Professional Documents

Culture Documents

Ch-6 Expected Utility As A Basis For Decision-Making The Evolution of Theories

Uploaded by

simmi330 ratings0% found this document useful (0 votes)

7 views17 pagesOriginal Title

Ch-6 Expected Utility as a Basis for Decision-making The Evolution of Theories.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views17 pagesCh-6 Expected Utility As A Basis For Decision-Making The Evolution of Theories

Uploaded by

simmi33Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 17

CHAPTER – 6

EXPECTED UTILITY AS A BASIS

FOR DECISION-MAKING: THE

EVOLUTION OF THEORIES

Expected Utility

Expected utility rests on the expected utility

hypothesis.

This hypothesis is related with people’s preferences

with regard to their choices that have uncertain

outcomes.

Three main pillars of expected utility are as follows:

Outcomes, which are objects of non-instrumental

preferences.

States are the things outside the decision-maker’s

control which influence the outcome of the

decision.

Acts are objects of the decision-makers

instrumental preferences

EXPECTED VALUE

In the presence of risky outcomes, usually a decision-

maker uses the expected value criterion for an

investment option.

The expected value (EV) is an anticipated value for a

given investment.

The EV is calculated by multiplying each of the

possible outcomes by the likelihood each outcome

will occur, and summing all of those values.

By calculating expected values, investors can choose

the scenario most likely to give them their desired

outcome.

UTILITY

The value of each outcome, measured in terms of real

numbers (mathematical form) is called a utility

DEVELOPMENT OF EXPECTED UTILITY

THEORY

Thought of Expected Utility Theory was

coined initially with the description given in

terms of mathematical explanations given by

Nicolas Bernoulli.

In a letter to Nicolas Bernoulli, Gabriel Cramer

explained that mathematicians estimate

money in proportion to its quantity.

RISK AVERSION AND EXPECTED

MARGINAL UTILITY

Risk aversion implies that the utility function of risk-

averse investors is concave in nature and show

diminishing marginal wealth utility.

Risk-neutral individuals have linear utility functions,

while risk-seeking individuals have convex utility

functions.

Hence the degree of risk aversion can be measured by

the curvature of the utility function.

It is further explained that concave expected utility

theory explains risk-averse behavior for both small-

stake gambles and large-stake gambles observed in

everyday life.

Expected Utility Theory & Loss

Aversion

The highlights of expected utility theory with

reference to loss aversion are given as below:

Investors are consistently deviated to one side only

from the point of view of prediction of risk neutrality

and these deviations are with risk aversion.

There is no relevance with the loss aversion in the

behavior of the investors.

In expected utility theory there is no implication of

calibration theory (comparison of measurement values).

EXPECTED UTILITY THEORY

“Expected utility theory can be defined

as the theory of decision-making

under risk based on a set of outcomes

for preference ordering.”

Expected Utility as a Basis for

Decision-Making

Expected Utility Theory (EUT) states that at the

time of decision-making, the decision maker

chooses among various risky or uncertain

options by comparing their expected utilities

with respect to his need.

EXAMPLES

You don’t know if it’s going to rain, and you

have to decide whether to carry an umbrella.

If you carry an umbrella,

then there are 10 per cent chance you lose

it,

70 per cent chance you carry it around

needlessly,

20 per cent chance you use it.

Expected Utility theory with

Reference to lottery

• A lottery [p1, p2, ..., pn] is a list of

probabilities, where pi is the probability with

the outcome i.

• John Von Neumann and Oskar Morgenstern

developed expected utility theory with

reference to lottery as a financial

instrument.

Assumptions of utility function on lotteries

1. Completeness: which means that as per the

preference of individual lotteries can be ranked.

2. Transitivity: which means that the preferences

among different options are open.

3. Continuity: says that the upper and lower outline

sets of a preference range over lotteries are closed.

4. Monotonicity: means that a gamble which gives a

higher probability to a preferred outcome will be

preferred to one which assigns a lower probability to

a preferred outcome.

5. Substitution: the outcomes of different lotteries

with same probability can be substituted by each

other.

Criticism of Expected Utility

Theory

Many experimental economists agree that concave

expected-utility theory explains systematic, one-sided

deviations from the predictions of risk-neutral models

because of the belief that expected utility theory does

not give right explanation of risk attitudes over modest

stakes of investors in different asset classes. Also if the

investors or subjects considered in experiments are risk-

averse, then they are not expected-utility maximizes.

