Professional Documents

Culture Documents

Derivatives and RM

Uploaded by

Michael WardOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Derivatives and RM

Uploaded by

Michael WardCopyright:

Available Formats

Derivatives & Risk Management

1

2

Introduction

Like options, forward and futures contracts

are derivative securities.

Derivative security is a financial security that is a

claim on another security or underlying asset.

Derivatives can be used to speculate on price

changes in attempts to gain profit or they can

be used to hedge against price changes in

attempts to reduce risk. In both cases, we

will compare strategies using options versus

using futures.

3

Both forward and futures contracts lock in a

price today for the purchase or sale of

something in a future time period

E.g., for the sale or purchase of commodities

like gold, canola, oil, pork bellies, or for the sale

or purchase of financial instruments such as

currencies, stock indices, bonds.

Futures contracts are standardized and

traded on formal exchange; forwards are

negotiated between individual parties.

Forward and Futures Contracts

4

Example of using a forward or

futures contract

COP Ltd., a canola-oil producer, goes long

in a contract with a price specified as $395

per metric tonne for 20 metric tonnes to be

delivered in September.

The long position means COP has a contract

to buy the canola. The payment of

$395/tonne 20 tonnes will be made in

September when the canola is delivered.

5

Futures and Forwards

Unlike option contracts, futures and

forwards commit both parties to the

contract to take a specified action

The party who has a short position in the

futures or forward contract has

committed to sell the good at the

specified price in the future.

Having a long position means you are

committed to buy the good at the

specified price in the future.

6

Futures and Forwards

No money changes hands between

the long and short parties at the

initial time the contracts are made

Only at the maturity of the forward or

futures contract will the long party pay

money to the short party and the short

party will provide the good to the long

party.

7

The initial margin requirement

Both the long and the short parties

must deposit money in their

brokerage accounts.

Typically 10% of the total value of the

contract

Not a down payment, but instead a

security deposit to ensure the contract

will be honored

8

Initial Margin Requirement

Example

Manohar has just taken a long position in a

futures contract for 100 ounces of gold to

be delivered in January. Magda has just

taken a short position in the same contract.

The futures price is $380 per ounce.

The initial margin requirement is 10%

9

Marking to market

At the end of each trading day, all futures

contracts are rewritten to the new closing

futures price.

I.e., the price on the contract is changed.

Included in this process, cash is added or

subtracted from the parties brokerage

accounts so as to offset the change in the

futures price.

The combination of the rewritten contract and

the cash addition or subtraction makes the

investor indifferent to the marking to market

and allows for standardized contracts for

delivery at the same time to trade at the same

price.

10

Hedging with Futures

For some business or personal reason, you

either need to purchase or sell the

underlying asset in the future.

Go long or short in the futures contract and

you effectively lock in the purchase or sale

price today. The net of the marking to

market and the changes in futures prices

results in you paying or receiving the

original futures price

I.e., you have eliminated price risk.

Types of Hedging

Long Hedge

Short Hedge

Cross Hedge

11

12

Speculating with Futures

Speculating involves going long (or

short) in a futures contract when the

underlying asset is NOT needed to be

purchased (or sold) in the future time

period.

Enter into the contract, profit or lose due

to futures price changes and marking to

market, do an offsetting position to get

out of the contract and take the money

from the brokerage account.

13

Should hedging or speculating be

done?

Speculating: If the market is informationally efficient,

then the NPV from speculating should be 0.

Hedging: Remember, expected return is related to

risk. If risk is hedged away, then expected return will

drop.

Investors wont pay extra for a hedged firm just

because some risk is eliminated (investors can easily

diversify risk on their own).

However, if the corporate hedging reduces costs that

investors cannot reduce through personal

diversification, then hedging may add value for the

shareholders. E.g., if the expected costs of financial

distress are reduced due to hedging, there should be

more corporate value left for shareholders.

What is an option?

The option is a right to buy 100 shares, or to

sell 100 shares.

Every option has four specific features:

1. It relates to a specific stock or other

security, called the underlying security.

2. It is a right to buy (call) or sell (put), and

every option controls 100 shares of stock.

