Professional Documents

Culture Documents

Motion To Approve MOU

Uploaded by

Sara SugarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Motion To Approve MOU

Uploaded by

Sara SugarCopyright:

Available Formats

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

Hearing Date and Time: March 18, 2013 at 2:00 p.m. (Eastern Time) Objection Deadline: March 11, 2013 at 4:00 p.m. (Eastern Time)

Alan J. Lipkin Shaunna D. Jones Jack M. Tracy II WILLKIE FARR & GALLAGHER LLP 787 Seventh Avenue New York, New York 10019 Tel: (212) 728-8000 Fax: (212) 728-8111 UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF NEW YORK ------------------------------------------------------x In re : : 1 Interfaith Medical Center, Inc., : : Debtor. : ------------------------------------------------------x

Chapter 11 Case No. 12-48226 (CEC)

NOTICE OF HEARING ON DEBTORS MOTION FOR ORDER APPROVING MEMORANDUM OF UNDERSTANDING BETWEEN THE BROOKLYN HOSPITAL CENTER AND INTERFAITH MEDICAL CENTER PLEASE TAKE NOTICE that annexed hereto is the Debtors Motion for Order Approving Memorandum of Understanding Between the Brooklyn Hospital Center and Interfaith Medical Center (the Motion). PLEASE TAKE FURTHER NOTICE that a hearing (the Hearing) on the Motion has been scheduled for March 18, 2013 at 2:00 p.m. (EDT) before the Honorable Carla E. Craig, United States Bankruptcy Judge in Courtroom 3529 of the United States Bankruptcy Court, 271 Cadman Plaza East - Suite 1595, Brooklyn, New York 11201-1800. PLEASE TAKE FURTHER NOTICE that responses or objections, if any, to entry of the order requested in the Motion must be made in writing, state with particularity the grounds therefor, conform to the Federal Rules of Bankruptcy Procedure and the Local

The last four digits of the Debtors federal tax identification number are 6155. The Debtors mailing address is 1545 Atlantic Avenue, Brooklyn, New York 11213.

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

Bankruptcy Rules for the Eastern District of New York, be filed electronically in text searchable portable document format (PDF) with the Court by registered users of the Courts case filing system and by all other parties in interest (with a hard-copy delivered directly to the Judges Chambers), and be served upon: (i) Interfaith Medical Center, 1545 Atlantic Avenue, Brooklyn, NY 11213 (Attn: Luis Hernandez and Robert Mariani); (ii) counsel for the Debtor, Willkie Farr & Gallagher LLP, 787 Seventh Avenue, New York, NY 10019 (Attn: Alan J. Lipkin, Esq. and Shaunna D. Jones, Esq.); (iii) the Office of the United States Trustee, 271 Cadman Plaza East, Suite 4529, Brooklyn, NY 11201 (Attn: William E. Curtin, Esq. and Susan D. Golden, Esq.); (iv) counsel to the Dormitory Authority of the State of New York, Winston & Strawn LLP, 200 Park Avenue, New York, NY 10166-4193 (Attn: David Neier, Esq. and Carey D. Schreiber, Esq.); and (v) counsel to the Official Committee of Unsecured Creditors, Alston & Bird LLP, 90 Park Avenue, New York, NY 10016 (Attn: Martin G. Bunin, Esq. and Craig Freeman, Esq.), so as to be actually received on or before 4:00 p.m. (prevailing Eastern Time) on March 11, 2013. PLEASE TAKE FURTHER NOTICE that if you wish to be heard with respect to any of the foregoing matters, you must attend the Hearing. The Hearing may be adjourned from time to time in open court.

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

PLEASE TAKE FURTHER NOTICE that if you would like to receive copies of the Motion set forth above, (a) you may access such documents online from either the Bankruptcy Courts electronic case filing system located at http://www.nyeb.uscourts.gov/ or the website of the Debtors claims agent at http://www.donlinrecano.com/interfaithmedical, or (b) you may contact Jack M. Tracy II, Esq., at Willkie Farr & Gallagher LLP, 787 Seventh Avenue, New York, NY 10019, by telephone at (212) 728-8000 or by e-mail at jtracy@willkie.com. Dated: February 22, 2013 WILLKIE FARR & GALLAGHER LLP By: /s/ Alan J. Lipkin Alan J. Lipkin Shaunna D. Jones Jack M. Tracy II 787 Seventh Avenue New York, New York 10019 Tel: (212) 728-8000 Fax: (212) 728-8111 Attorneys to Debtor and Debtor in Possession

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

Hearing Date and Time: March 18, 2013 at 2:00 p.m. (Eastern Time) Objection Deadline: March 11, 2013 at 4:00 p.m. (Eastern Time)

Alan J. Lipkin Shaunna D. Jones Jack M. Tracy II WILLKIE FARR & GALLAGHER LLP 787 Seventh Avenue New York, New York 10019 Tel: (212) 728-8000 Fax: (212) 728-8111 UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF NEW YORK ------------------------------------------------------x In re : : 1 Interfaith Medical Center, Inc., : : Debtor. : ------------------------------------------------------x

Chapter 11 Case No. 12-48226 (CEC)

DEBTORS MOTION FOR ORDER APPROVING MEMORANDUM OF UNDERSTANDING BETWEEN THE BROOKLYN HOSPITAL CENTER AND INTERFAITH MEDICAL CENTER TO THE HONORABLE CARLA E. CRAIG, CHIEF UNITED STATES BANKRUPTCY JUDGE: Interfaith Medical Center, Inc., the debtor and debtor in possession in the abovecaptioned case (the Debtor or IMC), hereby moves for entry of an order, pursuant to sections 105 and 363(b) of title 11 of the United States Code (the Bankruptcy Code) and Rules 2002 and 6004 of the Federal Rules of Bankruptcy Procedure (the Bankruptcy Rules), approving the Memorandum of Understanding, dated February 1, 2013, attached hereto as Exhibit A (the MOU), between IMC and The Brooklyn Hospital Center (TBHC). In support of this Motion, the Debtor respectfully states as follows:

The last four digits of the Debtors federal tax identification number are 6155. The Debtors mailing address is 1545 Atlantic Avenue, Brooklyn, New York 11213.

