Professional Documents

Culture Documents

Inter-Connected Stock Exchange of India LTD: Easier Access Wider Reach

Uploaded by

Amit GuptaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inter-Connected Stock Exchange of India LTD: Easier Access Wider Reach

Uploaded by

Amit GuptaCopyright:

Available Formats

Interconnected Stock Exchange Of India Ltd

Easier Access Wider Reach FINANCIAL MARKETS IN MOTION

31st August, 2012

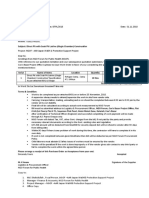

Market Summary: Markets recovered from the day lows to end its four-day losing streak on Thursday, following the expiry of August derivative contracts, on short covering in financial shares after recent losses and buying interest in FMCG shares. The Sensex ended at 17,542 up 51 points and the Nifty ended at 5,315 up by 27 points. On the sectoral front, BSE Realty index surged by almost 2% followed by counters like Healthcare, IT, TECk and Banks, all gaining by nearly 1% each. Sectors like Power, Consumer Durable, FMCG, PSU and Capital Goods ended marginally higher. However, BSE Metal, Oil & Gas and Auto indices ended marginally positive. From the Realty space, DLF Limited ended higher by nearly 4% after the countrys largest realty firm decided to end its five-year long association with the Indian Premier League (IPL). Shares of software exporters such as Infosys and TCS recovered from day lows and ended positive ahead of the key US economic data due Buzzing News for the day Ban on bulk SMS and MMS withdrawn: Home ministry BT begins sale of part stake in Tech Mahindra Deepak Fert cancels $350 mn-plant plan in Australia Elgi Equipments acquires 100% stake in Rotair India to see 30,000 MW renewable capacity addition in 12th plan Govt receives Rs 28,837 cr as licence fee from telcos MMTC to import nine lakh tonne coal for NTPC-SAIL Power No further extension to cable digitisation: govt

POLICY RATES (%) NE T (As on 30.08.2012) Bank Rate 9.00 Repo Rate Reverse Repo Rate CRR SLR MSF 1595 720 1644 710 8.00 7.00 4.75 23.00 9.00

Index

Dow Jones Nasdaq Nikkei Hang Seng FTSE 100 DAX

Value

13,000.70 3,048.71 8,893.50 19,546.00 5,719.45 6,895.49

Change

-0.81% -1.05% -1.00% -0.04% -0.42% -1.64%

NIFTY GAINERS (30.08.2012 AT 04.00 PM) Prev Symbol LTP (Rs) %

DLF IDFC HINDALCO JPASSOCIAT HINDUNILV R 198.50 138.95 106.75 65.50 534.00 190.85 135.05 103.80 64.00 522.55 4.01 2.89 2.84 2.34 2.19

NIFTY LOSERS (30.08.2012 AT 04.00 PM)

LTP (Rs) 365.85 356.65 352.00 Prev 374.40 364.85 359.60 % (2.28) (2.25) (2.11) FII DII

Symbol TATASTEE L GAIL JINDALSTE L BPCL

FII & DII (NSE & BSE AS ON 30.08.2012) (RS. Cr)

BUY LL SE

346.50 ECONOMIC INDICATORS Retail Inflation (Jul) Monthly Inflation (Jul) IIP (Jun)

352.15 (1.60) PERCENT 9.86 6.87 -1.80

5167.92 1836.46

2861.82 1508.35

Advanc es

2306.1 328.11

Decline

ADVANCES/DECLINES

NSE

Forex & Commodity Market Updates

FOREX RATES as on 30.08.2012 at 5.00 PM

Dollar Euro UK Pound Japanese Singapore $ Renminbi Taiwan $ 55.63 69.73 87.84 0.71 44.36 8.76 1.86

COMMODITIES as on 30.08.2012 at 5.00 PM

Gold (MCX) (RS./10G) Silver (MCX) (RS./KG) Crude Oil (BARREL) Aluminium (RS./KG) Copper (RS./KG) Nickel (RS./KG) Zinc (RS./KG) 30781.00 56916.00 5265.00 103.50 423.15 893.30 101.15

