Professional Documents

Culture Documents

BOARD BILL NO. 258 - Proposition P, 3/16% Sales Tax To Arch Grounds, Great Rivers Greenway and City Parks

Uploaded by

nextSTL.comOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BOARD BILL NO. 258 - Proposition P, 3/16% Sales Tax To Arch Grounds, Great Rivers Greenway and City Parks

Uploaded by

nextSTL.comCopyright:

Available Formats

1BOARD BILL NO.

258 INTRODUCED BY: ALDERWOMAN PHYLLIS YOUNG 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 An ordinance relating to parks; imposing, under and by the authority of Sections 67.1700 to 67.1769 RSMo (August 28, 2012), subject to the approval of the voters, an additional three-sixteenths of one cent sales tax on all retail sales made in the City of St. Louis which are subject to taxation as provided for in Sections 144.010 to 144.525 and 67.1700 to 67.1769 RSMo, for the purpose of funding the operation and maintenance of the Metropolitan Park and Recreation District and parks owned by and located in the City of St. Louis, in addition to any and all other sales taxes allowed by law; submitting to the qualified voters of the City of St. Louis a proposal to approve this Ordinance; providing for an election and the manner of voting thereat; providing that if such question shall receive the votes of a majority of the voter voting thereon that such tax shall be authorized and in effect as provided in Sections 67.1700 to 67.1769 RSMo (August 28, 2012); providing that the tax imposed pursuant to the provisions of this Ordinance shall be a tax on all retail sales made in the City of St. Louis which are subject to taxation under the provisions of Sections 144.010 to 144.525 and 67.1700 to 67.1769 RSMo; providing for the allocation of the proceeds of such tax to certain purposes; providing that certain real property previously designated as part of the Gateway Mall Master Plan shall instead be part of the projects funded by the portion of such proceeds applied by the Metropolitan Park and Recreation District pursuant to this Ordinance; and containing an interpretation clause, a severability clause and an emergency clause.

1December 7, 2012 2Page 1 of 10 3Board Bill No. 258

Introduced by: Alderwoman Phyllis Young

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21

BE IT ORDAINED BY THE CITY OF ST. LOUIS AS FOLLOWS: SECTION ONE. Under and by the authority of Sections 67.1700 to 67.1769 RSMo (August 28, 2012), there is hereby imposed, subject, however, to the approval of the qualified voters as hereinafter provided, an additional threesixteenths of one cent sales tax on retail sales (excluding sales of food and prescription drugs) made in the City of St. Louis for the purpose of funding certain operations and maintenance of the Metropolitan Park and Recreation District and of parks owned and operated by the City of St. Louis, in addition to any and all other sales tax allowed by law. SECTION TWO. The following question is hereby submitted to the qualified voters of the City of St. Louis and shall be voted upon at an election to be held as hereinafter provided. The question shall read substantially in words and figures as follows: PROPOSITION P SAFE AND ACCESSIBLE ARCH AND PUBLIC PARKS INITIATIVE For the purpose of increasing safety, security, and public accessibility for the Gateway Arch grounds and local, county and regional parks and trails for families and disabled and elderly visitors, and for providing expanded activities and improvements of such areas, shall the City of

22 St. Louis join such other of the counties of St. Louis and St. 1December 7, 2012 2Page 2 of 10 3Board Bill No. 258 Introduced by: Alderwoman Phyllis Young

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22

Charles to impose a three-sixteenths of one cent sales tax in addition to the existing one-tenth of one cent sales tax applied to such purposes, with sixty percent of the revenues derived from the added tax allocated to the Metropolitan Park and Recreation District for Gateway Arch grounds and other regional park and trail improvements, and the remaining forty percent allocated to the City of St. Louis for park improvements as authorized by the Board of Aldermen of the City of St. Louis under Ordinance No. ________ on the ___ day of _______. 2013, with such tax not to include the sale of food and prescription drugs and to be subject to an independent annual public audit? Yes No