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

JURISDICTION 1. This Court has jurisdiction over this Motion pursuant to 28 U.S.C. 157

and 1334. This matter is a core proceeding pursuant to 28 U.S.C. 157(b). Venue is properly before this court pursuant to 28 U.S.C. 1408 and 1409. The statutory predicates for the relief requested herein are sections 105 and 363(b) of the Bankruptcy Code, as supplemented by Bankruptcy Rules 2002 and 6004. GENERAL BACKGROUND 2. On December 2, 2012 (the Petition Date), the Debtor filed a voluntary

petition for relief under chapter 11 of the Bankruptcy Code. The Debtor is continuing in possession of its property and management of its business as a debtor in possession pursuant to sections 1107 and 1108 of the Bankruptcy Code. On December 13, 2012, the Office of the United States Trustee for the Eastern District of New York appointed an official committee of unsecured creditors in this case. 3. The events leading to the Debtors chapter 11 filing and certain facts and

circumstances supporting the relief requested herein are further described in the Declaration of Luis A. Hernandez, President and Chief Executive Officer of Interfaith Medical Center, in Support of Chapter 11 Petition and First Day Pleadings [Docket No. 2] (the Hernandez Declaration), which was filed with the Court on the Petition Date. 4. As referenced in the Hernandez Declaration, prior to the Debtors chapter

11 case, the Debtor was negotiating the terms of a business relationship with one or more other hospitals. Such negotiations continued postpetition and have resulted in the MOU between IMC and TBHC.

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

RELIEF REQUESTED 5. By this motion, IMC requests entry of an order (the Proposed Order)

substantially in the form attached as Exhibit B, approving the MOU. The purpose of the MOU is to set forth the general terms pursuant to which the Parties2 (i.e., IMC and TBHC) would continue their negotiations and due diligence efforts concerning a potential business integration (the Proposed Transaction). Consummation of any such Proposed Transaction would be conditioned upon, among other things, further due diligence, the negotiation, execution, and delivery of Definitive Agreements, the proposal and confirmation of a chapter 11 plan for IMC (i.e., the IMC Financial Restructuring Plan), approval by the governing boards of both TBHC and IMC, and any requisite government and other Court approvals. 6. In large part, the MOU constitutes a nonbinding statement of the Parties

current mutual intentions with respect to certain terms of the Proposed Transaction and the process for seeking agreement on those and all other terms. While the MOU does not include a complete list of all of the terms and conditions of a Proposed Transaction, the terms referenced in the MOU include, but are not limited to: (a) (i) the reorganization of IMC with TBHC or its designated affiliate as New IMCs sole member, or (ii) the transfer of IMCs assets to a not-forprofit successor entity that would have TBHC or its designated affiliate as its sole member; (b) in either case, the TBHC Member of IMC would be an active parent exercising a variety of reserved powers and would appoint 60% of New IMCs board of trustees with the remaining 40% to be current IMC board members; and (c) the formation of the BHC Network to engage in planning and strategic development for an integrated healthcare system in the Brooklyn marketplace. See MOU 3. Additionally, the MOU provides for the establishment of a joint

Capitalized terms not otherwise defined herein shall have the meanings ascribed to such terms in the MOU.

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

board and management committee to review current and future clinical services at IMC in order to address how services at the two hospitals would be integrated. See id. 7. The MOU is not intended to constitute a binding agreement of TBHC,

IMC or any other person or entity, except as to the following provisions:3 While the Definitive Agreements are being negotiated, TBHC and IMC will cooperate in conducting diligence of each other with a view to completing their respective due diligence reviews as expeditiously as practicable following execution of the MOU. (MOU, 2). No broker has been used in connection with the Proposed Transaction. (MOU, 5(a)). No third party beneficiary rights are, or are intended to be, created by the MOU. (MOU, 5(b)). Neither party will assume any obligations or liabilities of the other Party as a result of entering into the MOU. (MOU, 5(c)). The MOU constitutes a statement of the Parties mutual intentions with respect to the Proposed Transaction, does not contain all matters upon which agreement must be reached in order for the Proposed Transaction to be consummated and, therefore, does not constitute a binding commitment with respect to the Proposed Transaction itself. Further, the MOUs terms and conditions are subject to being supplemented or restructured in the course of negotiating the Definitive Agreements. (MOU, 6). The Parties shall be bound in respect of the Proposed Transaction only upon the execution and delivery of the Definitive Agreements, among other conditions. (MOU, 7(a)). Within 30 days of the date of the MOU, the Parties, with the approval of DASNY and DOH, shall agree upon a New CRO, who, subject to bankruptcy court approval, shall be appointed to replace IMCs existing Chief Restructuring Officer. The New CRO would report to IMCs Board and be in charge of IMCs operational and financial restructuring in connection with the Proposed Transaction or otherwise. (MOU, 7(b)). IMC and TBHC will work together towards a closing of the Proposed Transaction and will not solicit alternative proposals. Notwithstanding anything in the MOU to the contrary, however, higher or better offers for

The descriptions of the MOUs provisions are for summary purposes only.

