagesBocea V TevespatrixiaNo ratings yet

- Case DigestDocument39 pagesCase DigestKathleen Joy100% (1)

- Herb Gears Lawsuit Over Tax BreaksDocument14 pagesHerb Gears Lawsuit Over Tax BreaksaselkNo ratings yet

- Reviewer in LGC..Document923 pagesReviewer in LGC..Carmela Paola R. DumlaoNo ratings yet

- Attorney General's OpinionDocument4 pagesAttorney General's OpinionUSA TODAY NetworkNo ratings yet

- 21-109 - SCC - Executive Order Authority Over Facial CoveringsDocument4 pages21-109 - SCC - Executive Order Authority Over Facial CoveringsDougNo ratings yet

- Abakada Guro Party List Vs PurisimaDocument4 pagesAbakada Guro Party List Vs PurisimaDennisgilbert Gonzales100% (1)

- PRR 9106 PDFDocument4 pagesPRR 9106 PDFRecordTrac - City of OaklandNo ratings yet

- Law Making PowerDocument6 pagesLaw Making PowerAlecesse Vim CasinabeNo ratings yet

- COA Decision Upholds Limit on Judges' Allowances from LGUDocument6 pagesCOA Decision Upholds Limit on Judges' Allowances from LGURustom IbañezNo ratings yet

- Piper Letter March 19Document14 pagesPiper Letter March 19jsweigartNo ratings yet

- Helvering v. Powers, 293 U.S. 214 (1934)Document7 pagesHelvering v. Powers, 293 U.S. 214 (1934)Scribd Government DocsNo ratings yet

- Tax Case Digest Sept 9Document31 pagesTax Case Digest Sept 9ARCHIE AJIASNo ratings yet

- ABAKADA v. PURISIMA ruling on delegation of powerDocument2 pagesABAKADA v. PURISIMA ruling on delegation of powerMicaellaNo ratings yet

- Scribd TaxlienDocument2 pagesScribd TaxlienSandy SaenzNo ratings yet

- NSWMA Legal Mayor's LetterDocument3 pagesNSWMA Legal Mayor's LetterDallasObserverNo ratings yet

- ABAKADA Guro v. Executive SecretaryDocument7 pagesABAKADA Guro v. Executive SecretaryAlmarius CadigalNo ratings yet

- Cooperative Development Authority v. Dolefil (Dos Santos)Document3 pagesCooperative Development Authority v. Dolefil (Dos Santos)Tippy Dos SantosNo ratings yet

- Vent v. Brown Final Amended WritDocument50 pagesVent v. Brown Final Amended WritJon OrtizNo ratings yet

- What Is Fiscal AutonomyDocument3 pagesWhat Is Fiscal AutonomymtabcaoNo ratings yet

- Abakada Guro Party List Vs Executive SecretaryDocument8 pagesAbakada Guro Party List Vs Executive SecretaryAndrea TiuNo ratings yet

- Civil Service Commission vs. DBM Facts: Case 1Document23 pagesCivil Service Commission vs. DBM Facts: Case 1Pilacan KarylNo ratings yet

- Public Corporation 2Document22 pagesPublic Corporation 2michael jan de celisNo ratings yet

- CHREA Vs CHRDocument3 pagesCHREA Vs CHRLucifer MorningstarNo ratings yet

- Locgov ReviewerDocument284 pagesLocgov ReviewerGabrielAblolaNo ratings yet

- CA Assessment Appeals ManualDocument179 pagesCA Assessment Appeals ManualwbalsonNo ratings yet

- ANC 8E Did Not Properly Support All Reported Expenditures: February 10, 2015Document14 pagesANC 8E Did Not Properly Support All Reported Expenditures: February 10, 2015congressheightsontheriseNo ratings yet

- United States Court of Appeals, Third CircuitDocument7 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Declaration of Craig Engle in Support Oii' Plaintiff'S Opposition To Deflr, Ndants' Motion For Summary JudgmentDocument33 pagesDeclaration of Craig Engle in Support Oii' Plaintiff'S Opposition To Deflr, Ndants' Motion For Summary JudgmentEquality Case FilesNo ratings yet