If you are in favor of the question, place an X in the box opposite YES. If you are opposed to the question, place an X in the box opposite NO. SECTION THREE. The foregoing question shall be submitted to the qualified voters at an election called and to be held on Tuesday, the [second (2nd)] day of April, 2013, and if the question shall receive in its favor the votes of a majority of the voters voting thereon, the tax shall be authorized and shall become effective as provided in Sections 67.1700 to 67.1769 RSMo (August 28, 2012). The qualified voters may, at such election, vote a ballot in substantially the following form:

1December 7, 2012 2Page 3 of 10 3Board Bill No. 258

Introduced by: Alderwoman Phyllis Young

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22

PROPOSITION P SAFE AND ACCESSIBLE ARCH AND PUBLIC PARKS INITIATIVE For the purpose of increasing safety, security, and public accessibility for the Gateway Arch grounds and local, county and regional parks and trails for families and disabled and elderly visitors, and for providing expanded activities and improvements of such areas, shall the City of St. Louis join such other of the counties of St. Louis and St. Charles to impose a three-sixteenths of one cent sales tax in addition to the existing one-tenth of one cent sales tax applied to such purposes, with sixty percent of the revenues derived from the added tax allocated to the Metropolitan Park and Recreation District for Gateway Arch grounds and other regional park and trail improvements, and the remaining forty percent allocated to the City of St. Louis for park improvements as authorized by the Board of Aldermen of the City of St. Louis under Ordinance No. ________ on the ___ day of _______. 2013, with such tax not to include the sale of food and prescription drugs and to be subject to an independent annual public audit? Yes No

1December 7, 2012 2Page 4 of 10 3Board Bill No. 258

Introduced by: Alderwoman Phyllis Young

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21

If you are in favor of the question, place an X in the box opposite YES. If you are opposed to the question, place an X in the box opposite NO. SECTION FOUR. The Board of Election Commissioners of the City of St. Louis shall provide notice of such election pursuant to Section 115.127 RSMo, shall provide the ballots or voting machines, or both, and shall conduct the election and shall ascertain the results thereof, all according to the laws regulating such elections. Upon approval of this Ordinance, it shall be published once in the City Journal. Proof of publication of this Ordinance shall be made by affidavit of the City Register and such affidavit shall be filed in the office of the City Register and a copy of said publication shall be attached thereto. SECTION FIVE. The provisions of Sections 67.1700 to 67.1769 RSMo (August 28, 2012) are adopted and incorporated herein by reference as if fully set forth herein. SECTION SIX. The tax imposed pursuant to the provisions of this Ordinance shall be a tax on all retail sales made in the City of St. Louis which are subject to taxation under the provisions of Sections 144.010 to 144.525 and 67.1700 to 67.1769 RSMo. SECTION SEVEN. The portion of the revenue derived from the additional tax authorized by this Ordinance and allocated to the Metropolitan Park and Recreation District for Gateway Arch grounds shall be applied to property owned

22 or controlled by the City of St. Louis as provided for in that certain Cooperation 1December 7, 2012 2Page 5 of 10 3Board Bill No. 258 Introduced by: Alderwoman Phyllis Young 5

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

Agreement to be adopted by the City of St. Louis, the Port Authority of the City of St. Louis, the Metropolitan Park and Recreation District and CityArchRiver 2015 Foundation in the form attached hereto, and as amended or supplemented from time to time, and that certain comprehensive capital improvements program agreement authorized in Section 67.1742(2) RSMo (August 28, 2012). SECTION EIGHT. The portion of the revenue derived from the additional tax authorized by this Ordinance which is returned to the City of St. Louis from the tax authorized by this Ordinance pursuant to Section 67.1754 RSMo shall be deposited in the special trust fund created pursuant to Ordinance No. 64994, known as the Metropolitan Park and Recreation District Capital Improvements Sales Tax Trust Fund (the Metro Parks Trust Fund), to consist of two accounts, namely, a Major Parks Capital Improvements Account and a Neighborhood Parks Capital Improvements Account. All revenue of the Metro Parks Trust Fund and all interest on such revenue shall be allocated and credited upon receipt as follows: forty percent (40%) to the Major Parks Capital Improvements Account and sixty percent (60%) to the Neighborhood Parks Capital Improvements Account. Notwithstanding any provision of Ordinance No. 64994, the portion of the revenue derived from the additional tax authorized by this Ordinance that is credited and allocated to the Major Parks Capital Improvements Account shall be credited and allocated to six sub-accounts, one each for capital improvements in Carondelet, Fairground, Forest, OFallon, Tower Grove and Willmore Parks (the Major Parks) in the following proportions: Carondelet, fifteen and one-tenth percent (15.1%), Fairground, eleven percent (11%); Forest, thirty and six-tenths