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

IMC and/or its assets may be considered by IMC to the extent required by applicable bankruptcy or other law. (MOU, 7(c) and (d)). Except as otherwise required by applicable law, each party will not issue any press releases or make any other public announcements or disclosures with respect to the MOU or the Proposed Transaction without the prior approval of the other Party; provided, however, IMC may disclose the existence and terms of the MOU. (MOU, 7(e) and (f)). In connection with the Proposed Transaction, each Party will make available to the other certain information of a non-public, confidential, or proprietary nature concerning its respective business and affairs. Such information shall be kept confidential pursuant to the prepetition Confidentiality Agreement between the parties, except to the extent any such confidentiality requirement is rendered inoperative pursuant to the Confidentiality Agreement; provided, however, that the Parties may share Confidential Information with DOH and DASNY and IMC may share Confidential Information with any other IMC creditor or IMC creditor representative that agrees in writing to keep such information confidential or as required by court order. (MOU, 7(f)). Each of the Parties shall bear its own expenses in connection with the Proposed Transaction, including, without limitation, costs incurred in negotiating the Definitive Agreements. (MOU, 7(h)). Subject to the terms of the MOU, the MOU may be terminated and the Proposed Transaction may be abandoned: (i) at any time by the mutual agreement of the Parties, (ii) by either Party if the Definitive Agreements have not been executed by the Parties within 9 months of the date of the MOU; (iii) by TBHC if the New CRO has not been appointed within 60 days of the date of the MOU; or (iv) by either Party if it determines, in its sole discretion, that any of the conditions described in paragraph 4 of the MOU are unlikely to be satisfied. (MOU, 7(k)). Besides the Parties continued active work towards a Proposed

8.

Transaction, the main impact of the MOU (and the Debtors Third Interim Cash Collateral Order) is the Debtors retention of a new CRO. Efforts to select a new CRO are ongoing now. Upon appointment of a new CRO, Corbett Price, IMCs current CRO, will no longer be CRO, but will remain available for a limited period to facilitate the new CROs transition. The remainder of the senior management team that is provided by Kurron Shares of America, Inc. (Kurron) and engaged in managing IMCs operations will remain in their roles and function 5

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

as before. The Debtor appreciates and acknowledges both Mr. Prices extensive and productive efforts on IMCs behalf to date as well as his gracious cooperation in the transition to a new CRO that IMC is required to make. 9. By this Motion, pursuant to sections 105(a) and 363 of the Bankruptcy

Code, the Debtor requests that the Court enter the Proposed Order approving the MOU. BASIS FOR RELIEF REQUESTED 10. Section 363(b) of the Bankruptcy Code provides, in pertinent part, that a

debtor in possession may use, sell, or lease, other than in the ordinary course of business, property of the estate . . . 11 U.S.C. 363(b); see also Official Comm. of Unsecured Creditors of Enron Corp. v. Enron Corp. (In re Enron Corp.), 335 B.R. 22, 27 (S.D.N.Y. 2005); 255 West 4th St. Realty Corp. v. Nisselson, 1997 U.S. Dist. LEXIS 3894 *4 (S.D.N.Y. Apr. 1, 1997). 11. Under section 363(b), the standard for approval of a debtors decision to

use, sell or lease property of the estate other than in the ordinary course of business is whether the debtors decision is conducted with good business judgment. See Comm. of Equity Sec. Holders v. Lionel Corp. (In re Lionel Corp.), 722 F.2d 1063, 1071 (2d Cir. N.Y. 1983) (The rule we adopt requires that a judge determining a 363(b) application expressly find from the evidence presented before him at the hearing a good business reason to grant such an application.). In assessing whether the debtor exercised good business judgment, the court should consider all salient factors pertaining to the proceeding and, accordingly, act to further the diverse interests of the debtor, creditors and equity holders, alike. Id. at 1071; See also In re Metaldyne Corp., 409 B.R. 661, 667 (Bankr. S.D.N.Y. 2009) (In answering th[e] question [of whether a debtor exercised good business judgment] the Court is guided by the decisions in this jurisdiction emphasizing that the Court should not substitute its business judgment for that of the Debtors.) (citations omitted). 6

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

12.

It is generally understood that [w]here the debtor articulates a reasonable

basis for its business decisions (as distinct from a decision made arbitrarily or capriciously), courts will generally not entertain objections to the debtors conduct. In re Johns-Manville Corp., 60 B.R. 612, 616 (Bankr. S.D.N.Y. 1986). If a valid business justification exists, there is a strong presumption that the directors of a corporation acted on an informed basis, in good faith and in the honest belief that the action taken was in the best interests of the company. In re Integrated Res., Inc., 147 B.R. 650, 656 (S.D.N.Y. 1992) (quoting Smith v. Van Gorkom, 488 A.2d 858, 872 (Del. 1985)), appeal dismissed, 3 F.3d 49 (2d Cir. 1993). The burden of rebutting this presumption falls to parties opposing the proposed exercise of a debtors business judgment. Id. (citing Aronson v. Lewis, 473 A.2d 805, 812 (Del. 1984)). 13. The MOU is the culmination of a concerted and collaborative effort by

IMC, TBHC, and certain New York State agencies to reconfigure, enhance, and expand resources to improve the provision of healthcare to the community now served by IMC and of healthcare outcomes in Brooklyn generally. The terms of the MOU, including the Proposed Transaction, result from the Debtors analysis of its financial situation and ability to continue operating as an independent acute care hospital. The Debtor has determined that its continued operation probably is dependent upon entering into a business relationship with one or more local hospitals. Both prior to and during the Debtors chapter 11 case, the Debtor has sought to negotiate such a relationship. As of the date hereof, TBHC is the most viable option for the formation of such a business relationship. 14. As the Debtors senior management personnel provided by Kurron that

oversee the Debtors operations will remain in place and continue to function as before, the ongoing negotiations with TBHC on a Proposed Transaction and the replacement of IMCs