- DBM Approval Needed for CHR ReclassificationDocument2 pagesDBM Approval Needed for CHR ReclassificationNica Cielo B. LibunaoNo ratings yet

- NID Board Meeting Agenda For April 12, 2017Document3 pagesNID Board Meeting Agenda For April 12, 2017YubaNetNo ratings yet

- Nevada County Nov. Election Results Nov. 22Document417 pagesNevada County Nov. Election Results Nov. 22YubaNetNo ratings yet

- Nevada County Board of Supervisors May 9, 2017 Meeting AgendaDocument8 pagesNevada County Board of Supervisors May 9, 2017 Meeting AgendaYubaNetNo ratings yet

- NID Board Meeting Agenda April 26, 2017Document3 pagesNID Board Meeting Agenda April 26, 2017YubaNetNo ratings yet

- Nevada County Partial Results at 8:45 PMDocument9 pagesNevada County Partial Results at 8:45 PMYubaNetNo ratings yet

- Nevada County BOS Agenda For Feb. 14, 2017Document11 pagesNevada County BOS Agenda For Feb. 14, 2017YubaNetNo ratings yet

- NID Board Agenda March 22, 2017Document3 pagesNID Board Agenda March 22, 2017YubaNetNo ratings yet

- Nevada County BOS Agenda For April 11, 2017Document9 pagesNevada County BOS Agenda For April 11, 2017YubaNetNo ratings yet

- Nevada County BOS Agenda For March 28Document9 pagesNevada County BOS Agenda For March 28YubaNetNo ratings yet

- Nevada County BOS Agenda For January 24Document12 pagesNevada County BOS Agenda For January 24YubaNetNo ratings yet

- February 28 Nevada County BOS AgendaDocument9 pagesFebruary 28 Nevada County BOS AgendaYubaNetNo ratings yet

- Nevada County Partial Results at 8:45 PMDocument9 pagesNevada County Partial Results at 8:45 PMYubaNetNo ratings yet

- Nevada County BOS Agenda For March 14Document9 pagesNevada County BOS Agenda For March 14YubaNetNo ratings yet

- Ninth Circuit Court of Appeals Ruling On Trump's Travel BanDocument29 pagesNinth Circuit Court of Appeals Ruling On Trump's Travel BanKatie DowdNo ratings yet

- Nevada County BOS Agenda For January 10Document13 pagesNevada County BOS Agenda For January 10YubaNetNo ratings yet

- California Certificate of VoteDocument11 pagesCalifornia Certificate of VoteYubaNetNo ratings yet

- State of Jefferson Petition - Failed To QualifyDocument2 pagesState of Jefferson Petition - Failed To QualifyYubaNetNo ratings yet

- County of Nevada - Official Ballot 2016 General ElectionDocument9 pagesCounty of Nevada - Official Ballot 2016 General ElectionYubaNetNo ratings yet

- Grand Jury of Nevada County Report: Being A Better Board MemDocument15 pagesGrand Jury of Nevada County Report: Being A Better Board MemYubaNetNo ratings yet

- CU16-081626 Hurd v. County of Nevada, Et Al - RULING ON OSC Re PRELIM INJ - March 17 2016 PDFDocument9 pagesCU16-081626 Hurd v. County of Nevada, Et Al - RULING ON OSC Re PRELIM INJ - March 17 2016 PDFYubaNetNo ratings yet

- Nevada County BOS Meeting Agenda For November 8, 2016Document10 pagesNevada County BOS Meeting Agenda For November 8, 2016YubaNetNo ratings yet

- Nevada County Partial Results at 8:45 PMDocument9 pagesNevada County Partial Results at 8:45 PMYubaNetNo ratings yet

- Grand Jury Report: The Value of TransparencyDocument7 pagesGrand Jury Report: The Value of TransparencyYubaNetNo ratings yet

- Nevada County BOS Agenda For Dec. 8, 2015Document18 pagesNevada County BOS Agenda For Dec. 8, 2015YubaNetNo ratings yet

- Nevada County BOS Agenda For Oct. 27Document11 pagesNevada County BOS Agenda For Oct. 27YubaNetNo ratings yet

