Professional Documents

Culture Documents

International Financial Institutions: 1. World Bank

Uploaded by

Tabish AhmedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

International Financial Institutions: 1. World Bank

Uploaded by

Tabish AhmedCopyright:

Available Formats

International Financial Institutions

1. WORLD BANK

International Bank for Reconstruction and Development (IBRD)

International Finance Corporation (IFC)

International Development Association (IDA)

International Centre for the Settlement of Investment Disputes (ICSID)

Multilateral Investment Guarantee Agency (MIGA, est.)

2. INTERNATIONAL MONETARY FUNDS (IMF)

3. AFRICAN DEVELOPMENT BANK (AFDB)

4. EUROPEAN BOARD RECONSTRUCTION DEVELOPMENT

(EBRD)

5. ASIAN DEVELOPMENT BANK (ADB)

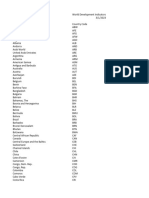

IMF

The IMF came into formal existence in December 1945, when

its first 29 member countries signed its Articles of Agreement.

It provides a forum for cooperation on international monetary

problems

It facilitates the growth of international trade, thus promoting

job creation, economic growth, and poverty reduction;

It promotes exchange rate stability and an open system of

international payments; and

Lend countries foreign exchange when needed, on a temporary

basis and under adequate safeguards, to help them address

balance of payments problems.

Functions of IMF

policy advice to government and central banks based on

analysis of economic trends and cross-country experiences;

research, statistics, forecasts, and analysis based on tracking of

global, regional, and individual economies and markets;

loans to help countries overcome economic difficulties;

concessional loans to help fight poverty in developing

countries; and

technical assistance and training to help countries improve the

management of their economies.

World Bank

The World Bank Group is comprised of five separate entities:

the International Bank for Reconstruction and Development (IBRD,

est. 1945),

the International Finance Corporation (IFC, est. 1956),

the International Development Association (IDA, est. 1960),

the International Centre for the Settlement of Investment Disputes

(ICSID, est. 1966) and the

Multilateral Investment Guarantee Agency (MIGA, est. 1988).

International Bank for Reconstruction and

Development (IBRD)

The International Bank for Reconstruction and Development (IBRD) aims to reduce

poverty in middle-income and creditworthy poorer countries by promoting sustainable

development through loans, guarantees, risk management products, and analytical

and advisory services.

Established in 1944 as the original institution of the World Bank Group, IBRD is

structured like a cooperative that is owned and operated for the benefit of its 187

member countries .

IBRD raises most of its funds on the world's financial markets and has become one of

the most established borrowers since issuing its first bond in 1947.

The income that IBRD has generated over the years has allowed it to fund

development activities and to ensure its financial strength, which enables it to borrow

at low cost and offer clients good borrowing terms.

International Development Association (IDA)

To promote economic development in the world's poorest

countriesthose that cannot afford to borrow from the IBRD.

164 member countries

till., 2002,About 81 countries were eligible to borrow

sources of financing :members' subscriptions; periodic

"replenishments" provided by richer members and certain special

contributions; and transfer of income from the IBRD and repayments

on IDA credits.

loan term is more than 20years and interest is lowest

IFC

It functions as the biggest source of equity and debt financing for

private sector projects that are taking place in the developing

nations

Loan term period is usually10 and comparatively high interest rate

182 member countries

MIGA

Its current membership stands at 175 countries.

Basically, to promote FDI in developing countries

offering political risk insurance to investors and lenders, and by

helping developing countries attract and retain private investment.

MIGA is a member of the World Bank Group. Mission is to promote

foreign direct investment (FDI) into developing countries to help

support economic growth, reduce poverty, and improve people's

lives.

International Centre for Settlement of Investment Disputes (ICSID)

ICSID is an autonomous international institution established under the Convention on

the Settlement of Investment Disputes between States and Nationals of Other States

(the ICSID or the Washington Convention).

Signatory member states 157. Of these, 147 States have also deposited their

instruments of ratification, acceptance or approval of the Convention.

The Convention sets forth ICSID's mandate, organization and core functions. The

primary purpose of ICSID is to provide facilities for conciliation and arbitration of

international investment disputes.

The ICSID Convention is a multilateral treaty formulated by the Executive Directors of

the International Bank for Reconstruction and Development (the World Bank).

It was opened for signature on March 18, 1965 and entered into force on October 14,

1966.