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

current CRO should not impact IMCs day-to-day operations during this chapter 11 case. As part of the negotiations on a Proposed Transaction, IMC will seek to ensure that substantially all of IMCs current operations continue post-confirmation on a financially viable basis and that safeguards will be instituted to ensure such continued operations. In that regard, in the MOU TBHC agreed that there will be commercially reasonable, good faith efforts to maintain the New IMC as a general hospital with inpatient services. See MOU, 3(a)(i)(C). Those issues will remain central in future negotiations on a Proposed Transaction. 15. As the Debtor is the primary acute care provider to its community, failure

to form a business relationship as contemplated by the MOU likely would have serious consequences for the provision of healthcare in the Brooklyn community served by IMC, the extent of the jobs created by such services, and the value of the Debtors estate. For these and other reasons, the Debtor believes that entering into the MOU with TBHC is a sound exercise of IMCs business judgment and warrants approval by the Court. 16. To successfully implement the foregoing, the Debtor respectfully seeks a

waiver of the fourteen-day stay under Bankruptcy Rule 6004(h). NOTICE 17. Notice of this Motion will be given in accordance with this Courts Order

Establishing Certain Notice, Case Management, and Administrative Procedures and Omnibus Hearing Dates, dated as of December 4, 2012 [Docket No. 35]. Under the circumstances, no other or further notice is required. 18. As the authorities relied upon herein are set forth above, the Debtor

respectfully submits that this motion satisfies the requirements of Rule 9013-1(a) of the Local Bankruptcy Rules of the Eastern District of New York regarding the submission of a memorandum of law. 8

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

19. any other court. .

No previous motion for the relief sought herein has been made to this or

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

CONCLUSION WHEREFORE, the Debtor respectfully requests that the Court enter an order substantially in the form annexed hereto as Exhibit B granting the relief requested in the Motion and granting the Debtor such other and further relief as may be just and proper. Dated: February 22, 2013 WILLKIE FARR & GALLAGHER LLP By: /s/ Alan J. Lipkin Alan J. Lipkin Shaunna D. Jones Jack M. Tracy II 787 Seventh Avenue New York, New York 10019 Tel: (212) 728-8000 Fax: (212) 728-8111 Attorneys for the Debtor and Debtor in Possession

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

EXHIBIT A MOU

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

EXECUTION COPY

MEMORANDUM

OF UNBKRSTAMMWG

(this "MOL"'), dated as

THIS MEMORANDUM OF UNDERSTANDING

of February 1,

2013, is by and

between

THE

BROOKLYN

HOSPITAL

CENTER

("TBHC"} and

INTERFAITH MEDICAL CENTER ("interfaith" or "SiVC")s each a "Party" and collectively,

the "Parhes.

"

Introduction.

The Parties hereby agree as follov s:

1.

(a)

~tcuidin

~Princi ies. The Parties share a mutual commitment

and mission

to reconfigure,

Brooklyn through

enhance

and

expand

resources

to improve

healthcare

outcomes

in

better access to primary

and preventative

care and other ambulatory

and chronic ambulatory

services; more effective and efficient management

sensitive

of acute

care-

conditions,

greater depth,

quality,

ef5ciency and effectiveness

of

inpatient

services; and coordinated

continuing

care to decrease redundancy

and cost while simultaneously

to serve and be responsive to their respective local conununity

health care

needs, which for IMC means the needs

population health concerns.

of

central and north Brooklyn, and addressing

(b)

organizational

streamline

nursing

Overview

of Structure.

The Parties desire to put in place a riew

under an active parent model to

structure comprised

of a hospital system

care, enhance coordination

and encourage partnerships

with other providers, physicians

homes and long-term

facilities, FQHCs and community

to reduce

duplicative services and faciTitate access to care for residents.

(c)

terms pursuant

ose

of this MOU.

The purpose of this MOU is to set forth the general

to which the Parties would be interested in continuing their discussions

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

and due diligence efforts concerning

their formation

of and

participation

anything

in such new

hospital svstem (the "Proposed Transaction"

).

Notwithstanding

to the contrary

contained

herein,

it is expressly

understood

and agreed between

the Parties that the

other things,

the

consummation

of

the Proposed

Transaction

is subject to, among

successful completion

definitive

of due

diligence and the negotiation,

agreement,

and

execution and delivery of a

related

and

corporate

reorganization

other

agreements

and

documents

restructuring

(collectively,

for Interfaith

the

"Depniiive

Agreements"),

a plan

of

fiinancial

{the "JMC Financial Restriicturing

J'Ian'), each mutually

acceptable in form and substance to TBHC and Interfaith, as well as the approval

governing boards

of the

of both TBHC

and Interfaith, which approval may be denied in the sole

discretion

of either or both of such

boards. It is anticipated that the Proyosed Transaction

the terxns set forth herein.

would be accomplished on substantially

il'

%'hile the Definitive Agreements

are being negotiated,

TBHC

and Irjterfaith will cooperate in conducting

diligence

of each

other with a view to coxnpleting

their respective due diligence reviews as expeditiously

this MOU.

as practicable following the execution. of

3.

Terms,

It is anticipated that the Definitive Agreements

will include,

axnong

others, the following terms:

{a)

Healthcare

S stem. The Parties intend to form an integrated healthcare

both Interfaith and

system under an active parent model that preserves and strengthens

TBHC, each having a governing body that is representative

may continue to be responsive

of its

coxxnnunity,

so &at each

to, and better serve, local comxnunity

health care needs.

interfaith and TBHC will become integrated as follows;

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

(i)

designated

IMC. Interfaith will either (x) be reorganized

with TBHC or its

aIfiliate as its sole member, or (y) transfer its assets to a new New

York not-for-profit corporation formed to be its successor. which corporation shall

have TBHC or its designated affiliate as its sole member.

Either such successor

of

IMC is referred to herein as "ew LMC

referred to herein as the "TBHC Member.

and TBHC or its designated

affiliate is

"

IMC's trustees;

(A)

reserved

TBHC. The TBHC Member will exercise the following

appoint

and remove

powers:

New

approve

operating and capital budgets; approve operating policies and procedhires;

approve

the appointment

of corporate officers

and senior inanagement,

approve afliliation, clinical service and management

agreements: approve

certificate

of need

and other regulatory applicatioris; approve settlements

of

administrative

proceedings and litigation in which New IMC is a party; and

such additional powers as shall be set forth in the Definitive Agreements.