Board Meeting

Company Aftek LTD Antarctica LTD Assam Company India LTD Bodal Chemicals LTD Cranes Software International LTD DCM Financial Services LTD EIH Associated Hotels LTD Essel Propack LTD First Winner Industries LTD GSL Nova Petrochemicals LTD Kohinoor Foods LTD Lyka Labs LTD Murli Industries LTD MVL Industries LTD Paras Petrofils LTD Prajay Engineers Syndicate LTD Prudential Sugar Corporation LTD Quintegra Solutions LTD

Purpose Results/Others Results/Others Board Meeting Adjourned Results/Others Results/Others Audited Financial Results Rights Issue Results/Dividend Results/Others Results/Others Miscelleneous Annual Accounts Results/Others Board Meeting Adjourned Audited Financial Results Audited Financial Results Audited Financial Results Results/Others

Date 31-Aug12 31-Aug12 31-Aug12 31-Aug12 31-Aug12 31-Aug12 31-Aug12 31-Aug12 31-Aug12 31-Aug12 31-Aug12 31-Aug12 31-Aug12 31-Aug12 31-Aug12 31-Aug12 31-Aug12 31-Aug12

Corporate Actions

Company Aanjaneya Lifecare LTD GMR Infrastructure LTD Hindalco Industries LTD IDBI Bank LTD Kamat Hotels (I) LTD Motherson Sumi Systems LTD NHPC LTD Omax Autos LTD Surya Roshni LTD Tamilnadu PetroProducts LTD

Purpose AGM And Dividend Rs.2/- Per Share AGM AGM/Dividend Rs 1.55 Per Share AGM/Dividend Of Rs 1.50 Per Share AGM AGM And Dividend Rs.2.25 Per Share (Bc Dates Revised) AGM/Dividend Re 0.70 Per Share AGM/ Dividend Of Rs.2 Per Share AGM AGM/Dividend Re 0.50 Per Share

Ex-Date 31-Aug12 31-Aug12 31-Aug12 31-Aug12 31-Aug12 31-Aug12 31-Aug12 31-Aug12 31-Aug12 31-Aug12

VIP Industries LTD

AGM/ Dividend Rs 1 Per Share

31-Aug12

NEWS UPDATES

CORPORATE NEWS

Elgi Equipments acquires 100% stake in Rotair

Elgi Equipments has acquired 100% stake in Rotair S.p.a. The acquisition is through its subsidiary Elgi Compressors Italy. The company did not disclose the value of acquisition. Rotair is engaged in design, manufacture and distribution of ranger of compressors and allied products for the construction and industrial sectors. The company has an annual turnover of Euro 15 million and has market presence across Europe and other leading international markets.

JSW Steel, JSW Ispat boards to meet on Sep 1 for merger

The boards of JSW Steel and its loss-making subsidiary JSW Ispat will meet on Saturday to decide merger of the two firms. JSW Steel had acquired 41% stake in debt-ridden Ispat Industries in December 2010, for about Rs 2,157 crore and subsequently renamed it as JSW Ispat. The April-June quarter was first profitable quarter for JSW Ispat in last few years as it had reported a net profit of Rs 478.24 crore, mainly due to accounting of Rs 779.17 crore as a deferred tax asset on its balance sheet.

MMTC to import nine lakh tonne coal for NTPC-SAIL Power

MMTC has invited bids to import nine lakh tonnes coal for NTPC-SAIL Power Company's Bhilai plant in Chhattisgarh. In a tender notice, MMTC said NTPC-SAIL Power Company have requirement of 9 lakh tonnes of imported coal for the current fiscal and the next for its 500 MW power plant. The last date for receiving bids is September 11, it said, adding that the first consignment should reach the plant within 30 days of agreement. NTPC-SAIL Power is a joint venture between two state-run firms and it supplies power to SAIL's various plants in the adjoining area.

