Professional Documents

Culture Documents

FICO Interview Questions Set 11

Uploaded by

Sam KuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FICO Interview Questions Set 11

Uploaded by

Sam KuCopyright:

Available Formats

ACADEMY: MANAGERIAL AND FINANCIAL ACCOUNTING FI PAPER: 11 The settings for Automatic Payment Program you make settings

for automatic outgoing payments to be processed by the payment program. 1. By assigning Paying company code to each company code you can have one company code process payment transactions centrally for several company codes. a. True b. False 2. You can group payments using payment met hod supplements and therefore, for example, control the sending of checks. a. True b. False 3. You cannot make down payments with the payment program and pay with bills of exchange a. True b. False 4. You can specify the minimum amount for which an incoming or outgoing payment is created for the Paying Company Code? a. True b. False 5. You can optimize by bank groups. This happens even if banks in the master records are not assigned to a bank group defined by you. a. True b. False 6. If you optimize by postal codes, the house bank selection is determined by the business partner's domicile. If you select the "Optimization by postal codes" field, you can go directly to the activity for assigning house banks to an interval of postal codes. a. True b. False 7. When processing a payment proposal, you can remove all payment blocking indicators from items or enter them for items. a. True b. False 8. Automatic payment run uses document type specified in Payment Method/ Country for posting the payment. Standard Posting keys are used to post the payment and cannot be changed? a. True b. False

ACADEMY: MANAGERIAL AND FINANCIAL ACCOUNTING FI PAPER: 11 You can use the dunning program to dun both customers and vendors. Answer the following questions on Dunning? 9. The individual dunning areas within one company code can use different procedures or the same dunning procedure. a. True b. False 10. The dunning area can be entered at the line item level a. True b. False 11. With the dunning keys, you can limit the dunning level for the Customer Master Record a. True b. False 12, The Dunning Block key can be entered in an item or in the account of a business partner. a. True b. False 13, Master Data reckrd Dunning Blocks need to be manually removed a. True b. False 14. In dunning procedure you can select which customers within for which company codes to include in dunning. All Customers need not be selected? a. True b. False 15. You can also set the dunning level at which you want to list all due items from an account in the dunning notice. a. True b. False 16. Dunning procedures are company code independent. a. True b. False 17. Interest Rates Entered in Dunning specify which interest rate is to be used for debit or credit balances a. True b. False Financial Accounting Closing Process 18. A valuation method represents a group of specifications that you require for balance and item valuation. Valuation methods can be defaulted from Master Records to Line Items a. True b. False 19. When valuating open items the system posts to a balance sheet adjustment account and to an account for exchange rate differences determined during the valuation?

ACADEMY: MANAGERIAL AND FINANCIAL ACCOUNTING FI PAPER: 11 a. True b. False 20. You can differentiate the accounts by currency. Exchange gains and losses are then posted to the accounts designated for the currency involved. If you do not want to differentiate the accounts by currency, you require an entry with the currency "blank" (this is the default value). The "exchange rate differences" key in the company code-dependent part of the G/L accounts must also be empty. a. True b. False 21. The goods receipt/invoice receipt (GR/IR) clearing account is posted to whenever you receive goods that have not been invoiced yet or whenever you receive invoices for goods that have not been delivered yet. a. True b. False 22. You define the versions you need to create a balance sheet and profit and loss statement In FSV besides G/L Accounts you can assign functional area intervals at the lowest level of the structure, instead of account intervals? a. True b. False To set up a cash journal, select the activity Cash Journal in Customizing for Banking-Related Accounting under Business Transactions. 23. For Setting up Cash Journal you need to create a G/L account, for the cash journal in the required company code a. True b. False 24. Several Cash Journals can be created in a company code but you need a unique G/l account for Cash Journal maintained in each currency a. True b. False 25. You have to define a number range interval for cash journal documents within G/L Accounting. a. True b. False 26. While Setting up Tax code in Cash Journal you can only make entries in this field for accounting transaction types E and R a. True b. False 27. In order to print the cash journal and the cash journal receipts, you have to set up the corresponding print program parameters per company code. a. True b. False 28. he Controlling Module and FI module can use Different Chart of Accounts as long as G/L are mapped to respective Cost Elements a. True b. False

ACADEMY: MANAGERIAL AND FINANCIAL ACCOUNTING FI PAPER: 11 29. A group COA can be assigned to the Alternate chart of account which is assigned to the company Code a. True b. False 30. The filed status for filed status group can in display transaction can only be display or hidden. a. True b. False 31. For document types with external number ranges, you have to define an individual reverse document type because the system can make automatic reverse entries only in document types that have internal number assignment. a. True b. False

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Chapter 10Document35 pagesChapter 10baburamNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Sap Fi Paper 12Document5 pagesSap Fi Paper 12baburam100% (1)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- CRS2008 Getting StartedDocument36 pagesCRS2008 Getting Startedbaburam100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Sap Fi Paper 16Document11 pagesSap Fi Paper 16baburam100% (9)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Sap Fi Paper 13Document7 pagesSap Fi Paper 13baburamNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Sap Fi Paper 14Document10 pagesSap Fi Paper 14baburam100% (3)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Sap Fi Paper 15Document31 pagesSap Fi Paper 15baburam100% (5)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Sap Fi Paper 10Document16 pagesSap Fi Paper 10baburam100% (1)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- FICO Interview Questions Set 7Document4 pagesFICO Interview Questions Set 7colinmarshallNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Academy: Managerial and Financial Accounting Fi Paper: 8Document4 pagesAcademy: Managerial and Financial Accounting Fi Paper: 8baburamNo ratings yet