The TBHC Member, as New IMC's parent, shall have no powers over

New Ii&C not expressly agreed upon by the Parties and enumerated

Definitive Documents.

in the

The initial board

of trustees of the

New

IMC shall have five members (or such higher number as the Parties may

agree upon), in a single class, consisting

of the

following:

(i) sixty percent

{60/o) of the board members shall be appointed by the TBHC Member (at

least one

of whom

shall also be a member

of the TBHC board of trustees).

shall be cmrent members

and (ii) forty percent (4P/0)

of the

inembers

of

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

the IMC board

of

trustees,

appointed

by IMC (the 'YMC Designated

Trustees" ). Each

of the

members

of the

New IMC board will be appointed

for an initial term

of S years.

During that initial 5 year period, none

of the

IMC Designated

Trustees may be removed

from the New IMC board

without cause. In the event that any IMC Designated Trustee

resi~

or is

removed for any reason, a replacement trustee nominated by the remaining

IMC Designated

Trustee shall be appointed

by the TBHC Member

(to

serve for tbe remainder

of the

initial trustee" s 5 year term). All New IMC

Trustees

bylaws, interest

shall comply

with applicable

statutes,

regulations,

New IMC

and New IMC policies for corporate and

comphance,

and

conflicts of

which

trustee

fiduciary

responsibilities

obligations,

policies will be consistent with the current policies of TBHC

{C)

Continued Medical Center

erations.

New IMC and the

TBHC Member (i} wiII make commercially

to maintain

the New IMC medical

reasonable, good faith efforts

hospital

center as a general

with

mpatient services; {ii) shall not approve a closure plan for New IMC as a

general

hospital

with

inpatient

services

without

full

consideration

of

reasonabl. e alternatives;

and (iii) shall only implement

such closure plan in

compliance with applicablc DOH regulations.

(D)

Cortununi

Re resentation

on New IMC Board.

Each

IMC Designated Trustee shall reside in Brooklyn and shall either (i) reside

in New IMC's primary service area; (ii} have experience within the health

care industry; or {iii) have knov ledge of local community health needs

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

(E)

TBHC Board. New IMC shall nominate one of its trustees

unless

to serve on the TBHC Member board of trustees,

otherwise agree to provide in the Defmitive Agreements

the Parties

that the chairman

of the board of New IMC

will serve as an ex o+rcio member

of the TBHC

Member board. During the initial 5 year period Designated

of the

New IMC, the IMC

Trustees shaH designate

one of' themselves

to be the trustee

nominated to sit on the TBHC Member board.

(ii)

BHC Network.

TBHC will form a New York not-for-profit

corporation (the "BHC Network"

and strategic development

).

The BHC Network will engage in planning

for the Brooklyn marketplace.

The BHC Network will

continuity

work with TBHC New IMC and other entities providing

of care, as

between

such are approved by the BHC Network.

Anv contractual

relationship

the BHC Network and New IMC shaH be satisfactory to New IMC and TBI-IC

(iii)

Man

ement Com anv

It is contemplated that TBHC will form a

and other services for members

for profit corporation to provide management

the BHC Network and other entities.

management

of

Any contractual relationship

betv. een such

company

and New IMC shaH be satisfactory

to New' IMC and

(b)

Financial Restructuring.

Agreements,

Concurrently

with the preparation

and consultation

and execution

of the

Defmitive

and in cooperation

with TBHC, it is

contemplated

that IMC will engage in a financial restructuring

under the circumstances

and its Board will take

such actions that are appropriate

to result in an IMC Financial

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

Restructuring

Plan. The IMC Financial Restructuring

Plan is expected to involve, among

other things, a restructuring

liabilities.

of PiIIC's balance

sheet and. the elimination

of significant

The restructuring

process will include meetings with representatives

of the

New York State Department

of Health,

the Dormitory Authority

of the State of New York

Plan

and such other third parties necessary to a successful IMC Financial Restructuring and to the obtaining

of appropriate

financing.

The IMC Financial Restructuring

Plan will

be responsive, as appropriate,

to the recommendations

of any DOH

approved Navigant

report, and shall include other elements appropriate and necessary to meet the health care

needs

of the

(c)

community

served by IMC,

Clinical Services Review.

The Parties acknov'ledge

that to achieve the

purposes

of this MOU

consistent with the guiding principles stated in Section 1{a)and to

maintain both TBHC and New IMC as first class, high quality hospitals serving the needs

of their respective

and reconfigured

communities,

the Parties must consider the possibility

of new,

reduced

services at New IMC. To that end. the Parties shall establish a joint

composed

board committee

of an

equal number

of trustees/directors

who may

from each Party' s

members

board (or non trustee/director

manageinent

representatives

include

of senior

as determined. by each Party's board in its sole discretion) to review the

current and Arture clinical services at IMC. The joint board committee will have the

following advisory responsibilities:

(i)

ser~~ces needs

Prepare

a community service

plan which will describe the clinical

of the

communities

served by 1MC;

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

(ii)

maintained

Compile

a list of "core services" at IMC which should

be

for the clinical services needs of the communities served by IMC to be

met; and

(iii)

Develop a demographic,

demand and financial assessment tool to

assess any addition, reduction, closure or reconfiguration

of clinical

services at

IMC subsequent to the Proposed Transaction.

The plans, lists and tools described above shall be submitted

to the TBHC and IMC

boards for considering clinical services changes at IMC in connection with the Proposed

Transaction.

will contain standard representations,

{d)

warranties,

Other.

The I3efmitive Agreements

covenants, disclosure schedules, closing conditions and other provisions that

are customary in a transaction

of this type

and size.

