Professional Documents

Culture Documents

Chap 009

Uploaded by

MarshalDSOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 009

Uploaded by

MarshalDSCopyright:

Available Formats

McGraw-Hill/Irwin Copyright 2008 by The McGraw-Hill Companies, Inc.

All rights reserved

CHAPTER

9

Risk and Return

Lessons from Market

History

Slide 2

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

Key Concepts and Skills

Know how to calculate the return on an

investment

Know how to calculate the standard deviation

of an investments returns

Understand the historical returns and risks on

various types of investments

Understand the importance of the normal

distribution

Understand the difference between arithmetic

and geometric average returns

Slide 3

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

Chapter Outline

9.1 Returns

9.2 Holding-Period Returns

9.3 Return Statistics

9.4 Average Stock Returns and Risk-Free

Returns

9.5 Risk Statistics

9.6 More on Average Returns

Slide 4

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

9.1 Returns

Dollar Returns

the sum of the cash

received and the change in

value of the asset, in

dollars.

Time 0 1

Initial

investment

Ending

market value

Dividends

Percentage Returns

the sum of the cash received and the

change in value of the asset divided by

the initial investment.

Slide 5

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

Dollar Return = Dividend + Change in Market

Value

Returns

yield gains capital yield dividend

ue market val beginning

ue market val in change dividend

ue market val beginning

return dollar

return percentage

+ =

+

=

=

Slide 6

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

Returns: Example

Suppose you bought 100 shares of Wal-Mart

(WMT) one year ago today at $25. Over the

last year, you received $20 in dividends (20

cents per share 100 shares). At the end of

the year, the stock sells for $30. How did you

do?

Quite well. You invested $25 100 = $2,500.

At the end of the year, you have stock worth

$3,000 and cash dividends of $20. Your dollar

gain was $520 = $20 + ($3,000 $2,500).

Your percentage gain for the year is:

20.8% =

$2,500

$520

Slide 7

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

Returns: Example

Dollar Return:

$520 gain

Time 0 1

-$2,500

$3,000

$20

Percentage Return:

20.8% =

$2,500

$520

Slide 8

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

9.2 Holding Period Returns

The holding period return is the return

that an investor would get when

holding an investment over a period

of n years, when the return during

year i is given as r

i

:

1 ) 1 ( ) 1 ( ) 1 (

return period holding

2 1

+ + + =

=

n

r r r

Slide 9

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

Holding Period Return: Example

Suppose your investment provides

the following returns over a four-year

period:

Year Return

1 10%

2 -5%

3 20%

4 15%

% 21 . 44 4421 .

1 ) 15 . 1 ( ) 20 . 1 ( ) 95 (. ) 10 . 1 (

1 ) 1 ( ) 1 ( ) 1 ( ) 1 (

return period holding Your

4 3 2 1

= =

=

+ + + + =

=

r r r r

Slide 10

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

Holding Period Returns

A famous set of studies dealing with rates of

returns on common stocks, bonds, and Treasury

bills was conducted by Roger Ibbotson and Rex

Sinquefield.

They present year-by-year historical rates of

return starting in 1926 for the following five

important types of financial instruments in the

United States:

Large-company Common Stocks

Small-company Common Stocks

Long-term Corporate Bonds

Long-term U.S. Government Bonds

U.S. Treasury Bills

Slide 11

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

9.3 Return Statistics

The history of capital market returns can be

summarized by describing the:

average return

the standard deviation of those returns

the frequency distribution of the returns

T

R R

R

T

) (

1

+ +

=

1

) ( ) ( ) (

2 2

2

2

1

+ +

= =

T

R R R R R R

VAR SD

T

Slide 12

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

Historical Returns, 1926-2004

Source: Stocks, Bonds, Bills, and Inflation 2006 Yearbook, Ibbotson Associates, Inc., Chicago (annually updates work by

Roger G. Ibbotson and Rex A. Sinquefield). All rights reserved.

90% + 90% 0%

Average Standard

Series Annual Return Deviation Distribution

Large Company Stocks 12.3% 20.2%

Small Company Stocks 17.4 32.9

Long-Term Corporate Bonds 6.2 8.5

Long-Term Government Bonds 5.8 9.2

U.S. Treasury Bills 3.8 3.1

Inflation 3.1 4.3

Slide 13

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

9.4 Average Stock Returns and Risk-Free

Returns

The Risk Premium is the added return (over and

above the risk-free rate) resulting from bearing risk.

One of the most significant observations of stock

market data is the long-run excess of stock return

over the risk-free return.