Rashtriya Chemicals to spend Rs 4,000 cr to expand urea capacity

Rashtriya Chemicals and Fertilizers plans to spend Rs 4,000 crore over the next three years to expand urea production capacity at its existing plant at Thal in the western state of Maharashtra. The staterun company, the No. 3 urea maker in India, has started the process to secure feedstock and get environmental clearance for the project. The expansion includes setting up one single stream ammonia plant of 2,200 tonnes per day capacity and one single stream urea plant with 3,850 tonnes per day capacity.

RIL submits revised proposal for 2 gas discoveries in KG basin

Reliance Industries has submitted revised commerciality of two gas discoveries it had made in a deep sea block in Krishna Godavari basin off the east coast. Revised proposal for the Declaration of Commerciality (DoC) for the Dhirubhai-39 and 41 natural gas discoveries in block KG-DWN-2003/1 or KG-D3 was submitted to the government in April. RIL is the operator of the block with 60% interest, while BP Plc of UK holds 30% stake. Hardy has the remaining 10%. To date, four consecutive gas discoveries -- Dhirubhai 39, 41, 44 and 52, have been made in the block but none has been so far put on production. The proposed development plan (to bring them on production) provides for a dry gas, sub-sea cluster development with the flexibility to add in additional zones and future area discoveries. RIL plans to drill a fifth exploration well on the block in the first half of 2013.

ECONOMY

Govt receives Rs 28,837 cr as licence fee from telcos

The government has received Rs 28,837.28 crore as licence fee from telecom operators between 2009-10 and the first quarter of 2012-13. Bharti Airtel paid Rs 8,182.63 crore as licence fee during the last three years and the first quarter of 2012-13, while Vodafone and Idea Cellular paid Rs 5,572.31 crore and Rs 2,800.17 crore in the same period, respectively. BSNL paid Rs 4,504.32 crore as licence fee, while MTNL paid Rs 988.07 crore between 2009-10 and the first quarter of 2012-13. The licence fee earned in 2009-10, 2010-11, 2011-12 and the first quarter of 2012-13 stood at Rs 8,440.85 crore, Rs 8,658.45 crore, Rs 9,359.61 crore and Rs 2,378.37, respectively. The government is likely to earn revenue of Rs 12,381.82 crore in licence fee, while Rs 5,126 crore is the budget estimate as spectrum

charges in fiscal 2012-13. The telecom operators in the country paid Rs 12,660.68 crore as spectrum charges to the government during the same period.

Govt : CSR guidelines not mandatory for companies

The government has not conducted any assessment to ascertain compliance on part of companies to various corporate social responsibility (CSR) guidelines. Apart from certain guidelines for the central public sector enterprises (CPSEs), there are no mandatory guidelines or provisions for spending by Indian companies on CSR activities.

Govt : BHEL to set up another manufacturing unit in Maharashtra

The government said BHEL has proposed setting up another manufacturing unit at Sakoli in Maharashtra. The manufacturing plant is proposed for meeting the requirements of fabricated assemblies of boilers, turbines etc., for power plants. The land required for the plant is about 500 acres and the first phase investment for the project is estimated at Rs 522 crore. The manufacturing plant once operational is likely to provide direct employment opportunity to around 700 persons. The company's current order book stands at Rs 1.34 lakh crore.