4,

Conditions

The closing

of

the Proposed Transaction

(the 'Closing"

will be

conditioned upon the satisfaction or waiver of, among other things:

{a)

HEAL Grants.

itj

~Pre-Clasin

. Both Parties

shall have received HEAL grants prior

to the Closing, which as to IMC, shall be sufficient, inter alia. to provide for

consummation

of the IMC Financial Restructuring Plan.

P~ost-Closin

(ii)

commitments

The Parties

governmental

each shall

authorities

have

received

written

from applicable

to provide HEAL grants

to both TBHC and New IMC following the Closing in amounts determined

necessary to provide for the future viability

to be

of TBHC, New IMC

and the BHC

Network.

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

{b)

Medicaid Rate Ad ustments.

t'i)

P~re-Ctosin

Each of the Parties shall have reached agreement

authorities

with appHcable

governmental

regarding

adjusted Medicaid rates for

services such party provides for periods prior to the Closing and such agreed upon

adjusted Medicaid rates shall have been implemented.

Each of the Parties shall have received written

commitments

from all applicable governmental

regard

authorities

to implement adjusted

IMC

Medicaid

rates with

to services

provided

by TBHC and. New

following the Closing, in amounts determined

future viability

to be necessary to provide for the

of TBHC, New

IMC and the BHC Network, as applicable.

(c)

Other Crrants and Subsidies.

Each of the Parties shall have received

authorities

written coininitments

from all applicable governmental

to provide such party

as may be

such other grants and subsidies (e.g. , bad debt and charity care disbursements)

determined

to be necessary to provide for the future viability of TBHC, New IMC and the

BHC Network, as applicable.

(d)

royal

of IMC

Financial Restructtirin

Plan.

IMC and TBHC shall

Plan.

each be satisfied with the terms

of the IMC

Financial Restructuring

(e)

Goverinnental

and Third P

rovaIs

Each Party shall be satisfied

shall have been filed with all

that (i) all requisite appropriate

governmental

notices and all other information

and regulatory

governmental

authorities,

and (ii) all necessary or appropriate and consents relating

and other third party

approvals,

orders

to the

Proposed Transaction shall have been obtained.

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

(f}

and the terms

royal b

the Parties' Governin

Boards.

The Proposed Transaction

Plan

of the Definitive Agreements

and the IMC Financial Restructuring

shall have been approved by the governing boards

of each

Party in its sole discretion prior

to execution.

{g}

Court Orders.

Orders

of any

applicable court entered in connection with

the IMC Financial Restructuring

Plan shall be in form and substance acceptable to IMC

and TBHC in their respective sole discretion.

5.

Other Matters.

{a}

No Broker. The Parties agree that no broker has been used in connection

with the Proposed Transaction.

{b)

No Third P

Benefici

No third party beneficiary rights are, or are

intended to be, created hereunder.

(c)

No Assum tion

of Liabilities. For

the avoidance

of

doubt, it is further

expressly acknowledged

other Party as a result

that neither Party mill assume any obligations or liabilities

entering

of thc

of the

of this MOU.

6.

Prclimin

Nature

of MOU.

The foregoing is not intended to be a complete

{a)

list

Fore~pin

Not Exhaustive.

of

all the terms and conditions

to the Parties' willingness

to participate

in the

Proposed Transaction.

The terms and conditions contained in this MOU are, of course,

subject to being supplemented

Agreements.

or restructured

in thc course

of negotiating

the Definitive

All

matters

referred

to herein

and

all

corporate

proceedings are subject to legal review and approval by the Parties' respective counscL

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

(c}

statement

No Contract.

It is understood

that this MOU merely

constitutes

of the Parties'

mutual intentions with respect to the Proposed Transaction. does

not contain all matters upon which agreement

must be reached in order for the Proposed

Transaction to be consmnnmted

and, therefore, does not constitute

a binding commitment

with respect to the Proposed Transaction itself.

7.

Bindin~ Obli ations.

(a)

Extent of Bindin

Obligations.

Except for the provisions of paragraphs 2,

5, 6, and 7 hereof, which will be fully binding on each of the Parties upon the execution

of this

MOU by both Parties, this MOU is not intended

to (and shall not under any

circumstances) constitute a binding agreement

entity.

of TBHC, Interfaith or any

other person or

upon the

The Parties shaH be bound in respect

of the Proposed Transaction only

execution and delivery

of the

Definitive Agreements.

ement

(b)

Parties

with

Interim Man

of Interfaith.

Within 30 days

of the

date hereof, the

the approval

of DASNY

and DOH, shall

agree upon

a new Chief

Restructuring

Officer (the "Pew CEO"), who, subject to bankruptcy court approval, shall

Officer and to have full authority

be appointed to replace the existing Chief Restructuring

over the management

of Interfaith.

The Ne~ CRO and the chief executive officers of

Interfaith and TBHC (and any other officers that Interfai& or TBHC determines

to be

necessary) shall meet weekly to discuss Interfaith's

the IMC Financial Restructuring

invited to attend such meetings

operations

and the development

of

Plan

Representatives

f'rom DOH and

DASNY shall be

and to consult with the Interfaith

and TBHC officers,

Trustees

of TBHC

and IMC sha11 meet periodically

to coordinate respective activities

Representatives

from DOH, DASNY and TBHC shall be invited to attend all Interfaith

10

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

board meetings.

On or before the Closing, Interfaith's

then existing management

team

shall step down and be replaced by a new rnanagernent

team approved by New IMC's

(c)

No Solicitation.

