Professional Documents

Culture Documents

Accounting Online Notes

Uploaded by

surfer16920 ratings0% found this document useful (0 votes)

47 views69 pagesCost accounting

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCost accounting

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

47 views69 pagesAccounting Online Notes

Uploaded by

surfer1692Cost accounting

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 69

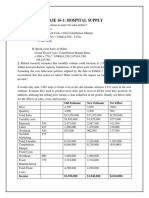

CHAPTER 16

Cost Analysis for Decision Making

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-2

Decision Making

Strategic,

Operational,

and Financial

Planning

Planning and control cycle

Executing

operational

activities

(Managing)

Data collection and

performance feedback

Performance

analysis:

Plans vs.

actual results

(Controlling)

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-3

A relevant cost is a future cost that

differs between alternatives.

Relevant Cost Information

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-4

Will you drive or fly to Colorado for an eight-day spring

break ski trip?

You have gathered the following information to help you with

the decision.

Motel cost is $90 per night.

Meal cost is $25 per day.

Your car insurance is $75 per month.

Kennel cost for your dog is $7 per day.

Round-trip cost of gasoline for your car is $200.

Round-trip airfare and rental car for a week is $700.

Driving requires two days, with an overnight stay, cutting your

time in Colorado by two days.

Relevant Cost Information

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-5

Colorado Spring Break

Drive/Fly Analysis

Cost Drive Fly

Motel 720 $ 720 $

Eating out costs 200 200

Kennel cost 56 56

Car insurance 75 75

Gasoline 200 -

Airfare/rental car - 700

8 days @ $90

8 days @ $25

8 days @ $7

Relevant Cost Information

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-6

Costs do not differ,

so they are not

relevant to decision.

Also, car insurance

is not relevant to

the decision as it

is a past cost.

Relevant Cost Information

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-7

Transportation

costs differ between

the two alternatives,

so they are relevant

to your decision

Are the two extra

days in Colorado

worth the $500

extra cost to fly?

Colorado Spring Break

Drive/Fly Analysis

Cost Drive Fly

Motel 720 $ 720 $

Eating out costs 200 200

Kennel cost 56 56

Car insurance 75 75

Gasoline 200 -

Airfare/rental car - 700

Relevant Cost Information

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-8

Relevant Cost Information

Relevant Irrelevant

Differential Cost -- will differ Allocated Cost -- a common cost that

according to alternative activities has been arbitrarily assigned to a

being considered. product or activity.

Opportunity Cost -- income foregone Sunk Cost -- has already been incurred

by choosing one alternative over and will not change.

another.

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-9

Example: If you were not

attending college, you could

be earning $20,000 per year.

Your opportunity cost of

attending college for one

year is $20,000.

Opportunity costs are not recorded in the

accounting records, but are relevant to

decisions because they are a real sacrifice.

Opportunity Cost

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-10

The decision to accept additional

business should be based on incremental

costs and incremental revenues.

Incremental amounts are those that

occur if the company decides to accept

the new business.

The Special Pricing Decision

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-11

MicroTech currently sells 4,400 laptop

computers. The company has revenue

and expenses as shown below:

Per Unit Total

Sales 2,400 $ 10,560,000 $

Direct materials 800 $ 3,520,000 $

Direct labor 450 1,980,000

Variable overhead 250 1,100,000

Fixed overhead 500 2,500,000

Total manufacturing cost 2,000 $ 9,100,000 $

Sales commission 120 528,000

Total expenses 2,120 $ 9,628,000 $

Operating income 280 $ 932,000 $

The Special Pricing Decision

Based on capacity of 5,000 units:

$2,500,000 5,000 units = $500 per

unit.

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-12

MicroTech receives an offer to purchase

500 of its laptop computers for $1,800 each.

If MicroTech accepts the offer, total fixed

overhead will not increase and a selling

commission will not be paid on the computers

in the special order.

Should MicroTech accept the offer?

The Special Pricing Decision

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-13

First lets look at incorrect reasoning

that leads to an incorrect decision.

Our manufacturing cost

is $2,000 per unit. I

cant sell for $1,800

per unit.

The Special Pricing Decision

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-14

Current

Business

Special

Order

Combined

Sales 10,560 $ 900 $ 11,460 $

Direct materials 3,520 $ 400 $ 3,920 $

Direct labor 1,980 225 2,205

Variable overhead 1,100 125 1,225

Fixed overhead 2,500 0 2,500

Total manufacturing costs 9,100 $ 750 $ 9,850 $

Sales commission 528 0 528

Total expenses 9,628 $ 750 $ 10,378 $

Operating income 932 $ 150 $ 1,082 $

This analysis leads to the correct decision.