You might also like

- World Bank.Document22 pagesWorld Bank.Kashish GuptaNo ratings yet

- Institutions International Financial: by Sachin N. ShettyDocument33 pagesInstitutions International Financial: by Sachin N. ShettyPrasseedha Raghavan100% (1)

- From Goatherd to Governor. The Autobiography of Edwin Mtei: The Autobiography of Edwin MteiFrom EverandFrom Goatherd to Governor. The Autobiography of Edwin Mtei: The Autobiography of Edwin MteiNo ratings yet

- BRICSDocument16 pagesBRICSAdarsh Nayan100% (2)

- World Bank AssignmentDocument16 pagesWorld Bank AssignmentAarzoo Dalal50% (2)

- Impediments To The Success of SAARCDocument12 pagesImpediments To The Success of SAARCSabahat AnsariNo ratings yet

- Funds Programmes Specialized Agencies and Others United NationsDocument6 pagesFunds Programmes Specialized Agencies and Others United NationsAjinath DahiphaleNo ratings yet

- The World Bank and Its CriticsDocument14 pagesThe World Bank and Its CriticsNayana SinghNo ratings yet

- International Financial InstitutionsDocument12 pagesInternational Financial InstitutionsKashif ShakeelNo ratings yet

- New International Economic OrderDocument20 pagesNew International Economic Orderrazz_22100% (1)

- Meaning & Scope of IRDocument6 pagesMeaning & Scope of IRTom JarryNo ratings yet

- 1. Понятие международных организаций. International Organizations The History of International OrganizationsDocument24 pages1. Понятие международных организаций. International Organizations The History of International OrganizationsLina VelichkoNo ratings yet

- Impact of IMF On Pakistan Economy: 17221598-144 (Neha Durani) 17221598-154 (Saira Irtaza) 17221598-145 (Fizba Tahir)Document46 pagesImpact of IMF On Pakistan Economy: 17221598-144 (Neha Durani) 17221598-154 (Saira Irtaza) 17221598-145 (Fizba Tahir)Neha KhanNo ratings yet

- International Economic InstitutionsDocument43 pagesInternational Economic Institutionssangeetagoele100% (1)

- IMF's Impact on Pakistan's EconomyDocument35 pagesIMF's Impact on Pakistan's EconomyKamran Noor80% (10)

- IMF Promotes Global Economic StabilityDocument4 pagesIMF Promotes Global Economic StabilityDwani SangviNo ratings yet

- Assignment-GAAT WTODocument9 pagesAssignment-GAAT WTOMohit Manandhar100% (1)

- The World BankDocument30 pagesThe World BankBhagirath AshiyaNo ratings yet

- Role of World Bank in Developing CountriesDocument19 pagesRole of World Bank in Developing Countriesdrmz4you79% (14)

- Foreign Policy of PakDocument12 pagesForeign Policy of PakUmair Saeed Khan92% (12)

- International Monetary FundDocument16 pagesInternational Monetary Fundakshatsigh100% (2)

- World BankDocument20 pagesWorld Banksaad124No ratings yet

- International Financial Institutions: MMS (University of Mumbai)Document28 pagesInternational Financial Institutions: MMS (University of Mumbai)asadNo ratings yet

- International Financial InstitutionsDocument34 pagesInternational Financial InstitutionsMelvin Jan ReyesNo ratings yet

- World BankDocument12 pagesWorld BankAravind Jayan100% (1)

- Organisation of Islamic CooperationDocument17 pagesOrganisation of Islamic CooperationUsama IdreesNo ratings yet

- ImfDocument20 pagesImfRohit GuptaNo ratings yet

- Monetary Policy-Presentation SlidesDocument12 pagesMonetary Policy-Presentation SlidesMuhammad Talha Khan100% (2)

- United Nations: Objectives, Achievements & Failures: B.A VI Semester, PLB 651Document16 pagesUnited Nations: Objectives, Achievements & Failures: B.A VI Semester, PLB 651Siddharth TamangNo ratings yet

- IMF AND IndiaDocument32 pagesIMF AND IndiaJeevan PatelNo ratings yet

- IBRDDocument12 pagesIBRDNarender Saini100% (1)

- Accounting for Cash and Short-Term InvestmentsDocument13 pagesAccounting for Cash and Short-Term InvestmentsZeshan ChNo ratings yet

- IPE Theories, Concepts, and Models ExplainedDocument45 pagesIPE Theories, Concepts, and Models Explainedsaad ali0% (1)

- An Exclusive Project Report On United Nations OrganizationDocument15 pagesAn Exclusive Project Report On United Nations OrganizationDilip JaniNo ratings yet

- United Nations OrganisationDocument4 pagesUnited Nations OrganisationSanjay SaptarshiNo ratings yet

- International OrganizationsDocument15 pagesInternational OrganizationsDahl Abella Talosig100% (1)

- History of International OrganizationsDocument11 pagesHistory of International OrganizationsUsman SheikhNo ratings yet