This MOU will constitute an agreement by Interfaith to

proposals.

work with TBHC toward the Closing and not to solicit alternative

From the

date

of this MOU to

the earlier

of (i) the execution of the

Definitive Agreements,

or (ii)

the termination

otherwise

of this MOU in accordance with

Paragraph

7(j) below, except as

its members or

required by law or IMC's fiduciary duties, none

of Interfaith,

trustees,

investment

any affiliate

of its

members

or trustees,

or any agent, employee,

attorne,

sha11

banker, broker or other person acting on behalf

inquiries

of any of the foregoing,

solicit or initiate

or proposals

&om any parties with respect to

{x} any

transaction that is similar to the Proposed Transaction,

{y) any clinical or administrative

other transaction the consummation

affiliation or business arrangement

of IMC, or (z) any

of which

would or could reasonably

be expected to interfere with, prevent or materially

between TBHC and IMC or

herein to the contrary,

delay the Proposed Transaction, the prospective relationship

the

desi~ of the

nev hospital system.

Notwithstanding

anything

higher or better offers for IMC and/or its assets may be considered by IMC to the extent

required by applicable bankruptcy

or other law.

This MOU will constitute an agreement by TBHC to

From the

(d)

work v ith Interfaith toward the Closing and not to solicit alternative proposals.

date

the of this MOU to the earlier of {i} execution of the

Definitive Agreements,

or (ii)

the termination

of

this MOU in accordance

with

Paragraph

7(j) below, except as

otherwise required by Iaw or TBHC's fiduciary duties, none

of TBHC or its trustees, or

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

any agent, employee, attorney, investment

banker, broker or other person acting on behalf

of any of the

foregoing, shall solicit or irutiate inquiries or proposals from any parties

with respect to

(x} any transaction that is similar to the Proposed Transaction, (y} any

affiliation or business arrangement

clinical or admimstrative

transaction

interfere

of IMC, or (z} any

other

the consununation

of

which

would

or could reasonably

be expected to

or the prospective

with, prevent or materially

delay the Proposed Transaction

relationship

between TBHC and IMC, without the prior ~vitten consent

Public Announcements.

of IMC.

(e}

Except as otherwise required by applicable law,

each Party agrees that it will not issue any press releases or make any other public

announcements

or disclosures with respect to this MOU or the Proposed Transaction

without the prior approval

of the other

Party.

In connection with the Proposed Transaction, each Party

will make available

proprietary

nature

to the other certain information

of a

non-public,

confidential,

or

concerning

its respective businesses and affairs.

by a Party and/or

advisors,

and

Such iiiformation,

attorneys,

whether

investment

disclosed orally or in writing

bankers

its accountants,

including

any

or other

professional

analyses,

compilations. studies or other documents prepared by a Party or its professional advisors

that

contain,

compile,

analyze,

sununarize,

or otherwise

the

meaning

reflect such information,

coMitutes

confidential

between

"Corrfiderctiai

pursuant

Information"

v ithin

of, and shall be kept

Agreement

1

to that certain Confidentiality

effective

and Non-Disclosure

TBHC and Interfaith,

as of June 8, 2012 (the "C nfid

requirement

A~cement"jt

except to the extent any such confidentiality

8 of the Conttdentiahty

is rendered

inoperative pursuant to paragraph

Agreement; provided

however,

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

that the Parties may share Confidentiai

Information

with DOH and DASNY and IMC

may share Confidential

Information

with any other IMC creditor

or IMC creditor or as required

representative

that agrees in writing to keep such information confidential

"notwithstanding

anything

by court order.

to the contrary

in the Confidentiality

Agreement.

and terms

if IMC is

under chapter 1 I protection, then IMC may disclose the existence

of this MOU. The

of this MOU.

obbgations contained in this Paragraph 7(f) shall survive the

termination

(g)

State

Governin~ Law. This MOU shall be governed by the internal laws

without regard to conflict

of the

of New York

(h)

of laws

principles thereof.

Exttenses.

Each of the parnes shall heat its own expenses in connection

with the Proposed Transaction, including, without limitation, costs incurred in negotiating

the Definitive Agreements.

(i)

Execution.

This MOU may be executed in counterparts,

each

of which

vill be deemed to be an original copy and both of which, when taken together, will be

deemed to constitute one and the same document.

and

The exchange

of copies of this

MOU

of signature pages by facsimile or other electronic transmission

shaH constitute

effective execution and delivery hereof as to the Parties and may be used in lieu

original MOU for all purposes.

of the

(0

No Amendment.

This MOU may not be amended,

except by a writing

signed by both Parties that refers specifically to this MOU.

(k)

terminated

Termination.

Subject to the terms set forth herein, this MOU may be

may be abandoned:

and the Proposed Transaction

{i) at

any time by the

mutual agreement

of the

Parties, (ii) by either Party

if the

Definitive Agreements have not

13

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

been executed by the Parties within 9 months

of the date hereof. (iii) by TBHC if the New

CRO has not been appointed within 60 days

Party

of the

date

of this of

MOU, or (iv} by either

described in

if it

determines,

in its sole discretion,

that any

the conditions

Paragraph 4 above is unlikely to be satisfied.

(remainder

ofpage

intentionallv

left blank)

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

IN

%VASTNESS

Wf-KREOF, the Parties have executed this MOU or caused this MOV to

ofTicers hereunto

duly

be executed by their respective

appearing above.

authorized,

all as of the date tu. st

THE BROOKLYN HOSPITAL CENTER.