The Special Pricing Decision

000s omitted from all numbers.

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-15

Current

Business

Special

Order

Combined

Sales 10,560 $ 900 $ 11,460 $

Direct materials 3,520 $ 400 $ 3,920 $

Direct labor 1,980 225 2,205

Variable overhead 1,100 125 1,225

Fixed overhead 2,500 0 2,500

Total manufacturing costs 9,100 $ 750 $ 9,850 $

Sales commission 528 0 528

Total expenses 9,628 $ 750 $ 10,378 $

Operating income 932 $ 150 $ 1,082 $

The Special Pricing Decision

500 new units $800 = $400,000

500 new units $1,800 selling price = $900,000

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-16

Current

Business

Special

Order

Combined

Sales 10,560 $ 900 $ 11,460 $

Direct materials 3,520 $ 400 $ 3,920 $

Direct labor 1,980 225 2,205

Variable overhead 1,100 125 1,225

Fixed overhead 2,500 0 2,500

Total manufacturing costs 9,100 $ 750 $ 9,850 $

Sales commission 528 0 528

Total expenses 9,628 $ 750 $ 10,378 $

Operating income 932 $ 150 $ 1,082 $

500 new units $450 = $225,000

The Special Pricing Decision

500 new units $250 = $125,000

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-17

Current

Business

Special

Order

Combined

Sales 10,560 $ 900 $ 11,460 $

Direct materials 3,520 $ 400 $ 3,920 $

Direct labor 1,980 225 2,205

Variable overhead 1,100 125 1,225

Fixed overhead 2,500 0 2,500

Total manufacturing costs 9,100 $ 750 $ 9,850 $

Sales commission 528 0 528

Total expenses 9,628 $ 750 $ 10,378 $

Operating income 932 $ 150 $ 1,082 $

Even though the $1,800 selling price is less than the

normal $2,400 selling price, MicroTech should accept the

offer because net income will increase by $150,000.

The Special Pricing Decision

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-18

If MicroTech accepts the offer, net

income will increase by $150,000.

Increase in revenue (500 $1,800) 900,000 $

Increase in variable costs (500 $1,500) 750,000

Increase in net income

150,000 $

We can reach the same results more quickly like this:

Special order contribution margin = $1,800 $1,500 = $300

Change in income = $300 500 units = $150,000.

The Special Pricing Decision

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-19

Should I

continue to make

the part, or should

I buy it?

What will I

do with my

idle facilities if

I buy the part?

The Make or Buy Decision

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-20

The Make or Buy Decision

The relevant cost of making a component

is the cost that can be avoided by buying

the component from an outside supplier.

Decision rule: Costs avoided must be

greater than outside suppliers price to

consider buying the component.

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-21

MicroTech currently makes the motherboards

used in its laptop computers. Unit cost for

manufacturing the motherboards are:

Unit Costs

Direct Material 120 $

Direct Labor 80

Variable Overhead 50

Fixed Overhead 100

Total 350 $

The Make or Buy Decision

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-22

An outside supplier has offered to provide

the motherboards at a cost of $300 each

plus a $5 shipping charge per motherboard.

Twenty percent of the fixed overhead will be

avoided if the motherboards are purchased.

MicroTech has no alternative use for the

facilities.

Should MicroTech accept the offer?

The Make or Buy Decision

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-23

Unit Cost

Direct Material 120 $

Direct Labor 80

Variable Overhead 50

Fixed Overhead (20% of $100) 20

Total 270 $

Differential costs of making (costs avoided if

bought from outside supplier):

The Make or Buy Decision

MicroTech should not pay $305 per unit to an outside

supplier to avoid the $270 per unit differential cost of

making the part ($35 disadvantage).

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-24

If MicroTech buys the motherboards from

the outside supplier, the idle facilities

could be used to expand production of

flat screen monitors that have a

contribution margin of $50 each.

Does this information change MicroTechs

decision?

The Make or Buy Decision

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-25

The real question to answer is,

What is the best use of MicroTechs facilities?

Disadvantage of buying ( $305 - $270 ) 35 $

Opportunity cost of facilities:

Monitor contribution margin 50

Advantage of buying part 15 $

The opportunity cost of facilities changes the decision.

