Professional Documents

Culture Documents

Compensation For The Named Executive Officers in 2011 and 2010

Uploaded by

GeorgeBessenyeiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Compensation For The Named Executive Officers in 2011 and 2010

Uploaded by

GeorgeBessenyeiCopyright:

Available Formats

Table of Contents

base salary for achievement of reasonable performance-related goals and milestones. In the event Mr. Creech is terminated without cause or for good reason (as these terms are defined in the employment agreement), he is entitled to receive: (i) continued payment of his base salary as then in effect for a period of nine months following the date of termination; (ii) immediate vesting of 50% of any unvested options previously granted by the Company to him, in addition to a 24-month period after termination to exercise any and all of his vested options to purchase the Company's common stock; and (iii) continued health and dental benefits paid by the Company until the earlier of nine months after termination or the time that Mr. Creech obtains employment with reasonably comparable or better health and dental benefits. Additionally, if Mr. Creech's employment is terminated without cause or for good reason within the 12-month period following a change of control (as the term is defined in the employment agreement), then, in addition to the severance obligations due to Mr. Creech as described above, 50% of any then-unvested options previously granted by the Company will vest upon the date of such termination. Compensation for the Named Executive Officers in 2011 and 2010 The compensation earned by the Named Executive Officers for the years ended December 31, 2011 and 2010 was as follows:

Nonqualified Deferred Compensation Earnings

Name and Principal Position Gail S. Page Director, President and Chief Executive Officer Sandra A. Gardiner Vice President and Chief Financial Officer Eric T. Fung, M.D., Ph.D. Senior Vice President and Chief Science Officer William Creech Vice President of Sales and Marketing Ashish Kohli, CFA Vice President of Corporate Strategy

Year

Salary

Bonus

Stock (1) Award

(3)

Option Awards

Non-Equity Incentive (2) Plan

All Other (11) Compensation $ 22,281 (4) 3,024,231 476 6,325 (7) 11,000

(5) (4)

Total $ 1,627,703 6,727,154 368,442 285,206 863,600 1,317,068 327,027 234,413 306,344 127,675

2011 $ 385,000 $ 2010 346,699 2011 2010 2011 2010 2011 2010 2011 2010 224,793 150,334 256,870 252,417 214,236 146,798 240,000 61,042

$ 1,085,946 $ 76,726 $ (3) 2,981,400 195,697 17,763 67,122 (6) 88,184 21,686 7,590 125,410 68,502 533,283 836,030 56,705 32,194 29,382 5,879

57,750 $ 179,127 66,370 129,437 27,000 49,421 28,800 18,889

7,400 (9) 6,000 572 (10) 41,865

(8)

(1)

Represents non-cash, equity-related compensation. More information regarding these awards is included the Compensation Discussion and Analysis as well as in Note 10 to our Annual Report on Form 10-K for the year ended December 31, 2011. (2) Amount represents performance bonus for fiscal year 2011 and 2010. (3) Represents non-cash, equity-related compensation determined as of the date of grant for restricted stock awards pursuant to the Debtor's Incentive Plan and included in the Company's financial statements for 2011 and 2010. Because the fair value of the Company's common stock fell significantly from the date of grant to the date of issuance, the taxable income related to these restricted stock awards was significantly lower than the amounts included in our financial statements. In the Company's 2011 Proxy, the amount included in the Compensation Table was the taxable income reported also in the 2011 "Options Exercised and Stock Vested" table, rather than the non-cash, equity related compensation included herein. In 2011, includes $993,780 from Debtor's Incentive Plan and $92,166 for 2011 Restricted Stock Awards (4) In 2011, represents tax gross-up payments on stock awards of $21,709 and $572 for insurance premiums. In 2010, includes Debtor Incentive Plan cash distribution of $3,000,000, consulting income of $23,660 and Cobra payment of $571. (5) Includes Dr. Fung's consulting income of $5,825. (6) Represents Dr. Fung's restricted stock awards pursuant to our emergence from bankruptcy. (7) Represents Dr. Fung's consulting income. (8) Includes Mr. Creech's car allowance of $6,900. (9) Represents Mr. Creech's car allowance. (10) Represents Mr. Kohli's consulting income. (11) All Other Compensation also includes Company paid insurance premiums of less than $1,000.