3. A specific strike price is the fixed price

at which the option can be exercised.

4. Every option has a fixed expiration date.

After that date, the option is worthless.

Option an

intangible right

bought or sold

by a trader to

control 100

shares of a

security; it

expires on a

specific date in

the future.

Type of option

There are two types of options, calls

and puts.

A call grants its owner the right, but not the obligation, to

buy 100 shares of stock.

This right relates to a specific underlying security, at a

fixed strike price, and expires on a specified date in

the future.

Options can be bought (a long position) or sold (a short

position). When you sell an option, you grant the

option right to the person on the other side of the

trade.

17

18

19

20

21

22

Option Premium

Option Premium primarily consists of two

components- Intrinsic Value and Time Value.

Option price/ premium= Intrinsic value + Time value

The intrinsic value of an option is equal to the amount

by which the option is in-the-money i.e. the amount

an option buyer will realize make (the option seller

will loose), before adjusting the premium, if he

exercises the option instantly

Only in-the-money options have intrinsic value and all

out-of-the-money or at-the-money options have zero

intrinsic value

Intrinsic value of an option can never be negative

Option Premium- Extrinsic Value

The time value of an option is the component which

takes care of future risk for seller of an option.

This value depends on time to expiration of the option

and volatility in the prices of the underlying asset

Mathematically, time value of an option is equal to

difference between option premium and its intrinsic

value

In case of out-of-the-money option or at-the-money

option, the entire premium is the time value of an option

Time value of an option cannot be negative

23

What are the three steps of corporate

risk management?

1. Identify the risks faced by the firm.

2. Measure the potential impact of the identified

risks.

3. Decide how each relevant risk should be handled.

24

What can companies do to minimize

or reduce risk exposure?

Transfer risk to an insurance company by paying

periodic premiums.

Transfer functions that produce risk to third parties.

Purchase derivative contracts to reduce input and

financial risks.

Take actions to reduce the probability of occurrence

of adverse events and the magnitude associated

with such adverse events.

25

SWAP

SWAP is a derivative instrument in which counterparties exchange cash

flows of one party's financial instrument for those of the other party's

financial instrument.

Exchange of one security for another to change the maturity (bonds),

quality of issues (stocks or bonds), or because investment objectives have

changed.

If firms in separate countries have comparative advantages on interest

rates, then a swap could benefit both firms. For example, one firm may

have a lower fixed interest rate, while another has access to a lower

floating interest rate. These firms could swap to take advantage of the

lower rates.

TYPES

Currency swaps

Interest rate swaps

Credit swaps

Commodity swaps

Equity swaps

What is Currency SWAP

A swap that involves the exchange of principal and

interest in one currency for the same in another

currency.

For example, suppose a U.S.-based company needs to

acquire Swiss francs and a Swiss-based company needs

to acquire U.S. dollars. These two companies could

arrange to swap currencies by establishing an interest

rate, an agreed upon amount and a common maturity

date for the exchange.

FEATURES

Currency swaps are over-the-counter derivatives

and are closely related to interest rate swaps.

Unlike interest rate swaps, currency swaps can

involve the exchange of the principal.

USES

To secure cheaper debt (by borrowing at the

best available rate regardless of currency and

then swapping for debt in desired currency

using a back-to-back-loan)

To hedge against (reduce exposure to)

exchange rate fluctuations

Convert liability/investment from one currency

to another

31

For example, a firm with fixed-rate debt that

expects interest rates to fall can change

fixed-rate debt to floating-rate debt.

In this case, the firm would enter into a pay

floating/receive fixed interest rate swap.

Interest Rate Swaps

32

Bank A is a AAA-rated international bank located in the U.K.

that wishes to raise $10,000,000 to finance floating-rate

Eurodollar loans.

Bank A is considering issuing 5-year fixed-rate Eurodollar

bonds at 10 percent.

It would make more sense for the bank to issue floating-

rate notes at LIBOR to finance the floating-rate

Eurodollar loans.