The Make or Buy Decision

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-26

Managers often face the problem of deciding

how scarce resources are going to be utilized.

Usually, fixed costs are not affected by this

particular decision, so management can focus

on maximizing total contribution margin.

Short-Term Allocation

of Scarce Resources

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-27

Integrated Technologies produces two products

and selected data is shown below:

Products

1

2

Selling price per unit $ 300 $ 200

Less: variable expenses per unit 150 100

Contribution margin per unit

150 $ 100 $

Processing time required (hours) 2 1

Short-Term Allocation

of Scarce Resources

If 120 hours of processing time are available,

which product should be produced?

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-28

Lets calculate the contribution margin

per hour of processing time.

Products

1

2

Contribution margin per unit $ 150 $ 100

Time required to produce one unit 2 hours 1 hour

Contribution margin per hour

75 $ 100 $

Short-Term Allocation

of Scarce Resources

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-29

Lets calculate the contribution margin

per hour of processing time.

Products

1

2

Contribution margin per unit $ 150 $ 100

Time required to produce one unit 2 hours 1 hour

Contribution margin per hour

75 $ 100 $

Short-Term Allocation

of Scarce Resources

Product 2 should be emphasized. It is the more

valuable use of processing time, yielding a contribution

margin of $100 per hour as opposed to $75 per hour

for Product 1.

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-30

Lets calculate the contribution margin

per hour of processing time.

Products

1

2

Contribution margin per unit $ 150 $ 100

Time required to produce one unit 2 hours 1 hour

Contribution margin per hour

75 $ 100 $

Short-Term Allocation

of Scarce Resources

If there are no other considerations, the best plan would

be to produce to meet current demand for Product 2 and

then use any time that remains to make Product 1.

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-31

Let s

change

topics.

Long-Run Investment Decisions

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-32

Capital Budgeting

How managers plan significant outlays on

projects that have long-term implications

such as the purchase of new equipment

and introduction of new products.

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-33

Capital budgeting:

Analyzing alternative long-

term investments and deciding

which assets to acquire or sell.

Outcome

is uncertain.

Large amounts of

money are usually

involved.

Investment involves a

long-term commitment.

Decision may be

difficult or impossible

to reverse.

Capital Budgeting

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-34

?

?

?

Limited

Investment

Funds

Plant

Expansion

New

Equipment

Office

Renovation

I will choose the

project with the most

profitable return on

available funds.

Investment Decision Special

Considerations

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-35

Business investments

extend over long periods

of time, so we must

recognize the time value

of money.

Investments that

promise returns earlier

in time are preferable to

those that promise

returns later in time.

Investment Decision Special

Considerations

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-36

The firms cost of capital is

usually regarded as the most

appropriate choice for the

discount rate to determine

the present value of the

investment proposal

being analyzed.

The cost of capital is the

average rate of return the

company must pay to its long-

term creditors and stockholders

for the use of their funds.

Cost of Capital

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-37

Capital Budgeting Techniques

Methods that use present value analysis:

Net present value (NPV).

Internal rate of return (IRR).

Methods that do not use present value analysis:

Payback.

Accounting rate of return.

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-38

A comparison of the present value of

cash inflows with the present value of

cash outflows

Net Present Value (NPV)

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-39

Chose a discount rate the

minimum required rate of return.

Calculate the present

value of cash inflows.

Calculate the present

value of cash outflows.

NPV =

Net Present Value (NPV)

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-40

General decision rule . . .

If the Net Present

Value is . . . Then the Project is . . .

Positive . . .

Acceptable, since it promises a

return greater than the cost of

capital.

Zero . . .

Acceptable, since it promises a

return equal to the cost of

capital.

Negative . . .

Not acceptable, since it

promises a return less than the

cost of capital.

Net Present Value (NPV)

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-41

BoxMover, Inc. is considering the purchase

of a conveyor costing $16,000 with a 7-year

useful life and a $5,000 salvage value that

promises annual net cash flows as shown in

the following table. BoxMovers cost of

capital is 12 percent. Ignoring taxes,

compute the NPV for this investment.