KNOWLEDGE CORNER

TYPES OF TERM INSURANCE PLANS

A term insurance policy, that only charges you for the cost of insurance, is what you should buy if you need a cover to protect your family. However, there are various types of term insurance covers that you should understand so that you can choose according to your needs. Pure term plan The simplest and cheapest of all, this one pays a fixed sum assured on the death of the policyholder. However, if the policyholder survives the term, he gets back nothing. The premium on term plans depends on three factors: age, term of the policy and the sum assured you choose. Even as term plans are the cheapest insurance product you get a further discount by buying them online. Return of premium plan Not everybody likes the thought of paying for years and not getting anything back at the end. Return of premium plans are meant for such people. These are slightly more expensive policies since they promise a return of premium. The policyholder gets the return of premium at the end of the term, but if he dies mid way, the nominee gets the sum assured. Decreasing plan A popular with mortgage products, the sum assured in this plan decreases every year, as does your outstanding loan amount. The premiums on these plans are lower than that of a level term plan since every year the sum assured decreases. Banks may bundle the single premium version of this policy and pay the premium on your behalf. The amount of premium gets added to your total debt liability, which you pay through an increased EMI. While it may seem easier to pay a single premium and get that added to your debt, a more cost effective technique is to pay regular premiums and that too on your own. Increasing plan This is the opposite of a decreasing plan. Here the amount of cover increases by about 5% every year until your sum assured increase by 50% or doubles up in value. The premiums are on the higher side as the insurer puts more money at risk every year. Unless you are sure that your assets wont suffice for your family, avoid this one. Convertible plan This combines the benefits of a term plan with a savings plan. Here, initially you buy a term plan, which you can convert into an investment-cum-insurance plan later. So, you cover your insurance needs during, say, your initial years of work and if you think you have saved enough over the years, you switch to a different plan where a part of your money is invested. However, your premium may change at the time of conversion. Source: Mint

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or

redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

You might also like

- Markets Today: World Indices & Indian Adrs (Us$)Document7 pagesMarkets Today: World Indices & Indian Adrs (Us$)Ajay BiswasNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument15 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Reasons For The Selection If Stocks For Trading: 1) Man IndustriesDocument6 pagesReasons For The Selection If Stocks For Trading: 1) Man IndustriesSreekumar ThottapillilNo ratings yet

- A2z FinalDocument12 pagesA2z FinalANIL_SHAR_MANo ratings yet

- Ahmedabad 27 December 2011 1Document1 pageAhmedabad 27 December 2011 1Rishit DalsaniaNo ratings yet

- Project Report On: Larsen & Toubro Limited (L&T)Document31 pagesProject Report On: Larsen & Toubro Limited (L&T)rohitghulepatilNo ratings yet

- R R 339,792 ($ 66.8) R C N P 19,724 ($ 3.9) H e e 208,042 ($ 40.9), 14% I ' eDocument27 pagesR R 339,792 ($ 66.8) R C N P 19,724 ($ 3.9) H e e 208,042 ($ 40.9), 14% I ' eDipen TusharNo ratings yet

- BUY BUY BUY BUY: Exide Industries LTDDocument13 pagesBUY BUY BUY BUY: Exide Industries LTDcksharma68No ratings yet

- Hedge Prakash 12dec09Document4 pagesHedge Prakash 12dec09Nishit MittalNo ratings yet

- Larsen Toubro C-WPS OfficeDocument7 pagesLarsen Toubro C-WPS OfficeNihal SonkusareNo ratings yet

- Chapter: Economy & Business Government Approved Denotification of Six SEZ ProjectsDocument2 pagesChapter: Economy & Business Government Approved Denotification of Six SEZ ProjectskrishnaparimalreddyNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument19 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 22nd March 2012Document4 pagesMarket Outlook 22nd March 2012Angel BrokingNo ratings yet

- Angel Broking: Bharat Heavy ElectricalsDocument27 pagesAngel Broking: Bharat Heavy ElectricalsChintan JethvaNo ratings yet

- Alance Sheet of Bharat Heavy Electricals12Document24 pagesAlance Sheet of Bharat Heavy Electricals12Parshant GargNo ratings yet

- Amtek India LTD F I R S T C A L L: SynopsisDocument18 pagesAmtek India LTD F I R S T C A L L: Synopsissneha.j26No ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Public Sector Enterprises ReformsDocument28 pagesPublic Sector Enterprises Reformsamit1234No ratings yet

- Commodity Price of Gold, Sliver, Copper, Doller/rs and Many More. Narnolia Securities Limited Market Diary 25.02.2014Document4 pagesCommodity Price of Gold, Sliver, Copper, Doller/rs and Many More. Narnolia Securities Limited Market Diary 25.02.2014Narnolia Securities LimitedNo ratings yet

- Top Ten Infrasturucture CompanyDocument12 pagesTop Ten Infrasturucture CompanyDwarkesh PanchalNo ratings yet