- Imf A Blessing or Curse For Pakistan S e 2 PDFDocument7 pagesImf A Blessing or Curse For Pakistan S e 2 PDFinayyatNo ratings yet

- UN AssignmentDocument6 pagesUN AssignmentErika Judith Bivera100% (1)

- The Euromarkets1Document22 pagesThe Euromarkets1Shruti AshokNo ratings yet

- United Nation OrganizationDocument23 pagesUnited Nation OrganizationAnonymous 0PAfX0UO100% (1)

- Financial System of BangladeshDocument24 pagesFinancial System of Bangladeshmoin06100% (2)

- Bangladesh's Role in the WTODocument10 pagesBangladesh's Role in the WTOরাকিব অয়নNo ratings yet

- The World Bank and IMF in Developing Countries: Helping or Hindering? International Journal of African and Asian Studies. Vol. 28, 2016Document12 pagesThe World Bank and IMF in Developing Countries: Helping or Hindering? International Journal of African and Asian Studies. Vol. 28, 2016Mauricio GamNo ratings yet

- International Financial InstitutionsDocument3 pagesInternational Financial InstitutionsYae ChanNo ratings yet

- World BankDocument38 pagesWorld Bankvishaldadhich100% (4)

- Entry Norms of WTODocument4 pagesEntry Norms of WTOAmandeep SinghNo ratings yet

- Democracy in MalaysiaDocument8 pagesDemocracy in MalaysiaMohamad Saiful AminNo ratings yet

- Notes On WTO (World Trade Organization)Document3 pagesNotes On WTO (World Trade Organization)Anand Verma0% (1)

- Regional Economic IntegrationDocument25 pagesRegional Economic IntegrationRajiv ShahNo ratings yet

- Types of Mutual FundsDocument7 pagesTypes of Mutual FundsMegha JhawarNo ratings yet

- Nature and Scope of International MarketingDocument8 pagesNature and Scope of International MarketingMr. Rain ManNo ratings yet

- History and Evolution of SAARCDocument21 pagesHistory and Evolution of SAARCSneha Mehta100% (2)

- What Is A Garnishee OrderDocument5 pagesWhat Is A Garnishee Ordergazi faisalNo ratings yet

- History and Development of Islamic Banking SystemsDocument33 pagesHistory and Development of Islamic Banking SystemsSaori Hara100% (3)

- Effect of Wto On India: AssignmentDocument6 pagesEffect of Wto On India: AssignmentDarpan BhattNo ratings yet

- CCCCCCCCC C C C CCC C: C C C C CDocument50 pagesCCCCCCCCC C C C CCC C: C C C C Cpinkeshparvani100% (2)

- Organization of Islamic Cooperation: History, Objectives and ChallengesDocument5 pagesOrganization of Islamic Cooperation: History, Objectives and ChallengesMuhammad JunaidNo ratings yet

- Agencies That Facilitate International FlowsDocument2 pagesAgencies That Facilitate International FlowsLê Thị Ngọc DiễmNo ratings yet

- IMF, World Bank, and other international financial institutionsDocument24 pagesIMF, World Bank, and other international financial institutionsAhmad AbdullahNo ratings yet

- Marketing Intelligence SystemDocument24 pagesMarketing Intelligence SystemTabish AhmedNo ratings yet

- MBA Marketing Research Project On Customer PreferenceDocument80 pagesMBA Marketing Research Project On Customer PreferenceSonu Antony NjaravelilNo ratings yet

- Apple Inc Presentation: Vanita Them Mary Tebby Gibril SophiaDocument35 pagesApple Inc Presentation: Vanita Them Mary Tebby Gibril SophiaRachit ShivNo ratings yet

- Standard Operating Procedure For A Company: 1) Works of Finance DepartmentDocument10 pagesStandard Operating Procedure For A Company: 1) Works of Finance DepartmentTabish AhmedNo ratings yet

- Wto 4Document24 pagesWto 4Tabish AhmedNo ratings yet

- Print Vs ElectronicDocument46 pagesPrint Vs ElectronicTabish Ahmed100% (1)

- Final Report On SavegenieDocument48 pagesFinal Report On SavegenieTabish Ahmed0% (2)

- Print Vs ElectronicDocument46 pagesPrint Vs ElectronicTabish Ahmed100% (1)

- Study of Market Potential of Modular Kitchen in IndiaDocument35 pagesStudy of Market Potential of Modular Kitchen in IndiaTabish Ahmed83% (12)

- Consumer TheoryDocument49 pagesConsumer TheoryTabish Ahmed100% (1)

- FEMA Act regulates foreign exchange transactions in India (38Document13 pagesFEMA Act regulates foreign exchange transactions in India (38Tabish AhmedNo ratings yet