28

You might also like

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionFrom EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionNo ratings yet

- Table of Content1Document3 pagesTable of Content1William HarrisNo ratings yet

- Maximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryFrom EverandMaximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryNo ratings yet

- Vivek Singh A-49 Compensation ProjectDocument16 pagesVivek Singh A-49 Compensation Projectakanksha singhNo ratings yet

- Assessing fringe benefits' impact on employee salary after FBT abolitionDocument5 pagesAssessing fringe benefits' impact on employee salary after FBT abolitionMeera Jasmiin0% (1)

- Google CEO CompensationDocument5 pagesGoogle CEO CompensationDhruba Jyoti DekaNo ratings yet

- Offer Letter Jane Lord December 1, 2004 PositionDocument3 pagesOffer Letter Jane Lord December 1, 2004 PositionTommy LiuNo ratings yet

- Executive Agreement - CEODocument13 pagesExecutive Agreement - CEOBrendaHamilton100% (1)

- A Project Report On Thecompensation Analysis On Tata MotorsDocument7 pagesA Project Report On Thecompensation Analysis On Tata MotorsParvathy Shelly vadakkedathuNo ratings yet

- Transitioning From Defined Benefit Plans To Defined Contribution PlansDocument9 pagesTransitioning From Defined Benefit Plans To Defined Contribution PlansCamille TilghmanNo ratings yet

- Offer Letter - ManishDocument12 pagesOffer Letter - ManishAnuj KumarNo ratings yet

- Table of ContentsDocument2 pagesTable of ContentsWilliam HarrisNo ratings yet

- 5.12 Employee Benefits AccountingDocument5 pages5.12 Employee Benefits AccountingBaher MohamedNo ratings yet

- Form 11-K: United States Securities and Exchange CommissionDocument15 pagesForm 11-K: United States Securities and Exchange CommissionSurya PermanaNo ratings yet

- Answers March2012 f2Document10 pagesAnswers March2012 f2Dimuthu JayawardanaNo ratings yet

- SESI 6 Ch15Document29 pagesSESI 6 Ch15astridNo ratings yet

- IAS 19 Employee BenefitsDocument56 pagesIAS 19 Employee BenefitsziyuNo ratings yet

- Offer Letter - Tyson Foods, IncorporatedDocument7 pagesOffer Letter - Tyson Foods, Incorporatedadreb7chelNo ratings yet

- Offer & Appointment Letter DetailsDocument12 pagesOffer & Appointment Letter DetailsArjav Jain0% (1)

- A Project Report On Thecompensation Analysis On Tata MotorsDocument7 pagesA Project Report On Thecompensation Analysis On Tata MotorsAbhishek KumarNo ratings yet

- Compensating Human ResourcesDocument13 pagesCompensating Human ResourcesM RABOY,JOHN NEIL D.No ratings yet

- Summarizing Chapter 17 Herring Ton The Risk ManagementDocument4 pagesSummarizing Chapter 17 Herring Ton The Risk ManagementMd Shohag AliNo ratings yet

- HDFC Life Insurance's Accolades and Product OfferingsDocument28 pagesHDFC Life Insurance's Accolades and Product OfferingsSandeep ChauhanNo ratings yet

- User FileDocument13 pagesUser Fileshreya arunNo ratings yet

- Incentive Pay: Casual Incentives-The Simplicity Inherent in The Casual IncentiveDocument14 pagesIncentive Pay: Casual Incentives-The Simplicity Inherent in The Casual IncentiveShaine CalabiaNo ratings yet

- May2012 Newsletter Print - InddDocument1 pageMay2012 Newsletter Print - InddesuttNo ratings yet

- Neelmetal Products Ltd.Document14 pagesNeelmetal Products Ltd.KaranvirNo ratings yet

- IAS 19 Employee BenefitsDocument110 pagesIAS 19 Employee BenefitsFritz MainarNo ratings yet

- Ca2 PJDocument6 pagesCa2 PJranniamokNo ratings yet

- Sec - Gov Archives Edgar Data 912183 000104746912004810 A2208902zdef14aDocument1 pageSec - Gov Archives Edgar Data 912183 000104746912004810 A2208902zdef14aAnonymous Feglbx5No ratings yet

- Contract Marissa Mayer YahooDocument12 pagesContract Marissa Mayer YahooOmRauNo ratings yet