Net Present Value

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-42

Year

Annual Net

Cash Flows

Present

Value of $1

Factor

Present

Value of

Cash Flows

1 4,000 $ 0.89286 3,571 $

2 4,200 0.79719 3,348

3 4,200 0.71178 2,989

4 4,400 0.63552 2,796

5 4,800 0.56743 2,724

6 4,000 0.50663 2,027

7 3,800 0.45235 1,719

salvage 5,000 0.45235 2,262

Total 34,400 $ 21,436 $

Amount to be invested (16,000)

Net present value of investment 5,436 $

Net Present Value

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-43

Year

Annual Net

Cash Flows

Present

Value of $1

Factor

Present

Value of

Cash Flows

1 4,000 $ 0.89286 3,571 $

2 4,200 0.79719 3,348

3 4,200 0.71178 2,989

4 4,400 0.63552 2,796

5 4,800 0.56743 2,724

6 4,000 0.50663 2,027

7 3,800 0.45235 1,719

salvage 5,000 0.45235 2,262

Total 34,400 $ 21,436 $

Amount to be invested (16,000)

Net present value of investment 5,436 $

Present value factors

for 12 percent

Net Present Value

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-44

Year

Annual Net

Cash Flows

Present

Value of $1

Factor

Present

Value of

Cash Flows

1 4,000 $ 0.89286 3,571 $

2 4,200 0.79719 3,348

3 4,200 0.71178 2,989

4 4,400 0.63552 2,796

5 4,800 0.56743 2,724

6 4,000 0.50663 2,027

7 3,800 0.45235 1,719

salvage 5,000 0.45235 2,262

Total 34,400 $ 21,436 $

Amount to be invested (16,000)

Net present value of investment 5,436 $

A positive net present value indicates that this

project earns more than 12 percent, so the

investment should be made.

Net Present Value

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-45

Brown Company can buy a new machine for

$96,000 that will save $20,000 cash per year in

operating costs. If the machine has a useful life of

10 years and Browns cost of capital return is 12

percent, what is the NPV? Ignore taxes.

a. $ 4,300

b. $12,700

c. $11,000

d. $17,000

Net Present Value (NPV)

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-46

Brown Company can buy a new machine for

$96,000 that will save $20,000 cash per year in

operating costs. If the machine has a useful life of

10 years and Browns cost of capital return is 12

percent, what is the NPV? Ignore taxes.

a. $ 4,300

b. $12,700

c. $11,000

d. $17,000

Using the present value of an annuity

PV of inflows = $20,000 5.650 = $113,000

NPV = $113,000 - $96,000 = $17,000

Net Present Value (NPV)

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-47

Calculate the NPV if Brown Companys cost of

capital is 15 percent instead of 12 percent.

Note that the NPV is smaller

using the larger interest rate.

Using the present value of an annuity

PV of inflows = $20,000 5.019 = $100,380

NPV = $100,380 - $96,000 = $4,380

Net Present Value (NPV)

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-48

Ranking Investment Projects

Profitability Present value of cash inflows

index Investment required

=

A B

Present value of cash inflows $81,000 $6,000

Investment required 80,000 5,000

Profitability index 1.01 1.20

Investment

The higher the profitability index, the

more desirable the project.

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-49

The actual rate of return that will be

earned by a proposed investment.

The interest rate that equates the present

value of inflows and outflows from an

investment project the discount rate at

which NPV = 0.

Internal Rate of Return (IRR)

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-50

Decker Company can purchase a new

machine at a cost of $104,320 that will save

$20,000 per year in cash operating costs.

The machine has a 10-year life.

Internal Rate of Return (IRR)

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-51

Future cash flows are the same every

year in this example, so we can

calculate the internal rate of return as

follows:

Investment required

Net annual cash flows

PV factor for the

internal rate of return

=

$104, 320

$20,000

= 5.216

Internal Rate of Return (IRR)

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-52

Find the 10-period row, move

across until you find the factor

5.216. Look at the top of the column

and you find a rate of 14%.

Periods 10% 12% 14%

1 0.909 0.893 0.877

2 1.736 1.690 1.647

. . . . . . . . . . . .

9 5.759 5.328 4.946

10 6.145 5.650 5.216

Using the present value of an annuity of $1 table . . .

Internal Rate of Return (IRR)

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-53

Decker Company can purchase a new

machine at a cost of $104,320 that will save

$20,000 per year in cash operating costs.

The machine has a 10-year life.

Internal Rate of Return (IRR)

The internal rate of return on

this project is 14%.

If the internal rate of return is equal to

or greater than the companys required

rate of return, the project is acceptable.