In order to clarify the fundamental differences between

expected utility theory and other decision theories, the

distinction between expected utility theory and expected

utility models need to be made.

EXPECTED UTILITY MODELS

1. The expected utility of income and

Initial wealth model (EUI & IW)

2. The expected utility of income model

(EUI)

3. The expected utility of terminal

wealth (EUTW)

THE EXPECTED UTILITY OF INCOME

UTILITY AND INITIAL WEALTH (EUI&IW)

MODEL

This model assumes that the prizes are ordered

pairs of amounts of initial wealth and income.

Indifference curves for this model are parallel

straight lines; therefore it is more or less an

expected utility model.

THE EXPECTED UTILITY OF INCOME

(EUI) MODEL

The expected utility of income (EUI) model is

based on the assumption that the prizes are

amounts of income.

The EUI model is mostly used in the theory of

auctions.

THE EXPECTED UTILITY OF TOTAL

WEALTH (EUTW) MODEL

The expected utility of terminal wealth (EUTW)

model is based on the assumption that the gains

are amounts of terminal wealth.

Terminal wealth is expected cash flow in future

by applying mathematical formula

It helps to explain some essential distinctions

among various models to briefly review the

familiar triangle-diagram representation of

indifference curves for simple gambles

You might also like

- HUMAN RESOURCE Accounting and AuditDocument45 pagesHUMAN RESOURCE Accounting and AuditNishu Singla100% (1)

- Question Bank FMDocument4 pagesQuestion Bank FMN Rakesh100% (3)

- International Working Capital ManagementDocument16 pagesInternational Working Capital ManagementSumant Kumar80% (10)

- WCMDocument10 pagesWCMTEJASREE SANIKEYNo ratings yet

- Responsibility CentersDocument6 pagesResponsibility CentersNitesh Pandita100% (1)

- ProjectDocument22 pagesProjectlipikaNo ratings yet

- Wto PPT 121124195716 Phpapp02Document10 pagesWto PPT 121124195716 Phpapp02Raaj KumarNo ratings yet

- International LiquidityDocument19 pagesInternational LiquidityAnu Narayanankutty100% (2)

- Investment Process and CharacteristicsDocument305 pagesInvestment Process and Characteristicsrajvinder deolNo ratings yet

- Syllabus of Shivaji University MBADocument24 pagesSyllabus of Shivaji University MBAmaheshlakade755No ratings yet

- Start & Manage Small Biz in Oman, Essential Skills & Business Plan TemplateDocument2 pagesStart & Manage Small Biz in Oman, Essential Skills & Business Plan TemplatekunalbrabbitNo ratings yet

- Managerial Economics Question Bank BBA-103Document1 pageManagerial Economics Question Bank BBA-103geetainderhanda4430No ratings yet

- Course of International Financial Management PDFDocument1 pageCourse of International Financial Management PDFTarun SrivastavaNo ratings yet

- BBA 603 Entrepreneurship GuideDocument20 pagesBBA 603 Entrepreneurship Guideaditya mishraNo ratings yet

- BFSM Unit IDocument30 pagesBFSM Unit IAbhinayaa SNo ratings yet

- Balance of Payments: International FinanceDocument42 pagesBalance of Payments: International FinanceSoniya Rht0% (1)

- CH 12. Risk Evaluation in Capital BudgetingDocument29 pagesCH 12. Risk Evaluation in Capital BudgetingN-aineel DesaiNo ratings yet

- Research Paper On FIIDocument7 pagesResearch Paper On FIIchitkarashellyNo ratings yet

- Indian Economy Lecture PPT Unit IDocument44 pagesIndian Economy Lecture PPT Unit IAmit Kumar100% (1)

- RNSTE Management NotesDocument71 pagesRNSTE Management Notesantoshdyade100% (1)

- Final MT 6003 New QBDocument27 pagesFinal MT 6003 New QBAshokNo ratings yet

- Capital Adequacy 148Document11 pagesCapital Adequacy 148Bindal Heena100% (1)

- Findings and SuggestionDocument5 pagesFindings and SuggestionShobhit Mishra0% (1)

- Corporate Finance SyllabusDocument2 pagesCorporate Finance SyllabusShailesh RajhansNo ratings yet

- Assignment 2 Paper 2Document6 pagesAssignment 2 Paper 2Akanksha Rathore100% (1)