1December 7, 2012 2Page 6 of 10 3Board Bill No. 258

Introduced by: Alderwoman Phyllis Young

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22

percent (30.6%); OFallon, ten and seven-tenths percent (10.7%); Tower Grove, twenty-three and six-tenths percent (23.6%) and Willmore, nine percent (9%). SECTION NINE. Appropriations from the Metro Parks Trust Fund shall be made pursuant to the policies and procedures for capital improvements planning and budgeting as provided in Ordinance 60419, as amended; provided, however, that as part of the annual budget preparation process, the Director of Parks Recreation and Forestry shall prepare and submit to the Budget Division his or her recommendations for expenditure of revenues on deposit in: i) the Major Parks Capital Improvements Account in a manner similar to current procedures for appropriating revenues in the Major Park Capital Improvements Account of the Capital Improvements Sales Tax Trust Fund established by Ordinance 62885; and ii) the Neighborhood Parks Capital Improvements Account pursuant to Section Ten hereof. SECTION TEN. Revenue on deposit in the Neighborhood Parks Capital

Improvements Account shall only be expended for capital improvements projects in public parks owned by the City of St. Louis and maintained by the Citys Department of Parks, Recreation and Forestry; provided, however, that no revenues in such account shall be expended for projects in any Major Park. Further, revenues, in such account shall not be expended for more than seventyfive percent (75%) of the cost of any specific capital improvement project. Matching funds for any such specific capital improvement project shall be accepted by the Comptroller from any source whatsoever, including, but not

1December 7, 2012 2Page 7 of 10 3Board Bill No. 258

Introduced by: Alderwoman Phyllis Young

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22

limited to: i) revenues in any Ward Capital Improvements Sub-Account of the Capital Improvements Sales Tax Trust Fund established by Ordinance 62885; ii) Community Development Block Grant Funds; and iii) private donations and/or private and public grants on deposit in the City Treasury in accounts established by the Comptroller for such purpose. In preparing and submitting to the Budget Division his or her annual appropriation recommendations for Neighborhood Parks, the Director of Parks, Recreation and Forestry shall consider various factors, including, but not limited to: i) the relative capital improvement needs of the neighborhood parks; ii) the amount of Neighborhood Parks Capital Improvements Account funds appropriated to specific Wards and neighborhoods in previous years; iii) the percentage of nonMetro Parks Trust Fund matching funds available for the project; and iv) that each annual appropriation be balanced to provide neighborhood park improvements in as many different Wards and neighborhoods as possible. In addition, said recommendations shall be approved by resolution of the Parks and Environmental Matters Committee of the Board of Aldermen prior to their submission to the Budget Division. SECTION ELEVEN. All monies from any account or sub-account within the Metro Parks Trust Fund shall be expended only by appropriating ordinances. No money credited and allocated to any account or sub-account within the Metro Parks Trust Fund shall be: i) transferred to any other fund, account or subaccount; or ii) appropriated, expended, used or encumbered for any purpose other