Example

33

Company B is a BBB-rated U.S. company. It needs

$10,000,000 to finance an investment with a five-year

economic life, and it would prefer to borrow at a fixed rate.

Firm B is considering issuing 5-year fixed-rate Eurodollar

bonds at 11.75 percent.

Alternatively, Firm B can raise the money by issuing 5-

year floating rate notes at LIBOR + percent.

Firm B would prefer to borrow at a fixed rate.

Example

34

The borrowing opportunities of the two firms are shown in the

following table.

COMPANY B BANK A DI FFERENTI AL

Fixed rate 11.75% 10% 1.75%

Floating rate LIBOR + 0.50% LIBOR 0.50%

Example

35

Bank A has an absolute advantage in borrowing relative to

Company B

Nonetheless, Company B has a comparative advantage in

borrowing floating, while Bank A has a comparative

advantage in borrowing fixed.

That is, the two together can borrow more cheaply if Bank A

borrows fixed, while Company B borrows floating.

Example

You might also like

- Derivatives 120821000932 Phpapp02Document54 pagesDerivatives 120821000932 Phpapp02Choco ChocoNo ratings yet

- Financial DerivavtivesDocument22 pagesFinancial DerivavtivesAlfe PinongpongNo ratings yet

- OTC Market Meaning: What is Traded Over-the-CounterDocument6 pagesOTC Market Meaning: What is Traded Over-the-CounterAman NegiNo ratings yet

- Derivatives: Prof Mahesh Kumar Amity Business SchoolDocument56 pagesDerivatives: Prof Mahesh Kumar Amity Business SchoolasifanisNo ratings yet

- Chapter VI DerivativesDocument36 pagesChapter VI Derivativesmulutsega yacobNo ratings yet

- What Does Derivative Mean?Document23 pagesWhat Does Derivative Mean?shrikantyemulNo ratings yet

- International DerivativesDocument56 pagesInternational DerivativesPradyumna SwainNo ratings yet

- Derivatives Explained: Futures, Forwards, Options & SwapsDocument11 pagesDerivatives Explained: Futures, Forwards, Options & SwapsSanchit KaushalNo ratings yet

- Derivatives and Risk Management: Answers To Beginning-Of-Chapter QuestionsDocument13 pagesDerivatives and Risk Management: Answers To Beginning-Of-Chapter QuestionsRiri FahraniNo ratings yet

- Derivatives Note SeminarDocument7 pagesDerivatives Note SeminarCA Vikas NevatiaNo ratings yet

- DERIVATIVES AND RISK MANAGEMENTDocument4 pagesDERIVATIVES AND RISK MANAGEMENTbhumishahNo ratings yet

- CUHK RMSC2001 Chapter 6 NotesDocument17 pagesCUHK RMSC2001 Chapter 6 NotesanthetNo ratings yet

- AMA535: Mathematics of Derivative PricingDocument46 pagesAMA535: Mathematics of Derivative PricingYu XinNo ratings yet

- Accounting for DerivativesDocument9 pagesAccounting for DerivativesEricka AlimNo ratings yet

- Derivatives & OptionsDocument30 pagesDerivatives & OptionsakshastarNo ratings yet

- Financial Security: Best Online Brokers)Document7 pagesFinancial Security: Best Online Brokers)Khabele LenkoeNo ratings yet

- Types of Financial Risk and Derivatives ExplainedDocument4 pagesTypes of Financial Risk and Derivatives ExplainedChristine CaridoNo ratings yet

- Derivatives and Commodity ExchangesDocument53 pagesDerivatives and Commodity ExchangesMonika GoelNo ratings yet

- Foreign Exchange Exposures - IFMDocument7 pagesForeign Exchange Exposures - IFMDivya SindheyNo ratings yet

- RatiosDocument15 pagesRatiosAmirah AzmiNo ratings yet

- Accounting for Derivatives and Hedge Relationships under PFRS 9Document9 pagesAccounting for Derivatives and Hedge Relationships under PFRS 9Mary Yvonne AresNo ratings yet

- Risk management and derivativesDocument8 pagesRisk management and derivativesIm NayeonNo ratings yet