- Ias 19Document41 pagesIas 19mohedNo ratings yet

- Supplemental BenefitsDocument7 pagesSupplemental Benefitsshubhankar paulNo ratings yet

- Types of CompensationDocument9 pagesTypes of CompensationthuybonginNo ratings yet

- Long-Term Disability Insurance: Benefits: PurposeDocument7 pagesLong-Term Disability Insurance: Benefits: Purpose1990sukhbirNo ratings yet

- Arsath Offer HDocument12 pagesArsath Offer HNilanjan KarmakarNo ratings yet

- Offer Letter - 24-Mar-2022 - 02 - 35 - 52Document15 pagesOffer Letter - 24-Mar-2022 - 02 - 35 - 52TestNo ratings yet

- HCLT Offer Letter for Member Technical Staff PositionDocument9 pagesHCLT Offer Letter for Member Technical Staff PositionBaljinder SinghNo ratings yet

- Compensation and Incentives for EmployeesDocument2 pagesCompensation and Incentives for EmployeesLuis WashingtonNo ratings yet

- Questionnaire On Fringe BenefitsDocument5 pagesQuestionnaire On Fringe BenefitsKhalid FirozNo ratings yet

- IAS 19 Employee Benefits (2021)Document6 pagesIAS 19 Employee Benefits (2021)Tawanda Tatenda Herbert100% (1)

- Ranjith Keerikkattil Booz Allen Offer LetterDocument6 pagesRanjith Keerikkattil Booz Allen Offer LetterGeorge RyanNo ratings yet

- Vidya DharDocument2 pagesVidya DharKatie PerryNo ratings yet

- Aetna Inc.: (Source S&P, Vickers, Company Reports)Document10 pagesAetna Inc.: (Source S&P, Vickers, Company Reports)sinnlosNo ratings yet

- OrganizationDocument3 pagesOrganizationBhavNo ratings yet

- Take It AgainDocument16 pagesTake It AgainTestNo ratings yet

- Compensation ManagementDocument117 pagesCompensation ManagementAnjali BanshiwalNo ratings yet

- GE Executive Pay History Over 115 YearsTITLEDocument25 pagesGE Executive Pay History Over 115 YearsTITLEMegha MishraNo ratings yet

- Offer & Appointment Letter: 1 Signature of EmployeeDocument12 pagesOffer & Appointment Letter: 1 Signature of EmployeeHarish DhanasekarNo ratings yet

- 1Document11 pages1Merry Rose Gimeno SerafinNo ratings yet

- User FileDocument14 pagesUser FileTapas SethNo ratings yet

- Employee Benefits and Compensation Research TopicDocument7 pagesEmployee Benefits and Compensation Research Topicnirosha449No ratings yet

- Ga Power Company Application Part 2Document177 pagesGa Power Company Application Part 2Southern Alliance for Clean EnergyNo ratings yet

- HDFC Life ProGrowth Plus IllustrationDocument3 pagesHDFC Life ProGrowth Plus IllustrationBullish Guy100% (1)

- Hewlett-Packard Company Léo Apotheker Employment Agreement: Exhibit 10.1Document24 pagesHewlett-Packard Company Léo Apotheker Employment Agreement: Exhibit 10.1Arik HesseldahlNo ratings yet

- Employee Bonus PlanDocument2 pagesEmployee Bonus PlanRocketLawyer100% (3)

- Compensation & Other Benefits To Managers in Foreign AssignmentsDocument6 pagesCompensation & Other Benefits To Managers in Foreign AssignmentsMousumi DasNo ratings yet

- Executive CompensationDocument2 pagesExecutive Compensationricha928No ratings yet

- Part A: Reward and Performance PracticesDocument6 pagesPart A: Reward and Performance PracticesAhsan AliNo ratings yet

- IAS 19 Employee BenefitsDocument5 pagesIAS 19 Employee Benefitshae1234No ratings yet

- Reprint of Page 83 From S-1 General Form of Registration Statement For All Companies Including Face-Amount Certificate Companies Filed On 01/21/2011 Filed by Vermillion With The SECDocument1 pageReprint of Page 83 From S-1 General Form of Registration Statement For All Companies Including Face-Amount Certificate Companies Filed On 01/21/2011 Filed by Vermillion With The SECGeorgeBessenyeiNo ratings yet

- Bessenyei: White Paper On OVA1Document4 pagesBessenyei: White Paper On OVA1GeorgeBessenyeiNo ratings yet