1December 7, 2012 2Page 8 of 10 3Board Bill No. 258

Introduced by: Alderwoman Phyllis Young

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21

than capital improvements as indicated by the name of the respective account or sub-account. SECTION TWELVE. The City shall not decrease its annual general revenue or capital fund appropriations or expenditures for park and recreation purposes from general revenues or capital funds as a result of the approval of the voters of the sales tax authorized by this Ordinance. SECTION THIRTEEN. This Ordinance is intended to be a supplement to, consistent with and not in derogation of Ordinance No. 64994. All provisions of Ordinance No. 64994 shall remain in full force and effect and shall apply with respect to the additional tax approved in this Ordinance except as expressly provided for herein and all provisions of this Ordinance shall be interpreted consistent with Ordinance No. 64994 unless clearly inconsistent, and in the case of any such inconsistency, the inconsistent provision of this Ordinance shall apply only with respect to the additional tax approved in this Ordinance. SECTION FOURTEEN. Notwithstanding any provision of Ordinance No. 68407 or the St. Louis Gateway Mall Master Plan, the area bounded by Broadway, Market Street, 7th Street and Chestnut Street shall be included in the projects funded in part by the portion of such proceeds applied by the Metropolitan Park and Recreation District pursuant to this Ordinance; and shall not be governed by Ordinance No. 68407 with respect to the Gateway Mall Master Plan. Except as provided herein, Ordinance No. 68407 for the area

1December 7, 2012 2Page 9 of 10 3Board Bill No. 258

Introduced by: Alderwoman Phyllis Young

1 2 3 4 5 6 7 8 9 10

bounded by 7th Street, Market Street, 21st Street and Chestnut Street shall remain in full force and effect. SECTION FIFTEEN. If any provision of this Ordinance shall be held invalid, the remainder of this Ordinance, to the extent severable therefrom, shall not thereby be invalidated. SECTION SIXTEEN. This being an ordinance providing for the submission of a question to the voters, it is hereby declared to be an emergency ordinance as provided by Article IV, Section 20 of the Charter of the City of St. Louis, and shall be effective immediately upon approval by the Mayor or its approval over his or her veto.

1December 7, 2012 2Page 10 of 10 3Board Bill No. 258

Introduced by: Alderwoman Phyllis Young

10

You might also like

- Knight Foundation - Soul of The Community OVERALL 2010 FindingsDocument36 pagesKnight Foundation - Soul of The Community OVERALL 2010 FindingsnextSTL.comNo ratings yet

- Emerson JJK Station Area PlanDocument167 pagesEmerson JJK Station Area PlannextSTL.comNo ratings yet

- An Assessment of The Effectiveness and Fiscal Impacts of The Use of Development Incentives in The St. Louis RegionDocument81 pagesAn Assessment of The Effectiveness and Fiscal Impacts of The Use of Development Incentives in The St. Louis RegionnextSTL.comNo ratings yet

- Forest Park Southeast Neighborhood Vision - 2015 (Park Central Development)Document80 pagesForest Park Southeast Neighborhood Vision - 2015 (Park Central Development)nextSTL.comNo ratings yet

- Union Station-Station Area PlanDocument152 pagesUnion Station-Station Area PlannextSTL.comNo ratings yet

- Fairview Heights-Station Area PlanDocument155 pagesFairview Heights-Station Area PlannextSTL.comNo ratings yet

- HUD Choice Neighborhood Grant Announcement 2016 - St. LouisDocument2 pagesHUD Choice Neighborhood Grant Announcement 2016 - St. LouisnextSTL.comNo ratings yet

- 4650 Hampton Avenue Rezoning - Eagle Bank To ApartmentsDocument25 pages4650 Hampton Avenue Rezoning - Eagle Bank To ApartmentsnextSTL.comNo ratings yet

- TOD Market Study Final 10-25-12Document114 pagesTOD Market Study Final 10-25-12nextSTL.comNo ratings yet

- UMSL South TAP ReportDocument16 pagesUMSL South TAP ReportnextSTL.comNo ratings yet

- Northside-Southside TOD StudyDocument265 pagesNorthside-Southside TOD StudynextSTL.comNo ratings yet

- North Hanley-Station Area PlanDocument165 pagesNorth Hanley-Station Area PlannextSTL.comNo ratings yet

- TOD Station Area Planning, Delmar & Forest Park Station - St. Louis, MODocument148 pagesTOD Station Area Planning, Delmar & Forest Park Station - St. Louis, MOnextSTL.com100% (2)