- Derivatives: You Need To Know About Derivatives TradingDocument35 pagesDerivatives: You Need To Know About Derivatives TradingPooja mahadikNo ratings yet

- Derivatives Instruments GuideDocument20 pagesDerivatives Instruments GuideKhyati MistryNo ratings yet

- WLH Finance CompilationDocument58 pagesWLH Finance CompilationSandhya S 17240No ratings yet

- Topic 8 Managing Risk New 1233829259255133 3Document17 pagesTopic 8 Managing Risk New 1233829259255133 3aasif383No ratings yet

- WORK SHEET - Financial Derivatives: Q1) Enumerate The Basic Differences Between Forward and Futures ContractsDocument5 pagesWORK SHEET - Financial Derivatives: Q1) Enumerate The Basic Differences Between Forward and Futures ContractsBhavesh RathiNo ratings yet

- Week 8 Financial Instruments - Hedging - Options and SwapsDocument20 pagesWeek 8 Financial Instruments - Hedging - Options and SwapsOv NomaanNo ratings yet

- Derivatives and Risk Management: What Does Forward Contract MeanDocument9 pagesDerivatives and Risk Management: What Does Forward Contract MeanMd Hafizul HaqueNo ratings yet

- Financial Derivative Instruments in Bangladesh: DefinitionDocument4 pagesFinancial Derivative Instruments in Bangladesh: DefinitionJahid AhnafNo ratings yet

- DERIVATIVESDocument30 pagesDERIVATIVESDeepak ParidaNo ratings yet

- What Are FuturesDocument4 pagesWhat Are FuturesGrace G. ServanoNo ratings yet

- Risk Management Cheat Sheet Risk Management Cheat SheetDocument4 pagesRisk Management Cheat Sheet Risk Management Cheat SheetEdithNo ratings yet

- Basis Risk, Options Risk, Structure Risk, and Repricing Risk.Document4 pagesBasis Risk, Options Risk, Structure Risk, and Repricing Risk.Puja DuaNo ratings yet

- FN - 04Document6 pagesFN - 04abhiNo ratings yet

- International Financial Management Techniques To Mitigate RiskDocument27 pagesInternational Financial Management Techniques To Mitigate RiskAsra HakakNo ratings yet

- What is a Futures ContractDocument4 pagesWhat is a Futures Contractareesakhtar100% (1)

- Basics of Investment Banking DomainDocument15 pagesBasics of Investment Banking DomainChakravarthi ChiluveruNo ratings yet

- Reviewed By: DerivativeDocument10 pagesReviewed By: DerivativefrancisNo ratings yet

- FD Bcom Module 1Document75 pagesFD Bcom Module 1Mandy RandiNo ratings yet

- Hedging Strategies ExplainedDocument28 pagesHedging Strategies ExplainedNadeem AhmadNo ratings yet

- DRM-Intro To DerivativesDocument6 pagesDRM-Intro To Derivativeschandu prakashNo ratings yet

- Foreign Currency Derivatives GuideDocument4 pagesForeign Currency Derivatives GuideÂn TrầnNo ratings yet

- Forward and Futures ContractsDocument29 pagesForward and Futures ContractsMaulik ShahNo ratings yet

- Introduction to Derivatives BasicsDocument29 pagesIntroduction to Derivatives BasicsRaheel SiddiquiNo ratings yet

- 02 Lecture21Document29 pages02 Lecture21Ashi GargNo ratings yet

- How Companies Use Derivatives For Hedging & Risk ManagementDocument17 pagesHow Companies Use Derivatives For Hedging & Risk ManagementBinitha B NairNo ratings yet

- Dividend Yield: RecapitalisationDocument6 pagesDividend Yield: RecapitalisationArun NadarNo ratings yet

- What Are DerivativesDocument11 pagesWhat Are DerivativesJayash KaushalNo ratings yet

- Chapter 6Document5 pagesChapter 6Muhammed YismawNo ratings yet

- Derivatives: Introduction To Derivatives: Meaning, Types, Uses and ClassificationDocument17 pagesDerivatives: Introduction To Derivatives: Meaning, Types, Uses and ClassificationAlok PandeyNo ratings yet