- Revenue Pages From 2011 10KDocument1 pageRevenue Pages From 2011 10KGeorgeBessenyeiNo ratings yet

- Forecast From Plan of Reorganization Dec 3 2009Document3 pagesForecast From Plan of Reorganization Dec 3 2009GeorgeBessenyeiNo ratings yet

- James S. Burns 2010-2011 Compensation at VRMLDocument2 pagesJames S. Burns 2010-2011 Compensation at VRMLGeorgeBessenyeiNo ratings yet

- Consulting Agreement Page F-37 From VRML 2010 10K-2Document1 pageConsulting Agreement Page F-37 From VRML 2010 10K-2GeorgeBessenyeiNo ratings yet

- ComplaintDocument16 pagesComplaintGeorgeBessenyeiNo ratings yet

- Austin Business Journal - Vermillion Under FireDocument2 pagesAustin Business Journal - Vermillion Under FireGeorgeBessenyeiNo ratings yet

- Debtor Incentive Plan - Page 29 From VRML 2010 10KDocument1 pageDebtor Incentive Plan - Page 29 From VRML 2010 10KGeorgeBessenyeiNo ratings yet

- James Besser Letter To Shareholders Dated April 2011Document8 pagesJames Besser Letter To Shareholders Dated April 2011GeorgeBessenyeiNo ratings yet

- Poison Pill Threat From VermillionDocument3 pagesPoison Pill Threat From VermillionGeorgeBessenyeiNo ratings yet

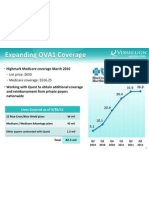

- Vermillion Claimed On 12/12 That Medicare Insures 55% of Covered Lives.Document1 pageVermillion Claimed On 12/12 That Medicare Insures 55% of Covered Lives.GeorgeBessenyeiNo ratings yet

- Letter To Vermillion ShareholdersDocument2 pagesLetter To Vermillion ShareholdersGeorgeBessenyeiNo ratings yet

- Click Here For Answers: ACC 400 Final ExamDocument4 pagesClick Here For Answers: ACC 400 Final Examclickme12No ratings yet

- Case Study On Lehman Brothers by Nadine SebaiDocument5 pagesCase Study On Lehman Brothers by Nadine Sebainadine448867% (3)

- Report On Adr GDR N IdrDocument9 pagesReport On Adr GDR N IdrManaswee Sahoo100% (1)

- Sabbir Hossain 111 161 350Document37 pagesSabbir Hossain 111 161 350Sabbir HossainNo ratings yet

- Working Capital IntroductionDocument18 pagesWorking Capital IntroductionShanmuka SreenivasNo ratings yet

- NTPC Group crosses 3GW renewable energy capacity; FuelBuddy partners with IOCLDocument3 pagesNTPC Group crosses 3GW renewable energy capacity; FuelBuddy partners with IOCLLikhitha YerraNo ratings yet

- Accounting 5008 Ch18 SolutionsDocument4 pagesAccounting 5008 Ch18 Solutionsferoz_bilalNo ratings yet

- SEC Revised Corporation Code 2019 QuestionsDocument12 pagesSEC Revised Corporation Code 2019 QuestionsFrances Ann Nacar0% (1)

- Chapter 4Document45 pagesChapter 4mperezNo ratings yet

- Afisco Insurance Vs CA (GR 112675)Document14 pagesAfisco Insurance Vs CA (GR 112675)ubermensch_12No ratings yet

- AegDocument40 pagesAegManjitKaurNo ratings yet

- Promise & Potential of US Savings BondsDocument55 pagesPromise & Potential of US Savings BondsSarika AbbiNo ratings yet

- Himadri Chemical Inv 5 2014 - 2016Document34 pagesHimadri Chemical Inv 5 2014 - 2016Poonam AggarwalNo ratings yet

- José Rizal's Declaration and Proclamation of The Gift of Love Twitter11.18.18.1Document8 pagesJosé Rizal's Declaration and Proclamation of The Gift of Love Twitter11.18.18.1karen hudes100% (1)

- Drafting, Registration, Stamping HandbookDocument89 pagesDrafting, Registration, Stamping HandbookramdeenNo ratings yet

- London Silver Market TimelineDocument4 pagesLondon Silver Market TimelineZerohedgeNo ratings yet