INTERFAITH MEDICAL CENTER

By:

Title: Chief Executive Of6cer

Name. Luis Hernandez Title: Chief Executive Officer

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

EXHIBIT B Proposed Order

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF NEW YORK ------------------------------------------------------x In re : : 1 Interfaith Medical Center, Inc., : : Debtor. : ------------------------------------------------------x

Chapter 11 Case No. 12-48226 (CEC)

ORDER APPROVING MEMORANDUM OF UNDERSTANDING BETWEEN THE BROOKLYN HOSPITAL CENTER AND INTERFAITH MEDICAL CENTER Upon the motion (the Motion) of Interfaith Medical Center, Inc., the debtor and debtor in possession in the above-captioned case (the Debtor), requesting entry of an order, pursuant to sections 105 and 363(b) of title 11 of the United States Code (the Bankruptcy Code) and Rules 2002 and 6004 of the Federal Rules of Bankruptcy Procedure (the Bankruptcy Rules), approving the memorandum of understanding attached to the Motion as Exhibit A; and due and sufficient notice of the Motion having been given; and it appearing that no other or further notice need be provided; and a hearing on the Motion having been held; and it appearing that the relief requested by the Motion is in the best interest of the estate, its creditors, and other parties in interest; and after due deliberation and sufficient cause appearing therefore, it is hereby ORDERED, ADJUDGED, AND DECREED that: 1. 2. The Motion is granted to the extent set forth herein. Capitalized terms not otherwise defined herein shall have the meanings

ascribed to such terms in the Motion.

The last four digits of the Debtors federal tax identification number are 6155. The Debtors mailing address is 1545 Atlantic Avenue, Brooklyn, New York 11213.

Case 1-12-48226-cec

Doc 260

Filed 02/22/13

Entered 02/22/13 17:05:19

3.

The MOU is approved, and the Debtors execution and implementation of

the MOU is authorized nunc pro tunc. 4. Notwithstanding any Bankruptcy Rule to the contrary, including, without

limitation, Bankruptcy Rule 6004, this Order shall be immediately effective and enforceable upon its entry. 5. This Court shall retain jurisdiction over any matters arising from or related

to the implementation or interpretation of this Order.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- AP GeographyDocument95 pagesAP GeographyKhimavathBharathNaik88% (8)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Interpretations: How To Use Faecal Elastase TestingDocument6 pagesInterpretations: How To Use Faecal Elastase TestingguschinNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Stem Cells and The Regenerative Therapy Following Lameness Resulting From Equine Tendon InjuryDocument15 pagesStem Cells and The Regenerative Therapy Following Lameness Resulting From Equine Tendon InjuryCharlotte ButlerNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Noureen Zawar Family Medicine FMH Oct 21, 2017Document32 pagesNoureen Zawar Family Medicine FMH Oct 21, 2017Noureen ZawarNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

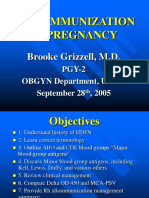

- Alloimmunization in Pregnancy: Brooke Grizzell, M.DDocument40 pagesAlloimmunization in Pregnancy: Brooke Grizzell, M.DhectorNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 478 PeriodizationDocument13 pages478 Periodizationomarou1867% (3)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Adolescent GangsDocument289 pagesAdolescent GangsReuben EscarlanNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Factors Affecting Demand For Soft DrinksDocument8 pagesFactors Affecting Demand For Soft Drinksخلود البطاحNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Benchmark Report 2011Document80 pagesBenchmark Report 2011summitdailyNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Pet Registration FormDocument1 pagePet Registration FormBRGY MABUHAYNo ratings yet

- Worksheet Normal Distribution PDFDocument3 pagesWorksheet Normal Distribution PDFJustin Eduard MarzanNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Poverty Is General Scarcity or The State of One Who Lacks A Certain Amount of Material Possessions or MoneyDocument41 pagesPoverty Is General Scarcity or The State of One Who Lacks A Certain Amount of Material Possessions or MoneyChristian Cañon GenterolaNo ratings yet

- The X Factor 11Document31 pagesThe X Factor 11writerguy78No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Diare Pada BalitaDocument10 pagesDiare Pada BalitaYudha ArnandaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Mobil™ Dexron-VI ATF: Product DescriptionDocument2 pagesMobil™ Dexron-VI ATF: Product DescriptionOscar GonzálezNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- MMG 301 Study Guide For Exam 1Document14 pagesMMG 301 Study Guide For Exam 1Juyeon CheongNo ratings yet

- 2019 EC 006 REORGANIZING BADAC Zone - 1Document5 pages2019 EC 006 REORGANIZING BADAC Zone - 1Barangay BotongonNo ratings yet

- CIC-My Vision of CounsellingDocument4 pagesCIC-My Vision of CounsellingChristeeba F MNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Case Study Keme 1Document9 pagesCase Study Keme 1JhovelNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Chest Drains Al-WPS OfficeDocument16 pagesChest Drains Al-WPS OfficeisnainiviaNo ratings yet

- CPE On Ethico-Moral Practice in NursingDocument21 pagesCPE On Ethico-Moral Practice in NursingBernardo, Joan Eloise S.No ratings yet

- Is Our Brain Really Necessary-LorberDocument3 pagesIs Our Brain Really Necessary-Lorberbigjon1359100% (1)

- Essential DrugsDocument358 pagesEssential Drugsshahera rosdiNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Steven Franklin Greer 1 PDFDocument136 pagesSteven Franklin Greer 1 PDFWKYC.comNo ratings yet

- Req. #1: EMPLOYEES Toyota Workers Say Bosses Have Ignored Safety Concerns For YearsDocument8 pagesReq. #1: EMPLOYEES Toyota Workers Say Bosses Have Ignored Safety Concerns For YearsbellalitNo ratings yet

- Trainee's CharacteristicDocument3 pagesTrainee's CharacteristicRoldan EstibaNo ratings yet

- NCP Acute Pain Related To Tissue Ischemia As Manifested by Changes in Level of Consciousness PDFDocument3 pagesNCP Acute Pain Related To Tissue Ischemia As Manifested by Changes in Level of Consciousness PDFOGNTVNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Pharmacology 1 Exam 1 Study GuideDocument5 pagesPharmacology 1 Exam 1 Study GuideHeroNo ratings yet

- Hospital Income Benefit Plan HIBDocument2 pagesHospital Income Benefit Plan HIBIngrid SastrilloNo ratings yet

- Texas Medicaid and CHIP Provider FAQsDocument4 pagesTexas Medicaid and CHIP Provider FAQsangelina smithNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)