The average excess return from large company common

stocks for the period 1926 through 2005 was:

8.5% = 12.3% 3.8%

The average excess return from small company common

stocks for the period 1926 through 2005 was:

13.6% = 17.4% 3.8%

The average excess return from long-term corporate

bonds for the period 1926 through 2005 was:

2.4% = 6.2% 3.8%

Slide 14

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

Risk Premia

Suppose that The Wall Street Journal

announced that the current rate for one-year

Treasury bills is 5%.

What is the expected return on the market of

small-company stocks?

Recall that the average excess return on small

company common stocks for the period 1926

through 2005 was 13.6%.

Given a risk-free rate of 5%, we have an

expected return on the market of small-company

stocks of 18.6% = 13.6% + 5%

Slide 15

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

The Risk-Return Tradeoff

2%

4%

6%

8%

10%

12%

14%

16%

18%

0% 5% 10% 15% 20% 25% 30% 35%

Annual Return Standard Deviation

A

n

n

u

a

l

R

e

t

u

r

n

A

v

e

r

a

g

e

T-Bonds

T-Bills

Large-Company Stocks

Small-Company Stocks

Slide 16

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

9.5 Risk Statistics

There is no universally agreed-upon

definition of risk.

The measures of risk that we discuss

are variance and standard deviation.

The standard deviation is the standard

statistical measure of the spread of a sample,

and it will be the measure we use most of this

time.

Its interpretation is facilitated by a discussion

of the normal distribution.

Slide 17

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

Normal Distribution

A large enough sample drawn from a

normal distribution looks like a bell-shaped

curve.

Probability

Return on

large company common

stocks

99.74%

3o

48.3%

2o

28.1%

1o

7.9%

0

12.3%

+ 1o

32.5%

+ 2o

52.7%

+ 3o

72.9%

The probability that a yearly return

will fall within 20.2 percent of the

mean of 12.3 percent will be

approximately 2/3.

68.26%

95.44%

Slide 18

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

Normal Distribution

The 20.2% standard deviation we

found for large stock returns from

1926 through 2005 can now be

interpreted in the following way: if

stock returns are approximately

normally distributed, the probability

that a yearly return will fall within 20.2

percent of the mean of 12.3% will be

approximately 2/3.

Slide 19

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

Example Return and Variance

Year Actual

Return

Average

Return

Deviation from

the Mean

Squared

Deviation

1 .15 .105 .045 .002025

2 .09 .105 -.015 .000225

3 .06 .105 -.045 .002025

4 .12 .105 .015 .000225

Totals .00 .0045

Variance = .0045 / (4-1) = .0015 Standard Deviation = .03873

Slide 20

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

9.6 More on Average Returns

Arithmetic average return earned in an

average period over multiple periods

Geometric average average compound return

per period over multiple periods

The geometric average will be less than the

arithmetic average unless all the returns are

equal.

Which is better?

The arithmetic average is overly optimistic for long

horizons.

The geometric average is overly pessimistic for short

horizons.

Slide 21

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

Geometric Return: Example

Recall our earlier example:

Year Return

1 10%

2 -5%

3 20%

4 15%

% 58 . 9 095844 .

1 ) 15 . 1 ( ) 20 . 1 ( ) 95 (. ) 10 . 1 (

) 1 ( ) 1 ( ) 1 ( ) 1 ( ) 1 (

return average Geometric

4

4 3 2 1

4

= =

=

+ + + + = +

=

g

g

r

r r r r r

So, our investor made an average of 9.58% per year,

realizing a holding period return of 44.21%.

4

) 095844 . 1 ( 4421 . 1 =

Slide 22

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

Geometric Return: Example

Note that the geometric average is

not the same as the arithmetic

average:

Year Return

1 10%

2 -5%

3 20%

4 15%

% 10

4

% 15 % 20 % 5 % 10

4

return average Arithmetic

4 3 2 1

=

+ +

=

+ + +

=

r r r r

Slide 23

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

Forecasting Return

To address the time relation in forecasting

returns, use Blumes formula:

Average Arithmetic

N

T N

verage GeometricA

N

T

T R

|

.

|

\

|

+

|

.

|

\

|

=

1 1

1

) (

where, T is the forecast horizon and N is the number of

years of historical data we are working with. T must be

less than N.

Slide 24

Copyright 2008 by The McGraw-Hill Companies, Inc. All rights reserved McGraw-Hill/Irwin

Quick Quiz

Which of the investments discussed has

had the highest average return and risk

premium?

Which of the investments discussed has

had the highest standard deviation?

Why is the normal distribution informative?

What is the difference between arithmetic

and geometric averages?

