Professional Documents

Culture Documents

Allegheny County Tax-Exempt Review Letter

Uploaded by

Andrew McGillOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Allegheny County Tax-Exempt Review Letter

Uploaded by

Andrew McGillCopyright:

Available Formats

COUNTY OF

Rich Fitzgerald

County Executive

ALLEGHENY

Parcel ID: 0002-G-00044-0000-00

*0002-G-00044-0000-00*

LEWIS ROBERT J 1344 5TH AVE PITTSBURGH PA 15219

Concerning the property located at:

February 28, 2013 Dear Property Owner, Allegheny County is conducting a review of all tax-exempt property in the County. This review is being conducted pursuant to Ordinance 49-07, which was passed in 2007. Not only is this review required by our own laws, but it is also required to ensure that all property owners in Allegheny County are paying their fair share to maintain the level of services to which our residents are entitled. The records of the Allegheny County Office of Property Assessments (OPA) indicate that your parcel is designated tax-exempt as an Institution of Purely Public Charity. That classification is one of five classifications set forth in the Pennsylvania Constitution, and it is the classification that is the subject of Ordinance 49-07. OPA will also be conducting a review of parcels which are exempt under the other four classifications, (actual places of worship, non-profit places of burial, public property used for a public purpose, and property owned and occupied by any branch, post or camp of honorably discharged servicemen and women use for charitable or patriotic purposes), but the initial phase of the review will address the Institutions of Purely Public Charity. In April 2012 the Supreme Court of Pennsylvania issued its ruling in the case of Eitz Chaim of Bobov, Inc v. Pike County Board of Assessment Appeals, et al., 44 A.3d 3, (Pa. 2012). The Court ruled that Institutions of Purely Public Charity must meet a five-prong test, known as the HUP Test, in order to qualify for tax-exempt status under the Pennsylvania Constitution. To qualify under the HUP Test as an Institution of Purely Public Charity, a property-owning institution must: 1. 2. 3. 4. 5. Advance a charitable purpose; Donate or render gratuitously a substantial portion of its services; Benefit a substantial and indefinite class of persons who are legitimate subjects of charity; Relieve the government of some of its burden; and Operate entirely free from private profit motive.

(cont. on reverse)

Department of Administrative Services

Jerry Tyskiewicz, Director

202 Courthouse 436 Grant Street Pittsburgh, PA 15219 Phone (412) 350-6109 Fax (412) 350-4925 www.alleghenycounty.us

In order to maintain the tax-exempt status of your property, you must provide OPA with an explanation as to how your institution meets each of the above five criteria. There is no limit to the amount of information you can provide, and it can be provided in either written or electronic format, along with any supporting documentation you deem necessary and appropriate in order to reach a determination. If further information is required to make a determination, you will be so notified. Written replies can be sent to: Office of Property Assessments 400 North Lexington Avenue Suite LL109 Pittsburgh, PA 15208 Electronic replies can be submitted to: TaxexemptHUP@alleghenycounty.us

The enclosed HUP Test Cover Sheet and Review Application are mandatory components of your reply and should be submitted no later than 60 days from the date of this mailing. Failure to comply may result in a loss of your tax-exempt status. A call center will be made available to answer inquires at 412.350.4600. You may also visit the Allegheny County Property Assessment web site at www.alleghenycounty.us\assessments\exempt\FAQ to answer frequently asked questions regarding your exemption. Please note that the call center will not be providing legal advice. We understand that this process may not necessarily be an easy one for many of the property owners receiving this letter. It is, however, long overdue and is intended to ensure that no one in Allegheny County is paying more than their fair share of real estate taxes to any taxing jurisdiction. We look forward to receiving your response and thank you in advance for your role in achieving that important objective.

Sincerely,

Jerry Tyskiewicz Director, Administrative Services

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Veterans Services Guide in PennsylvaniaDocument2 pagesVeterans Services Guide in PennsylvaniaJesse WhiteNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Hillary Clinton Department of State Emails - June ReleaseDocument2,847 pagesHillary Clinton Department of State Emails - June ReleaseAndrew McGill100% (1)

- Stone Ornaments of American IndiansDocument234 pagesStone Ornaments of American Indiansbreezenunya100% (1)

- Haldeman Family GenealogyDocument396 pagesHaldeman Family GenealogyInuko ArashiNo ratings yet

- Voter Registration Trends (Seth Keshel)Document17 pagesVoter Registration Trends (Seth Keshel)Ray BleharNo ratings yet

- 03.23.20 TWW COVID 19 Stay at Home OrderDocument2 pages03.23.20 TWW COVID 19 Stay at Home OrderGovernor Tom WolfNo ratings yet

- 03.28.20 GOV Stay at Home Order AmendmentDocument1 page03.28.20 GOV Stay at Home Order AmendmentGovernor Tom Wolf0% (1)

- Lifeline Scholarships Coalition LetterDocument4 pagesLifeline Scholarships Coalition LetterPennLiveNo ratings yet