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-54

If cash inflows are unequal, trial and error

solution will result if present value tables

are used.

Sophisticated business calculators and

electronic spreadsheets can be used to

easily solve these problems.

Internal Rate of Return (IRR)

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-55

Some Analytical Considerations

Sensitivity analysis and post audits are

helpful in dealing with estimates.

Cash flows far into the future are often not

considered because of uncertainty and a

small impact on present values.

Cash flows are assumed to occur

at the end of the year.

Some projects will require additional

investments over time.

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-56

Some Analytical Considerations

Often, after-tax cash flow can be estimated by

adding depreciation to income.

Increased working capital is initially treated as

an additional investment (cash outflow) and

as a cash inflow if recovered at

the end of the projects life.

Least cost projects, often required

by law, will have negative NPVs.

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-57

Jones company is considering purchasing a

machine with a 5-year life and $5,000 salvage value.

Cost and revenue information

Cost of machine

$ 55,000

Revenue 76,000 $

Cost of goods sold 50,000

Gross profit 26,000 $

Cash operating costs 5,000 $

Depreciation 10,000 15,000

Pretax income 11,000 $

Income tax 4,400

After-tax income 6,600 $

($55,000 - $5,000) 5 years

Some Analytical Considerations

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-58

Most capital budgeting techniques use

annual net cash flow.

Depreciation is not a cash outflow.

Annual net income 6,600 $

Add annual depreciation 10,000

Annual net cash flow 16,600 $

Some Analytical Considerations

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-59

Payback Period

The payback period of an investment

is the number of years it will take to

recover the amount of the investment.

Managers prefer investing in projects

with shorter payback periods.

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-60

TexCo wants to

install a machine

that costs $17,000

and has an 8-year

useful life with

$1,000 salvage

value. Annual net

cash flows are:

Year

Annual Net

Cash Flows

Cumulative

Net Cash

Flows

0 (17,000) $ (17,000) $

1 4,000 (13,000)

2 3,500 (9,500)

3 3,500 (6,000)

4 3,500 (2,500)

5 3,500 1,000

6 3,500 4,500

7 3,000 7,500

8 3,000 10,500

Payback Period

Includes salvage

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-61

Year

Annual Net

Cash Flows

Cumulative

Net Cash

Flows

0 (17,000) $ (17,000) $

1 4,000 (13,000)

2 3,500 (9,500)

3 3,500 (6,000)

4 3,500 (2,500)

5 3,500 1,000

6 3,500 4,500

7 3,000 7,500

8 3,000 10,500

4.7

TexCo recovers the

$17,000 purchase price

between years 4

and 5, about 4.7

years for the

payback period.

Payback Period

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-62

Ignores the

time value

of money.

Ignores cash

flows after

the payback

period.

Payback Period

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-63

Consider two projects, each with a five-year

life and each costing $6,000.

Project One Project Two

Net Cash Net Cash

Year Inflows Inflows

1 2,000 $ 1,000 $

2 2,000 1,000

3 2,000 1,000

4 2,000 1,000

5 2,000 1,000,000

Would you invest in Project One just because

it has a shorter payback period?

Payback Period

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-64

The accounting rate of return focuses on

accounting income instead of cash flows.

Accounting Rate of Return

Accounting Operating income

rate of return Average investment

=

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-65

Reconsider the $17,000 investment being

considered by TexCo. The annual operating

income is $2,000. Compute the

accounting rate of return.

Accounting Rate of Return

Accounting Operating income

rate of return Average investment

=

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-66

Reconsider the $17,000 investment being

considered by TexCo. The annual operating

income is $2,000. Compute the

accounting rate of return.

Accounting Rate of Return

Cash flow 4,000 $

Depreciation 2,000

Operating income 2,000 $

Depreciation = ($17,000 - 1,000) 8 years

Accounting Operating income

rate of return Average investment

=

Beginning book value + Ending book value

2

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-67

Accounting Rate of Return

Accounting $2,000

rate of return $9,000

=

$17,000 + $1,000

2

Reconsider the $17,000 investment being

considered by TexCo. The annual operating

income is $2,000. Compute the

accounting rate of return.

= 22.2%

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-68

Depreciation may

be calculated

several ways.

Income may vary

from year to year.

Time value of

money is ignored.

So why

would I ever

want to use

this method

anyway?