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Request Travel Approval Email TemplateDocument1 pageRequest Travel Approval Email TemplateM AsaduzzamanNo ratings yet

- Efektivitas Pengaruh Kebijakan Moneter Dalam Kinerja Sektor PerbankanDocument14 pagesEfektivitas Pengaruh Kebijakan Moneter Dalam Kinerja Sektor PerbankanBagus MahatvaNo ratings yet

- 13 Marginal CostingDocument5 pages13 Marginal CostingPriyanka ShewaleNo ratings yet

- Contem ReviewerDocument9 pagesContem ReviewerKenNo ratings yet

- D01 - Scope of Work-Jenna McClendonDocument3 pagesD01 - Scope of Work-Jenna McClendonadriana sierraNo ratings yet

- Partnership Formation Answer KeyDocument8 pagesPartnership Formation Answer KeyNichole Joy XielSera TanNo ratings yet

- ISLAMIYA ENGLISH SCHOOL MONEY CHAPTER EXERCISESDocument1 pageISLAMIYA ENGLISH SCHOOL MONEY CHAPTER EXERCISESeverly.No ratings yet

- China Daily - April 12 2018Document24 pagesChina Daily - April 12 2018Boki VaskeNo ratings yet

- Espresso Cash Flow Statement SolutionDocument2 pagesEspresso Cash Flow Statement SolutionraviNo ratings yet

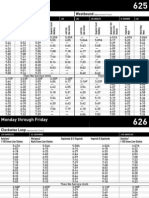

- LA Metro - 625-626Document4 pagesLA Metro - 625-626cartographicaNo ratings yet

- India Inc's Baby Steps On Long Road To Normalcy: HE Conomic ImesDocument12 pagesIndia Inc's Baby Steps On Long Road To Normalcy: HE Conomic ImesShobhashree PandaNo ratings yet

- Description of Empirical Data Sets: 1. The ExamplesDocument3 pagesDescription of Empirical Data Sets: 1. The ExamplesMANOJ KUMARNo ratings yet

- IptspDocument6 pagesIptspMD ABUL KHAYERNo ratings yet

- Final EA SusWatch Ebulletin February 2019Document3 pagesFinal EA SusWatch Ebulletin February 2019Kimbowa RichardNo ratings yet

- Introduction To Macroeconomics: Unit 1Document178 pagesIntroduction To Macroeconomics: Unit 1Navraj BhandariNo ratings yet

- Practical IFRSDocument282 pagesPractical IFRSahmadqasqas100% (1)

- SHFL Posting With AddressDocument8 pagesSHFL Posting With AddressPrachi diwateNo ratings yet

- Dhakras Bhairavi SDocument137 pagesDhakras Bhairavi SReshma PawarNo ratings yet

- Integration of Renewable Energie Sources Into The German Power Supply System in The 2015-2020 Period With Outlook To 2025Document587 pagesIntegration of Renewable Energie Sources Into The German Power Supply System in The 2015-2020 Period With Outlook To 2025tdropulicNo ratings yet

- Sources of FinanceDocument3 pagesSources of FinanceAero Vhing BucaoNo ratings yet

- Advanced Engineering Economy & CostingDocument84 pagesAdvanced Engineering Economy & Costingduraiprakash83No ratings yet

- (Maria Lipman, Nikolay Petrov (Eds.) ) The State of (B-Ok - Xyz)Document165 pages(Maria Lipman, Nikolay Petrov (Eds.) ) The State of (B-Ok - Xyz)gootNo ratings yet

- COCO Service Provider Detailed Adv. Madhya PradeshDocument5 pagesCOCO Service Provider Detailed Adv. Madhya PradeshdashpcNo ratings yet

- Understanding essay questionsDocument11 pagesUnderstanding essay questionsfirstclassNo ratings yet

- Emirates Airlines Pilots Salary StructureDocument6 pagesEmirates Airlines Pilots Salary StructureShreyas Sinha0% (1)

- Book No. 13 Accountancy Financial Sybcom FinalDocument380 pagesBook No. 13 Accountancy Financial Sybcom FinalPratik DevarkarNo ratings yet

- Rent Agreement - (Name of The Landlord) S/o - (Father's Name of TheDocument2 pagesRent Agreement - (Name of The Landlord) S/o - (Father's Name of TheAshish kumarNo ratings yet

- Ch-3 Financial Market in BangladeshDocument8 pagesCh-3 Financial Market in Bangladeshlabonno350% (1)

- Beximco Pharmaceuticals International Business AnalysisDocument5 pagesBeximco Pharmaceuticals International Business AnalysisEhsan KarimNo ratings yet

- AE 5 Midterm TopicDocument9 pagesAE 5 Midterm TopicMary Ann GurreaNo ratings yet