- Arch Lacledes Stadium AreaPlanDocument198 pagesArch Lacledes Stadium AreaPlannextSTL.comNo ratings yet

- Forest Park Connectivity and Mobility Study - 2016Document78 pagesForest Park Connectivity and Mobility Study - 2016nextSTL.comNo ratings yet

- Saint Louis City LCRA - RFP - 4101 ManchesterDocument7 pagesSaint Louis City LCRA - RFP - 4101 ManchesternextSTL.comNo ratings yet

- Grand TAP ReportDocument16 pagesGrand TAP ReportnextSTL.comNo ratings yet

- Technical Advisory Committee Meeting Presentation On Forest Park DeBaliviere and Delmar Loop MetroLink Station Areas June 4 2013Document250 pagesTechnical Advisory Committee Meeting Presentation On Forest Park DeBaliviere and Delmar Loop MetroLink Station Areas June 4 2013nextSTL.comNo ratings yet

- Cortex TAP ReportDocument16 pagesCortex TAP ReportnextSTL.comNo ratings yet

- City Foundry, St. Louis - TIF ApplicationDocument154 pagesCity Foundry, St. Louis - TIF ApplicationnextSTL.comNo ratings yet

- Plans For The Northern and Southern Riverfronts - St. Louis 1929Document33 pagesPlans For The Northern and Southern Riverfronts - St. Louis 1929nextSTL.comNo ratings yet

- Slow Your Streets - How To Guide - Trailnet 2016Document158 pagesSlow Your Streets - How To Guide - Trailnet 2016nextSTL.comNo ratings yet

- Downtown STL, Inc. Annual Report - 2016Document7 pagesDowntown STL, Inc. Annual Report - 2016nextSTL.comNo ratings yet

- A Plan For The Central Riverfront - St. Louis 1928Document51 pagesA Plan For The Central Riverfront - St. Louis 1928nextSTL.comNo ratings yet

- ULI St. Louis TAP Powerpoint - Railway Exchange BuildingDocument40 pagesULI St. Louis TAP Powerpoint - Railway Exchange BuildingnextSTL.comNo ratings yet

- Transit Oriented Development Study For Proposed Northside-Southside AlignmentDocument265 pagesTransit Oriented Development Study For Proposed Northside-Southside AlignmentAmy LampeNo ratings yet

- Record of Decision - Next NGA West Campus in The Greater St. Louis Metropolitan AreaDocument38 pagesRecord of Decision - Next NGA West Campus in The Greater St. Louis Metropolitan AreanextSTL.comNo ratings yet

- Centene Clayton Campus Conceptual Design Presentation - June 6, 2016Document42 pagesCentene Clayton Campus Conceptual Design Presentation - June 6, 2016nextSTL.comNo ratings yet

- 501 Olive - LaSalle Building National Register of Historic Places ApplicationDocument30 pages501 Olive - LaSalle Building National Register of Historic Places ApplicationnextSTL.comNo ratings yet

- Wild Carrot Proposal For 3901 Shaw Boulevard - St. Louis, MODocument30 pagesWild Carrot Proposal For 3901 Shaw Boulevard - St. Louis, MOnextSTL.comNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

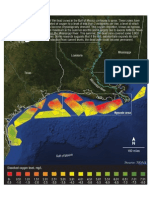

- Dead Zones in The Gulf of MexicoDocument1 pageDead Zones in The Gulf of MexicoSethNo ratings yet

- Gatchalian Vs COMELEC Case DigestDocument2 pagesGatchalian Vs COMELEC Case DigestMa Nikka Flores Oquias100% (3)

- Esraa ResumeDocument8 pagesEsraa ResumeEsraa MahadinNo ratings yet

- Soce2023bskeforms Form1Document1 pageSoce2023bskeforms Form1a67288491No ratings yet

- Dailycareers - In-Telangana Movement Telangana History TSPSC General Studies GK PDFDocument5 pagesDailycareers - In-Telangana Movement Telangana History TSPSC General Studies GK PDFSandeep Vemula0% (2)