- Women Empowerment Through EntrepreneurshipDocument39 pagesWomen Empowerment Through EntrepreneurshipClassic PrintersNo ratings yet

- Preparation For An AuditDocument33 pagesPreparation For An Auditanon_672065362No ratings yet

- 0.1. Introduction To International Trade FinancingDocument11 pages0.1. Introduction To International Trade Financingphillip HaulNo ratings yet

- Foreign Exchange Risk Management in IndiaDocument13 pagesForeign Exchange Risk Management in IndiaRaman Sehgal100% (1)

- Credit Rating FinalDocument32 pagesCredit Rating FinaldevrajkinjalNo ratings yet

- Nature and Significance of Capital Market ClsDocument20 pagesNature and Significance of Capital Market ClsSneha Bajpai100% (2)

- Benefits of Depository SystemDocument4 pagesBenefits of Depository SystemAnkush VermaNo ratings yet

- Unit-II ADocument26 pagesUnit-II APaytm KaroNo ratings yet

- India's Mega Online Education Hub For Class 9-12 Students, Engineers, Managers, Lawyers and DoctorsDocument41 pagesIndia's Mega Online Education Hub For Class 9-12 Students, Engineers, Managers, Lawyers and DoctorsDivyashree100% (5)

- Central Bank InterventionDocument31 pagesCentral Bank InterventionmilktraderNo ratings yet

- Foreign Exchange MarketDocument8 pagesForeign Exchange MarketYadhu ManuNo ratings yet

- Ethical Issues in Functional AreasDocument31 pagesEthical Issues in Functional AreasAmal RajNo ratings yet

- Innovative Financial ServicesDocument9 pagesInnovative Financial ServicesShubham GuptaNo ratings yet

- MBA Entrepreneurship Notes on Definitions, Qualities, FactorsDocument48 pagesMBA Entrepreneurship Notes on Definitions, Qualities, FactorsSantosh SunnyNo ratings yet

- Principles of Management Unit II Reference NotesDocument19 pagesPrinciples of Management Unit II Reference NotesshanmugamhrNo ratings yet

- Management Accounting 5th SemDocument24 pagesManagement Accounting 5th SemNeha firdoseNo ratings yet

- 09A Risk and UncertaintyDocument22 pages09A Risk and UncertaintySaTish KdkaNo ratings yet

- Case Study - VCDocument5 pagesCase Study - VCapi-3865133No ratings yet

- Case Study For 2nd Year Students PDFDocument3 pagesCase Study For 2nd Year Students PDFArjun JosNo ratings yet

- BA7021-Security Analysis and Portfolio PDFDocument6 pagesBA7021-Security Analysis and Portfolio PDFLavanya GunalanNo ratings yet

- Week 1FMDocument52 pagesWeek 1FMchitkarashelly100% (1)

- Comparative Analysis of Business Environment and Risks in Briics CountriesDocument40 pagesComparative Analysis of Business Environment and Risks in Briics Countriesqqvids100% (2)

- Role of Banks in Foreign TradeDocument7 pagesRole of Banks in Foreign TradeShilpi Jain40% (5)

- Consumer Behavior StagesDocument16 pagesConsumer Behavior StagesPriyanka Zalpuri100% (1)

- A Study On Consumer Behaviour On Green Marketing With Reference To Organic Food Products in Tiruchirappalli DistrictDocument10 pagesA Study On Consumer Behaviour On Green Marketing With Reference To Organic Food Products in Tiruchirappalli DistrictIAEME PublicationNo ratings yet

- SCDL - PGDBA - Finance - Sem 1 - Managerial EconomicsDocument16 pagesSCDL - PGDBA - Finance - Sem 1 - Managerial Economicsapi-376241950% (2)

- Clearance or Permission For Establishing Industries: Prepared By:-Pankaj Preet SinghDocument22 pagesClearance or Permission For Establishing Industries: Prepared By:-Pankaj Preet SinghpreetsinghjjjNo ratings yet

- 7 Ps of ICICIDocument8 pages7 Ps of ICICIshirishaggNo ratings yet

- MARWADI FINANCE MBA Porject Report Prince DudhatraDocument89 pagesMARWADI FINANCE MBA Porject Report Prince DudhatrapRiNcE DuDhAtRa100% (1)