Accounting Rate of Return

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

16-69

End of Chapter 16

You might also like

- ACG2071 Managerial AccountingDocument31 pagesACG2071 Managerial Accountinganon_117931956No ratings yet

- Relevant Costing Sample ProblemsDocument29 pagesRelevant Costing Sample ProblemsAngela Padua100% (2)

- Managerial Accounting Case ProblemDocument14 pagesManagerial Accounting Case ProblemFrancis SarmientoNo ratings yet

- Chapter 4 decision making guideDocument28 pagesChapter 4 decision making guideranjithaNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Make or BuyDocument51 pagesMake or BuySitaramanjaneyulu ManthaNo ratings yet

- Solution Manual For Managerial Accounting 7th Edition James Jiambalvo DownloadDocument25 pagesSolution Manual For Managerial Accounting 7th Edition James Jiambalvo DownloadGaryLeemtno100% (45)

- Lecture 10 Relevant Costing PDFDocument49 pagesLecture 10 Relevant Costing PDFShweta Sridhar57% (7)

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 12Document34 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 12jasperkennedy078% (27)

- Carbapenamses in Antibiotic ResistanceDocument53 pagesCarbapenamses in Antibiotic Resistancetummalapalli venkateswara raoNo ratings yet

- Talon Star Trek Mod v0.2Document4 pagesTalon Star Trek Mod v0.2EdmundBlackadderIVNo ratings yet

- BL3B User Manual PDFDocument142 pagesBL3B User Manual PDFRandy VanegasNo ratings yet

- CGL Flame - Proof - MotorsDocument15 pagesCGL Flame - Proof - MotorspriteshNo ratings yet

- Docx 1Document10 pagesDocx 1Anna Marie AlferezNo ratings yet

- Principles of Marketing Eighth Edition Philip Kotler and Gary ArmstrongDocument17 pagesPrinciples of Marketing Eighth Edition Philip Kotler and Gary ArmstrongJunaid KhalidNo ratings yet

- Chap 016Document69 pagesChap 016Pooja Grover ShandilyaNo ratings yet

- Decsion-Making Using Incremental PrincipleDocument7 pagesDecsion-Making Using Incremental Principlek61.2212155104No ratings yet

- 8.ACCT112 Relevant Costing - LMSDocument42 pages8.ACCT112 Relevant Costing - LMSKelvin Lim Wei LiangNo ratings yet

- BA Problems 2Document6 pagesBA Problems 2rassaNo ratings yet

- Study ProbesDocument48 pagesStudy ProbesRose VeeNo ratings yet

- MakeORBuy NumericalsDocument6 pagesMakeORBuy Numericalsgurjit20No ratings yet

- Responsibility Accounting Decision MakingDocument32 pagesResponsibility Accounting Decision MakingChokie NavarroNo ratings yet

- MGNT1010 - Business Justification (Group 2)Document6 pagesMGNT1010 - Business Justification (Group 2)Lai Ka ChunNo ratings yet

- COMA Mid Term - 2022-23 V1 - SolutionsDocument6 pagesCOMA Mid Term - 2022-23 V1 - SolutionssurajNo ratings yet

- Week 9 - Appendix A - Pricing Products and ServicesDocument15 pagesWeek 9 - Appendix A - Pricing Products and ServicesAnh Thư PhạmNo ratings yet

- Analisis Diferencial y Fijación de PreciosDocument43 pagesAnalisis Diferencial y Fijación de Preciosnutrihome100% (1)

- TargetcostingDocument4 pagesTargetcostingDebarpan HaldarNo ratings yet

- Chap11 - Flexible Budgets and Overhead AnalysisDocument58 pagesChap11 - Flexible Budgets and Overhead AnalysisMuhammad Munim100% (1)

- Coma Quiz 6 KeyDocument20 pagesComa Quiz 6 KeyMD TARIQUE NOORNo ratings yet

- Week 3Document11 pagesWeek 3Sophie DaoNo ratings yet

- Chap1 MgtscienceDocument20 pagesChap1 Mgtsciencearianne chiuNo ratings yet

- Problem SolvingDocument2 pagesProblem SolvingGileah ZuasolaNo ratings yet

- GNB 11 12eDocument78 pagesGNB 11 12eAtif SaeedNo ratings yet

- Class 1 NotesDocument57 pagesClass 1 Notesbenny1011No ratings yet

- Case 16-1: Hospital Supply: 1. What Is The Break-Even Volume in Units? in Sales Dollars?Document6 pagesCase 16-1: Hospital Supply: 1. What Is The Break-Even Volume in Units? in Sales Dollars?Lalit SapkaleNo ratings yet