- Governance and accountabilityDocument108 pagesGovernance and accountabilityThirnugnanasampandar ArulananthasivamNo ratings yet

- Standard Balance Sheet PT Cahaya AdamDocument1 pageStandard Balance Sheet PT Cahaya AdamAdam Al MukhaffiNo ratings yet

- PNB Vs Andrada ElectricDocument14 pagesPNB Vs Andrada ElectricYe Seul DvngrcNo ratings yet

- COMP255 Question Bank Chapter 7Document9 pagesCOMP255 Question Bank Chapter 7Ferdous RahmanNo ratings yet

- AIESEC Benak Account Balances 2022-06-20Document2 pagesAIESEC Benak Account Balances 2022-06-20sadi raniaNo ratings yet

- The Relevance of Leverage, Profitability, Market Performance, and Macroeconomic To Stock PriceDocument11 pagesThe Relevance of Leverage, Profitability, Market Performance, and Macroeconomic To Stock PriceHalimahNo ratings yet

- Annual Report 2017 PDFDocument96 pagesAnnual Report 2017 PDFSajid BalochNo ratings yet

- Payment Card Number Structure and IdentificationDocument4 pagesPayment Card Number Structure and IdentificationlunwenNo ratings yet

- Demerger of Bajaj AutoDocument3 pagesDemerger of Bajaj AutokeyurchhedaNo ratings yet

- Binary OptionsDocument10 pagesBinary Optionsmimimi_88100% (1)

- Kirsty Nathoo - Startup Finance Pitfalls and How To Avoid ThemDocument33 pagesKirsty Nathoo - Startup Finance Pitfalls and How To Avoid ThemMurali MohanNo ratings yet

- Business Taxation Notes Income Tax NotesDocument39 pagesBusiness Taxation Notes Income Tax NotesvidhyaaravinthanNo ratings yet

- Ibf Bond Valuation .Document8 pagesIbf Bond Valuation .Anas4253No ratings yet

- Financial Regulation 01 Introduction Notes 20170818 Parab PDFDocument15 pagesFinancial Regulation 01 Introduction Notes 20170818 Parab PDFNisarg SavlaNo ratings yet

- 8-Bit Apocalypse: The Untold Story of Atari's Missile CommandFrom Everand8-Bit Apocalypse: The Untold Story of Atari's Missile CommandRating: 3.5 out of 5 stars3.5/5 (10)

- Blood, Sweat, and Pixels: The Triumphant, Turbulent Stories Behind How Video Games Are MadeFrom EverandBlood, Sweat, and Pixels: The Triumphant, Turbulent Stories Behind How Video Games Are MadeRating: 4.5 out of 5 stars4.5/5 (335)

- The Advanced Roblox Coding Book: An Unofficial Guide, Updated Edition: Learn How to Script Games, Code Objects and Settings, and Create Your Own World!From EverandThe Advanced Roblox Coding Book: An Unofficial Guide, Updated Edition: Learn How to Script Games, Code Objects and Settings, and Create Your Own World!Rating: 4.5 out of 5 stars4.5/5 (2)

- Get That Job! The Quick and Complete Guide to a Winning InterviewFrom EverandGet That Job! The Quick and Complete Guide to a Winning InterviewRating: 4.5 out of 5 stars4.5/5 (15)

- Lost in a Good Game: Why we play video games and what they can do for usFrom EverandLost in a Good Game: Why we play video games and what they can do for usRating: 4.5 out of 5 stars4.5/5 (31)

- How to Be Everything: A Guide for Those Who (Still) Don't Know What They Want to Be When They Grow UpFrom EverandHow to Be Everything: A Guide for Those Who (Still) Don't Know What They Want to Be When They Grow UpRating: 4 out of 5 stars4/5 (74)

- Job Interview: Outfits, Questions and Answers You Should Know aboutFrom EverandJob Interview: Outfits, Questions and Answers You Should Know aboutRating: 5 out of 5 stars5/5 (4)

- The Super World of Mario: The Ultimate Unofficial Guide to Super Mario®From EverandThe Super World of Mario: The Ultimate Unofficial Guide to Super Mario®Rating: 4 out of 5 stars4/5 (11)