- The Human in Human ResourceFrom EverandThe Human in Human ResourceNo ratings yet

- Expected Utility Theory as a Basis for Decision-MakingDocument17 pagesExpected Utility Theory as a Basis for Decision-Makingsimmi33No ratings yet

- Risk Aversion and Expected Utility Theory: Coherence for Small and Large GamblesDocument39 pagesRisk Aversion and Expected Utility Theory: Coherence for Small and Large Gamblesstupid90No ratings yet

- Jofi 13061Document68 pagesJofi 13061RSIA HARAPAN BUNDANo ratings yet

- Efficient Utility Theory - & - Efficient Market HypotheesisDocument23 pagesEfficient Utility Theory - & - Efficient Market Hypotheesisjoeljose2019jjNo ratings yet

- Project FinancingDocument3 pagesProject FinancingSimmi KhuranaNo ratings yet

- Tools and Techniques of Project ManagementDocument4 pagesTools and Techniques of Project Managementsimmi33No ratings yet

- Capital BudgetingDocument12 pagesCapital Budgetingsimmi33No ratings yet

- Chapter 1 Behavioral Finance: An IntroductionDocument8 pagesChapter 1 Behavioral Finance: An Introductionsimmi33No ratings yet

- Elasticity of DemandDocument41 pagesElasticity of Demandsimmi33No ratings yet

- Behavioural FinanceDocument8 pagesBehavioural Financesimmi33No ratings yet

- Banking and Indian Financialt200813 PDFDocument425 pagesBanking and Indian Financialt200813 PDFsimmi33No ratings yet

- Project ImplementationDocument8 pagesProject Implementationsimmi33No ratings yet

- Ch-6 Expected Utility As A Basis For Decision-Making The Evolution of TheoriesDocument17 pagesCh-6 Expected Utility As A Basis For Decision-Making The Evolution of Theoriessimmi33100% (2)

- Capital StructureDocument7 pagesCapital Structuresimmi33No ratings yet

- Demand ForecastingDocument4 pagesDemand Forecastingsimmi33No ratings yet

- Project OrganizationDocument8 pagesProject Organizationsimmi33No ratings yet

- Forward Rate AgreementDocument19 pagesForward Rate Agreementsimmi33No ratings yet

- Financial InstrumentsDocument19 pagesFinancial InstrumentsRamswaroop ChoudharyNo ratings yet

- Foreign Direct InvestmentDocument4 pagesForeign Direct Investmentsimmi33No ratings yet

- Tools and Techniques of Project ManagementDocument4 pagesTools and Techniques of Project Managementsimmi33No ratings yet

- Financial AnalysisDocument5 pagesFinancial Analysissimmi33No ratings yet

- Feasibility Study and Preparation of Feasibility ReportDocument3 pagesFeasibility Study and Preparation of Feasibility Reportutcm77No ratings yet

- Project ImplementationDocument8 pagesProject Implementationsimmi33No ratings yet

- SharesDocument16 pagesSharessimmi33No ratings yet

- Case Studies of Cost and Works AccountingDocument17 pagesCase Studies of Cost and Works AccountingShalini Srivastav50% (2)

- Responsibility AccountingDocument12 pagesResponsibility Accountingsimmi33No ratings yet

- Case Study Punjab National BankDocument3 pagesCase Study Punjab National BankHirenGandhiNo ratings yet

- Ch-6 Expected Utility As A Basis For Decision-Making The Evolution of TheoriesDocument17 pagesCh-6 Expected Utility As A Basis For Decision-Making The Evolution of Theoriessimmi33100% (2)

- Target Costing for Profit and Customer DelightDocument5 pagesTarget Costing for Profit and Customer Delightsimmi33No ratings yet

- Sources of Long-Term FinanceDocument26 pagesSources of Long-Term Financerrajsharmaa100% (2)

- Case Studies of Cost and Works AccountingDocument17 pagesCase Studies of Cost and Works AccountingShalini Srivastav50% (2)

- Chapter 1 Behavioral Finance: An IntroductionDocument8 pagesChapter 1 Behavioral Finance: An Introductionsimmi33No ratings yet

- Indian Banking SystemDocument13 pagesIndian Banking Systemsimmi33No ratings yet

- Life Cycle CostingDocument14 pagesLife Cycle CostingMUNAWAR ALI87% (15)