- Virginia Tech ACIS Study GuideDocument10 pagesVirginia Tech ACIS Study Guidebilly bobNo ratings yet

- Quiz KeysDocument11 pagesQuiz KeyspragadeeshwaranNo ratings yet

- Accounting Info Helps Investors & Lenders Make DecisionsDocument4 pagesAccounting Info Helps Investors & Lenders Make DecisionsNadjah JNo ratings yet

- Individual Assignment 2A - Aisyah Nuralam 29123362Document4 pagesIndividual Assignment 2A - Aisyah Nuralam 29123362Aisyah NuralamNo ratings yet

- Lecture 3-Linear ProgrammingDocument40 pagesLecture 3-Linear ProgrammingadmiremukureNo ratings yet

- Decisions Involving Alternative ChoicesDocument42 pagesDecisions Involving Alternative Choicesvaibhavmakkar54No ratings yet

- Incremental Analysis ProblemsDocument10 pagesIncremental Analysis ProblemsLiyana Chua0% (1)

- 4 5852725223857587726Document6 pages4 5852725223857587726survivalofthepolyNo ratings yet

- Make or Buy Analysis and Target CostingDocument14 pagesMake or Buy Analysis and Target CostingGloriana FokNo ratings yet

- BUS 5110 Written Assignment Unit 4Document5 pagesBUS 5110 Written Assignment Unit 4Roba HassanNo ratings yet

- On Tap Ke Toan Quan Tri 1 Quiz Ke Toan Quan TriDocument45 pagesOn Tap Ke Toan Quan Tri 1 Quiz Ke Toan Quan TriPhan HieuNo ratings yet

- Final Key 2519Document2 pagesFinal Key 2519DanielchrsNo ratings yet

- Accounting Management MAY 2' 2019 Final Test: $405,000 / $225 1,800 Units Sold 1,800 + 400 2,200 UnitsDocument2 pagesAccounting Management MAY 2' 2019 Final Test: $405,000 / $225 1,800 Units Sold 1,800 + 400 2,200 UnitsDanielchrsNo ratings yet

- Relevant Decision FactorsDocument7 pagesRelevant Decision FactorsFreya Dela Calzada0% (1)

- 321 HWK Week Two NewDocument2 pages321 HWK Week Two NewAshish BhallaNo ratings yet

- Study ProbesDocument64 pagesStudy ProbesEvan Jordan100% (1)

- Chapter 19 QuizzDocument6 pagesChapter 19 QuizzmattNo ratings yet

- Final Managerial 2014 SolutionDocument8 pagesFinal Managerial 2014 SolutionRanim HfaidhiaNo ratings yet

- Chapter 9 Flexible Budget & Overhead AnalysisDocument66 pagesChapter 9 Flexible Budget & Overhead AnalysisVhum PogiNo ratings yet

- BUS 5110 Managerial Accounting Unit 4 WRDocument5 pagesBUS 5110 Managerial Accounting Unit 4 WRkuashask2No ratings yet

- ACCT 505 Week 6 Quiz Segment Reporting and Relevant Costs For DecisionsDocument7 pagesACCT 505 Week 6 Quiz Segment Reporting and Relevant Costs For DecisionsNatasha DeclanNo ratings yet

- Day 7Document35 pagesDay 7muthurajmsmNo ratings yet

- Solutions CH 1 For StudentsDocument20 pagesSolutions CH 1 For Studentsاكاديمية RNo ratings yet

- Target Costing and Consumer Profitability AnalysisDocument32 pagesTarget Costing and Consumer Profitability AnalysisMuhammad AsadNo ratings yet

- Variable Cost Analysis Using High-Low MethodDocument6 pagesVariable Cost Analysis Using High-Low MethodApoorva DhimarNo ratings yet

- A to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationFrom EverandA to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationNo ratings yet

- Business in the Cloud: What Every Business Needs to Know About Cloud ComputingFrom EverandBusiness in the Cloud: What Every Business Needs to Know About Cloud ComputingRating: 4 out of 5 stars4/5 (1)

- Software Rules: How the Next Generation of Enterprise Applications Will Increase Strategic EffectivenessFrom EverandSoftware Rules: How the Next Generation of Enterprise Applications Will Increase Strategic EffectivenessNo ratings yet