- Hillary Clinton Emails - July 31 ReleaseDocument2,206 pagesHillary Clinton Emails - July 31 ReleaseAndrew McGillNo ratings yet

- Steelers Coach Mike Tomlin Press 12/30/13 Press Conference TranscriptDocument7 pagesSteelers Coach Mike Tomlin Press 12/30/13 Press Conference TranscriptAndrew McGillNo ratings yet

- 2012 Monessen ContractDocument38 pages2012 Monessen ContractAndrew McGillNo ratings yet

- Steckel Elementary May-June 2012 NewsletterDocument6 pagesSteckel Elementary May-June 2012 NewsletterAndrew McGillNo ratings yet

- May Zephyr Elementary NewsletterDocument6 pagesMay Zephyr Elementary NewsletterAndrew McGillNo ratings yet

- Volunteers Talking Points 111711Document3 pagesVolunteers Talking Points 111711Andrew McGillNo ratings yet

- Gocley Elementary School May NewsletterDocument4 pagesGocley Elementary School May NewsletterAndrew McGillNo ratings yet

- Graduates of Distinction BiosDocument6 pagesGraduates of Distinction BiosAndrew McGillNo ratings yet

- Budget Reduction Suggestions 2011-2012Document2 pagesBudget Reduction Suggestions 2011-2012Andrew McGillNo ratings yet

- Lee, Han Byul - ResumeDocument1 pageLee, Han Byul - Resumedomestic_shoeNo ratings yet

- Education: Bridget C. CoreyDocument1 pageEducation: Bridget C. CoreyBridget CoreyNo ratings yet

- Lawsuit by Piazza Parents Against Security Firm, Former Frat Brothers of Timothy PiazzaDocument102 pagesLawsuit by Piazza Parents Against Security Firm, Former Frat Brothers of Timothy PiazzaPennLive100% (1)

- PA Appeals Court Doc - Kasich InvalidDocument4 pagesPA Appeals Court Doc - Kasich InvalidThe Conservative TreehouseNo ratings yet

- Module 11 NORTH AMERICA No Activities Global Culture and Tourism Geography 11Document10 pagesModule 11 NORTH AMERICA No Activities Global Culture and Tourism Geography 11Mary Jane PelaezNo ratings yet

- Oct. 29, 2013, Public NoticesDocument1 pageOct. 29, 2013, Public NoticesPennLiveNo ratings yet

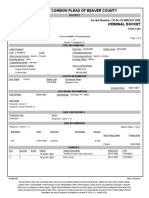

- Court of Common Pleas of Beaver County: Docket Docket Number: CP-04-CR-0002319-1996Document4 pagesCourt of Common Pleas of Beaver County: Docket Docket Number: CP-04-CR-0002319-1996sw higglebottomNo ratings yet

- Philadelphia Senators Hs Baseball Roster 2010Document1 pagePhiladelphia Senators Hs Baseball Roster 2010DIANE1HNo ratings yet

- Jonathan Dejesus' Criminal HistoryDocument4 pagesJonathan Dejesus' Criminal HistoryAnonymous arnc2g2NNo ratings yet

- CORRUPT Lancaster County Prothonotary and Judge Leonard G. Brown - EVIDENCE July 14, 2016Document131 pagesCORRUPT Lancaster County Prothonotary and Judge Leonard G. Brown - EVIDENCE July 14, 2016Stan J. CaterboneNo ratings yet

- Sole Hi Tribune High-ResDocument12 pagesSole Hi Tribune High-ResJudd WilsonNo ratings yet

- Cameron Kellock Resume Senior FinalDocument2 pagesCameron Kellock Resume Senior Finalapi-302617068No ratings yet

- Court Docket - Askia SaburDocument11 pagesCourt Docket - Askia SaburThe DeclarationNo ratings yet

- Thirteen Colonies ChartDocument3 pagesThirteen Colonies ChartХиба ЮNo ratings yet

- 2011 Voters Guide: Lehigh CountyDocument16 pages2011 Voters Guide: Lehigh CountyThe Morning CallNo ratings yet

- Our Lancaster County 2014Document68 pagesOur Lancaster County 2014LNP MEDIA GROUP, Inc.No ratings yet

- New York Citi Bikes - Raw DataDocument1,992 pagesNew York Citi Bikes - Raw Dataوديع الربيعيNo ratings yet

- Michael D. Rawlins: ExperienceDocument3 pagesMichael D. Rawlins: Experienceapi-320203459No ratings yet

- IMG Friendly Hospitals-1Document4 pagesIMG Friendly Hospitals-1ihallucinationcoreNo ratings yet

- Bucks County General Election Voters GuideDocument38 pagesBucks County General Election Voters GuideBucksLocalNews.comNo ratings yet

- List - All Approved ProvidersDocument6 pagesList - All Approved ProvidersJon GilliamNo ratings yet

- Bianca's ResumeDocument2 pagesBianca's ResumeBianca HooperNo ratings yet

- DFA Prevention Petition 052012Document24 pagesDFA Prevention Petition 052012Alice ChenNo ratings yet