- StocksDocument4 pagesStocksNehaSharmaNo ratings yet

- Electronic Components Industry - Power Equipment Manufacturing HubDocument4 pagesElectronic Components Industry - Power Equipment Manufacturing HubVinod GopalaswamyNo ratings yet

- NTPC LimitedDocument7 pagesNTPC LimitedUtkarsh UpadhyayaNo ratings yet

- Top 30 Infrastructure Companies - ConstructionWeekIndiaConstructionWeekIndia PDFDocument9 pagesTop 30 Infrastructure Companies - ConstructionWeekIndiaConstructionWeekIndia PDFMelwin PaulNo ratings yet

- Taking A BreatherDocument4 pagesTaking A Breatherlaloo01No ratings yet

- Morning Briefing (May 07, 2012)Document2 pagesMorning Briefing (May 07, 2012)tanyaqamarNo ratings yet

- Infrastructure Finance News April 20 2015-April 26 2015Document2 pagesInfrastructure Finance News April 20 2015-April 26 2015YaIpha NaOremNo ratings yet

- Cbe News FinalDocument32 pagesCbe News FinalShraddha GhagNo ratings yet

- Market Outlook: Dealer's DiaryDocument5 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- India Cements: Performance HighlightsDocument12 pagesIndia Cements: Performance HighlightsAngel BrokingNo ratings yet

- BHEL Performance Highlights 2012-13Document16 pagesBHEL Performance Highlights 2012-13Manu DixitNo ratings yet

- Capital Goods-Non Electrical Equipment - Update1 - NewDocument20 pagesCapital Goods-Non Electrical Equipment - Update1 - Newjasraj_singhNo ratings yet

- NMDC - FpoDocument10 pagesNMDC - FpoAngel BrokingNo ratings yet

- Directors Report 12 ACC CementsDocument13 pagesDirectors Report 12 ACC Cements9987303726No ratings yet

- Market Outlook 9th March 2012Document4 pagesMarket Outlook 9th March 2012Angel BrokingNo ratings yet

- Assignment On Mergers and Acquisitions: Abhishek Shaw 2011011Document7 pagesAssignment On Mergers and Acquisitions: Abhishek Shaw 2011011Abhishek ShawNo ratings yet

- Tata Motors Should Be More Mature by 2020: Ratan Tata (CMP 980)Document6 pagesTata Motors Should Be More Mature by 2020: Ratan Tata (CMP 980)venkatrao_gvNo ratings yet

- Bharat Heavy Electricals LTD.: Business & Strategy OverviewDocument24 pagesBharat Heavy Electricals LTD.: Business & Strategy Overviewpraveen_scribdNo ratings yet

- Adding Muscle To The Core: Impact On InfrastructureDocument1 pageAdding Muscle To The Core: Impact On Infrastructuresmdali05No ratings yet

- 5.4 Rashtriya Ispat Nigam LTD.: Performance HighlightsDocument2 pages5.4 Rashtriya Ispat Nigam LTD.: Performance HighlightsRavi ChandNo ratings yet

- A Presentation On NTPC Limited by Mr. A.K. Singhal Director (Finance), NTPC at 2 Analysts & Investors Meet 1 - 2 August 2006Document46 pagesA Presentation On NTPC Limited by Mr. A.K. Singhal Director (Finance), NTPC at 2 Analysts & Investors Meet 1 - 2 August 2006Bala MNo ratings yet

- Ultra Tech Final 2007Document16 pagesUltra Tech Final 2007pvinayakamNo ratings yet

- Company Presentation September 2010 PDFDocument20 pagesCompany Presentation September 2010 PDFsonar_neelNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- R. Wadiwala: Morning NotesDocument7 pagesR. Wadiwala: Morning NotesRWadiwala SecNo ratings yet

- L&T To Sell Electrical and Automation Business To Schneider For Rs 140 BNDocument8 pagesL&T To Sell Electrical and Automation Business To Schneider For Rs 140 BNkaran pawarNo ratings yet

- GE T&D India LTD: PCG ResearchDocument10 pagesGE T&D India LTD: PCG ResearchumaganNo ratings yet