- Fish Investment ProfileDocument5 pagesFish Investment Profilesurfer1692No ratings yet

- AGL ResourcesDocument11 pagesAGL Resourcessurfer1692No ratings yet

- AGL ResourcesDocument11 pagesAGL Resourcessurfer1692No ratings yet

- Accounting Online NotesDocument69 pagesAccounting Online Notessurfer1692No ratings yet

- BA II Plus 說明書Document114 pagesBA II Plus 說明書qaztemp01No ratings yet

- Relation of Jurisprudence With Other Social Sciences - LLB NotesDocument4 pagesRelation of Jurisprudence With Other Social Sciences - LLB NotesPranjaliBawaneNo ratings yet

- Recent Advances in Active Metal Brazing of Ceramics and Process-S12540-019-00536-4Document12 pagesRecent Advances in Active Metal Brazing of Ceramics and Process-S12540-019-00536-4sebjangNo ratings yet

- ĐỀ CƯƠNG ANH 9 - CK2 (23-24)Document7 pagesĐỀ CƯƠNG ANH 9 - CK2 (23-24)thuyhagl2710No ratings yet

- Introduction To Global Positioning System: Anil Rai I.A.S.R.I., New Delhi - 110012Document19 pagesIntroduction To Global Positioning System: Anil Rai I.A.S.R.I., New Delhi - 110012vinothrathinamNo ratings yet

- Galley cleaning hazards and controlsDocument9 pagesGalley cleaning hazards and controlsRosalie RosalesNo ratings yet

- Issue 189Document38 pagesIssue 189Oncampus.net100% (1)

- Sheet (1) : An Iron Ring Has A Cross-Sectional Area of 3 CMDocument2 pagesSheet (1) : An Iron Ring Has A Cross-Sectional Area of 3 CMKhalifa MohamedNo ratings yet

- Deep Learning Based Eye Gaze Tracking For Automotive Applications An Auto-Keras ApproachDocument4 pagesDeep Learning Based Eye Gaze Tracking For Automotive Applications An Auto-Keras ApproachVibhor ChaubeyNo ratings yet

- 114 ArDocument254 pages114 ArJothishNo ratings yet

- Raptor SQ2804 Users Manual English v2.12Document68 pagesRaptor SQ2804 Users Manual English v2.12JaimeNo ratings yet

- Irc SP 65-2005 PDFDocument32 pagesIrc SP 65-2005 PDFAjay Kumar JainNo ratings yet

- Batool2019 Article ANanocompositePreparedFromMagn PDFDocument10 pagesBatool2019 Article ANanocompositePreparedFromMagn PDFmazharNo ratings yet

- Ace3 1122.03 GB PDFDocument16 pagesAce3 1122.03 GB PDFArpit VermaNo ratings yet

- Confined Space SafetyDocument33 pagesConfined Space SafetyEneyo VictorNo ratings yet

- Module 3 Paired and Two Sample T TestDocument18 pagesModule 3 Paired and Two Sample T TestLastica, Geralyn Mae F.No ratings yet

- Performance of a Pelton WheelDocument17 pagesPerformance of a Pelton Wheellimakupang_matNo ratings yet

- tsb16 0008 PDFDocument1 pagetsb16 0008 PDFCandy QuailNo ratings yet

- FRABA - Absolute - Encoder / PLC - 1 (CPU 314C-2 PN/DP) / Program BlocksDocument3 pagesFRABA - Absolute - Encoder / PLC - 1 (CPU 314C-2 PN/DP) / Program BlocksAhmed YacoubNo ratings yet

- Working With Session ParametersDocument10 pagesWorking With Session ParametersyprajuNo ratings yet

- Classification of Methods of MeasurementsDocument60 pagesClassification of Methods of MeasurementsVenkat Krishna100% (2)

- Imp RssDocument8 pagesImp RssPriya SharmaNo ratings yet

- AP World History: Islamic Empires and Scientific AdvancementDocument55 pagesAP World History: Islamic Empires and Scientific AdvancementJa'TasiaNo ratings yet

- Chapter 2 Literature ReviewDocument10 pagesChapter 2 Literature ReviewSharan BvpNo ratings yet

- Roll Covering Letter LathiaDocument6 pagesRoll Covering Letter LathiaPankaj PandeyNo ratings yet

- Heads of Departments - 13102021Document2 pagesHeads of Departments - 13102021Indian LawyerNo ratings yet