- Sap Fi Paper 06Document2 pagesSap Fi Paper 06baburamNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Sap Fi Paper 09Document3 pagesSap Fi Paper 09baburamNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Sap Fi Paper 04Document6 pagesSap Fi Paper 04baburam100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sap Fi Paper 05Document5 pagesSap Fi Paper 05baburam100% (2)

- Configuring FICO Lawrence RebelloDocument148 pagesConfiguring FICO Lawrence Rebellobaburam100% (8)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Chapter 17Document17 pagesChapter 17baburam100% (1)

- FICO Interview Questions Set 1Document5 pagesFICO Interview Questions Set 1Jai Kiran VasistaNo ratings yet

- FICO Interview Questions Set 3Document4 pagesFICO Interview Questions Set 3sachinvernekarNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Sap Fi Paper 02Document4 pagesSap Fi Paper 02baburam100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Chapter 15Document18 pagesChapter 15baburamNo ratings yet

- Chapter 09Document38 pagesChapter 09baburam100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Chapter 13Document20 pagesChapter 13baburamNo ratings yet

- Chapter 12Document28 pagesChapter 12baburamNo ratings yet

- Ethics: Understanding and Meeting Ethical ExpectationsDocument30 pagesEthics: Understanding and Meeting Ethical ExpectationsbaburamNo ratings yet

- Chapter 02Document29 pagesChapter 02baburamNo ratings yet

- Chapter 07Document16 pagesChapter 07baburamNo ratings yet

- Auditing: Integral To The EconomyDocument32 pagesAuditing: Integral To The Economybaburam100% (2)

- Research - Criminal - BP22 Vs EstafaDocument2 pagesResearch - Criminal - BP22 Vs EstafaJunnieson BonielNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Digital Payments Process SafeguardsDocument19 pagesDigital Payments Process SafeguardsGOPALA KRISHNANo ratings yet

- Financial Management PORTFOLIO MidDocument8 pagesFinancial Management PORTFOLIO MidMyka Marie CruzNo ratings yet

- SAP FICO Transaction CodesDocument17 pagesSAP FICO Transaction CodesandrefumianNo ratings yet

- Application For Modification/Waiver of Fire Safety Requirements (Section 27 of The Fire Safety Act (CHAPTER 109A) )Document3 pagesApplication For Modification/Waiver of Fire Safety Requirements (Section 27 of The Fire Safety Act (CHAPTER 109A) )Daren RitonNo ratings yet

- 1107-920-46-3559 e ADDENDUM2Document171 pages1107-920-46-3559 e ADDENDUM2asharani_ckNo ratings yet

- Cashless Transaction in Rural Areas: A Study With Reference To Udupi TalukDocument6 pagesCashless Transaction in Rural Areas: A Study With Reference To Udupi TalukrohitmahaliNo ratings yet

- 10 Sumacad Et Al. vs. Province of Samar and PNBDocument2 pages10 Sumacad Et Al. vs. Province of Samar and PNBrNo ratings yet

- Academy of Finance - PTP, Otc, RTR - Londonsam Polska 2019 PDFDocument9 pagesAcademy of Finance - PTP, Otc, RTR - Londonsam Polska 2019 PDFJinore GomaceNo ratings yet

- Billing PlanDocument55 pagesBilling PlanSourav Kumar100% (5)

- Edf InvoiceDocument3 pagesEdf Invoicemoran64800No ratings yet

- Intermediate Accounting 1Document46 pagesIntermediate Accounting 1Jashi SiñelNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 1801 Estate Tax Return FormDocument2 pages1801 Estate Tax Return FormMay DinagaNo ratings yet

- FNB Payment NotificationDocument1 pageFNB Payment Notificationsamuelzuriel001No ratings yet

- Paper 1 (Set1) Reading and Use of English FinalDocument11 pagesPaper 1 (Set1) Reading and Use of English FinalSyuhada NurNo ratings yet

- Henry Hardware Business Plan - TobeprintDocument24 pagesHenry Hardware Business Plan - TobeprintHenry L Banaag100% (3)

- 1Document4 pages1Rohan ShresthaNo ratings yet

- Tugas GSLC: Multiple ChoiceDocument4 pagesTugas GSLC: Multiple ChoiceJSKyungNo ratings yet

- Htmlburger Web Design ProposalDocument12 pagesHtmlburger Web Design Proposalevilleta_1No ratings yet

- Anur DTP Final As Per Erc PDFDocument573 pagesAnur DTP Final As Per Erc PDFnutanmanjuNo ratings yet

- Guidelines To Fill Application Form of Executive PGDM ProgramDocument9 pagesGuidelines To Fill Application Form of Executive PGDM ProgramJaydeepdasforeverNo ratings yet

- NFL Standard Representation AgreementDocument6 pagesNFL Standard Representation AgreementTrey CephusNo ratings yet

- SalesDocument6 pagesSalesRoma Monzon100% (1)

- Bangalore University PDFDocument2 pagesBangalore University PDFShriharsh KatageriNo ratings yet

- Account Statement From 2 Nov 2015 To 1 Feb 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 2 Nov 2015 To 1 Feb 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceGirish ChowdaryNo ratings yet

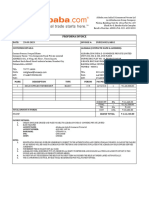

- Alibaba PIDocument1 pageAlibaba PIvivaacpseoNo ratings yet

- Proposal FormDocument9 pagesProposal FormrohitNo ratings yet

- Ethiopia Customs Guide PDFDocument182 pagesEthiopia Customs Guide PDFnuruye100% (1)

- How To Exclude An Expense From The FI Posting 20180409Document5 pagesHow To Exclude An Expense From The FI Posting 20180409Roman FischerNo ratings yet

- 2024 Budget Binder Pink BlueDocument87 pages2024 Budget Binder Pink Bluewentoly1No ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)