- New In-Principle Approval Format Bank of BarodaDocument13 pagesNew In-Principle Approval Format Bank of BarodaPriyanka VermaNo ratings yet

- Top Ten PSUsDocument22 pagesTop Ten PSUsAbhishek SangalNo ratings yet

- RIL Seeks Green Nod For $13 B Plan To Upgrade Jamnagar ComplexDocument1 pageRIL Seeks Green Nod For $13 B Plan To Upgrade Jamnagar ComplexMukesh Kumar SinghNo ratings yet

- Abhyaas Business Bulletin - March 1st, 2012Document4 pagesAbhyaas Business Bulletin - March 1st, 2012Abhyaas Edu CorpNo ratings yet

- Summer Training Project Report ON Effectiveness of Performance Management System of NTPCDocument74 pagesSummer Training Project Report ON Effectiveness of Performance Management System of NTPCAnsh KumarNo ratings yet

- Premarket OpeningBell ICICI 25.11.16Document8 pagesPremarket OpeningBell ICICI 25.11.16Rajasekhar Reddy AnekalluNo ratings yet

- News Brief (1-15 Sept)Document8 pagesNews Brief (1-15 Sept)pavan_kumar_146No ratings yet

- Punj Lloyd LTD: Rs237 High Growth Play-Oil & Gas, Infrastructure ServicesDocument8 pagesPunj Lloyd LTD: Rs237 High Growth Play-Oil & Gas, Infrastructure ServicesNirav ParikhNo ratings yet

- Executive SummaryDocument35 pagesExecutive SummaryManikantta SwamyNo ratings yet

- Infra On Growth Drive: India's Infrastructure Spend at 3.5% of GDP Is Not Only Much LowerDocument6 pagesInfra On Growth Drive: India's Infrastructure Spend at 3.5% of GDP Is Not Only Much Lowergagan585No ratings yet

- JK Cement LTD.: S W N SDocument5 pagesJK Cement LTD.: S W N STeja_Siva_8909No ratings yet

- How Better Regulation Can Shape the Future of Indonesia's Electricity SectorFrom EverandHow Better Regulation Can Shape the Future of Indonesia's Electricity SectorNo ratings yet

- Week 3 Assignment 3 - UnsolvedDocument4 pagesWeek 3 Assignment 3 - UnsolvedAmit GuptaNo ratings yet

- Ace of Capital MarketsDocument4 pagesAce of Capital MarketsAmit GuptaNo ratings yet

- Assignment 1 SolvedDocument4 pagesAssignment 1 SolvedAmit GuptaNo ratings yet

- Introduction To Data Analytics - AnnouncementsDocument16 pagesIntroduction To Data Analytics - AnnouncementsAmit GuptaNo ratings yet

- Feedback For The WebinarDocument3 pagesFeedback For The WebinarAmit GuptaNo ratings yet

- Itslowdown, Demonetisation - Doublewhammyforrealestate: 11 Nov 2016, by Ketan ChaphalkarDocument2 pagesItslowdown, Demonetisation - Doublewhammyforrealestate: 11 Nov 2016, by Ketan ChaphalkarAmit GuptaNo ratings yet

- Club Mahindra EmailerDocument2 pagesClub Mahindra EmailerAmit GuptaNo ratings yet

- Financial ModelingDocument8 pagesFinancial ModelingAmit GuptaNo ratings yet

- AMFI ReportsDocument592 pagesAMFI ReportsAmit GuptaNo ratings yet

- 160by2 ContactsDocument4 pages160by2 ContactsAmit GuptaNo ratings yet

- UNIT 4 Standard Costing and Variance AnalysisDocument39 pagesUNIT 4 Standard Costing and Variance Analysisannabelle albaoNo ratings yet

- CRUDIFY - The Best Crude Oil Intraday Trading StrategyDocument11 pagesCRUDIFY - The Best Crude Oil Intraday Trading StrategyRajeswaran DhanagopalanNo ratings yet