- Life and Health InsuranceDocument10 pagesLife and Health InsuranceTabish AhmedNo ratings yet

- Business Law NotesDocument27 pagesBusiness Law NotesTabish AhmedNo ratings yet

- ECS3702-Cp 12 Test BankDocument5 pagesECS3702-Cp 12 Test BankDeanNo ratings yet

- EcoDocument4 pagesEcoShilpan ShahNo ratings yet

- Voy A Conquistar Tu Amor Fagot-FagotDocument2 pagesVoy A Conquistar Tu Amor Fagot-FagotDaniel AvilaNo ratings yet

- The Law of Comparative Advantage CH 2Document28 pagesThe Law of Comparative Advantage CH 2Dharmajaya SoetotoNo ratings yet

- Importance of International EconomicDocument3 pagesImportance of International Economicrajdeep singh100% (1)

- Baec-102 Ec-02Document8 pagesBaec-102 Ec-02Ashutosh palNo ratings yet

- ECON 351-International Trade-Turab HussainDocument6 pagesECON 351-International Trade-Turab HussainshyasirNo ratings yet

- Mo Billing Recon NewDocument6,447 pagesMo Billing Recon NewsolealiNo ratings yet

- Ec 392 PS 2Document1 pageEc 392 PS 2Pablo MercadoNo ratings yet

- Kelompok 7. Customs UnionDocument23 pagesKelompok 7. Customs Unionsri yuliaNo ratings yet

- API LP - Lpi.infr - XQ Ds2 en Excel v2 5269708Document47 pagesAPI LP - Lpi.infr - XQ Ds2 en Excel v2 5269708Thúy HàNo ratings yet

- Unit I Lessons 1 To 6: A.Hidhayathulla Associate Professor of Economics Jamal Mohamed College Trichy - 2Document31 pagesUnit I Lessons 1 To 6: A.Hidhayathulla Associate Professor of Economics Jamal Mohamed College Trichy - 2Mohammed HarunNo ratings yet

- Core Countries Semi-Periphery Countries and The Periphery CountriesDocument2 pagesCore Countries Semi-Periphery Countries and The Periphery CountriesAnthropologist BaigNo ratings yet

- The Agri Handbook 2013-14Document676 pagesThe Agri Handbook 2013-14Craig Macaskill92% (13)

- India's exports of paintings, drawings and pastels under HS codes 970110 and 970190Document13 pagesIndia's exports of paintings, drawings and pastels under HS codes 970110 and 970190amit08_kecNo ratings yet

- Course Outline For Econ 231Document8 pagesCourse Outline For Econ 231hellothere999No ratings yet

- Differences between inter-regional and international tradeDocument30 pagesDifferences between inter-regional and international tradeSuzi GamingNo ratings yet

- G 20Document2 pagesG 20Tanoj PandeyNo ratings yet

- 10.4324 9781315014562 PreviewpdfDocument22 pages10.4324 9781315014562 PreviewpdfChi Vo Thi KimNo ratings yet

- Elena Pinderhughes Solo On C Jam BluesDocument2 pagesElena Pinderhughes Solo On C Jam BluesDanielNo ratings yet

- The International Economy - Tutorial Topics and Reading ListsDocument6 pagesThe International Economy - Tutorial Topics and Reading ListschyelingyeohNo ratings yet

- Lecture Plan - International EconomicsDocument2 pagesLecture Plan - International Economicsdeepakarora201188No ratings yet

- A Corporate Culture Is Fashioned by A Shared Pattern of All of The Following ExceptDocument26 pagesA Corporate Culture Is Fashioned by A Shared Pattern of All of The Following ExceptEman Mirza22% (9)

- SopDocument7 pagesSopssrini07No ratings yet

- API SP - Pop.totl - Ma.in Ds2 en Excel v2 10226911Document71 pagesAPI SP - Pop.totl - Ma.in Ds2 en Excel v2 10226911mehedy09No ratings yet

- التحليل الفني للشموع اليابانيةDocument22 pagesالتحليل الفني للشموع اليابانيةbousdjiramouradNo ratings yet

- Specialized Credit Institution-InternationalDocument27 pagesSpecialized Credit Institution-InternationalNoaman Ahmed100% (1)

- BEO2003 Group Assignment Sem 2 2022 Sunway KLDocument5 pagesBEO2003 Group Assignment Sem 2 2022 Sunway KLrheaNo ratings yet

- ImfDocument19 pagesImfAashay AgarwalNo ratings yet

- BEC 420 International EconomicsDocument21 pagesBEC 420 International EconomicsPresley SaviyeNo ratings yet