- Ca - Final - SFM TheoryDocument13 pagesCa - Final - SFM TheoryPravinn_MahajanNo ratings yet

- Chap001 RevisedDocument43 pagesChap001 Revisedp6yq4n9ykjNo ratings yet

- What Are Futures and ForwardsDocument22 pagesWhat Are Futures and ForwardsMuneeza AzharNo ratings yet

- Interest Rate Derivatives Credit Default Swaps Currency DerivativesDocument30 pagesInterest Rate Derivatives Credit Default Swaps Currency DerivativesAtul JainNo ratings yet

- Basics of DeivativesDocument9 pagesBasics of DeivativesGaurav ThigaleNo ratings yet

- Mortgage Markets and Derivatives - AnswerDocument3 pagesMortgage Markets and Derivatives - AnswerSarang SNo ratings yet

- Understanding Derivatives in 40 CharactersDocument10 pagesUnderstanding Derivatives in 40 CharactersSanjai SivañanthamNo ratings yet

- M M M MDocument46 pagesM M M MajithsubramanianNo ratings yet

- CreativeDocument1 pageCreativeMichael WardNo ratings yet

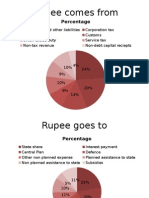

- Rupee Comes From: PercentageDocument2 pagesRupee Comes From: PercentageMichael WardNo ratings yet

- Organisational Ambidexterity Key to Long-Term SuccessDocument15 pagesOrganisational Ambidexterity Key to Long-Term SuccessMichael WardNo ratings yet

- Basel ComitteeDocument26 pagesBasel ComitteeMichael WardNo ratings yet

- AseanDocument15 pagesAseanMichael WardNo ratings yet

- Valuechainanalysis 130703070548 Phpapp01Document36 pagesValuechainanalysis 130703070548 Phpapp01Michael WardNo ratings yet

- Condom Social Marketing in India July232012Document16 pagesCondom Social Marketing in India July232012Michael WardNo ratings yet

- Factors Influencing Consumer Buying BehaviorDocument7 pagesFactors Influencing Consumer Buying BehaviorMichael WardNo ratings yet

- Hindalco CaseDocument33 pagesHindalco CaseMichael WardNo ratings yet

- Hindalco CaseDocument33 pagesHindalco CaseMichael WardNo ratings yet

- Monetary PolicyDocument135 pagesMonetary PolicyMayank ChawlaNo ratings yet

- Group Dynamics Presentation: Concepts, Types, Stages and PrinciplesDocument24 pagesGroup Dynamics Presentation: Concepts, Types, Stages and PrinciplesMichael WardNo ratings yet

- How To Trade For Consistent ReturnsDocument46 pagesHow To Trade For Consistent Returnsliang yuanNo ratings yet

- Vietnam Banks: The Sector To Own Significant Potential Upside in The Next 12 MonthsDocument56 pagesVietnam Banks: The Sector To Own Significant Potential Upside in The Next 12 MonthsViet HoangNo ratings yet

- Question Paper Financial Accounting (MB131) : January 2005Document32 pagesQuestion Paper Financial Accounting (MB131) : January 2005Ujwalsagar SagarNo ratings yet

- Indian Shipping Industry RoleDocument11 pagesIndian Shipping Industry RoleThejasvi AnchanNo ratings yet

- Balance Sheet of Shakti PumpsDocument2 pagesBalance Sheet of Shakti PumpsAnonymous 3OudFL5xNo ratings yet

- SEBI's Disclosures and Investor Protection Guidelines Explained! Do You FeelDocument2 pagesSEBI's Disclosures and Investor Protection Guidelines Explained! Do You Feelabhisheksh100% (2)

- Moneylife 26 October 2017Document68 pagesMoneylife 26 October 2017ADNo ratings yet

- Castillo Et - Al Vs BalinghasayDocument10 pagesCastillo Et - Al Vs BalinghasaySimeon SuanNo ratings yet