- Five Crazy Nights: The Survival Guide to Five Nights at Freddy's and Other Mystery GamesFrom EverandFive Crazy Nights: The Survival Guide to Five Nights at Freddy's and Other Mystery GamesRating: 4.5 out of 5 stars4.5/5 (10)

- Pokémon X Walkthrough and Pokémon Y Walkthrough Ultımate Game GuidesFrom EverandPokémon X Walkthrough and Pokémon Y Walkthrough Ultımate Game GuidesRating: 4 out of 5 stars4/5 (14)

- Getting Back in the Game: How to Build Your Resume After Taking a BreakFrom EverandGetting Back in the Game: How to Build Your Resume After Taking a BreakRating: 4.5 out of 5 stars4.5/5 (3)

- A Joosr Guide to... What Color is Your Parachute? 2016 by Richard Bolles: A Practical Manual for Job-Hunters and Career-ChangersFrom EverandA Joosr Guide to... What Color is Your Parachute? 2016 by Richard Bolles: A Practical Manual for Job-Hunters and Career-ChangersRating: 4 out of 5 stars4/5 (1)

- Pojo's Unofficial Ultimate Pokemon Trainer's HandbookFrom EverandPojo's Unofficial Ultimate Pokemon Trainer's HandbookNo ratings yet

- The Science of Rapid Skill Acquisition: Advanced Methods to Learn, Remember, and Master New Skills and Information [Second Edition]From EverandThe Science of Rapid Skill Acquisition: Advanced Methods to Learn, Remember, and Master New Skills and Information [Second Edition]Rating: 4.5 out of 5 stars4.5/5 (23)

- Master Builder Combat & Mob Mods: The Best Mods in Minecraft©From EverandMaster Builder Combat & Mob Mods: The Best Mods in Minecraft©Rating: 5 out of 5 stars5/5 (1)

- Elden Ring Analysis & Review: Understand the Depth of Philosophical GameplayFrom EverandElden Ring Analysis & Review: Understand the Depth of Philosophical GameplayNo ratings yet

- COBOL Programming Interview Questions: COBOL Job Interview PreparationFrom EverandCOBOL Programming Interview Questions: COBOL Job Interview PreparationRating: 4.5 out of 5 stars4.5/5 (2)

- Control Freak: My Epic Adventure Making Video GamesFrom EverandControl Freak: My Epic Adventure Making Video GamesRating: 4.5 out of 5 stars4.5/5 (2)

- Unbeatable Resumes: America's Top Recruiter Reveals What REALLY Gets You HiredFrom EverandUnbeatable Resumes: America's Top Recruiter Reveals What REALLY Gets You HiredRating: 5 out of 5 stars5/5 (2)

- The STAR Method Explained: Proven Technique to Succeed at InterviewFrom EverandThe STAR Method Explained: Proven Technique to Succeed at InterviewRating: 4 out of 5 stars4/5 (4)

- The Resume and Cover Letter Phrase Book: What to Write to Get the Job That's RightFrom EverandThe Resume and Cover Letter Phrase Book: What to Write to Get the Job That's RightRating: 4 out of 5 stars4/5 (9)

- A History of Video Games in 64 ObjectsFrom EverandA History of Video Games in 64 ObjectsRating: 4.5 out of 5 stars4.5/5 (26)

- Encyclopedia of Job Winning Resumes, Third EditionFrom EverandEncyclopedia of Job Winning Resumes, Third EditionRating: 1.5 out of 5 stars1.5/5 (2)

- Ultimate Guide to Mastering Command Blocks!: Minecraft Keys to Unlocking Secret CommandsFrom EverandUltimate Guide to Mastering Command Blocks!: Minecraft Keys to Unlocking Secret CommandsRating: 4.5 out of 5 stars4.5/5 (12)

- Sonic the Hedgehog: The Official CookbookFrom EverandSonic the Hedgehog: The Official CookbookRating: 3 out of 5 stars3/5 (2)

- The SNES Encyclopedia: Every Game Released for the Super Nintendo Entertainment SystemFrom EverandThe SNES Encyclopedia: Every Game Released for the Super Nintendo Entertainment SystemRating: 4.5 out of 5 stars4.5/5 (3)

![The Science of Rapid Skill Acquisition: Advanced Methods to Learn, Remember, and Master New Skills and Information [Second Edition]](https://imgv2-2-f.scribdassets.com/img/word_document/419715394/149x198/b9c2899614/1683669291?v=1)