- Consumer Preferences and Choice Chapter AnalysisDocument22 pagesConsumer Preferences and Choice Chapter AnalysisDrGarima Nitin SharmaNo ratings yet

- QUIZ - Equi-Marginal PrincipleDocument4 pagesQUIZ - Equi-Marginal PrincipleKaryll JustoNo ratings yet

- CH 3 Demand Theory Ing-IndoDocument55 pagesCH 3 Demand Theory Ing-IndoNovhendra100% (1)

- Booklet Cons EquDocument3 pagesBooklet Cons EquStuti KathuriaNo ratings yet

- Income and Spending Determines OutputDocument13 pagesIncome and Spending Determines OutputTeesha AggrawalNo ratings yet

- Expected Utility and Risk AversionDocument56 pagesExpected Utility and Risk Aversionrobertclee1234No ratings yet

- Change in Demand and Supply Due To Factors Other Than PriceDocument4 pagesChange in Demand and Supply Due To Factors Other Than PriceRakesh YadavNo ratings yet

- Introduction To Economics 2 and 3Document38 pagesIntroduction To Economics 2 and 3Yonas D. EbrenNo ratings yet

- Homework 2 - AnswerDocument9 pagesHomework 2 - Answer蔡杰翰No ratings yet

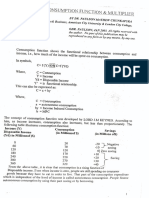

- KEYNESIAN CONSUMPTION FUNCTION & MULTIPLIERDocument6 pagesKEYNESIAN CONSUMPTION FUNCTION & MULTIPLIERDuaa WajidNo ratings yet

- Water Diamond Paradox Name of Student: Name of InstituteDocument5 pagesWater Diamond Paradox Name of Student: Name of InstitutearsafeelNo ratings yet

- Tables PvifaDocument2 pagesTables PvifaDdy Lee50% (4)

- Philippe Van Parijs - What (If Anything) Is Intrinsically Wrong With Capitalism (1984)Document18 pagesPhilippe Van Parijs - What (If Anything) Is Intrinsically Wrong With Capitalism (1984)guilmoura100% (1)

- Indifference Curve PDFDocument2 pagesIndifference Curve PDFsrinath asNo ratings yet

- All Important Names EconomicsDocument2 pagesAll Important Names EconomicsHitesh SonarNo ratings yet

- Basic Principles in Economics: Unit IDocument12 pagesBasic Principles in Economics: Unit IMarifher Kate Dela CruzNo ratings yet

- Individual and Market Demand: Review QuestionsDocument14 pagesIndividual and Market Demand: Review Questionsbuzz20090No ratings yet

- Chapter Three Aggregate Demand & Aggregate SupplyDocument44 pagesChapter Three Aggregate Demand & Aggregate SupplyHasbiyallah Weni'imal WakiilNo ratings yet

- Problem Set 1 Ram SinghDocument2 pagesProblem Set 1 Ram SinghAkshay JainNo ratings yet

- The "Marginalist Revolution"Document2 pagesThe "Marginalist Revolution"JinjunNo ratings yet

- UTILITY AnalysisDocument2 pagesUTILITY AnalysisImtiaz RashidNo ratings yet

- Economics Final Term Examination (2016) QPDocument8 pagesEconomics Final Term Examination (2016) QPakmohideenNo ratings yet

- Abhinay Muthoo Bargaining Theory With APDocument5 pagesAbhinay Muthoo Bargaining Theory With AP姚望No ratings yet

- AssignmentDocument5 pagesAssignmentHabiba KausarNo ratings yet

- TITLE Microeconomics Orientation ProgramDocument6 pagesTITLE Microeconomics Orientation ProgramSunu 3670No ratings yet

- Demand and Elasticity of DemandDocument7 pagesDemand and Elasticity of DemandaakaNo ratings yet

- Demand and Supply WorkbookDocument20 pagesDemand and Supply WorkbookJustNo ratings yet

- (S) Topic 3 - Market Theory - Elasticities of Demand and SupplyDocument14 pages(S) Topic 3 - Market Theory - Elasticities of Demand and SupplyKelvin YapNo ratings yet

- Stag Hunt Game Theory: Stag Rabbit Stag RabbitDocument1 pageStag Hunt Game Theory: Stag Rabbit Stag RabbitAman BaidNo ratings yet

- ECO558Document26 pagesECO558Nur Adriana binti Abdul AzizNo ratings yet