- APCRDA Engages Consultant to Support Capital City DevelopmentDocument1 pageAPCRDA Engages Consultant to Support Capital City DevelopmentSettyDinakarrambabaNo ratings yet

- PetronDocument61 pagesPetronTrinity Mae QuinaNo ratings yet

- Anmol Biscuits Limited: Rating Analyst ContactsDocument6 pagesAnmol Biscuits Limited: Rating Analyst ContactsSachin BidNo ratings yet

- WEF Alternative Investments 2020 FutureDocument59 pagesWEF Alternative Investments 2020 FutureR. Mega MahmudiaNo ratings yet

- Ratio Analysis Guide for Financial Statement EvaluationDocument66 pagesRatio Analysis Guide for Financial Statement Evaluationthella deva prasad100% (2)

- Chapter 21 - Introduction To Derivative MarketsDocument31 pagesChapter 21 - Introduction To Derivative MarketsSaad KhanNo ratings yet

- NOT To Sell in MayDocument23 pagesNOT To Sell in Maynom1237100% (1)

- Royal Dutch Shell PLC Investor's Handbook 2010-2014: Consolidated Balance Sheet (At December 31)Document1 pageRoyal Dutch Shell PLC Investor's Handbook 2010-2014: Consolidated Balance Sheet (At December 31)Shara ValleserNo ratings yet

- BBM 206 BCM 2209 Principles of Finance End Sem Exam Final Jan-Feb 2017Document3 pagesBBM 206 BCM 2209 Principles of Finance End Sem Exam Final Jan-Feb 2017Hillary Odunga100% (1)

- Impact of M&A on Tata Steel and Cours GroupDocument8 pagesImpact of M&A on Tata Steel and Cours Groupaashish0128No ratings yet

- (1st Exam) Taxation 1 - DigestsDocument36 pages(1st Exam) Taxation 1 - DigestsAnonymous kDxt5UNo ratings yet

- Day Trading - Systems & Methods C Le Beau & D W Lucas PDFDocument80 pagesDay Trading - Systems & Methods C Le Beau & D W Lucas PDFElizabeth Hammon100% (1)

- DAR Securities Wire Transfer Instructions February 2023Document2 pagesDAR Securities Wire Transfer Instructions February 2023michaelblaschke973No ratings yet

- Assignment On Payment Methods: Submitted byDocument6 pagesAssignment On Payment Methods: Submitted bySanam ChouhanNo ratings yet

- Intermediate Accounting, Volume 1: Donald E. Kieso PH.D., C.P.ADocument9 pagesIntermediate Accounting, Volume 1: Donald E. Kieso PH.D., C.P.AFitriani AllethaNo ratings yet

- Zuari Industries LimitedDocument32 pagesZuari Industries LimitedSachin AcharyaNo ratings yet

- Notes From Invest Malaysia 2014: KPJ HealthcareDocument7 pagesNotes From Invest Malaysia 2014: KPJ Healthcareaiman_077No ratings yet

- Negotiable Instruments ExplainedDocument50 pagesNegotiable Instruments ExplainedRolly AcunaNo ratings yet

- Study of Tstockmantra Investment - Offered Services, Risk & GainsDocument47 pagesStudy of Tstockmantra Investment - Offered Services, Risk & GainsBHUPENDRANo ratings yet

- RUNNING HEAD: Forex Risk Management ProductsDocument6 pagesRUNNING HEAD: Forex Risk Management ProductsFatima ShahidNo ratings yet

- 4 Property Plant Equipment Classification Acquisition Govt Grant and Borrowing CostDocument11 pages4 Property Plant Equipment Classification Acquisition Govt Grant and Borrowing CostElvie PepitoNo ratings yet

- PQ PQ PQ PQ B/229 B/229 B/229 B/229 Parliamentary Parliamentary Parliamentary Parliamentary Questions Questions Questions QuestionsDocument6 pagesPQ PQ PQ PQ B/229 B/229 B/229 B/229 Parliamentary Parliamentary Parliamentary Parliamentary Questions Questions Questions QuestionsL'express Maurice100% (1)