- Anti-Semitic Jew Fred Newman Led His Cult-Like Followers To Independence Party Power in New York City - NY Daily NewsDocument3 pagesAnti-Semitic Jew Fred Newman Led His Cult-Like Followers To Independence Party Power in New York City - NY Daily NewsgbabeufNo ratings yet

- Statement of FEC Chair Ellen Weintraub in J. Whitfield Larrabee v. Party of Regions, Et. Al.Document3 pagesStatement of FEC Chair Ellen Weintraub in J. Whitfield Larrabee v. Party of Regions, Et. Al.J. Whitfield LarrabeeNo ratings yet

- Supreme Court: Reyes v. COMELEC G.R. No. 207264Document9 pagesSupreme Court: Reyes v. COMELEC G.R. No. 207264Jopan SJNo ratings yet

- Iowa City Sample BallotDocument2 pagesIowa City Sample BallotdmronlineNo ratings yet

- Testimony Before The Senate Committee On Rules & AdministrationDocument65 pagesTestimony Before The Senate Committee On Rules & AdministrationThe Brennan Center for Justice100% (1)

- Jair Messias Bolsonaro (Document56 pagesJair Messias Bolsonaro (John ShitNo ratings yet

- Consti SamplexDocument2 pagesConsti SamplexphoebelazNo ratings yet

- LLP Partnership Agreement CaliforniaDocument8 pagesLLP Partnership Agreement Californiaapi-25948763100% (1)

- National Symbols of The PhilippinesDocument8 pagesNational Symbols of The PhilippinesMakuyan DiazNo ratings yet

- Class Struggle UnionismDocument12 pagesClass Struggle UnionismAlex HoganNo ratings yet

- I. Omnibus Election Code (Sec 118)Document43 pagesI. Omnibus Election Code (Sec 118)Jose Antonio BarrosoNo ratings yet

- Atal Bihari Vajpayee: AccomplishmentsDocument2 pagesAtal Bihari Vajpayee: AccomplishmentsPriya Sahu Student, Jaipuria LucknowNo ratings yet

- Read Mark Zuckerberg's Full 6,000-Word Letter On Facebook's Global AmbitionsDocument19 pagesRead Mark Zuckerberg's Full 6,000-Word Letter On Facebook's Global AmbitionsThavam RatnaNo ratings yet

- Reach New Hampshire Poll 01-10-16Document15 pagesReach New Hampshire Poll 01-10-16The Conservative TreehouseNo ratings yet

- Fulani Oligarchy and The Death of Bola IgeDocument17 pagesFulani Oligarchy and The Death of Bola IgeneirotsihNo ratings yet

- Notes & Reviewer On Election Laws (For Final Exam)Document15 pagesNotes & Reviewer On Election Laws (For Final Exam)Miguel Anas Jr.No ratings yet

- Gavin ChallengeDocument10 pagesGavin ChallengeAnthony WarrenNo ratings yet

- The Deceivers Exposed PDFDocument196 pagesThe Deceivers Exposed PDFMaurice Lamar Fleming100% (2)

- IN RE Strunk - DC Cir - Petition For Writ of MandamusDocument314 pagesIN RE Strunk - DC Cir - Petition For Writ of MandamusJack RyanNo ratings yet

- Voter BehaviourDocument2 pagesVoter BehaviourShyra VargasNo ratings yet

- Donald TrumpDocument108 pagesDonald Trumpnimer sheikhNo ratings yet

- Seminole Producer - TWD at StrotherDocument1 pageSeminole Producer - TWD at StrotherPrice LangNo ratings yet

- Area Handbook - UgandaDocument316 pagesArea Handbook - UgandaRobert ValeNo ratings yet

- NA-121 Lahore-VDocument51 pagesNA-121 Lahore-VFahad FarooqiNo ratings yet

- History and Colonial Life in The Philippines DuringDocument15 pagesHistory and Colonial Life in The Philippines DuringVicheeckoOrtegaNo ratings yet