- Nevada County BOS Agenda For Nov. 10Document10 pagesNevada County BOS Agenda For Nov. 10YubaNetNo ratings yet

- Higgins Area Fire Protection District Special Election Measure VDocument7 pagesHiggins Area Fire Protection District Special Election Measure VYubaNetNo ratings yet

- Nevada County BOS Agenda For July 21, 2015Document10 pagesNevada County BOS Agenda For July 21, 2015YubaNetNo ratings yet

- Washington Water&Fire District Meeting Agenda For June 25, 2015Document4 pagesWashington Water&Fire District Meeting Agenda For June 25, 2015YubaNetNo ratings yet

- Week 7 MAT101Document28 pagesWeek 7 MAT101Rexsielyn BarquerosNo ratings yet

- Perang Inggeris Burma PDFDocument12 pagesPerang Inggeris Burma PDFMaslino JustinNo ratings yet

- Walder - The Remaking of The Chinese Working ClassDocument47 pagesWalder - The Remaking of The Chinese Working ClassWukurdNo ratings yet

- Residents Free Days Balboa ParkDocument1 pageResidents Free Days Balboa ParkmarcelaNo ratings yet

- Crash Course 34Document3 pagesCrash Course 34Gurmani RNo ratings yet

- Referencias DynaSand ETAP.01.06Document19 pagesReferencias DynaSand ETAP.01.06ana luciaNo ratings yet

- Swing States' Votes Impact Federal SpendingDocument13 pagesSwing States' Votes Impact Federal SpendingozzravenNo ratings yet

- Rutland County GOP LeadershipDocument1 pageRutland County GOP LeadershipRutlandGOPNo ratings yet

- Party 2: Dr. Ramiz J. Aliyev Ukraine: Non-Circumvention, Non-Disclosure, Confidentiality AgreementDocument2 pagesParty 2: Dr. Ramiz J. Aliyev Ukraine: Non-Circumvention, Non-Disclosure, Confidentiality AgreementAmaliri GeoffreyNo ratings yet

- S.B. 43Document22 pagesS.B. 43Circa NewsNo ratings yet

- Copar Pumice Co., Inc. v. Tidwell, 603 F.3d 780, 10th Cir. (2010)Document42 pagesCopar Pumice Co., Inc. v. Tidwell, 603 F.3d 780, 10th Cir. (2010)Scribd Government DocsNo ratings yet

- Critical Meme AnalysisDocument6 pagesCritical Meme Analysisapi-337716184No ratings yet

- Jurisprudence Notes - Nature and Scope of JurisprudenceDocument11 pagesJurisprudence Notes - Nature and Scope of JurisprudenceMoniruzzaman Juror100% (4)

- Agnew and Cashel v. St. Louis CountyDocument31 pagesAgnew and Cashel v. St. Louis CountyKelsi AndersonNo ratings yet

- Joseph R. Ledbetter v. Koss Construction, 153 F.3d 727, 10th Cir. (1998)Document2 pagesJoseph R. Ledbetter v. Koss Construction, 153 F.3d 727, 10th Cir. (1998)Scribd Government DocsNo ratings yet

- 12.17.22 Letter To WW Community - Antisemitic GraffitiDocument2 pages12.17.22 Letter To WW Community - Antisemitic GraffitiParents' Coalition of Montgomery County, MarylandNo ratings yet

- Singapore Court of Appeals' Decision Awarding Marcos' Ill-Gotten Wealth To PNBDocument72 pagesSingapore Court of Appeals' Decision Awarding Marcos' Ill-Gotten Wealth To PNBBlogWatchNo ratings yet

- Judicial Activism vs RestraintDocument26 pagesJudicial Activism vs RestraintAishani ChakrabortyNo ratings yet

- Overseas or Away From VictoriaDocument2 pagesOverseas or Away From VictoriaSargurusivaNo ratings yet

- A Guide To The Characters in The Buddha of SuburbiaDocument5 pagesA Guide To The Characters in The Buddha of SuburbiaM.ZubairNo ratings yet

- Difference Between Home and School Language-1Document20 pagesDifference Between Home and School Language-1Reshma R S100% (1)