- Acctg 303Document9 pagesAcctg 303Anonymous IsEZYR1No ratings yet

- 08 LSF - Load Momment IndicatorDocument4 pages08 LSF - Load Momment IndicatorenharNo ratings yet

- VP Director IT Professional Services in Detroit MI Resume Rick PaulDocument3 pagesVP Director IT Professional Services in Detroit MI Resume Rick PaulRickPaulNo ratings yet

- Country Report MyanmarDocument34 pagesCountry Report MyanmarAchit zaw tun myatNo ratings yet

- Work Order - Twin Pit Latrine - ShohanDocument1 pageWork Order - Twin Pit Latrine - ShohanProdip Debnath NayanNo ratings yet

- Cas Final ReportDocument15 pagesCas Final ReportMaria KochańskaNo ratings yet

- 1 Industrial Revolution PDFDocument14 pages1 Industrial Revolution PDFKiaraNo ratings yet

- Service Sector in Nepal - Status, Potential and ChallengesDocument17 pagesService Sector in Nepal - Status, Potential and ChallengesAakriti SanjelNo ratings yet

- Contributions of Physician Recruitment To Regional Economic Development: Case of Windsor/Essex, OntarioDocument3 pagesContributions of Physician Recruitment To Regional Economic Development: Case of Windsor/Essex, OntarioAaronMavrinacNo ratings yet

- Micro Finance AppendicesDocument42 pagesMicro Finance AppendicesJiya PatelNo ratings yet

- There Were No Winners in This Govt Shutdown.Document4 pagesThere Were No Winners in This Govt Shutdown.My Brightest Star Park JisungNo ratings yet

- Catalogo GROFE IngDocument50 pagesCatalogo GROFE IngAlvaro Antonio Cristobal AtencioNo ratings yet

- Project Capstone Abhishek AcharyaDocument54 pagesProject Capstone Abhishek AcharyaRajan PrasadNo ratings yet

- Boq 3Document2 pagesBoq 3China AlemayehouNo ratings yet

- ADVENT'19 Encipher: Case It To Ace It: The Commerce Society - Kirori Mal CollegeDocument3 pagesADVENT'19 Encipher: Case It To Ace It: The Commerce Society - Kirori Mal CollegeParth ChawlaNo ratings yet

- MIB, Semester 1 Accounting and Finance Luvnica Rastogi: Amity International Business SchoolDocument25 pagesMIB, Semester 1 Accounting and Finance Luvnica Rastogi: Amity International Business SchoolRatika GuptaNo ratings yet

- Cost Analysis PaperDocument6 pagesCost Analysis PaperJeff MercerNo ratings yet

- SITXWHS001 - Participate in Safe Work Practices Student Assessment GuideDocument34 pagesSITXWHS001 - Participate in Safe Work Practices Student Assessment GuideKAROL ESTEFANIA GARCIANo ratings yet

- BB Russian Luxury Goods MarketDocument42 pagesBB Russian Luxury Goods MarketShadman KhanNo ratings yet

- Gap Analysis of IRCTCDocument37 pagesGap Analysis of IRCTCHitesh SethiNo ratings yet

- SLA Lead Goal CalculatorDocument20 pagesSLA Lead Goal CalculatorRejoy RadhakrishnanNo ratings yet

- SOAL LATIHAN INTER 1 - Chapter 4Document14 pagesSOAL LATIHAN INTER 1 - Chapter 4Florencia May67% (3)

- Risk of ByjuDocument3 pagesRisk of Byjuashwin moviesNo ratings yet

- Project On VST TillersDocument7 pagesProject On VST TillersrajeshthumsiNo ratings yet

- Market BasketDocument13 pagesMarket Basketmajmuni1No ratings yet

- RJCNortheasDocument2 pagesRJCNortheastrentonianNo ratings yet

- Draft Resolution (Saudi Arabia, Usa, Japan)Document2 pagesDraft Resolution (Saudi Arabia, Usa, Japan)Aishwarya PotdarNo ratings yet

- Form of Application For Repurchase of UnitsDocument2 pagesForm of Application For Repurchase of UnitsHaritha SankarNo ratings yet