- Why Bharat Matters Mapping Indias Rise As A Civilisational StateDocument2 pagesWhy Bharat Matters Mapping Indias Rise As A Civilisational Statevaibhav chaudhariNo ratings yet

- Adr Notes 1 PDFDocument9 pagesAdr Notes 1 PDFYanhicoh CySa100% (6)

- Republic of The PhilippinesDocument3 pagesRepublic of The PhilippinesVin Grace Tiqui - GuzmanNo ratings yet

- BRICS Summit 2017 highlights growing economic cooperationDocument84 pagesBRICS Summit 2017 highlights growing economic cooperationMallikarjuna SharmaNo ratings yet

- Outsourcing Strategies ChallengesDocument21 pagesOutsourcing Strategies ChallengesshivenderNo ratings yet

- Deutsche Bank AG Manila Branch v. Commissioner of Internal Revenue, G.R. No. 18850, August 19, 2013Document2 pagesDeutsche Bank AG Manila Branch v. Commissioner of Internal Revenue, G.R. No. 18850, August 19, 2013Dominique VasalloNo ratings yet

- Edfd261 Assignment 2Document7 pagesEdfd261 Assignment 2api-253728480No ratings yet

- CPDprovider PHYSICALTHERAPY-71818Document7 pagesCPDprovider PHYSICALTHERAPY-71818PRC Board100% (1)

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- The Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityFrom EverandThe Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityNo ratings yet

- Broadway General Manager: Demystifying the Most Important and Least Understood Role in Show BusinessFrom EverandBroadway General Manager: Demystifying the Most Important and Least Understood Role in Show BusinessNo ratings yet

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- Fundamentals of Theatrical Design: A Guide to the Basics of Scenic, Costume, and Lighting DesignFrom EverandFundamentals of Theatrical Design: A Guide to the Basics of Scenic, Costume, and Lighting DesignRating: 3.5 out of 5 stars3.5/5 (3)

- Digital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetFrom EverandDigital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetNo ratings yet

- What Are You Laughing At?: How to Write Humor for Screenplays, Stories, and MoreFrom EverandWhat Are You Laughing At?: How to Write Humor for Screenplays, Stories, and MoreRating: 4 out of 5 stars4/5 (2)

- Law of Contract Made Simple for LaymenFrom EverandLaw of Contract Made Simple for LaymenRating: 4.5 out of 5 stars4.5/5 (9)

- Crash Course Business Agreements and ContractsFrom EverandCrash Course Business Agreements and ContractsRating: 3 out of 5 stars3/5 (3)

- Contract Law for Serious Entrepreneurs: Know What the Attorneys KnowFrom EverandContract Law for Serious Entrepreneurs: Know What the Attorneys KnowRating: 1 out of 5 stars1/5 (1)

- How to Win Your Case In Traffic Court Without a LawyerFrom EverandHow to Win Your Case In Traffic Court Without a LawyerRating: 4 out of 5 stars4/5 (5)

- How to Win Your Case in Small Claims Court Without a LawyerFrom EverandHow to Win Your Case in Small Claims Court Without a LawyerRating: 5 out of 5 stars5/5 (1)

- Independent Film Producing: How to Produce a Low-Budget Feature FilmFrom EverandIndependent Film Producing: How to Produce a Low-Budget Feature FilmNo ratings yet

- Starting Your Career as a Photo Stylist: A Comprehensive Guide to Photo Shoots, Marketing, Business, Fashion, Wardrobe, Off Figure, Product, Prop, Room Sets, and Food StylingFrom EverandStarting Your Career as a Photo Stylist: A Comprehensive Guide to Photo Shoots, Marketing, Business, Fashion, Wardrobe, Off Figure, Product, Prop, Room Sets, and Food StylingRating: 5 out of 5 stars5/5 (1)

- How to Improvise a Full-Length Play: The Art of Spontaneous TheaterFrom EverandHow to Improvise a Full-Length Play: The Art of Spontaneous TheaterNo ratings yet

- The Perfect Stage Crew: The Complete Technical Guide for High School, College, and Community TheaterFrom EverandThe Perfect Stage Crew: The Complete Technical Guide for High School, College, and Community TheaterNo ratings yet